Lucius

Legendary

Offline Offline

Activity: 3220

Merit: 5634

Blackjack.fun-Free Raffle-Join&Win $50🎲

|

~snip~

But of course for each train there are passengers. There will be people, (later Boidom confessed he is a Greyscale investor), who will keep money in Greyscale, believing everything is fine. So, Greyscale won't go down to 0BTC, probably. The real bull run will start when they stop flooding the market with thousands each day.

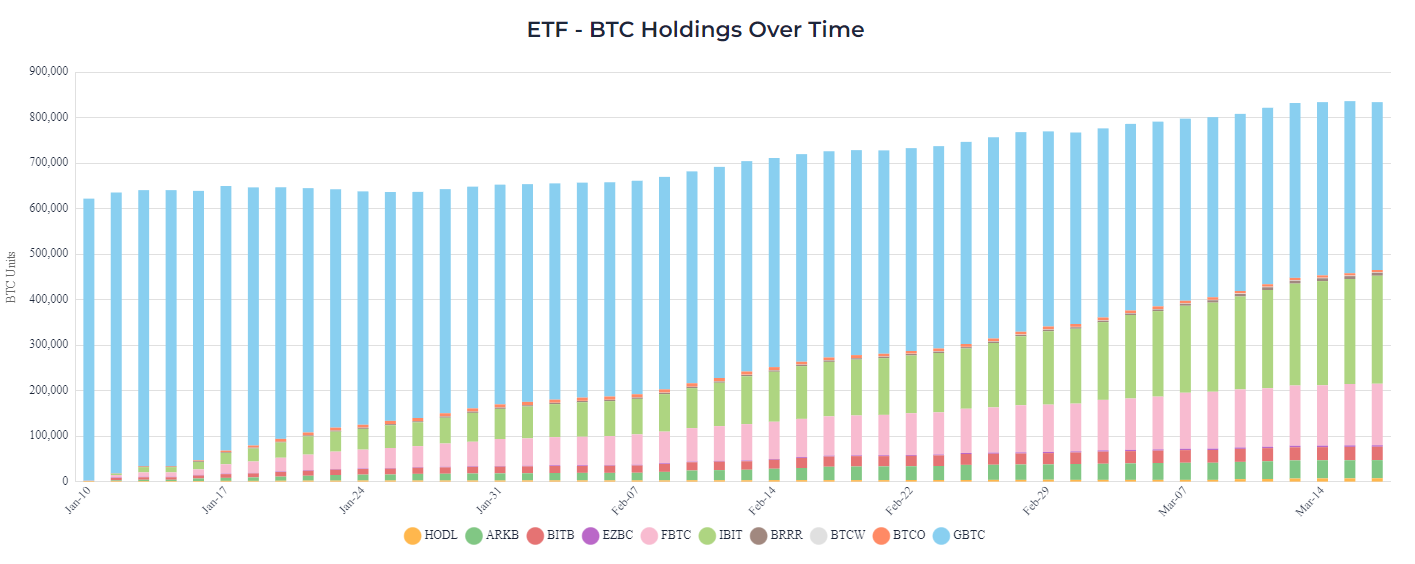

There is no doubt that Grayscale affects the price of Bitcoin, but if we take into account that since the spot ETFs were approved, they have sold about 250 000 BTC, and that as of yesterday, the total number of BTC held by all other US spot ETFs is 467 000+ BTC, that means that they all bought from another source if we also take into account that BlackRock holds roughly the amount of BTC that Grayscale has sold so far? It is also interesting that the last significant inflow of BTC to ETFs was exactly one week ago (10 000 BTC), and that since then there have been no significant inflows, in fact, in the last 2 days, an outflow of 7300 BTC was recorded. |

|

|

|

|

|

|

|

Bitcoin mining is now a specialized and very risky industry, just like gold mining. Amateur miners are unlikely to make much money, and may even lose money. Bitcoin is much more than just mining, though!

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

OutOfMemory

Legendary

Offline Offline

Activity: 1526

Merit: 2995

Man who stares at charts

|

|

March 20, 2024, 12:15:51 PM |

|

It is also interesting that the last significant inflow of BTC to ETFs was exactly one week ago (10 000 BTC), and that since then there have been no significant inflows, in fact, in the last 2 days, an outflow of 7300 BTC was recorded.

