fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

Grayscale has distributed a transcript of the meeting of the D.C. Circuit Court of Appeals on Grayscale's lawsuit against the SEC to challenge the SEC's refusal in an application to convert GBTC into a spot Bitcoin ETF. which took place on March 7, 2023. Oral arguments of the parties were heard at this meeting. Grayscale was represented by attorney Donald B. Verily Jr., a partner at Munger, Tolles & Olson, and Emily True Parise represented the SEC. The main arguments of the parties: The SEC stated that the refusal was intended to prevent the impact of fraud and manipulation in the spot market on CME futures, as well as the possibility of manipulation within the ETP itself. Grayscale adhered to the opposite side and believes that we will not be able to determine that the ETP market for bitcoin spot will not have such a powerful effect on the price of the CME futures market and that in fact they completely contradict each other. After both sides had been heard, Chief Justice Srinivasan announced that the case would be heard. The transcript of the meeting is available here: https://grayscale.com/gbtc-litigation-oral-arguments-court-transcript/You can listen to the audio recording from the courtroom here: https://www.youtube.com/watch?v=VDUKyMPTIIE&t=2160sThe case of the SEC seems pretestuoso to me. The CFTC declared Bitcoin Futures a tradable assets years ago, and the decided the spot price is liquid enough to settle a multibillion open interest on that price. But the SEC refutes this thesis. I want Grayscale to call the CFTC to testify it! |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

If you want to be a moderator, report many posts with accuracy. You will be noticed.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

March 17, 2023, 11:17:52 AM |

|

one thing the regulators are confused about is.. if bitcoin is a asset or a commodity my opinion because a commodity is a raw product used to make other products bitcoin used with legacy addresses are treated as assets not commodities due to lack of 'locking mechanism's in legacy to peg coins to other networks for tokenisation(new products) thus segwit funded btc is used to then peg to subnetworks for tokenisation(new units of measure) meaning segwit funded btc can be treated as commodities. but not legacy funded btc so when funds are locked to trusts using legacy its a asset trust. when stored on segwit its a commodity trust. if the analysis of GBTC trust custodian is to be believed. the coins are on a legacy store https://pbs.twimg.com/media/FiAX83OXEAAbKxf?format=jpg&name=mediummeaning its an asset trust. thus SEC remit. not CFTC remit so its the SEC that should be approving it. not the CFTC gensler(SEC) wants to make bitcoin be treated as a commodity. even though we all know certain assets and currencies can be on different regulators hands depending on how its treated yep gold traded for industry to make electric devices and jewellery. and also 'futures' is on the CFTC market but gold for investment is regulated by the SEC SEC and Gold

Buying and selling gold is highly regulated by federal agencies. The legal involvement of the SEC is based on the type of investment – although it does not directly regulate the bullion trade, it deals with other gold investments, like options, gold ETFs, or gold stocks. For example, in 2008 the SEC approved the trading in options on the SPDR Gold Trust, while the CFTC approved the trading in futures on it. Moreover, exchange traded commodity funds (like GLD or IAU) must register with the SEC when they want a new subscription of shares, and provide regulatory filings. Gold mining companies which issues stocks also have to file periodic reports with the SEC.

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

|

|

Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

|

April 27, 2023, 08:07:37 AM |

|

How quiet it has become here, let's raise the topic. The broadcast will begin soon on the CoinDesk youtube channel (although judging by the counter on the broadcast channel, it is not clear whether it will take place or not), where Grayscale CEO Michael Sonnenshein will discuss the ongoing lawsuit of the Grayscale platform against the SEC, Sonnenshein himself expects a positive decision in favor of Grayscale by the end of Q3 this year. |

