Personally, I agree with him but some might think Tesla's got this one bagged. What do you guys think??

Don't be so quick to claim victory, there are cheaper Chinese-made electric vehicles with good value for money, the BYD brand stands out quite a lot in this respect. I don't know if Tesla will end up succeeding as a matter of branding, having acquired the fame earlier, something like Apple, but at least it will have competition. Those looking for the best value for money without looking so much at the brand name will probably opt for BYD or other brands that might be able to make a name for themselves. I agree with Buffet that the market is not mature enough to draw firm conclusions. For a better understanding of this topic, it is important to know two things: 1. Currently, BYD is the world leader in the electric car market in terms of the number of cars produced, with a 1.5-fold advantage over Tesla. 2. Warren Buffett's investment fund Berkshire Hathaway is one of BYD's largest shareholders. |

|

|

|

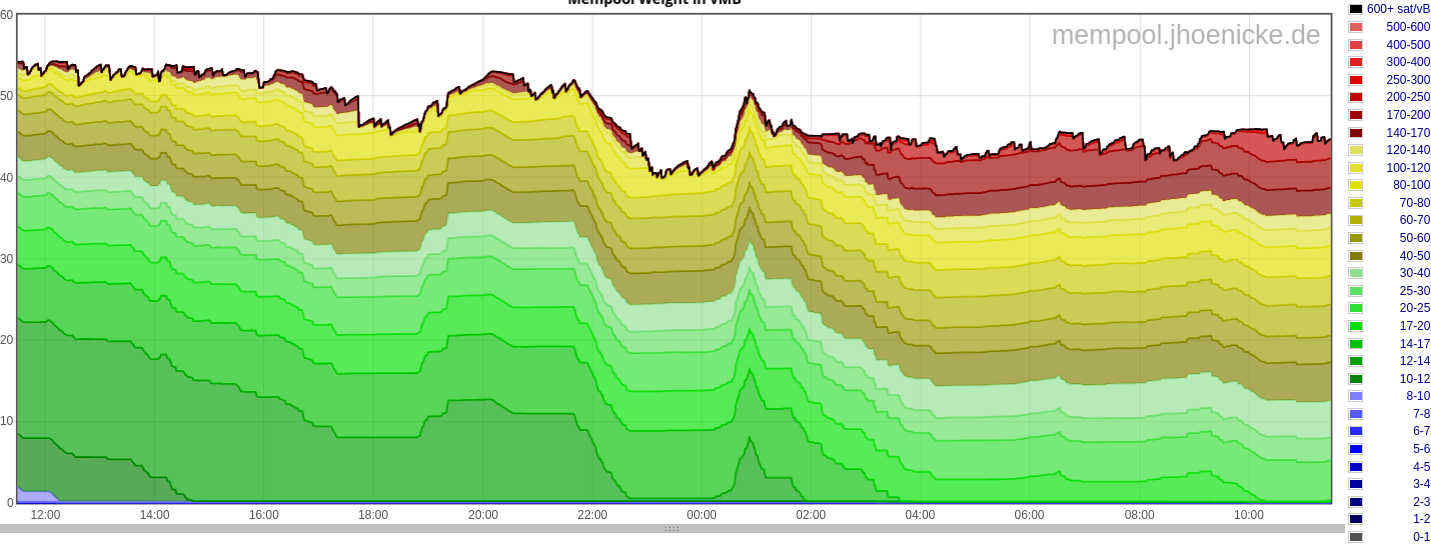

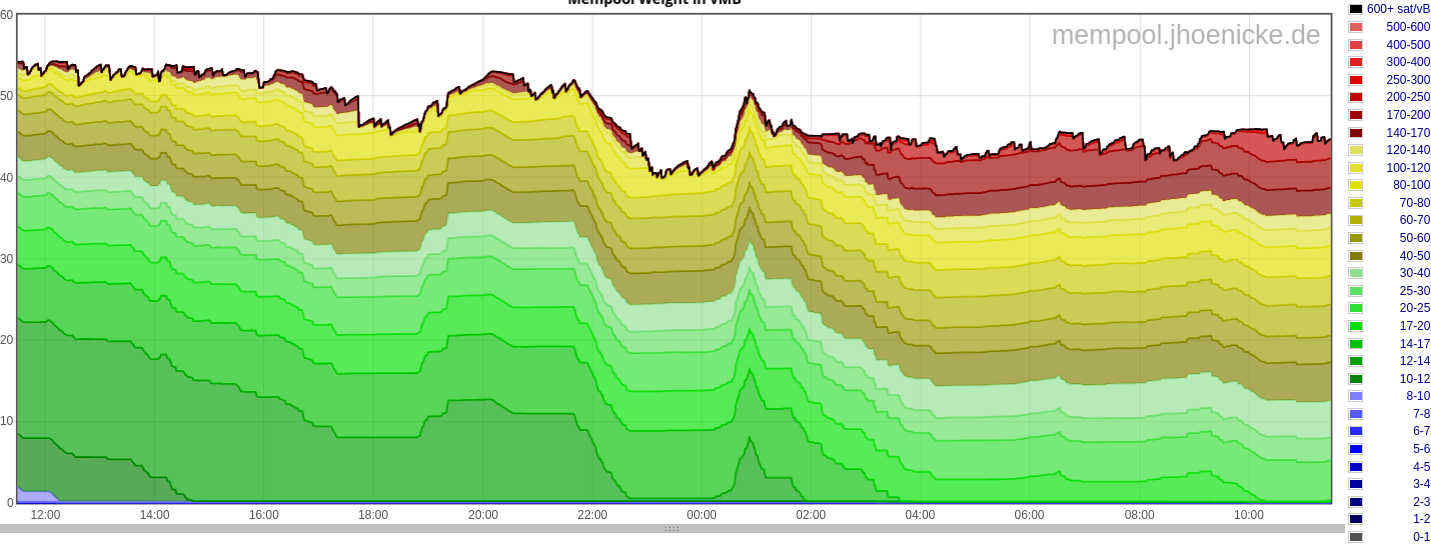

As for the current topic, have read a bit more into the whole "ordeal". I still see nothing wrong and only high demand. I get that it can be frustrating for average users wanting to make transactions to either have to wait or pay high gas fees, but if you're going to use Bitcoin, you should be aware that this can be the case. As I said before, otherwise use Lightning network. Ideally this will help drive further adoption.

Also on a selfish note the last month or so has been pretty boring for Bitcoin imo. This actually makes it more interesting in my opinion. Miners must be having a blast with transaction fees per block that have higher than the 6.25 block reward. I did used to think that it was possible that block rewards going so low could reduce hash rate growth over-time, so looks like this situation has removed that theory.

Although the current frenzy around funny green frog pictures seems a little artificially stimulated, this is another great stress test to test the Bitcoin network for anti-fragility and a clear demonstration in real time that the network can remain stable even in the distant future, when the reward for the block will tend to zero and the commission will be the only incentive for miners to continue working without relying only on sheer enthusiasm. |

