Richy_T

Legendary

Offline Offline

Activity: 2422

Merit: 2113

1RichyTrEwPYjZSeAYxeiFBNnKC9UjC5k

|

|

January 11, 2024, 12:45:01 AM |

|

do you have him counting backwards? would be a nice and very unexpected surprise.

Some of his older posts may have evaporated. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Even if you use Bitcoin through Tor, the way transactions are handled by the network makes anonymity difficult to achieve. Do not expect your transactions to be anonymous unless you really know what you're doing.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

BitcoinBunny

Legendary

Offline Offline

Activity: 1442

Merit: 2493

|

|

January 11, 2024, 12:51:33 AM |

|

Gary Gensler right now BTC🥱🥱  Did you read his statement? It sounds like he didn't want to do this at all. Actually I'm pretty sure this wouldn't have happened, had it not been for the court of appeals. We are now faced with a new set of filings similar to those we have disapproved in the past. Circumstances, however, have changed. The U.S. Court of Appeals for the District of Columbia held that the Commission failed to adequately explain its reasoning in disapproving the listing and trading of Grayscale’s proposed ETP (the Grayscale Order).[1] The court therefore vacated the Grayscale Order and remanded the matter to the Commission. Based on these circumstances and those discussed more fully in the approval order, I feel the most sustainable path forward is to approve the listing and trading of these spot bitcoin ETP shares.

....

Though we’re merit neutral, I’d note that the underlying assets in the metals ETPs have consumer and industrial uses, while in contrast bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware,[4] money laundering,[5] sanction evasion,[6] and terrorist financing.[7]

While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.[8]

https://www.sec.gov/news/statement/gensler-statement-spot-bitcoin-011023 |

|

|

|

|

Richy_T

Legendary

Offline Offline

Activity: 2422

Merit: 2113

1RichyTrEwPYjZSeAYxeiFBNnKC9UjC5k

|

|

January 11, 2024, 12:58:38 AM |

|

We are now faced with a new set of filings similar to those we have disapproved in the past. Circumstances, however, have changed. The U.S. Court of Appeals for the District of Columbia held that the Commission failed to adequately explain its reasoning in disapproving the listing and trading of Grayscale’s proposed ETP (the Grayscale Order).[1] The court therefore vacated the Grayscale Order and remanded the matter to the Commission. Based on these circumstances and those discussed more fully in the approval order, I feel the most sustainable path forward is to approve the listing and trading of these spot bitcoin ETP shares.

....

Though we’re merit neutral, I’d note that the underlying assets in the metals ETPs have consumer and industrial uses, while in contrast bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware,[4] money laundering,[5] sanction evasion,[6] and terrorist financing.[7]

While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.[8]

Translation: We wanted to continue to interfere in the private activities of citizens to keep our buddies in yachts and fancy cars but the judge is a HODLer. |

|

|

|

|

BitcoinBunny

Legendary

Offline Offline

Activity: 1442

Merit: 2493

|

|

January 11, 2024, 12:59:59 AM |

|

"So you said the BTC ETFs got approved. So I will buy ETH, ok?!"  I can understand this from a trader’s perspective. It seems pretty obvious that an Ethereum ETF is going to happen down the line. I could see why traders would want to be there for the runup to that. You can almost tell how motivated by money someone is to be in crypto by whether their main holding is BTC, ETH, or SOL. I wonder if the SEC can use (technical) reasons to block ETFs based on other chains and to potentially kick those in the long grass for a far longer period of time. Most shitcoins are nowhere near as decentralised as BTC (or completely not) and there often doesn't even seem to be an issue cap built in the currency or it is completely vague (exactly like with Eth). Perhaps the particulars don't matter, as long as they are on the likes of Coinbase? |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