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 27, 2023, 09:08:22 AM |

|

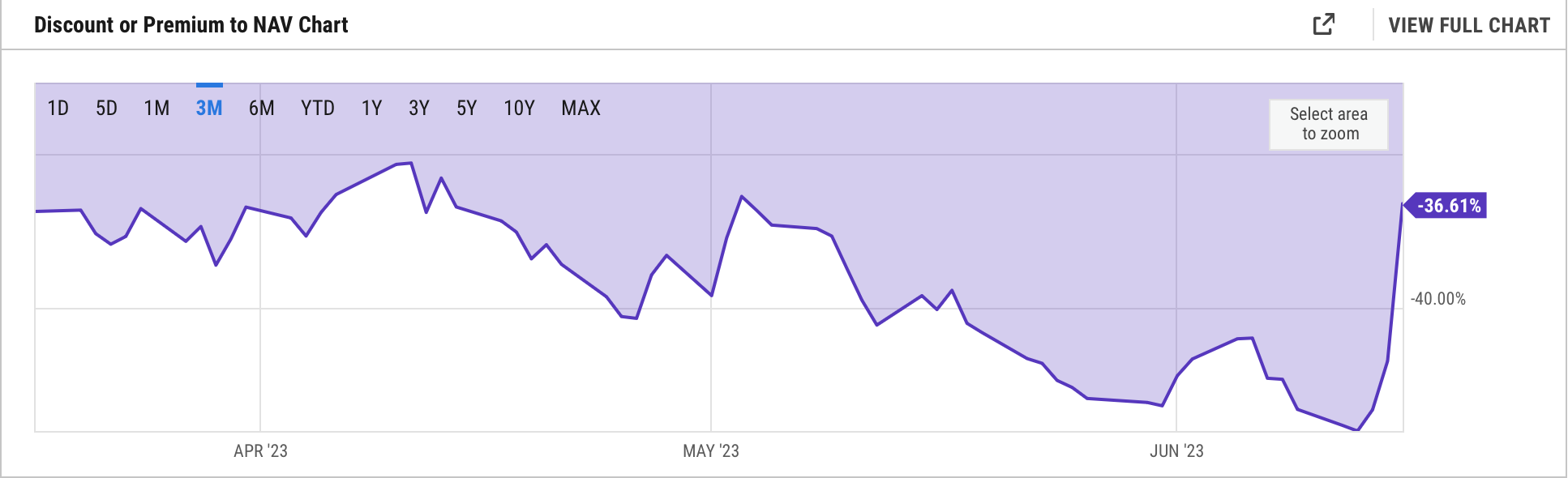

Grayscale has reverted the trend in the discount, that after having peaked at -35% is back on a negative track toward -40%.

Of course, the SEC is under building pressure from Government and the public to have a clearer and definitive stance toward ETP, and ETF in particular.

Until then, I see all other initiatives, YT channel included, with little interest. The real battle is fought behind closed doors.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

the thing about a btc ETF is that once one is approved every institutional finance company will copy the template of terms of the approved ETF to get easy sign-off and approval themselves, and so once that snowball starts there is no stopping it

my belief is the SEC wants one of its trusted boysclub wallstreet brotheren to be the first. but that means setting up the high walls of admittance to stop small players competing and starting said snowball. so SEC is delaying all it can with many reasons to not approve outsiders first, to give them more time to get all its decks shuffled and aligned and the right preferred players on the table.

after all he who gets first mover status and holds it long enough, recruits the most investment customers and once those customers are settled they wont want or need to move to other small players if all players are all pegging to the same bitcoin price and thus giving the same gains

speculation:

im just surprised that the SEC and the law enforcement that holds alot of confiscated coins are not doing OTC deals with institutional banks to fill their reserves to set up the first basket offerings .. or they probably are but just not publicised yet

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

April 27, 2023, 03:10:53 PM Merited by JayJuanGee (1) |

|

the thing about a btc ETF is that once one is approved every institutional finance company will copy the template of terms of the approved ETF to get easy sign-off and approval themselves, and so once that snowball starts there is no stopping it

my belief is the SEC wants one of its trusted boysclub wallstreet brotheren to be the first. but that means setting up the high walls of admittance to stop small players competing and starting said snowball. so SEC is delaying all it can with many reasons to not approve outsiders first, to give them more time to get all its decks shuffled and aligned and the right preferred players on the table.

after all he who gets first mover status and holds it long enough, recruits the most investment customers and once those customers are settled they wont want or need to move to other small players if all players are all pegging to the same bitcoin price and thus giving the same gains Couldn't agree more with this sentiment, I think you nailed it. Although not 100% convinced about the first mover advantage, as I imagine there would otherwise be more reputable companies offering ETFs than Greyscale, that's exclusively crypto-based. But I do think they are holding off as long as possible in order to get their own players at the table first. They need to hurry up if they want bear market prices though. speculation:

im just surprised that the SEC and the law enforcement that holds alot of confiscated coins are not doing OTC deals with institutional banks to fill their reserves to set up the first basket offerings .. or they probably are but just not publicised yet

