|

WatChe

|

|

June 19, 2023, 12:11:00 PM |

|

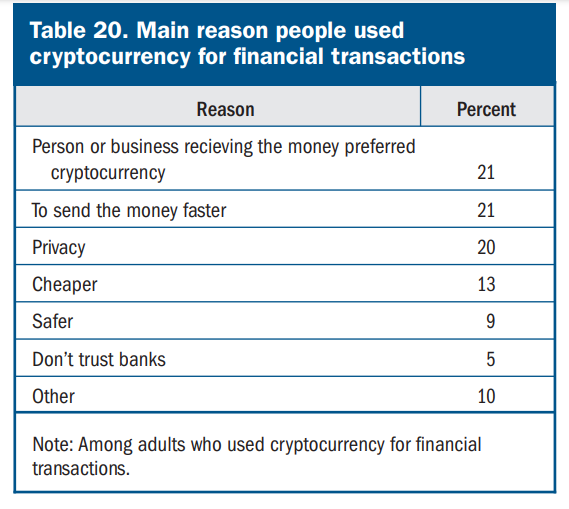

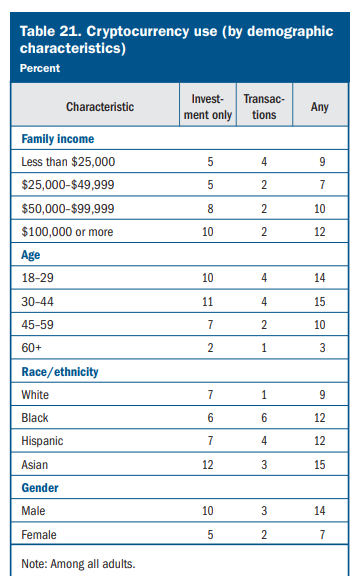

The report also tells three main reason why people using crypto currency for sending money. 1) Receiver prefer to receive money in crypto. 2) To send money quickly. 3) Privacy concerns. Cheap transfer rate is forth reason to use crypto, which is very much surprising to me.  Adults having income over 100,000$ are more likely to hold cryptocurrency as investment while adults with income less then 25000$ are more likely to use cryptocurrency for financial transactions. Asian are winners among all HODLers in term of Race/Ethnicty  )  Source Source |

|

|

|

|

|

|

|

TalkImg was created especially for hosting images on bitcointalk.org: try it next time you want to post an image

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

ivomm

Legendary

Offline Offline

Activity: 1852

Merit: 2838

All good things to those who wait

|

|

June 19, 2023, 12:44:59 PM |

|

Blackrock’s (BLK) iShares Bitcoin Trust application to the U.S. Securities and Exchange Commission (SEC) this week might stand a better chance than previous attempts by other fund managers thanks to the promise of a “surveillance-sharing agreement” between exchanges. On page 36 of the Nasdaq (where the proposed ETF will be listed) 19b-4 filing, it's stated that to mitigate against market manipulation, Nasdaq will be brought in to enter into a surveillance-sharing agreement with an operator of a spot trading platform for Bitcoin (BTC). https://www.coindesk.com/business/2023/06/16/blackrock-may-have-found-way-to-get-sec-approval-for-spot-bitcoin-etf/------- “If the Blackrock ETF does get approved, the real winner here is going to be $GBTC,” Adam Cochran, a partner at venture capital firm Cinneamhain Ventures, wrote in part of Twitter commentary at the weekend. “Because Blackrock will show the path to conversion, and GBTC’s 40%+ discount will resolve on top of industry growth.” Cochran said that he thought BlackRock’s offering has “good odds” of getting U.S. regulatory approval. “Very different structure than other efforts by a behemoth who doesn’t lose. ‘30 act redeemable trust w/ redemptions (unlike GBTC) + proposed rule change filing. They came to play,” he added. https://cointelegraph.com/news/grayscale-bitcoin-trust-2023-high-blackrock-etf-filing-buyers---- P.S. It is intriguing also what will be the outcome of Greyscale vs SEC case. There are some unconfirmed rumours that Fidelity is also preparing a spot ETF acquiring Greyscale trust. All this looks pretty promising for better times. Who knows, perhaps this is the last chance to buy Bitcoin at these low prices?!? |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 19, 2023, 01:04:52 PM |

