Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

Here in the network they tried to conduct, as the researcher himself calls it, an additional forensic examination with the help of which he seems to have managed to prove that as of November 23, Grayscale Investments through GBTC owned ~ 633,000 BTC on Coinbase Custody wallets. Due to the fact of reorientation of Grayscale from Xapo to Coinbase Custody, as well as using publicly available data, @Ergo was able to attribute 317,705 BTC belonging to GBTC to 432 addresses with a high probability. To search for the remaining bitcoins, the blockchain was scanned and additional addresses were identified that correspond to the profile of those previously discovered, and these addresses contain almost the same remaining number of coins that should belong to GBTC. Part 1: https://twitter.com/ErgoBTC/status/1594308379182305280Part 2: https://twitter.com/ErgoBTC/status/1595504799016841216  |

|

|

|

|

|

|

|

The Bitcoin software, network, and concept is called "Bitcoin" with a capitalized "B". Bitcoin currency units are called "bitcoins" with a lowercase "b" -- this is often abbreviated BTC.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

November 25, 2022, 01:06:27 PM |

|

Here in the network they tried to conduct, as the researcher himself calls it, an additional forensic examination with the help of which he seems to have managed to prove that as of November 23, Grayscale Investments through GBTC owned ~ 633,000 BTC on Coinbase Custody wallets.   i know that it seems like a lot of addresses to churn through (over 800 addresses) but if an outsider can find the collateral . then certainly greyscale themselves can.. and publish regularly the totals and address list to be validated easily at any time by anyone that enquires. if grey scale dont have to hand a readily available list of their cold wallet addresses themselves for internal auditing and security checking. then thats bad practice |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

OgNasty

Donator

Legendary

Offline Offline

Activity: 4718

Merit: 4226

Leading Crypto Sports Betting & Casino Platform

|

|

November 25, 2022, 07:00:21 PM |

|

DCG's problematic asset is Genesis Global Capital and is currently working on all possible ways out of the current situation, judging by the fact that, according to The New York Times, the company hired the investment bank Moelis & Company to explore options, including potential bankruptcy, although according to a representative of Genesis, “Their goal is to resolve the current situation unnecessarily filing for bankruptcy” I would love to grab GBTC at the current discount and I personally believe people who do so will be rewarded. However, I’m not familiar enough with the structure of everything to know all the liabilities involved. If the parent company goes bankrupt, is the fund liquidated and investors get a return as the premium is eliminated, or are the fund’s assets sold off and creditors of the company receive the funds first? These are things investors should be aware of before diving in. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

November 25, 2022, 07:08:45 PM |

|

DCG's problematic asset is Genesis Global Capital and is currently working on all possible ways out of the current situation, judging by the fact that, according to The New York Times, the company hired the investment bank Moelis & Company to explore options, including potential bankruptcy, although according to a representative of Genesis, “Their goal is to resolve the current situation unnecessarily filing for bankruptcy” I would love to grab GBTC at the current discount and I personally believe people who do so will be rewarded. However, I’m not familiar enough with the structure of everything to know all the liabilities involved. If the parent company goes bankrupt, is the fund liquidated and investors get a return as the premium is eliminated, or are the fund’s assets sold off and creditors of the company receive the funds first? These are things investors should be aware of before diving in. DCG is grayscale. (insider knowledge/management) greyscale(as legal entity "on the papers") owes debt to DCG DCG(as legal entity "on the papers") is major older of GBTC shares if grey scale showed any wobble in its accounting it cant escape. i see the smart business plan is for DCG to claw back its position first. get out its assets and demand all returns on debt first. then let greyscale do as it pleases as in share out whats left to other creditors or liquidate |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