Hadn't thought of this, baring in mind the US Gov has been selling BTC and is planning to sell more, and not disclosing to who or where, suggests this could well be the case right now. Either way they'd be daft not to be selling OTC, as otherwise they would suffer a lot of slippage, or otherwise could take much longer to sell the coins on spot market by avoiding it. Also, would exchanges be accepting these "tainted" coins, knowing they originate from and were stolen from Silk Road? By default, I don't think so. But US Gov could certainly make an exception to a friendly institutional bank to use as an ETF reserve rubber-stamped by the SEC. |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

April 27, 2023, 05:12:43 PM |

|

Hadn't thought of this, baring in mind the US Gov has been selling BTC and is planning to sell more, and not disclosing to who or where, suggests this could well be the case right now. Either way they'd be daft not to be selling OTC, as otherwise they would suffer a lot of slippage, or otherwise could take much longer to sell the coins on spot market by avoiding it. Also, would exchanges be accepting these "tainted" coins, knowing they originate from and were stolen from Silk Road? By default, I don't think so. But US Gov could certainly make an exception to a friendly institutional bank to use as an ETF reserve rubber-stamped by the SEC. remember exchanges are red flagging suspect coins according to regulation policy. same said policy created by the financial action task force. the same teams that enforced financial task forces to seize the coins years prior. exchanges would accept coins deposited from known government agencies even with grandfathered taint of silk road because the government had now whitelisted those coins by seizing them as for greyscale. though i see the SEC dragging its feet. i also see grayscale not really sprinting to a finish line.. they to are treading water and sinking with each season that passes.. i still think that it will be a big institute like blackrock or jpmorgan that will get first mover advantage of a spot ETF. once the SEC have been lobbied by the right types of banker people to form the right walls to monopolise the market |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

April 27, 2023, 05:48:29 PM |

|

Hadn't thought of this, baring in mind the US Gov has been selling BTC and is planning to sell more, and not disclosing to who or where, suggests this could well be the case right now. Either way they'd be daft not to be selling OTC, as otherwise they would suffer a lot of slippage, or otherwise could take much longer to sell the coins on spot market by avoiding it. Also, would exchanges be accepting these "tainted" coins, knowing they originate from and were stolen from Silk Road? By default, I don't think so. But US Gov could certainly make an exception to a friendly institutional bank to use as an ETF reserve rubber-stamped by the SEC. exchanges would accept coins deposited from known government agencies even with grandfathered taint of silk road because the government had now whitelisted those coins by seizing them Fair enough, I guess Gov sets the rules so they are able to launder them into "clean coins" again  i still think that it will be a big institute like blackrock or jpmorgan that will get first mover advantage of a spot ETF.

If I had to guess, I also think one of these two would be the first to get an ETF. Although the likes of Greyscale as well as others have been waiting/wanting an ETF since 2018, I actually think this year or next will be the year to get one approved. SEC can't hold it back forever, and better to get one launched during a bear market or price consolidation, rather than full blown bull market for institutional demand reasons. That said, I also thought 2020 was the year to finally get an ETF launched due to prices stabilising towards the end of the year, but that didn't happen, so maybe it'll still make many more years. |

|

|

|

|

Mate2237

|

|

April 27, 2023, 09:00:48 PM |

|

In an unexpected move, Grayscale is up 10% on the day with a BTC down 1.5%. The discount is finally narrowing. This is because of the court hearing of for the SEC vs Grayscale trial. GBTC Discount Narrows to Lowest Level Since November Following Court HearingThe discount narrowed to 35% following the hearing where a panel of appeals court judges appeared skeptical about the U.S. Securities and Exchange Commission's (SEC) arguments in rejecting Grayscale’s bid to convert its GBTC into an exchange-traded fund (ETF). If Grayscale wants to change is bitcoin GBTC to an exchange traded fund, they should allow them because exchange is a business on is own and the authority can tax the company to pay their taxation dues. Even as it is at the end if the court allow them to convert the asset to the exchange, the authority will still tax tbem. What really delay the court process was the denial of Grayscale. The company went to court Tuesday to argue the SEC's denial of its ETF application was "arbitrary," telling the panel of judges that Grayscale is "asking to be regulated" by the SEC through its conversion of GBTC to an ETF. |

