JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 20, 2023, 07:16:06 PM |

|

i dont make claims of superior knowledge but i do admit i do do research. my claims are of opinion based on math logic common sense and research..

the parts that get me annoyed, (and yes i confess i do show my annoyances when i write. im human, not a script bot).. is when people pretend to be influencers or hope to send their message out to go viral or get attention, trying to shout deadlines of big news to cause some media hype.. but they themselves have not even done any research.. (not personal to just you. a few have done it which is multiplying the annoyance.. which then requires poking at suggested reasoning)

Sure, sometimes some primary sources may well need to be looked at besides what people are saying, and there are various levels of research that others might have had done, if they are linking their sources, and maybe sometimes you might end up being a good source for some primary materials if you link the materials, but you don't always link your resources either, so some times guys will need to have faith in regards to your resources, and surely sometimes it may well not matter to do "further" research on a project or to do "better research" because sometimes it will take a long time to suss out some of the primary sources and even some needs to interview people or to travel or to otherwise be resourceful with some documents, whether they are legal documents or reading various kinds of bitcoin-related code... to the extent that might be part of the topic. Sometimes you say that you do research, but you come out with baloney ideas, so sometimes the research is not leading, even you, to very decent conclusions and/or presentations that are either unclear, misleading or wrong. for instance

december is not actually a deadline of approval/rejection of the 12.. yet some keep saying it is

for instance the hype of

"all 12 will get approved at same time"

based on what!!!??

Based on speculation that does not even matter as much as you are seeming to now make it out to be. You are placing more concreteness into my statement than I had meant to say.. and even when it came down to framing our potentially earlier bet (that you rejected but I proposed), I had mentioned that I would be willing to bet more than 6 applicants would get approved at the same time and suggesting that if you wanted to take the other side of such bet, then you would be saying 6 or fewer would get approved.. which seems quite great since you had affirmatively said no more than 4, and maybe it would be better for me to get 5 and above especially since I don't have as much confidence as you seem to have, and if you seem to have confidence of no more than 4, then maybe we should adjust the bet in order to account for the certainty of your claims rather than my already conceded uncertainty that you are trying to suggest that I said something that I did not.. even though I said that all of them might get approved, but you are correct, I did not do any research except for my undstanding that they SEC is getting all of them to update or refile their applications and the SEC would likely need to distinguish them on some kind of a rationale basis.. which in my thinking the ONLY one really distinguishable is Grayscale because of its many civil lawsuit issues and even some allegations that could end up converting into criminal allegations, especially if we are talking about fraud.. So you have already come off as pretty confident in such a bet, and I have already stated that I am only around 50/50 confident, and I hardly know shit, so I am not even placing much weight on how much that I am inclined to suggest that I am right, except to say that I am more inclined towards my side than your side, and the more that we go back and forth, my opinion might end up changing, but at the time that I proposed the bet, that was my inclination... so my making the proposed bet does not even necessarily mean that I have a lot of confidence, but I do have enough confidence to see if you are willing to stand up for your words enough to take the other side of the bet. Maybe we could bet 10k satoshis or something like that, even though it might not even cover fees.. and surely you may well not be agreeable (you party pooper) to using the lightning network to receive your BTC transaction if you were to win..... that saves on current fees which current fees are probably right around the same amount that I am currently proposing for our bet. .. anyhow, we would not need to bet in BTC or satoshis or whatever, we could just make a bet that might result in some kind of concession from the other, and those are known as gentlemen bets, if you know of such a social and interactive and sometimes funzies concept... if you are supposedly human, as you claim to be, then you should know about these kinds of practices.. ie fun. if people even took a non-superior, common sense glance at all 12 they would see many of the applications fall short on even basic/standard fiat asset ETF practices of fund management security/processes.. so it does annoy me when blanket statements are made to suggest market movements are approaching due to all ETF being approved on X date.. but lack any reasonable justification for why they think all of them will be approved at same time(non superiorly, just logically, commonsensically based on even a glance of the applications)

I am still willing to take a bet that more than 4 will be approved at the same time, even though I have not done shit for research, and I don't think that I need to based on how busy I am writing long posts to guys like you... not even claiming that you are not unique in your own right.. but recall we had one or two previous similar battles in one of the Craig Wright related threads? or was it another thread? I cannot remember exactly which thread it was, and I am not going to research into the matter at this particular moment.. I do recall that at one point I was arguing with you about how you said that people needed to reach bitcoin's fair market value or some other thing that I considered to be worth arguing about at that (or those) particular time(s). Yes, and it would be a mistake to select the winner as Blackrock only, even if they might be superior. The market can choose in regards to which product is superior as long as each of the products have mechanisms in place that protect consumers in regards to rug pulling, price manipulation, lack of truthful disclosures or whatever it is that the SEC is supposed trying to protect when it comes to different ways that the various ETF applicants might set up their ETF and try to distinguish themselves from other players.. whether it is fees or liquidity or some other kind of term/service that they might offer.

but thats the thing.. a passing glance at all applications shows not all of them meet the min SEC standards. Well, that would be grounds to deny the ones that do not meet SEC's minimum standards, and so does that mean that you are still wanting to not take the bet about no more than 4 get approved, and I will blindly bet that more than 4 get approved (let's say within two weeks of the first approval). Let's say that I am saying that more than 4 of the applicants get approved (that may or may not end up including Grayscale) within 2 weeks of the date that the first one gets approved.. .and you are taking the opposite side of that bet... and maybe we can put a time-limit for the running of the bet.. by no later than 1st quarter of 2024... or something like that. and the SEC is not there just to rubber stamp any boiler room scam into running on nasdaq and just play "let the market decide". there would be lawsuit hell if the SEC took that much of a back seat (though yes decades of seeing fiat boiler room scams and inaction of SEC may appear the contrary)