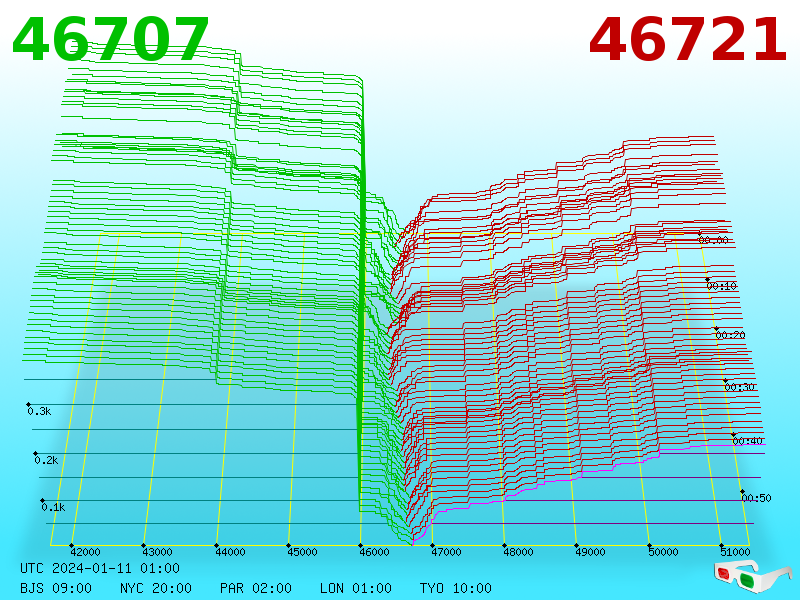

January 11, 2024, 01:01:16 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7768

'The right to privacy matters'

|

|

January 11, 2024, 01:12:18 AM |

|

"So you said the BTC ETFs got approved. So I will buy ETH, ok?!"  I can understand this from a trader’s perspective. It seems pretty obvious that an Ethereum ETF is going to happen down the line. I could see why traders would want to be there for the runup to that. You can almost tell how motivated by money someone is to be in crypto by whether their main holding is BTC, ETH, or SOL. I wonder if the SEC can use (technical) reasons to block ETFs based on other chains and to potentially kick those in the long grass for a far longer period of time. Most shitcoins are nowhere near as decentralised as BTC (or completely not) and there often doesn't even seem to be an issue cap built in the currency or it is completely vague (exactly like with Eth). Perhaps the particulars don't matter, as long as they are on the likes of Coinbase? they will try to block ETH and other pos coins.

"So you said the BTC ETFs got approved. So I will buy ETH, ok?!"  I can understand this from a trader’s perspective. It seems pretty obvious that an Ethereum ETF is going to happen down the line. I could see why traders would want to be there for the runup to that. You can almost tell how motivated by money someone is to be in crypto by whether their main holding is BTC, ETH, or SOL. I do not think it will happen. But I am just a soon to be 67 year old typing on a keyboard in NJ, USA. So it is just a simple guess on my part. |

|

|

|

|

bananaunana

Member

Offline Offline

Activity: 321

Merit: 20

|

|

January 11, 2024, 01:13:44 AM |

|

I wonder if the SEC can use (technical) reasons to block ETFs based on other chains and to potentially kick those in the long grass for a far longer period of time.

Most shitcoins are nowhere near as decentralised as BTC (or completely not) and there often doesn't even seem to be an issue cap built in the currency or it is completely vague (exactly like with Eth).

BINGO, you've just uncovered that there's Bitcoin and then, there's Shitcoin. |

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7768

'The right to privacy matters'

|

|

January 11, 2024, 01:15:50 AM |

|

I wonder if the SEC can use (technical) reasons to block ETFs based on other chains and to potentially kick those in the long grass for a far longer period of time.

Most shitcoins are nowhere near as decentralised as BTC (or completely not) and there often doesn't even seem to be an issue cap built in the currency or it is completely vague (exactly like with Eth).

BINGO, you've just uncovered that there's Bitcoin and then, there's Shitcoin. Well I would think they may have trouble blocking scrypt as it is a long established set of P.O.W. coins. There are very few algo's that might be allowed. |

|

|

|

|

xhomerx10

Legendary

Offline Offline

Activity: 3822

Merit: 7969

|

|

January 11, 2024, 01:37:47 AM |

|

do you have him counting backwards? would be a nice and very unexpected surprise.

Some of his older posts may have evaporated. Segwit? Pruned? |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

