ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

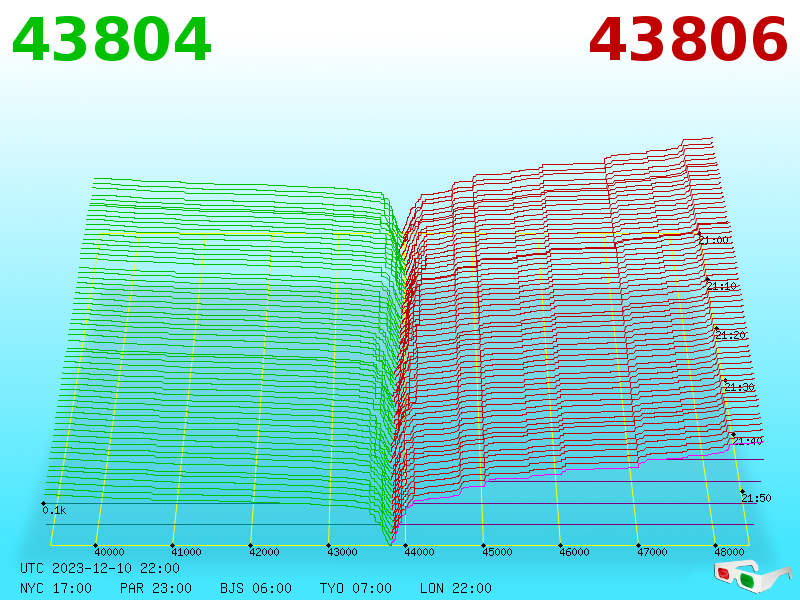

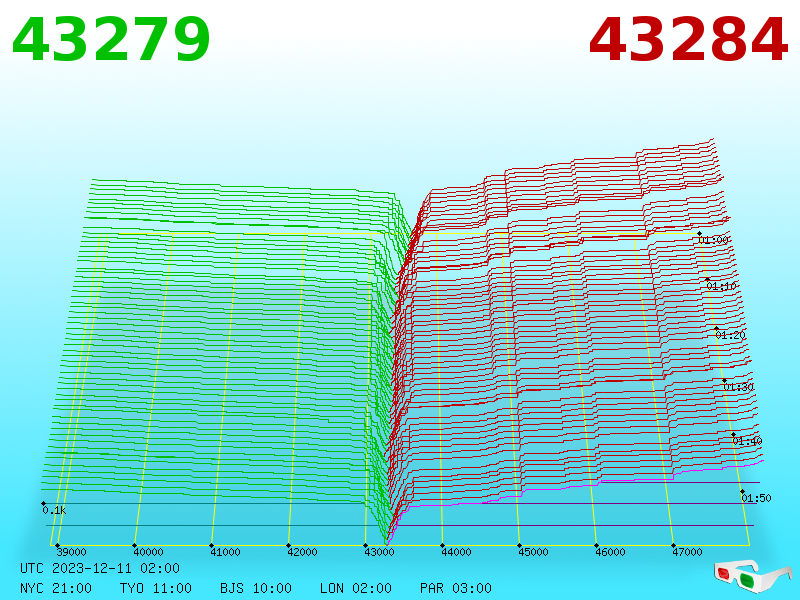

December 10, 2023, 10:01:22 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

|

|

|

|

|

|

"You Asked For Change, We Gave You Coins" -- casascius

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

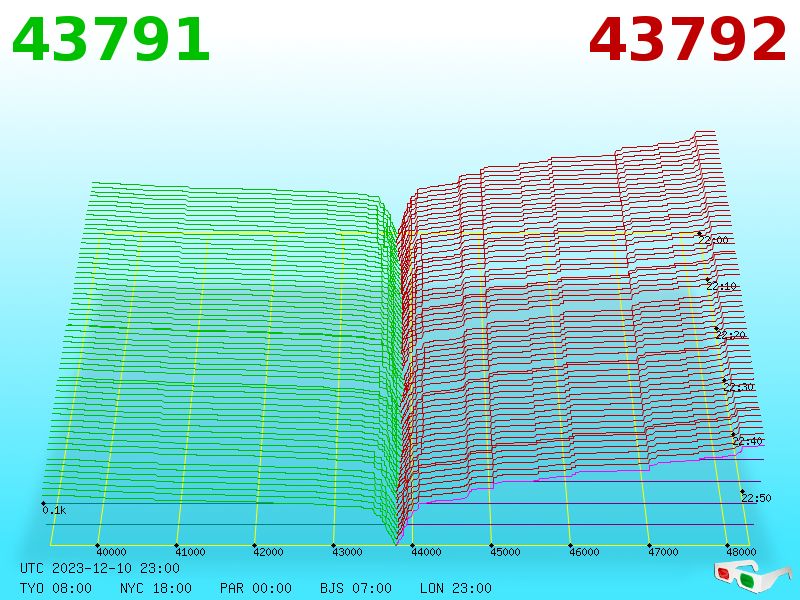

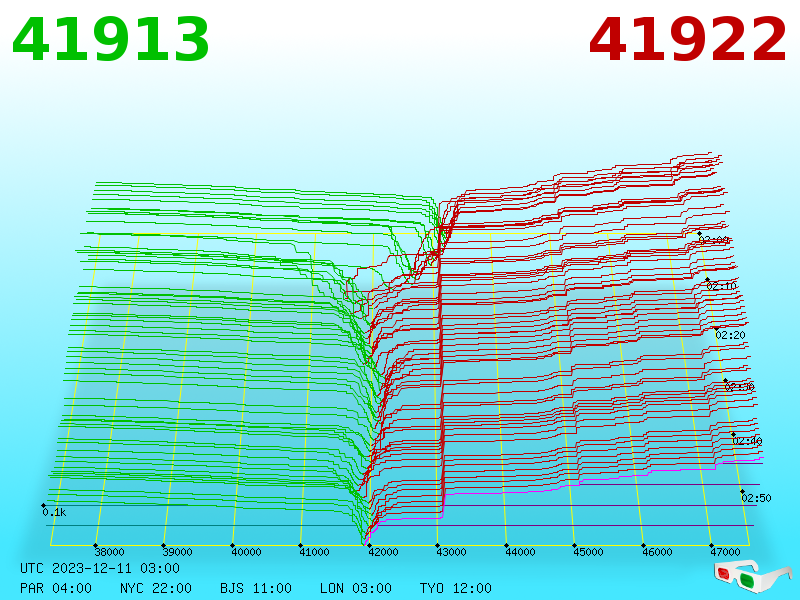

December 10, 2023, 11:01:17 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

True Myth

|

|

December 10, 2023, 11:03:24 PM |

|

On the lifestyle/retirement subject.

I was not in as early as many of you. I do not have retirement or fuck you levels of BTC stashed away. Fortunately, I am what I consider to be "very young" with a very well paying career. My sole objective has always been a responsibile early retirement. Retirement in the sense of not needing to work if I dont want to, no daily agenda of things I need to do other than necessities, and a comfortable lifestyle. I'll add that I will also be an unofficial expat once retired.