You make some good points there.. .and there is some validity to any kind of claim that the SEC wants to maintain some standards so that it does not have to approve shitcoin ETFs merely because they had approved some BTC ETFs.. and other standards as well... but surely, there can be some difficulties regarding where to draw the line and your research may well have helped you in that regard, but I am still willing to bet you about the 4 or more getting approved within 2 weeks by no later than the end of the 1st quarter of 2024 thingie. however mentioning it again. the SEC also wants to ensure the first approval "sets the standard" as its a precedence. setting minimal requirements for the next application to reach/exceed.

you might be right that the SEC doesnt want to set a super high bar/barrier of entry standard so "might" that more than one get approved in quick succession/same time. but looking (even at a glance) at the applications. not all of them have the basic kinks worked out

Ok.. so with all your supposed previous research and your further thoughts on the matter, are you sticking with your no more than 4 are going to get approved claim, or do you need some wiggle room in regards to that? Even with more wiggle room, I might still be willing to take the other side of the bet, even though I have done hardly jack for research beyond what I have heard and maybe I can look at a few documents.. I am not a dummy but I also don't feel like I have a lot of time to be trying to figure out some of these kinds of potentially irrelevant details... even though you have concluded that they are relevant and a kind of insightful (if not superior) knowledge that you have based on your having had done more due diligence than this here cat. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

|

|

|

|

|

|

There are several different types of Bitcoin clients. The most secure are full nodes like Bitcoin Core, but full nodes are more resource-heavy, and they must do a lengthy initial syncing process. As a result, lightweight clients with somewhat less security are commonly used.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

November 20, 2023, 07:41:34 PM

Last edit: November 20, 2023, 09:23:23 PM by franky1 |

|

im not the one making claims and setting deadlines.. im doing the opposite. im dispelling peoples "certainty's"

for me the odds of 1 application in 2024 is higher than some at same time in 2024

for me the odds of some at same time in 2024 is higher than most in quick succession but separate in 2024

for me the odds of most in 2024 is higher than 1 in 2023

for me the odds of 1 in 2023 is lower then majority of alternatives

all 12 at same time. lowest of all alternatives

there is also no point in blanket statements of "four get approved" because although readings of previous applications in last few months may indicate only 4 may be fairly treated. the companies can re-file and adjust any day and change before 2024.. but im sure that 2023 is not an approval year. and if more then one is approved in 2024 it wont be most/all at same time.

you also made a comment in other posts about the "let the market choose" well seeing as these spot etf will all be shadowing the bitcoin price the ups-downs of the market would be the same and the fiat-share-fiat of triggering cap gains/losses will be the same. the only main differeince of choices will be

a. preference of the company brand (grayscale, ark, blackrock)

b. preference of the agent brand

c. fee's

d. share/sat rate

many people that are big income earners would invest in ones where 1 share is 0.001

many people that are min wage earners would invest in ones where 1 share is 0.00001

the markets will play the same market patterns but minimum wage earners investing in their pension wont be able to put their 5% monthly to buy a whole 1 share of one brand. but can buy dozens of shares of other brand

so the differences between the ETF offerings is their peg rate and fee's

have you noticed how you went fro a stance just days ago of meriting others suggesting 2023 approval OR 12 at same time suggestions.. and you repeating them suggestions as high odds

to now have a more rational possibility of 4 within first quarter of 2024..

im not setting deadlines.. instead im hedging against the suggestions/ calming down the suggestions.. the only HUMOUR i will give is 50 merit to you if one was approved in 2023

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 20, 2023, 09:58:14 PM |

|

there is also no point in blanket statements of "four get approved" because although readings of previous applications in last few months may indicate only 4 may be fairly treated. the companies can re-file and adjust any day and change before 2024.. but im sure that 2023 is not an approval year. and if more then one is approved in 2024 it wont be most/all at same time.

I only used "4" because you had said something like probably only one BTC spot ETF would be approved, yet if the SEC were to approve more than one then no more than 4 would be approved at the same time. I had only thrown 6 out there because it seemed more realistic than all of them to be approved (such as 12), but I did not really have any reason to believe that any of them might be denied (once the threshold is broken and some the first one ends up getting approved). im not the one making claims and setting deadlines.. im doing the opposite. im dispelling peoples "certainty's"

That's a good point. I was further thinking about potential non-monetary bet terms that could test conviction, but I really doubt that we are as far apart as you had initially suggested that we are, and surely it is much harder to enter into any bet if you are NOT really putting out your own ideas, but just see yourself as contesting the ideas of others.. which I see myself in a similar kind of situation.. and even if I might talk about a lot of ideas, I don't necessarily get very convicted about x, y or z happening for the reasons stated in my earlier post... and so if ever I do say anything with conviction and/or strength, I do not mind that people point those kinds of things out to me, and if they propose to bet on such thing that I said, the surely there could be some instances if we might be able to hash out some kinds of mutually agreeable bet terms in which we are able to take opposite sides of such bet. you also made a comment in other posts about the "let the market choose" well seeing as these spot etf will all be shadowing the bitcoin price the ups-downs of the market would be the same and the fiat-share-fiat of triggering cap gains/losses will be the same. the only main differeince of choices will be

a. preference of the company brand (grayscale, ark, blackrock)

b. preference of the agent brand

c. fee's

d. share/sat rate

many people that are big income earners would invest in ones where 1 share is 0.001

many people that are min wage earners would invest in ones where 1 share is 0.00001