|

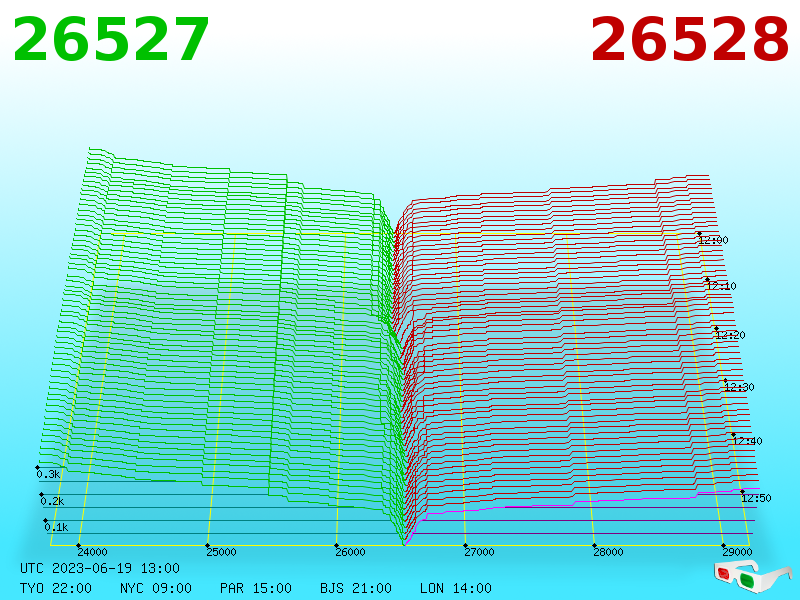

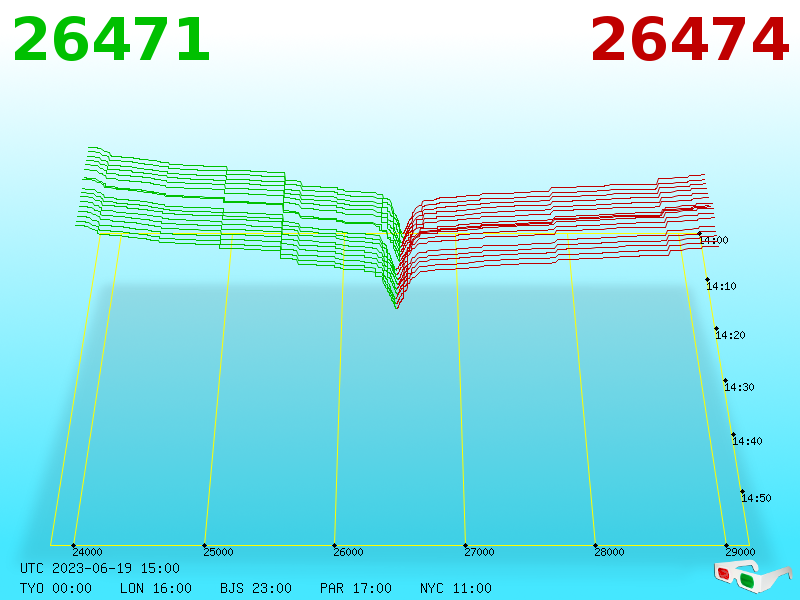

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 19, 2023, 02:01:19 PM |

|

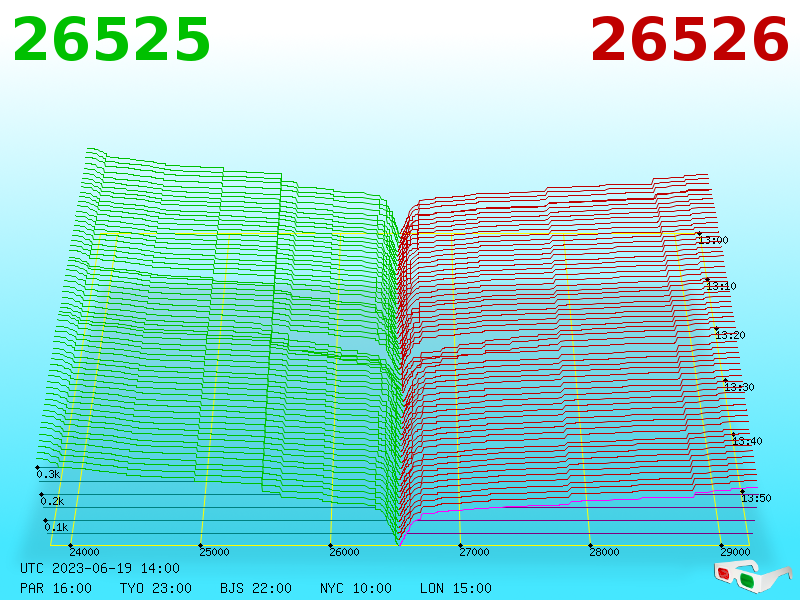

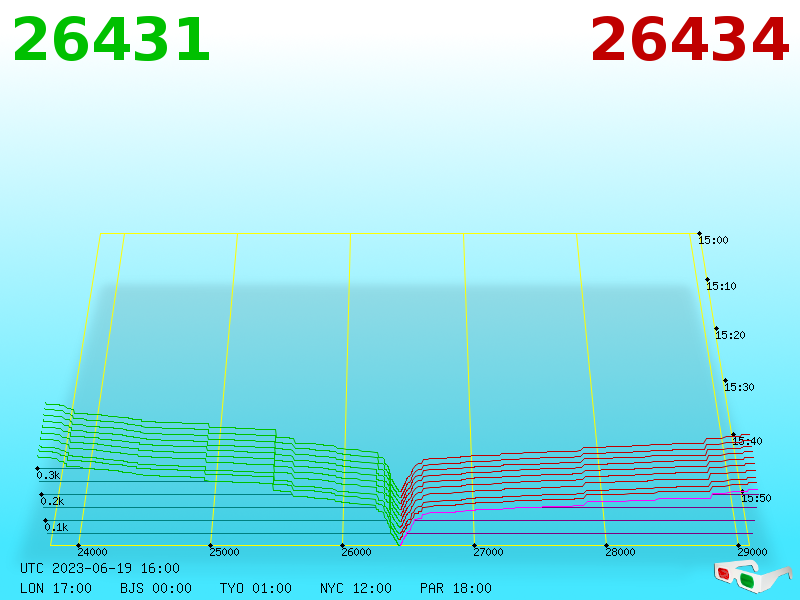

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7765

'The right to privacy matters'

|

Blackrock’s (BLK) iShares Bitcoin Trust application to the U.S. Securities and Exchange Commission (SEC) this week might stand a better chance than previous attempts by other fund managers thanks to the promise of a “surveillance-sharing agreement” between exchanges. On page 36 of the Nasdaq (where the proposed ETF will be listed) 19b-4 filing, it's stated that to mitigate against market manipulation, Nasdaq will be brought in to enter into a surveillance-sharing agreement with an operator of a spot trading platform for Bitcoin (BTC). https://www.coindesk.com/business/2023/06/16/blackrock-may-have-found-way-to-get-sec-approval-for-spot-bitcoin-etf/------- “If the Blackrock ETF does get approved, the real winner here is going to be $GBTC,” Adam Cochran, a partner at venture capital firm Cinneamhain Ventures, wrote in part of Twitter commentary at the weekend. “Because Blackrock will show the path to conversion, and GBTC’s 40%+ discount will resolve on top of industry