9fingerlogan

Newbie

Offline Offline

Activity: 1

Merit: 1

|

|

January 11, 2024, 10:55:44 AM Merited by vapourminer (1) |

|

At what time point does the ETF providers have to buy or sell Bitcoin from the market?

What I mean is: If an investor wants to buy 25 BTC now, the 25 BTC will not be bought from the market right now. This is because each provider already has a certain supply of BTC, the initial supply (which is also the reason why the price will not rise immediately). But at some point they will have to update their cash book. But when? Half a year?

The market makers will have to buy spot pretty regularly to not let the spread widen too much. I expect more of an hourly/daily adjustment of the underlying assets, depends a lot on liquidity inflow. Coinbase volume could act as a good indicator. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unlike traditional banking where clients have only a few account numbers, with Bitcoin people can create an unlimited number of accounts (addresses). This can be used to easily track payments, and it improves anonymity.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

Lucius

Legendary

Offline Offline

Activity: 3220

Merit: 5633

Blackjack.fun-Free Raffle-Join&Win $50🎲

|

|

January 11, 2024, 10:57:08 AM Merited by JayJuanGee (1) |

|

I think market, again, might have surprised most participants. Many expected a huge pump / dump upon approval. But we went sideways.

And instead of BTC price action shitcoins started pumping. funny how that works.

Market is waiting for the Twitter message from SECGov.

Fake ETF Approval message at Twitter -> green candle

No message at Twitter -> sidewaysPerhaps the point is that the official attitude towards Bitcoin has not generally changed when it comes to the SEC (Gensler), but as he himself says, the approval of the spot BTC ETF is actually the result of the fact that they were forced to do so due to the court decision in the case of the Grayscale lawsuit which they lost. Besides, when someone says the following, it doesn't really encourage the market (investors) who still respect the opinion of people like Gensler. "We did not approve or endorse bitcoin," Gensler said. "Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto."

In fact, he said that bitcoin "is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion and terrorist financing."

And Gensler sought to make it clear that these ETF sign-offs don't pave the way for any further action from the U.S. securities regulator.

"It should in no way signal the commission’s willingness to approve listing standards for crypto asset securities," he said. "Nor does the approval signal anything about the commission’s views as to the status of other crypto assets under the federal securities laws or about the current state of non-compliance of certain crypto asset market participants with the federal securities laws." |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 11, 2024, 11:01:16 AM |

|

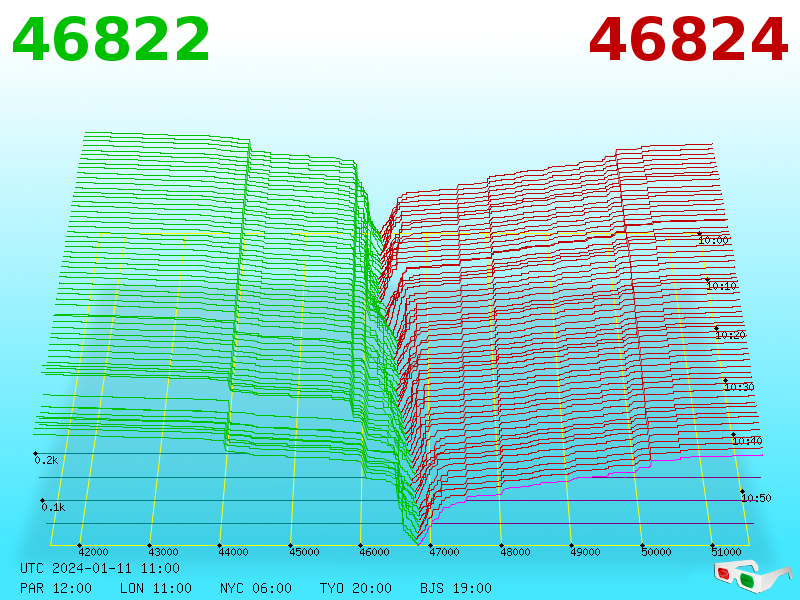

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

rdbase

Legendary

Offline Offline

Activity: 2856

Merit: 1499

Join the world-leading crypto sportsbook NOW!

|

|

January 11, 2024, 11:54:47 AM |

|

I think market, again, might have surprised most participants. Many expected a huge pump / dump upon approval. But we went sideways.

And instead of BTC price action shitcoins started pumping. funny how that works.

Market is waiting for the Twitter message from SECGov.

Fake ETF Approval message at Twitter -> green candle

No message at Twitter -> sidewaysPerhaps the point is that the official attitude towards Bitcoin has not generally changed when it comes to the SEC (Gensler), but as he himself says, the approval of the spot BTC ETF is actually the result of the fact that they were forced to do so due to the court decision in the case of the Grayscale lawsuit which they lost. Besides, when someone says the following, it doesn't really encourage the market (investors) who still respect the opinion of people like Gensler. "We did not approve or endorse bitcoin," Gensler said. "Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto."

In fact, he said that bitcoin "is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion and terrorist financing."