|

|

|

Judging by the history of messages, this is a girl from Nigeria who really wants to become a full member, but I could not find a single meaningful message that somehow correlates with bitcoin to give her a couple of merits. Maybe I didn't try hard enough and her determination should be rewarded.

I don't think this is a good idea. If you give her one merit, she will mistake you for a benefactor and periodically ask you to check her posts. This happened to me, and the more you feel sorry for her, the more often she will write to you. She has a good community, and I think that soon her dream of wearing an avatar will come true.Glad she didn't have to wait too long. I hope that the quality of her messages will grow, with the support of financial incentives, and soon she will become the most progressive and richest bride in her geographical location. |

|

|

|

This means the world's most famous cryptocurrency is now being utilized more than ever * But not for actual bitcoin transactions... True fact is Bitcoin is being attacked by a spam exploit and you don't care this is killing REAL bitcoin transactions. For others reading: Bitcoin = Network/Project, and bitcoin = the electronic cash. These spam advocates don't care that the spam is preventing Bitcoin to function for bitcoin and instead turn it into some sort of general spam database that would be useless for electronic cash. And this is not innocent. Pay very well attention to the people who defend the spam clogging Bitcoin for they have an agenda, and its not in favor of bitcoin.  You have a very limited view of the current situation. Why don't you, for example, be happy for the miners who earn a nice premium on top of their usual reward for their efforts to keep the bitcoin network running? Or do you think miners are not an important enough part of the bitcoin community? What makes you think that you have the exclusive right to determine exactly how the public blockchain should be used? Don't you see in the picture clear signs of success for the wider adoption of bitcoin, albeit not in the way you planned to see it? |

|

|

|

All the developers need to do is strictly validate Taproot witness sizes, and this loophole will be closed, everything will go back to normal.

