Bloomberg published an interesting article about Graysale.

Nothing too new, but a couple of graphs are food for thoughts here.

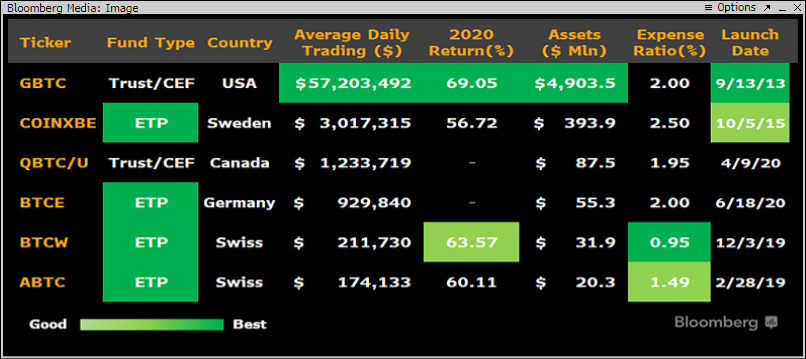

First of all, a small recap of where we are, with ETP on bitcoin:

Of course GBTC is the name of the game, but other competitor are beginning to crowd the dance floor: particularly I am bullish on the BTCE ETP, being listed on a good number of European countries, thus being very widely reachable by a wide arena of investors.

Also We observed his pricing is quite consistent with the NAV. Here, my thread about this product:

ETC Group to launch bitcoin ETP on Deutsche Boerse)

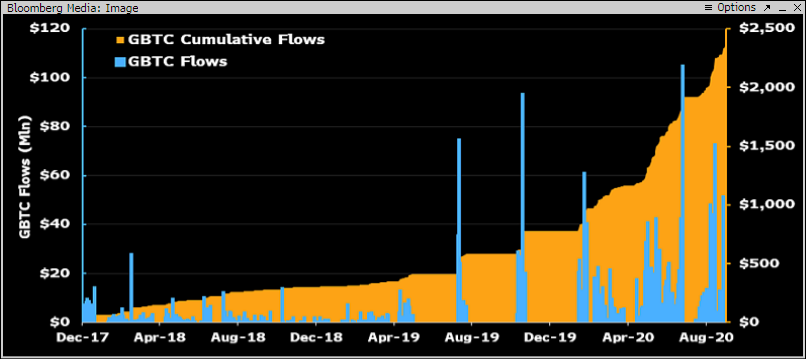

Still GBTC was able to hoover the vast majority of flows, he collected $ 1.6B in 2020 only, notwithstanding the very high premium of their shares over the NAV and their high management fees. To put this in perspective, this inflows is greater than 97% of every other ETF in the US.

Of course, as we have seen in the past posts, this is mainly due, in my opinion to the very favourable taxing deferral instrument status it sports.

The GBTC growth was phenomenal state, but in fact it is not "constant" they have burst in AUM, when they open their primary market share subscriptions. :

|  |

| You can find a very similar graph in the OP's spreadsheet |

Those "peaks" are the shares subscribed in primary, and nothing gets me out of my head that at the end of the lock period, 6 months, they will be offloaded on the market to collect the premium. Nothing dramatic, but if by chance a couple of air pockets add up, there may be some shakes in the underlying BTC market. To give you an example in June, GBTC created more than 11 millions of shares (you can also check the worksheet), worth more than 100 mios $. Around Christmas this Year those shares will be available to sell: we will se what happen to the premium (and bitcoin price) by then).

This is something we should be accustomed to, but it is worth nothing these kind of market distortions are probably adding volatility.

In the end, looking at the first table posted above, I very much hope that other more "competitive" vehicles (a Bitcoin ETF in the US, for example) can steal shares from GBTC, leading to the compression of the premium on the NAV and therefore to a more competitive market.

A second kind of consideration arises from the reading of an article from Forbes:

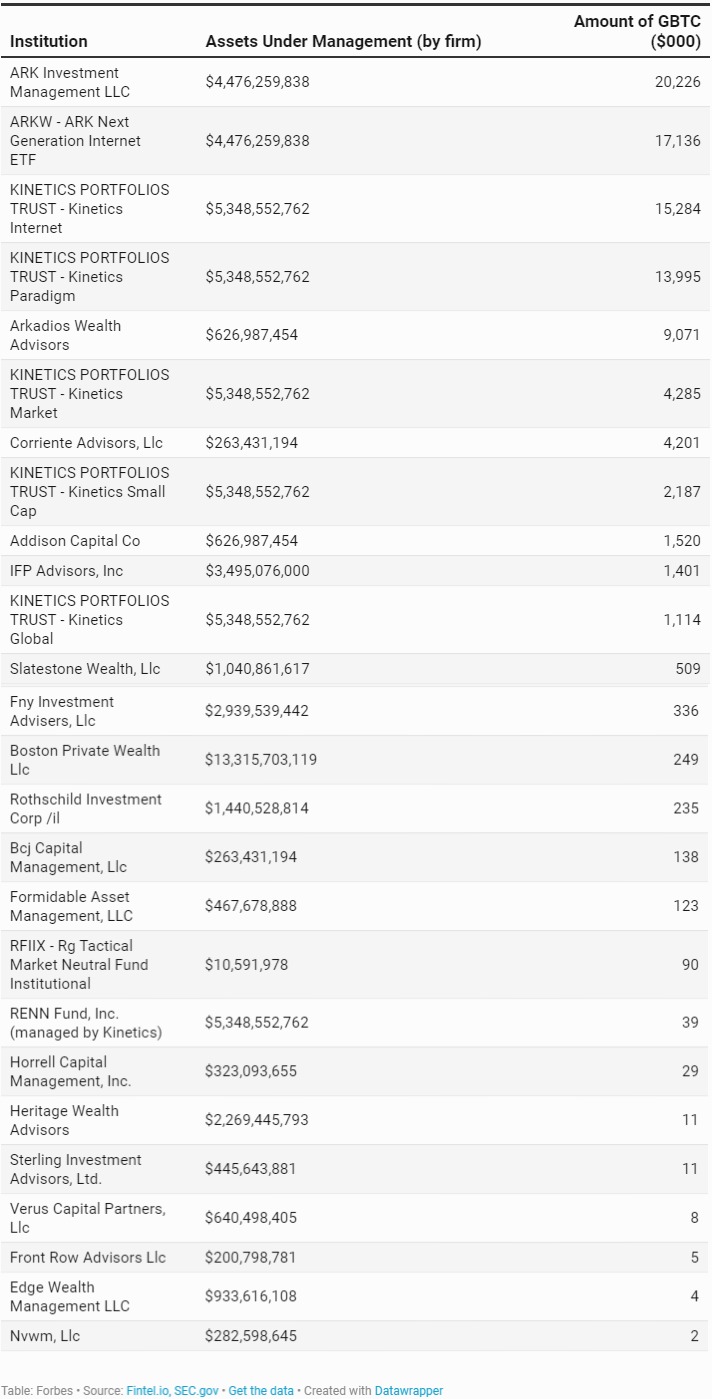

20 Institutional Bitcoin Investors Revealed, But Soon The List May VanishThis article analyse the SEC filing of institutional investors who subscribed the GBTC fund, and there is the following table included:

A somewhat bleak picture I would say, if the main investor in GBTC has put in only 20 million.

If you think about it, however, you shouldn't be too surprised. If I were a large institution seeking to enter bitcoin, that is, that does not already have Bitcoin in its portfolio, to be given "in kind", I would never choose to enter GBTC.

Of course, any institution looking to buy a stake in BTC would not buy on the secondary market at such an absurd premium over the NAV. But I also doubt that any institution will buy on the primary market with a six-month lock-up period. It would probably not be allowed by the investment mandates of many institutions. I believe that is why only such small investments from "low quality" funds appear on this list.

It is likely that a larger fund will decide to resort to more structured methods to have exposure to bitcoin, or maybe even they are through derivatives at the regulated "legacy" markets (CME and / or BAKKT), without having to pay the 2 annual commission. a manager of a passive fund.

Also remember that most of Grayscale's success comes from some sort of "tax arbitrage" that essentially allows investors to "defer" taxes permanently, as long as they trade on GBTC. An aspect that the institutions do not care about.

Also, let's remember what the list we are reading is:

The problem is, the vast majority of the institutional investors who filed the paperwork, called a 13F filing, will no longer need to do so if the SEC gets its way and raises the threshold to report from $ 100 million to $ 3.5 billion. Though bitcoin represents only a tiny fraction of the total assets that will no longer have to be disclosed if the change is implemented, the nascent industry stands to be disproportionately impacted.

This means that only institutions with assets under management over US $ 100 million should disclose their ownership. Of course, there are many other smaller foundations or even individuals with larger resources (over $2,000, for sure). The point is, they don't have to report to the SEC.

On a positive note: if the GBTC has amassed such a massive influx of money without proper institutional money, guess what might happen when/if the "real" institutions decide to invest!