I'd like to add that all these outflown BTC were from Grayscale (according to https://farside.co.uk/?p=997). |

|

|

|

|

criptoevangelista

Full Member

Online Online

Activity: 238

Merit: 501

Siga sempre em frente! always move forward!

|

|

March 20, 2024, 12:20:37 PM |

|

Grayscale, instead of lowering its rates, prefers to lose to the competition  |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 12019

BTC + Crossfit, living life.

|

|

March 20, 2024, 12:25:55 PM |

|

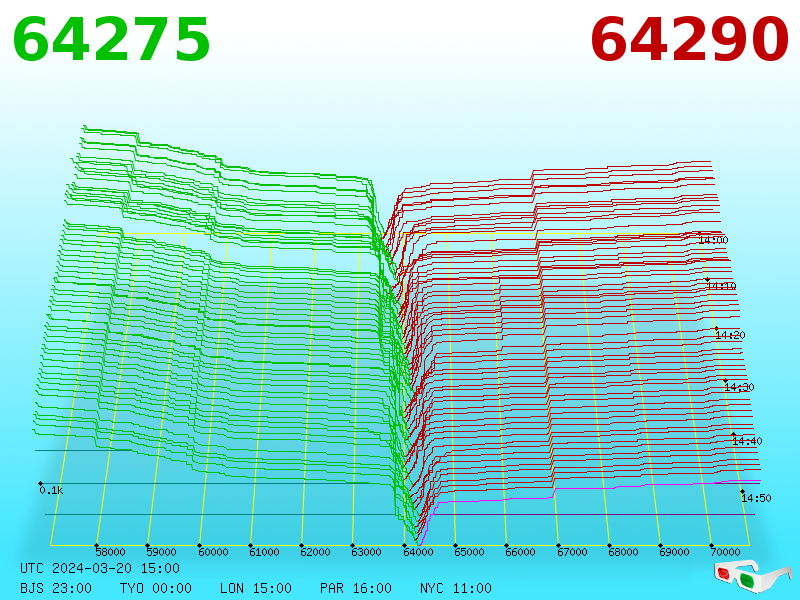

|

|

|

|

|

philipma1957

Legendary

Online Online

Activity: 4102

Merit: 7820

'The right to privacy matters'

|

|

March 20, 2024, 12:37:31 PM |

|

this is a corn 🌽 sale.

I grabbed .025 nice and cheap.

I had a spot order on bitmex, it had been sitting there for a while and got triggered. Well below market price. Not at 8.9k though... Ready for more if it drops.

You and me both. I ended up getting about 0.05 btc yesterday. |

|

|

|

|

criptoevangelista

Full Member

Online Online

Activity: 238

Merit: 501

Siga sempre em frente! always move forward!

|

|

March 20, 2024, 12:39:57 PM |

|

Those expecting 12k will have to settle for 120k   |

|

|

|

|

BitcoinBunny

Legendary

Offline Offline

Activity: 1442

Merit: 2493

|

|

March 20, 2024, 12:40:29 PM |

|

WTF?! Ukraine bought billions worth! Edit: looks like they bought 46k+ BTC for a little over US$20k each in Sept 2022 I cant respond to my DMs as I can only message twice a day due to my account status. I’ve already renewed your main account and just need to know what content you want on the second account that you purchased. So xhomerx10 or BitcoinBunny purchased their account from you?  I have no idea what he is talking about. Probably the only forum I've ever visited I don't understand certain posts whatsoever. |

|

|

|

|

philipma1957

Legendary

Online Online

Activity: 4102

Merit: 7820

'The right to privacy matters'

|

|

March 20, 2024, 12:49:21 PM

Last edit: March 21, 2024, 12:37:15 PM by philipma1957 |

|

I was wrong so I deleted most of this. <big snip>

I cant respond to my DMs as I can only message twice a day due to my account status. I’ve already renewed your main account and just need to know what content you want on the second account that you purchased.

So xhomerx10 or BitcoinBunny purchased their account from you? [/quote] I have no idea what he is talking about. Probably the only forum I've ever visited I don't understand certain posts whatsoever. [/quote] Yeah I personally feel he was trying to fuck with wo heads.

Both you and xhomerx10 have posted here on the wo longer than me.

