JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 16, 2024, 03:16:55 PM |

|

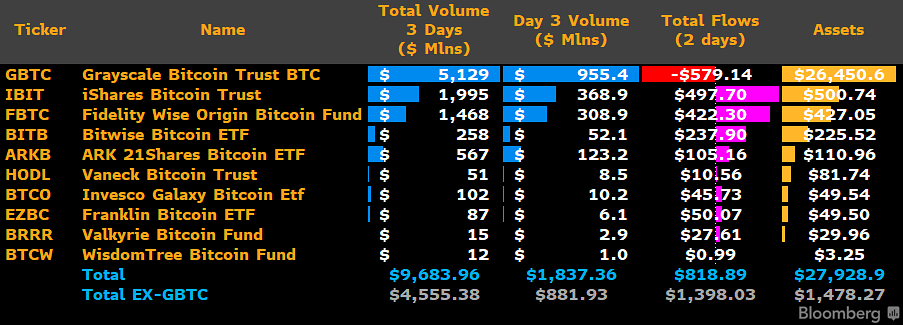

GBTC has been characterised by sustained outflows during the first two days:  Outflows in GBTC continue to push the discount to NAV at very high levels for an ETF. The question is how much outflow to expect in the next few days, keeping this discount up. Another question is: weren't the APs, or Market Makers, supposed to close this "arbitrage" through the creation/redemption mechanism? last week blackrock only had 227btc and GBTC had 630k-ish this week blackrock has 11,440btc and GBTC has gone down to 617k-ish i knew grayscale were not looking to accumulate more AP's nor more baskets. so we have to wait and see what the rest of this weeks brings because they didnt update their funding for monday so we just gotta wait and see if this week is any different than the initial rush of launch week we could see alot of the 600k slide out of grayscale, but too soon to tell, all depends on the master plan of the big boys like fidelity and blackrock. ark21 already left grayscale befor launch week, but that was small amounts compared to grayscales large hoard Yes. It would be good to have one or two more columns showing the 1) total assets (bitcoin) under management and/or 2) changes in total assets under management. It's really a thing when I see legendary post on this forum the difference is always so clear. Its really good beign here, lots of profitable knowledge, bur how do you guys know about all this stuff, can someone refer me to a place I can get indept technical lectures about the working of some technologies in bitcoin, cause I'm still stuck in a lot of things, can someone show the way forward to start understanding somethings like you guys. Like damn I'd love to

Rome was not built in a day, so most likely attempt to read and post in areas that you know, and you can even create some of your own in-depth research on specific areas and then the more you interact with the materials, by both organizing it, analyzing it, and perhaps proposing opinions and/or questions about it, then the more knowledge you would likely build with the passage of time. Of course some newer members come to the forum with a lot of experience from other areas, so there are some non-legendary members who come to the forum with a lot of knowledge and/or great presentation skills, too. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

|

|

|

|

|

|

|

|

You get merit points when someone likes your post enough to give you some. And for every 2 merit points you receive, you can send 1 merit point to someone else!

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 16, 2024, 08:17:28 PM Merited by bastisisca (2) |

|

Yes. It would be good to have one or two more columns showing the 1) total assets (bitcoin) under management and/or 2) changes in total assets under management.

The more I dig in those numbers, the more I find horrible results. There are errors, inaccuracies, delays, E.g. Friday flows for some of the funds aren’t still available (is that for MLK day?Are you serious?). Anyways, I surely can try to produce something similar to what you ask, but I suspect someone will start pointing out those inconsistencies. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 16, 2024, 09:15:23 PM

Last edit: January 16, 2024, 10:34:29 PM by JayJuanGee |

|

Yes. It would be good to have one or two more columns showing the 1) total assets (bitcoin) under management and/or 2) changes in total assets under management.

