Biodom

Legendary

Offline Offline

Activity: 3752

Merit: 3869

|

|

November 29, 2022, 01:53:30 AM |

|

He is mostly right, although I don't believe that US-based VCs would not invest offshore IF SEC put screws on "crypto" in US. It is very easy for them to spawn a subsidiary on some island and proceed from there. BTW, Fidelity already opened up some beta site for retail investment in something they call "bitcoin", but, apparently, you cannot withdraw such 'bitcoin", lol. Fake bitcoin would be the next "thing" among banks, me thinks. I read that twitter story by Mark Moss and I should apologize in advance if my questions are way too newbish... I am very new to crypto I invested in btc and some altcoins and I really believe that btc is the future. While this Mark's does make sense to me, I have had some questions though... If SEC could be so tough to declare all crypto except btc as a security why they have not won that battle against XRP for such a long time? Since SEC is a regulating authority, shouldn't it its decisions be approved by both senate and congress before going public which seems hard to me since they belong to two different parties now? What about btc forks (I know most of them is a total crap) - how would SEC decide which of them is a security and which not? On a larger scale - all real POW projects - how to spot a security vs non-security. It just seems to me very time consuming job for SEC given that lengthy battle against XRP... My personal take on this (I could be wrong of course) that just an announcement that SEC starts its review whether all crypto is a security will likely put entire crypto market into a lengthy bearish season... Any insights would be appreciated.... PS I also anticipate a bunch of lawyers from large crypto projects suing SEC obviously they dont want to loose their money because of SEC good questions... If SEC could be so tough to declare all crypto except btc as a security why they have not won that battle against XRP for such a long time? Because both parties are throwing 100 of mil (minimum) at each other. i don't really know the current score. If XRP to disappear, bitcoin would not be affected. the question of forks is not relevant anymore due to their size or the lack of it. My personal take on this (I could be wrong of course) that just an announcement that SEC starts its review whether all crypto is a security will likely put entire crypto market into a lengthy bearish season... Why is this? It's all Howey-test based idiocy anyway. The world DOES NOT care about security/not security...it's SEC who are obsessed over it due to, I guess, the desire to "regulate" everything. If you are angling to predict when is the good time to invest (if ever), then you will never DO IT. Your loss. |

|

|

|

|

|

|

|

Each block is stacked on top of the previous one. Adding another block to the top makes all lower blocks more difficult to remove: there is more "weight" above each block. A transaction in a block 6 blocks deep (6 confirmations) will be very difficult to remove.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 29, 2022, 02:01:17 AM |

|

|

|

|

|

|

newbtc101

Jr. Member

Offline Offline

Activity: 45

Merit: 17

|

He is mostly right, although I don't believe that US-based VCs would not invest offshore IF SEC put screws on "crypto" in US. It is very easy for them to spawn a subsidiary on some island and proceed from there. BTW, Fidelity already opened up some beta site for retail investment in something they call "bitcoin", but, apparently, you cannot withdraw such 'bitcoin", lol. Fake bitcoin would be the next "thing" among banks, me thinks. I read that twitter story by Mark Moss and I should apologize in advance if my questions are way too newbish... I am very new to crypto I invested in btc and some altcoins and I really believe that btc is the future. While this Mark's does make sense to me, I have had some questions though... If SEC could be so tough to declare all crypto except btc as a security why they have not won that battle against XRP for such a long time? Since SEC is a regulating authority, shouldn't it its decisions be approved by both senate and congress before going public which seems hard to me since they belong to two different parties now? What about btc forks (I know most of them is a total crap) - how would SEC decide which of them is a security and which not? On a larger scale - all real POW projects - how to spot a security vs non-security. It just seems to me very time consuming job for SEC given that lengthy battle against XRP... My personal take on this (I could be wrong of course) that just an announcement that SEC starts its review whether all crypto is a security will likely put entire crypto market into a lengthy bearish season... Any insights would be appreciated.... PS I also anticipate a bunch of lawyers from large crypto projects suing SEC obviously they dont want to loose their money because of SEC good questions... If SEC could be so tough to declare all crypto except btc as a security why they have not won that battle against XRP for such a long time? Because both parties are throwing 100 of mil (minimum) at each other. i don't really know the current score. If XRP to disappear, bitcoin would not be affected. the question of forks is not relevant anymore due to their size or the lack of it. My personal take on this (I could be wrong of course) that just an announcement that SEC starts its review whether all crypto is a security will likely put entire crypto market into a lengthy bearish season... Why is this? It's all Howey-test based idiocy anyway. The world DOES NOT care about security/not security...it's SEC who are obsessed over it due to, I guess, the desire to "regulate" everything. If you are angling to predict when is the good time to invest (if ever), then you will never DO IT. Your loss. But the world does care about the US financials including SEC... and FED's hikes clearly show it... unfortunately... I was not angling at a lower price for BTC and some altcoins, I am using a DCA strategy anyway. I personally think that now is a very good price to buy btc regardless of future SEC actions... However, my concern that SEC actions can put all crypto including btc into a bearish chaos... Does it make sense |