Here in the network they tried to conduct, as the researcher himself calls it, an additional forensic examination with the help of which he seems to have managed to prove that as of November 23, Grayscale Investments through GBTC owned ~ 633,000 BTC on Coinbase Custody wallets.   i know that it seems like a lot of addresses to churn through (over 800 addresses) but if an outsider can find the collateral . then certainly greyscale themselves can.. and publish regularly the totals and address list to be validated easily at any time by anyone that enquires. if grey scale dont have to hand a readily available list of their cold wallet addresses themselves for internal auditing and security checking. then thats bad practice Yes, but Greyscale cannot disclose public bitcoin storage addresses according to the Bitcoin trust's statement to the SEC dated January 2017, "the custodian cannot disclose such public keys to the sponsor, trust or any other individual or legal entity," page 94 section "Security of the Account" https://www.sec.gov/Archives/edgar/data/1588489/000119312517013693/d157414ds1.htm |

|

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

November 26, 2022, 11:12:08 AM

Last edit: November 26, 2022, 11:29:35 AM by franky1 |

|

i know that it seems like a lot of addresses to churn through (over 800 addresses) but if an outsider can find the collateral . then certainly greyscale themselves can.. and publish regularly the totals and address list to be validated easily at any time by anyone that enquires.

if grey scale dont have to hand a readily available list of their cold wallet addresses themselves for internal auditing and security checking. then thats bad practice

Yes, but Greyscale cannot disclose public bitcoin storage addresses according to the Bitcoin trust's statement to the SEC dated January 2017, "the custodian cannot disclose such public keys to the sponsor, trust or any other individual or legal entity," page 94 section "Security of the Account" https://www.sec.gov/Archives/edgar/data/1588489/000119312517013693/d157414ds1.htm "cannot" a. coinbase is DCG family b. greyscale is DCG family if they are saying its impossible.. that is a lie if you gave your wife $10billion.. to look after for you and then you tell your accountant. that you cannot locate your $10b and that your wife cant even tell you where she has your $10b its not just bad accounting.. but its also time to get a divorce if your wife sets a rule that you must comply to the wifes rule of never telling you where she put his money.. dont give her the money. dont marry her and find a better woman to marry bitcoin is a very good system. you can organise funds very well. its not rocket science. if they are trying to say coinbase cannot tell greyscale where greyscale funds are. as the reason why greyscale cant tell the SEC.. thats bad oh by the way FTX is the brother inlaw and look what it done |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

|

November 27, 2022, 09:09:43 AM Merited by JayJuanGee (1) |

|

It seems that regulators of several US states have seriously taken up Genesis Global Capital company and several other unnamed firms will check for attracting residents to invest in securities related to cryptocurrency without proper registration, as Joseph Borg, Director of the Alabama Securities Commission, commented on this investigation. Source(full version by subscription only): https://www.barrons.com/articles/hormel-foods-hp-dividend-increases-51669404128Archive: https://archive.ph/3z3Sr |

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 27, 2022, 04:18:14 PM |

|

a. coinbase is DCG family

Not so sure about that. What tells you Coinbase is part of the DCG family? As far as I know Neither Coinbase holds significant investment in DCG, neither the other way round. It would be also extremely unsatisfactory the custody of GBTC were given to an entity controlled by the same subject. all I found is that DCG invested in some equity or token by Coinbase. But this is a completely different story. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

November 27, 2022, 04:59:02 PM Merited by JayJuanGee (1) |

|

a. coinbase is DCG family

Not so sure about that. What tells you Coinbase is part of the DCG family? oh look coinbase also https://www.crunchbase.com/person/barry-silbertBarry Silbert is the Founder & CEO of Digital Currency Group, a company helping to build the foundation of the digital currency and blockchain technology industry by launching, incubating, and investing in groundbreaking companies that will transform the global financial services ecosystem and usher in the “internet of value”. DCG has been an active seed investor in the digital currency industry with over 50 investments in 15 countries including BitGo, BitPay, BitPagos, BitPesa, Chain, Circle, Coinbase, Gyft, Kraken, Ripple Labs, TradeBlock, Unocoin, and Xapo.

also https://www.omersventures.com/portfolio/digital-currency-group/Barry Silbert is the founder and CEO of Digital Currency Group. A pioneer in bitcoin investing, Barry established himself in 2012 as one of the earliest and most active investors in the industry. In 2015, he founded DCG and today, DCG is one of the industry’s most prolific investors, backing more than 120 companies in 30 countries around the world, including Coinbase, Ripple, BitPay, and Circle. need me to go on or can you google too? |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 04, 2022, 05:43:25 PM

Last edit: December 04, 2022, 11:12:23 PM by fillippone |

|

Now it's the turn of a Wall street bank to spread some FUD on Grayscale.

