fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 20, 2023, 07:17:44 PM

Last edit: October 23, 2023, 10:59:02 PM by fillippone Merited by LFC_Bitcoin (3), JayJuanGee (1) |

|

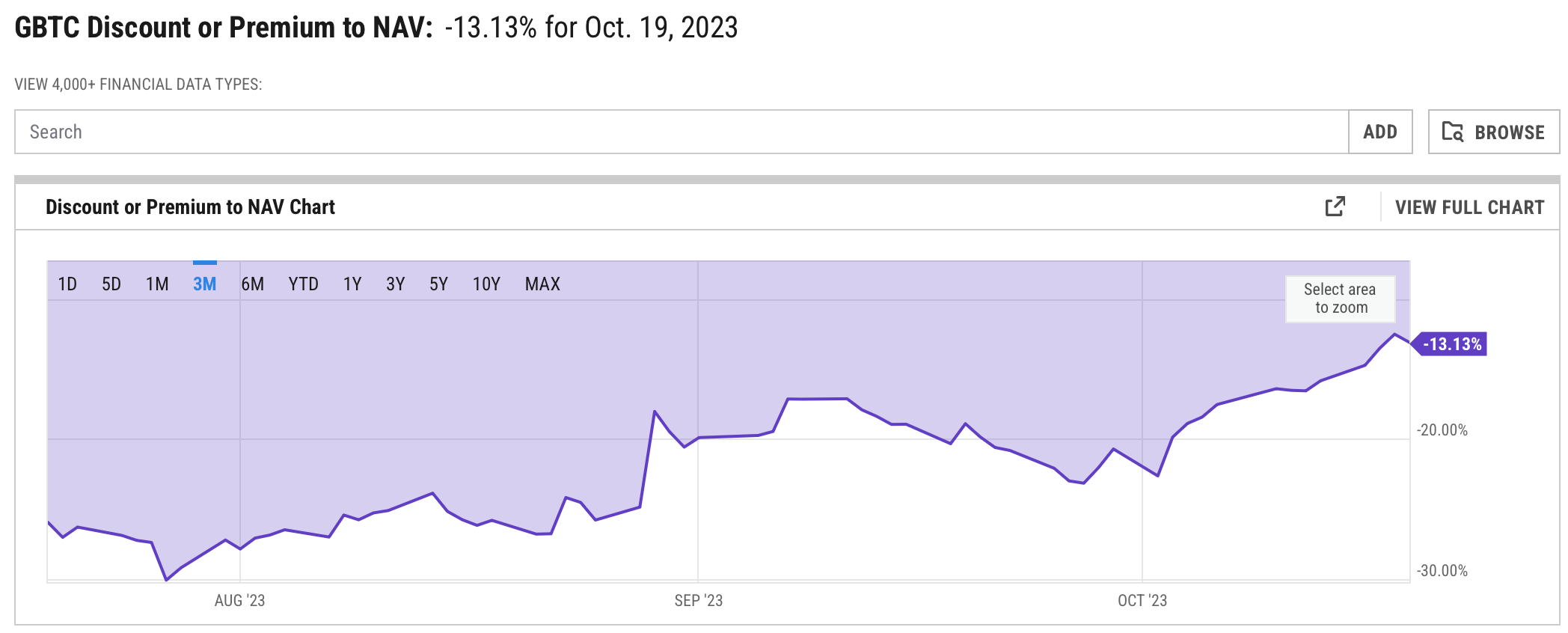

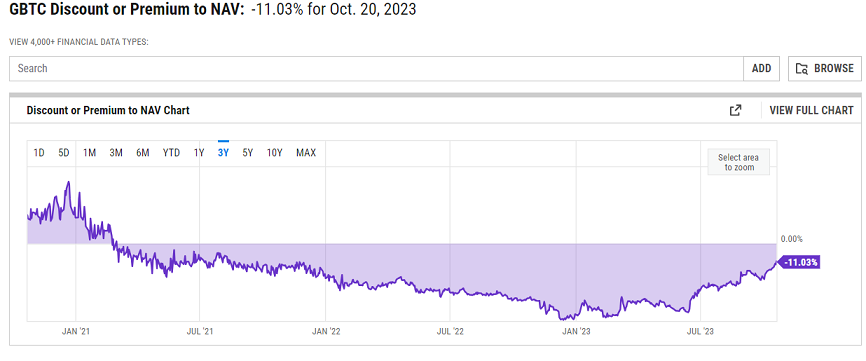

Grayscale Investments announces that they have filed with the SEC a registration application on Form S-3 for the registration of shares of Grayscale Bitcoin Trust (OTCQX: GBTC) the application is submitted one day before the issuance of the judicial mandate by the Court of Appeals of the DC. https://www.grayscale.com/blog/legal-topics/gbtcs-s-3-filing-explainedIf I understand correctly, this is a new application in a simplified form as part of an attempt to convert Grayscale Bitcoin Trust into a spot bitcoin ETF. it seems to me in the 7 day period(DCG said there was a 7 day period of discussion/answer seeking) after appeal deadline SEC and grayscale have been communicating about issues with the application, and it seems grayscale got some advice from SEC as to some of the hindrances imagine if all the drama of rejections all along was grayscale filing using the wrong form.. if they get accepted via the new form. watch all the other companies rush to file on that same form using grayscale as the template model to fast approval. (for applicants that filed a few years ago) Greyscale premium is hovering toward recent minimums:  Optimism about Grayscale