|

|

|

|

|

Popkon6

|

|

November 29, 2022, 02:31:20 AM |

|

Christmas at 54. Not bad.   Just Fun bro don't feel bad |

|

|

|

|

HI-TEC99

Legendary

Offline Offline

Activity: 2772

Merit: 2846

|

|

November 29, 2022, 02:44:39 AM |

|

Is SBF still speaking at that event tomorrow?  |

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4116

Merit: 7862

'The right to privacy matters'

|

|

November 29, 2022, 02:50:34 AM |

|

He is mostly right, although I don't believe that US-based VCs would not invest offshore IF SEC put screws on "crypto" in US. It is very easy for them to spawn a subsidiary on some island and proceed from there. BTW, Fidelity already opened up some beta site for retail investment in something they call "bitcoin", but, apparently, you cannot withdraw such 'bitcoin", lol. Fake bitcoin would be the next "thing" among banks, me thinks. I read that twitter story by Mark Moss and I should apologize in advance if my questions are way too newbish... I am very new to crypto I invested in btc and some altcoins and I really believe that btc is the future. While this Mark's does make sense to me, I have had some questions though... If SEC could be so tough to declare all crypto except btc as a security why they have not won that battle against XRP for such a long time? Since SEC is a regulating authority, shouldn't it its decisions be approved by both senate and congress before going public which seems hard to me since they belong to two different parties now? What about btc forks (I know most of them is a total crap) - how would SEC decide which of them is a security and which not? On a larger scale - all real POW projects - how to spot a security vs non-security. It just seems to me very time consuming job for SEC given that lengthy battle against XRP... My personal take on this (I could be wrong of course) that just an announcement that SEC starts its review whether all crypto is a security will likely put entire crypto market into a lengthy bearish season... Any insights would be appreciated.... PS I also anticipate a bunch of lawyers from large crypto projects suing SEC obviously they dont want to loose their money because of SEC good questions... If SEC could be so tough to declare all crypto except btc as a security why they have not won that battle against XRP for such a long time? Because both parties are throwing 100 of mil (minimum) at each other. i don't really know the current score. If XRP to disappear, bitcoin would not be affected. the question of forks is not relevant anymore due to their size or the lack of it. My personal take on this (I could be wrong of course) that just an announcement that SEC starts its review whether all crypto is a security will likely put entire crypto market into a lengthy bearish season... Why is this? It's all Howey-test based idiocy anyway. The world DOES NOT care about security/not security...it's SEC who are obsessed over it due to, I guess, the desire to "regulate" everything. If you are angling to predict when is the good time to invest (if ever), then you will never DO IT. Your loss. But the world does care about the US financials including SEC... and FED's hikes clearly show it... unfortunately... I was not angling at a lower price for BTC and some altcoins, I am using a DCA strategy anyway. I personally think that now is a very good price to buy btc regardless of future SEC actions... However, my concern that SEC actions can put all crypto including btc into a bearish chaos... Does it make sense The attacks will trudge on when eth shits the bed in late 2023 to early 2025 it is a wide spread of when eth death spirals |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 29, 2022, 03:01:20 AM |