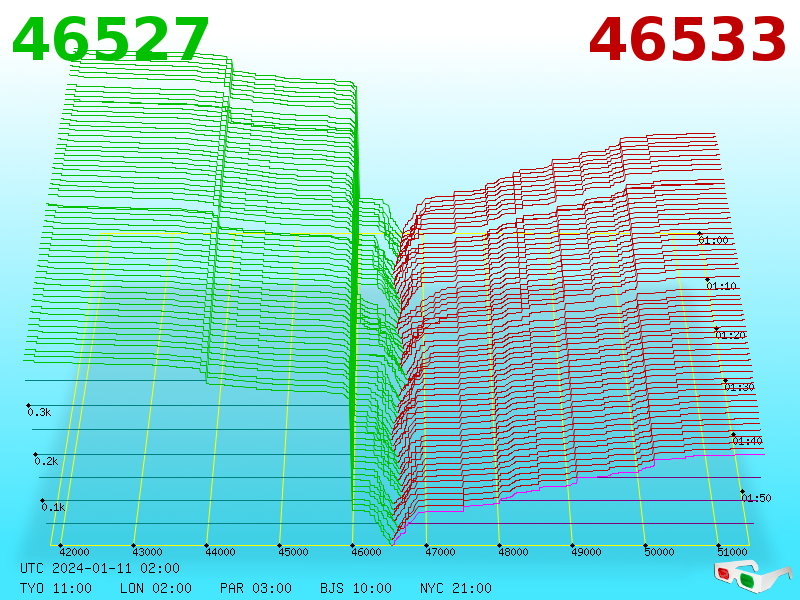

January 11, 2024, 02:01:16 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

January 11, 2024, 02:02:50 AM |

|

of note..at 4pm bitcoin was $45385, which indicates GBTC NAV at $40.45.

GBTC closing price $40.50...the discount is gone...it could move to a premium in the next day or two, imho.

IMHO, Coinbase will push trading in s-tcoins because bitcoin trading on Coinbase would probably diminish now, although if ETF sponsors would source btc on Coinbase, maybe it would even increase, not sure which way it would go.

|

|

|

|

|

cmacwuz

Member

Offline Offline

Activity: 64

Merit: 50

|

|

January 11, 2024, 02:05:53 AM |

|

Well times have changed from 2017 when I was furiously refreshing the page in the airport only to find Winklevoss ETF denial. Over the coming years the funds for these ETFs will slowly grow as bitcoin supply rate dwindles. Gary will be a sniveling footnote. And the US debt will exceed 100 trillion greenbacks. This whole thing feels like the promotion at work that comes a bit late. Nice, we get legacy onramps, but what took so damn long  |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

January 11, 2024, 02:25:47 AM |

|

Well times have changed from 2017 when I was furiously refreshing the page in the airport only to find Winklevoss ETF denial. Over the coming years the funds for these ETFs will slowly grow as bitcoin supply rate dwindles. Gary will be a sniveling footnote. And the US debt will exceed 100 trillion greenbacks. This whole thing feels like the promotion at work that comes a bit late. Nice, we get legacy onramps, but what took so damn long  yea, I feel that Winkelvoss twins were wronged in this. This should have been approved at least in 2020 if not 2017. |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 11, 2024, 02:46:12 AM |

|

Investors spooked by X "incident"? ETFs priced-in? "Buy the rumor, sell the news"? I don't see much action (yet)...  the ETF is not priced in. but the 1/2 ing is priced in. no one really knows what the etf will do to price. Neither is priced in. Of course, people know about the halvening and they know that the supply of new bitcoin will continue to be reduced until the year 2140, but still that is not priced in either, even though I get your point about the halvening being better known.. . but the efficient market hypothesis is incorrect when it comes to something like the halvening, especially since so many folks really do not know what is bitcoin, so don't get fooled by how much press bitcoin is getting in order to cause you to wrongly believe that people (and therefore the market) sufficiently knows what bitcoin is in order to sufficiently and adequately prepare for each of the time (every four years) that it's new issuance gets cut in half and little by little the squeeze is felt, which partially contributes the historically largest portion of the UPpity squeeze (and exponential price movement) tending to happen several months after the halvenings rather than before hand.. since if the halvening was really priced in then the BTC price would go up in anticipation of the halvenings rather than after their effects are more and more greatly felt. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