I am fortunate enough to have existing retirement assets such as pensions, annuity, 401k, (ect). All of those are not reasonably accessible to me until later in my life when social security is also available. Simply put, 60-death I should have more than enough even if I make a few poor decisions or have an emergency or two. My focus has been on filling the gap between retirement and "retirement age" with personal assets. By current conservative estimates I am on target to reach my goal in 8-10 years which puts me at an age many would consider an unsually young retirement age.

My personal assets are composed of approximately 80% Bitcoin. I have treated it as an asset that I want as much as possible of because I believe it's value will be much higher in the future than now. I project it's increase in value as the average stock market increase of 7-9% per year to keep myself conservative. Meanwhile, it's proved to smoke those estimates to date.

I have not worked out or planned what I will do with my bitcoin once I have achieved retirement level funds. I do plan to run through everything else before touching it though. Honestly, I have hoped once I am at that point I won't need to sell it for cash to use. I am hoping I can actually make direct purchases with it instead. With planning to do a bit of traveling it adds the utility of a being a worldwide currency as well.

I thought I would share this as a truthful post on how bitcoin fits into my life. I know I and others tend to post extreme "hold till I'm dead" type of comments but, that's just the fun side of WO for me. Thought this might be a helpful point of view for others who did not start buying BTC at $10 a coin.

|

|

|

|

|

|

Taskford

|

|

December 10, 2023, 11:13:25 PM |

|

Hopefully we will see 50k next week.

Have a nice week ahead.

$50k? For sure there's a lot of possibilities that it will happen. The price drop didn't come to any worse situation and bitcoin stays at $43k to $44k so provably next stop is $50k and there's still many days left for this month. Quiet positive for $50k is reachable this month. |

|

|

|

|

AlcoHoDL

Legendary

Offline Offline

Activity: 2352

Merit: 4138

Addicted to HoDLing!

|

[edited out]

For what it's worth, my experience with people of faith (mainly Christians, bus some from other religions), has been pretty negative, on average. I find many of them to be among the most aggressive, intolerant, arrogant, stubborn, closed-minded, bitter, toxic individuals I've ever met. For me, the fact that someone is deeply religious is a pretty accurate predictor of one or more of the above traits. There are exceptions, of course, but the norm seems to be like that. It's sad, really... I wouldn't wish it on anybody. I don't really like to subscribe to the theories of Bitcoin as a religion, but it seems that some of us can become the same way about bitcoin, and so to the outsiders (or the non-believers) or those who do not get bitcoin, we can come off in those kinds of similar ways in terms of our having a kind of vision that might not be shared by others - and so many times, even when people are seeming to be closed-minded and stubborn, they frequently will still like to consider themselves as being reasonable and open to a variety of views, but at the same time, are going to be wedded towards seeing the world through their own ways of framing matters... .. so I am not sure, I am feeling mixed on the topic regarding how strongly even some people feel about their beliefs, because they might actually be open in regards to some topics, while at the same time being stubborn in other topics... and yeah, sure, I have met people who are irritating to be around.. and sure sometimes it might go back to seeming to be about religion, but I am not sure the difficulties of dealing with others is merely religion.. Of course, in recent times, we have been seeing a lot of political divides, and so worship of the state or being anti-state and then dividing of camps on these kinds of grounds, but then how much anyone divides or how much they believe their party might resolve their issues might depend upon which issue(s) we are discussing.. and looking towards leaders to rescue us from our broken money system while not necessarily recognizing that the various aspects of the broken money system might be the cause of the problems and/or disagreements about not getting enough, while at the same time blaming the problem on other kinds of ways that there are inequalities and differences of opinion regarding how the pie should get divided. I wouldn't call Bitcoin (or, perhaps, "Bitcoinism") a religion, although it may seemingly share some similarities with religion, mostly attributed to Bitcoin by those who don't understand it. It is not a religion, because it is based on objectively true, real-world, physical, repeatable, verifiable processes (i.e., math & science), and does not rely at all on dogma or faith in a metaphysical set of principles. Even the traditional (and scientifically acceptable) notion of "trust" is taken out of the picture ("Don't trust, verify!"), and this is precisely what makes Bitcoin so important, so revolutionary, so scientifically significant. Contrast this with religion, where everything is based on metaphysics, dogma, and blind faith in some supernatural, all-knowing, all-powerful entity, whose existence appears to be unprovable by design. Blind faith in the success or superiority of Bitcoin, just because some fancy, self-proclaimed Bitcoin "priest" says so, is the wrong way to approach this (did you know that Craig S. Wright is [also] a theologian, and calls himself a " pastor"?). Satoshi Nakamoto is no God, and the White Paper is not some Bitcoin bible to be worshiped and blindly accepted as truth, but a scientific paper, open to scrutiny and experimental evaluation. This evaluation (which is extremely brutal, as there's big money involved) has been going on for nearly 15 years non-stop, and no fundamental flaws have been found. Even with such a great track record, I will be the first to reject Bitcoin the moment a weakness is discovered in its code base, that makes the code so fundamentally flawed that it cannot be patched. Surely, I will be deeply disappointed if this ever happens, but I don't expect it to happen any time soon, if ever. This reminds me of Bitconnect (some old lulz here), where all the people in the video were effectively disciples of a religion/cult, driven by greed. And we all know what happened. Not with Bitcoin. This is science, not metaphysics, and those who see it that way are missing the point. But I do see the logic behind the points you're making. Humans have a tendency to want to "belong" to some superior group, call it a society, cult, religion, whatever. So people may see Bitcoin as a kind of special club they want to belong to, even though they don't understand it. Come to think of it, still good for them if they become coiners, as long as they stick to BTC, rather than BSV, BCH, or other "crypto" varieties. That's why understanding is so important. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10179

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 10, 2023, 11:30:38 PM |

|

I like seeing Bitcoin on the rise, but have this eerie feeling it will not mean much by the time it really takes off (hopefully wrong about that).

I am not sure what you mean. If you are suggesting that there is some kind of a correction, then why would any kind of correction matter, if the price ends up "taking off" and then presumptively going past our current price, going past $50k, going past previous ATH and at minimum ending up supra $80k.. .. You would be presuming that at least the minimum has decently good chances in the next 1 to 2 years and so that would be a doubling of whatever you have into bitcoin in 1-2 years. Sure, it is possible that even the "minimum" does not end up playing out, but you don't really seem to be suggesting that kind of a scenario, are you? Now on the upside, there are a lot of really decent scenarios ranging from supra $100k to $2.5 million and above, but surely even many of the really decent upside scenarios seem to be erroring quite low in the range, which seems to be $500k or lower, but even that would not be bad, and we cannot take any of those various upside scenarios for granted, and we cannot even take for granted that we are going to get up from here rather than sideways or down, but hardly any of us who have been studying bitcoin for very long would consider sideways or down from here scenarios to have better than 50/50 chances, and maybe even we might be assigning less than 35% odds to those kinds of downity and/or sideways scenarios... so what is the "hopefully [I'm] wrong about that" part of your statement? No need to splurge and act like a high-roller when that really means just being another consumerist sucker.