|

|

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10227

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 29, 2022, 03:07:58 AM |

|

I am all fine with proclaiming that something is not enough... yet? Do we want to go from zero to perfect? And, what is perfect? What would be perfect? Is perfect achievable? Is perfect even desirable? I am not saying don't do nothing, but still there are balances to any of these matters. Wouldn't progress be being made by first having all (or most) exchanges showing their bitcoin (showing what is verifiable, first?)? That would be a start, no? That would be a step in the right direction, no? Powell seems to be suggesting that it is totally worthless to show the reserves because it is not enough and it is misleading - but is it a step in the right direction? Do we believe that a company is going to show everything? Every single thing? Where's the incentive to show every single little thing? And where is the verifiability in terms of showing every single little thing? At least with bitcoin, and the bitcoin's blockchain there is verifiability.. and what else has anything close to the same level of verifiability as bitcoin? Everything else requires some level of trust, no? So I am not sure how you can show everything else without trust, so why not start with the verifiable aspects first.. and then once we get everyone showing the verifiable aspects (if that's even possible?), then we might be able to take some additional steps from there? Maybe some exchanges are willing to show some of the their liabilities, but getting to show everything seems a bit much to expect anyone to cooperate in doing or even to consider that we want that level of transparency? Then when is it going to stop? When are the disclosures going to stop? First institutions (such as exchanges) disclosing, but do the disclosures stop at that point, or then will we require individuals to disclose too? The point is CZ is a snake and he is trying to show how all funds are safu with sleight of hand akin to craig wrong signature scam. CZ is the one who started all this your funds are not backed that started the dominos and as I pointed out a few days earlier he had this all ready to go while he tried to goad armstrong into calling him out. But Jesse Powell (Kraken CEO) is not a fool and a true cypherpunk Idealist who has had his books open and audited for years is calling him out on his little maneuvers. I do agree it is cool to see some info being provided but now is the time to pressure that snake into FULL Disclosure. Especially since he is the one who started it and apparently thinks he has all his dominos lined up. https://www.youtube.com/watch?v=DelF6zEHXpEI have no problem with you presenting your point of view, but frequently we still need to take some of these characterizations of motives with considerable grains of salt - even if some angles might be more convincing than others. Yesterday, I was listening to The Bitcoin Matrix podcast in which Phil Gibson was proclaiming a kind of conspiratorial theory regarding so many players coordinating to cause the FTX crash - including asserting that CZ was in on the deal because CZ (Binance) was an initial investor into FTX. I appreciated several of the connections that Gibson was making, but still I thought that he was drawing too many conspiratorial lines for my own comfort levels And, today I was listening to another podcast (I cannot remember which one) in which I was reminded that FTX had paid back Binance in a combination of FTT token and also in BNB token - which highlighted that some of these off-shore exchanges are using a combination of token to make payments, including frequently using their own coin - which reminded me of a previous post that I had made to defend the BNB token and CZ, in terms of the BNB token being around longer and also my presumption that the BNB token was much better backed than then FTT token - and even though we can see a lot of these games, we cannot really know the extent to which the games are being played until shit really hits the fan.. and sure some of the tokens have BIGGER red flags than other tokens.... I am not sure exactly what my point is - except that I am reluctant to buy into very much of any of these stories - and I am not even suggesting that you, Hueristic, are buying too much into any one story - even though I feel that some of my leanings are slightly different than yours - even though each of us are surely working with incomplete information - and each of us only has so much time to be researching into these matters and trying to figure out for our own comfort levels regarding how much time we want to spend investigating various angles of these stories and how much weight to give to factual, logical and conclusory representations that we come across. |