And Gensler sought to make it clear that these ETF sign-offs don't pave the way for any further action from the U.S. securities regulator.

"It should in no way signal the commission’s willingness to approve listing standards for crypto asset securities," he said. "Nor does the approval signal anything about the commission’s views as to the status of other crypto assets under the federal securities laws or about the current state of non-compliance of certain crypto asset market participants with the federal securities laws." Heard this too and it seemed that Gary was forced into approving it, just like the video i posted a link to earlier inwhich his wife dresses him since he doesn't have a choice in what clothes he wears and has his ass wiped right after he poosies afterwards. He knows he is still getting fired whether he approved it yesterday or not. That is a given at this point. Since the hack and having egg on his face since they were the ones toting high level of security when they offered none for their own property and breach of operations via an outside source is appaling at any level he wants to swing this or spin it. He f0rKed up so now his neck is on the line for this one. Thanks spot BTC ETF on finally being the last nail in the coffin for this absolute clown and out of our lives forever. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 11, 2024, 12:01:21 PM |

|

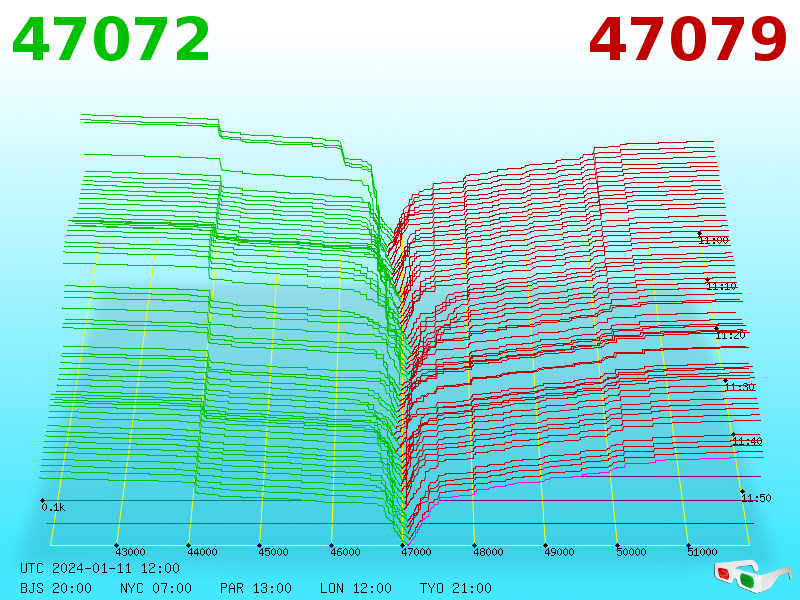

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

BitcoinBunny

Legendary

Offline Offline

Activity: 1442

Merit: 2493

|

|

January 11, 2024, 12:06:54 PM |

|

Looks like a lift off is brewing...

|

|

|

|

|

|

True Myth

|

|

January 11, 2024, 12:15:18 PM |

|

Looks like a lift off is brewing...

I see that too. On one hand I don't expect BTC to break previous ATH until after halving. Although, even breaking 48k would be a nice touch. On the other... how exciting would that be to break a new ATH even before the halving this bull run... lots of "this is uncharted territory" posts if that happens. |

|

|

|

|

OutOfMemory

Legendary

Offline Offline

Activity: 1526

Merit: 2995

Man who stares at charts

|

|

January 11, 2024, 12:27:25 PM

Last edit: January 11, 2024, 05:33:37 PM by OutOfMemory |

|

Looks like a lift off is brewing...

I see that too. On one hand I don't expect BTC to break previous ATH until after halving. Although, even breaking 48k would be a nice touch. On the other... how exciting would that be to break a new ATH even before the halving this bull run... lots of "this is uncharted territory" posts if that happens. I'd be OK with breaking and staying above $48-$49k until halvening too, but as we know from the past, FOMO will exaggerate a bit more than last cycle, so i also take higher prices (pre Halvening) into account. No matter what, i'm hodling, though i do consider to set up some minor laddering sells for only the next three months above last ATH to buy back moar. In theory... |

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3542

Merit: 5039

|

|

January 11, 2024, 12:29:45 PM

Last edit: January 11, 2024, 12:59:05 PM by Torque |

|

No one ever asks the real question : "Why now?"

So, why now? In an ever-increasing Ponzi world where all corporations are now zombie entities on the verge of collapse, and wealthy elites and financial institutions have nowhere left to run (with their money) for hedge and protection, a new "where" must be endorsed to run to. In just 14 years they've moved from scoffing and laughing at bitcoin, to embracing and institutionalizing it. And they never wanted to embrace it. So why now? Because yes, now, it's gotten that bad. |

|

|

|

|

Stapleddiet

Member

Offline Offline

Activity: 89

Merit: 13

|

|

January 11, 2024, 12:36:37 PM |

|

|

|

|

|

|

|

AirtelBuzz

|

|

January 11, 2024, 12:43:59 PM |

|

Although, even breaking 48k would be a nice touch.