I guess he will target me or JJG or the dude next. |

|

|

|

|

|

aesma

|

|

March 20, 2024, 12:52:30 PM Merited by JayJuanGee (1) |

|

Saylor, Black Crock, Grayscale, ETFs, NFTs, Eth, Solana, Binance with its own coin, coin burning, stable coins, Dog wiv hat, staking, shite this, shite that. Countless distractions....  EFTs may give some people peace of mind but so far every time we have seen "not your keys but we will keep you coin and promise to be good" end in complete disaster, I'm not sure I would recommend them. Since the ETFs are backed by large, rich companies, shouldn't they be able to guarantee the funds anyway ? I'm not invested personally but just wondering. By law the ETF providers have to buy the number of BTC that are represented by the sales of shares to their clients, and I am not sure how much shenanigans they can play in that process.. surely they have figured out ways to play the various gaps and arbitrage it.... but at the same time, I am pretty sure they have to buy within a pretty short period of time perhaps less than 24 hours - and I am not sure how the weekends factor into those buying (or collateral maintenance) requirements. There are also likely spaces between clients committing to the purchase of the ETF shares and the finalizing of the share sales price for the client and at what point they purchase the BTC and at what point the charge the client, and there could be situations where the client has to commit in advance, so that leaves the ETF provider with some wiggle room in how to play their clients. I would imaging that some of the ETF providers play around with those time differences more than others in terms of gaining additional arbitrage, since they they seems to have good past practices of milking whatever clients that they can in the name of "good business." I agree with you on that "normal ops" of the ETFs but I was talking about abnormal ops, like a hack with loss of coins. Unlike CEX that have nothing other than coins (and some cash sometimes) Blackrock and co have other assets and revenue streams so they should be able to withstand such events. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1749

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 20, 2024, 01:01:28 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

d_eddie

Legendary

Offline Offline

Activity: 2478

Merit: 2895

|

|

March 20, 2024, 01:02:45 PM |

|

I cant respond to my DMs as I can only message twice a day due to my account status. I’ve already renewed your main account and just need to know what content you want on the second account that you purchased.

So xhomerx10 or BitcoinBunny purchased their account from you?  Seems to be IPTV-related (t3nz0 is selling this service). Oh, I see. Thanks for the clarification. Pulling t3nz0 out of ignore. |

|

|

|

|

vapourminer

Legendary

Offline Offline

Activity: 4312

Merit: 3518

what is this "brake pedal" you speak of?

|

|

March 20, 2024, 01:10:14 PM Merited by JayJuanGee (1) |

|

this is a corn 🌽 sale.

I grabbed .025 nice and cheap.

I had a spot order on bitmex, it had been sitting there for a while and got triggered. Well below market price. Not at 8.9k though... Ready for more if it drops.

You and me both. I ended up getting about 0.05 btc yesterday. nice snagged a bit at just over 62k. next buy is at 58k |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1749

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 20, 2024, 02:01:21 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

sirazimuth

Legendary

Offline Offline

Activity: 3346

Merit: 3485

born once atheist

|

.... I don't understand certain posts whatsoever.

Confirmation. I knew I wasn't the only one.

snagged a bit at just over 62k. next buy is at 58k

Seems like every time one does that, it dumps big time, and one gets replies like "thanx for taking one for the team!". |

|

|

|

|

xhomerx10

Legendary

Offline Offline

Activity: 3822

Merit: 7976

|

|

March 20, 2024, 02:34:47 PM |

|

WTF?! Ukraine bought billions worth! Edit: looks like they bought 46k+ BTC for a little over US$20k each in Sept 2022 I cant respond to my DMs as I can only message twice a day due to my account status. I’ve already renewed your main account and just need to know what content you want on the second account that you purchased. So xhomerx10 or BitcoinBunny purchased their account from you?  I have no idea what he is talking about. Probably the only forum I've ever visited I don't understand certain posts whatsoever. Yeah I personally feel he was trying to fuck with wo heads. Both you and xhomerx10 have posted here on the wo longer than me. I guess he will target me or JJG or the dude next. No no no. I've purchased IPTV subs from t3nzo and didn't give him an email address. Since he's a newbie, his PMs are rate-limited which I had forgotten. The guy deserves an "A" for effort to get in touch with me  He's a stand-up guy who deserves a merit so he can get to junior status so we don't have to resort to alarming people in the WO rather than keeping to the PMs. |

