cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

January 11, 2024, 07:45:59 PM |

|

Exactly. It's currently a drop in the ocean. As predicted by much of the media, it's barely relevant, much like when Bitcoin Futures initially launched. The interest was almost non-existent.

I am seeing some data that contradicts this. Like the fact the Bitcoin ETFs pulled in over 1.2Billion in the first 30 minutes of trading. This is nothing like the futures launch. At least not yet. I suppose if the inflow stops there it could cool down? And: https://twitter.com/JoeConsorti/status/1745527450358989212 |

|

|

|

|

|

|

|

|

|

|

|

I HATE TABLES I HATE TABLES I HA(╯°□°)╯︵ ┻━┻ TABLES I HATE TABLES I HATE TABLES

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

January 11, 2024, 07:47:50 PM |

|

I'm thinking that maybe it's time to stop watching charts, go full RL and come back in a month or two.

You are absolutely correct. That would be wise and probably support one's mental health. But who can resist?

Not I. |

|

|

|

|

AlcoHoDL

Legendary

Offline Offline

Activity: 2352

Merit: 4145

Addicted to HoDLing!

|

|

January 11, 2024, 07:48:48 PM |

|

There's still time...   [ Link @ X] |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 11, 2024, 08:01:15 PM |

|

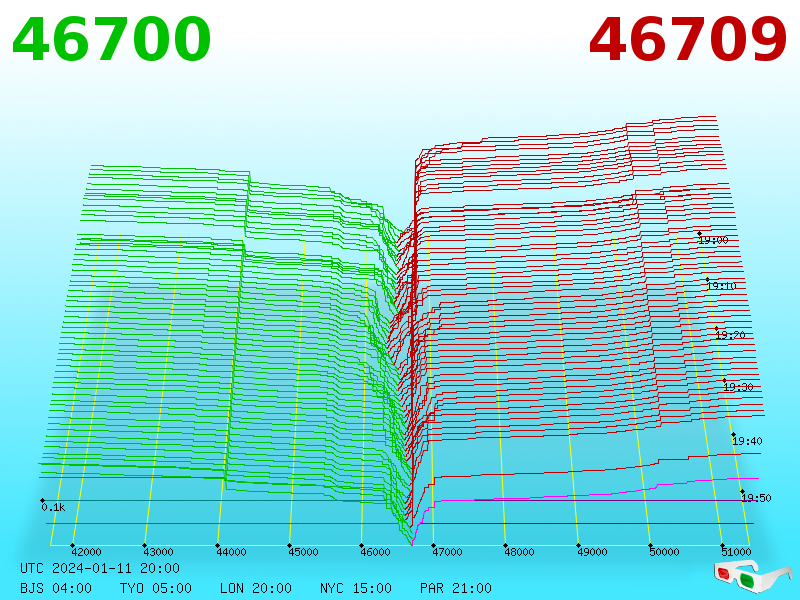

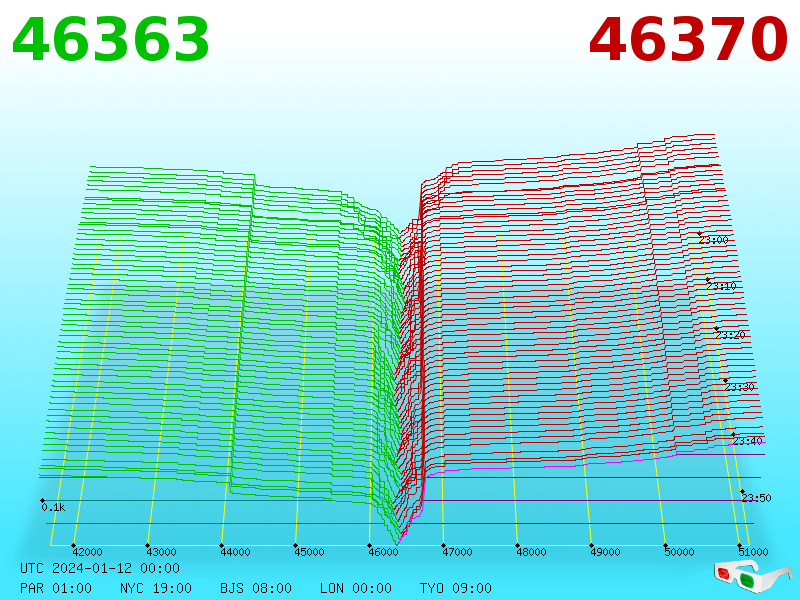

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

OgNasty

Donator

Legendary

Offline Offline

Activity: 4718

Merit: 4235

Leading Crypto Sports Betting & Casino Platform

|

|

January 11, 2024, 08:12:24 PM Merited by JayJuanGee (1) |

|

Exactly. It's currently a drop in the ocean. As predicted by much of the media, it's barely relevant, much like when Bitcoin Futures initially launched. The interest was almost non-existent.

I am seeing some data that contradicts this. Like the fact the Bitcoin ETFs pulled in over 1.2Billion in the first 30 minutes of trading. This is nothing like the futures launch. At least not yet. I suppose if the inflow stops there it could cool down? And: https://twitter.com/JoeConsorti/status/1745527450358989212 Indeed it was a spectacular launch. There are rumors that known large Bitcoin holders are being contacted and asked if they’ll sell their BTC at a large premium in order to meet demand. Apparently there’s a lot of BTC that needs to be purchased with the money brought in from these funds. I’m no expert in how it all works (yet) but if true we could have a genuine supply squeeze on our hands in as soon as an hour. My advice is to not sell your BTC to Wall Street until it can change your life. https://x.com/bradmillscan/status/1745515552234184775 |