▄▄████████▄▄

▄▄████████████████▄▄

▄██████████████████████▄

▄█████████████████████████▄

▄███████████████████████████▄

| ███████████████████▄████▄

█████████████████▄███████

████████████████▄███████▀

██████████▄▄███▄██████▀

████████▄████▄█████▀▀

██████▄██████████▀

███▄▄████████████▄

██▄███████████████

░▄██████████████▀

▄█████████████▀

█████████████

███████████▀

███████▀▀ | | | .

| | ▄▄███████▄▄

▄███████████████▄

▄███████████████████▄

▄█████████████████████▄

▄███████████████████████▄

█████████████████████████

█████████████████████████

█████████████████████████

▀███████████████████████▀

▀█████████████████████▀

▀███████████████████▀

▀███████████████▀

▀▀███████▀▀ | .

ElonCoin.org | │ | | .

| │ | ████████▄▄███████▄▄

███████▄████████████▌

██████▐██▀███████▀▀██

███████████████████▐█▌

████▄▄▄▄▄▄▄▄▄▄██▄▄▄▄▄

███▀░▐███▀▄█▄█▀▀█▄█▄▀

██████████████▄██████▌

█████▐██▄██████▄████▐

█████████▀░▄▄▄▄▄

███████▄█▄░▀█▄▄░▀

███▄██▄▀███▄█████▄▀

▄██████▄▀███████▀

████████▄▀████▀█████▄▄ | .

"I could either watch it

happen or be a part of it"

▬▬▬▬▬ |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4447

|

|

April 27, 2023, 11:01:35 PM |

|

the thing is.

anyone can start a OTC (darkpool) spot ETF now. infact its what grayscale are doing now. but then putting in stupid "no redemption" policy stuff to lock people in

but grayscale want to be listed on the wallstreet listings.. and that comes with higher criteria of stable-ish trade variance where prices dont move 5% in a day every day

the SEC like stable variance not volatility. they like day traders getting the ups and downs of 0.1% whi;e investors only accumulate 5% a year

they dont want to see winners and losers of 5% a day and so they are hesitant to just allow a bitcoin spot etf.

alot of things have to be put in place like "circuit breakers" that stops trading if a x% variance in price occurs in a short period or getting the ETF to not be true spot but just "yesterdays close" trading of each day

along with wanting the presumed gained trust of an established regulated institution being on point as the first mover advantage

grayscale is trying to act like "we deserve to be wall street listed because we are a company" thinking its the only pre-requisite needed due to "freedom". however they should really work on redrafting their proposal template of offering and booking a sit down talk with the sec(lobbying) to really have a face to face discussion with those in charge of decision making to actually find out what template proposal would work

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

I was going to open a thread on this. Actually, the filing from Blackrock has little to no innovation compared to those already rejected. Sure, they are a prominent player in the space and are proposing the same plumbing that has been approved for other EFT (SPDR; for example, has the exact same logic). Yet I find it difficult to think they will have their filing approved unless something really changes in the SEC. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10165

Self-Custody is a right. Say no to"Non-custodial"

|

|

June 19, 2023, 08:18:45 PM |

|

You should provide a link to the extent that you believe one of Ivomm's post in the WO thread is relevant in order that we are easily able to go to such post that you are referencing so we don't have to waste too much time trying to figure out the puzzle of what you mean, exactly.. I am not exactly sure what you are wanting to say.. or the extent to which what Ivomm said is what you want to say or if you might be saying something else.