Yes, and it's even worse when not enjoying spending, turning into a jaded consumerist. Remind me why we do this again? I would think that many of us do it in order to have more options. So, if we are looking at having bitcoin versus not having bitcoin, having bitcoin seems to give us more options, even if we may or may not end up getting rich off of the matter. Probably, bitcoin also gives hope because there are not too many investments in which anyone can have hope, and surely people buy real estate and houses for themselves at least, because they can say at least they have a place to live, but surely houses are not very liquid and we still have to eat and engage in various other activities besides just having a house.. even though surely it is nice to have a house, but even if we completely own the house, some people run out of abilities to pay for the taxes (and/or other costs) of completely owning a house, so there should continue to be some value in terms of having liquid value, even surely there are ongoing attempts to attack bitcoin's liquidity, but I doubt many of us HODLers consider that bitcoin liquidity is going to be falling merely because there are various avenues in which rich people and governments are likely considering that they are going to have some success in terms of channeling normies into official financial products... yet bitcoin does allow us various kinds of powers to transact peer to peer. .and likely there are going to continue to be ways to transact in those kinds of direct ways, even if there are going to likely be ongoing challenges too... where are we keeping our keys and have various avenues to interact been shut down.. an we run an app on our phone? or do we have to use the computer or do we have to resort to some other means of transacting? [edited out]

Why don't you move to a better place where things are much cheaper and the rent doesn't cost you 700 euros per month? In many countries people live for less then $200 per month and that life isn't just simple living but fully enjoyable living for that amount. I know in many places the rent for a whole house if around $100 to $150 per month where you can get 2 bed rooms and 2 bathrooms plus a 1000 sq ft area. If you purpose is to save money then my suggestion would help you better but if your purpose is to save your money and not utilize your Bitcoin earned wealth then you might do whatever suits you better. I doubt that UnDerDoG81's purpose is to merely save money. He is describing various expenses that he has and plus options that he has to upgrade if he wants to, yet he still chooses to live with a slightly smaller budget and to choose a bit less luxury. .and sure there is a balance with a combination of savings and choice of consumption. I don't have any problem with the idea of relocating for less expenses and maybe even being able to upgrade your lifestyle by moving to an area that has lower costs of living, but at the same time, there tend to be quite a few costs regarding getting used to living in new areas - including that we would not be able to bring our friends with us too. We have got this life for one time only and we must have to enjoy it fully. We won't return to planet Earth after departure so it's not really needed to live below average life when you have the money that you can spend to acquire things that make your life more enjoyable. I won't say that it's fair to waste money but utilizing money is needed sometimes in order to have pure happiness in our lives.

You are not really saying anything different from UnDerDoG81, except you seem to be presuming that the mere running of a budget and living within limits is a kind of great sacrifice - and sure living within a budget does bring sacrifice, but it does not necessarily mean that we perceive ourselves to be suffering or to unable to enjoy any luxuries. It just remains a matter of choice how many luxuries to partake and then the extent to which our luxuries might end up costing us more because we failed/refused to sufficiently and adequately defer gratification. Let's say for example, I have gotten to 10 bitcoin, and I need a new car because it helps me to work and to enjoy life. So if I don't have the cash to buy the new car and I need to dip into various resources and to cut my spending and maybe I only have to dip into less than 0.5 bitcoin to buy a practical car, I might be able to do much better for my longer term future, and maybe not even end up depleting my bitcoin stash by very much because I am able to continue accumulating BTC as compared to someone who might choose a more luxurious and easy path to end up spending 2-3 bitcoins to buy a more luxurious car and maybe not engaging in the various efforts to cut spending in other areas. So maybe the person with the more frugal spending might be able to continue to accumulate bitcoin to get up to 12 BTC or so within the next 8-10 years, and the person who is continuing to make choices to spend more and to live it up might still be at 7-8 BTC (or maybe even fewer BTC) 8-10 years from now, and so even in accordance with my entry-level fuck you status chart, the person with 12 BTC may even get up to western entry level fuck you status in 2031 or so, and the person with only 7-8 BTC might not get there until 2033 or 2044.. and sure maybe I am presuming too many things, but still trying to give an example of how these kinds of matters can make pretty decently large differences with the passage of time. Exactly!!! It is gone. It got pulled. -gif- That 24 hour review does end un highlighting the poofed-ness of that wall, and such poofed-ness might cause some of us to wonder whether it is going to come back or not. That is one of the interesting things about actually noticing walls, and wondering if they serve some kind of a purpose, and sometimes they will also move quite a bit, and it can be a kind of demonstration that some entity either has coins to sell (on the ask side) or money to buy BTC (on the buy side), and surely one of our favorites do play out if the walls are eaten rather than moved around and there have actually been some times in which walls were eaten really quickly, which will sometimes cause some of us to speculate that maybe the bluff (or the play) did not end up working out as planned. . but that it is one of the risks that any whale takes when s/he might be trying to keep the price within a range, and the play does not end up working out.. getting back to the idea of fake walls versus real walls, and it is difficult for anyone (outside of the person who put it up) to really know if the wall is real or fake.. we can ONLY infer. I couldn't tell if the wall was out of frame or moved/pulled. It does seem to wash down towards the spread. 3 hour Wall recapThe wall could have also been sort of random. If you've worked at a restaurant you might have noticed times that there were no customers for hours, and then out of no where everyone seems to just start piling in. That was a pretty steep wall, but it was on a very round number. Yeah, but that is how these kinds of walls work. They get placed, and sure, the person who placed it could have moved it and put it at another location, but usually if they are just trying to bluff the market, they might put the wall closer to the actual price, especially if the actual price is getting further away rather than putting the wall further away. Another thing that can happen is that the wall will get put back in place when the BTC price starts to get closer to that $48k-ish price. So walls that disappear are not necessarily permanently gone, and maybe one of the better case scenarios would be if the wall got put back in place at $48k when the BTC price was about to return to and to break through $45k, and so the wall is put in place as a kind of deterrent, yet maybe the BTC price rushes up so fast that the wall gets eaten up faster than it can get pulled... and even better if the BTC price keeps going past the price of the wall and does not return, which frequently cause problems for people (or institutions) that are placing those kinds of walls as mechanisms to deter rather than really wanting to sell at that price. is the wall gone?