|

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

Exactly. It's currently a drop in the ocean. As predicted by much of the media, it's barely relevant, much like when Bitcoin Futures initially launched. The interest was almost non-existent.

I am seeing some data that contradicts this. Like the fact the Bitcoin ETFs pulled in over 1.2Billion in the first 30 minutes of trading. This is nothing like the futures launch. At least not yet. I suppose if the inflow stops there it could cool down? And: https://twitter.com/JoeConsorti/status/1745527450358989212 Ok, maybe nothing like futures launch back in 2017, but also potentially proportionate based on market cap? Even so, I wouldn't rely too much solely on new tickers and the volume appearing quite yet... I need to have a proper analysis of these Bitcoin tickers in general, from new ETFs to old products, because one thing I have noticed today is the bearish spike in selling volume for the likes of BTC1!, BITO and BITS (more so than BTC), which suggests to me that those speculating on Bitcoin's price rise into the ETF were doing so not only on the spot market but also on older products, ETNs and futures I'm assuming. If I had to guess, Wall St are playing each other with older products being used to dump on newer products. At least that's the initial impression I'm getting. Also what happened to the "normality" of simply expecting/waiting for a 50% drop once new products are listed? This is like the defacto move for Wall St; wait for the -50%, then buy in. It explains a lot of previous Bitcoin-based launches as well. Ie maybe this is less about Bitcoin correcting the usual 30%-50% after a parabolic move, and more about new launches on stock exchanges dropping 50% before going anywhere relevant. Just a thought. Let's not forget the amount of money invested in Bitcoin futures right now, because no doubt a lot of futures speculation was based on a future ETF that has now been launched. Again, just food for thought here. |

|

|

|

|

xhomerx10

Legendary

Offline Offline

Activity: 3822

Merit: 7976

|

|

January 11, 2024, 08:43:11 PM |

|

T-minus 4 days. Patience young ones.

When moon? |

|

|

|

|

darkangel11

Legendary

Offline Offline

Activity: 2338

Merit: 1345

Defend Bitcoin and its PoW: bitcoincleanup.com

|

|

January 11, 2024, 08:58:05 PM |

|

When moon?

