Raja_MBZ

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

|

November 23, 2019, 01:00:52 AM |

|

Published on 21 March 2014, 15:06 UTC: Fake China Bitcoin Ban pushes BTC price below $600 https://www.ccn.com/fake-china-bitcoin-ban-pushes-btc-price-below-600/

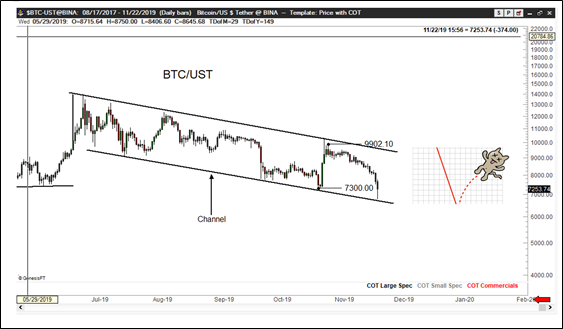

Bitcoin's parabolic uptrend which started in January 2015 is still intact. Now nearly touching support again, for the first time since March 2019. #buythedip

Peter Brandt:

|

|

|

|

|

|

|

|

|

|

Once a transaction has 6 confirmations, it is extremely unlikely that an attacker without at least 50% of the network's computation power would be able to reverse it.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 12014

BTC + Crossfit, living life.

|

|

November 23, 2019, 01:35:01 AM |

|

#HODLsleep #LETtheDUMBASSESkeepTALKING  |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

November 23, 2019, 01:44:05 AM

Last edit: November 23, 2019, 03:24:49 AM by realr0ach |

|

If the evil cult of Judaism admits they're running an unelected, treasonous, 5th column, deep state, it looks like an open and shut case for public execution in a court of military law since such a thing is not supposed to exist. Since Jews as a whole are criminal, inbred psychopaths, they will likely not get the message until the entire 'deep state' apparatus like the CFR is tried in military court, convicted, and publicly hanged, from the CFR president, all the way down to every single lowly typist secretary that works there. Then they can try and hang the numerous other Jewish criminal rackets posing as "think tanks" one by one as well. |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

November 23, 2019, 01:59:43 AM |

|

I spent three months of my life on btctalk.

Oh, well.

As Bob might say:

"Sheeeeit"

|

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

November 23, 2019, 03:11:29 AM |

|

Could be. Could be.

|

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

November 23, 2019, 03:33:06 AM |

|

Told you guys were in the great long-term downtrend. There is no substantial up from here. Yeah, sure, it'll wobble around, but we are definitely witnessing the "slow" death of bitcoin. There is not going to be another all time high. No more sustained above $10k prices anymore. That's in the past. I know it sucks for a lot of you to hear this, but it's just done. Play the market if you want, play a long term low leverage short if you really want to make money, but bitcoin has run it's course. 2 years from now bitcoin will not be above $10k, that's guaranteed.

I love you are hedging your 10k quote there since the last time you said it would not go above 10k again it did... Nice to see you... nice timing. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 23, 2019, 03:46:13 AM |

|

...edited...

hahahahaha

You seem to have some correct in you from time to time, lambie bambie.

When there are posts about extravagances, then that seems to be an opposite behavior to HODL and accumulate... especially when the BTC prices are dipping.

Seems that we might need more McDonalds posts and possible ways of frugality during these kinds of trying times.