I don't see how unit bias makes much difference. there are going to be some employers who have these options in their various 401k plans, and then the workers can choose the extent of their exposure through the plan, and they might ONLY be able to choose based on which ones are offered in their plan. Some employers do not have very many options and others have greater number of options, and there could be various reasons that employers will set up their plans in certain ways that may well limit which ETF might be available. Certain brokers might offer some plans but not others, and some of the BIGGER players might be able to shop around for the plans and to be able to the terms of what is offered to employees or versus what a pension fund might choose which one to get into based on prior relationships with the entity and what that entity offers. the markets will play the same market patterns but minimum wage earners investing in their pension wont be able to put their 5% monthly to buy a whole 1 share of one brand. but can buy dozens of shares of other brand

so the differences between the ETF offerings is their peg rate and fee's

To the extent that employers even have pensions, the employee is not usually able to negotiate what is in the pension plan like they are able to select options within their 401k, and surely today 401k options are greater than they were in the 90s when they first were coming out, but there are still some employers that do not have very many offerings, so there could be questions about whether some employers will add ETFs as options to their plans... including government sector employers that might not have as many options in their plans as private sector employers, but they might have better terms than some of the private sector plans that might have fees already built into their 401k plans. have you noticed how you went fro a stance just days ago of meriting others suggesting 2023 approval OR 12 at same time suggestions.. and you repeating them suggestions as high odds

to now have a more rational possibility of 4 within first quarter of 2024..

That is called discussing various possible bet terms. My position has not changed very much, even though we have batted around a few ideas that may or may not be helpful in terms of tweaking my thoughts.. or allowing me to look out for certain things that I might not have had considered previously.. but I doubt that I have changed very much because sometimes just the passage of time could change how a bet might be considered and/or negotiated. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

November 20, 2023, 11:21:02 PM |

|

{franky ignoring JJG desperate begs and endless cries to try to get a bet} you also made a comment in other posts about the "let the market choose" well seeing as these spot etf will all be shadowing the bitcoin price the ups-downs of the market would be the same and the fiat-share-fiat of triggering cap gains/losses will be the same. the only main differeince of choices will be

a. preference of the company brand (grayscale, ark, blackrock)

b. preference of the agent brand

c. fee's

d. share/sat rate

many people that are big income earners would invest in ones where 1 share is 0.001

many people that are min wage earners would invest in ones where 1 share is 0.00001

I don't see how unit bias makes much difference. there are going to be some employers who have these options in their various 401k plans, and then the workers can choose the extent of their exposure through the plan, and they might ONLY be able to choose based on which ones are offered in their plan. Some employers do not have very many options and others have greater number of options, and there could be various reasons that employers will set up their plans in certain ways that may well limit which ETF might be available. unit bias is a thing imagine 1btc was $100,000 where 1 share pegs to 0.001 each share is $100. meaning someone putting aside 10% of their minimum wage (40hrs*4wks*$15)/10= $240 someone cannot invest 2.4 shares.. so end up losing investment potential of $40 or has to invest more then 10% to round up to $300 where as if shares are 0.00001 meaning $1 a share.. anyone can buy.. even on things like robinhood. in dollar amounts without having to round up or down the $240 can buy 240 shares. thus has 0.00240 pegged exposure

JJG get over yourself.. you seem obsessed to think theres any chance of a bet i already told you i dont gamble, trade on this forum.. GET THE HINT you have been now trying to poke me in my private messages begging.. you are desperate.. chill out. read the room.. there is no deal thr never was. dont get desperate posting my reply to the PM for all to see me telling JJG to chill the hell out you are obsessing about trying to get me to agree to a bet.

one last time.. I DO NOT GAMBLE, TRADE, BET on the forum

but for a zero cost laugh id give you merit if something got approved in 2023

its not a deal/negotiation/bet/promise.. its just a damned laugh

stop pretending you have any power in trying to tender me into any deal

there is no negotiating. chill your pants. ud lose anyway. move on

that said. if something is approved in 2023 ill still send 50merit to the post i mentioned about first.. because merits are non-monetary, crap things. worthless things thrown about to pat people on the back

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 21, 2023, 02:26:06 AM |

|

JJG get over yourself.. you seem obsessed to think theres any chance of a bet

i already told you i dont gamble, trade on this forum.. GET THE HINT

I already addressed a lot of this in terms of suggesting that framing a bet is a good way to figure out the extent to which a member will stand behind their assertions. Of course, sometimes the terms of the bet could be changing, and sometimes there can also be utility in terms of presenting the sticking points, especially if dealing with someone who might be genuinely trying to figure out the extent to which there is differences of opinion rather than just arguing for the mere sake of it. I think that I already sufficiently outlined my parameters as kind of talking points, but it is getting a bit weary to have you get so worked up about various things. you have been now trying to poke me in my private messages begging.. you are desperate.. chill out. read the room.. there is no deal thr never was. dont get desperate

I was not trying to make any kind of deal, I was ONLY trying to clarify some matters in the form of a bet, so anyone can look back if they wish to attempt to sort through something that you seem to be wanting to muddy rather than clarify... with a little bonus franky drama, and I was not even trying to provoke you since you were mostly making good points until you are now seeming to get worked up about nothing.. or nearly nothing. posting my reply to the PM for all to see me telling JJG to chill the hell out you are obsessing about trying to get me to agree to a bet.

one last time.. I DO NOT GAMBLE, TRADE, BET on the forum

but for a zero cost laugh id give you merit if something got approved in 2023

its not a deal/negotiation/bet/promise.. its just a damned laugh

stop pretending you have any power in trying to tender me into any deal

there is no negotiating. chill your pants. ud lose anyway. move on

that said. if something is approved in 2023 ill still send 50merit to the post i mentioned about first.. because merits are non-monetary, crap things. worthless things thrown about to pat people on the back