A few years ago, while they were designing this specification for Taproot, they said that they did not want to prevent other use cases with Taproot. But in hindsight, it was clearly a mistake not to impose strict validation.

I have sent a message to the bitcoin-dev mailing list with this proposal and I hope to start a huge conversation about it over there.

How do you imagine it in terms of implementation? It should be some kind of open letter from the developers in the style of "dear miners, these records for the number of transactions are not at all the adoption that we all dreamed of, please vote for our changes so that you can earn less, and we can send transactions again with low commission"? |

|

|

|

The weak point of your privacy strategy is that the full cycle of interaction "money-goods" or "money-services" is only partially performed in a decentralized peer-to-peer network, and the other part is performed in real life or on the Internet, where, generally speaking, it is much more difficult to protect yourself from deanonymization Correct. But I don't want to go full privacy. Again, I don't want from the merchant I exchange stuff everyday to know I have an account here on bitcointalk, which makes me an extra income. I am fully aware that I can be de-anonymized in real life, but my goal is to retain part of my personal life private; specifically, this business in this forum. These are different things. In the case of Monero, not only the content of your payment is hidden from prying eyes, but the very fact of the payment is also hidden. Without a key to read a particular transaction, you won't even be able to know that it actually happened. This only strengthens my argument, which is that I want financial privacy on the Internet. What you just described is the reason most privacy experts advocate for Monero. It serves better privacy. According to your reasoning, we should neither use Monero because it makes us look suspicious. Why would I want to use a currency which completely hides my financial activity? Isn't that correct?  Yep. We're really talking here about a public ledger that you're trying to misuse by mixing - and in doing so, claim that "it's okay, it's definitely not for dirty illegal business like money laundering." So, utilizing privacy-respecting tools for bitcoin with limited privacy gained is "bad", "for criminals only", but using monero which is the most completed black-box cryptocurrency to this date is "good", "for every person who wants some privacy". Okay.  BTW, I hope you know that it's entirely possible to receive coins which were used for illicit activity prior X transactions; and that X is arbitrarily marked as "good" and "bad" from mass surveillance corps which analyze the chain and create this "taint" perception. You are wrong to attribute to my messages a moral coloring in the style of "good" and "bad", I condemn only the misuse of tools. My extensive experience and diverse background in the field of information and physical security allows me to argue that partial and unsystematic efforts to preserve confidentiality are a waste of resources, and it would often be better if they did not exist at all, because the harm is greater than the benefit. It's like building a house with three walls and leaving a huge gaping hole instead of a fourth. You will be protected from idle prying eyes from three sides, but do not be fooled by the illusion that you are safe in such a house. |

|

|

|

Therefore, I ask: Libertarians -- where are they now? Crypto-anarchists -- where are they now? Where are you now?

Well, well, what do we have here - a roll call of the surviving cypherpunks? I don't like these flat and stereotyped labels, but the true spirit of anarchy is close to me and I'm here. |

|

|

|

А какие тебе нужны например доказательства? Массовость падежа сойдёт за веское доказательство, что это не лудомания и долбоебизм отдельно взятого человеческого фактора, а глубокий системный фатал еррор?