Soon. The price action is pretty normal if you know what's going on (people are moving their funds from GBTC to ETFs). The volumes on exchanges aren't high. When we were bouncing back from 16k last year there was more money coming in than it is right now, meaning the FOMO hasn't started yet and we've already visited the high from 2022. Looking good. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 11, 2024, 09:01:20 PM |

|

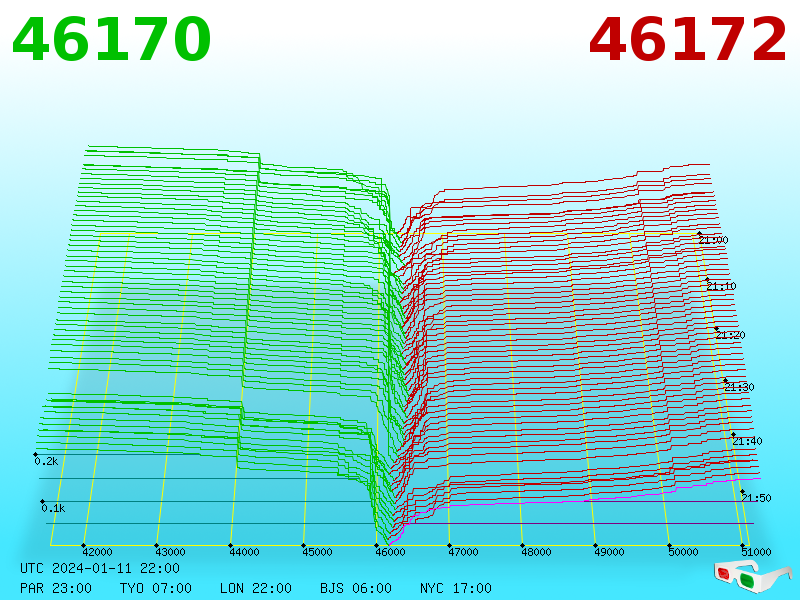

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3848

|

|

January 11, 2024, 09:33:10 PM Merited by JayJuanGee (1) |

|

Long time no post. Came to see if anyone else was selling this news event, guess I'm not the only one. Felt comfortable with a decent sell at $48K. Now will wait for pull-back. Still think we could see $30K within next few months as below $40K there isn't a lot to keep us at higher levels. No doubt ETF will help in the long-run, but that will take a few months imo, rather than a few weeks. Already the 4hr candle is looking bearish and sellers clearly taking advantage of the "sell the launch" opportunity. Let's be honest 2023 was a good year with +150%, now all that's needed is for price to cool off and balance out. It's ironic as $48.5K was the 0.618 retracement level I had talked about hitting for a long-time, even if it took until 2024 to get there as opposed to 2023 as initially anticipated. You can consider my return and post as a local top signal  Could be, but not by as much as you are suggesting, imho. Well no, not really. It's been well documented in the media and such that this could be an "implosion of new money into Bitcoin" or a "buy the rumour sell the news" type event. So far, I'd say it's the latter, but only time will tell. To me it's more the fact Bitcoin has reached my minimum target for a retracement from ATH to bear market low. It's just a "concidence" it occurred on the day of the ETF launch. Ie, not a coincidence at all. Even with no ETF launch I'd be taking profits at current levels, because it feels eerily similar to summer 2019 parabolic run, at very similar levels as it were. Even if not I'm anticipating any sort of black swan event, a 35% to 50% correction feel due, much like in 2020 even before the covid crash, ie from $14K to $7K. In this case a think a milder (by %) pull-back to around $30K is in order. Not gonna lie though, the trend is still bullish, even with current rejection on lower time-frames. It's more the red flags on the chart that's causing me to lose faith in continued upside right now. To me it's the same as $12.8K in 2019, so sure price could go a bit higher in the short-term, but notably anything above $12K back then was a solid selling opportunity. At least until price returned to $7K. this is not summer of 2019. this is 2016 pre 1/2ing  Sure, price wicks down -40% to $30K rather than $25K, otherwise closing weekly candle around $35K (-27%). No arguments there. 0.618 fib retracement painted the same picture. Now that i have time to post a longer argument...here it goes: Now, bitcoin ETF is one of the tradfi assets. Tradfi asset in a "bull market' is not supposed to decline more than 20% 9and maintain such market). Of course, i know that bitcoin in 2017 and 2021 bull market had much greater local declines, apart from 50% decline in the middle of 2021. If we plot 20% decline from ~46K (which was the price before the approval), then it s"should not" go below $36.8K If you count from intraday high of ~48K (but we probably shouldn't), then $38.4K. We shall see it this prediction would hold. Bitcoin doesn't care about no TradFi. If you're already open to the idea of mid thirties than we're not that different. My estimate is somewhere between $25K to $35K. If you are right regarding a local top Cramer would be too.. And, out of experience, that's extremely hard to swallow.... Even a broken clock is right twice a day. Well, 5% is NOT a drop in the ocean....you remind me of my students who think that 5% of a grade is NOTHING, when it is exactly what it is, 5%. For fun, there are approximately 2.664X10^25 drops in the ocean ( https://www.quora.com/How-many-drops-of-water-make-up-the-sea) while ETFs volume is 5 "drops" in a 100 "drops" (about 5ml or about a teaspoon). For a supposedly "numbers guy" you threw these comparisons around with a bit too much ease, but don't take it as a criticism..I understand what you meant, emotionally, but let's stick to numbers, OK? Peace. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 11, 2024, 10:01:17 PM |