|

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

March 20, 2024, 02:45:54 PM |

|

Isn't it $40b? It shouldn't take that long I don't think, maybe another month or two? Especially if the selling continues to increase. Can someone remind me how much Bitcoin GBTC had to begin with, how much they've sold already? Want to calculate what the timeframe is looking like. Ironically without GBTC outflows, there basically are no outflows, even if lower inflows at present, which speaks volumes... The sooner that GBTC is flushed out the market the better. At the time of approval of the spot ETFs, Grayscale had just over 600 000 BTC, and according to the data I am looking at today, it has about 368 000 BTC - which means that their bag is still quite full. It seems that a few more months will pass until they sell everything they have planned.  Source SourceSo according to CoinTelegraph, it'd be around 4 months (though the wording "current rate" shouldn't be considered accurate here): If its outflows continue at the current rate, it could be out of assets by as soon as late July. By my calculations, and current average selling, it'd be more like 3 months ( 26.6 billion (total) / 274.2 million (average per day) = 97 days). Based on the actual current rate of this week's average (so far) of 542.5 per day, it would actually take 49 days. So somewhere between 1.6 months ("current rate") and 3.2 months (average so far). That puts the estimated range as May 8 to June 23. The middle of that range is May 30*. The fact GBTC is recording record outflows is a good thing however and should be encouraged. The sooner they sell their coins, the better, it is literally just a matter of time. If anything, the lack of inflows at current price is more of a concern in the immediate term, with Blackrock recording their lowest inflows to date of only $75m, compared to an average of $277m. Especially when the record of $849m was made at $70K prices. Price has dropped -15% since then and remains at a 10% discount. Where did all the ETF buyers go? It gives the impression they only want to buy in big amounts on the way up, not on the way down (buying strength not weakness), as I suspected might happen. It also shows that GBTC holders are not currently moving their investments to other ETFs, but instead to cash to put it in simple terms (at least this week). This is only based on two days of data, even if it's very similar to Jan correction outflows. Similarly ETF data is only 2 months old (mostly during an uptrend as well), so is too early to tell whether investors will be buying down as well as up. *Probably should be noted that it's unlikely 100% of investors will flee GBTC, so the end date for continuous outflows could be much sooner |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1749

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

March 20, 2024, 03:01:20 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3848

|

Another $440 million outflow from you know who... 50 dumps of Grayscale.  So another day of -1%, leaving them with ~58% from what they started with on 11Jan. Speculators will speculate on how low they'll go, and how fast they'll get there, but it won't be too long before they fade into history. The CEO claimed that once outflows hit $12 billion they will lower the ETF fees. I believe they are close to/over that mark now. Something to do with covering probable fines or whatever. You can find the details if interested. Whatever happened here exactly, we will probably find out eventually. Usually, someone ends up behind bars it seems.  The behaviour of those who run away from the high fee is completely understandable. The funny thing is that the individual wisdom of running away from 1.5% fee leads to collective stupidity causing the current stall of the bull run. But I am not convinced that the fee is the main reason for these outflows. I've read some opinions that most of them didn't go in any other ETF company. May be the reason is that there are many people/companies that have had their funds locked up for years at a loss and are now rushing to release them at a very good profit. A while back I quoted a long twitter thread where some pretty shady dealings of DCG/Genesis, investigated by SEC were discussed. It was funny for me that Boidom refuted them, as made up by me?!? Then what about the hundreds of pages on Internet? Are they also made up by me? I will add just one quote from the many written on the matter: Back in November, DCG's CEO Barry Silbert seemed optimistic that the company could weather the storm. Since then, however, things seem to have gotten worse because the company is under investigation and it has closed down its wealth management division called HQ this month. Moreover, Genesis sent home 30% of its staff this January after making a 20% employee cut in August last year. https://www.bankfrick.li/en/news-and-insights/the-dcg-genesis-and-grayscale-saga-explainedBut of course for each train there are passengers. There will be people, (later Boidom confessed he is a Greyscale investor), who will keep money in Greyscale, believing everything is fine. So, Greyscale won't go down to 0 BTC, probably. The real bull run will start when they stop flooding the market with thousands each day. To the substance: I don't understand the obsession what @ivomm, @BitcoinBunny and @dragonvslinux display with regards to GBTC. Like, who gives a f-k as long as the peg is maintained? So far it has been very orderly and helped inflows to other ETFs. About the 1.5% fee and the endless discussions of it: again, it matter only in years, especially since they trade at peg to NAV or even with a small premium. Incidentally, some other ETFs are trading at a small discount: https://ycharts.com/companies/GBTC/discount_or_premium_to_nav0.5% discount=4 months worth of GBTC fees, lol Naturally, the 1.5% fee could cause small diffusion in time, but current flows are caused by something else. Personally, I did not like the fact that the flows continued, so I divested 2/3 at a premium, kept 1/3 just in case premium would increase (posted this beforehand), which is contrary what the "crowd" expects, but very well may happen due to collaboration between Greyscale and Goldman Sachs. Maybe those three peeps were short GBTC? I dunno, they seem to have a lot of venom against poor little Barry. Finally, who is that Boidom? Either spell it right or not at all, pal. |

