Bloomberg Intelligence released a survey on GBTC is doing recently, comparing with other investment vehicle available to the US investor.

GBTC: Premium and Discount Concerns

GBTC Offers Below-Market Bitcoin as Futures ETFs Spur Discounts

Contributing Analysts

Eric Balchunas

(Strategy)

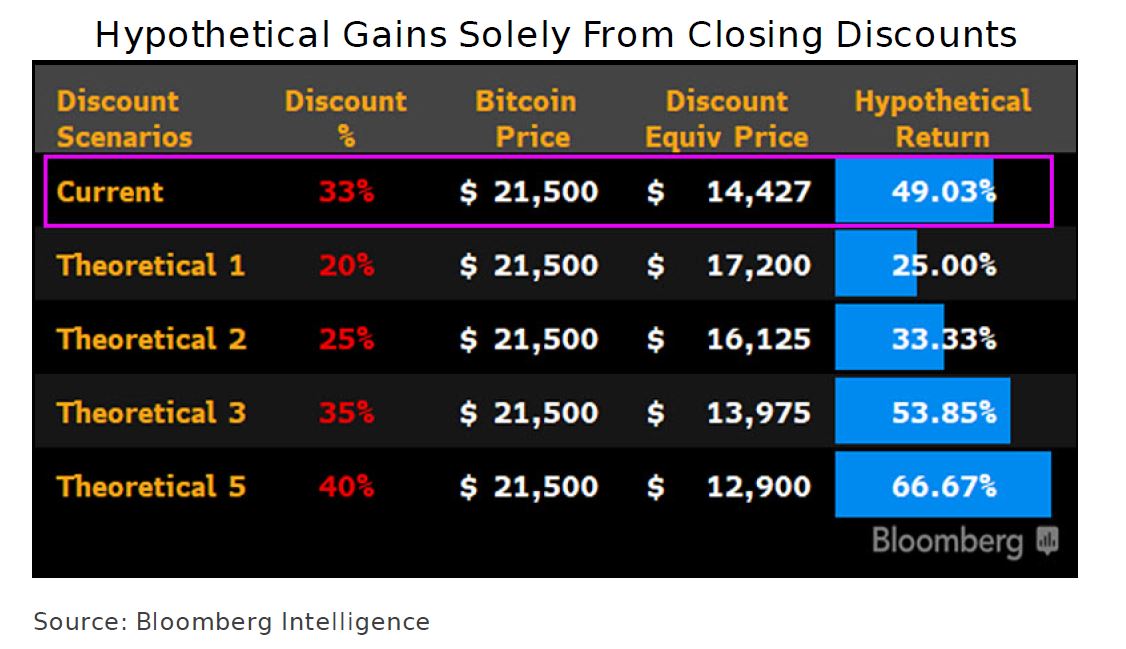

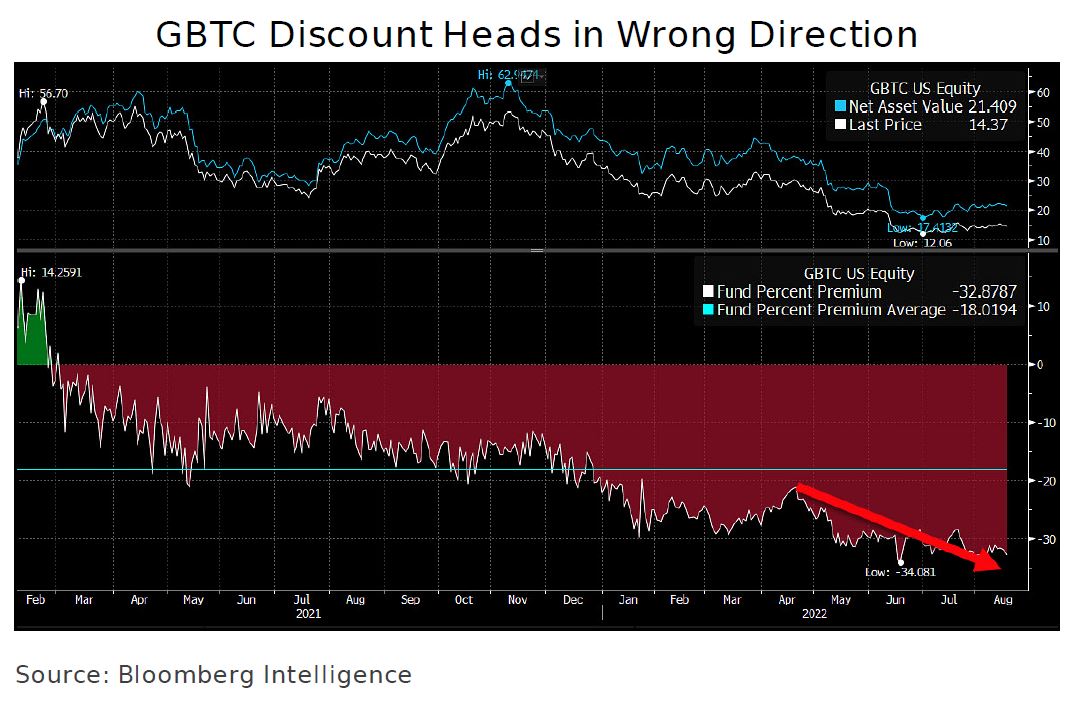

(Bloomberg Intelligence) -- Grayscale Bitcoin Trust is at a deep, expanding 33% discount to the value of Bitcoin it holds, enabling buyers to purchase the cryptocurrency for far less than market prices – currently below $15,000. Bitcoin futures ETFs offer cheaper alternatives and have aggravated GBTC's discount expansion since their approval in October 2021.(08/23/22)

1. GBTC Discount Likely Until at Least Next Year

Contributing Analysts Athanasios Psarofagis (Strategy)

GBTC's discount offers investors Bitcoin exposure at below-market prices. When it traded at a premium, investors paid as much as twice the market price to gain access to the cryptocurrency through the fund. That benefited existing GBTC holders, who could sell at inflated prices. GBTC now stands at a 32.9% discount, equivalent to buying Bitcoin for $14,430 while it trades around $21,500.