TLDR: link or it didn't happen. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

wavessurfing

Member

Offline Offline

Activity: 370

Merit: 41

|

|

June 19, 2023, 10:01:08 PM |

|

|

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15397

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 20, 2023, 09:08:20 PM

Last edit: August 30, 2023, 06:46:11 PM by fillippone Merited by vapourminer (1), JayJuanGee (1) |

|

In the meantime, Grayscale is having a good moment following BlackRock Application. GBTC trading volume spikes 400% after BlackRock files for bitcoin ETFOf course, in case of ETF approval, Grayscale would be converted into an ETF very quickly.  Hence the reduction in the NAV discount. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

|

July 04, 2023, 05:14:52 PM |

|

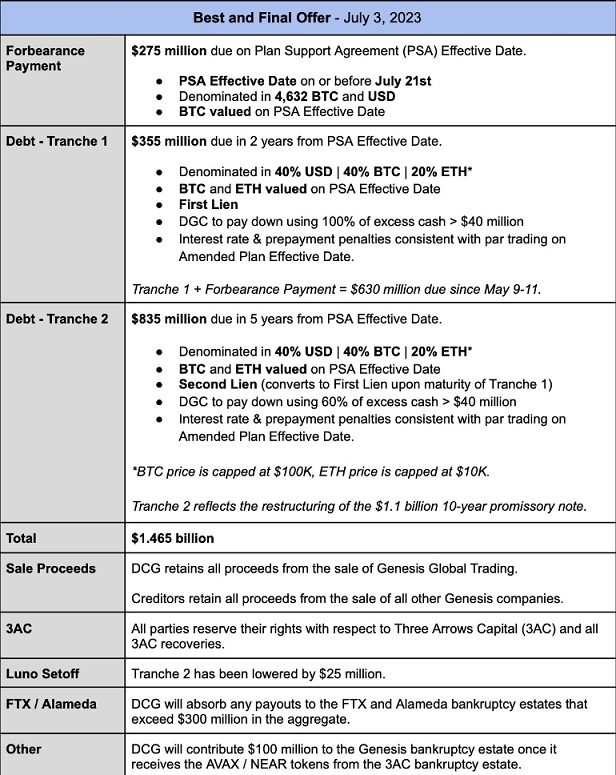

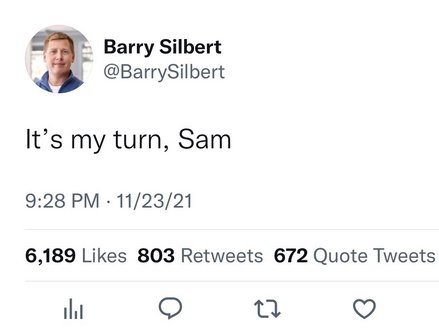

Gemini, represented by co-founder Cameron Winklevoss, has accused DCG Enterprise of fraudulent behavior and is threatening legal action if Barry Silbert refuses to pay a total of $1.465 billion, including a payment of $630 million, which was due back in May. Cameron Winklevoss says that this is the final offer to the founder of DCG as part of the repayment of the debt. the last one. https://twitter.com/cameron/status/1676024844641550337Best and final offer |

|

|

|

|

bbc.reporter

Legendary

Offline Offline

Activity: 2912

Merit: 1440

|

@Daltonik. According to this article Genesis Global gave undercollaterized loans that totalled to $2.3 billion to famous cryptospace gamblers Su Zhu and Kylie Davis, the founders of 3 Arrows Capital. This is head shaking because it appears that Barry Silbert has done something similar as Sam Bankman-Fraud when Sam gave loans backed by questionable collateral to Alameda Research.  The lawsuit specifically alleges that Genesis misrepresented its risk management process by making huge loans to irresponsible counter parties, including Three Arrows Capital (3AC), motivated in part by those counter parties benefiting the Grayscale Bitcoin Trust (GBTC), another DCG subsidiary. The lawsuit details loans to 3AC totaling $2.3 billion and suggests that the collateral for this trade was valued at less than 50% of the loan total. A portion of this collateral was actually shares of GBTC.Source https://protos.com/dcg-fraudulently-covered-up-3ac-induced-insolvency-gemini-lawsuit/ The lawsuit specifically alleges that Genesis misrepresented its risk management process by making huge loans to irresponsible counter parties, including Three Arrows Capital (3AC), motivated in part by those counter parties benefiting the Grayscale Bitcoin Trust (GBTC), another DCG subsidiary. The lawsuit details loans to 3AC totaling $2.3 billion and suggests that the collateral for this trade was valued at less than 50% of the loan total. A portion of this collateral was actually shares of GBTC.Source https://protos.com/dcg-fraudulently-covered-up-3ac-induced-insolvency-gemini-lawsuit/ |

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

|