I don't even dislike you Franky, even though you make it a bit difficult some times with the level of your tackiness. At this point, I don't think it is worth getting into any of the details of the matter, except maybe to say that if a member brings something to another member through PM, there should be some appreciation for that rather than seeming to get overly paranoid about the matter... but hey, you do you... You are the best person to do you.. even though there probably are a few forum members who might be able to imitate your a little bit crazy style... I don't really want to go that far, yet.. because I was mostly attempting to talk about substance rather than to attempt to beat up on you in any kind of specific way,... even though you might deserve a wee tad bit of mocking when you end up going a bit overboard from time to time.... @fillippone.. are you getting mad at us yet.. sorry for some of the extent to which we may be deviating from the topic. and gosh how many posts has it been that we have not really weaved very much about Grayscale into our discussion. except maybe a few comments on the side, here and there along the way.. and my guess is as good as anyone else if there ends up being some BTC spot ETF approvals if Grayscale ends up being in the mix of the approvals.. or even if they would be able to accomplish their conversion in a similar timeline as the other ETFs might end up going live.. I suppose that could be a bit of an issue in terms of how long it takes for each of the kinds of processes to end up going live. As I already mentioned, I am inclined to think that Grayscale would be in the mix of the approvals, even though some of the charges against them could constitute some rational basis to delay (or even deny) approval of their attempt to convert their BTC fund into a BTC spot ETF without some kind of specific assurances regarding that the Grayscale conversion process is not otherwise causing injustices towards various claimants or even being in the public interest to do so.. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

November 21, 2023, 07:05:57 AM

Last edit: November 21, 2023, 10:00:12 AM by franky1 |

|

[franky again ignores many paragraphs about bets and personalities, .. boring]

I am inclined to think that Grayscale would be in the mix of the approvals, even though some of the charges against them could constitute some rational basis to delay (or even deny) approval of their attempt to convert their BTC fund into a BTC spot ETF without some kind of specific assurances regarding that the Grayscale conversion process is not otherwise causing injustices towards various claimants or even being in the public interest to do so..

im inclined to think because coinbase is grayscales sister company. it makes grayscale more complex case for the whole "separation" of shares-coin custody/access detail, which this little back and forth discussion in recent days started with where as blackrock<>coinbase share less relations thus appear as less of a risk to nefariously collude internally, which is another factor thats a pro for blackrock and a con for grayscale and yes with the grayscale and coinbase legal battles with SEC with the US attorney general suing DCG and genesis last month with the SEC suing genesis in january vs SEC experience with blackrocks many old school ETF is another pro for blackrock con for grayscale DCG with the FTX-DCG-genesis mismanagement of funds saga is another con for grayscale. analogy: if a guardian is trying to adopt a kid. but one kid is causing enough trouble that guardian takes him to court or he takes the guardian to court for allegations of misbehaving.. you dont then adopt him and call him the best choice of kid all other foster kids should emulate if they want to be adopted too. they are not going to become the poster child for the foster-adoption system .. with DCG CEO B.S being charged with defrauding upto 230,000 investors and the public by trying to conceal more than $1.1 billion in losses.. i dont think the SEC is going to approve a DCG sister company as the "best representation of funds management". well not untill the case is settled or DCG is found innocent

other conclusions summarised about points raised in last couple days (ontopic) it was said that JJG was not completely sure that SEC/wallstreet is purposefully creating barriers of entry to avoid competition. and yet year long battles with the SEC show the SEC isnt so open handed about what their preferences for acceptance are. they are not so transparent about minimal standard or any standard and instead want to build the standard to then be precedent for all others to follow it was also said by JJG that unit bias was not a thing.. yet just look at ark21.. shares are $0.59 and their total cap is about $5m meaning they have only 150btc collateralised.. compare that to grayscales.. and also the annualised fee's between the two... people will make different decisions based on that alone lets go one step further. with only 150btc collateralised in shares21. they dont even have enough volume/liquidity to take to market. yes there are lots of microshares. (like penny stocks) but not enough to cater to millions of people. imagine it they only have $5m of collateral which is like only 10k people putting one month of minimal grade pension money aside($100) if we go back to the discussions about impact on the spot market(CEX) of agents buying baskets.. grayscale wont need or want to adopt agents untill they sell their own shares and buy up new baskets to not have competition to supply to investors.. however shares21 wil definitely need to call around to brokers to become agents and go on a buying frenzy of basket of btc to increase the pool of coins available to collateralise as shares |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 21, 2023, 08:06:52 PM |

|

[edited out]

....... other conclusions summarised about points raised in last couple days (ontopic) it was said that JJG was not completely sure that SEC/wallstreet is purposefully creating barriers of entry to avoid competition. and yet year long battles with the SEC show the SEC isnt so open handed about what their preferences for acceptance are. they are not so transparent about minimal standard or any standard and instead want to build the standard to then be precedent for all others to follow Not sure exactly if that is what I had been saying, but it is in the ballpark of what I was kind of saying. I just heard an interview with Ric Edelman (founder of Digital Assets Council of Financial Professionals) with Laura Shin on the Unchained podcast. The interview just published today, and he seems to be closer to what I have been trying to say in terms of both his seemingly optimism of some Bitcoin spot ETFs having good chances of getting approved this year, but maybe more importantly his thoughts that several of the Bitcoin Spot ETFs (if not all 12 of them) will get approved at around the same time, which was part of the dynamic that I was trying to suggest too. At the same time, there was not too much discussion of any kind of worry that I seem to have on my inner sides in regards to possibilities of Grayscale not being approved for its spot ETF conversion.. but his discussion of the concerns about the Gold ETF having way greater advantages over any other gold-related ETF seems to be part of the justification why he seems to be also suggesting that Grayscale is likely to get approved at the same time as the other BTC spot ETFs because of some of the unfairness that can develop (and seems to have had been learned by the SEC) if they were to approve ONLY one and give favorability to any of them over others. He also seemed to have had been describing Grayscale as an already existing large base of about 30 million BTC exposed clients (through the current Grayscale product and expectantly converting over to the spot ETF in a kind of immediate way). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

November 23, 2023, 01:58:08 PM

Last edit: November 23, 2023, 04:30:44 PM by franky1 |

|

i just looked into some other reasons why the SEC does not want shares to be easily swapped direct for btc..

much like wheat, gold, (commodity) which at the end of contract the receiver has to claim the actual underlying asset (gold/wheat)

but by being just share-fiat, the SEC treats share provisions of spot ETF as a security.

if when someone sells a share they are just given btc, not fiat.. it would be a commodity regulator involved in the share regulation(CFTC not SEC)

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 23, 2023, 11:26:26 PM |

|

i just looked into some other reasons why the SEC does not want shares to be easily swapped direct for btc..