The discount will disappear if the SEC allows Grayscale to convert GBTC to an ETF but we don't expect that to happen until at least 2023.

The potential compression return would be higher than the discount: Eliminating a 32.9% discount would be analogous to a security appreciating to $100 from $67.10 -- a whopping 49% return. This scenario excludes the risks and price movements of the underlying asset. (08/23/22)

2. Stalled ETF Conversion Leaves GBTC Behind

GBTC has no chance of converting to an ETF soon, based on statements by the SEC and Chairman Gary Gensler. The fund is structured as a grantor trust, akin to gold ETFs such as SPDR Gold Shares.

The inability to convert for such an extended period of time amid competition from cheaper futures based Bitcoin ETFs in the US and other alternatives worldwide continues to erode demand for GTBC.

That caused the fund to turn to a discount last year and has only gotten worse. Competition and a Bitcoin bear market have eroded much of the demand for GBTC shares.

GBTC, launched in September 2013, holds $15 billion in Bitcoin but trades at a market cap of $10 billion due to its discount. At its peak, the fund held $43.5 billion in assets. (08/23/22)

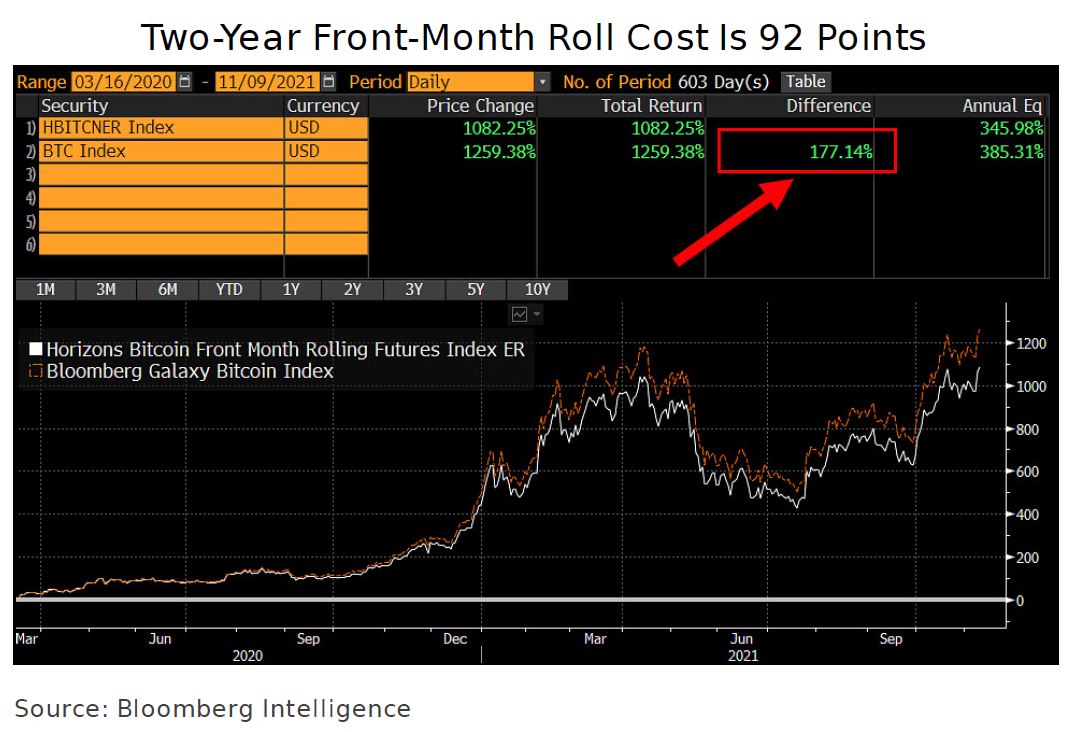

3. Futures ETFs' Roll Costs Could Erode Returns

A futures-based Bitcoin ETF has to roll futures to maintain exposure, meaning it constantly buys and sells the monthly contracts. A focus on front-month contracts can be particularly costly, decaying returns if the futures curve is in steep contango as the fund buys high and sells low. Roll costs average about 9 percentage points annually but can surge when the price of the underlying commodity rises rapidly, as during Bitcoin's 2020 bull market. The performance difference between front-month futures and spot Bitcoin from March 2020 trough to November 2021 peak was a whopping 177 percentage points. GBTC's potential for discounts puts it at a similar disadvantage when compared with a physically backed Bitcoin ETF.

Alternatively, the rolling process can boost returns when the futures curve is in backwardation. (08/23/22)