BTC Now $47,306. BTC Going to touch $48k very soon. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 11, 2024, 01:01:18 PM |

|

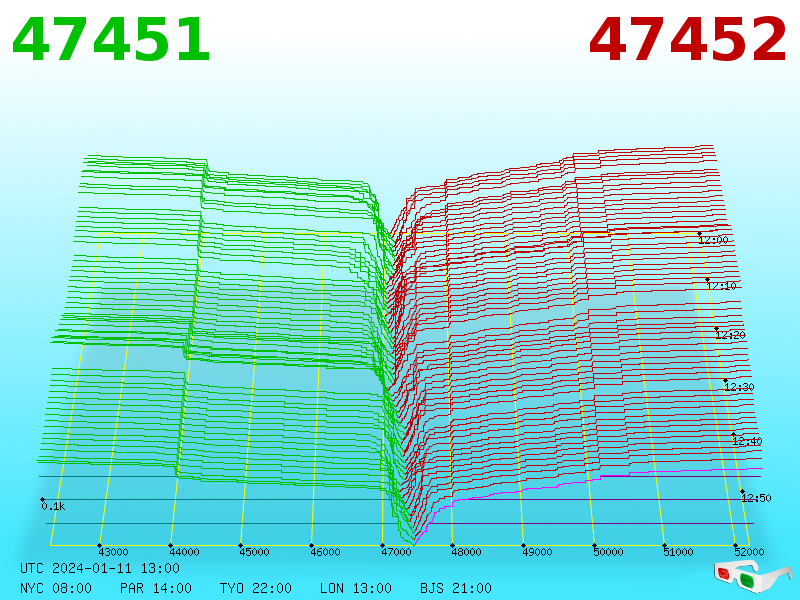

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

vapourminer

Legendary

Offline Offline

Activity: 4312

Merit: 3509

what is this "brake pedal" you speak of?

|

|

January 11, 2024, 01:26:20 PM |

|

errr

when moon?

guys?

lol mediocre

|

|

|

|

|

vroom

Legendary

Offline Offline

Activity: 1302

Merit: 1681

a Cray can run an endless loop in under 4 hours

|

|

January 11, 2024, 01:39:45 PM |

|

errr

when moon?

guys?

lol mediocre

After the gold ETF was accepted it took 300 days to liftoff. Bitcoin will do it faster 😀 |

|

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

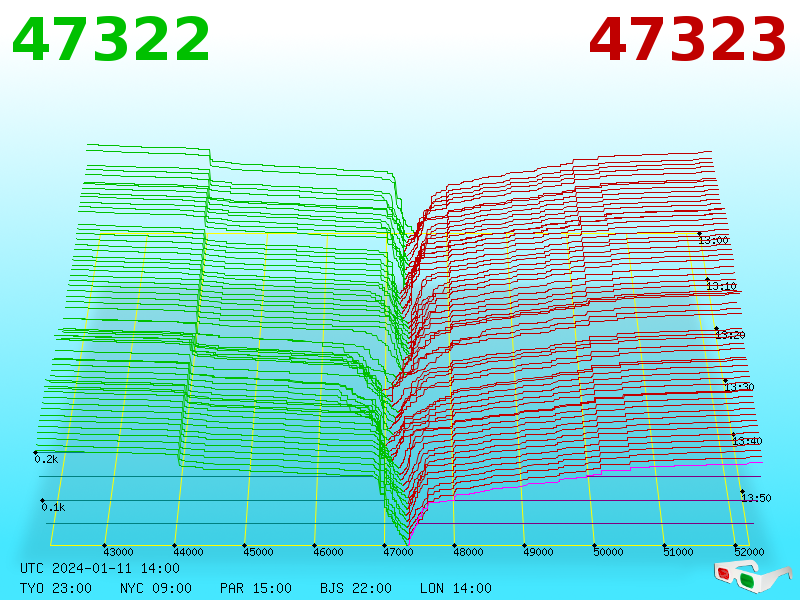

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

AirtelBuzz

|

|

January 11, 2024, 02:13:10 PM |

|

15 years since the first tweet about Bitcoin by the legendary cypherpunk @halfin Bitcoin makes its mainstream finance debut on the same date with 11 Bitcoin ETFs listing this today. Still BTC running  |

|

|

|

|

bitcoinPsycho

Legendary

Offline Offline

Activity: 2464

Merit: 2066

$120000 in 2024 Confirmed

|

|

January 11, 2024, 02:15:40 PM |

|

|

|

|

|

|

BobLawblaw

Legendary

Offline Offline

Activity: 1822

Merit: 5551

Neighborhood Shenanigans Dispenser

|

|

January 11, 2024, 02:22:43 PM |

|

Gentlemen.  |

|

|

|

|

vroom

Legendary

Offline Offline

Activity: 1302

Merit: 1681

a Cray can run an endless loop in under 4 hours

|

|

January 11, 2024, 02:36:21 PM |

|

|

|

|

|

|

|

Poll

Poll