|

|

|

|

|

tiCeR

|

|

November 29, 2022, 03:30:46 AM |

|

I am all fine with proclaiming that something is not enough... yet? Do we want to go from zero to perfect? And, what is perfect? What would be perfect? Is perfect achievable? Is perfect even desirable? I am not saying don't do nothing, but still there are balances to any of these matters. Wouldn't progress be being made by first having all (or most) exchanges showing their bitcoin (showing what is verifiable, first?)? That would be a start, no? That would be a step in the right direction, no? Powell seems to be suggesting that it is totally worthless to show the reserves because it is not enough and it is misleading - but is it a step in the right direction? Do we believe that a company is going to show everything? Every single thing? Where's the incentive to show every single little thing? And where is the verifiability in terms of showing every single little thing? At least with bitcoin, and the bitcoin's blockchain there is verifiability.. and what else has anything close to the same level of verifiability as bitcoin? Everything else requires some level of trust, no? So I am not sure how you can show everything else without trust, so why not start with the verifiable aspects first.. and then once we get everyone showing the verifiable aspects (if that's even possible?), then we might be able to take some additional steps from there? Maybe some exchanges are willing to show some of the their liabilities, but getting to show everything seems a bit much to expect anyone to cooperate in doing or even to consider that we want that level of transparency? Then when is it going to stop? When are the disclosures going to stop? First institutions (such as exchanges) disclosing, but do the disclosures stop at that point, or then will we require individuals to disclose too? The point is CZ is a snake and he is trying to show how all funds are safu with sleight of hand akin to craig wrong signature scam. CZ is the one who started all this your funds are not backed that started the dominos and as I pointed out a few days earlier he had this all ready to go while he tried to goad armstrong into calling him out. But Jesse Powell (Kraken CEO) is not a fool and a true cypherpunk Idealist who has had his books open and audited for years is calling him out on his little maneuvers. I do agree it is cool to see some info being provided but now is the time to pressure that snake into FULL Disclosure. Especially since he is the one who started it and apparently thinks he has all his dominos lined up. https://www.youtube.com/watch?v=DelF6zEHXpEI suppose he needs a gigantic audit team to consolidate his own numbers. Just look at his "corporate structure", if it can even be called "structure". It is absurd that to this date I believe he hasn't clearly stated where the headquarter is. It is not just about where they are registered. It is about how and where any issues could seriously be addressed. He doesn't care. When Malta said Binance has no license, he just moved on. The fact that Binance now established some headquarter in Paris is really puzzling. I don't know what happened behind the scenes and what guarantees Binance received from the French government, but when the decision between Ireland and France is made in favor of France, something must be going on. Is this where the company seriously pays tax? Or is this term "headquarter" now just the place where the biggest office with real people working there is to be found? What's the deal between the French government and Binance? I am asking myself whether CZ himself does even know off the top of his head how much in assets his messed up global corporate network even has. But with one thing I totally agree here: it is time to lay the cards on the table. Following the FTX collapse, tens of billions have been withdrawn from all kinds of exchanges. I wonder whether CZ caused a bank run that even he didn't really like. Or Binance is perfectly solvent and played this sneaky he had up his sleeves. Then again, I also wondered whether causing an exchange like FTX to collapse could also backfire in many regards concerning his own exchange. People withdrawing assets en masse, massive push for harsh regulation, also massive push for innovation in the DEX space etc. |

|

|

|

|

HI-TEC99

Legendary

Offline Offline

Activity: 2772

Merit: 2846

|

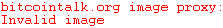

He is mostly right, although I don't believe that US-based VCs would not invest offshore IF SEC put screws on "crypto" in US. It is very easy for them to spawn a subsidiary on some island and proceed from there. BTW, Fidelity already opened up some beta site for retail investment in something they call "bitcoin", but, apparently, you cannot withdraw such 'bitcoin", lol. Fake bitcoin would be the next "thing" among banks, me thinks. I read that twitter story by Mark Moss and I should apologize in advance if my questions are way too newbish... I am very new to crypto I invested in btc and some altcoins and I really believe that btc is the future. While this Mark's does make sense to me, I have had some questions though... If SEC could be so tough to declare all crypto except btc as a security why they have not won that battle against XRP for such a long time? Since SEC is a regulating authority, shouldn't it its decisions be approved by both senate and congress before going public which seems hard to me since they belong to two different parties now? What about btc forks (I know most of them is a total crap) - how would SEC decide which of them is a security and which not? On a larger scale - all real POW projects - how to spot a security vs non-security. It just seems to me very time consuming job for SEC given that lengthy battle against XRP... My personal take on this (I could be wrong of course) that just an announcement that SEC starts its review whether all crypto is a security will likely put entire crypto market into a lengthy bearish season... Any insights would be appreciated.... PS I also anticipate a bunch of lawyers from large crypto projects suing SEC obviously they dont want to loose their money because of SEC good questions... If SEC could be so tough to declare all crypto except btc as a security why they have not won that battle against XRP for such a long time? Because both parties are throwing 100 of mil (minimum) at each other. i don't really know the current score. If XRP to disappear, bitcoin would not be affected. the question of forks is not relevant anymore due to their size or the lack of it. My personal take on this (I could be wrong of course) that just an announcement that SEC starts its review whether all crypto is a security will likely put entire crypto market into a lengthy bearish season... Why is this? It's all Howey-test based idiocy anyway. The world DOES NOT care about security/not security...it's SEC who are obsessed over it due to, I guess, the desire to "regulate" everything. If you are angling to predict when is the good time to invest (if ever), then you will never DO IT. Your loss. But the world does care about the US financials including SEC... and FED's hikes clearly show it... unfortunately... I was not angling at a lower price for BTC and some altcoins, I am using a DCA strategy anyway. I personally think that now is a very good price to buy btc regardless of future SEC actions... However, my concern that SEC actions can put all crypto including btc into a bearish chaos... Does it make sense The attacks will trudge on when eth shits the bed in late 2023 to early 2025 ... Is that when they allow spending locked staked coins? Is that what this guy is talking about?  |