Массовость падежа как доказательство консервативного управления? Странно как-то. Из этого консерватизм не вытекает, как по мне. Скорее доказывает, что проблемные банки управлялись из рок вон плохо, брали на баланс рискованные активы и не выдерживают вследствие этого конкуренцию с другими, адекватно управляющимися банками. Хотя - да, условия были жёсткие. И конкуренция в Америке между банками высокая и эпоха низких ставок прошлась по ним тяжело. Ведь в эпоху низких ставок депозиты непопулярны, а на кредитах с околонулевыми процентами не заработаешь, вот и вынуждены банки де факто стать трейдерами-инвесторами. А трейдерами-инвесторами мало у кого получается быть. Если вкратце, в период низких ставок банки привлекали бабло до 1% и выдавали бабло под 3-4% - и на эти два процента вполне себе безбедно жили. А когда ставка поднялась до пяти процентов - образовался досадно-неприятный кассовый разрыв в те же два процента, но в минус. Просто потому что оленей, желающих влезть в ипотечную кабалу под 7% внезапно оказалось не так уж много. Не усложняй, я где-то читал расследование по поводу Силикон Валлей Банка, чёт не могу найти ссылку. Короче они финансово обслуживали успешные стартапы, которым венчурные фонды с периодом два пи выписывали жирные чеки в каждый новый очередной раунд финансирования. Венчурные фонды рисковали, стартапы тоже рисковали, а обслуживающему их банку то нахуя рисковать? Они как раз и придерживались супер-консервативной стратегии, чтобы не проебать чужую жирную кубышку, покупали трежерис и в ус не дули. А когда стартапы прибежали за баблом банку пришлось эти трежерис продавать до срока истечения, соответственно себе в убыток - потому что раньше они их покупали с доходностью один процент, а свежие трежерис продаются с доходностью 3-4%, соответственно старые трежерис без дисконта нахуй никому не нужны. Вся эта банковская система оказалась типичным классическим гигантом на глиняных ногах. Два процента туда, два процента сюда - и вот ты уже не успешный банкир с портфелем из кожи крокодила, а выход в окно вон там. Вот и вся история. |

|

|

|

Also, it there is some photo evidence that the Orcs are using banned weapons in Bakhmut such as Phosporous / Termite munitions. A dangerous path to follow.

Phosphorus weapons are not used in Bakhmut, you confused them with 9M22S or 9M28S magnesium shells launched from Grads. Magnesium shells have a number of advantages over obsolete and long-decommissioned phosphorus shells - they have a much higher combustion temperature, they are easier to store without the risk of self-ignition, they cannot be extinguished by cutting off the supply of oxygen, and they are not prohibited by the Geneva Convention. It is important certainly. These missiles were kind of the answer from China and the RF to the Carrier Groups of the USA, currently 11 in active if I remember correctly. If a Patriot can intercept, let's say with a 60% chance a modern Khinzal, Sea based systems, usually x 10 times better, can do it too. It is a game changer to have a carrier group at 200 miles from your coast and not being able to do much about it (other than nuking it I guess).

Shit, it seems now the Russians will have to spend two whole Khinzals on one aircraft carrier.  |

|

|

|

You mean like censor transactions? That sounds like a centralised solution to me.

i think it's fair to expect only financial banking transactions to be on the bitcoin blockchain. censorship or not. if you don't have censorship to some degree then guess what you have? anarchy. If you only want to see financial banking transactions on the blockchain, why not use your favorite bank? There is censorship, a stable commission size and no anarchy - everything you like. |

|

|

|

If necessary, you will be deanonymized not by the peer-to-peer payment passed through the mixer, but by the context of the payment. I don't want to reveal the origins of my coins, some of which come from this very forum, and this is enough to have them sent to a mixer. I don't understand for what context are you talking about.I think you don't usually make a payment for the sole purpose of "make a payment". For this payment, you want to receive something in return - a specific product or service. The weak point of your privacy strategy is that the full cycle of interaction "money-goods" or "money-services" is only partially performed in a decentralized peer-to-peer network, and the other part is performed in real life or on the Internet, where, generally speaking, it is much more difficult to protect yourself from deanonymization, especially if you voluntarily and knowingly display a "red flag" when making a payment using a mixer. The context can be almost anything - an unclosed adjacent browser tab, a smartphone’s geolocation not turned off, a voluntarily filled in postal address for a delivery service, a gait identification system through an outdoor surveillance camera at a pharmacy in a neighboring house, and you never know what else. If you want to make an anonymous payment, it's much more reasonable to use a monero-type blockchain that was initially closed than to try to obfuscate the trail in a public ledger like bitcoin No, it's exactly the same thing. Using Monero means you want on-chain privacy. It not reasonable to distinguish it, as it's essentially a protocol with continuous and mandatory mixing, similar to making coinjoins. These are different things. In the case of Monero, not only the content of your payment is hidden from prying eyes, but the very fact of the payment is also hidden. Without a key to read a particular transaction, you won't even be able to know that it actually happened. Do I need to remind you we're talking about public ledger here?

