Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1823

|

|

August 11, 2021, 10:50:46 AM |

|

This is my motto actually. Buying the dip is always good. I think that noone can deny that.

Yes.. people can deny it. The best strategy is DCA, and buying the dip is a good supplement to DCA.. but it is not as good as DCA... So when in doubt and you are not sure about what strategy to follow, DCA is the best Hands down. The best way to convince people about DCA, especially in Bitcoin, is to have them ask their grandfather how much they purchased their first house, or their first car. Then let them imagine that they are grandparents with grandchildren asking them how much they purchased their first Bitcoins.  |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

|

|

|

|

|

|

|

The grue lurks in the darkest places of the earth. Its favorite diet is adventurers, but its insatiable appetite is tempered by its fear of light. No grue has ever been seen by the light of day, and few have survived its fearsome jaws to tell the tale.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10167

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 11, 2021, 04:01:49 PM |

|

This is my motto actually. Buying the dip is always good. I think that noone can deny that.

Yes.. people can deny it. The best strategy is DCA, and buying the dip is a good supplement to DCA.. but it is not as good as DCA... So when in doubt and you are not sure about what strategy to follow, DCA is the best Hands down. The best way to convince people about DCA, especially in Bitcoin, is to have them ask their grandfather how much they purchased their first house, or their first car. Then let them imagine that they are grandparents with grandchildren asking them how much they purchased their first Bitcoins.  I doubt that is the best way of thinking about how to tailorize bitcoin to individual circumstances and the particular opportunities that present themselves (especially to normies) through something like bitcoin. I have outlined several times that people do not tend to have lump sums of cash that they are either hanging onto or that they would like to go into debt or that they would like to hang onto cash and try to time opportunities to enter into whatever investment. Of course, a house is a bit of a different investment because of living in it, but it is still subject to the bullshit over-skewing of the importance of debt.. so currently there are all kinds of people and institutions hoarding housing because they are afraid to keep their value in cash or some other assets that are questionable in their fundamentals. So, even though history can sometimes inform us about what we might want to do now, or what kinds of risks that we might want to take, one of the great things about something like bitcoin is that any of us (even the most normie of normies) can get into it with very little capital and we can customize our strategies and do not even have to qualify to become eligible to get into it.. We just have to take some actions to set up accounts or get some contacts with folks to buy directly.. sure there can sometimes be some elitism in terms of those with banks have more options, but we see systems developing in very poor locations (including El Salvador) that seem to be increasing the developments of options in which even the poorest of the poor can get into bitcoin without having very many fees and then they can take advantage of even smaller incremental investments if that might be all their budget (and situation) may be able to tolerate. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

This is my motto actually. Buying the dip is always good. I think that noone can deny that.

Yes.. people can deny it. The best strategy is DCA, and buying the dip is a good supplement to DCA.. but it is not as good as DCA... So when in doubt and you are not sure about what strategy to follow, DCA is the best Hands down. The best way to convince people about DCA, especially in Bitcoin, is to have them ask their grandfather how much they purchased their first house, or their first car. Then let them imagine that they are grandparents with grandchildren asking them how much they purchased their first Bitcoins.  I doubt that is the best way of thinking about how to tailorize bitcoin to individual circumstances and the particular opportunities that present themselves (especially to normies) through something like bitcoin. I have outlined several times that people do not tend to have lump sums of cash that they are either hanging onto or that they would like to go into debt or that they would like to hang onto cash and try to time opportunities to enter into whatever investment. Of course, a house is a bit of a different investment because of living in it, but it is still subject to the bullshit over-skewing of the importance of debt.. so currently there are all kinds of people and institutions hoarding housing because they are afraid to keep their value in cash or some other assets that are questionable in their fundamentals. Agreed that recognizing the value fiat has lost over the decades isn't the most advertising reason to invest in Bitcoin. It's a good reason to invest in something, but doesn't give BTC any specific merit for investment really. I'm going to be the contrarian here though (as per usual). While true most people don't have a lump of cash in order to invest, I've realized more recently that those that do still don't want to risk investing in Bitcoin, or anything for that matter. It's those that don't have cash aside that appear to be more likely to putting a small % of their earnings into BTC, either as DCA or otherwise after some tax return, or something similar ("average joe"). It's no longer about the high risk it seems, but simply the risk in itself of investing money. Knowing that enough of my friends have taken the plunge and invested a decent amount of what they have, knowing the probability and risk/reward is worth it to at minimum sell half when price doubles (if they want a safe investment) or otherwise hodl on knowing it's their best chance of buying a house in the future, or developing their retirement fund. While others who are saving up for a deposit on a mortgage (millennials specifically), or paying off a mortgage and therefore have limited savings, are too worried about investing in anything right now, in fear of losing everything and more. Mainly concerned about being unable to get their mortgages or being able to pay if off in the future, therefore setting themselves back by many years. It's a shame, but I do understand the concern. At any time prices could crash, in any investment market, even in the "safest" with the lowest reward. In contrast, Gen X don't really even consider that a crash could happen, while other generations know how to cope with it and manage risk. The problem doesn't appear to be the fear of investing in Bitcoin anymore (that's so 2018!), nor the risk, but investing itself (which is a scary concept for many, as a scary reality as well). But we have to remember we live in covid times now. Gen X know to take a leap of faith, while millennials appear to be stuck in the 20th century still, usually anticipating the next market crash that could last a decade, and consider Bitcoin too high risk despite being a hedge against this type of event (mainly due to the covid dump I think). Bare in mind they could also be right, despite BTC's hedge against inflation and a global market crash or great depression that the gloom and doomers predict daily, we never know what might actually happen. The decade long bull market could certainly end, just like it did for gold. Obviously I don't see this happening, I give it a 1% chance at best, but without spending years study blockchain and the economic values of cryptocurrency then it's difficult for others not to consider it a much higher possibility. Those that witnessed the dotcom bubble for example, and probably will always feel they are now too late to invest in anything after saving their money for over a decade. I honestly think "we" need to develop a new strategy for most of the millennials here, that make up a large size of the population. Gen X are all on board it seems, they grew up in the tech generation and can simply buy bitcoin at a click of a button unless their bank prevents from it. Even the older generations are speculating, knowing it's the responsible thing to do to put at least 2-5% of their wealth in (as if Elon says it's a good idea, they generally don't argue with successful investors). To me it seems like grandparents are more likely to have their grandchildren invest in Bitcoin for them, that millennials who are currently questioning "what the fuck did I do for the past 10 years just saving X per year". They don't want to retreat from their plans. Maybe this is overgeneralizing for sure, my group of friends aren't exactly the investor type, nor the savings types for that matter, but from discussion with millennials from different backgrounds and classes, the general idea of investing just seems too risky for them. Either the reward is too low for it to be worthwhile (like the stock market), or the risk is too high such as with cryptocurrency. This mentality needs to be destroyed to atttract this generation that are falling behind. I could be wrong about the stats here, but last I checked, millennials are falling behind and I worry for them! |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10167