|

|

|

|

HI-TEC99

Legendary

Offline Offline

Activity: 2772

Merit: 2846

|

|

November 29, 2022, 03:59:25 AM |

|

I am all fine with proclaiming that something is not enough... yet? Do we want to go from zero to perfect? And, what is perfect? What would be perfect? Is perfect achievable? Is perfect even desirable? I am not saying don't do nothing, but still there are balances to any of these matters. Wouldn't progress be being made by first having all (or most) exchanges showing their bitcoin (showing what is verifiable, first?)? That would be a start, no? That would be a step in the right direction, no? Powell seems to be suggesting that it is totally worthless to show the reserves because it is not enough and it is misleading - but is it a step in the right direction? Do we believe that a company is going to show everything? Every single thing? Where's the incentive to show every single little thing? And where is the verifiability in terms of showing every single little thing? At least with bitcoin, and the bitcoin's blockchain there is verifiability.. and what else has anything close to the same level of verifiability as bitcoin? Everything else requires some level of trust, no? So I am not sure how you can show everything else without trust, so why not start with the verifiable aspects first.. and then once we get everyone showing the verifiable aspects (if that's even possible?), then we might be able to take some additional steps from there? Maybe some exchanges are willing to show some of the their liabilities, but getting to show everything seems a bit much to expect anyone to cooperate in doing or even to consider that we want that level of transparency? Then when is it going to stop? When are the disclosures going to stop? First institutions (such as exchanges) disclosing, but do the disclosures stop at that point, or then will we require individuals to disclose too? The point is CZ is a snake and he is trying to show how all funds are safu with sleight of hand akin to craig wrong signature scam. CZ is the one who started all this your funds are not backed that started the dominos and as I pointed out a few days earlier he had this all ready to go while he tried to goad armstrong into calling him out. But Jesse Powell (Kraken CEO) is not a fool and a true cypherpunk Idealist who has had his books open and audited for years is calling him out on his little maneuvers. I do agree it is cool to see some info being provided but now is the time to pressure that snake into FULL Disclosure. Especially since he is the one who started it and apparently thinks he has all his dominos lined up. https://www.youtube.com/watch?v=DelF6zEHXpEI suppose he needs a gigantic audit team to consolidate his own numbers. Just look at his "corporate structure", if it can even be called "structure". It is absurd that to this date I believe he hasn't clearly stated where the headquarter is. It is not just about where they are registered. It is about how and where any issues could seriously be addressed. He doesn't care. When Malta said Binance has no license, he just moved on. The fact that Binance now established some headquarter in Paris is really puzzling. I don't know what happened behind the scenes and what guarantees Binance received from the French government, but when the decision between Ireland and France is made in favor of France, something must be going on. Is this where the company seriously pays tax? Or is this term "headquarter" now just the place where the biggest office with real people working there is to be found?... I don't know if this still applies, but in 2018 he deliberately kept all those company details secret. https://economictimes.indiatimes.com/markets/stocks/news/cryptos-billionaire-trading-king-has-suddenly-run-into-problems/articleshow/63533807.cmsZhao keeps the locations of Binance’s offices and servers secret -- making it tough to determine which country has jurisdiction over the company -- and he instructs employees to keep quiet about their affiliation with the exchange on social media. He said he never stays in one place for too long, living out of short-term rentals and hotels in Singapore, Taiwan and Hong Kong (where he prefers the Mandarin Oriental or the Ritz-Carlton). |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 29, 2022, 04:01:17 AM |