The more I dig in those numbers, the more I find horrible results. There are errors, inaccuracies, delays, E.g. Friday flows for some of the funds aren’t still available (is that for MLK day?Are you serious?). Anyways, I surely can try to produce something similar to what you ask, but I suspect someone will start pointing out those inconsistencies. I can understand why the first few days and maybe even week might have some inconsistencies in data and maybe even getting used to how to find the data or to have some folks assembling the data, so many times we just get glimpses of the data, and maybe we get a more clear picture later down the road. For many of us longer term bitcoiners who do not necessarily buy these kinds of products, we still may well be curious regarding the usage and the overall BTC flow into these kinds of products, and surely if there is net inflow or net outflow that would be interesting too - especially in regards to Grayscale having the ONLY starting product that would have outflow, but then after the various ETFs are in existence for a while, we are likely going to see some of them as leaders in the space and maybe even some drama related to fighting for liquidity (customers), and maybe it will become more clear or not regarding what kinds of switching costs any of them (talking about the end user) might have or if they might have tax consequences from their moving of funds - perhaps they might not have tax events if they are switching from one product to another, but if they completely get out, then they might have tax consequences at that point to the extent that they are not just getting into some other tax deferred/sheltered non-btc related product versus completely getting out.

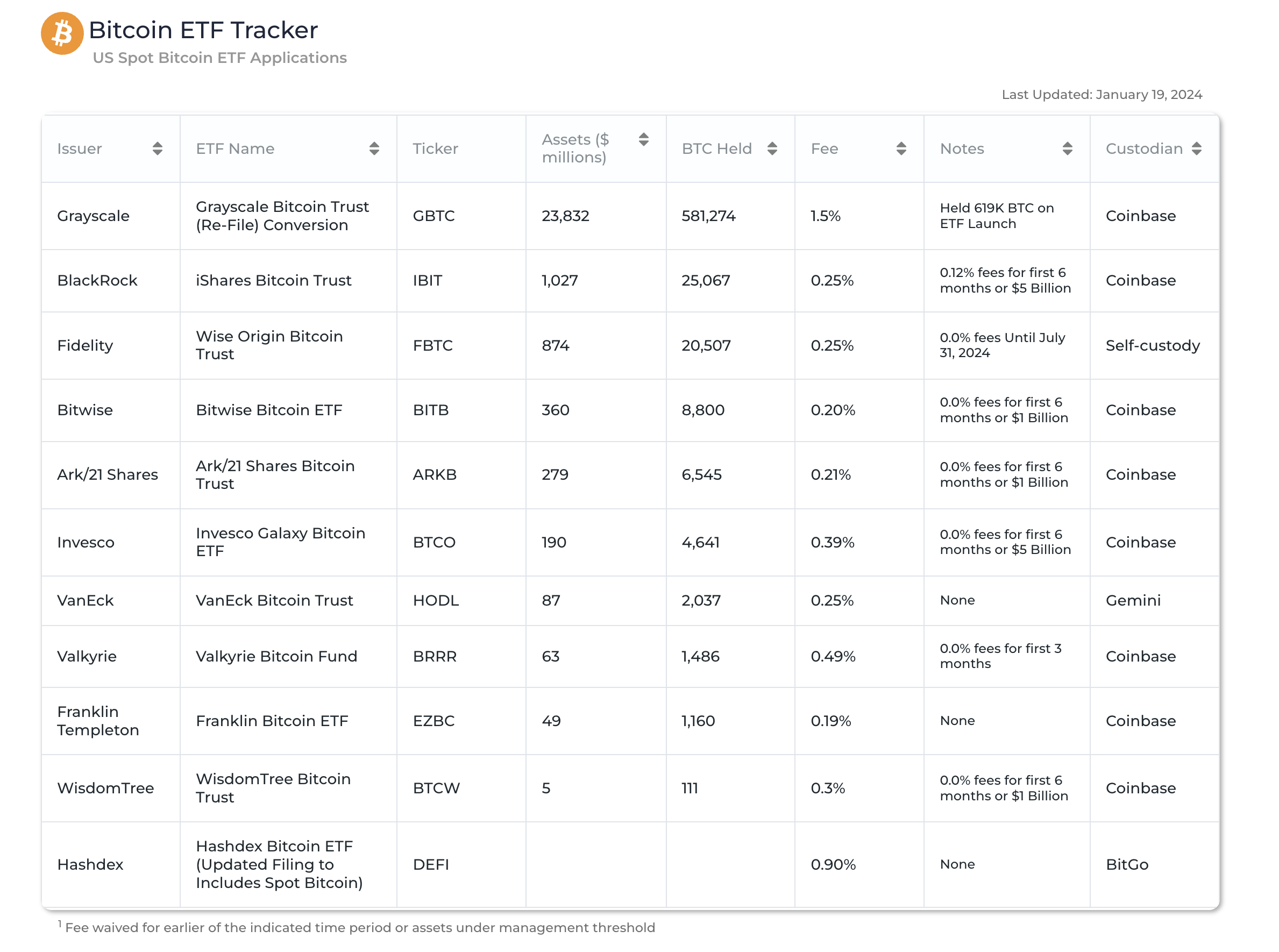

Edited 1: DaRude's post/chart from earlier today & twitter thread shows assets (BTC) under management. https://twitter.com/JSeyff/status/1747366266166206505

Edited 2: By the way, I noticed that the two later charts ONLY show 10 ETF's and they are missing Hashdex.. which the chart from your earlier post shows as having 0 volume on day 1 and only $11.9 million on day 2.. which $11.9 million isn't nothing, especially since it is not the smallest, and Wisdom tree was only showing $1million in the earlier charts.. but yeah, it is probably too preliminary and I don't claim to understand much of it. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

For many of us longer term bitcoiners who do not necessarily buy these kinds of products, we still may well be curious regarding the usage and the overall BTC flow into these kinds of products, and surely if there is net inflow or net outflow that would be interesting too