Self-Custody is a right. Say no to"Non-custodial"

|

This is my motto actually. Buying the dip is always good. I think that noone can deny that.

Yes.. people can deny it. The best strategy is DCA, and buying the dip is a good supplement to DCA.. but it is not as good as DCA... So when in doubt and you are not sure about what strategy to follow, DCA is the best Hands down. The best way to convince people about DCA, especially in Bitcoin, is to have them ask their grandfather how much they purchased their first house, or their first car. Then let them imagine that they are grandparents with grandchildren asking them how much they purchased their first Bitcoins.  I doubt that is the best way of thinking about how to tailorize bitcoin to individual circumstances and the particular opportunities that present themselves (especially to normies) through something like bitcoin. I have outlined several times that people do not tend to have lump sums of cash that they are either hanging onto or that they would like to go into debt or that they would like to hang onto cash and try to time opportunities to enter into whatever investment. Of course, a house is a bit of a different investment because of living in it, but it is still subject to the bullshit over-skewing of the importance of debt.. so currently there are all kinds of people and institutions hoarding housing because they are afraid to keep their value in cash or some other assets that are questionable in their fundamentals. Agreed that recognizing the value fiat has lost over the decades isn't the most advertising reason to invest in Bitcoin. It's a good reason to invest in something, but doesn't give BTC any specific merit for investment really. I'm going to be the contrarian here though (as per usual). While true most people don't have a lump of cash in order to invest, I've realized more recently that those that do still don't want to risk investing in Bitcoin, or anything for that matter. It's those that don't have cash aside that appear to be more likely to putting a small % of their earnings into BTC, either as DCA or otherwise after some tax return, or something similar ("average joe"). It's no longer about the high risk it seems, but simply the risk in itself of investing money. Knowing that enough of my friends have taken the plunge and invested a decent amount of what they have, knowing the probability and risk/reward is worth it to at minimum sell half when price doubles (if they want a safe investment) or otherwise hodl on knowing it's their best chance of buying a house in the future, or developing their retirement fund. While others who are saving up for a deposit on a mortgage (millennials specifically), or paying off a mortgage and therefore have limited savings, are too worried about investing in anything right now, in fear of losing everything and more. Mainly concerned about being unable to get their mortgages or being able to pay if off in the future, therefore setting themselves back by many years. It's a shame, but I do understand the concern. At any time prices could crash, in any investment market, even in the "safest" with the lowest reward. In contrast, Gen X don't really even consider that a crash could happen, while other generations know how to cope with it and manage risk. The problem doesn't appear to be the fear of investing in Bitcoin anymore (that's so 2018!), nor the risk, but investing itself (which is a scary concept for many, as a scary reality as well). But we have to remember we live in covid times now. Gen X know to take a leap of faith, while millennials appear to be stuck in the 20th century still, usually anticipating the next market crash that could last a decade, and consider Bitcoin too high risk despite being a hedge against this type of event (mainly due to the covid dump I think). Bare in mind they could also be right, despite BTC's hedge against inflation and a global market crash or great depression that the gloom and doomers predict daily, we never know what might actually happen. The decade long bull market could certainly end, just like it did for gold. Obviously I don't see this happening, I give it a 1% chance at best, but without spending years study blockchain and the economic values of cryptocurrency then it's difficult for others not to consider it a much higher possibility. Those that witnessed the dotcom bubble for example, and probably will always feel they are now too late to invest in anything after saving their money for over a decade. I honestly think "we" need to develop a new strategy for most of the millennials here, that make up a large size of the population. Gen X are all on board it seems, they grew up in the tech generation and can simply buy bitcoin at a click of a button unless their bank prevents from it. Even the older generations are speculating, knowing it's the responsible thing to do to put at least 2-5% of their wealth in (as if Elon says it's a good idea, they generally don't argue with successful investors). To me it seems like grandparents are more likely to have their grandchildren invest in Bitcoin for them, that millennials who are currently questioning "what the fuck did I do for the past 10 years just saving X per year". They don't want to retreat from their plans. Maybe this is overgeneralizing for sure, my group of friends aren't exactly the investor type, nor the savings types for that matter, but from discussion with millennials from different backgrounds and classes, the general idea of investing just seems too risky for them. Either the reward is too low for it to be worthwhile (like the stock market), or the risk is too high such as with cryptocurrency. This mentality needs to be destroyed to atttract this generation that are falling behind. I could be wrong about the stats here, but last I checked, millennials are falling behind and I worry for them! I am a little bit opposed (and annoyed) by your use of the word cryptocurrencies here, partly because it seems that such use of the term muddies the waters regarding what the fuck are we talking about, and it is NOT like I am really opposed to the conclusions that some people might make regarding a need to diversify out of bitcoin, but learn about what is bitcoin first and what differentiates bitcoin from those various other cryptocurrencies before screwing around with them, so in that regard, I am opposed (and annoyed) by ongoing perpetuation of ignorance that seems to exist when any of us employ the use of such an amorphous term when bitcoin really is the one making the longer term strong case for hedging against various dollar based legacy investments whether stocks, bonds, precious metals such as gold or silver, investment properties (including home) and perhaps some other ways that people might consider their money to be invested (such as in businesses). Having attempted to clarify that, for sure many of us already recognize that there is a lack of conscious practice in terms of focusing on setting some money aside rather than spending it all and other ways of investing to attempt to leverage time now for the future perhaps when you might want to have had built up a nest egg, and really I have my doubts about your attempts to make generational categorization conclusions about problems that extend across generations - and sure there have been some changes in the way jobs are structured and also ongoing changes in the extent to which debt might have been used historically versus how it has changed and could be used in current times, and so if peeps (normies) are able to get access to credit (which is another world-wide distribution of disparities), then frequently there can be ways to use credit to leverage investments (not necessarily increasing consumption through it, which is a BIG mistake that many people make). Another thing is that bitcoin gives no fucks about various deficiencies that normies might have in terms of identifying it as an investment opportunity that is staring them in the face, and sure if they fail/refuse to jump on board earlier then those who jump on board are going to experience way more of the largest wealth generation than they will - and even "we" or bitcoin does not need them.. bitcoin is going forward to gravitate a vast majority of value into it, whether less enlightened normies jump on board and figure it out or not. I really am not sure about what kind of potential alternative investment strategy you might be suggesting to potentially be within our grasps to try to edumacate the ignorant masses, dragonvslinux, but the school of hard knocks which is life may well teach them that if they do not get on board at earlier times in their life, they may well NOT completely lose opportunities to prosper from bitcoin's incentivizing more responsible monetary systems, but the upside of their investment (and the compounding effect) is likely NOT as great the longer that they wait. So I am of the school of thought to use any fucking kind of investment strategy that you like, and sure I don't mind helping to attempt to get people to figure out their personal situations in order that they can attempt to better know their own personal situations so that they can figure out how much to invest and how to invest, and so many times once they get passed the hurdles of figuring out their own personal financial and psychological situation, then they are going to be further along to being able to better employ a variety of investment strategies, including DCA, lump sum investing, buying on dip and HODL strategies. Please note that while I am typing this post, I am kind of coming to the conclusion that part of your point (besides some of your getting wrapped into analysis of generational distinctions), dragonvslinux, may well be that normies have to figure out their own personal financial and psychological circumstances before even being able to know how much that they are even capable of investing, and surely I cannot disagree with those kinds of points that suggest that peeps/normies are not going to be in any kind of position to be able to invest in hardly shit if they do not engage in some kind of decent amount of assessment of their personal circumstances, to the extent those may have been some of the points that you may have been suggesting. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Miaallen