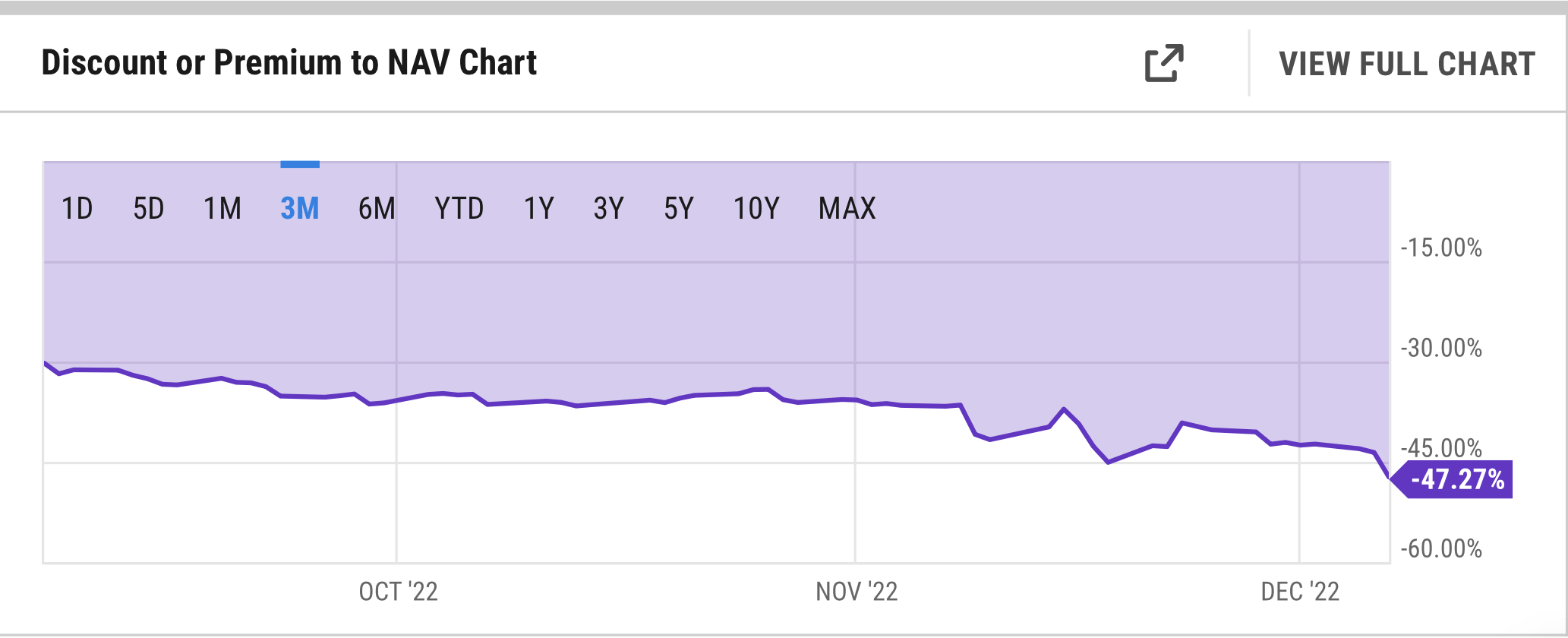

GBTC's near $11 billion assets under management pose a risk in the bear market: UBSThis is the summary of the paper from The Block: QUICK TAKE - Grayscale’s GBTC and ETHE are trading at ever-increasing discounts to NAV.

- Issues for the asset managers’ sister firm pose a potential threat, according to UBS.

Looks like this is rocket science research! /s GBTC has been trading with a negative premium for over 18 months now. It shouldn't be something new to the average reader of this kind of paper. Regarding the second point, the UBS analyst tries to figure out what could happen in a dissolution event of GBTC:

Grayscale's size can be extremely problematic in a bear market, Kachkovski said.

Any sale would widen the GBTC discount further but not necessarily affect the bitcoin price. However, if GBTC itself were liquidated, it could affect bitcoin — since fund rules stipulate investors must be paid out in cash.

"We believe the sheer size of GBTC's holdings—633k BTC, or 3.3% of all coins mined— would spell trouble for the entire market, as bitcoin still comprises more than 45% of the space, excluding stablecoins," the report read, while stressing that it still believes a liquidation remains unlikely.