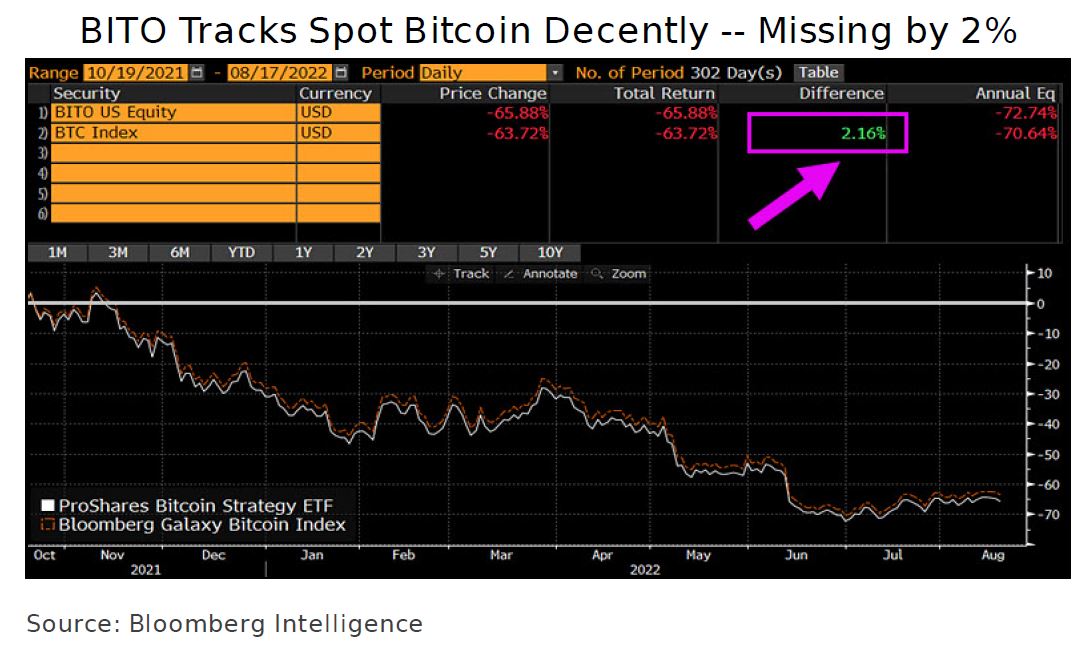

4. Futures ETFs Log Minimal Roll Costs

Though we were worried about Bitcoin futures ETFs' roll costs, they've been muted, with the ETF trailing spot by 2.16% since their October 2021 launch, which includes fees. There are two key reasons, we believe. First, Bitcoin entered a bear market within a month of BITO's introduction and the futures curve hasn't had significant contango. Second, the CME Bitcoin futures market matured significantly as institutions entered and made it more efficient. Institutions likely arbitraged away much of the profitable carry trade by hedging futures positions with spot positions.

Though we expect the futures market to act relatively efficiently, a sharp bull market alongside steep contango could spur significant underperformance for these products when compared with spot Bitcoin exposure. (08/23/22)

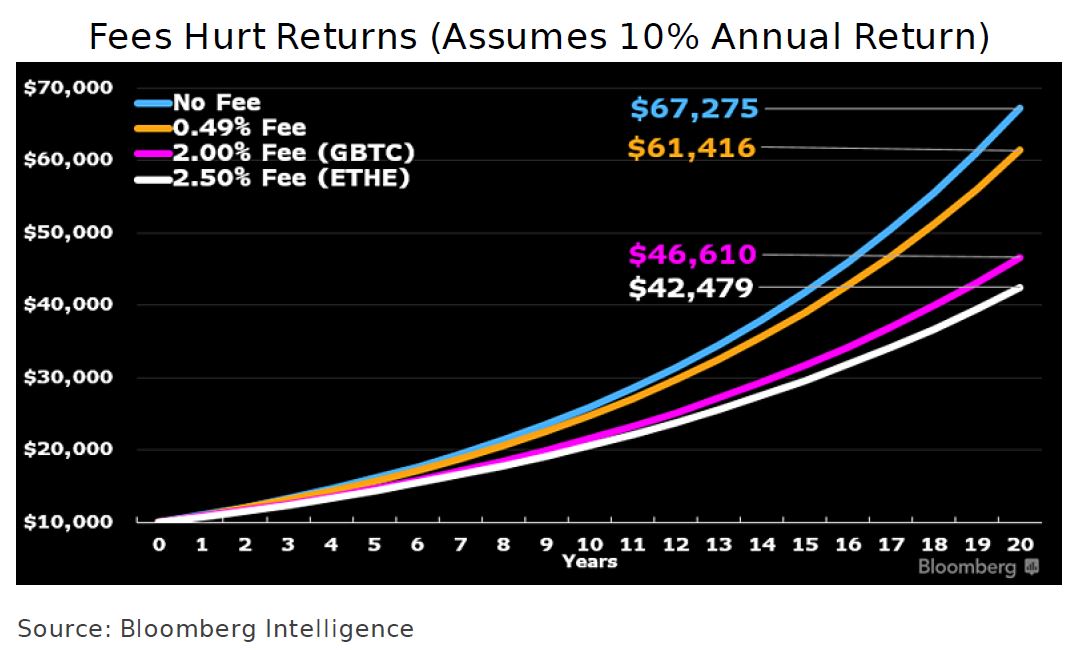

5. Lower Fees Could Limit Exodus and Discounts

Grayscale may have to reduce GBTC's fees to remain competitive. Shrinking demand for its shares – and their expanding discount -- stem partly from the proliferation of alternative ways to access Bitcoin, with many offered at far lower cost. We expect the discount to linger until Grayscale or some other issuer can get US approval for spot Bitcoin ETFs. Until then, GBTC will not trade at its net asset value.

Higher fees can dramatically erode returns, as illustrated by hypothetical growth of $10,000 at 10% annually for 20 years. Without fees, the portfolio would reach $67,275. At an annual fee of 0.49%, that drops almost $6,000 to $61,416. Increasing the fee to 2%, like GBTC's, cuts the value by nearly a third, to $46,610. (08/23/22)