Member

Offline Offline

Activity: 573

Merit: 30

|

|

August 12, 2021, 09:24:06 AM |

|

Buying the dip is mostly sweet but sometimes be also sour. One has to be taking necessary discretion and financial precautions needed ó be financially safe when making such decisions. Remember to always buy the dips just the sum you can afford to lose. |

|

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1823

|

|

August 12, 2021, 09:48:01 AM Merited by JayJuanGee (1) |

|

This is my motto actually. Buying the dip is always good. I think that noone can deny that.

Yes.. people can deny it. The best strategy is DCA, and buying the dip is a good supplement to DCA.. but it is not as good as DCA... So when in doubt and you are not sure about what strategy to follow, DCA is the best Hands down. The best way to convince people about DCA, especially in Bitcoin, is to have them ask their grandfather how much they purchased their first house, or their first car. Then let them imagine that they are grandparents with grandchildren asking them how much they purchased their first Bitcoins.  . I have outlined several times that people do not tend to have lump sums of cash that they are either hanging onto or that they would like to go into debt or that they would like to hang onto cash and try to time opportunities to enter into whatever investment. Of course, a house is a bit of a different investment because of living in it, but it is still subject to the bullshit over-skewing of the importance of debt.. so currently there are all kinds of people and institutions hoarding housing because they are afraid to keep their value in cash or some other assets that are questionable in their fundamentals. So, even though history can sometimes inform us about what we might want to do now, or what kinds of risks that we might want to take, one of the great things about something like bitcoin is that any of us (even the most normie of normies) can get into it with very little capital and we can customize our strategies and do not even have to qualify to become eligible to get into it.. We just have to take some actions to set up accounts or get some contacts with folks to buy directly.. sure there can sometimes be some elitism in terms of those with banks have more options, but we see systems developing in very poor locations (including El Salvador) that seem to be increasing the developments of options in which even the poorest of the poor can get into bitcoin without having very many fees and then they can take advantage of even smaller incremental investments if that might be all their budget (and situation) may be able to tolerate. It might not be for you, but I believe it would make them understand, and come to a realization that inflation is devaluing their savings from the moment when their Central Bank stopped using the Gold Standard. Bitcoin is the great equalizer that increases in fiat-value, it sucks fiat as long as more of it is printed. Inflation Medicine? |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

dragonvslinux

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

August 12, 2021, 11:20:57 AM Merited by JayJuanGee (2) |

|

I doubt that is the best way of thinking about how to tailorize bitcoin to individual circumstances and the particular opportunities that present themselves (especially to normies) through something like bitcoin.