conversion is making the fund's share constantly bid. To me, the risk-reward in the trade starts being neutral. Yes, we are close to the finish line, but we are discounting every possible positive news. Even a blip in the road to conversion can scare the investors (who are not pretty in the money in the trade, I would say, and make the discount widen again. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

Be very wary of relying on JavaScript for security on crypto sites. The site can change the JavaScript at any time unless you take unusual precautions, and browsers are not generally known for their airtight security.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 23, 2023, 10:58:44 PM Merited by JayJuanGee (1) |

|

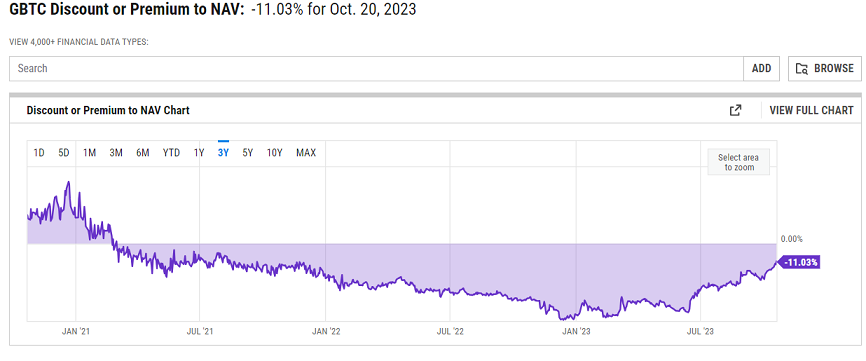

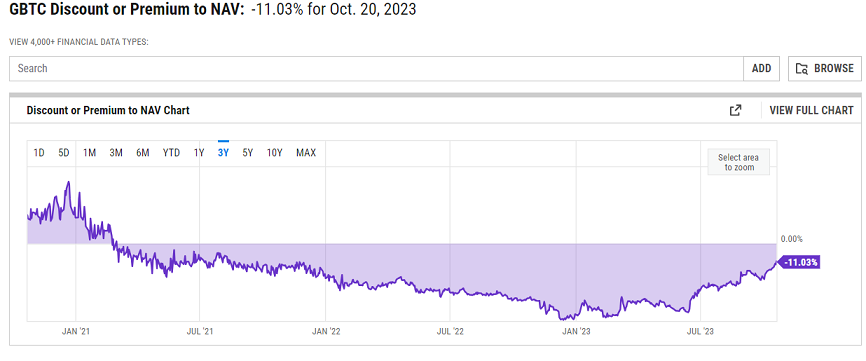

another day, another record:  11% discount wasn't seen on the NAV discount since Aug '21. The optimism on the SEC trial has been overwhelming since the agency didn't appeal the court, which has already taken the discount skyrocketing toward 0%. Ideally, on ETF conversion date this discount should evaporate. Hence the sentiment is very positive and still grinding north. A lot of traders are shorting spot instruments (from futures, to spot itself or even strange things like Microstrategy). THis is definitely an easy trade for the trading community. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