Feels like it's out there somewhere, just biding its time. Yes. The wall might get reactivated at some point, and it could get put at the same price, it could get put at a lower price or it could get put at a higher price.. We will see if and/or when it comes back, and surely your little 24 hour revision does make it easier to catch as long as it might get placed over several hours, rather than getting placed and pulled right away.. which those kinds of wall-manipulation behaviors happen from time to time too. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

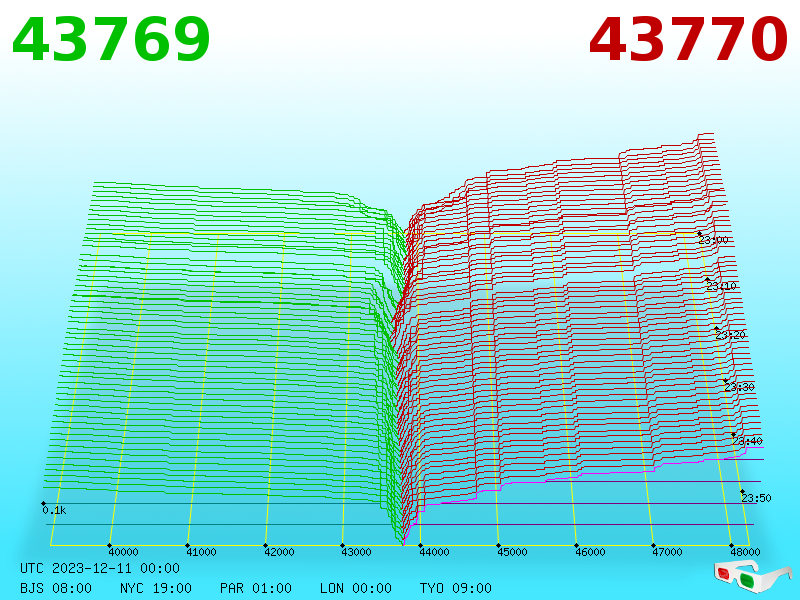

December 11, 2023, 12:01:22 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

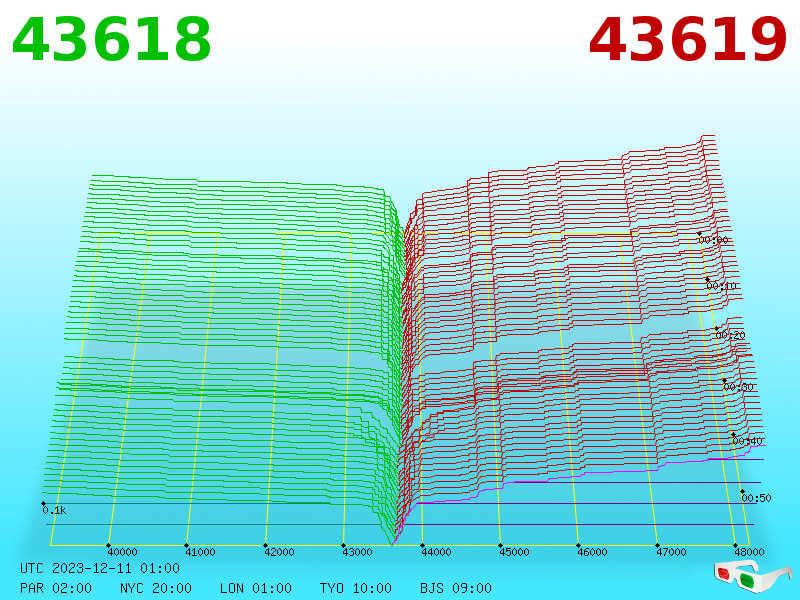

December 11, 2023, 01:01:17 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

December 11, 2023, 01:22:52 AM

Last edit: December 11, 2023, 01:48:12 AM by Biodom Merited by JayJuanGee (1), True Myth (1) |

|

On the lifestyle/retirement subject.

I was not in as early as many of you. I do not have retirement or fuck you levels of BTC stashed away. Fortunately, I am what I consider to be "very young" with a very well paying career. My sole objective has always been a responsibile early retirement. Retirement in the sense of not needing to work if I dont want to, no daily agenda of things I need to do other than necessities, and a comfortable lifestyle. I'll add that I will also be an unofficial expat once retired.

I am fortunate enough to have existing retirement assets such as pensions, annuity, 401k, (ect). All of those are not reasonably accessible to me until later in my life when social security is also available. Simply put, 60-death I should have more than enough even if I make a few poor decisions or have an emergency or two. My focus has been on filling the gap between retirement and "retirement age" with personal assets. By current conservative estimates I am on target to reach my goal in 8-10 years which puts me at an age many would consider an unsually young retirement age.

My personal assets are composed of approximately 80% Bitcoin. I have treated it as an asset that I want as much as possible of because I believe it's value will be much higher in the future than now. I project it's increase in value as the average stock market increase of 7-9% per year to keep myself conservative. Meanwhile, it's proved to smoke those estimates to date.

I have not worked out or planned what I will do with my bitcoin once I have achieved retirement level funds. I do plan to run through everything else before touching it though. Honestly, I have hoped once I am at that point I won't need to sell it for cash to use. I am hoping I can actually make direct purchases with it instead. With planning to do a bit of traveling it adds the utility of a being a worldwide currency as well.

I thought I would share this as a truthful post on how bitcoin fits into my life. I know I and others tend to post extreme "hold till I'm dead" type of comments but, that's just the fun side of WO for me. Thought this might be a helpful point of view for others who did not start buying BTC at $10 a coin.

Nice plan...here is a very 'old' remark on love, happiness and money: https://www.youtube.com/watch?v=srwxJUXPHvEEDIT: BTw, the investanswers "character" (James) on youtube claims that there could be only 300 thou people having at least one bitcoin (maybe he meant the situation of buying roght now). Here are more solid stats, perhaps: 859 thou addr with 1-10 btc 139 thou with 10-100 14 thou with 100-1000 Source: https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html |

|

|

|

|

|

True Myth

|

|

December 11, 2023, 01:40:59 AM Merited by JayJuanGee (1) |

|

On the lifestyle/retirement subject.

I was not in as early as many of you. I do not have retirement or fuck you levels of BTC stashed away. Fortunately, I am what I consider to be "very young" with a very well paying career. My sole objective has always been a responsibile early retirement. Retirement in the sense of not needing to work if I dont want to, no daily agenda of things I need to do other than necessities, and a comfortable lifestyle. I'll add that I will also be an unofficial expat once retired.

I am fortunate enough to have existing retirement assets such as pensions, annuity, 401k, (ect). All of those are not reasonably accessible to me until later in my life when social security is also available. Simply put, 60-death I should have more than enough even if I make a few poor decisions or have an emergency or two. My focus has been on filling the gap between retirement and "retirement age" with personal assets. By current conservative estimates I am on target to reach my goal in 8-10 years which puts me at an age many would consider an unsually young retirement age.

My personal assets are composed of approximately 80% Bitcoin. I have treated it as an asset that I want as much as possible of because I believe it's value will be much higher in the future than now. I project it's increase in value as the average stock market increase of 7-9% per year to keep myself conservative. Meanwhile, it's proved to smoke those estimates to date.

I have not worked out or planned what I will do with my bitcoin once I have achieved retirement level funds. I do plan to run through everything else before touching it though. Honestly, I have hoped once I am at that point I won't need to sell it for cash to use. I am hoping I can actually make direct purchases with it instead. With planning to do a bit of traveling it adds the utility of a being a worldwide currency as well.

I thought I would share this as a truthful post on how bitcoin fits into my life. I know I and others tend to post extreme "hold till I'm dead" type of comments but, that's just the fun side of WO for me. Thought this might be a helpful point of view for others who did not start buying BTC at $10 a coin.