I have outlined several times that people do not tend to have lump sums of cash that they are either hanging onto or that they would like to go into debt or that they would like to hang onto cash and try to time opportunities to enter into whatever investment. Of course, a house is a bit of a different investment because of living in it, but it is still subject to the bullshit over-skewing of the importance of debt.. so currently there are all kinds of people and institutions hoarding housing because they are afraid to keep their value in cash or some other assets that are questionable in their fundamentals. Agreed that recognizing the value fiat has lost over the decades isn't the most advertising reason to invest in Bitcoin. It's a good reason to invest in something, but doesn't give BTC any specific merit for investment really. I'm going to be the contrarian here though (as per usual). While true most people don't have a lump of cash in order to invest, I've realized more recently that those that do still don't want to risk investing in Bitcoin, or anything for that matter. It's those that don't have cash aside that appear to be more likely to putting a small % of their earnings into BTC, either as DCA or otherwise after some tax return, or something similar ("average joe"). It's no longer about the high risk it seems, but simply the risk in itself of investing money. Knowing that enough of my friends have taken the plunge and invested a decent amount of what they have, knowing the probability and risk/reward is worth it to at minimum sell half when price doubles (if they want a safe investment) or otherwise hodl on knowing it's their best chance of buying a house in the future, or developing their retirement fund. While others who are saving up for a deposit on a mortgage (millennials specifically), or paying off a mortgage and therefore have limited savings, are too worried about investing in anything right now, in fear of losing everything and more. Mainly concerned about being unable to get their mortgages or being able to pay if off in the future, therefore setting themselves back by many years. It's a shame, but I do understand the concern. At any time prices could crash, in any investment market, even in the "safest" with the lowest reward. In contrast, Gen X don't really even consider that a crash could happen, while other generations know how to cope with it and manage risk. The problem doesn't appear to be the fear of investing in Bitcoin anymore (that's so 2018!), nor the risk, but investing itself (which is a scary concept for many, as a scary reality as well). But we have to remember we live in covid times now. Gen X know to take a leap of faith, while millennials appear to be stuck in the 20th century still, usually anticipating the next market crash that could last a decade, and consider Bitcoin too high risk despite being a hedge against this type of event (mainly due to the covid dump I think). Bare in mind they could also be right, despite BTC's hedge against inflation and a global market crash or great depression that the gloom and doomers predict daily, we never know what might actually happen. The decade long bull market could certainly end, just like it did for gold. Obviously I don't see this happening, I give it a 1% chance at best, but without spending years study blockchain and the economic values of cryptocurrency then it's difficult for others not to consider it a much higher possibility. Those that witnessed the dotcom bubble for example, and probably will always feel they are now too late to invest in anything after saving their money for over a decade. I honestly think "we" need to develop a new strategy for most of the millennials here, that make up a large size of the population. Gen X are all on board it seems, they grew up in the tech generation and can simply buy bitcoin at a click of a button unless their bank prevents from it. Even the older generations are speculating, knowing it's the responsible thing to do to put at least 2-5% of their wealth in (as if Elon says it's a good idea, they generally don't argue with successful investors). To me it seems like grandparents are more likely to have their grandchildren invest in Bitcoin for them, that millennials who are currently questioning "what the fuck did I do for the past 10 years just saving X per year". They don't want to retreat from their plans. Maybe this is overgeneralizing for sure, my group of friends aren't exactly the investor type, nor the savings types for that matter, but from discussion with millennials from different backgrounds and classes, the general idea of investing just seems too risky for them. Either the reward is too low for it to be worthwhile (like the stock market), or the risk is too high such as with cryptocurrency. This mentality needs to be destroyed to atttract this generation that are falling behind. I could be wrong about the stats here, but last I checked, millennials are falling behind and I worry for them! I am a little bit opposed (and annoyed) by your use of the word cryptocurrencies here, partly because it seems that such use of the term muddies the waters regarding what the fuck are we talking about, and it is NOT like I am really opposed to the conclusions that some people might make regarding a need to diversify out of bitcoin, but learn about what is bitcoin first and what differentiates bitcoin from those various other cryptocurrencies before screwing around with them, so in that regard, I am opposed (and annoyed) by ongoing perpetuation of ignorance that seems to exist when any of us employ the use of such an amorphous term when bitcoin really is the one making the longer term strong case for hedging against various dollar based legacy investments whether stocks, bonds, precious metals such as gold or silver, investment properties (including home) and perhaps some other ways that people might consider their money to be invested (such as in businesses). Ah this I understand, but in this context, it's more about my use of English I think you'll find. I really hate repeating the same words over and over regarding Bitcoin & BTC (as becomes repetitive, slang reminders appreciated), and therefore swap these terms to include cryptocurrency or digital money etc, so as to use more diverse language. It's more about my occasional lack of ability to structure sentences that require re-referencing the subject more than anything else. You can read any alternative terms I use in that context as a reference to the Daddy, and nothing else when we talking about investing. Obviously, if we discuss trading, the context would be different. I can otherwise assure you regarding your deeper concern that I suggest alternatives to Bitcoin to newcomers regarding cryptocurrency investing, rest assured this isn't the case, as would be deeply irresponsible. Apart from those desperate to diversify, then I tell them the high risks and attempt to describe the strategy for stacking sats in this way. For anyone who's interested and wants to know more generally (which are many), I only talk BTC and small percentage allocations, as well as make clear that everything else is a trade. Especially Ethereum, and therefore best avoided, unless you've got a good year or two of research, study, understanding technical analysis, risk/reward, as well as the concept of only ever trading against Bitcoin (otherwise you'll simply lose BTC value). The other reason why in face-to-face discussions I often reference cryptocurrency or cryptographic money is to reinforce the notion that Bitcoin is a currency that is cryptographic, as it helps to remind people from the onset that it is money as well as likely to more much more secure than traditional fiat, as an alternative. To elaborate, here's of an example of meeting new people with a highly socialable dog when we get talking and they ask what I am doing for a living right now, and why using these terms "can" be useful imo: Q) "What do you do for work / a living?" ==> "I trade crypto / cryptocurrency" A) "What's crypto" ==> "Oh sorry, I mean cryptographic currency" ==> "You mean like Bitcoin?" ===> "Yes similar, but not Bitcoin, I trade other shit for Bitcoin" ... B) "Oh like Bitcoin you mean?" ===> "Not quite, I trade other shit for Bitcoin. I don't trade Bitcoin for euros, that just seems dumb to me" ... It's an intentionally misleading approach I know, but it's intended to initially reinforce the key aspects of Bitcoin's technology; money and cryptography combined. The immutual blockchain aspect imo is less relevant as most don't know what immutable means. Generally around 30-40% will want to know either a bit more or a lot more and ask the usual questions, as it's still rare to meet investors who have been in the same for a numbers of years (instead of just this year). The usual questions arise; why Bitcoin, what else should I invest in, and I therefore make it clear only BTC and the best strategy is buy and hold, nothing else, apart from arguably DCA. Many often question about Ethereum, and I confirm it's a great asset to trade due to liquidity and predictability, compared to other crypto, but otherwise a trade and nothing more. It can double against Bitcoin, as well as go to zero. Until proven otherwise, which has not happened clearly. Stick with the no.1 theory, stay the f**k away from deriv exchanges etc. Recently I learnt most newcomers are coming in with 10x leverage and losing all their money, which has become the most recent reason why others are skeptical about losing all their money these days  Having attempted to clarify that, for sure many of us already recognize that there is a lack of conscious practice in terms of focusing on setting some money aside rather than spending it all and other ways of investing to attempt to leverage time now for the future perhaps when you might want to have had built up a nest egg, and really I have my doubts about your attempts to make generational categorization conclusions about problems that extend across generations - and sure there have been some changes in the way jobs are structured and also ongoing changes in the extent to which debt might have been used historically versus how it has changed and could be used in current times, and so if peeps (normies) are able to get access to credit (which is another world-wide distribution of disparities), then frequently there can be ways to use credit to leverage investments (not necessarily increasing consumption through it, which is a BIG mistake that many people make).