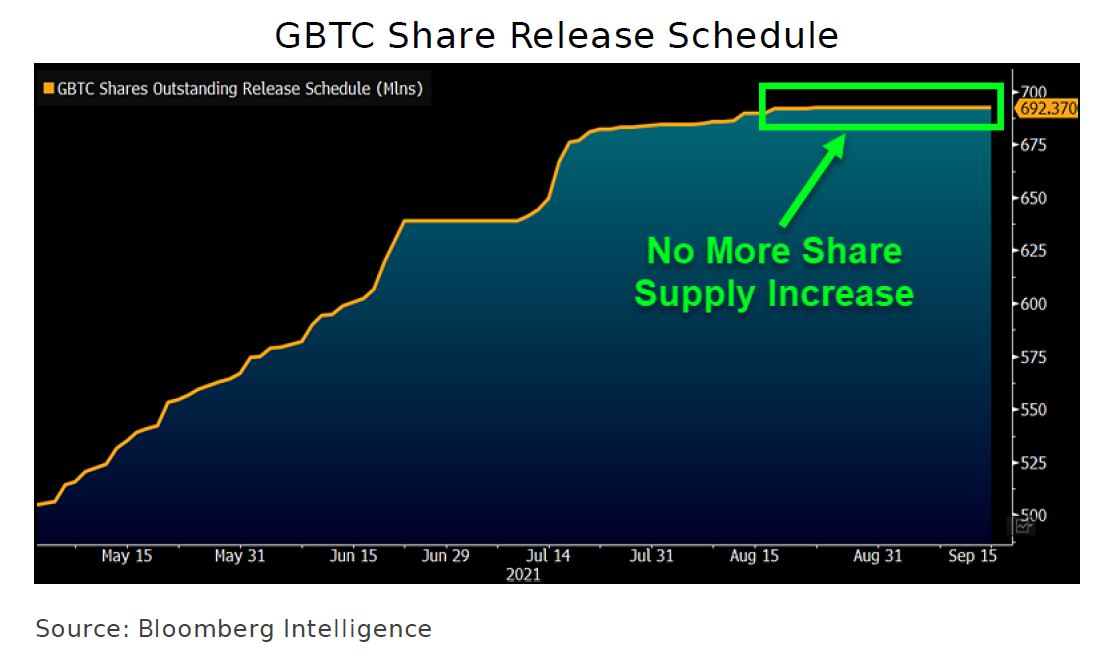

6. A Discount Positive: Share Supply Plateaus

The supply of GBTC shares has leveled off, removing a key driver of the initial discount expansion. The fund spent most of 2021 absorbing the release of over 300 million new shares, requiring a six months lock up before they could be sold. This flood of supply and a collapse in Bitcoin's price from its peak were likely critical in leading to discounts exceeding 20% at the time, a reversal from five years of premiums of as much as 140%.

GBTC has been closed to new investors since March 2021, meaning no new shares have been added to the market since September 2021. That means the fund's share price since has been solely a function of demand. (08/23/22)

7. Six-Month Lockup for Private Placement Issuance

GBTC shares can be created through private placements for accredited investors when the fund is open to new investors. It's currently closed but the mechanics and history are important if Grayscale decides to reopen the fund. Private placements originally had a 12-month lockup on sales. That lasted until Jan. 21, 2020, when GBTC won approval as an SEC-registered vehicle, halving the required holding period to six months.

Private-placement investors who flooded into GBTC were seeking to buy the shares at net asset value and sell them later at a premium. The strategy was successful for much of the trust's history, helping to drive the fund's asset growth, but fell apart along with the premium. Many of GBTC's investors were investing for the premium, not for access to Bitcoin, meaning supply was inflated beyond demand.(08/23/22)

Company Filing

"Grayscale Bitcoin Trust (BTC) (the 'Trust') is voluntarily filing this

Registration Statement on Form 10 to register its common units

of fractional undivided beneficial interest ('Shares') pursuant to

Section 12(g) of the Securities Exchange Act of 1934, as

amended (the 'Exchange Act'). Once this Registration Statement

is deemed effective, the Trust will be subject to the requirements

of Regulation 13A under the Exchange Act, which will require it

to file annual reports on Form 10-K, quarterly reports on Form

10-Q, and current reports on Form 8-K, and to comply with all

other obligations of the Exchange Act."

Form 10 Filing, Grayscale Investments LLC

SEC.Gov, Nov. 19, 2019

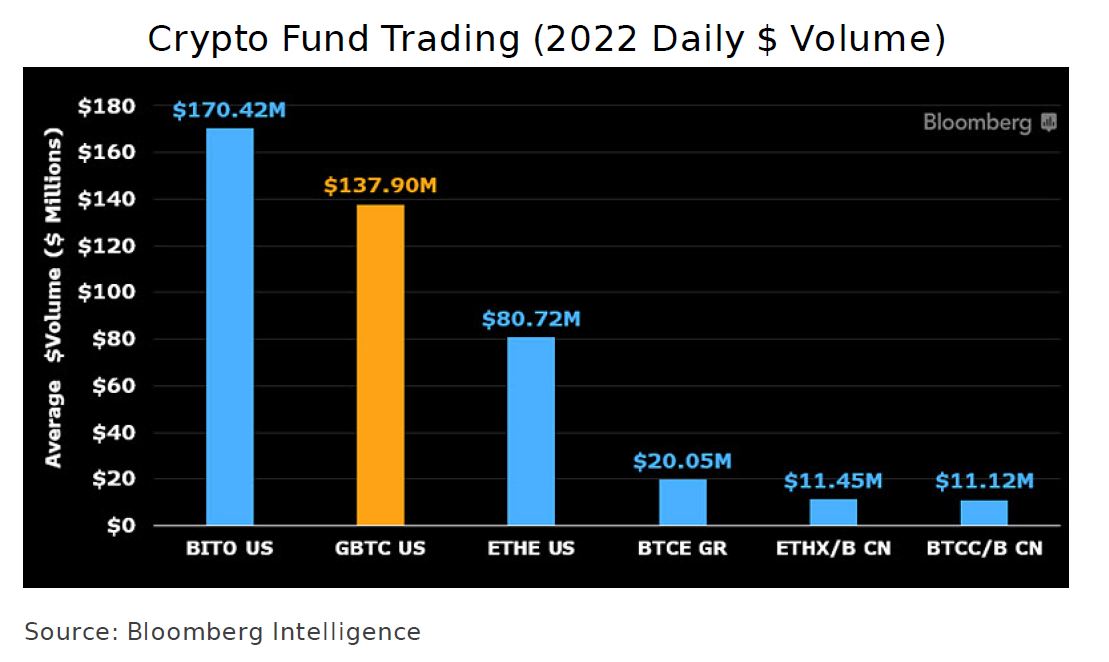

GBTC Dethroned by Bitcoin Futures ETF as Top Crypto-Trading Fund

Contributing Analysts Eric Balchunas (Strategy)

The Grayscale Bitcoin Trust (GBTC) has been supplanted as the most traded cryptocurrency fund this year by the ProShares Bitcoin Strategy ETF (BITO), and their combined volume indicates to us that a US spot Bitcoin ETF would be a success. GBTC dominated crypto-fund trading in 2021 despite its discounts and premiums, high fees and over-the-counter status. (07/11/22)