That's because DCG nets $210 million from GBTC management fees. Crucially, the fee is levied irrespective of performance or discount to NAV. The fund's other products, including ETHE, bring in a further $100 million per annum.

Still, there is no reason that the trust could be dissolved by giving Bitcoins to the shareholders instead of cash. This is an extremely interesting point, yet it is difficult to assess precisely if the dissolution implies the liquidation of BTC or only their distribution to the shareholders. But in the end, it is because it's worth paying professional journalists in this matter instead of relying on anonymous profiles on a bitcoin forum over the internet! I will try to read the original article by UBS. EDIT: above link has been corrected. Thanks, JJG. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 04, 2022, 10:37:23 PM Merited by fillippone (3) |

|

Now it's the turn of a Wall street bank to spread some FUD on Grayscale.

GBTC's near $11 billion assets under management pose a risk in the bear market: UBSThis is the summary of the paper from The Block: QUICK TAKE - Grayscale’s GBTC and ETHE are trading at ever-increasing discounts to NAV.

- Issues for the asset managers’ sister firm pose a potential threat, according to UBS.

Looks like this is rocket science research! /s GBTC has been trading with a negative premium for over 18 months now. Shouldn't be something new to the average reader of this kind of paper. Regarding the second point, the UBS analyst tries to figure out what could happen in a dissolution event of GBTC: Grayscale's size can be extremely problematic in a bear market, Kachkovski said.

Any sale would widen the GBTC discount further but not necessarily affect the bitcoin price. However, if GBTC itself were liquidated, it could affect bitcoin — since fund rules stipulate investors must be paid out in cash.

"We believe the sheer size of GBTC's holdings—633k BTC, or 3.3% of all coins mined— would spell trouble for the entire market, as bitcoin still comprises more than 45% of the space, excluding stablecoins," the report read, while stressing that it still believes a liquidation remains unlikely.

That's because DCG nets $210 million from GBTC management fees. Crucially, the fee is levied irrespective of performance or discount to NAV. The fund's other products, including ETHE, bring in a further $100 million per annum.

Still, there is no reasoning about the fact the trust could be dissolved by giving Bitcoins to the shareholders instead of cash. This is an extremely interesting point, yey quote is difficult to assess precisely. But in the end, it is because it's worth paying professional journalists in this matter instead of relying on anonymous profiles on a bitcoin forum over the internet! I will try to read the original article Your above link is messed up fillippone.. but the article was easy enough to find. https://www.theblock.co/post/191776/gbtcs-near-11-billion-assets-under-management-pose-a-risk-in-the-bear-market-ubsI largely agree with you that The Block (author Adam Morgan) seems to be exaggerating the magnitude of the situation, including emphasizing a lacking of options - which still remains a bit unclear to me in terms of what options are present and may result in a resolution that does not necessarily require liquidation of the coins and/or liquidating of the currently existing cashcow funds. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 08, 2022, 11:36:31 PM

Last edit: May 15, 2023, 11:01:03 AM by fillippone Merited by JayJuanGee (1), Daltonik (1) |

|

Another day, another record. On December 7th GBTC closed with a record negative discount of 47%  There is no end to this pain trade, and I guess more has to come until something finally breaks. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

December 08, 2022, 11:44:58 PM

Last edit: December 09, 2022, 12:52:42 AM by franky1 Merited by vapourminer (1), JayJuanGee (1) |

|

when greyscale, and thus DCG are only earning under $220m in fees (2% of 11bill) a year. but are showing they are paying out BILLIONS to bail out other businesses. and taking on debt within the DCG .. there is alot more risk on GBTC users NAV value than just the GBTC discount (that may never come to fruition as something they can take out full btc discounted)

so primary risk

GBTC customers cant take out btc from GBTC

secondary risk

greyscale cant know where the $11b btc collateral for the GBTC is due to coinbase security

third risk

DCG mother company has more outgoings than incoming,

which can mean if DCG, coinbase or greyscale had to close trading/services. then those coins get locked into some creditor lump of all creditors(broadly not independently)

which then becomes a first come first serve all you can eat buffet of everyone taking smaller portions due to less supply of a high creditor demand lunch

especially if coinbase had to close. the GBTC coins get mixed into a single pot of coins of other coinbase users, (GBTC as creditor is treated as one of many creditors merged together)

and then split based on creditor % of loss evenly..

in short.. not-your-key-not-your-coin

buying actual bitcoins and sole custody them is different than investing in some business share that cough promises cough to back at a peg of 1:moving rate

be prepared to lose more then just the market rate if things go bad

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

December 09, 2022, 11:03:19 AM |

|

Coindesk share the pain of the GBTC holders: Grayscale Bitcoin Trust Discount Widens to Record High Near 50%

“The fact that Grayscale’s Bitcoin Trust is now trading at nearly 50% discount is just awful for holders of GBTC. It really highlights the vast differences in structure quality between different investment vehicles,” Bradley Duke, co-CEO at ETC Group, said in a note to CoinDesk.