growth.” Cochran said that he thought BlackRock’s offering has “good odds” of getting U.S. regulatory approval. “Very different structure than other efforts by a behemoth who doesn’t lose. ‘30 act redeemable trust w/ redemptions (unlike GBTC) + proposed rule change filing. They came to play,” he added. https://cointelegraph.com/news/grayscale-bitcoin-trust-2023-high-blackrock-etf-filing-buyers---- P.S. It is intriguing also what will be the outcome of Greyscale vs SEC case. There are some unconfirmed rumours that Fidelity is also preparing a spot ETF acquiring Greyscale trust. All this looks pretty promising for better times. Who knows, perhaps this is the last chance to buy Bitcoin at these low prices?!? This news matches the constant difficulty increase for all of 2023. The largest difference in this price drop slump after 2021 compared to 2017 is we never had a difficulty fall off like the oct 2018 to june 2019 time span. A lot of big companies are pouring cash into mining. We are doing 2-4% diff jumps all of 2023. Jan 2023 diff = 34t June 2023 diff = 51t a full 50% jump in diff a lot of cash turned into gear. Me mine has jumped a bit over 100% in this time frame. |

|

|

|

|

|

Learn Bitcoin

|

|

June 19, 2023, 02:18:30 PM |

|

We found only three bitcoin halvings in this bitcoin biography.