Yep. We're really talking here about a public ledger that you're trying to misuse by mixing - and in doing so, claim that "it's okay, it's definitely not for dirty illegal business like money laundering." |

|

|

|

The risks of losing the fungibility of coins in the open blockchain in the future may differ from different points of view, depending on future development scenarios and on individual risk tolerance. There are no associated risks as long as you use bitcoin peer-to-peer. Such risks only arise if third parties, which are prone to regulation, are the backbone of the ecosystem. I don't recognize any third party which, if shut down or regulated, would take the entire currency with it. You do not live in a vacuum, but in real life. If necessary, you will be deanonymized not by the peer-to-peer payment passed through the mixer, but by the context of the payment. And using a mixer, you only attract additional attention to yourself, advertising that you are hiding something. You can deceive yourself as much as you like, but anonymity and privacy are a myth in the modern world. Why would I want to advertise the fact of mixing my coins? I don't argue you advertise such thing; I'm just saying that if someone tries to trace you on-chain, it's good for you to have them known you've used a mixer. That clarifies you are not the owner of all mixer's outputs, and that the history prior mixing is not important. If you want to make an anonymous payment, it's much more reasonable to use a monero-type blockchain that was initially closed than to try to obfuscate the trail in a public ledger like bitcoin. Mixing in a mixer gives the illusion of privacy, which, like any self-deception, is sometimes much more dangerous than its complete absence. |

|

|

|

There's no clog, only a lot of people trying to outbid each other for the first block transaction. Every time this happens there's a spike in fees, but there are many ways to go around it, or simply ignore it. One of them is to use LN, the other is to opt out of the race and pay much less fee than required to be in the fist block. I never overpay and it's completely fine for me to wait 30min. Just going from 0 to 25 min lowers your fee by 40%. 25 min is nothing, I can make myself lunch in that time, or take a dump and a shower afterwards and be back to see my TX confirmed.

telling people bitcoin is completely fine to wait longer.. and then advertise people should instead use another network. is not a great way to promote bitcoin imagine if my bank (it does instant transfers uk-uk and uk-eu) told me that instead of being in and out of the bank branch in 10 minutes i should go home take a dump, have a shower and come back later to check the wire transfer complete.. id change my bank there are reasons people hate banks already. and your advocating that bitcoin should be a high fee system of delayed transfers.. and then advertise some other system .. shameful mindset you have i guess your not a bitcoiner anymore It would be great if there was a censorship mechanism in the bitcoin network that sorted all transactions in the mempool into those that Franky would like and those that Franky would not like, and would allow miners to confirm only the first ones. But no, wait, it's some kind of crap.  |

|

|

|

But that's the "problem" with Ordinals, some of those being built, and communities formed, might be incentived to keep "spamming" the blockchain because some users found out that dick pics/fart sounds are valuable, and they could make profit from them. It's not a real problem by itself, but it's definitely an inconvenience for users who want to use Bitcoin for financial transactions.

For a user who sends a dick pics or fart sound hoping to make a profit, this is also a financial transaction. And he paid the current actual price for its inclusion in the blockchain. This use case of the bitcoin network seems unusual to you, but this does not make it wrong. Don't worry, bitcoin has already proven itself anti-fragile enough not to break at the sound of a fart. |