|

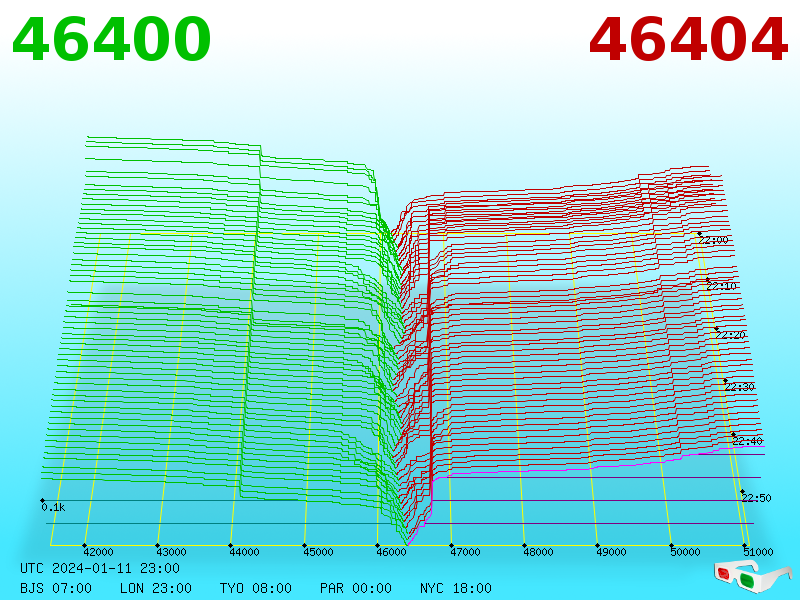

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

January 11, 2024, 10:06:29 PM |

|

Well, 5% is NOT a drop in the ocean....you remind me of my students who think that 5% of a grade is NOTHING, when it is exactly what it is, 5%. For fun, there are approximately 2.664X10^25 drops in the ocean ( https://www.quora.com/How-many-drops-of-water-make-up-the-sea) while ETFs volume is 5 "drops" in a 100 "drops" (about 5ml or about a teaspoon). For a supposedly "numbers guy" you threw these comparisons around with a bit too much ease, but don't take it as a criticism..I understand what you meant, emotionally, but let's stick to numbers, OK? Peace. Seriously?! It's a phrase that means "insignificant" as opposed to literally a drop in an ocean, which would be miniscual, quite obviously as it's a metaphor that's not meant literally. Maybe this is a British phrase or something? Can't believe I feel the need to have to do this for something so trivial, but here are dictionary definitions of the phrase for you (spoiler; it has nothing to do 2.664X10^25 drops): If you say that something is a drop in the ocean, you mean that it is a very small amount which is unimportant compared to the cost of other things or is so small that it has very little effect on something. an amount that is so small that it does not make an important difference or have much effect So yes, when we are talking about 5% of volume, I consider it a very small amount. Others may just consider it a small amount, but I'd consider it very small. To me it's the equivalent of a strong wind when driving down the highway/motorway at 70mph/110kmh (en/us context). It's not enough to take you of course 99% of the time, as it's only about 5% of the force in play, but it does mean you have to adjust for it; that analogy you're welcome to take literally. My point was more to whoever said that Bitcoin had "become TradFi". Whereas actually it's 95% not TradFi, and won't be, until ETF volume is at least 51%. |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3848