Nice plan...here is a a very 'old' remark on love, happiness and money: https://www.youtube.com/watch?v=srwxJUXPHvEHaha got a chuckle out of that one. Money doesn't buy happiness or love but, it is a necessity to operate in today's society. If I wake up tomorrow and decide I'd rather sit beach side for the next two weeks, then go hiking in South East Asia for 3 weeks, followed by site seeing some islands in the gulf of Thailand until I'm bored... I'd end up losing my job resulting in being unable to pay for my home ect... Many people "live so they are able to work" until they retire at an age where they have begun deteriorating physically and often mentally. While I enjoy my career, there are many other things I'd prefer to do if I didn't require a weekly paycheck to maintain a roof over my head and food on my table. Sure, there are people that do not have money and are still happy. That is not what I want in my life or can have due to personal reasons and preferences. Besides, if you don't have a dream or a goal what's the purpose of getting out of bed in the morning? |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10179

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 11, 2023, 01:44:06 AM

Last edit: December 11, 2023, 01:58:04 AM by JayJuanGee Merited by AlcoHoDL (2), True Myth (1) |

|

On the lifestyle/retirement subject.

I was not in as early as many of you. I do not have retirement or fuck you levels of BTC stashed away. Fortunately, I am what I consider to be "very young" with a very well paying career. My sole objective has always been a responsibile early retirement. Retirement in the sense of not needing to work if I dont want to, no daily agenda of things I need to do other than necessities, and a comfortable lifestyle. I'll add that I will also be an unofficial expat once retired.

I am fortunate enough to have existing retirement assets such as pensions, annuity, 401k, (ect). All of those are not reasonably accessible to me until later in my life when social security is also available. Simply put, 60-death I should have more than enough even if I make a few poor decisions or have an emergency or two. My focus has been on filling the gap between retirement and "retirement age" with personal assets. By current conservative estimates I am on target to reach my goal in 8-10 years which puts me at an age many would consider an unsually young retirement age.

My personal assets are composed of approximately 80% Bitcoin. I have treated it as an asset that I want as much as possible of because I believe it's value will be much higher in the future than now. I project it's increase in value as the average stock market increase of 7-9% per year to keep myself conservative. Meanwhile, it's proved to smoke those estimates to date.

I have not worked out or planned what I will do with my bitcoin once I have achieved retirement level funds. I do plan to run through everything else before touching it though. Honestly, I have hoped once I am at that point I won't need to sell it for cash to use. I am hoping I can actually make direct purchases with it instead. With planning to do a bit of traveling it adds the utility of a being a worldwide currency as well.

I thought I would share this as a truthful post on how bitcoin fits into my life. I know I and others tend to post extreme "hold till I'm dead" type of comments but, that's just the fun side of WO for me. Thought this might be a helpful point of view for others who did not start buying BTC at $10 a coin.

You might consider my sustainable withdraw thread to be helpful in terms of the kinds of ideas regarding how to consider withdrawing bitcoin and valuing it, and my fuck you status post (and chart) for how many BTC you might need to have by certain points in your bitcoin journey. Of course, if you end up retiring 20-30 years prior to your normal retirement age, and maybe we can use 60 as that age (since that is what you mentioned as the age in which your normal retirement money would come in), then surely you would have to have bitcoin sustain you for the time that you stop working and the time that those other sources of income (cashflow) start to become available to you... so yeah, if you end up retiring 20 to 30 years early.. (so maybe at the age 35 to 40?) then you would have to make sure that whatever you are doing, including your withdrawal rate is meaningful, because it probably would not be a good thing to deplete your principle, even if you get to the age 60 and more funds come available.. those extra funds that come available when you are around 60 should be considered as supplements rather than something that rescues you because you had overly depleted the withdrawal rate on your investment (namely bitcoin in this case). I personally attempt to consider that we should be attempting to value bitcoin in terms of today's dollar value, so we should be attempting to presume that any future projection of how much we need is accurate in terms of today's dollars, but at the same time, it is quite likely that the way that the dollar (and other fiat currencies) have been so heavily debased in the last several years, there are vary low odds that various kinds of hyper-inflation are not going to kick in at various times, so surely it may well be better to be earning money during those kinds of times rather than being stuck with cashflows that come from various kinds of fixed income sources.. and perhaps bitcoin might be one of the ONLY assets that have any kind of decently good chances of both being able to keep up with inflation (and the ongoing degradation of money) and being able to have some sort of price appreciation on top of it. There have been many assessments of both stocks and property values that likely show that they have not really gone up in value over the past 20-30 years, but instead have merely been keeping pace with the ongoing degradation of the dollar, so it is kind of a misconception and even a lopsided way in which the ONLY people who have not lost as much are those who are invested, versus anyone who has been relying on cash and income and other ways of saving (not talking about bitcoin) have not really been able to keep up at all, and so bitcoin so far seems to be one of the ONLY ones that is regularly outpacing the degradation of the dollar.. and sure there are some stocks and properties that outperform the others, so there are some ways that you could have had selected stocks that generally outperform index funds and the rest of the market.. but we know that many times asset managers do not even have much luck in terms of just being able to out perform index funds. [edited out]

For what it's worth, my experience with people of faith (mainly Christians, bus some from other religions), has been pretty negative, on average. I find many of them to be among the most aggressive, intolerant, arrogant, stubborn, closed-minded, bitter, toxic individuals I've ever met. For me, the fact that someone is deeply religious is a pretty accurate predictor of one or more of the above traits. There are exceptions, of course, but the norm seems to be like that. It's sad, really... I wouldn't wish it on anybody. I don't really like to subscribe to the theories of Bitcoin as a religion, but it seems that some of us can become the same way about bitcoin, and so to the outsiders (or the non-believers) or those who do not get bitcoin, we can come off in those kinds of similar ways in terms of our having a kind of vision that might not be shared by others - and so many times, even when people are seeming to be closed-minded and stubborn, they frequently will still like to consider themselves as being reasonable and open to a variety of views, but at the same time, are going to be wedded towards seeing the world through their own ways of framing matters... .. so I am not sure, I am feeling mixed on the topic regarding how strongly even some people feel about their beliefs, because they might actually be open in regards to some topics, while at the same time being stubborn in other topics... and yeah, sure, I have met people who are irritating to be around.. and sure sometimes it might go back to seeming to be about religion, but I am not sure the difficulties of dealing with others is merely religion.. Of course, in recent times, we have been seeing a lot of political divides, and so worship of the state or being anti-state and then dividing of camps on these kinds of grounds, but then how much anyone divides or how much they believe their party might resolve their issues might depend upon which issue(s) we are discussing.. and looking towards leaders to rescue us from our broken money system while not necessarily recognizing that the various aspects of the broken money system might be the cause of the problems and/or disagreements about not getting enough, while at the same time blaming the problem on other kinds of ways that there are inequalities and differences of opinion regarding how the pie should get divided. I wouldn't call Bitcoin (or, perhaps, "Bitcoinism") a religion, although it may seemingly share some similarities with religion, mostly attributed to Bitcoin by those who don't understand it. It is not a religion, because it is based on objectively true, real-world, physical, repeatable, verifiable processes (i.e., math & science) I can see that you are serious, especially since you use maths and sciences in the singular. , and does not rely at all on dogma or faith in a metaphysical set of principles.