October 24, 2023, 06:38:04 AM Merited by JayJuanGee (1) |

|

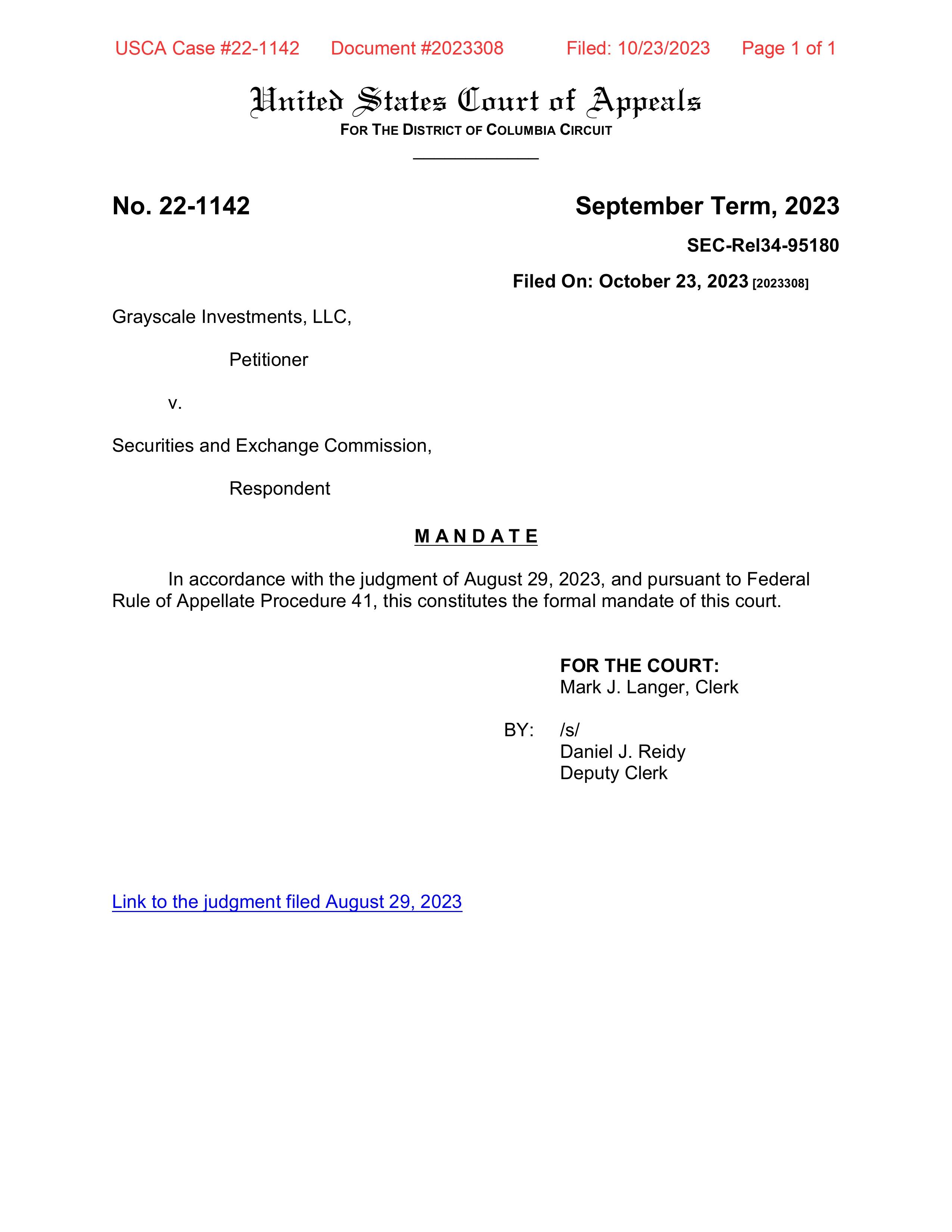

so the appeal happened. the deadline to appeal happened the 7 day consultation period happened and now the courts finally release the mandate formalising the court decision https://storage.courtlistener.com/recap/gov.uscourts.cadc.38827/gov.uscourts.cadc.38827.1208564168.0_1.pdf now the SEC has to officially reconsider grayscale application |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