those "flows" charts are fiat measured. i personally am more interested in how many BTC are lockedup things like blackrock have no updates since the 12th (presuming they done no deals) so sit at 11439btc(from 227btc on launch) things like grayscale have updates as of the 16th so sit at 605,890btc(from ~630k on launch) |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

January 17, 2024, 02:28:46 PM

Last edit: January 18, 2024, 10:16:44 AM by franky1 |

|

update (17th posted about results of end of day of 16th)

blackrock 16,361.64 btc

grayscale still 605,890 btc

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

January 18, 2024, 10:16:52 AM

Last edit: January 18, 2024, 01:05:11 PM by franky1 Merited by hugeblack (2), JayJuanGee (1) |

|

update (18th edited about results of end of day of 17th)

Grayscale Investments ($GBTC) : 591,947btc

BlackRock Inc (IBIT) : 25,067.06btc

Fidelity Investments (FBTC) : 10,000btc

Bitwise (BITB) : 8,309btc

ARK 21Shares (ARKB) : 6,544btc

Invesco Galaxy (BTCO) : 3,200btc

VanEck (HODL) : 2,000btc

Valkyrie (BRRR) : 1,457btc

Franklin Templeton (EZBC) : 1,160btc

Hashdex (DEFI) : 400btc

WisdomTree (BTCW) : 75btc

total: 650,159~

majority is shifted from grayscale that was at something like 637k btc in 2023(from memory). and now down to 591k

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 19, 2024, 05:46:55 PM |

|

Here's a nice one provided by Bitebits.  |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

January 19, 2024, 07:17:10 PM |

|

blackrock is at 28,622

grayscale is at 579,728

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

January 19, 2024, 07:50:02 PM Merited by vapourminer (1) |

|

GBTC has been characterised by sustained outflows during the first two days:

Outflows in GBTC continue to push the discount to NAV at very high levels for an ETF. The question is how much outflow to expect in the next few days, keeping this discount up. Another question is: weren't the APs, or Market Makers, supposed to close this "arbitrage" through the creation/redemption mechanism? last week blackrock only had 227btc and GBTC had 630k-ish this week blackrock has 11,440btc and GBTC has gone down to 617k-ish ETF inflows from first week remain positive, but does indeed provide some important context when GBTC are selling off coins. i knew grayscale were not looking to accumulate more AP's nor more baskets. so we have to wait and see what the rest of this weeks brings because they didnt update their funding for monday so we just gotta wait and see if this week is any different than the initial rush of launch week

we could see alot of the 600k slide out of grayscale, but too soon to tell, all depends on the master plan of the big boys like fidelity and blackrock.