There's gotta be some faith in there, even though there is a lot of laden maths and science.. I am not going to deny the existence of maths and science, yet one interesting thing about bitcoin is that it has some ways in which it ties back to human behavior, human incentives, which is the proof of work part that can be gamed and manipulated, but it would have a lot of difficulties to overcome the built in incentives and even the presumptions that man will work in his self-interest. Sure, many of us likely realize that satoshi came up with something that must be very close to a perfect design, but bitcoin is still man made and likely and invention and a discovery all at the same time. Even the traditional (and scientifically acceptable) notion of "trust" is taken out of the picture ("Don't trust, verify!"),

remember the Regan statement. Trust, but verify. We have to have some of that going on, too. Surely not every normie is going to want to or be able to run a node, so we have to have some trust and faith that some of the open source aspects of bitcoin are going to be checked-and-balanced by some other people who have the skills to do the checking (the crowd sourcing idea) and if enough eyes are on bitcoin, then likely any flaws that exist are going to mostly get fixed... maybe not perfectly, but perfectly enough.. and surely the older people might not be able to change careers and learn how to code and to check code, but we still have to figure out the extent to which we are going to run some of the software and the extent to which are going to try to verify some of the matters for ourselves, to the extent that we are able to verify, and maybe those difficulties to verify matters scare away some of the older people, but some younger people may well be more than willing to go down the road of learning some of those kinds of bitcoin-related things. But, you know that I have said to several young people that they should look into bitcoin and if I were younger, I may or may not choose to go to college, but I would like to spend some of my time learning about the world from a bitcoin related angle (bitcoin bitcoin bitcoin, not shitcoins.. stay away from shitcoins).. and so surely I might be too old of a person to be suggesting areas in which might be good for young people and I kind of remind myself about the movie "the graduate" in which the advice was "one word," "plastics" "There is a great future in plastics. Will you think about it?" Substitute "plastics" for bitcoin. Or perhaps another perspective is to communicate the one word in this way: https://twitter.com/frankiemacd/status/1731825464551821709and this is precisely what makes Bitcoin so important, so revolutionary, so scientifically significant. Contrast this with religion, where everything is based on metaphysics, dogma, and blind faith in some supernatural, all-knowing, all-powerful entity, whose existence appears to be unprovable by design.

Really hard to argue with any of that... but there are some religious people in bitcoin and bitcoin is for everyone, so there are going to be smart people, dumb people, evil people, religious people and not religious people in bitcoin, and sure some of them are going to know bitcoin better than others, but merely because some folks have a lot of religion does not necessarily mean that they are not somehow able to resolve some of that religiousness and still be smart about bitcoin. I am not sure if I should name any names, but there are are quite a few people who are pretty religious, but still quite prominent in bitcoin and even writing books on the topic that are not even dumb. Blind faith in the success or superiority of Bitcoin, just because some fancy, self-proclaimed Bitcoin "priest" says so, is the wrong way to approach this

I don't really disagree with you, but there are a lot of us who do attempt to trust some people more than others, and I am not able to verify everything myself, so I kind of have some faith about some aspects of what people are saying about certain aspects of bitcoin, especially some of the technical - software and hardware matters.. and even lightning and there are so many areas in which bitcoin-related matters are being built and there is ONLY so much due diligence that I can do, and even many others seem to know even less than me in some areas, but then they seem to be way smarter than me in other areas.. I even seen some really smart people in bitcoin say some pretty dumb stuff, but then they seem to be right about a lot of other stuff.. I am not even sure if I can pinpoint the various differences, and some times there are some people who I believe that I agree with them about everything, then all of a sudden they say some really silly and/or dumb things.. and I don't necessarily take away from their credibility in all areas, even if I might have identified some areas in which I am not in agreement with them or that I believe that I know better in that particular area or way of framing matters. (did you know that Craig S. Wright is [also] a theologian, and calls himself a " pastor"?). Yes.. he is ridiculous.. and not really much of a good example of anything.. except for maybe being somewhat capable of convincing dumb people about things that they seem to want to believe. Satoshi Nakamoto is no God, and the White Paper is not some Bitcoin bible to be worshiped and blindly accepted as truth, but a scientific paper, open to scrutiny and experimental evaluation.

Well, yeah, Satoshi went away, which does seem to lock in some aspects of what he did and said, and yeah there are several ways in which the current implementations of bitcoin goes beyond the whitepaper in several ways and some aspects of the whitepaper does not seem to capture very well some of the consensus based movements of bitcoin over the last nearly 15 years that it has been running (well it will be about 15 years on January 3). This evaluation (which is extremely brutal, as there's big money involved) has been going on for nearly 15 years non-stop, and no fundamental flaws have been found. Even with such a great track record, I will be the first to reject Bitcoin the moment a weakness is discovered in its code base, that makes the code so fundamentally flawed that it cannot be patched. Surely, I will be deeply disappointed if this ever happens, but I don't expect it to happen any time soon, if ever.

Fair enough. I have maintained a similar position, yet there are people who get into shitcoins because they might not have enough confidence in bitcoin so they hedge their bets. I did not feel that way about Bcash, and so I did sell my Bcash soon after getting airdropped and figuring out how to do it.. but at the same time, there were a lot of smart people who hedged their uncertainties about bitcoin by keeping their Bcash.. just in case.. and I am not even sure if that ended up being a bad decision, even though monetarily it did not work out and it was not the one that I choose to make... because I thought bcash was a bunch of bullshit from the start... mostly based on their seemingly wanting to be able to change bitcoin so easily.. so I had already identified the difficulties to change bitcoin as a feature rather than a bug, and so the bcash era was a time in which our resolve was tested in terms of if we were able to identify the difference between the two. and surely I was not really looking at bitcoin versus bcash from a technical position but in stead from a kind of maintaining the status quo position for something that was not broken (namely bitcoin) so the various dramatic proposals regarding how to fix bitcoin seemed to me to be quite misplace during that era. This reminds me of Bitconnect (some old lulz here), where all the people in the video were effectively disciples of a religion/cult, driven by greed. And we all know what happened. I am not sure if bitconnect or even one coin and some of those others were very good examples of a way to deviate from bitcoin, but yeah, I get your religious angle on bitconnect. Not with Bitcoin. This is science, not metaphysics, and those who see it that way are missing the point.

But I do see the logic behind the points you're making. Humans have a tendency to want to "belong" to some superior group, call it a society, cult, religion, whatever. So people may see Bitcoin as a kind of special club they want to belong to, even though they don't understand it. Come to think of it, still good for them if they become coiners, as long as they stick to BTC, rather than BSV, BCH, or other "crypto" varieties. That's why understanding is so important.