Another thing is that bitcoin gives no fucks about various deficiencies that normies might have in terms of identifying it as an investment opportunity that is staring them in the face, and sure if they fail/refuse to jump on board earlier then those who jump on board are going to experience way more of the largest wealth generation than they will - and even "we" or bitcoin does not need them.. bitcoin is going forward to gravitate a vast majority of value into it, whether less enlightened normies jump on board and figure it out or not.

I really am not sure about what kind of potential alternative investment strategy you might be suggesting to potentially be within our grasps to try to edumacate the ignorant masses, dragonvslinux, but the school of hard knocks which is life may well teach them that if they do not get on board at earlier times in their life, they may well NOT completely lose opportunities to prosper from bitcoin's incentivizing more responsible monetary systems, but the upside of their investment (and the compounding effect) is likely NOT as great the longer that they wait. So I am of the school of thought to use any fucking kind of investment strategy that you like, and sure I don't mind helping to attempt to get people to figure out their personal situations in order that they can attempt to better know their own personal situations so that they can figure out how much to invest and how to invest, and so many times once they get passed the hurdles of figuring out their own personal financial and psychological situation, then they are going to be further along to being able to better employ a variety of investment strategies, including DCA, lump sum investing, buying on dip and HODL strategies.

Please note that while I am typing this post, I am kind of coming to the conclusion that part of your point (besides some of your getting wrapped into analysis of generational distinctions), dragonvslinux, may well be that normies have to figure out their own personal financial and psychological circumstances before even being able to know how much that they are even capable of investing, and surely I cannot disagree with those kinds of points that suggest that peeps/normies are not going to be in any kind of position to be able to invest in hardly shit if they do not engage in some kind of decent amount of assessment of their personal circumstances, to the extent those may have been some of the points that you may have been suggesting.

As for the rest, I realise you're almost certainly right. I'm more used to meeting with other millennials, so had assumed my perception was unique to that generation, but likely it's more the difference betwen gen x and most other generations as opposed to gen x and millennials. I'll take your word for it that other generations are the same with their skepticism of investing, regardless of their age. It does seem that gen x are more debt-orientated though unless I'm mistaken, patronisingmore risk prone in general. You're completely right Bitcoin never cares about average Joe or Elon or anyone/anything else. I do get that, I think it's something you've taught me to be honest over the years, and it'll go up whether the normies invest or not. It's more about my desire to help others who want to help themselves financially. Obviously if someone has no interest in investing, then I'm not going to waste my time trying to convince them to invest in BTC. That would just be pointless, arrogant and patronising. More often than not, I advise that someone doesn't invest if they have their savings ready and waiting to be used for property investment, or don't feel comfortable with the idea, or otherwise don't understand any of it what so ever. Even if I remind them that they also likely don't understand how the motor car works, electricity or SSL certiciates, but trust these innovations regardless. This is always a theory that opens some eyes, but it's a bit different talking about risking money than switching on a light bulb or making an online transaction I know. You're completely right as well as that interested parties do not need to gain Bitcoin exposure at the moment. Most ask "is it really being adopted right now" and to this I always laugh out loud and say "hell no!". I remind them that Bitcoin is part of the innovators wave. Thus mainly only gamers, tech junkies, programmers, computer literate and the odd mathematician is invested "normie wise". Aside from institutions that begrudgingly are putting there small % in due to their financial advisors warning them it'd be irresponsible not to at this point, now it's made it to a trillion dollar asset class. But otherwise, without someone guiding them through it (which I've done enough times), most people don't stand a chance in buying Bitcoin. To people like "us" it's easy, we teach ourselves and learn to press the big green button. To others, it seems absurd sending money to the abyss. I remind them that the adoption comes from banks and money institutions, so they will still have the opportunity in the upcoming adoption wave by clicking an easy button in their bank account / paypal / otherwise that holds their value in Bitcoin rather than Euros, Dollars, Pounds, etc. Not a green button button, but likely an Orange one, without much need to do anything else but tick the T&C button. And finally yes, normies need to analyse and asses their own financial situation and physiological circumstances (or barriers) these days it seems, it's not longer about the risks of Bitcoin anymore I don't believe. That was my general thesis  Nice talking with you again and appreciate the opinions, has been a while  |

|

|

|

Kittygalore

Member

Offline Offline

Activity: 882

Merit: 63

|

|

August 12, 2021, 01:35:41 PM Merited by JayJuanGee (1) |

|

Buying the dip is mostly sweet but sometimes be also sour. One has to be taking necessary discretion and financial precautions needed ó be financially safe when making such decisions. Remember to always buy the dips just the sum you can afford to lose.