If you have a substantial stash of coin, retired off it, need income but are loath to sell at these prices, consider earning weekly interest on a portion of holdings through Celsius. It's way better than selling. ... Then again, by lending, am I providing the central bankers a means to drive the price down I wonder? I don't rest understand these aspects of market mechanics. A lot of people get distracted and lured into interest bearing products because they believe that the return on BTC is not good enough for them. Seems too risky to me, and also seems unnecessary, but if you want to trust your coins with third parties, then so be it. That's your choice. Many times people who borrow BTC are actually dumping those BTC so yes, there is that aspect to it, on a more macro level. I lend a portion of my btc Stash for weekly interest payments because I have no regular income investments at all, it's in btc mostly, and a bit in managed investments. Being retired, I need income, and btc lending is the most obvious source to put it to work. Well, that is fair enough. Each person has to consider his/her own situation and what investment options that s/he has including what other investments that s/he has, which might include various forms of cashflow that might be available, including whether cash flow comes from other places. Surely, I would not recommend any kind of diversification of investments that only involve BTC or have no other investments or has all money only in BTC, but whatever each of us has different situations whether we have to start drawing from our BTC or if we have other sources upon which we can draw - and of course, if you are retired, then either you have an income from your retirement and/or your accumulated assets or you don't, so if you have no other accumulated assets that can draw income and/or you do not have an income from other retirement plans, then yeah, you might not have any other choice but to start to attempt to earn an income off of your BTC stash. Does not seem to be a preferred situation, but it is what it is in terms of where you are at and your age or health conditions or your mere choice to go into retirement status (if not choosing prematurely, only you would know the answers to those various questions). I will never sell my btc Stash at below ath prices if I can live off interest, as a matter of principle. But is it really more principled and better for btc to lend instead of sell?

Those are factors that you need to weigh for yourself the extent to which it would be better to lend than to sell, and not everyone is going to come to the same conclusion. I am pretty sure that I am not going to come to that conclusion, but my plan is likely going to play out differently, since I had considered the most intense aspect of my BTC accumulation phase to have been in 2014, and even though I still accumulate some BTC, especially on large price swing, my whole system has gone more into a kind of maintenance stage. I am thinking 4-5 years in which I might go into more of a liquidation phase, and currently my going into a liquidation phase has more to do with other things going on in my life rather than purely considerations of BTC price, because currently, I would ONLY not sell BTC if they BTC price were below $5k, otherwise, my liquidation phase (if I were to feel some need to go into it) is already tentatively authorized (by me) so long as the BTC price is over $5k. By the way, early liquidation (which is theorized as a kind of maintenance of principle) authorizes a withdrawal of 1% of value per quarter, but if I go into a more aggressive liquidation that involves selling principle, then that would likely mean that I either have some emergency situation or some thoughts of needs to attempt to liquidate before end of life, if such a health situation or age were in consideration of such timeline issues. I figure if central bankers are borrowing mine and others btc through middlemen like celsius.network to dump it, assuming they have infinite Fiat to play with, the price will go down as long as people are willing to lend. But if deep pocket buyers ever buy more than what's available to lend, the price has to shoot up like fireworks when they cover their shorts by actually buying.

Those things could happen, but your decision to lend BTC through celsius network or through any other platform like that should be made on an individual level in terms of whether you believe that it is a prudent risk for you to leave your private keys with some other entity including the pay off that you get or if there might be better ways to either generate income (whether from BTC or otherwise). I will concede that I had gained some interest on BTC that I had on Bitfinex during the 2017 market, and I recall that a lot of guys made a killing on Poloniex during that time, and even though I chose to make some BTC (or stack some sats) at that time, I have subsequently come to different conclusions about the level of risk, and that was only less than 10% of my total BTC, anyhow, but still, I no longer believe it to be prudent risk for myself, but I understand that guys (and gal) are going come to differing conclusions regarding the amount of risk that they are willing to take for the pay off that they believe that they will get through the use of such lending service(s). Increasing volatility will not be good for growing adoption, yet isn't it better to lend than to sell?

It is not necessarily better to lend than sell. You are taking on additional risk, and that is a choice that you make, and not everyone will conclude it to be a prudent risk. Furthermore, there are also ways to make money through volatility, and surely volatility are one of the most guaranteed to happen phenomenons in bitcoin, moreso whether it's price is going up or going down, it is almost inevitably going to be volatile for a decently long period of time into the future, and if you know how to play volatility you can either make money off of that or at least attempt to use volatility to your advantage. If I had a do over I would have sold off half my holdings earlier, but it's so easy to get greedy.

I don't recommend playing around like that, and sure it is easy to make those kinds of proclamations retrospectively, but it is really hard to predict the BTC price direction, so it might not pan out too well to be selling large portions of your BTC and believe that you know that a correction is coming, when it may or may not come in such a way that would allow you to sufficiently profit over having had just held through the ups and downs and just keep accumulating BTC like a long term investment rather than trying to play short term moves with large amounts of your BTC stash. |

|

|

|

|

|

Lambie Slayer

|

|

November 23, 2019, 03:47:23 AM |

|

Hopefully 6400 will have a shot, but the speed down is brutal and the volume is still sad and longing for the Bargain Boyz to return.