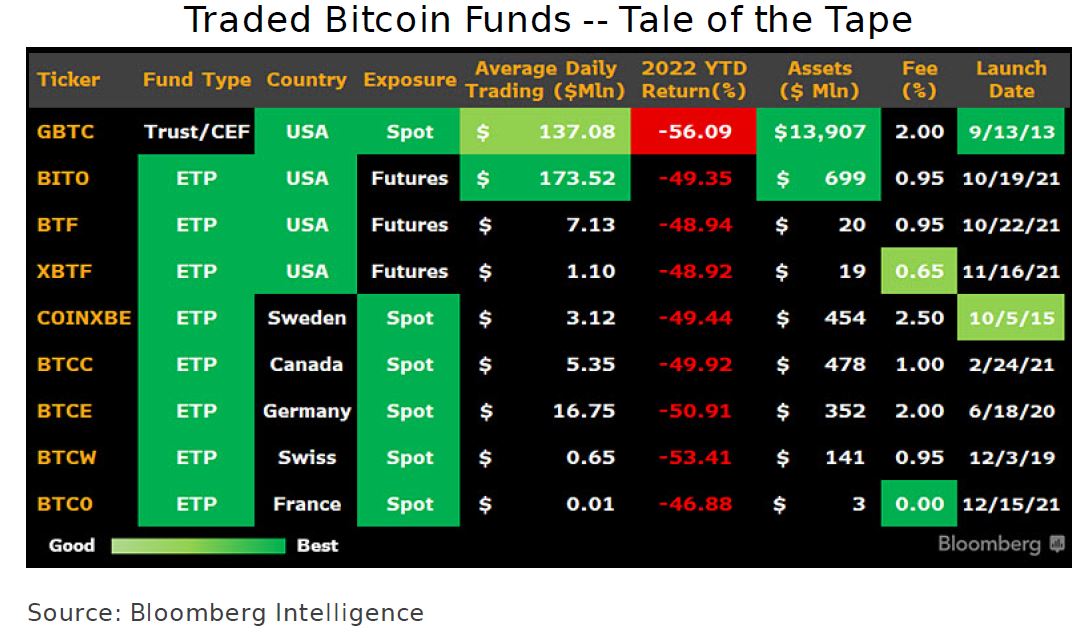

8. Volume Dominance Has Evaporated in 2022

GBTC dominated Bitcoin fund trading globally in 2021, with more than $370 million in average daily notional trading, despite its over-the-counter status. But overall volume is down in 2022 and so is GBTC's ranking. ProShares' BITO has taken the top spot at $170 million a day, followed by GBTC's $138 million. BTCetc's BTCE in Germany is the most traded international fund at $20 million and Purpose's BTCC leads in Canada. Spot Bitcoin ETPs are available in Brazil, Canada, Switzerland,Sweden, Germany, France and Australia.

GBTC and BITO's combined volume indicates to us that a US-listed spot Bitcoin ETF would likely dominate global cryptocurrency-fund trading. The SEC has repeatedly rejected ETF proposals, citing concerns about market oversight, but we believe 2023 may be the year for a US spot Bitcoin ETF launch. (07/11/22)

9. No Longer a Leveraged Play, Unless It Converts

Contributing Analysts Eric Balchunas (Strategy)