<...>

it would be a commodity regulator involved in the share regulation(CFTC not SEC)

This is quite an interesting point and a nice explanation for an otherwise frankly (pun intended) inexplicable decision. On the other hand, it still surprises me how all the major issuers agreed on an in-kind process only. What was the problem on their side in cash creation/redemption? |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

November 23, 2023, 11:44:10 PM

Last edit: November 24, 2023, 12:12:30 AM by franky1 Merited by fillippone (3) |

|

i just looked into some other reasons why the SEC does not want shares to be easily swapped direct for btc..

<...>

it would be a commodity regulator involved in the share regulation(CFTC not SEC)

This is quite an interesting point and a nice explanation for an otherwise frankly (pun intended) inexplicable decision. On the other hand, it still surprises me how all the major issuers agreed on an in-kind process only. What was the problem on their side in cash creation/redemption? to convert share to BTC is easy. the custodian has to just give away the BTC, institutions love it. custodians love it. SEC/IRS hate it however.. scenario time: imagine agent buying 5,000BTC at $35,000 each =$175m to lock up 50000BTC to become collateral for shares coinbase holds onto the BTC. .. but the cash is not also held onto by coinbase.. the seller that sold the BTC takes the cash out of coinbase and custodian announces locking the 5000btc and the ETF produces shares for the agent... (ignore the etf market,, lets continue the scenario at the CEX) now image 100,000 people just play the CEX markets starting from $350 each for 0.01 amounts coinbase doesnt keep the cash the buyers and sellers deposit and withdraw but imagine after 100,000 trades of other users cause the price to pump to $70k/coin again remember no cash left in coinbase the 100,000 CEX customers withdrew and went to bed, thus the cash was not coinbases to mis appropriate anyway so now imagine share holders of an ETF were to want to sell a basket of shares amounting to 5000btc via the agent(destroying the shares).. to close a basket unlocking 5000btc means having to search for $350m of cash to make share basket redemptions sales whole compared to share price.. OR sell on the market causing a price crash meaning the amount combined of the sales wont meet the agreed share sale price earlier in the day so the SEC dont want agents/brokers closing off their baskets (destroying shares) to exit the ETF easily at all because it would be difficult for coinbase to find $350m to cover the basket yes offering BTC "in-kind" is easier for the ETF, broker and custodian... as no cash needs to be found to honour the exit.. X shares=X sats.. easy right but the SEC doesnt want "in-kind" redemptions (destroying shares to unlock btc) because then CFTC will be the regulator the SEC want basket redemptions to be a very rare event, planned well ahead of time to give time for other brokers wanting baskets to become etf agents to get in, to buy in at set price of 'match day'. purely so that closing off of baskets can trigger cap gains/losses without causing a spot cex price crash

with all that said.. what i see happening is where baskets would need to be bought and sold, off-market in 'darkpools' between institutions and large agents.. to not affect the public spot cex markets |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 26, 2023, 11:39:42 PM |

|

with all that said.. what i see happening is where baskets would need to be bought and sold, off-market in 'darkpools' between institutions and large agents.. to not affect the public spot cex markets

Of course, you cannot sell those corn in the open books; In confusing terminology, the OTC desks (which, in the end trade against the largest CEX customers) are here to help. The funny thing: the OTC desks actually trade on CEX. OTC here means that all the trading happens outside the open books, not outside the exchanges. When a trade happens the OTC desk ends up trading in a block trade In the venue |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

November 27, 2023, 01:19:47 AM Merited by fillippone (3) |

|

with all that said.. what i see happening is where baskets would need to be bought and sold, off-market in 'darkpools' between institutions and large agents.. to not affect the public spot cex markets

Of course, you cannot sell those corn in the open books; In confusing terminology, the OTC desks (which, in the end trade against the largest CEX customers) are here to help. The funny thing: the OTC desks actually trade on CEX. OTC here means that all the trading happens outside the open books, not outside the exchanges. When a trade happens the OTC desk ends up trading in a block trade In the venue yes in this case coinbase will be the custodian/reserve.. much like gold reserves, the coins stay in custody, but the ownership labels of each basket changes, so coinbase will be doing backroom darkpool trading aka otc though im sure any large holders with more then one basket worth of coins will also make their own darkpool |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 27, 2023, 08:33:27 AM |

|

though im sure any large holders with more then one basket worth of coins will also make their own darkpool

For sure the introduction of the ETF will definitely impact the market microstructure. You are suggesting there will be more dark pool trading, and this is for sure one of the differences, but for sure there will be a clear distinction before and after the ETF launch in spot trading. Not necessarily attaching a "good" label to this. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

November 29, 2023, 04:19:14 PM Merited by fillippone (3) |

|

though im sure any large holders with more then one basket worth of coins will also make their own darkpool

For sure the introduction of the ETF will definitely impact the market microstructure. You are suggesting there will be more dark pool trading, and this is for sure one of the differences, but for sure there will be a clear distinction before and after the ETF launch in spot trading. Not necessarily attaching a "good" label to this. im still running scenarios based on details i find. EG knowing that alot of grayscale(with 630k btc holdings) some large share holders will want to exit grayscale which can cause some baskets of shares to dissolve and move btc baskets out of grayscale(coinbase) custody where as ark21(with just 150btc holdings) will want to recruit agents/brokers and bring in new btc basket to lock up and create shares. the impact of grayscale on the public spot (with or without darkpools) wont see mega bull run spot activity the impact of ark21 on the public spot (with with darkpool) wont see mega bull run spot activity the impact of ark21 on the public spot (without darkpools) WILL see mega bull run spot activity the impact of blackrock on the public spot (with or without darkpools) WILL see mega bull run spot activity |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 29, 2023, 08:35:00 PM |

|

though im sure any large holders with more then one basket worth of coins will also make their own darkpool