If 6400 doesnt hold I dont see how we dont get to at least as low as 5200. That should be a compelling price even for the stingy, cold and calculating Bargain Boyz.

Damn Lambie, I have to say I'm pretty impressed with the general gist of your calls over the last couple of months. Your bearish leanings have been vindicated. The Bargain Boyz attempting to pick up just north of $7k have thus proven themselves to not be very good at their profession. The real Bargain Boyz will only be known to us after they have already picked up. The art of identifying the steep dollar-store bargain as its happening is one that is difficult to master.  Sir take my last 4 merits. The obvious truths are hardest to see through a cloud of bias and neediness and I commend you for having vision to pierce through that miasma. The bubble to 14k while it was spectacularly surprising and not obvious in its rise, was destined for an obvious fall if you were impartial to the circumstances. This impartiality is exceedingly difficult for people who have not invested enough. This is counterintuitive so I will explain what I mean. The general dollar store advice is that if you are biased and stressed about your investment you have invested too much, while this is true, even with Bitcoin, the opposite is also true when it comes to King Bitcoin. It is such a good investment that true bias and stress comes from investing a large amount, but the amount not being large enough. When you take your investment level to ridiculous extremes in percent of your net worth you become free of worry because you are forced to accept the fact that it could all go to zero and you will be wiped out in savings. As you deal with and accept this possibility early you realize that you are part of a cause greater than yourself and hypothetical losses in the future are inconsequential. This same phenomena is why you see children with cancer who may not survive enjoying life while their family freaks out and is sad all the time. The child is all in, while the parents are just heavily invested. The child is forced to accept the potential of his death and he becomes ok with it, the parents worry and stress the whole time. So the only stress free way I know of to invest in King Bitcoin is to go virtually all in. Any other option is where the worry can get you and the bias can cloud your judgement. Move over Tulsi, Lambie is my man! (slightly homo) Lol, bro we can go family style on Tulsi, thats not homo as long as swords dont cross. https://www.youtube.com/watch?v=k5znpQLH8vEShe is a public servant so Im sure she wont mind serving us properly.   via Imgflip Meme Generator via Imgflip Meme Generator |

|

|

|

|

realr0ach

Sr. Member

Offline Offline

Activity: 924

Merit: 311

#TheGoyimKnow

|

|

November 23, 2019, 03:51:54 AM |

|

Just don't sell ANYTHING otherwise the kikes and Chinese communists will buy the coins then try to rig the market up in a pump and dump scam. We need everyone to HODL so none of these retard scammers can monopolize the float. Then anyone that has anything to do with shilling for imaginary, valueless timestamps over physical metals can lose their shirts in a sea of destruction as the entire market implodes. To defeat the kikes and Chinese communists, we need people willing to take one for the team and HODL to zero.

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 23, 2019, 03:56:56 AM |

|

Do you see? It never reached the curve! It had to be lowered and adjusted! Stability in the parameters of a model is a good things. This is why I am bullish on the Stock to Flow model: his parameters have been very stable since 2009-2012 era, hence even before the first halvening. Given the fact the price has done probably 100x since then, this is a very reassuring quality of the model. More info here: Stock To Flow Model: Modeling Bitcoin's Value with Scarcity    here is more of them, they all get adjusted and always lowered so you might lower your expectations. If somebody lives in a clouds then this fall might seem to harsh. The more that you post, SuperTA, the more that you come off as an out of touch goofball. Who fucking gives any shits about how historical projections have played out, unless you are suggesting that bitcoin would have been a bad investment from 2010 to present. Surely you are not saying that. Are you? Bitcoin has been amongst the best of investments for the past 9 years, especially for anyone who either buys and holds or has a more strategic plan to accumulate BTC, and especially if such plan lasts longer than 3.5 years. Surely frequently there have been shorter periods in which such a consistent buy and accumulation of BTC plan would have worked out, but so long as there was buying and accumulating, historically you would NOT have gone wrong if you only engaged in those two activities (presuming that you safeguarded your BTC so they would not get lost or stolen, too). |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 23, 2019, 04:15:41 AM |

|

Hopefully 6400 will have a shot, but the speed down is brutal and the volume is still sad and longing for the Bargain Boyz to return.