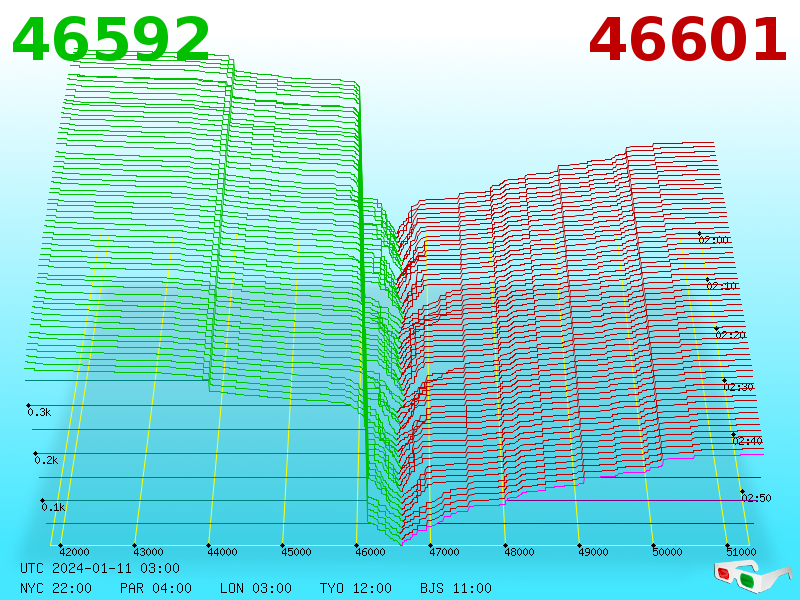

January 11, 2024, 03:01:18 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

True Myth

|

|

January 11, 2024, 03:08:10 AM |

|

Investors spooked by X "incident"? ETFs priced-in? "Buy the rumor, sell the news"? I don't see much action (yet)...  the ETF is not priced in. but the 1/2 ing is priced in. no one really knows what the etf will do to price. Neither is priced in. Of course, people know about the halvening and they know that the supply of new bitcoin will continue to be reduced until the year 2140, but still that is not priced in either, even though I get your point about the halvening being better known.. . but the efficient market hypothesis is incorrect when it comes to something like the halvening, especially since so many folks really do not know what is bitcoin, so don't get fooled by how much press bitcoin is getting in order to cause you to wrongly believe that people (and therefore the market) sufficiently knows what bitcoin is in order to sufficiently and adequately prepare for each of the time (every four years) that it's new issuance gets cut in half and little by little the squeeze is felt, which partially contributes the historically largest portion of the UPpity squeeze (and exponential price movement) tending to happen several months after the halvenings rather than before hand.. since if the halvening was really priced in then the BTC price would go up in anticipation of the halvenings rather than after their effects are more and more greatly felt. Well said. Talking with friends and colleagues I'm getting the feeling that we are in the pre-halving limbo. The phase when people are noticing Bitcoin again and hearing about it on the news. However, those folks and even folks who have been around for maybe the last bull run are silently observing. Some kind of thinking like "$46k to the dollar is better than $20k but, it's still significantly lower than $69k." Even potential large market movers may be waiting. It seems like there is a disbelief every bull run that Bitcoin will increase significantly in value to the dollar. Eventually after the halving it seems like the snowball starts rolling and just keeps going. The ETF news was surely welcomed positive news however, it was also mixed with the Twitter bullshit. I noticed some pretty quick run ups followed by quick run downs over the last couple days that happened within minutes. I think many are not sure if ETF is sell the news or "God candle" time. They may be waiting for the market to settle or take off unexpectedly before making a move. Another point to back this up is the amount of money that was sucked out of shitcoins the days leading up to the ETF announcement. The market as a whole is unsure if it's upity time or wait and buy lower time. All of this doesn't much matter to me and many others who are steadily accumulating. What does matter is when the supply gets cut while the demand remains. |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 11, 2024, 03:42:20 AM |

|

[edited out]