Nope, just wait for the prices to go up in the long-term and you will see that it's all sweet, hodling bitcoin isn't going to sour if you don't panic and just hodl no matter what's happening in the short-term. No need for in depth decisions when it comes to this, just don't buy what you can't afford to lose and you're good to go. |

|

|

|

|

|

elisabetheva

|

|

August 16, 2021, 09:43:37 AM |

|

Buying the dip is mostly sweet but sometimes be also sour. One has to be taking necessary discretion and financial precautions needed ó be financially safe when making such decisions. Remember to always buy the dips just the sum you can afford to lose.

Obviously we also have to think about finances, whether we can afford to be able to buy. because don't force what we can't afford, if you can use funds that are not used it's very good. so that when something goes wrong we are not directly affected. still be able to do activities that do not actually make it difficult for yourself. Nope, just wait for the prices to go up in the long-term and you will see that it's all sweet, hodling bitcoin isn't going to sour if you don't panic and just hodl no matter what's happening in the short-term. No need for in depth decisions when it comes to this, just don't buy what you can't afford to lose and you're good to go.

holding bitcoin at any time you do is the best move, but we know that the price of bitcoin is so high that it requires a lot of funds. but there is a guarantee from bitcoin because whenever you buy it can be ascertained that the price that will occur in the future will be higher than when you bought it. because the nature of bitcoin always increases continuously after the halving that occurs. there is no need to be afraid and panic when you hold bitcoin, it is certain that you will profit in time. |

|

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1823

|

|

August 16, 2021, 12:19:12 PM Merited by JayJuanGee (1) |

|

This website is a compilation of charts, graphs, and diagrams that will SHOW YOU why we should be Buying the dip, and HODL, https://wtfhappenedin1971.com/All the charts/graphs have a common subject-matter. The annual reduction of income of plebs, and the increase of our costs. If there was only an asset we can HODL as an “equalizer”. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10167

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 16, 2021, 04:04:26 PM |

|

Buying the dip is mostly sweet but sometimes be also sour. One has to be taking necessary discretion and financial precautions needed ó be financially safe when making such decisions. Remember to always buy the dips just the sum you can afford to lose.

Obviously we also have to think about finances, whether we can afford to be able to buy. because don't force what we can't afford, if you can use funds that are not used it's very good. so that when something goes wrong we are not directly affected. still be able to do activities that do not actually make it difficult for yourself. What about $10 per week is that affordable? Many people can do $10 week, and some can do way the hell more without hardly putting any dent in their budget. The more of a stake (aggressive approach) that anyone is able to do, then the more that they have decent chances for having a good payoff in the longer term (perhaps after a few more cycles), and of course, performance is not guaranteed even though historically bitcoin has been a very great place to put value and even though there is no real signs that bitcoin is losing its investment thesis... more likely the opposite is true.. bitcoin is increasing in its investment thesis with the passage of time and its more than 12.5 years of existence. Nope, just wait for the prices to go up in the long-term and you will see that it's all sweet, hodling bitcoin isn't going to sour if you don't panic and just hodl no matter what's happening in the short-term. No need for in depth decisions when it comes to this, just don't buy what you can't afford to lose and you're good to go.

holding bitcoin at any time you do is the best move, but we know that the price of bitcoin is so high that it requires a lot of funds. Huh? Your first point is correct in that holding bitcoin is a good move, and especially a good move over a longer period of time (short-term, of course, there has been all kinds of volatility - which is likely to continue), but what the fuck are you talking about in terms of your second point, elisabetheva. You can buy $10 of bitcoin if you want, so what causes you to conclude that bitcoin costs a lot.. satoshis are fractions of bitcoin.. same damned thing, just in smaller amounts.. but there is a guarantee from bitcoin because whenever you buy it can be ascertained that the price that will occur in the future will be higher than when you bought it.

There is no guarantee about the future price of bitcoin. because the nature of bitcoin always increases continuously after the halving that occurs. there is no need to be afraid and panic when you hold bitcoin, it is certain that you will profit in time.

Surely it is good to have an investment plan into bitcoin that takes more time to play out in order to have higher chances of ensuring that your BTC holdings are in a place of profitability... but people are all over the place in terms of their investment timeline, so for sure there are no guarantees in the shorter term or the longer term for that matter, but like you mentioned, it does seem that the longer the time horizon the higher the likelihood that investing into bitcoin will be profitable. Dip buying is much better buying and holding is the trader's own opinion, but traders earn more if they buy and hold at a lower price there is no fear of a long-term hold even if the market is dip, traders are not disappointed because there is a golden opportunity to buy it in the crypto market. Once prices rise it changes the lives of traders.

I think it will depend on the coins you are going to buy because some of them take some time before they finally go up. an effective method of earning profit after buying a coin in multiple declines is like double down but make sure that the coin has the potential to reverse its trend after several dips. lots of buyable tokens like ethereum are also great to buy any market price correction. Fuck shitcoins, including but not limited to that dumb-ass scam known as ethereum. We are only talking about bitcoin in this thread. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|

BobK71

|

|

August 16, 2021, 04:26:50 PM |

|

This is the truth in this platform where buy form dip and hold until your expected range. The main fact is buying at lowest price. Here we can never survive by fighting Blue whales but we have to gather our knowledge and adopt with them. I just utter this would be the best strategy.

|

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10167

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 16, 2021, 05:37:27 PM |

|

This is the truth in this platform where buy form dip and hold until your expected range. The main fact is buying at lowest price. Here we can never survive by fighting Blue whales but we have to gather our knowledge and adopt with them. I just utter this would be the best strategy.

Buying BTC at any price is likely a better strategy than adding the complication of trying to figure out if there happens to be a dip or not and whether such dip (if any) is sufficient. In other words, I doubt that buying the dip is "the best" strategy as you asserted, but it is likely a good strategy that is a wee bit lower than the strategy of buying at any time.. such as the systems of DCA buying on a consistent and regular basis no matter what the price... at least until reaching BTC accumulation goals (and perhaps beyond reaching such earlier conceptualized BTC accumulation goals.. perhaps? perhaps?). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Sanugarid

Full Member

Offline Offline

Activity: 1442

Merit: 153

★Bitvest.io★ Play Plinko or Invest!

|

|

August 16, 2021, 05:49:47 PM |

|

This is the truth in this platform where buy form dip and hold until your expected range. The main fact is buying at lowest price. Here we can never survive by fighting Blue whales but we have to gather our knowledge and adopt with them. I just utter this would be the best strategy.