October 26, 2023, 07:01:16 AM |

|

another day, another record:  and with this, ARK sold 100k of shares monday and 70k of shares tuesday to get out some profit its only a $few million, but still i personally dont see grayscale getting accepted before blackrock. looking at the legal issues of other DCG drama. the SEC is not confident with DCG compared to blackrock |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 26, 2023, 08:30:01 AM |

|

another day, another record:  and with this, ARK sold 100k of shares monday and 70k of shares tuesday to get out some profit its only a $few million, but still i personally dont see grayscale getting accepted before blackrock. looking at the legal issues of other DCG drama. the SEC is not confident with DCG compared to blackrock This is peanut amount for ARK, probably a take profit for one of their junior portfolio manager. The bulk of the position stay still, and probably will do until conversion. Speaking of which, I do disagree with your position. I was fascinated by this possibility in the last, but recent development in the saga made me think it won't happen in the end. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

October 28, 2023, 07:51:17 AM

Last edit: October 28, 2023, 08:12:28 AM by franky1 Merited by JayJuanGee (1) |

|

This is peanut amount for ARK, probably a take profit for one of their junior portfolio manager.

The bulk of the position stay still, and probably will do until conversion. Speaking of which, I do disagree with your position. I was fascinated by this possibility in the last, but recent development in the saga made me think it won't happen in the end.

the way i see it. due to the legal stuff of grayscale. the application review process stopped for them months ago. however the application reviews of things like blackrock continued. now the SEC has been asked to re-review grayscale. they are at the bottom of the pile(back at the start) grayscale recently submitted its promotional material and prospectus pamphlets to the SEC to show their wording is not misleading. but this is not a sign of them being a stage closer than other applicants, it shows the SEC is scrutinising the small print and terms more with the added stuff of the bankruptcy's/debts of grayscale sister companies, and lack of documented experience in the ETF industry, also does not add positive weight to their review. where as blackrocks long history does add positive weight to blackrocks review i know some will say ARK21 deadline in january is closer than blackrocks march deadline. but the SEC can do another delay on ark and favour to give 'first mover' to blackrock on or before march |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 28, 2023, 02:13:03 PM |

|

i know some will say ARK21 deadline in january is closer than blackrocks march deadline. but the SEC can do another delay on ark and favour to give 'first mover' to blackrock on or before march

I doubt the SEC won’t pick all the issuers at the same time. Not only they won’t pick a winner, but as well they will be careful not to pick a loser. This would expose them to a huge legal risk for so much money that they could destroy the reputation of SEC. So, I don’t know when it happens, but when this happen it will be for all of the issuers. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

October 28, 2023, 03:32:01 PM |

|

i know some will say ARK21 deadline in january is closer than blackrocks march deadline. but the SEC can do another delay on ark and favour to give 'first mover' to blackrock on or before march

I doubt the SEC won’t pick all the issuers at the same time. Not only they won’t pick a winner, but as well they will be careful not to pick a loser. This would expose them to a huge legal risk for so much money that they could destroy the reputation of SEC. So, I don’t know when it happens, but when this happen it will be for all of the issuers. nope. each application has different review/deadline dates.. however you are right the SEC do not want to make a mistake of accepting the wrong candidate first as it can put huge legal risk back on the SEC which is more reason to not blanket accept all at same time this legal risk is another reason why non-experienced grayscale vs for instance very ETF experienced blackrock. gives more weight to blackrock winning. blackrock already have the platform and technical communication ISO standards to nasdaq platform. where for blackrock its just adding another asset to its system. however grayscale with no nasdaq experience has to create the platform, conform to ISO communication standards with nasdaq and set up alot of legal compliance frame work for the first time.. its not a case of just adding an asset to nasdaq for grayscale, there is alot more to it to show experience of compliance and readiness. i believe there would be a first mover advantage. followed by other applicants adjusting/editing their applications to be templates of the blackrock application to then "fast track" their acceptances |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 29, 2023, 05:47:14 PM |

|

nope. each application has different review/deadline dates..

<...<

i believe there would be a first mover advantage. followed by other applicants adjusting/editing their applications to be templates of the blackrock application to then "fast track" their acceptances

I respectfully disagree with this one. Once again, for the exact reason you just stated, the first-mover advantage is so relevant that anyone excluded from such an advantage will sue the SEC so quickly and for so much money that they will obliterate it in any court. I'm sorry, but I can't imagine Gary letting the agency go through this yet another time only to lose another time (embarrassing his sponsors in DC). |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

October 30, 2023, 07:16:51 AM

Last edit: October 30, 2023, 07:35:12 AM by franky1 Merited by fillippone (3) |

|

nope. each application has different review/deadline dates..