Bearish sentiment surrounding the trust deepened over the last few weeks as fears surfaced that crypto trading firm Genesis Global Trading, which is owned by Grayscale’s parent company, Digital Currency Group (DCG), could file for bankruptcy. DCG is also CoinDesk's parent company.

Coindesk is part of the DGC empire, so you cannot expect a fully independent audit of those facts, but in this case they were quite objective in reporting the various causes of these shenanigans. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

December 09, 2022, 05:09:33 PM |

|

if i owned DCG and thus greyscale. my smart move would be to take out ethereum from the game

bitcoin and ethereum are not some vapour priced social drama speculative assets. they both have underlying value. this is the base cost of acquisition on the planet.

bitcoins mining cost has a base level of year: $15k meaning that the speculative market premium above this of public exchange price is GREAT value(cheap) level right now(compared to premium ATH of $70k)

however ethereum speculative price is now way way way too high above its base value level due to the underlying cost of coin acquisition dropping due to the switch to PoS(coin creation cost is now negligible amount compared to before)

so while ethereum is at a bubble high premium being artificially held up due to arbitrage.. where its now underlying value is just $50.. ethereum market price would and should tank and correct down to a newer low level too. so i would take out the ETHE and drive that market down and reap rewards for it. allow it to settle and use that fiat to bring DCG back to liquidity

then maybe start a reset ETHE fund again at the amounts it should be trading at

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 09, 2022, 05:47:12 PM Merited by vapourminer (1) |

|

if i owned DCG and thus greyscale. my smart move would be to take out ethereum from the game

bitcoin and ethereum are not some vapour priced social drama speculative assets. they both have underlying value. this is the base cost of acquisition on the planet.

bitcoins mining cost has a base level of year: $15k meaning that the speculative market premium above this of public exchange price is GREAT value(cheap) level right now(compared to premium ATH of $70k)

however ethereum speculative price is now way way way too high above its base value level due to the underlying cost of coin acquisition dropping due to the switch to PoS(coin creation cost is now negligible amount compared to before)

so while ethereum is at a bubble high premium being artificially held up due to arbitrage.. where its now underlying value is just $50.. ethereum market price would and should tank and correct down to a newer low level too. so i would take out the ETHE and drive that market down and reap rewards for it. allow it to settle and use that fiat to bring DCG back to liquidity

then maybe start a reset ETHE fund again at the amounts it should be trading at

I don't see how taking Ethereum out of their product offerings would generate any money for them in the short term, unless they might be able to sell that division off to someone who might be willing to buy it. So, in that regard, they could sell all of the shitcoin trust products, but they generate money from each and all of them, even though all of them (outside of bitcoin) are shitcoin-based, but likely customers still believe that it is smart (those dumb fucks) to "diversify" into a bunch of crap products.. which earns DCG money, even if the underlying is a bunch of crap. The punchline seems to be that DCG has a short-term liquidity issue and they are having trouble finding someone to loan them money, even though it seems that there could be some ways that their current customers (or is it working out a deal on the genesis side of the matter) - might be able to work out some kind of a deal.. to allow the short-term liquidity to NOT be detrimental (and that kind of solution would almost be like getting a loan and solving the short-term liquidity issue). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