ark21 already left grayscale befor launch week, but that was small amounts compared to grayscales large hoard I anticipate a lot more to be sold off, so far it's around 6% of total holdings as of today. This therefore could indicate ~17 weeks of selling if the pace continues, but only time will tell. Given Greyscale is owned by DGC, it's in their best interest to not crash or spook the market (based on their overall holdings), so I'd like to think they will continue conservative selling, ideally OTC directly to the new ETFs who are needing to acquire BTC based on inflows (potentially at a slight discount as well). This would be the most sensible way to deal with offloading such a large number of coins, as always. I'd like to see this as a "win win" situation: GBTC need to unload and new ETFs need to acquire coins, but it's too early to speculate whether this is how it will play out, and whether demand will meet the current supply being redistributed. The concern is that GBTC could pull the plug at any point, which would naturally crash the market based on selling pressure. I think the reality is that for now this remains unlikely. |

|

|

|

bbc.reporter

Legendary

Offline Offline

Activity: 2912

Merit: 1440

|

|

January 20, 2024, 03:06:38 AM |

|

blackrock is at 28,622

grayscale is at 579,728

However, Barry will not sell all of these coins hehehe. According to this article GBTC is beginning to track bitcoin's price since the conversion into an ETF and selling or buying is a requirement. https://protos.com/grayscale-bought-bitcoin-for-a-decade-then-became-its-1-seller-overnight/This might imply that GBTC discount or premium to NAV should always be close to 0%. If GBTC is on a premium, this requires Grayscale to buy bitcoin and bring it back to 0%. Discount or premium to NAV is presently on -0.47%. |

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

January 21, 2024, 08:15:13 AM

Last edit: January 21, 2024, 10:58:15 PM by franky1 |

|

update(at time of post) GBTC holdings 566,973btc

edit:

update(time of post +14 hours) blackrock holdings 33,430.57btc

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

January 21, 2024, 08:23:57 AM |

|

However, Barry will not sell all of these coins hehehe. According to this article GBTC is beginning to track bitcoin's price since the conversion into an ETF and selling or buying is a requirement. https://protos.com/grayscale-bought-bitcoin-for-a-decade-then-became-its-1-seller-overnight/This might imply that GBTC discount or premium to NAV should always be close to 0%. If GBTC is on a premium, this requires Grayscale to buy bitcoin and bring it back to 0%. Discount or premium to NAV is presently on -0.47%. nope, thats not how it works if GBTC has 566,973 btc at spot price 41,512.62 and a share is 0.00089397 with 634,220,100 shares = 566,973.742797 then it all tallies all they need to do is know the share price is 37.111 for 100% peg so they should be marketing shares at 37.11 instead of 37.01 so all they need to do is just have bids and asks of 37.11 |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 21, 2024, 04:41:55 PM Merited by fillippone (1) |

|

update GBTC holdings 566,973btc

I have a hard time believing that Grayscale would not have done calculations in regards to how fast that they could expect various GBTC accounts to bleed away, and I would think that Grayscale would have had known the quantity of GBTC shares that are held through tax sheltered accounts versus being held in non-tax privileged accounts. So presumptively it would be much easier to move value in the tax sheltered/tax privileged accounts as compared to the ones that aren't, and so in that regard, Grayscale might have estimated that ONLY so many of the account holders are going to be ready and willing to transfer value away from their account, and sure it is also possible that Grayscale has miscalculated these kinds of matters, but I would think that they have pretty good ideas about their account holders and through what kinds of vehicles that their GBTC shares are being held. It would be nice to see some statistics regarding those kinds of matters, if they are available. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