All of this doesn't much matter to me and many others who are steadily accumulating. What does matter is when the supply gets cut while the demand remains. I would suspect that those folks who recognize the value of bitcoin and who are ongoingly accumulating as many BTC as they are able to, have some appreciation for the asymmetric information, which means that bitcoin remains way underpriced, and if you realize and recognize that as well as act upon that asymmetric information, then you are going to be better off - and also partially able to front-run some of the financial institutions and the BIG money coming into bitcoin, as well as front running the many retail normie laggards. Some folks who have been consistently, persistently and ongoingly accumulating BTC for the past several years may feel some regrets about their own inabilities to have enough cashflow to be able to accumulate even more BTC, yet each of us can ONLY do as much as we can, and surely there are several of us who had been able to largely reach our BTC accumulation goals years and years back, and so there are some advantages in that, and part of my own advantage (or disadvantage) is that I had already spent more than 20 years building an investment portfolio prior to starting to get into bitcoin in late 2013 - and so that has costs as well.. in terms of 20 years is 20 years... so there are aging factors involved... yet I surely had some cashflow issues in the 90s that might have made it quite difficult for me to invest into something like bitcoin if it had been around at the earlier stages of my investment career... so I can appreciate that sometimes it can take a while to get into something like bitcoin and also to be able to build your investment portfolio.. so there can be some appreciation by the earlier accumulators to be able to generate some cash so that they are able to buy bitcoin more aggressively than you might have otherwise been ready, willing and able to do if you were less able to identify its value.. There will be smart and even well off people just starting their bitcoin journey 8-12 years from now (2-3 cycles), and surely you would have had ended up front-running them too.. by a considerable amount of time, and they may well never be able to catch up with you, even if they have more fiat money than you.. just like my peers from 2013, 2014, 2015, and 2016, are never going to be able to catch-up to me in 2024 and beyond if they might have merely only begun to recognize and appreciate the value of bitcoin and the actual value of stacking sats... Think about 2013 - 2016, bitcoin could have been gotten for between $200 and $800 for much of that time, so even if someone did badly and has an average cost of BTC that is close to $1k per BTC, the person coming into bitcoin now, is going to have to pay right around 46x higher prices for their BTC.. which is a pretty BIG deal... some of us can say I stacked some bitcoin for $1k or less, each, and they may well be saying I was able to stack some BTC between $27k and $46k, but most of my stacking was done at higher than $46k prices. We don't know for sure, but we may well suspect that it may well be difficult to even get BTC for in the $30ks anymore.. I am not sure, but that surely may well be the case. And if anyone has a timeline that is 8-12 years from now (2-3 cycles), it may well be the case that they are thinking that anyone who got bitcoin in the 5 digit prices are doing quite well because it could be the case that they are then looking at upper 6 digits and maybe into the 7 digits for BTC prices.. We cannot be sure about future prices, but we can spend some time stacking now and considering that the BIGGER financial people are going to be coming into bitcoin through ETFs and ETFs have just gotten approval to begin trading tomorrow. We are on the cusp of the pre-ETF times versus the post-ETF times, and the folks who really know about those kinds of financial instruments are describing this kind of issuance as something that had never previously been seen. The US SEC approving of 11 spot -ETFs all in one day. That seems like a pretty interesting thing that just happened in the financial world. |

|

|

|

|

|

AirtelBuzz

|

|

January 11, 2024, 03:57:04 AM |

|

January marked significant milestones in Bitcoin history 1. Genesis Block Mined (3rd January 2009) 2. Hal Finney Runs Bitcoin (10th Jan 2009) 3. SEC Approves Spot BitcoinETF (10 Jan 2024) 4. Satoshi's first Bitcoin transaction, sending 10 BTC to @halffin (12 Jan 2009) |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

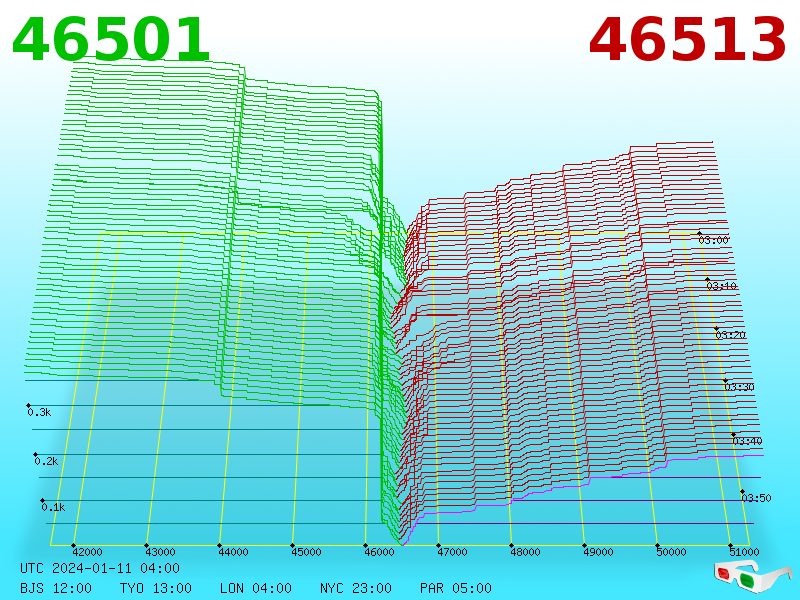

January 11, 2024, 04:01:15 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

d_eddie

Legendary

Offline Offline

Activity: 2478

Merit: 2895

|

No one ever asks the real question : "Why now?"

So, why now? |

|

|

|

|

|

Poll

Poll