Yeah... I am not sure why it seems to take a while for people to come over to bitcoin.. and maybe if either you or I might have come to bitcoin in a different way, then maybe we would have had been more vulnerable to get distracted by some of the dumb anti-bitcoin talking points.. and maybe I am being too cruel to suggest that all the talking points are dumb because some of the other talking points seem to be quite convincing... especially if you haven't studied bitcoin first, then you end up getting lured into such shitcoin and then when you invest into it, then you might end up being biased by your investment (the weight of your shitcoin bags). You and I probably are not even thinking about these matters very differently, and it is good to hear different ways of expressing matters, but both of us still come back to a lot of similar ideas, even if we might phrase some of our observations differently. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 11, 2023, 02:01:16 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

True Myth

|

You might consider my sustainable withdraw thread to be helpful in terms of the kinds of ideas regarding how to consider withdrawing bitcoin and valuing it, and my fuck you status thread for how many BTC you might need to have by certain points in your journey.

Of course, if you end up retiring 20-30 years prior to your normal retirement age, and maybe we can use 60 as that age (since that is what you mentioned), then surely you would have to have bitcoin retain you for the time that you stop working and the time that those other sources of income (cashflow) start to become available to you.

I personally attempt to consider that we should be attempting to value bitcoin in terms of today's dollar value, so we should be attempting to presume that any future projection of how much we need is accurate in terms of today's dollars, but at the same time, it is quite likely that the way that the dollar (and other fiat currencies) have been so heavily debased in the last several years, there are vary low odds that various kinds of hyper-inflation are not going to kick in at various times, so surely it may well be better to be earning money during those kinds of times rather than being stuck with cashflows that come from various kinds of fixed income sources.. and perhaps bitcoin might be one of the ONLY assets that have any kind of decently good chances of both being able to keep up with inflation (and the ongoing degradation of money) and being able to have some sort of price appreciation on top of it.

There have been many assessments of both stocks and property values that likely show that they have not really gone up in value over the past 20-30 years, but instead have merely been keeping pace with the ongoing degradation of the dollar, so it is kind of a misconception and even a lopsided way in which the ONLY people who have not lost as much are those who are invested, versus anyone who has been relying on cash and income and other ways of saving (not talking about bitcoin) have not really been able to keep up at all, and so bitcoin so far seems to be one of the ONLY ones that is regularly outpacing the degradation of the dollar.. and sure there are some stocks and properties that outperform the others, so there are some ways that you could have had selected stocks that generally outperform index funds and the rest of the market.. but we know that many times asset managers do not even have much luck in terms of just being able to out perform index funds.

I appreciate the feedback and insight. I did read through your posts that you mentioned and found some helpful information. Explaining to other people that keeping large sums of money in a "savings account" is actually resulting in them losing money over time is a struggle I run into. They ussually say something like but, "I get a 2.5% interest rate so I'm actually gaining money." They fail to understand inflation and its affects on their buying power. I got funny looks from the account manager at the bank the day I went in to close my savings account and withdraw all of it. She told me I have the highest interest rate possible because I was grandfathered into a high yield account. She said we dont even offer that high of a rate anymore so why would I want to lose that. I asked her what the rate was and she said 3%. I told her that's not enough please close the account. She was in disbelief. Cost of living is another factor that varies greatly and is impacted by inflation. That is part of the reason why I mention becoming an unofficial expat. I do not have some sort of great patriotism that ties me to any one country. I am perfectly happy hopping around to what ever country fits my wants or needs at any point in my life once retired. There are obviously factors such as standard of living, cost of living, political climate, and Healthcare system that must be taken into account though. The value of my "over 60 assets" and its buying power is definitely something that concerns me as they are tied to the US economy and USD strength. The world is an unpredictable place and the only thing certain is change. Sometimes I wonder if I made the right decision not to empty those accounts, take the early withdraw fee, and buy BTC with it. I have a friend that did this in 2017 and it obviously worked out for him so far. |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

December 11, 2023, 02:34:41 AM

Last edit: December 11, 2023, 02:48:28 AM by Biodom Merited by vapourminer (1), JayJuanGee (1) |

|

Well, using a bit of leverage would have worked during 2014-2015, in early 2017, in late 2018 and 2022, but in my experience, significant leverage always kills your account in the end...maybe that's why i was a bit worried about M. Saylor in late 2022, but, apparently, he did not have any covenants that would have caused him to buy back the loan at that time, despite the fact that MSTR book value was probably deeply negative back then. If he would have been obligated to buy back the loans, MSTR would have to sell into a 'hole", then go bankrupt, and btc would dip even more. There are multiple stories about successes, like people using credit card debt and buying gobs of btc in 2015, but the stories of some who did the same in an inopportune time are not being told and, obviously, you could have put yourself in a pickle by doing this in late 2017 and 2021. So, my general thought about the leverage is...just don't do it! EDIT: someone wants to create the negative weekly handle in US or close the CME gap? $41894 read...  |

|

|

|

|

|

True Myth

|

Well, using a bit of leverage would have worked during 2014-2015, in early 2017, in late 2018 and 2022, but in my experience, significant leverage always kills your account in the end...maybe that's why i was a bit worried about M. Saylor in late 2022, but, apparently, he did not have any covenants that would have caused him to buy back the loan at that time, despite the fact that MSTR book value was probably deeply negative back then. If he would have been obligated to buy back the loans, MSTR would have to sell into a 'hole", then go bankrupt, and btc would dip even more. There are multiple stories about successes, like people using credit card debt and buying gobs of btc in 2015, but the stories of some who did the same in an inopportune time are not being told and, obviously, you could have put yourself in a pickle by doing this in late 2017 and 2021. So, my general thought about the leverage is...just don't do it! EDIT: someone wants to create the negative weekly handle in US or close the CME gap? $41894 read...  If this was in reference to my post above yours, I am not referencing leverage. I talking about accounts like a 401k. If you withdraw before you are 60 years old there is the typical income tax (let's say 24%) plus an additional 10% fee since you are not 60 years old. So, if in 2017 someone emptied say $100,000usd from thier 401k they would end up with $66,000usd. They then used that to buy bitcoin with. No leverage involved. Only the bet that you make up the $34,000 you had to pay as well as any compounded interest you would of made if it remained in the 401k. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

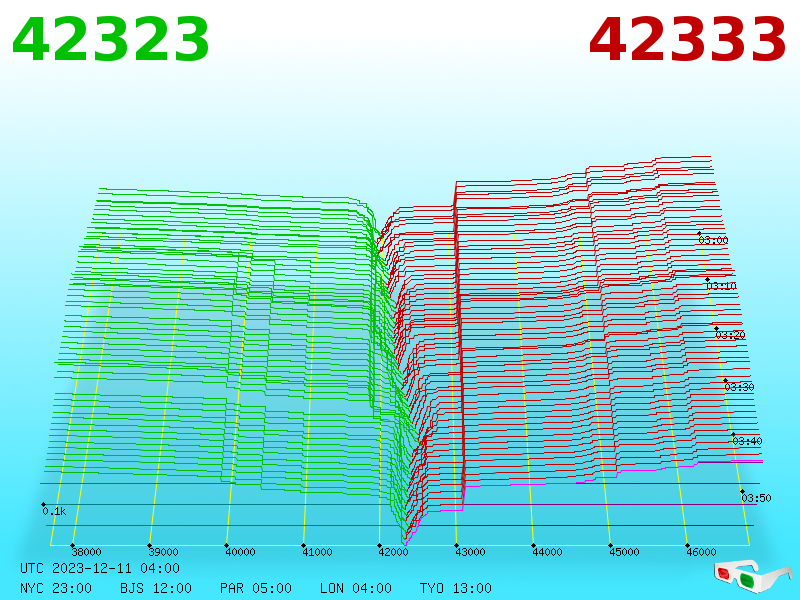

December 11, 2023, 03:03:25 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