December 09, 2022, 08:24:02 PM

Last edit: December 09, 2022, 10:40:49 PM by franky1 |

|

so while ethereum is at a bubble high premium being artificially held up due to arbitrage.. where its now underlying value is just $50.. ethereum market price would and should tank and correct down to a newer low level too. so i would take out the ETHE and drive that market down and reap rewards for it. allow it to settle and use that fiat to bring DCG back to liquidity

then maybe start a reset ETHE fund again at the amounts it should be trading at

I don't see how taking Ethereum out of their product offerings would generate any money for them in the short term, unless they might be able to sell that division off to someone who might be willing to buy it. So, in that regard, they could sell all of the shitcoin trust products, but they generate money from each and all of them, even though all of them (outside of bitcoin) are shitcoin-based, but likely customers still believe that it is smart (those dumb fucks) to "diversify" into a bunch of crap products.. which earns DCG money, even if the underlying is a bunch of crap. first of all. ethereums market price is being unsustainably held up via arbitrage, not real independent speculative trading. ethereums price is at a 20x+ premium bubble compared to new value level (PoS dropped value by 20x but the market didnt correct accordingly..YET) the price WILL correct. so best to sell coin. before the dump/correction hits. very rough numbers of value to price multiplier

price value

jan 3000 800 3.8x -|

feb 2400 815 2.9x |

mar 3000 830 3.6x |

apr 2800 845 3.3x \_ only had a 4.5x bubble at most

may 2000 860 2.3x /

jun 1000 875 1.1x |

jul 1500 900 1.7x |

aug 1500 925 1.6x -|

sep 1400 40 35.0x PoS merge

oct 1300 45 28.9x

nov 1200 45 26.7x now has a 20x+ bubble.

dec 1250 50 25.0x

EG imagine if when bitcoin was at its 5x premium($70k price of $15k value) and you knew eventually it was going to correct to ~$16k. would you hold at $70k or be selling at $70k and thats my point ethereum is going to correct down to a lower price as 20x+ bubble is not sustainable.. so it will to get nearer to its new lower value down to a new 4x max of new low value.. so its stupid to hoard it at its bubble price now. sell now, short it. and buy in at lower price.. keep the profits use profits to add liquidity to the other sister companies to offset any further contagion risk

bitcoin is already at/very near value. it cant really tank. thus no opportunity to short/sell for profit. so no point removing a GBTC to sell the btc coins to add funds to sister companies. but you are right there are some other crap coins greyscale can remove first but their price:value is not as huge a bubble compared to where ethereum is right now. ethereum has more crash potential out of the lot of them. also the other crapcoin trusts.. dont have much AUM to actuammy make a difference EG if DCG is $1b in the hole(debt) due to sister companies. they need to generate $1b quick if they sold all "filecoin" .. that wont even generate $1m let alone the needed $1b where as ethereum AUM is at $3b.. but if you calculate the underlying value of 153m if you work out the real underlying value chance since the PoS change so selling just $1b of ethereum now. gets them their $1b. and when the correction happens then they can reset and buy ethereum at the new low when the correction happens |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

December 10, 2022, 06:29:09 AM Merited by fillippone (3) |

|

so while ethereum is at a bubble high premium being artificially held up due to arbitrage.. where its now underlying value is just $50.. ethereum market price would and should tank and correct down to a newer low level too. so i would take out the ETHE and drive that market down and reap rewards for it. allow it to settle and use that fiat to bring DCG back to liquidity

then maybe start a reset ETHE fund again at the amounts it should be trading at

I don't see how taking Ethereum out of their product offerings would generate any money for them in the short term, unless they might be able to sell that division off to someone who might be willing to buy it. So, in that regard, they could sell all of the shitcoin trust products, but they generate money from each and all of them, even though all of them (outside of bitcoin) are shitcoin-based, but likely customers still believe that it is smart (those dumb fucks) to "diversify" into a bunch of crap products.. which earns DCG money, even if the underlying is a bunch of crap. first of all. ethereums market price is being unsustainably held up via arbitrage, not real independent speculative trading. ethereums price is at a 20x+ premium bubble compared to new value level (PoS dropped value by 20x but the market didnt correct accordingly..YET) the price WILL correct. so best to sell coin. before the dump/correction hits. very rough numbers of value to price multiplier

price value

jan 3000 800 3.8x -|

feb 2400 815 2.9x |

mar 3000 830 3.6x |

apr 2800 845 3.3x \_ only had a 4.5x bubble at most

may 2000 860 2.3x /

jun 1000 875 1.1x |

jul 1500 900 1.7x |

aug 1500 925 1.6x -|

sep 1400 40 35.0x PoS merge

oct 1300 45 28.9x

nov 1200 45 26.7x now has a 20x+ bubble.