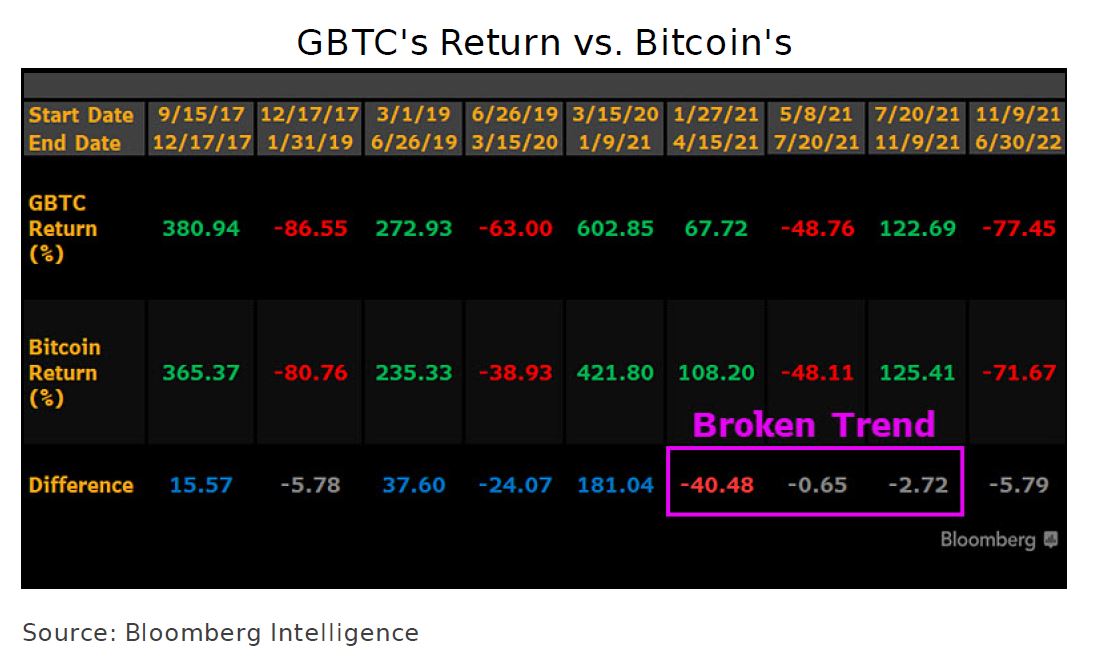

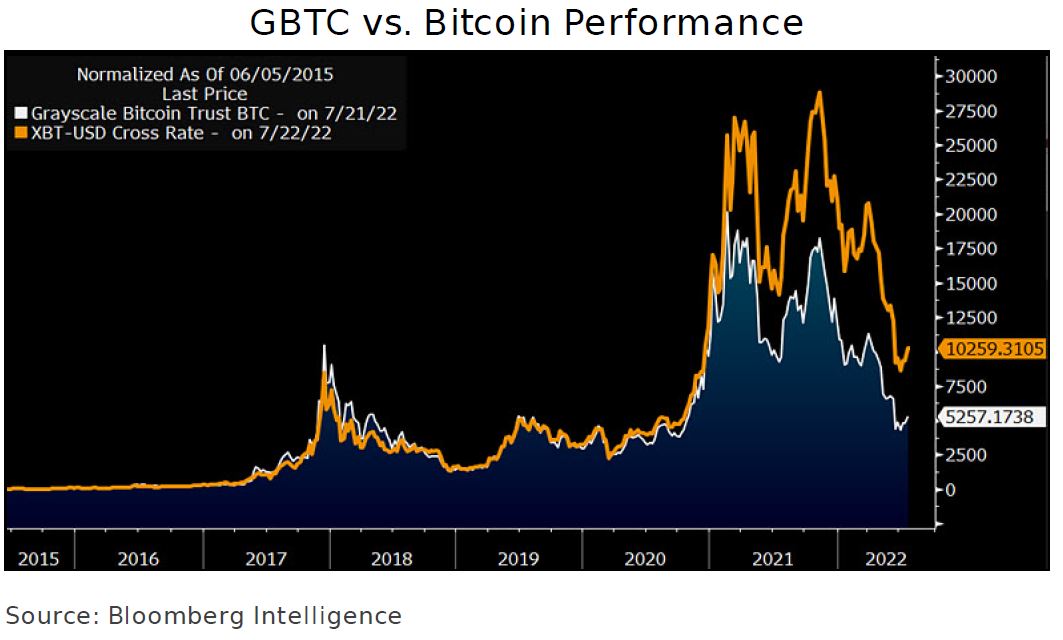

A limited supply of shares amid surging demand underpinned GBTC's historical premium, causing it to act like a leveraged bet on Bitcoin, but that trend ended in early 2021 as the fund descended into a discount that has since steepened. In five of the biggest peaks to troughs (and vice versa) from 2017-21, GBTC's swings were more extreme than Bitcoin's. The biggest divergence stretched from March 2020-early 2021, when GBTC beat Bitcoin by 181 percentage points. GBTC followed that with a 41-point underperformance from late January to mid-April as Bitcoin rallied. It has since traded relatively close to the digital asset.

If GBTC can convert to an ETF, it might again be used as a leveraged play as the discount approaches zero. (07/11/22)

10. Collapsing Short Positions and No Options

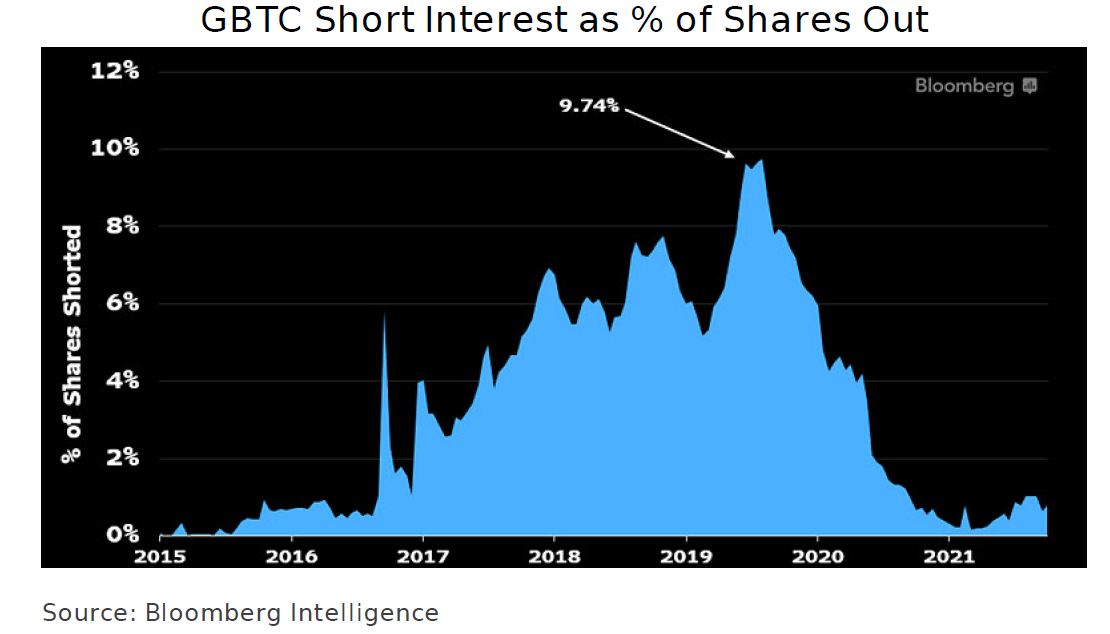

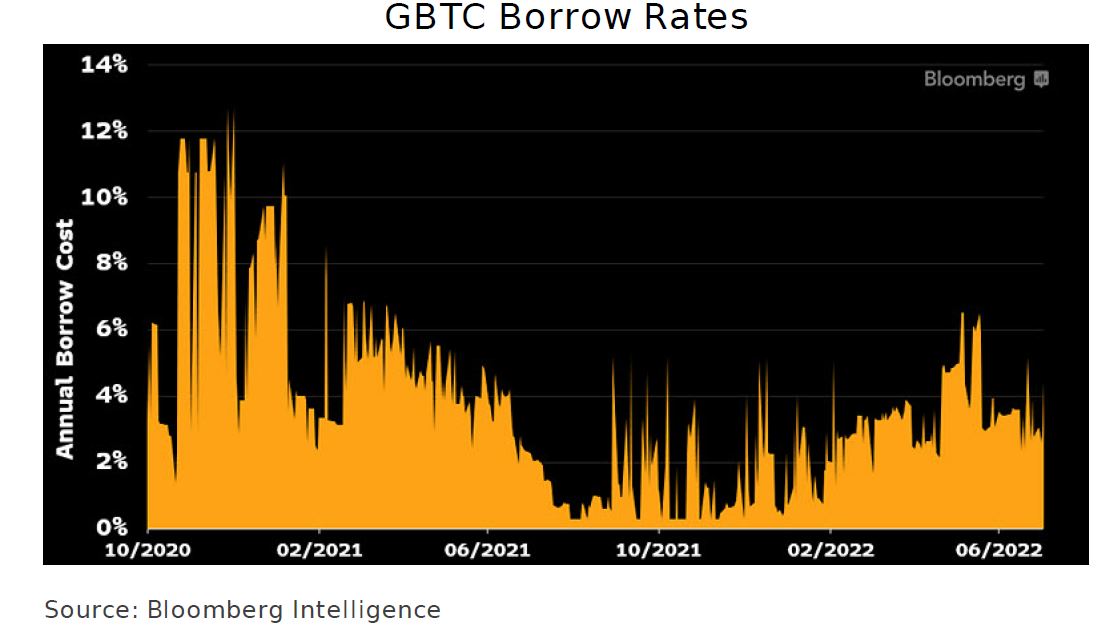

Short interest in GBTC plummeted below 1% as it cratered into a steep discount. The fund's inefficient structure adds idiosyncratic risk and basis risk, making it an inferior option for investors looking to short or hedge Bitcoin. Short interest initially rose steadily from GBTC's public listing to 9.74% in April 2020, during the height of Covid-19-related volatility. Traders now are likely opting to short BITO instead. The ability to short a fund adds to its appeal for some investors -- especially hedge funds --but borrowing GBTC can be expensive. Borrowing costs have averaged 3.2% in 2022, down from 10.74% in 2020, according to S3 Partners.G