<...<

i believe there would be a first mover advantage. followed by other applicants adjusting/editing their applications to be templates of the blackrock application to then "fast track" their acceptances

I respectfully disagree with this one. Once again, for the exact reason you just stated, the first-mover advantage is so relevant that anyone excluded from such an advantage will sue the SEC so quickly and for so much money that they will obliterate it in any court. I'm sorry, but I can't imagine Gary letting the agency go through this yet another time only to lose another time (embarrassing his sponsors in DC). each application has different submission dates and deadline dates.. so you cannot assume that companies will sue the SEC simply for choosing one first. applicants know they wont all get an answer at the same date normally.. its a queuing system of first in first out. and no, first in does not default to first success. however IF they all applied on the same date and had a deadline response of the same date. then you might have atleast a foot in the door point where some applicants can sue if they are rejected(for dodgy/absent sec reason) even if their offering sounds the same as the successful applicant but it still requires the SEC to give dodgy/absent reason to reject others with same deadline, same offering. however if the SEC gives good reason to reject majority or each one didnt have same offerings, meaning they missed certain sec demands/requirements. SEC can reject them and it sucks to be the loser. the loser just need to take the advice tweak the application and submit again |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 30, 2023, 07:35:15 AM Merited by JayJuanGee (1) |

|

however if they all applied on the same date and had a deadline response of the same date. then you might have atleast a foot in the door point where some companies can sue if they are rejected(for dodgy/absent reason) even if their offering sounds the same as the successful applicant

Absolutely not. Each application has different submission date and different deadline, and usually the SEC took all the available time in the deadline before procrastinating. But this is not the norm, it is not a first in, first out process, it’s a parallel process for various filings (Gary recently stated they are looking at 8/10 of them) that ends when the paperwork is ready, even before the deadline. Every decision at the SEC is taken when they are ready, before the deadline. This is how it works on every other product. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

October 30, 2023, 07:42:03 AM

Last edit: October 30, 2023, 07:53:14 AM by franky1 |

|

however if they all applied on the same date and had a deadline response of the same date. then you might have atleast a foot in the door point where some companies can sue if they are rejected(for dodgy/absent reason) even if their offering sounds the same as the successful applicant

Absolutely not. Each application has different submission date and different deadline, and usually the SEC took all the available time in the deadline before procrastinating. But this is not the norm, it is not a first in, first out process, it’s a parallel process for various filings (Gary recently stated they are looking at 8/10 of them) that ends when the paperwork is ready, even before the deadline. Every decision at the SEC is taken when they are ready, before the deadline. This is how it works on every other product. everything you have said does NOT show that the SEC will make a multi-acceptance decision on the same day before deadlines where are your logical responses of indepth thought and proof that there will be a multiple acceptance day.. so far in your many posts you have not shown any reason or rationale or evidence that multiple ETF will get accepted on same day before deadlines, you have only shown your hopes (dont get me wrong, i share your hopes.. but rationally and logically, expectations differ from hopes) the very evidence that the SEC waited until the very last minute to give rejection response SOLO to grayscale alone, shows the sec dont rush to respond before deadlines, nor give multiple applicant responses at same time real life examples show the situation of grayscale is not a multi ETF accept/rejection on same day.. emphasis: grayscale is proof they look at each applicant differently and respond on different dates/deadlines in short and double emphasis: they did not give all applicants a response when they gave grayscale bad news this year |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

the very evidence that the SEC gave rejection response SOLO to grayscale alone and not a multi ETF rejection on same day as grayscale is proof they look at each applicant differently and respond on different dates/deadlines

My rationale are: - SEC has got a beating in court against Grayscale, that was rejected for “inconsistent and capricious reasons”. The SEC was respectful of this sentence, as they didn’t appeal (and didn’t use the “fake news” pump to their advantage). This made the SEC realise they had to move on with their “passive aggressive” strategy.

- SEC is actively working with major issuers to fine tune their filing. We saw many filing update from many issuers over the past weeks. This make me think all the filings are approaching their final state

- SEC realise that there is a huge “first movers advantage” in the ETF industry. Authorising only a few ETF, means picking a winner. After months of filing negotiations this could lead to so many causes for so much amount of money the SEC could be destroyed in court.