Well, using a bit of leverage would have worked during 2014-2015, in early 2017, in late 2018 and 2022, but in my experience, significant leverage always kills your account in the end...maybe that's why i was a bit worried about M. Saylor in late 2022, but, apparently, he did not have any covenants that would have caused him to buy back the loan at that time, despite the fact that MSTR book value was probably deeply negative back then. If he would have been obligated to buy back the loans, MSTR would have to sell into a 'hole", then go bankrupt, and btc would dip even more. There are multiple stories about successes, like people using credit card debt and buying gobs of btc in 2015, but the stories of some who did the same in an inopportune time are not being told and, obviously, you could have put yourself in a pickle by doing this in late 2017 and 2021. So, my general thought about the leverage is...just don't do it! EDIT: someone wants to create the negative weekly handle in US or close the CME gap? $41894 read...  If this was in reference to my post above yours, I am not referencing leverage. I talking about accounts like a 401k. If you withdraw before you are 60 years old there is the typical income tax (let's say 24%) plus an additional 10% fee since you are not 60 years old. So, if in 2017 someone emptied say $100,000usd from thier 401k they would end up with $66,000usd. They then used that to buy bitcoin with. No leverage involved. Only the bet that you make up the $34,000 you had to pay as well as any compounded interest you would of made if it remained in the 401k. i did not quote your post..therefore it was not in response, but simply influenced by. Your scenario could be called a "sacrificial lamb" trade. I wouldn't lose 34% upfront voluntarily on anything, though, as there is no guarantee of making it back. In that sense, small leverage (like 10-25%) looks like a better course of action, at least to me. BTW, in 2017 (and since the fall of 2015) someone could have bought GBTC in the retirement account (IRA, not sure about 401K). More drastically, someone could have quit or change jobs, then transfer money from 401K to IRA, then buy GBTC there...no need to lose 34% upfront. |

|

|

|

|

|

modrobert

|

I like seeing Bitcoin on the rise, but have this eerie feeling it will not mean much by the time it really takes off (hopefully wrong about that).

I am not sure what you mean. If you are suggesting that there is some kind of a correction, then why would any kind of correction matter, if the price ends up "taking off" and then presumptively going past our current price, going past $50k, going past previous ATH and at minimum ending up supra $80k.. .. You would be presuming that at least the minimum has decently good chances in the next 1 to 2 years and so that would be a doubling of whatever you have into bitcoin in 1-2 years. Sure, it is possible that even the "minimum" does not end up playing out, but you don't really seem to be suggesting that kind of a scenario, are you? Now on the upside, there are a lot of really decent scenarios ranging from supra $100k to $2.5 million and above, but surely even many of the really decent upside scenarios seem to be erroring quite low in the range, which seems to be $500k or lower, but even that would not be bad, and we cannot take any of those various upside scenarios for granted, and we cannot even take for granted that we are going to get up from here rather than sideways or down, but hardly any of us who have been studying bitcoin for very long would consider sideways or down from here scenarios to have better than 50/50 chances, and maybe even we might be assigning less than 35% odds to those kinds of downity and/or sideways scenarios... so what is the "hopefully [I'm] wrong about that" part of your statement? I was thinking that something besides Bitcoin turns to shit by the time the price takes off; hyperinflation, chaos, world war, or worse. No need to splurge and act like a high-roller when that really means just being another consumerist sucker.

Yes, and it's even worse when not enjoying spending, turning into a jaded consumerist. Remind me why we do this again? I would think that many of us do it in order to have more options. So, if we are looking at having bitcoin versus not having bitcoin, having bitcoin seems to give us more options, even if we may or may not end up getting rich off of the matter. Probably, bitcoin also gives hope because there are not too many investments in which anyone can have hope, and surely people buy real estate and houses for themselves at least, because they can say at least they have a place to live, but surely houses are not very liquid and we still have to eat and engage in various other activities besides just having a house.. even though surely it is nice to have a house, but even if we completely own the house, some people run out of abilities to pay for the taxes (and/or other costs) of completely owning a house, so there should continue to be some value in terms of having liquid value, even surely there are ongoing attempts to attack bitcoin's liquidity, but I doubt many of us HODLers consider that bitcoin liquidity is going to be falling merely because there are various avenues in which rich people and governments are likely considering that they are going to have some success in terms of channeling normies into official financial products... yet bitcoin does allow us various kinds of powers to transact peer to peer. .and likely there are going to continue to be ways to transact in those kinds of direct ways, even if there are going to likely be ongoing challenges too... where are we keeping our keys and have various avenues to interact been shut down.. an we run an app on our phone? or do we have to use the computer or do we have to resort to some other means of transacting? You have some good points there, thanks for the reminder. Challenges and people are what drives me to towards happiness, if you remove all the challenges and people eventually apathy takes over. On the other hand, I guess if you hate challenges and people, then being rich is great. If the challenge is to exert power over others by making sure they can never reach their dreams, then it's not for me. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

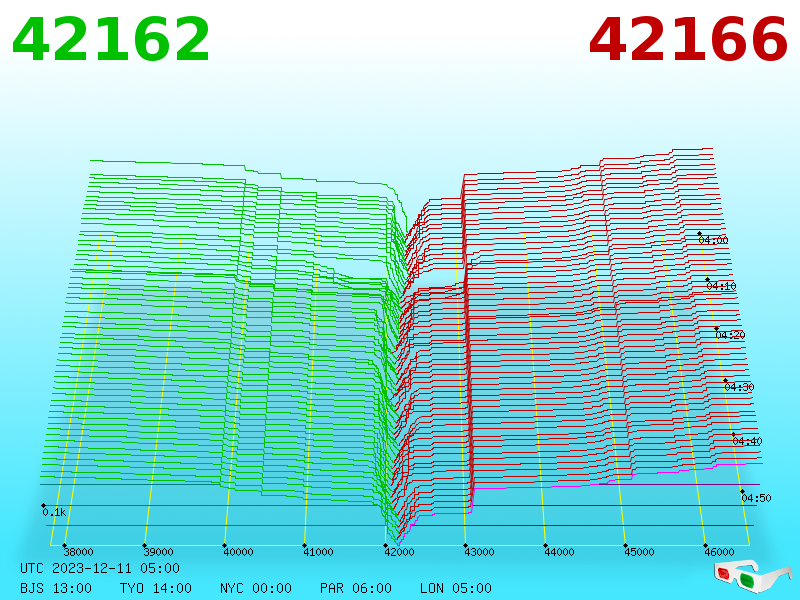

December 11, 2023, 04:03:24 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

December 11, 2023, 05:01:16 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

Poll

Poll