January 21, 2024, 04:56:56 PM Merited by fillippone (3) |

|

update GBTC holdings 566,973btc

I have a hard time believing that Grayscale would not have done calculations in regards to how fast that they could expect various GBTC accounts to bleed away, and I would think that Grayscale would have had known the quantity of GBTC shares that are held through tax sheltered accounts versus being held in non-tax privileged accounts. So presumptively it would be much easier to move value in the tax sheltered/tax privileged accounts as compared to the ones that aren't, and so in that regard, Grayscale might have estimated that ONLY so many of the account holders are going to be ready and willing to transfer value away from their account, and sure it is also possible that Grayscale has miscalculated these kinds of matters, but I would think that they have pretty good ideas about their account holders and through what kinds of vehicles that their GBTC shares are being held. It would be nice to see some statistics regarding those kinds of matters, if they are available. what if i told you maybe (DCG)grayscale wants to bleed. after all DCG have some legal issues with gemini and other companies and dont want to be holding a bag of coin they have to hand back to gemini/others. which would then cause de-pegging. they want to move the coins out of "their sponsorship" and then eventually lower the fee to then have others as agents managing a basket thus no coin associated with DCG to be bitten off in lawsuits. but instead having agents basket managing coin where Grayscale live off the trade fee's if DCG is showing as having $XXbillion assets locked in GBTC. it's ripe for picking if DCG can offload its assets there is nothing to pick. it can also sell its other portfolios to other sister companies. so if/when gemini pull the trigger, DCG can just liquidate with a bankruptcy, only have to pay pennies on the dollar. and then ride the gravy train of income from share fee's, custodial fees via its separate entities |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 21, 2024, 04:59:29 PM Merited by LFC_Bitcoin (3) |

|

what if i told you maybe grayscale wants to bleed. after all DCG have some legal issues with gemini and dont want to be holding a bag of coin they have to hand back to gemini. which would then cause de-pegging.

Coins held by Grayscale are not in Grayscale availability; those are the client's funds and cannot be transferred to DCG as part of the settlement process. Maybe Grayscale could sell his entire business to fidelity to pay off his debt, but this is a completely different scenario. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

January 21, 2024, 05:14:14 PM |

|

what if i told you maybe grayscale wants to bleed. after all DCG have some legal issues with gemini and dont want to be holding a bag of coin they have to hand back to gemini. which would then cause de-pegging.

Coins held by Grayscale are not in Grayscale availability; those are the client's funds and cannot be transferred to DCG as part of the settlement process. Maybe Grayscale could sell his entire business to fidelity to pay off his debt, but this is a completely different scenario. grayscale(dcg) accumulated coin over the decade and THEY locked it to coinbase their customers bought private shares but the coins were still 'sponsored' by dcg/grayscale they are now allowed for the share holders to get enough shares to form a basket for the share holder to request their share allotment to unlock grayscale coin |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 21, 2024, 05:50:38 PM |

|

update GBTC holdings 566,973btc

I have a hard time believing that Grayscale would not have done calculations in regards to how fast that they could expect various GBTC accounts to bleed away, and I would think that Grayscale would have had known the quantity of GBTC shares that are held through tax sheltered accounts versus being held in non-tax privileged accounts. So presumptively it would be much easier to move value in the tax sheltered/tax privileged accounts as compared to the ones that aren't, and so in that regard, Grayscale might have estimated that ONLY so many of the account holders are going to be ready and willing to transfer value away from their account, and sure it is also possible that Grayscale has miscalculated these kinds of matters, but I would think that they have pretty good ideas about their account holders and through what kinds of vehicles that their GBTC shares are being held. It would be nice to see some statistics regarding those kinds of matters, if they are available. what if i told you maybe (DCG)grayscale wants to bleed. after all DCG have some legal issues with gemini and other companies and dont want to be holding a bag of coin they have to hand back to gemini/others. which would then cause de-pegging. they want to move the coins out of "their sponsorship" and then eventually lower the fee to then have others as agents managing a basket thus no coin associated with DCG to be bitten off in lawsuits. but instead having agents basket managing coin where Grayscale live off the trade fee's if DCG is showing as having $XXbillion assets locked in GBTC. it's ripe for picking if DCG can offload its assets there is nothing to pick. it can also sell its other portfolios to other sister companies. so if/when gemini pull the trigger, DCG can just liquidate with a bankruptcy, only have to pay pennies on the dollar. and then ride the gravy train of income from share fee's, custodial fees via its separate entities It sure as well could be the case that Grayscale has already calculated that no matter what possible financially viable course of action that they take, they are likely going to bleed a lot of their assets under management, but it likely does not mean that they would like to bleed those assets under management, but they may well have been putting themselves into a worse position if they had engaged more in the race to the bottom of fees race. I would still expect that Grayscale may well be trying to calculate the maximum fees that they believe that they are able to receive to help to sustain them as long as they can, even if they continue to have ongoing legal battles. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