For sure the introduction of the ETF will definitely impact the market microstructure. You are suggesting there will be more dark pool trading, and this is for sure one of the differences, but for sure there will be a clear distinction before and after the ETF launch in spot trading. Not necessarily attaching a "good" label to this. im still running scenarios based on details i find. EG knowing that alot of grayscale(with 630k btc holdings) some large share holders will want to exit grayscale which can cause some baskets of shares to dissolve and move btc baskets out of grayscale(coinbase) custody where as ark21(with just 150btc holdings) will want to recruit agents/brokers and bring in new btc basket to lock up and create shares. the impact of grayscale on the public spot (with or without darkpools) wont see mega bull run spot activity the impact of ark21 on the public spot (with with darkpool) wont see mega bull run spot activity the impact of ark21 on the public spot (without darkpools) WILL see mega bull run spot activity the impact of blackrock on the public spot (with or without darkpools) WILL see mega bull run spot activity You mentioned three out of 12 or is it 3 out of 13. So of course, based on your earlier post, you had assumed no more than 4 of the spot BTC ETFs would get approved at the same time (which I placed within two weeks as being at the same time), but your mentioning of Ark seems to be presuming that they might get approved, but the fact that they are so small, you may well be assuming that they are very unlikely to get approved anyhow. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

November 29, 2023, 10:59:31 PM

Last edit: November 29, 2023, 11:39:06 PM by franky1 |

|

what if i told you the total is not 13 nor 12 but less..

what if i told you applicants like franklin want to remove themselves from the SEC lineup for nasdaq securities ETF listing.. and instead jump into the CFTC regulatory permit of CME commodity ETF listing

what if i told you franklin is not the only one that wants to do 'in-kind' basket settlement and jump ship over to CFTC regulatory permit

what if i told you my mentioning of blackrock, greyscale, ark21 was not an endorsement of whom is going to get gold silver and bronze of the approval olympic race. but instead just 3 well known applications where grayscale has most collateral and ark21 has least collateral.. just as a collateral comparison of scenarios of which would recruit agent/brokers or not

as for the 4.. well anything can happen but it sure as hell isnt going to be all 12 at once. nor 10

as for which single might win gold.. my odd are on blackrock

i was looking at genslers personal financial disclosers and blackrock and vanguard are his prefered investment managers. and im sure there has been alot of push to get vanguard to apply.. but vanguard just weeks ago announced no interest.. so im sure that might have given gensler one less excuse to delay things hoping his buddy vanguard might step in.. now they are not. this adds more points towards blackrock.

my reasoning for favouring blackrock is summarised as:

a. blackrock has a long history of running successful ETF and know what they are doing

b. blackrock already got their ticker listed on DTCC meaning traders new software update will have blackrock ready to pick (other applicants are not part of the traders software update)

c. blackrock (not others) were in talks with SEC about how they propose to secure value of share->fiat settlements of dissolving baskets

d. blackrock settled all legal issues and paid all fines to appease the SEC. other applicants stil have some legal issues holding hem back

the others are not yet having these key steps finalised so they still have a few steps to go to catch up with blackrocks progress

im not saying blackrock will definitely get accepted. gensler can veto them all for many many many months using delays.. but blackrock appears to be a few steps ahead of the game

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 30, 2023, 02:19:43 AM |

|

what if i told you the total is not 13 nor 12 but less..

I would tell you: "Great. Thanks for being so specific with the results of your 'research.' " what if i told you applicants like franklin want to remove themselves from the SEC lineup for nasdaq securities ETF listing.. and instead jump into the CFTC regulatory permit of CME commodity ETF listing

I would say: "That's wonderful. I am not sure why it matters in the whole scheme of things and maybe the overall landscape of the forest, which is more of my concerns rather than getting caught up with the weeds and/or the trees." what if i told you franklin is not the only one that wants to do 'in-kind' basket settlement and jump ship over to CFTC regulatory permit

I would say: "Great. Wonderful. I hope this is going somewhere with a point." what if i told you my mentioning of blackrock, greyscale, ark21 was not an endorsement of whom is going to get gold silver and bronze of the approval olympic race. but instead just 3 well known applications where grayscale has most collateral and ark21 has least collateral.. just as a collateral comparison of scenarios of which would recruit agent/brokers or not

I would say: "Fair enough." as for the 4.. well anything can happen but it sure as hell isnt going to be all 12 at once. nor 10

as for which single might win gold.. my odd are on blackrock

I doubt that the supposed fleeing of the sinking ship has caused a situation in which the SEC would error on the side of ONLY approving 1 or 2 applicants, as was explained in the earlier interview that I linked in which the guy being interviewed mentioned that the SEC is aware of the error of its way in the way it had approved the GOLD ETF and took a long time before it approved any more than one... so in that regard, I am going to stick with my idea that it will be more than 4 within 2 weeks rather than 4 or less, which still seems to be your position.. . but hey.. I don't care either way, and I hardly even feel like it anything to really get too worked up about, especially since I am not changing any of my own BTC portfolio management behaviors based on whether this happens or not.. and whether you are or not, you would have to make those kinds of representations to the extent that they even matter. I thought that you said that your overall position is that you don't really trade.. but hey, why should I be studying what Franky1 does with his BTC when I have my own ways of dealing with these kinds of thingies? i was looking at genslers personal financial disclosers and blackrock and vanguard are his prefered investment managers. and im sure there has been alot of push to get vanguard to apply.. but vanguard just weeks ago announced no interest.. so im sure that might have given gensler one less excuse to delay things hoping his buddy vanguard might step in.. now they are not. this adds more points towards blackrock.