|

|

|

One bitcoin in an address with multiple inputs is not equal to one bitcoin in an address with one input. Incorrect. One input is not the same as ten. But one bitcoin is exactly the same quantity regardless the number of inputs. This is the same as arguing that ten euro coins can have different value than a 10-euro banknote. They have exactly the same value, it's just the weight that changes. One bitcoin on a legacy address is not equal to one bitcoin on a segwit address or one bitcoin on a taproot address. Incorrect. Legacy address is not equal to Segwit address. But one bitcoin is exactly the same quantity regardless the script used. Similar analogy applies here as well. There is a number of evidence that investors of a certain class prefer to buy bitcoins not on the exchange, but directly from mining companies, and even pay an additional premium to the market price for owning bitcoins with zero history Please point me to one such case. Bitcoins from the earliest period of history (about a year after the genesis block) are under close scrutiny by blockchain analyzers, and their transition from a quiescent to an active state can lead to significant consequences. One bitcoin from this period of early history is not equal to one bitcoin from a more modern period of history. Again, bitcoins are equal. I can acknowledge that the owners of those particular coins need privacy, but the bitcoins per se are no different to "modern" coins. Let's stop this dialogue if the above arguments are not enough for you. I'm willing to admit that bitcoin coins are fungible enough these days to not worry too much about it. The risks of losing the fungibility of coins in the open blockchain in the future may differ from different points of view, depending on future development scenarios and on individual risk tolerance. Because you can mix well, but you can't hide the fact of mixing. You have fundamentally misunderstood mixing. You're not supposed to hide the fact that you mixed. You're supposed to obfuscate your coins' origins. You pretty much want from the rest to know that your coins come from a mixer. I guess I really don't understand the meaning of mixing. Why would I want to advertise the fact of mixing my coins? What do I benefit from this to offset the potential problems associated with the common use case for mixers to launder "dirty" money? |

|

|

|

the thing is that the second setup transaction of 10ksat fee then pushes the average tx fee up if lots of idiots spam this scheme

you may have noticed this week the average fee's went from <$3 to >$9

Wasting money by denial-of-service... by no means, is that new to us at all.  It's going to cool down eventually, because blokes will either run out of money or realize that throwing away mountains of several million satoshis is literally throwing their money down a sinkhole never to return again. I don't understand what the problem is here either. If the transaction is confirmed and included in the blockchain, then it is correct, and if it was rejected, then it is not correct, that's all. Attempts to impose any other criteria for the correct use of bitcoin are laughable. |

|

|

|

You contradict yourself. First say that the history of a particular bitcoin does not matter, and then admit that this is only true until you use centralized exchanges, otherwise you will have problems freezing funds. I'm not contradicting myself. Just because there exist services which enforce arbitrary rules, it doesn't mean the coins are the problem. Just as if there would be a merchant in real life, who would not accept your cash because he thinks you're not trustworthy, and asked for further info like bank transactions, passport, phone number etc., it doesn't mean your cash are problematic; the merchant is. And problems with freezing funds will also arise for someone who buys bitcoins from you that have passed through a mixer on a decentralized exchange, and then wants to bring them to a centralized exchange. Notice that you repeat the usage of centralized exchange as if it was an indivisible part of the Bitcoin ecosystem. It's not. I have not used a centralized exchange in my life that enforces such nonsense. I trade peer-to-peer using decentralized, trustless exchanges*, just as bitcoin was designed to be. Conditional freedom is a kind of non-freedom. Depends on the conditions. If the only condition is "don't use such services", I don't think you have much freedom encroached. * with this exception.If you don't like the example of centralized exchanges, I can cite a number of others to support the generally self-evident point that bitcoins are not the same. 1. One bitcoin in an address with multiple inputs is not equal to one bitcoin in an address with one input. You can consolidate many inputs into one by making a transaction to your own address, but this will require additional effort, time, and miner fee overhead from you. 2. One bitcoin on a legacy address is not equal to one bitcoin on a segwit address or one bitcoin on a taproot address. You can transform address types by transacting to your own address, but this will also require you to add extra effort, time, and miner fee overhead. 3. There is a number of evidence that investors of a certain class prefer to buy bitcoins not on the exchange, but directly from mining companies, and even pay an additional premium to the market price for owning bitcoins with zero history. 4. Bitcoins from the earliest period of history (about a year after the genesis block) are under close scrutiny by blockchain analyzers, and their transition from a quiescent to an active state can lead to significant consequences. One bitcoin from this period of early history is not equal to one bitcoin from a more modern period of history. I respect your right to confidentiality, anonymity and privacy, but it seems to me a rather stupid idea to use for this purpose a completely open and transparent bitcoin blockchain, which does not have the native fungibility of coins. I am not against the use of bitcoin mixers, but you should be aware of the possible negative consequences of their use in the present and in the future, which I mentioned above. The spread of bitcoin adoption could lead to the segmentation of the single bitcoin space into partially isolated fragments, some of which may be significantly affected by the efforts of regulators. If you live in an anarchist commune and use bitcoin as your only payment instrument, never touch fiat money, then you have nothing to worry about. If you live in a normal society and continue to use fiat gateways, then you should be aware that the use of bitcoin mixers increases your privacy and at the same time increases the risk of your deanonymization. Because you can mix well, but you can't hide the fact of mixing. |