It's a good strategy but unless you are on the market 24/7, I don't think that it's the optimal thing to do. Yes you can't fight whales and learning to adopt is good but it's difficult to do that because by the time that you've heard of it, it's already too late. Buying the dip is risky too because you might buy at the wrong dip and end up going down a bad rabbit hole that makes.you lose focus and in time do rash decisions due to frustrations because the dips keep going lower, patience is the key to all of this. |

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1823

|

|

August 18, 2021, 11:29:40 AM Merited by JayJuanGee (1) |

|

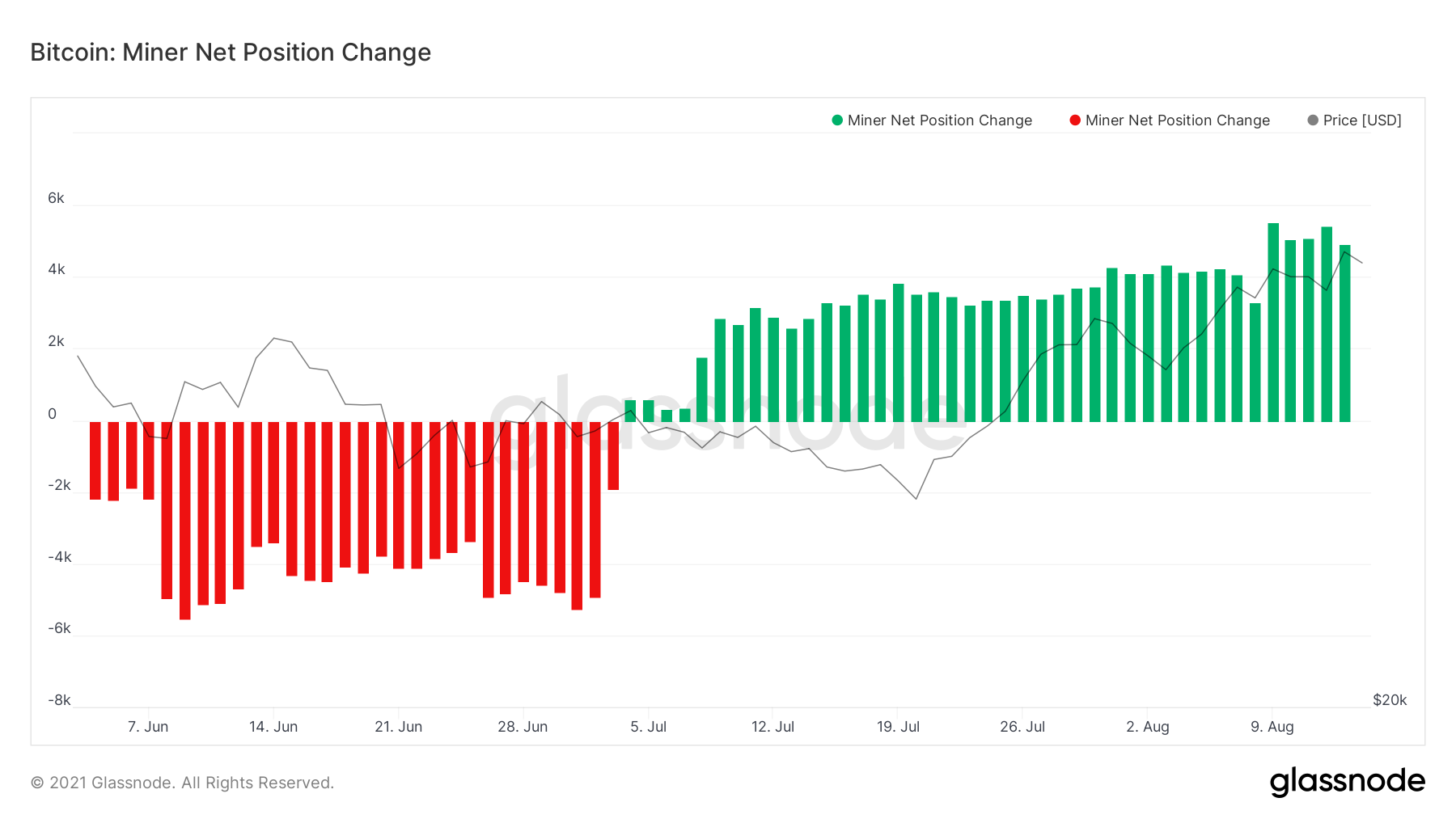

The miners have been accumulating the coins that they have been mining. This means less new coins in circulation in the open market, more scarcity, and higher probability of a market surge.  Plus miners are also speculators. Bullish.  |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1823

|

|

August 24, 2021, 07:23:42 AM |

|

I believe no one is prepared for the insanity of the resurgence of the bull market. It will be more bullish than February. We say “Bitcoin-six-digits” like we truly believe in it, but seeing it in front of us might actually be unbelievable. What is crazy is, it might not actually be “the moon”. Buy the DIP, and?

|

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10167

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 24, 2021, 03:48:16 PM |

|

I believe no one is prepared for the insanity of the resurgence of the bull market. It will be more bullish than February. We say “Bitcoin-six-digits” like we truly believe in it, but seeing it in front of us might actually be unbelievable. What is crazy is, it might not actually be “the moon”. Buy the DIP, and?