2012 Bitcoin Halving Price= $13

2016 Bitcoin Halving price= $680

2020 Bitcoin Halving price= $9146

But with this bitcoin halving in 2024 and how high the bitcoin market can go.

But now waiting 300 days for bitcoin halving...

2024 Bitcoin Halving price= ?

Nobody knows! I don't think too many peoples understood how halving works, or better to say, most generic bitcoin users didn't know there is something named halving. But things changed. More people use the internet, and they learn more about technology. I believe most real Bitcoiners know how halving pumped the bitcoin in the old days. Every other company and Bitcoiner waiting for the next halving. But, If everyone wait for it and then everyone try to take benefit of halving and start selling. We might have seen some roller coaster ride again. The possibility is unlimited. That's just assumption. Nobody knows what is going to happen. |

|

|

|

|

Paashaas

Legendary

Offline Offline

Activity: 3424

Merit: 4344

|

What Blackrock wants Blackrock gets.

They applied 575 ETF's.

574 approved and 1 rejected.

The big institutionals are coming.

Pension/hedge funds, asset managers, money-market funds, insurers, companies, banks, councils, state governments and nation states.

The stars are aligned for $1 million per coin and above.

|

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7765

'The right to privacy matters'

|

It needs to be close to 53k or a shit ton of mines will fail.

Most mining gear is in large farms.

A 1 megawatt farm is not that large I am about 200kwatts of power I am a small commercial farm.

Plenty of farms are 5 megawatts and up.

So I see a strong move to near 50k or a disaster for large mines.

I estimate that a large farm now needs a 40k price for next fall to breakeven.

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 19, 2023, 03:03:18 PM |

|

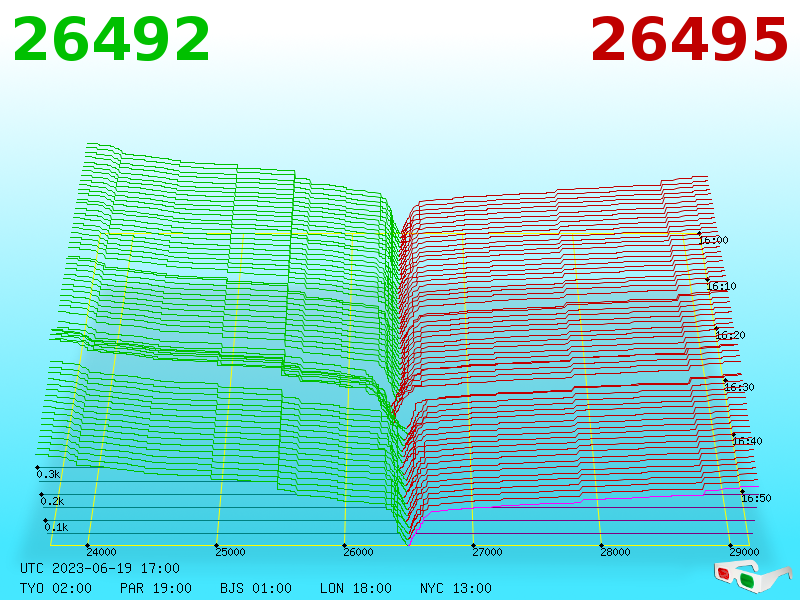

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

June 19, 2023, 03:52:30 PM Merited by JayJuanGee (1) |

|

It needs to be close to 53k or a shit ton of mines will fail.

Most mining gear is in large farms.

A 1 megawatt farm is not that large I am about 200kwatts of power I am a small commercial farm.

Plenty of farms are 5 megawatts and up.

So I see a strong move to near 50k or a disaster for large mines.

I estimate that a large farm now needs a 40k price for next fall to breakeven.

Fall of 2023, I assume. The large difficulty move is perplexing, for sure, although price made a move similar to difficulty in % YTD (50-60%). I saw the price of btc at about 35-40K at the halving, but now, with Blackrock submission, it could be higher as ETF, if approved by the EOY, would front run it. Maybe 50K or even higher, however, if miners would also add into this, they would have troubles around actual halving because the 'flow' would be cut in half. Is it possible that a newer silicon would be ready by then? S20 or something like this with 12-15 J/T. |

|

|

|

|

|

Who is John Galt?

|

|

June 19, 2023, 03:53:04 PM Merited by JayJuanGee (1) |

|

P.S. It is intriguing also what will be the outcome of Greyscale vs SEC case. There are some unconfirmed rumours that Fidelity is also preparing a spot ETF acquiring Greyscale trust. All this looks pretty promising for better times. Who knows, perhaps this is the last chance to buy Bitcoin at these low prices?!?