If 6400 doesnt hold I dont see how we dont get to at least as low as 5200. That should be a compelling price even for the stingy, cold and calculating Bargain Boyz.

Damn Lambie, I have to say I'm pretty impressed with the general gist of your calls over the last couple of months. Your bearish leanings have been vindicated. The Bargain Boyz attempting to pick up just north of $7k have thus proven themselves to not be very good at their profession. The real Bargain Boyz will only be known to us after they have already picked up. The art of identifying the steep dollar-store bargain as its happening is one that is difficult to master.  Sir take my last 4 merits. The obvious truths are hardest to see through a cloud of bias and neediness and I commend you for having vision to pierce through that miasma. The bubble to 14k while it was spectacularly surprising and not obvious in its rise, was destined for an obvious fall if you were impartial to the circumstances. This impartiality is exceedingly difficult for people who have not invested enough. This is counterintuitive so I will explain what I mean. The general dollar store advice is that if you are biased and stressed about your investment you have invested too much, while this is true, even with Bitcoin, the opposite is also true when it comes to King Bitcoin. It is such a good investment that true bias and stress comes from investing a large amount, but the amount not being large enough. When you take your investment level to ridiculous extremes in percent of your net worth you become free of worry because you are forced to accept the fact that it could all go to zero and you will be wiped out in savings. As you deal with and accept this possibility early you realize that you are part of a cause greater than yourself and hypothetical losses in the future are inconsequential. This same phenomena is why you see children with cancer who may not survive enjoying life while their family freaks out and is sad all the time. The child is all in, while the parents are just heavily invested. The child is forced to accept the potential of his death and he becomes ok with it, the parents worry and stress the whole time. So the only stress free way I know of to invest in King Bitcoin is to go virtually all in. Any other option is where the worry can get you and the bias can cloud your judgement. hahahahaha How about you can fuck off, lambie? holier than thou, art.. thee, not.     You are not more insightful or free merely because you are purportedly overinvested in BTC. Get real. Of course, for yourself, you might have come to that conclusion, and believe that such a way of "all in" investment works, presuming that you are actually representing what you actually do. Each person can decide for him/herself regarding the amount to invest (or to invest) and whether s/he believes that his/her level of investment (or not) has brought enlightenment. |

|

|

|

|

jojo69

Legendary

Offline Offline

Activity: 3150

Merit: 4309

diamond-handed zealot

|

|

November 23, 2019, 04:16:38 AM |

|

last 3 pages, 10/10 would read again, well done WO

honorable mention to Arrie, if that Iraqi shit pans out...that is funny as fuck

Tulsi's tits...

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 23, 2019, 04:20:43 AM |

|

I'm not expecting ~$9000 support level to break down, but if it actually does break down, $6000 ain't out of cards.  Whoaza Raja. You seem to be a bit ahead of yourself, and yes I do agree that there should be some decent support at $9k, but there should also be some decent support in the $8k to $8.5k range too, no? Hmmm... from a bird's eye view at the late-2017 to 2019 price chart, it doesn't really seem like that $7xxx-$8xxx are the levels which can prove to be strong (as both, support and resistance). I know this is a very big range of values, but that's just how I look at it!  Tested $6xxx support today. The next few days are critical. Are you trying to say that you were correct about lack of buying support in the $7ks? Seems a bit strange that we also had a price spurt from $7,300 to $10,300, which would have come after your previous post that was asserting lack of support in the $7ks and $8ks. Not exactly a clear assertion, even though 2 months later we find ourselves in the midst of either a price drop or consolidation in the lower $7ks. |

|

|

|

|

jojo69

Legendary

Offline Offline

Activity: 3150

Merit: 4309

diamond-handed zealot

|

|

November 23, 2019, 04:38:21 AM |

|

somehow this fits can't put my finger on it  |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 23, 2019, 04:39:33 AM |

|

Only IF we turn around sharply right here or in vicinity and go to 80K-90K in one move, which could happen.