imagine this

during 2013-2019 you bought housing property at say <$5k /sqr metre

2019-23 value is $10k-$30k/square metre

2024 value is ~$43k/square metre

so you were happy to sell(money upfront) timeshares in your property, for even 50% of 2019-2023 prices as its still profit compared to the <$5/mtr you paid pre 2019

you then syphon off the fiat from time shares into your sister companies.. but you are still at the end of 2023 owner of the deeds to the house and unable to sell the property for legal reasons upto end of 2023

if you ever got in legal trouble the courts take the house leaving the timeshare holders out of pocket with nothing

so now2024 you can let the time share holders redeem shares for house. so you sell the house deed for cash via a property developer/escrow(coinbase premium) and the investors get cash.. and same day investors use cash to buy the house deed but temporarily put it into another property managers scheme (blackrock)

you dont want other managers partnering with you offering their shares in your property manager business as its competition. you want time share people redeeming your shares, to take the properties(deeds) off you

once you offloaded your property. you then set your property management fee to be super low

and then the home owners come back to you. not selling the house back to you. but asking you to be their property manager where you get a commission per time share sold by them

so now you still get recurring income from the property. but the property is no longer in your name. thus the court cant grab it

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

odolvlobo

Legendary

Offline Offline

Activity: 4298

Merit: 3209

|

|

January 22, 2024, 12:02:42 AM |

|

I suggest that we retire this thread. There is no longer anything unique about GBTC, now that it is an ETP and there are a dozen others just like it.

|

Join an anti-signature campaign: Click ignore on the members of signature campaigns.

PGP Fingerprint: 6B6BC26599EC24EF7E29A405EAF050539D0B2925 Signing address: 13GAVJo8YaAuenj6keiEykwxWUZ7jMoSLt

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 22, 2024, 02:49:28 AM Merited by fillippone (3) |

|

I suggest that we retire this thread. There is no longer anything unique about GBTC, now that it is an ETP and there are a dozen others just like it.

GBTC still seems unique to me, including that there is going to be an ongoing dynamic in which several of the GBTC incumbent clients are going to gravitate towards other ETFs or ETPs or whatever they might be called...and there could be some questions about whether they ever get new clients and/or new money or if maybe the ONLY money remaining in GBTC might be those clients who do not have tax-beneficial accounts. Sure these kinds of discussions could take place on some other thread, but I don't see any real issue or confusion in terms of keeping this thread going, especially there are several of us who are active here and also the topic of GBTC relation and/or difference from other offerings is likely way more interesting than what you are making it out to be. There probably has never been any kind of situation like this in the history of finances, in which part of the reason that the trade volume is breaking so many records has to do with the preexistence of this GBTC product and how there is likely even some politics and conspiracy theories involved in how GBTC has been or is being treated, including ongoing civil and potential criminal law suits that might end up drying up into nothingness - but even Barry Silbert's resignation is not exactly a resolved issue in terms of his likely still being involved in Grayscale and in other matters, and at some point there were theories of his deserving criminal prosecution, which I doubt that those questions and/or particularities have been resolved either.. So congrats to fillippone for creating a seemingly somewhat evergreen topic in which everything that any of us would want to know but were afraid to ask about Grayscale BTC has not even come close to drying up. TLDR: Long live this thread... until it doesn't.       |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|