For all these reasons I guess all the ETF will be approved in the immediate vicinity of the final deadline in January. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

October 30, 2023, 07:58:21 AM Merited by fillippone (3) |

|

the very evidence that the SEC gave rejection response SOLO to grayscale alone and not a multi ETF rejection on same day as grayscale is proof they look at each applicant differently and respond on different dates/deadlines

My rationale are: - SEC has got a beating in court against Grayscale, that was rejected for “inconsistent and capricious reasons”. The SEC was respectful of this sentence, as they didn’t appeal (and didn’t use the “fake news” pump to their advantage). This made the SEC realise they had to move on with their “passive aggressive” strategy.

- SEC is actively working with major issuers to fine tune their filing. We saw many filing update from many issuers over the past weeks. This make me think all the filings are approaching their final state

- SEC realise that there is a huge “first movers advantage” in the ETF industry. Authorising only a few ETF, means picking a winner. After months of filing negotiations this could lead to so many causes for so much amount of money the SEC could be destroyed in court.

For all these reasons I guess all the ETF will be approved in the immediate vicinity of the final deadline in January. SEC has never responded to all applicants with progress at the same time SEC has never responded to all applicants with adjustment requirements at the same time SEC has always let the time run out before responding to applicants individually to that applicants own deadline even the decision not to appeal was not a mid week announcement. the SEC let the timer run out the SEC has never shown any reason to respond early before deadlines nor shown multi response to all applications at the same time the ETF applicants that did not file first know they wont get responses first/equally... their only HOPE to skip the queue is by having a better application that ticks all the SEC requirement boxes avoiding any back and forth communication/adjustments. to fast track one before the other by just being the best candidate.. but thats a hope.. SEC still shows they wait til deadline day even if they know they will reject one |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

wavessurfing

Member

Offline Offline

Activity: 370

Merit: 41

|

|

November 18, 2023, 09:02:23 AM |

|

the very evidence that the SEC gave rejection response SOLO to grayscale alone and not a multi ETF rejection on same day as grayscale is proof they look at each applicant differently and respond on different dates/deadlines

My rationale are: - SEC has got a beating in court against Grayscale, that was rejected for “inconsistent and capricious reasons”. The SEC was respectful of this sentence, as they didn’t appeal (and didn’t use the “fake news” pump to their advantage). This made the SEC realise they had to move on with their “passive aggressive” strategy.

- SEC is actively working with major issuers to fine tune their filing. We saw many filing update from many issuers over the past weeks. This make me think all the filings are approaching their final state

- SEC realise that there is a huge “first movers advantage” in the ETF industry. Authorising only a few ETF, means picking a winner. After months of filing negotiations this could lead to so many causes for so much amount of money the SEC could be destroyed in court.

For all these reasons I guess all the ETF will be approved in the immediate vicinity of the final deadline in January. SEC has never responded to all applicants with progress at the same time SEC has never responded to all applicants with adjustment requirements at the same time SEC has always let the time run out before responding to applicants individually to that applicants own deadline even the decision not to appeal was not a mid week announcement. the SEC let the timer run out the SEC has never shown any reason to respond early before deadlines nor shown multi response to all applications at the same time the ETF applicants that did not file first know they wont get responses first/equally... their only HOPE to skip the queue is by having a better application that ticks all the SEC requirement boxes avoiding any back and forth communication/adjustments. to fast track one before the other by just being the best candidate.. but thats a hope.. SEC still shows they wait til deadline day even if they know they will reject one can you precise if SEC is "useful" in any sense for its people ? |

|

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

November 18, 2023, 09:13:37 AM |

|

can you precise if SEC is "useful" in any sense for its people ?

they are not pro-active. they are reactive/retroactive they wait for reports to come to them. and have other departments or private business to collect data for them. and only IF a report raises to a risk standard do they then react to get court orders to retroactively audit/investigate old historic data for a crime. i would love it if regulators actually audited custodians pro-actively and also ensured custodians has some bankruptcy protection/hacker insurance to protect users funds where the insurer just pays out should the business go bad. whereby with audits and compliance the business can just start-up and operate knowing there is some "security" in its exchange.. this whole setting a deadline and on last minute moving goalposts shows they are not actually doing any active work when the grayscale vs sec deadline came for sec to appeal. they didnt make a decision to not appeal and announce it early to start the next period. they waited to the last day, said nothing and just let the deadline passing be their answer to if they would appeal or not there was another deadline on nov 17th to possibly give a ETF announcement.. again no response just let the deadline pass. now most people are waiting until january for next deadline.. the SEC is not fit for purpose and act like they dont even know their own role. they cant even categorise what is a commodity or asset properly to decide if its their jurisdiction or not to act on.. the SEC needs an overhaul. and the replacement should be more prioritising consumer protection not consumer policing via their businesses they regulate |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10161