Yes, that's what i'm talking about. The thread is full of those hopium charts based on the longterm curve that was never a good indicator for the future's price. Based on the previous wrong longterm curves it would be good to lower the curve and expectation. This thread had too many of those hopiums in recent months that are now bringing a dissapointment to some readers.

It could go the other way just as well (much higher than current graphs indicate). Why not? AMZN chart in the first 11 years of it's existence did not predict the moonshot that followed in the next 11. Same for AAPL. I agree. It could go even higher. But what are probabilities for that? Based on the btc history from 2010 those longterm curves were always adjusted to the lower areas, not to the upside. So based on that, it is a much higher probability that this will happen again. Your supposed science, SuperTA, comes off as retarded as fuck. There have been people who over predicted BTC's price moves in the past, therefore, current BTC price predictions need to be adjusted downwards out of the presumption that they are also overstating BTC's price predictions.  Seems like time to bring out the classic: "you are so dumb for real" meme:  |

|

|

|

|

infofront (OP)

Legendary

Offline Offline

Activity: 2632

Merit: 2780

Shitcoin Minimalist

|

|

November 23, 2019, 04:53:00 AM |

|

Not my chart, but fuck it. It's a bull flag:  |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 23, 2019, 04:54:38 AM |

|

I would not keep it in Fiat. Stocks or real estate or what ever brings me 5% a year.

This. With a good managed portfolio, I've been pulling in 10-12% over the last three years on my traditional investments. Very happy with the numbers I'm seeing. Does not make sense to keep money liquid, just sitting there, earning basic sub 0.5% interest rates in a traditional checking account; take a number you are comfortable with not touching for at least a year, and put it into a managed fund, if you can. The fee's are more than made up for with the profits you will likely realize. In my experience, anyway. Well, if what you say is actually accurate, then you are pulling out way the fuck more than what is within the realms of conventional recommendations, which is to pull out within the area of 4%. Of course, any of us can tweak recommendations because as people we have discretion to do whatever the fuck we like; however, your pulling out 2.5x to 3x of the conventional recommendations seem a bit much.. and I suppose that within you assertion, you might be suggesting that you are able to achieve returns that are on average 2.5x to 3.5x greater than normal peeps? Could be. Could be. But doesn't seem too likely, especially if you consider real long term projections about what actual returns are. Of course, in recent years, we have BTC that can be added into the mix regarding our actual returns, so in that regard, our actual returns could end up getting way the fuck skewed to the upside if BTC continues to generally (and even quite exponentially) outperform traditional asset classes. Mine is a managed 4-5% for the last year on traditional investments. I did put windows and siding on the house this year as well as a newer truck ...this because i expect a pretty good 20-40% recession coming along soon. I took the house/truck money out of the traditional investments to take some 'cream' off the top for my view of a pretty harsh recession. Guess I forgot about BTC's version of such now that we are down to $7,250 USD now I see. What the heck bought about 0.266 BTC in the last couple of days...so wtf. Been in this too long to lame out now. The 2013 BTC Kool-Aid seems to be keeping me buying on the lows (dust or not) it seems. If I'm wrong with the current BTC hoard on buying in now and monthly, big whoop, I'll have much bigger problems with the BTC I hodl if that is the case for any of that to matter... If I'm right, however, I will look like (and claim) I had it all planned. (even though I just placed a bet...BTC always drama) oh well, chump or champ we will see in the next couple of years I guess... Plan on buying more BTC whatever the price on Dec 1st, 2019....would be nice if I could keep up monthly buying 'some' as a habit...no matter the amount.  Anyway IF my recession idea of 20-40% correction on the traditional stock market, etc. Bitcoin will come back. If not....well it was fun! later Brad I remain a bit unclear about whether what you are saying makes sense exactly. If you have reached a stage of your investment that you are starting to withdraw, then you would likely NOT continue to invest too. I mean, you could withdraw up to 1% per quarter or 4% per year, and still be within a kind of conventionally accepted withdraw rate that allows you to largely average out in keeping the value of the principle. If you are still accumulating BTC or buying a position into BTC, I suppose you could do that too, but I think that you have to be a bit more strategic than a pure DCA kind of approach - which works all fine and dandy during initial accumulation, but does not seem to be very applicable to attempt to randomly mix such an approach with a withdrawal strategy. On the other hand, if you are taking from one kind of investment and moving to BTC, then you are reallocating rather than withdrawing, so anyhow my point is that your description of your strategy, Searing, comes off as a bit confusing and potentially a bit contradictory in the event that you really were to consider yourself to be in a kind of withdrawal phase on your BTC. Now, on the other hand (I know that I am running out of hands, but whatever), if you believe that you had withdrawn more BTC than you had wanted to withdraw, and you were in the process of replenishing some of your withdrawal of funds, then I suppose that could be a reasonable thing to attempt, too, especially if you remain a bit unclear about what stage you are in, or if you are kind of in a transition stage rather than a liquidation stage (which seems to be the most plausible reading regarding where you perceive yourself to be at, currently). |