my reasoning for favouring blackrock is summarised as:

a. blackrock has a long history of running successful ETF and know what they are doing

b. blackrock already got their ticker listed on DTCC meaning traders new software update will have blackrock ready to pick (other applicants are not part of the traders software update)

c. blackrock (not others) were in talks with SEC about how they propose to secure value of share->fiat settlements of dissolving baskets

d. blackrock settled all legal issues and paid all fines to appease the SEC. other applicants stil have some legal issues holding hem back

the others are not yet having these key steps finalised so they still have a few steps to go to catch up with blackrocks progress

I am not sure if you are saying anything especially original or revealing since most people are already mostly presuming that blackrock is amongst the ones that are approve in the event that any are approved, so probably the only way blackrock would be denied would be if all of them were denied or if maybe one of them was approved a bit prior to Blackrock.. whether that would be more than two weeks prior might be surprising but probably not a total shock if there ended up being some reason to carry out the approvals that way.. maybe to create the appearance of not having favorites or something like that. im not saying blackrock will definitely get accepted. gensler can veto them all for many many many months using delays.. but blackrock appears to be a few steps ahead of the game

So yeah there are non-zero chances of outlier scenarios, but I doubt that it is productive to explore those outlier scenarios instead of trying to consider the more likely scenarios.. even though we know sometimes outlier scenarios sometimes do end up happening.. but still I doubt it is necessary to explore outlier scenarios unless we have some reason to do so, and you already seem to have stated that there is no real reason to consider outlier scenarios, except to acknowledge that they exist. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 03, 2023, 12:56:50 AM

Last edit: December 03, 2023, 01:26:03 AM by fillippone Merited by franky1 (50), JayJuanGee (1) |