Smaller players like Bitwise also lined up at the back of the queue behind Blackrock to be among the first to offer the new service. If Blackrock gets the go-ahead, then there will be a lot more willing companies like Bitwise. Attracting investors through the image of large players and the wide offer of small players can really seriously affect the price of bitcoin. And then bitcoin is unlikely to ever return to today's rates. |

|

|

|

|

|

Who is John Galt?

|

|

June 19, 2023, 04:01:52 PM |

|

It needs to be close to 53k or a shit ton of mines will fail.

Most mining gear is in large farms.

A 1 megawatt farm is not that large I am about 200kwatts of power I am a small commercial farm.

Plenty of farms are 5 megawatts and up.

So I see a strong move to near 50k or a disaster for large mines.

I estimate that a large farm now needs a 40k price for next fall to breakeven.

The largest players are now actively investing in the construction of their own power plants around the world. Take at least Tether, which over the past month has already announced the construction of renewable energy power plants for mining in Uruguay and El Salvador. Many are gearing up to cut costs by the time the halving happens. |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

June 19, 2023, 04:02:24 PM |

|

Blackrock’s (BLK) iShares Bitcoin Trust application to the U.S. Securities and Exchange Commission (SEC) this week might stand a better chance than previous attempts by other fund managers thanks to the promise of a “surveillance-sharing agreement” between exchanges. On page 36 of the Nasdaq (where the proposed ETF will be listed) 19b-4 filing, it's stated that to mitigate against market manipulation, Nasdaq will be brought in to enter into a surveillance-sharing agreement with an operator of a spot trading platform for Bitcoin (BTC). https://www.coindesk.com/business/2023/06/16/blackrock-may-have-found-way-to-get-sec-approval-for-spot-bitcoin-etf/------- “If the Blackrock ETF does get approved, the real winner here is going to be $GBTC,” Adam Cochran, a partner at venture capital firm Cinneamhain Ventures, wrote in part of Twitter commentary at the weekend. “Because Blackrock will show the path to conversion, and GBTC’s 40%+ discount will resolve on top of industry growth.” Cochran said that he thought BlackRock’s offering has “good odds” of getting U.S. regulatory approval. “Very different structure than other efforts by a behemoth who doesn’t lose. ‘30 act redeemable trust w/ redemptions (unlike GBTC) + proposed rule change filing. They came to play,” he added. https://cointelegraph.com/news/grayscale-bitcoin-trust-2023-high-blackrock-etf-filing-buyers---- P.S. It is intriguing also what will be the outcome of Greyscale vs SEC case. There are some unconfirmed rumours that Fidelity is also preparing a spot ETF acquiring Greyscale trust. All this looks pretty promising for better times. Who knows, perhaps this is the last chance to buy Bitcoin at these low prices?!? I am all ears, having quite a bit of GBTC in a couple of my IRAs. Somehow, I feel that the last action of Barry in that regard would be to continue screwing us, as he did in the last 2-2.5 years or so. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 19, 2023, 04:03:17 PM |