dec 1250 50 25.0x

EG imagine if when bitcoin was at its 5x premium($70k price of $15k value) and you knew eventually it was going to correct to ~$16k. would you hold at $70k or be selling at $70k and thats my point ethereum is going to correct down to a lower price as 20x+ bubble is not sustainable.. so it will to get nearer to its new lower value down to a new 4x max of new low value.. so its stupid to hoard it at its bubble price now. sell now, short it. and buy in at lower price.. keep the profits use profits to add liquidity to the other sister companies to offset any further contagion risk

bitcoin is already at/very near value. it cant really tank. thus no opportunity to short/sell for profit. so no point removing a GBTC to sell the btc coins to add funds to sister companies. but you are right there are some other crap coins greyscale can remove first but their price:value is not as huge a bubble compared to where ethereum is right now. ethereum has more crash potential out of the lot of them. also the other crapcoin trusts.. dont have much AUM to actuammy make a difference EG if DCG is $1b in the hole(debt) due to sister companies. they need to generate $1b quick if they sold all "filecoin" .. that wont even generate $1m let alone the needed $1b where as ethereum AUM is at $3b.. but if you calculate the underlying value of 153m if you work out the real underlying value chance since the PoS change so selling just $1b of ethereum now. gets them their $1b. and when the correction happens then they can reset and buy ethereum at the new low when the correction happens As I tried to already assert, I am still having difficulties understanding how Grayscale is able to generate actual money from what you are suggesting that they are able to do - because they actually cannot sell ethereum and various shitcoins merely because those shitcoins are in their trust and they are holding the various shitcoins on behalf of their clients. Accordingly, Grayscale has to hold the funds, and they generate revenue (2% or whatever) from holding/managing the funds, so in that regard hose shitcoins are client funds, so sure clients can sell those kinds of shares in those shitcoins which would then cause Grayscales management fees to go down, and so Grayscale makes money by the fees that they generate from holding those various shares that they created, and the shitcoinst hat they would have bought would merely be the underlying assets of the shares. Grayscale wants to hold as many shitcoins as possible in order to generate more fees, so even if the price of the underlying asset (and the reflected shares) are down, Grayscale still generates fees, just a smaller overall amount if their clients do not sell any of the shares. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

December 10, 2022, 10:47:26 AM

Last edit: December 10, 2022, 11:00:24 AM by franky1 Merited by fillippone (3), vapourminer (1) |

|

the answer is MATHS

staying as they are

2% of GBTC and 2.5% of ETHE is only at most

~$220m and ~$100m (rounded) = 330m a year income

which wont fill the DCG $1b hole this year will it!?

if greyscale wanted to do a "buy back" of SHARES

buying back the other crap coins wont net them $1b even if they bought back 100% of multiple trusts because their holdings are way under $1b of value of other crapcoins each

however

ETHE does have $3.9b of holdings

so its the only option, bar gbtc

so

buying back ETHE shares is cheaper to do, to get to unlock a stash of coin out of trust.. to then sell

they then sell the unlocked ethereum coin. and then sort out their corporate holes

ETHE holdings per share is the asset value locked

market price per share is the offer they give to customer of the trust

there is about a 50% discrepancy in the 2 prices

they have ~3mill ether coins

lets say they want to buy back just 1mill

so they pay their trust customers the $6.16/share to buy back enough shares to get 1m coins unlocked.(rounded $640m buy back cost)

which then nets the $over $1.280bill to play with

they can then sell ether coins on the public exchange markets. to fill the $1b hole

and then using the $280m spare($1.28b -$1b)

start a fresh ethereum coin public buy up from the public exchanges at a new lower public exchange market price next month, compared to this month market price

and put back in X ether to sit along side the 2m ether they still have locked in trust, hoping that the public market corrects down enough to get as close to able to buy back 1m ether to be back where they sat today

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

|

December 11, 2022, 03:57:06 AM |

|

Another day, another record. On December 7th GBTC closed with a record negative discount of 47%  There is no end to this pain trade, and I guess more has to come until something finally breaks. Yes, you are right that it looks like this is already some kind of turbulence and how long does it have to last to start a reversal? The discount is breaking new and new records with each reporting day and has now reached -48.62% as of December 9.  |

|

|

|

|

|