|

|

|

|

bitebits

Legendary

Offline Offline

Activity: 2211

Merit: 3178

Flippin' burgers since 1163.

|

|

March 20, 2024, 03:39:21 PM Merited by JayJuanGee (1) |

|

[...] If anything, the lack of inflows at current price is more of a concern in the immediate term, with Blackrock recording their lowest inflows to date of only $75m, compared to an average of $277m. Especially when the record of $849m was made at $70K prices. [...]

We had an 11% drop yesterday and non of the ETF's had outflows. Inflows even. Not sure how that possibly can be 'a concern in the immediate term'. Seems the ETF buyers know what they are getting into. |

|

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

March 20, 2024, 03:51:09 PM

Last edit: March 20, 2024, 04:12:57 PM by dragonvslinux Merited by OgNasty (1), JayJuanGee (1) |

|

To the substance: I don't understand the obsession what @ivomm, @BitcoinBunny and @dragonvslinux display with regards to GBTC.

Like, who gives a f-k as long as the peg is maintained? So far it has been very orderly and helped inflows to other ETFs.

The only relevance to me is based on potential selling pressure, as I explained above. We've seen consistent outflows in the past 2 months and it's fair to assume that will continue (irrespective of price), until it no longer does or slows down to become insignificant. Naturally these outflows weren't that relevant when the overall inflows of ETFs outweighed the outflows when price was trending upwards, especially when a lot can be attributed to GBTC holders moving to other ETFs. However this week, similar to January correction, the outflows are again outweighing the inflows. It means that GBTC is significant when it comes to selling pressure, at least at present. Even if just one of many factors including miners reserves (that last I heard they hold 1.82m BTC), liquidiations, even exchange holdings, etc. Your questions in general seem better directed to GBTC holders, rather than myself and potentially others. I actually agree with what you're saying overall though. Why do holders care if GBTC is holding it's peg, why bother move to Blackrock just because the fee is currently lower (when next year it could be same as GBTC anyway). But this "why the outflows" question isn't relevant to me, only the data, that shows outflows. [...] If anything, the lack of inflows at current price is more of a concern in the immediate term, with Blackrock recording their lowest inflows to date of only $75m, compared to an average of $277m. Especially when the record of $849m was made at $70K prices. [...]

We had an 11% drop yesterday and non of the ETF's had outflows. Inflows even. Not sure how that possibly can be 'a concern in the immediate term'. Seems the ETF buyers know what they are getting into. Overall, there was $362 million outflows, following $154m on Monday. You're right that except for GBTC none of the ETF's had outflows. This is somewhat irrelevant if the overall sum of inflows and outflows ETFs is negative (selling pressure), especially with GBTC holding $26 billion in Bitcoin still, selling an average of $277m per day. If not obvious, the inflows from other ETFs needs to be higher than the outflows from GBTC, in order for there to be overall positive inflows (buying pressure). Cherry picking the data and ignoring GBTC, while relevant to new investor interest, isn't relevant to buying/selling pressure at present. The concern should be obvious. If there are more outflows than inflows as there has been this week, then there is selling presure from ETFs (overall), not buying pressure. And for the avoidance of doubt, there has been a very strong correlation between overall inflows with price increase and overall outflows with price decrease, so this buying/selling pressure is far from theoretical, even if not tested long-term yet. The reference to "immediate term" should be obvious; during the period where GBTC is offloading Bitcoin. Without that, the inflows would still be positive despite the price correction, so isn't applicable long-term. |

|

|

|

|

|

Poll

Poll