|

|

|

Самый потрясающий по красоте цимес этой истории с американским банкопадом в том, что эти самые проблемные региональные банки всю дорогу в целом всё делали правильно! В массе своей они не увлекались высокорискованными инвестициями в мусорные облигации и в акции сомнительных убыточных стартапов, они всё делали по науке в консервативном стиле - акции "голубых фишек" и облигации Казначейства США, в отличие от солидных инвестиционных фондов с акцентом не на первые, а на последние, то есть действовали ещё более консервативно. И эта сверх-консервативная низко-рискованная (и соответственно низко-маржинальная - потому что риск напрямую коррелирует с маржой) стратегия сыграла с банками очень злую шутку из серии "больше всех рискует тот, кто не рискует"

Ну не знаю, не знаю... а есть какие-то доказательства, что эти банки управлялись консервативно и не занимались рискованными инвестициями? Про первый республиканский ничего не скажу, просто не знаю и не читал каких-то подробных исследований на эту тему, но в отношении Силиконового банка долины краем глаза видел инфу (да она вроде была в общем доступе), что это был банк, крайне популярный у крипто-учреждений. Последние в общем-то можно считать синонимом как рискованных инвестиций, так и синонимом сомнительных контрагентов, учитывая насколько плохо разработано законодательство по регулированию крипты в США. (Тёрки с Рипплом, например, доказательство регуляторной неопределённости в крипте). А какие тебе нужны например доказательства? Массовость падежа сойдёт за веское доказательство, что это не лудомания и долбоебизм отдельно взятого человеческого фактора, а глубокий системный фатал еррор? Последствия человеческой ошибки как правило всегда можно исправить, купировать, откатить всё взад из резервного бэкапа, наказать виновного и продолжить жить дальше. Есть подозрение, переходящее в уверенность, что нынешняя проблема с банками регионального калибра имеет характер фундаментального системного кризиса и мы на пороге грандиозного шухера. Посмотрим, чё гадать-то - это тот случай, когда шила в мешке не утаишь и географией США думаю дело тоже не ограничится. |

|

|

|

|

My money lesson, which I learned this year, can be formulated as follows: there is a more successful year in the economic aspect, and there is a less successful one. But do not get too hung up on this, there are more important things in life.

|

|

|

|

this does not mean that it will always and everywhere be like this. There will always be decentralized exchanges, which are superior in terms of enforcing arbitrary coin criteria, because they cannot be shut down. So you will always have the option to go and buy / sell this way. Although it seems that some centralized exchanges even today will automatically block your deposit if the incoming bitcoin had traces of passing through the mixer in its history. Great, so don't use a centralized exchange. You will never have your coins treated unequally in Bisq. You contradict yourself. First say that the history of a particular bitcoin does not matter, and then admit that this is only true until you use centralized exchanges, otherwise you will have problems freezing funds. And problems with freezing funds will also arise for someone who buys bitcoins from you that have passed through a mixer on a decentralized exchange, and then wants to bring them to a centralized exchange. For you it doesn't matter, but for someone it can be a serious limitation in the freedom to manage their funds. So don't tell me that the history of a particular bitcoin is unimportant, because it isn't. Conditional freedom is a kind of non-freedom. |

|

|

|

|

It's going to cool down eventually, because blokes will either run out of money or realize that throwing away mountains of several million satoshis is literally throwing their money down a sinkhole never to return again.

It's going to cool down eventually, because blokes will either run out of money or realize that throwing away mountains of several million satoshis is literally throwing their money down a sinkhole never to return again.