|

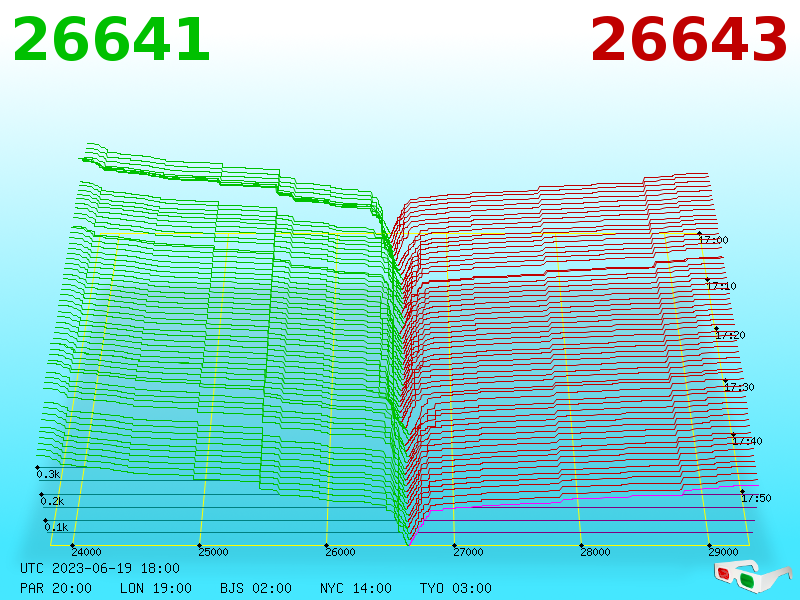

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Madu$11

Jr. Member

Offline Offline

Activity: 234

Merit: 4

Pepemo.vip

|

|

June 19, 2023, 04:44:09 PM |

|

Better to have something than nothing. Future planning is always a good thing to get a better life. Life is meaningless without ambition. Enjoy life as much as you can and plan to support yourself in times of emergency to maintain it.

We still don't need to keep our eye on one basket, we still need to do other businesses to support Bitcoin efforts and trading.

|

|

|

|

|

STT

Legendary

Offline Offline

Activity: 3892

Merit: 1413

Leading Crypto Sports Betting & Casino Platform

|

|

June 19, 2023, 05:03:16 PM Merited by JayJuanGee (1) |

|

Some big trader talking about the 'fiscal gap' the thing that will likely drive down Dollar into oblivion possibly: https://youtu.be/53wThFFuOqU?t=464 We can hope for otherwise but a turn around seems unlikely and no indication of any attempt to properly pay off debt or balance fiscal budget is there by any part of politics. A glacier can move is how I view it, its so slow we cant see it but it matters and its not really possible to stop thats the weight of changes most probable imo. BTC has a surprisingly long term underlying movement to it a bit like this, I think they relate. This trader doesnt and he doesnt think 40% inflation is possible, I'd like to inform him its not only possible its most probable but thats my opinion hopefully wrong. BTC has a negative price channel short term and more importantly longer term is challenging now attempting to recover above the 200 week average. If we dont slip below Feb lows, its still positive trend overall. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 19, 2023, 05:03:26 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

nlovric

|

|

June 19, 2023, 05:08:58 PM |

|

IMF Initiates Development of a Global Digital Currency PlatformThe International Monetary Fund (IMF) is developing a CBDC platform to simplify cross border transactions. IMF Managing Director Kristalina Georgieva emphasized the need for global interoperability and a unified regulatory framework for CBDC. She revealed that 114 central banks are reviewing CBDCs 10 of which are close to completion and emphasized the importance of asset backed CBDCs. The IMF efforts are aimed at preventing gaps that could be filled by cryptocurrencies.

|

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

June 19, 2023, 05:15:16 PM |

|

Some big trader talking about the 'fiscal gap' the thing that will likely drive down Dollar into oblivion possibly: https://youtu.be/53wThFFuOqU?t=464 We can hope for otherwise but a turn around seems unlikely and no indication of any attempt to properly pay off debt or balance fiscal budget is there by any part of politics. A glacier can move is how I view it, its so slow we cant see it but it matters and its not really possible to stop thats the weight of changes most probable imo. BTC has a surprisingly long term underlying movement to it a bit like this, I think they relate. This trader doesnt and he doesnt think 40% inflation is possible, I'd like to inform him its not only possible its most probable but thats my opinion hopefully wrong. BTC has a negative price channel short term and more importantly longer term is challenging now attempting to recover above the 200 week average. If we dont slip below Feb lows, its still positive trend overall. I saw that interview. I think that he is an "entitlement opponent", so to speak. He basically thinks that with the growth of interest rates and entitlement outlays, we would have to either increase taxes 40% or decrease spending 36% in a few decades. However, when boomers hear this 'talk', they have blood coming out of their eyes... and they vote. Why? Because they PAID into Social security and Medicare out of their pockets (and doubly so if you are/were a business owner/LLC guy). Even without a consideration that gov had our money for decades with nothing to show for it as they just spent it at whim, it would take quite a few years to exhaust whatever I literally put in there, so Stan can shove it. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

June 19, 2023, 06:01:23 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

Poll

Poll