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 18, 2023, 01:48:01 PM |

|

can you precise if SEC is "useful" in any sense for its people ?

they are not pro-active. they are reactive/retroactive they wait for reports to come to them. and have other departments or private business to collect data for them. and only IF a report raises to a risk standard do they then react to get court orders to retroactively audit/investigate old historic data for a crime. i would love it if regulators actually audited custodians pro-actively and also ensured custodians has some bankruptcy protection/hacker insurance to protect users funds where the insurer just pays out should the business go bad. whereby with audits and compliance the business can just start-up and operate knowing there is some "security" in its exchange.. this whole setting a deadline and on last minute moving goalposts shows they are not actually doing any active work when the grayscale vs sec deadline came for sec to appeal. they didnt make a decision to not appeal and announce it early to start the next period. they waited to the last day, said nothing and just let the deadline passing be their answer to if they would appeal or not there was another deadline on nov 17th to possibly give a ETF announcement.. again no response just let the deadline pass. now most people are waiting until january for next deadline.. the SEC is not fit for purpose and act like they dont even know their own role. they cant even categorise what is a commodity or asset properly to decide if its their jurisdiction or not to act on.. the SEC needs an overhaul. and the replacement should be more prioritising consumer protection not consumer policing via their businesses they regulate Regarding the spot ETF deadline and also in regards to what might be happening with the SEC and the ETF applicants, did you not hear the news from the last 24 hours Franky? Of course, you can look it up yourself from various sources, but the essence of the news seems to be that the SEC has given two weeks to the ETF applicants to provide their "cash creates" details to the SEC. SEC allegedly wants spot Bitcoin ETFs to do cash creates, not crypto, after possible meet-up with exchangeswhich seems to mean that ETF providers have to go through the exchanges that they list on their application in terms of buying the underlying BTC whenever anyone buys ETF shares through them. To me, that also seems to indicate that the soonest that any Spot ETF would be approved would be two weeks from yesterday.. which would be right around December 1, at the earliest.. .and sure, the theory is that all of them would be approved at once, and presumptively that would include the Grayscale conversion of their trust to an ETF in the mix of the approvals, once the approvals come out. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

November 18, 2023, 02:24:19 PM

Last edit: November 18, 2023, 02:50:00 PM by franky1 |

|

in a bitcoin spot ETF .. they do not trade in bitcoin... they trade in shares for fiat..

the idea actually is the brokerdealers manage, as agents of the ETF... a basket of SHARES which are sold for fiat

its already been known that the SEC wants to know which btc exchanges will secure, audit and transfer the actual bitcoin (EG coinbase for greyscale/blackrock)

so lets say broker-dealer "ABC investments" wanted to be spot ETF agents..

they would with fiat, go to coinbase. pay $XXXXX fiat for a basket worths of BTC and coinbase would custody it and register the basket with greyscale. making it part of greyscales trust.. not ABC investments property/custody/ownership..

grayscale will then give ABC investments a lump of GBTC shares. where the GTBC shares are ABC investments property/customer/ownership.. which ABC investments can sell shares to its customers

ABC investments would not be trading bitcoin with its customers

im sure the link your wrote got details in wrong order/misunderstood. but im thinking the SEC is talking to coinbase to ensure coinbases systems are ready to register the baskets with blackrock, greyscale, ark.. so that agents can hand fiat over and the ETF hand shares back in a secure audited way via coinbase ratifying, securing and registering the custody of coins to allow ETF to create the shares to give agents access to

it a known think that dealers cant do bitcoin direct with their customers... its kinda the whole entire point of this whole 10 year saga of trying to get an ETF that shadows the spot price. rather than direct trade bitcoin itself.

its just that some applications are not doing what greyscale, blackrock and ark are doing.. some smaller applications have wanted to self custody actual btc and allow direct btc redemptions, which the SEC doesnt want and are saying no to.

the reasons the SEC want it the greyscale,blackrock,ark way.. of a middleman between agent and etf doing the custody. is this:

by a agent not doing "in-kind" share->btc redemption.. and instead SEC wanting just share->cash trading.. is that the trades trigger cap-gains

IF a broker/agent were to take a customers cash. give them shares then later at sell redeem to btc for the customer.. the customer is not then triggering cap-gains because they fiat-share-btc has not looped back to fiat to trigger gains.. its a "in-kind" non taxable swap to not see gains

so yes the sec wants the dealer-agent not to self custody, offer btc, do share->btc redemptions. its for tax reasons

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

Gormicsta

Member

Offline Offline

Activity: 168

Merit: 75

|

|

November 18, 2023, 04:44:53 PM |

|

Some of those privately offered investments are also publicly quoted on the public market.