BTC lacks options, further limiting its liquidity and the ability of market participants to hedge risks. BITO offers options. (07/11/22)

11. Historical Cost to Short GBTC Varies Widely

(07/11/22)

Costly GBTC Lagging Behind Competitors in All But Asset Size

The Grayscale Bitcoin Trust (GBTC) still dominates global Bitcoin-fund assets, but we expect that lead to continue to erode unless GBTC can convert into an ETF, given its trailing liquidity and relatively high cost. GBTC trails Bitcoin in performance by thousands of percentage points over the past five years and charges a 2% fee. (07/22/22)

12. Competing With Growing Stable of Bitcoin Funds The SEC's repeated rejection of spot Bitcoin ETF proposals helped GBTC peak at $44 billion in assets despite trading over the counter and charging 2% annually. GBTC launched in September 2013 as a private trust and has benefited from that first-mover advantage, but US Bitcoin futures ETFs that

launched in 2021 are chipping away at its lead. GBTC still dominates in assets globally, partly because it can't offer redemptions. Its fee is substantially higher than the average ETP's, especially when compared with new launches, such as one in France that charges no fee and makes money by lending Bitcoin.

GBTC's inefficient structure underpins its poor performance vs. peers. (07/22/22)

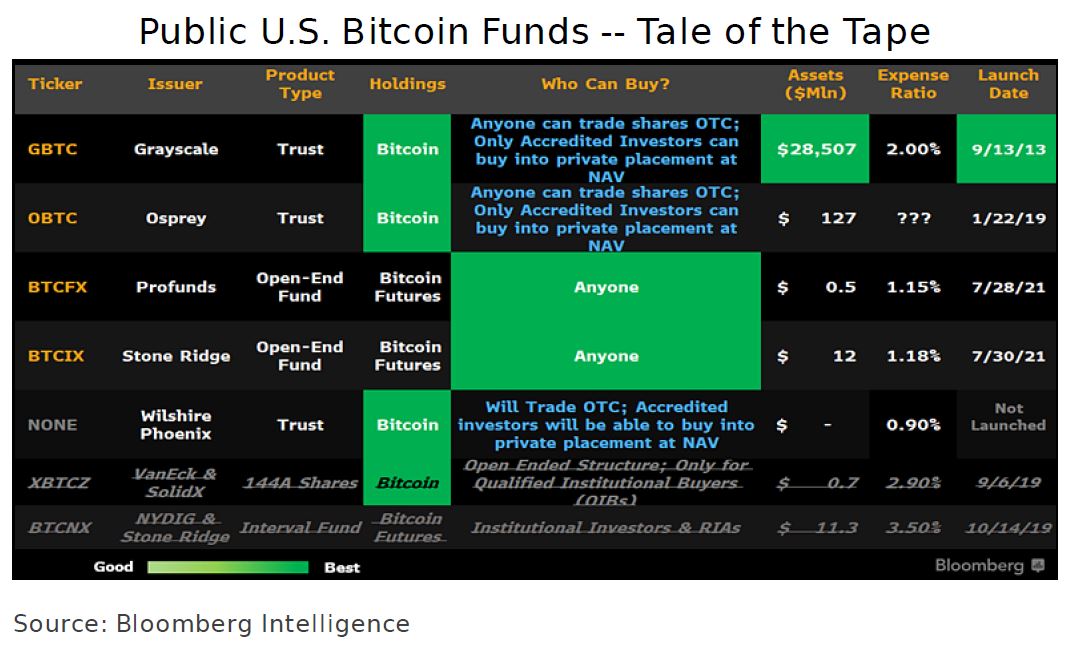

13. Retail Competitors Available in U.S. But Ignored

In the U.S., many private equity funds and hedge funds invest directly in crypto assets, but GBTC was the only Bitcoin fund that retail investors could buy until February, when the Osprey Bitcoin Trust (OBTC) began trading. It now has $120 million in assets. In July, Stone Ridge and ProFunds launched open-end funds that hold Bitcoin futures, but neither one has attracted much interest. Investors may prefer an ETF (or at least a tradeable fund) and funds that hold Bitcoin directly, rather than futures.

Institutional Bitcoin products launched by Stone Ridge and VanEck in 2019 failed to gain assets and liquidated. Wilshire Phoenix, after its planned ETF was rejected, submitted an S-1 proposal that could be a direct competitor to GBTC. (09/27/21)

14. Tracks Bitcoin Poorly Despite High Correlation

GBTC holds Bitcoin directly yet doesn't replicate its price moves. The gap -- visible in the chart -- has continued to widen since 2021, when GBTC collapsed into a persistent discount. From 2016-20, the fund had an 85% daily and 75% weekly correlation to Bitcoin's price, while maintaining a daily beta of 1.052 to the cryptocurrency. Bitcoin returned about 2,900% in the period, and GBTC roughly 2,600%.

Since the start of 2021, Bitcoin is down 20% and GBTC has fallen 53%, giving the fund's holders an additional 33 percentage-point loss. This is despite GBTC maintaining a 91% daily correlation and a beta of 1.07 to Bitcoin.