|

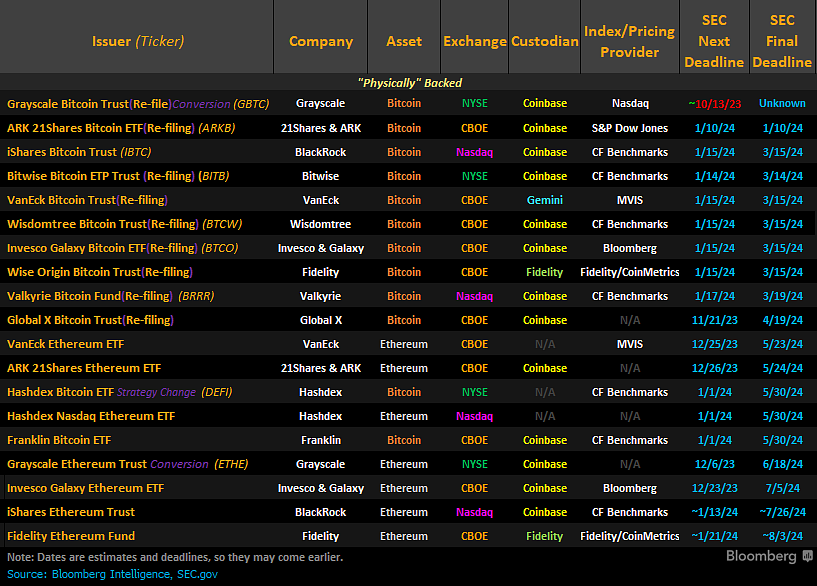

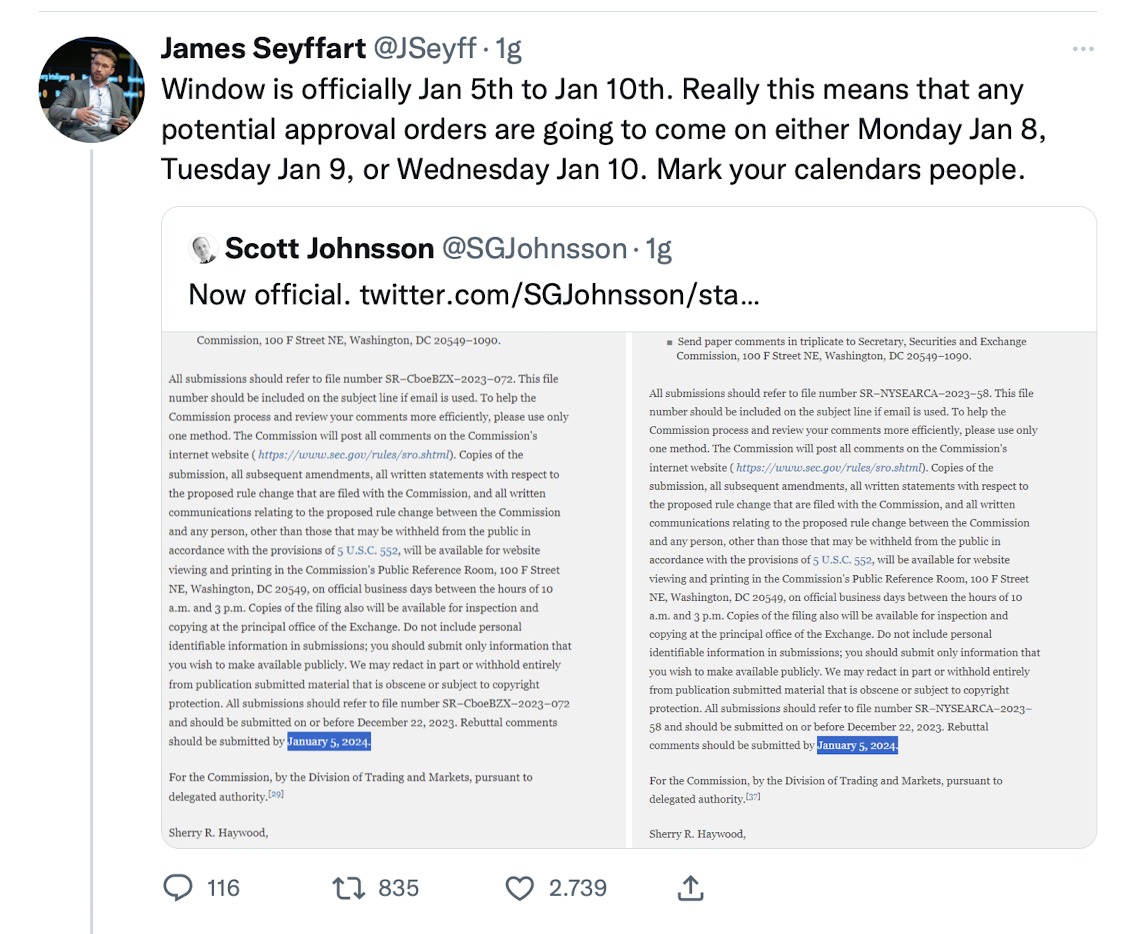

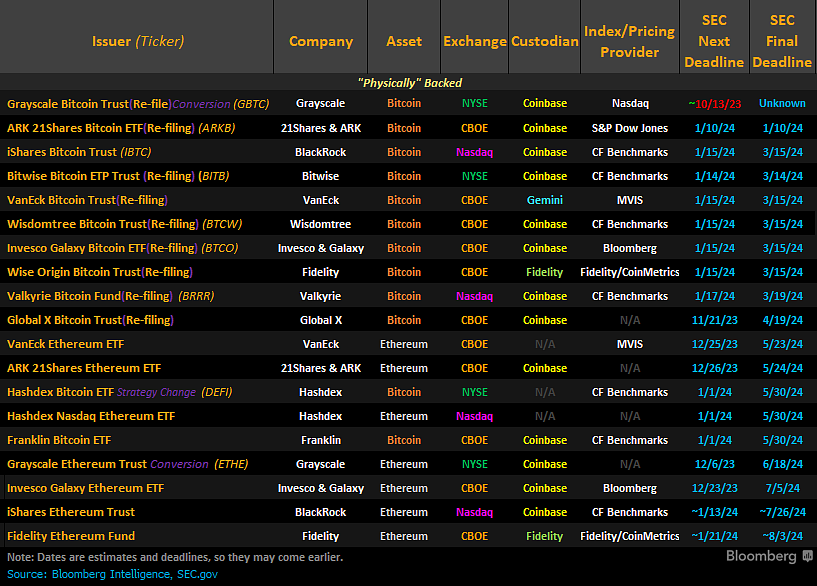

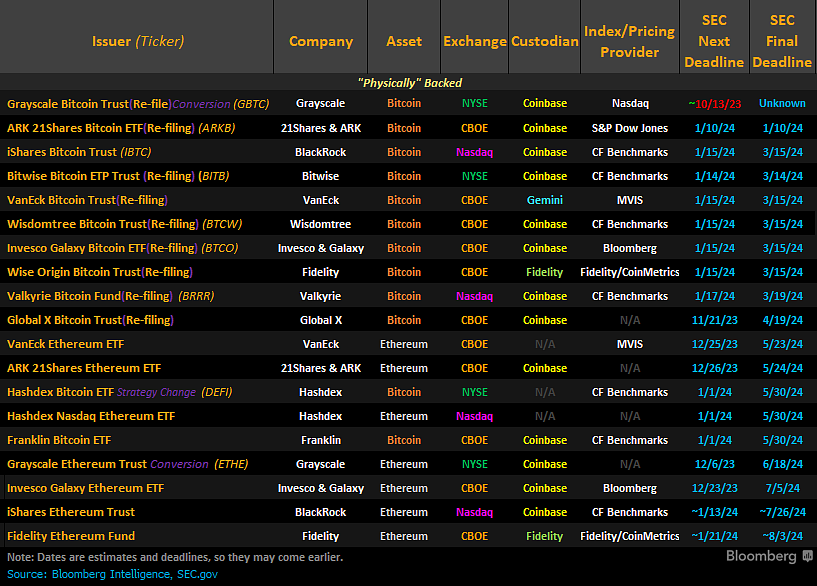

Let's just make a small recap. Firstly, an overview of the current situation: applicants, exchange custodian, the usual stuff:  Secondly, the confirmation there will be a window open between Jan 5th and Jan 10th.  Bloomberg didn't move their estimate from 90% in January, still. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

December 03, 2023, 01:19:58 AM

Last edit: December 03, 2023, 01:35:11 AM by franky1 |

|

Let's just make a small recap of the current situation. Firstly, an overview of the current situation:  i was about to put together a table of the different exchanges the applicants want to appear on. thanks for saving me time(have my usual merit giveaway) most share traders/pension managers care more about the nasdaq first then NYSE second.. the cboe are way down the scale my odds are still on blackrock(ishares) being first mover for nasdaq as for NYSE though bitwise and hashdex are a few steps behind. i still dont think SEC trusts grayscale enough so could delay all NYSE candidates. but thats my opinion based on all the DCG drama with the SEC. grayscale also realised they were not etf experts so recently head-hunted and hired one from investco.. grayscale may now have some expertise to adapt their platform to tick-box a few more sec requirements, only time will tell |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7765

'The right to privacy matters'

|

|

December 03, 2023, 01:25:31 AM |

|

Let's just make a small recap of the current situation. Firstly, an overview of the current situation:  i was about to put together a table of the different exchanges the applicants want to appear on. thanks for saving me time(have my usual merit giveaway) most share traders/pension managers care more about the nasdaq first then NYSE second.. the cboe are way down the scale my odds are still on blackrock(ishares) being first mover for nasdaq I think blackrock does grab it. |

|

|

|

|