Absolutely correct. There have apparently been public quotes on the OTC market for a few of the Grayscale Trusts that were made available through private placements. On the OTCQX Best Market, individual and institutional investors may also trade the Trusts' shares publicly. https://www.grayscale.com/crypto-products |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10161

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 18, 2023, 04:53:32 PM |

|

in a bitcoin spot ETF .. they do not trade in bitcoin... they trade in shares for fiat..

the idea actually is the brokerdealers manage, as agents of the ETF... a basket of SHARES which are sold for fiat

its already been known that the SEC wants to know which btc exchanges will secure, audit and transfer the actual bitcoin (EG coinbase for greyscale/blackrock)

so lets say broker-dealer "ABC investments" wanted to be spot ETF agents..

they would with fiat, go to coinbase. pay $XXXXX fiat for a basket worths of BTC and coinbase would custody it and register the basket with greyscale. making it part of greyscales trust.. not ABC investments property/custody/ownership..

grayscale will then give ABC investments a lump of GBTC shares. where the GTBC shares are ABC investments property/customer/ownership.. which ABC investments can sell shares to its customers

ABC investments would not be trading bitcoin with its customers

im sure the link your wrote got details in wrong order/misunderstood. but im thinking the SEC is talking to coinbase to ensure coinbases systems are ready to register the baskets with blackrock, greyscale, ark.. so that agents can hand fiat over and the ETF hand shares back in a secure audited way via coinbase ratifying, securing and registering the custody of coins to allow ETF to create the shares to give agents access to

it a known think that dealers cant do bitcoin direct with their customers... its kinda the whole entire point of this whole 10 year saga of trying to get an ETF that shadows the spot price. rather than direct trade bitcoin itself.

its just that some applications are not doing what greyscale, blackrock and ark are doing.. some smaller applications have wanted to self custody actual btc and allow direct btc redemptions, which the SEC doesnt want and are saying no to.

the reasons the SEC want it the greyscale,blackrock,ark way.. of a middleman between agent and etf doing the custody. is this:

by a agent not doing "in-kind" share->btc redemption.. and instead SEC wanting just share->cash trading.. is that the trades trigger cap-gains

IF a broker/agent were to take a customers cash. give them shares then later at sell redeem to btc for the customer.. the customer is not then triggering cap-gains because they fiat-share-btc has not looped back to fiat to trigger gains.. its a "in-kind" non taxable swap to not see gains

so yes the sec wants the dealer-agent not to self custody, offer btc, do share->btc redemptions. its for tax reasons

My main reason for bringing it up was ONLY to suggest that the dates for approval might be December 1st at the soonest, and I was not really even caring to get into any of the details of the meaning of what they were doing, even though I presumed that it would have been for various kinds of control and/or manipulation prevention reasons and that sourcing of the coins would be known, and sure maybe there is also the tax monitoring advantages .. whether that was a central motivation or not, we already should have known that self-custody is not part of any the current expectations of any of the ETFs.. so that surely is part of the reason that the ownership of any ETF is inferior to owning spot BTC.. but surely there are going to be both institutions and also some individuals who end up getting into BTC because of the ETF price exposure that is allowable through their retirement savings accounts that would not allow for the direct purchasing and/or custody of BTC. I suppose many of us have concerns about BIG players owning and controlling so many BTC, even if they have fiduciary duties to the supposed real owners, while we still have a not your keys not your coins situation that could end up having various blow-up scenarios that are bad for the users and perhaps even bad for bitcoin as a whole since some of the direct power of owning and controlling BTC would be held by the custodian who may well not be acting in the interest of the person who believes that he owns bitcoin when he only owns claims to bitcoin...or maybe he ONLY owns bitcoin price exposure.. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|