Of course, I would characterize this particular bullrun as starting from April 2019, but for sure there has been quite a few ups and downs along the way, and I would not proclaim that there was anything too special about last February, except that it was in the midst of a streak that is part of the longer bullrun... so in that sense, we had a UPpity streak in late 2020 to early 2021 for about 8 months that largely took us from a $10k-ish foundation and the $64,895 top.. so that is like a 6.5x price run that had ATH numbers every month between December 2020 and April 2021... January had a decent sized correction and February resumed the already existing short term trajectory. In other words, 6 digits would hardly be any kind of crazy rise, whether we are measuring from our $30ks correction zone (a bit more than 3x) or measuring from our current prices $48,300-ish (a bit more than 2x). Yes, people likely currently think that 6 digits looks BIG, just like they thought 4 digits looked BIG in 2015 when we were stuck in the $200s for most of the year, and just like 5 digits also was seeming big in just recent times. Now, we have spent a decent amount of time in 5 digits and not even in entry level 5 digits so we have had some pretty solid times in 5 digits already and creating aspects of Lindy effects that people just get more and more used to it.. same thing will likely be true of 6 digits.. people will get used to 6 digits and it will no longer become a BIG deal instead of a place in which bitcoin is likely to be for a while before moving up to 7 digits.. and sure it could take longer to pass through each of these higher zones because surely bitcoin cannot just keep doing 10x and 10x and 10x in the same ways as it did in the past, but since we are still likely in pretty damned early levels of adoption, support is likely to catch up to each of these levels and there are a decently large number of normies (should I more accurately refer to them as no coiners or precoiners?) who just remain of a very ignorant understanding of bitcoin.. mention bitcoin to some people who have heard of bitcoin and they just poo poo it, and surely some of those people are going to end up coming into bitcoin in the mid to upper 6 digits, or in the 7 digits or maybe some higher location.. but sooner or later bitcoin is going to become a thing that everyone ends up realizing that they are going to need some of it.. just to fit in, and just to have options in life. So anyhow, seems to me that we can be referring to 6 digits as merely a place that we have not yet been, but not a place that should be very difficult to get to - even though it is not guaranteed it is just a place that is likely to be in our near future... and too bad more normies did not prepare themselves for such likely 6-digits situation in better ways than they are.. but whatever, peeps are going to get into BTC when they are ready, even if it is likely going to cost them a wee bit more to wait rather than starting some kind of more immediate getting-involved actions.. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Wind_FURY (OP)

Legendary

Offline Offline

Activity: 2898

Merit: 1823

|

|

August 25, 2021, 11:08:59 AM |

|

I believe no one is prepared for the insanity of the resurgence of the bull market. It will be more bullish than February. We say “Bitcoin-six-digits” like we truly believe in it, but seeing it in front of us might actually be unbelievable. What is crazy is, it might not actually be “the moon”. Buy the DIP, and?

In other words, 6 digits would hardly be any kind of crazy rise, whether we are measuring from our $30ks correction zone (a bit more than 3x) or measuring from our current prices $48,300-ish (a bit more than 2x). But what I said was, “What is crazy is, Bitcoin at “6 digits” is might not actually be the moon”.

Yes, people likely currently think that 6 digits looks BIG, just like they thought 4 digits looked BIG in 2015 when we were stuck in the $200s for most of the year, and just like 5 digits also was seeming big in just recent times.

But think of it as how high Bitcoin has reached in current market value. An experimental protocol that started its development in someone’s “basement”. It’s INSANE that the “PONZI SCHEME” lasted this long, and will last for the next generation. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

|

osasshem

|

|

August 25, 2021, 12:15:39 PM |

|

The best thing to do during the deep season which are currently experiencing, buy the deep and hold for the next run. It's funny to say, when the hard time calls and you have to sell your little assets in other to move on with life, and seat back watching the bull run preparing to take off.  One thing I know is the time is never too late, no matter the little fraction that can be purchased at the moment. Holders hold, it's the best option, cause the next bull run is planning for a take off. |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10167

Self-Custody is a right. Say no to"Non-custodial"

|

|

August 25, 2021, 01:24:40 PM |

|

I believe no one is prepared for the insanity of the resurgence of the bull market. It will be more bullish than February. We say “Bitcoin-six-digits” like we truly believe in it, but seeing it in front of us might actually be unbelievable. What is crazy is, it might not actually be “the moon”. Buy the DIP, and?

In other words, 6 digits would hardly be any kind of crazy rise, whether we are measuring from our $30ks correction zone (a bit more than 3x) or measuring from our current prices $48,300-ish (a bit more than 2x). But what I said was, “What is crazy is, Bitcoin at “6 digits” is might not actually be the moon”.  Yes, people likely currently think that 6 digits looks BIG, just like they thought 4 digits looked BIG in 2015 when we were stuck in the $200s for most of the year, and just like 5 digits also was seeming big in just recent times.

But think of it as how high Bitcoin has reached in current market value. An experimental protocol that started its development in someone’s “basement”. It’s INSANE that the “PONZI SCHEME” lasted this long, and will last for the next generation. Of course, many of us longer term BTC HODLers are recognizing and appreciating that likely the BTC investment thesis is stronger in current times than it had been a few years back, so even if the UPside BTC price performance potential has been reduced by already happened bitcoin price movements, there remains some additional assurances regarding the downside potential (safety) too. And, buy the dip also might be questions about how much of a dip is sufficient this time around, and so far we have had a dip of about 7% from $50,562 to $47,100 - is the dip over? did anyone buy this particular dip? The best thing to do during the deep season which are currently experiencing, buy the deep and hold for the next run. It's funny to say, when the hard time calls and you have to sell your little assets in other to move on with life, and seat back watching the bull run preparing to take off.  One thing I know is the time is never too late, no matter the little fraction that can be purchased at the moment. Holders hold, it's the best option, cause the next bull run is planning for a take off. Well if we go by your forum registration date osasshem, we can see that you may well have been involved in bitcoin for a whole 4-year cycle (maybe even close to 5 years).. so you have had the ability to experience both significant UP and DOWN periods in BTC's price.. and for anyone it can take a while to stock up to a sufficient position in BTC to feel sufficiently prepared for either UP or DOWN BTC price movements. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|