|

|

January 11, 2024, 10:54:31 PM |

|

Well, 5% is NOT a drop in the ocean....you remind me of my students who think that 5% of a grade is NOTHING, when it is exactly what it is, 5%. For fun, there are approximately 2.664X10^25 drops in the ocean ( https://www.quora.com/How-many-drops-of-water-make-up-the-sea) while ETFs volume is 5 "drops" in a 100 "drops" (about 5ml or about a teaspoon). For a supposedly "numbers guy" you threw these comparisons around with a bit too much ease, but don't take it as a criticism..I understand what you meant, emotionally, but let's stick to numbers, OK? Peace. Seriously?! It's a phrase that means "insignificant" as opposed to literally a drop in an ocean, which would be miniscual, quite obviously as it's a metaphor that's not meant literally. Maybe this is a British phrase or something? Can't believe I feel the need to have to do this for something so trivial, but here are dictionary definitions of the phrase for you (spoiler; it has nothing to do 2.664X10^25 drops): If you say that something is a drop in the ocean, you mean that it is a very small amount which is unimportant compared to the cost of other things or is so small that it has very little effect on something. an amount that is so small that it does not make an important difference or have much effect So yes, when we are talking about 5% of volume, I consider it a very small amount. Others may just consider it a small amount, but I'd consider it very small. To me it's the equivalent of a strong wind when driving down the highway/motorway at 70mph/110kmh (en/us context). It's not enough to take you of course 99% of the time, as it's only about 5% of the force in play, but it does mean you have to adjust for it; that analogy you're welcome to take literally. My point was more to whoever said that Bitcoin had "become TradFi". Whereas actually it's 95% not TradFi, and won't be, until ETF volume is at least 51%. If i had a "drop in the ocean" 5% of all bitcoins or even 5% of today's $ flow from just ETFs or bitcoin, it would not be something insignificant: 5% of all btc-1.05 mil btc or $48.3 bil $$ 5% of all bitcoin flow today was $ 3.6 bil (before, now it is an even higher number of ~7%) Is this nothing for you? Gee, man, for myself, those numbers are significant. I am not even sure what is the point of this non-quantitative conversation....maybe i just don't want to call something that has some value to be called insignificant. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 11, 2024, 11:01:33 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 12, 2024, 12:01:24 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

|

DaRude

Legendary

Offline Offline

Activity: 2778

Merit: 1791

In order to dump coins one must have coins

|

|

January 12, 2024, 12:50:49 AM |

|

Exactly. It's currently a drop in the ocean. As predicted by much of the media, it's barely relevant, much like when Bitcoin Futures initially launched. The interest was almost non-existent.

I am seeing some data that contradicts this. Like the fact the Bitcoin ETFs pulled in over 1.2Billion in the first 30 minutes of trading. This is nothing like the futures launch. At least not yet. I suppose if the inflow stops there it could cool down? And: https://twitter.com/JoeConsorti/status/1745527450358989212 This just tells me that all of those speculators that poured over 3% of all BTC in existing [619,162.0971] and got caught in GBTC discount with a 2% annual fee, can finally close their positions without paying steep discount. GBTC still has the nerve to charge the remaining idiots 1,5%/yr fee. Inflows into other funds seem to offset the dismantling of GBTC, watch their AUM closely. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 12, 2024, 01:01:15 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

d_eddie

Legendary

Offline Offline

Activity: 2478

Merit: 2895

|

|

January 12, 2024, 01:08:52 AM |

|

Did you do it yourself, or is it a repost from somewhere else? |

|

|

|

|

|

Poll

Poll