|

|

|

|

VB1001

Legendary

Offline Offline

Activity: 938

Merit: 2540

<<CypherPunkCat>>

|

|

November 23, 2019, 05:43:38 AM |

|

Bitcoin's parabolic uptrend which started in January 2015 is still intact. Now nearly touching support again, for the first time since March 2019.  logarithmic scale https://twitter.com/TuurDemeester/status/1197937180519346176Go Bitcoin |

|

|

|

|

ðºÞæ

Sr. Member

Offline Offline

Activity: 1176

Merit: 297

Bitcoin © Maximalist

|

|

November 23, 2019, 06:25:05 AM |

|

Guys, I've been reading this crazy stuff posted by someone called "Shelby Moore" (whose messages were recently re-posted in the WO thread by user THX 1138), about how all coins held in SegWit addresses will be donated to miners, as they are free-to-spend coins in the legacy (pre-SegWit) blockchain, and only the coins held in legacy addresses will stay intact and belonging to their owners (private key holders). Supposedly, this attack will occur near the 2020 Halving event and will wreak havoc, resulting in the legacy chain being resurrected from the dead and becoming the dominant one, and the SegWit chain disintegrating into oblivion and causing a massive BTC price drop to near-zero.

What do you make of this?

Some more Qs:

1. Is it possible to move any of our coins held in SegWit addresses to legacy addresses (so that they would belong to the legacy chain if the above attack does happen)? Does the fact that, at some point in their history, those coins were held in SegWit addresses, taint them in any way? Would they still be considered as fully belonging to the legacy chain once moved to legacy addresses?

2. Would you do it? Do you think it's worth it?

3. Do these questions even make any sense?

4. Am I wasting my time with all this?

Thanks for any insights.

1. With the SW exploit segwit coins will be unmovable at first, current transactions, then the coins resting in sw addresses and at last any coin ever moved through a sw address is frozen. Exchanges with coin in SW addresses may become insolvent. 2. Stick to Bitcoin fundamentals, decentralize not follow the herd, flock or mob. Everyone needs to do his own homework. 3. Yes 4. No Core devs know the problems with segwit https://www.reddit.com/r/btc/comments/6qftjc/holy_shit_greg_maxwell_and_peter_todd_both_just/?utm_source=reddit&utm_medium=usertext&utm_name=bitcoincashSV&utm_content=t3_dgbb1t

Segregated witnesses separates transaction information about what coins were transferred from the information proving those transfers were legitimate.

The precondition to creating a new block is the data of the last block, the witness.

If you belief to be the 10th owner of a stolen car and the 5th owner has stolen it, when it is established that this is the case you will lose the car and the last lawful owner (4th) will get it back.

This is the very basic rudimentary form of it. |

|

|

|

|

|

Cryptotourist

|

|

November 23, 2019, 07:13:57 AM |

|

1. With the SW exploit segwit coins will be unmovable at first, current transactions, then the coins resting in sw addresses and at last any coin ever moved through a sw address is frozen. Exchanges with coin in SW addresses may become insolvent.

|

|

|

|

|

|

Poll

Poll