These differences add up: Since GBTC began trading in 2015, it has trailed Bitcoin by almost 5,400 percentage points. (07/22/22)

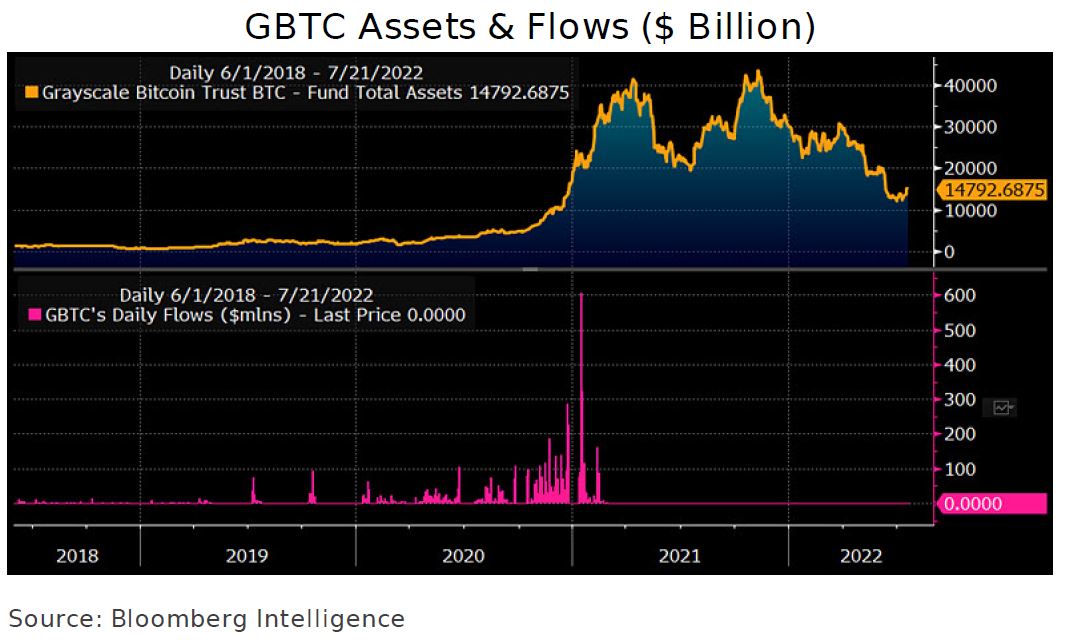

15. Unhindered by Price Swings, Inefficiencies

Bitcoin's price affects the value of GBTC's assets, but the trust pulled in money amid all market conditions when it was still open to new investors. With no redemptions allowed, GBTC's assets grew faster than Bitcoin's rate of return, highlighting demand for access to the cryptocurrency within the traditional financial system. Daily inflows peaked at more than $600 million on Jan. 19, shortly before the fund was closed to new investors. Since then, widening discounts and the launch of Bitcoin ETFs are likely hindering GBTC demand, spurring Grayscale's efforts to convert it into an ETF.

Bitcoin's December 2017 price of about $20,000 coincided with GBTC assets of $3.2 billion. The cryptocurrency's price is now back around $20,000, while GBTC's assets sit almost 5x higher at $15 billion. (07/22/22)

16. Suite of Crypto Trusts Continues to Expand

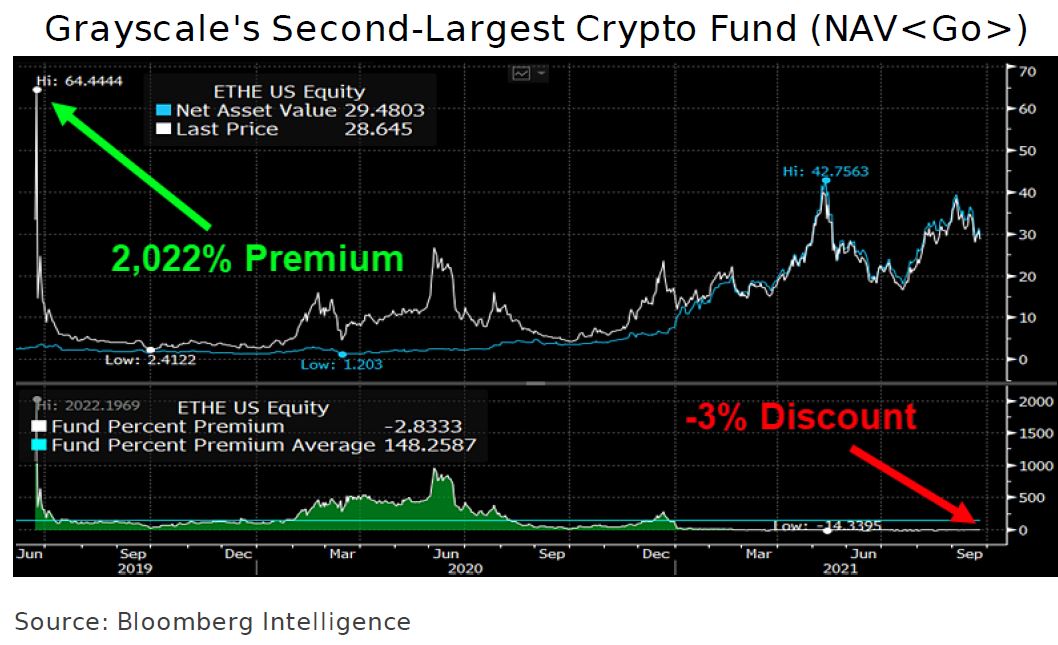

Grayscale has a suite of 15 trusts, with 13 focused on individual crypto assets and two holding baskets of cryptos. Each is at a different maturity and not all trade over the counter. The largest after GBTC, the Grayscale Ethereum Trust (ETHE), operates identically to its sibling, but holds Ethereum instead of Bitcoin. It has a history of even more extreme premiums than GBTC, peaking at 2,022% when it began trading, but now stands at a discount, like many of Grayscale's products.

Grayscale's other single-asset trusts hold Bitcoin Cash, Ethereum Classic, Horizen, Litecoin, Stellar Lumens, Zcash, Filecoin, Decentraland, Livepeer, Chainlink and Basic Attention Token. The Grayscale Digital Large Cap Fund holds six cryptos, with 92% in Bitcoin and Ethereum. The Grayscale Defi Fund holds 10 defi-focused cryptos. (09/27/21)