|

|

|

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3808

Merit: 4898

Doomed to see the future and unable to prevent it

|

|

November 29, 2022, 04:06:27 AM

Last edit: November 29, 2022, 06:12:14 AM by Hueristic |

|

I have no problem with you presenting your point of view, but frequently we still need to take some of these characterizations of motives with considerable grains of salt - even if some angles might be more convincing than others. Yesterday, I was listening to The Bitcoin Matrix podcast in which Phil Gibson was proclaiming a kind of conspiratorial theory regarding so many players coordinating to cause the FTX crash - including asserting that CZ was in on the deal because CZ (Binance) was an initial investor into FTX. I appreciated several of the connections that Gibson was making, but still I thought that he was drawing too many conspiratorial lines for my own comfort levels And, today I was listening to another podcast (I cannot remember which one) in which I was reminded that FTX had paid back Binance in a combination of FTT token and also in BNB token - which highlighted that some of these off-shore exchanges are using a combination of token to make payments, including frequently using their own coin - which reminded me of a previous post that I had made to defend the BNB token and CZ, in terms of the BNB token being around longer and also my presumption that the BNB token was much better backed than then FTT token - and even though we can see a lot of these games, we cannot really know the extent to which the games are being played until shit really hits the fan.. and sure some of the tokens have BIGGER red flags than other tokens.... I am not sure exactly what my point is - except that I am reluctant to buy into very much of any of these stories - and I am not even suggesting that you, Hueristic, are buying too much into any one story - even though I feel that some of my leanings are slightly different than yours - even though each of us are surely working with incomplete information - and each of us only has so much time to be researching into these matters and trying to figure out for our own comfort levels regarding how much time we want to spend investigating various angles of these stories and how much weight to give to factual, logical and conclusory representations that we come across. I fail to see a question here.  I don't follow anyone's conspiracy theories, I make up my own.  I suppose he needs a gigantic audit team to consolidate his own numbers. Just look at his "corporate structure", if it can even be called "structure". It is absurd that to this date I believe he hasn't clearly stated where the headquarter is. It is not just about where they are registered. It is about how and where any issues could seriously be addressed. He doesn't care. When Malta said Binance has no license, he just moved on.

The fact that Binance now established some headquarter in Paris is really puzzling. I don't know what happened behind the scenes and what guarantees Binance received from the French government, but when the decision between Ireland and France is made in favor of France, something must be going on. Is this where the company seriously pays tax? Or is this term "headquarter" now just the place where the biggest office with real people working there is to be found? What's the deal between the French government and Binance?

I am asking myself whether CZ himself does even know off the top of his head how much in assets his messed up global corporate network even has. But with one thing I totally agree here: it is time to lay the cards on the table. Following the FTX collapse, tens of billions have been withdrawn from all kinds of exchanges. I wonder whether CZ caused a bank run that even he didn't really like. Or Binance is perfectly solvent and played this sneaky he had up his sleeves.

Then again, I also wondered whether causing an exchange like FTX to collapse could also backfire in many regards concerning his own exchange. People withdrawing assets en masse, massive push for harsh regulation, also massive push for innovation in the DEX space etc.

You make alot of good points here, I think when all is said and done CZ is going to regret this move he made. The funny thing is my guess is he saw Bankman pulling the same shit he did with BNB and wanted to get him before he was able to make his shitcoin FTT market cap liquid enough to survive. But he has forgotten the glass houses and started a shit storm that has gone deeper into alphabet agencies than he counted on and he may not make it himself. |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10227

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 29, 2022, 04:53:08 AM |

|

Grabbed a piece today on top of the dca .

, dca is on friday.

A right move at the right time. Good luck. I don't know about that. You gotta take the whole thing into account, and I really doubt that we have enough information for that. Bitcoin ‘millionaire’ wallets drop 80% in year of BTC price bear market Well? If we are talking about entry-level millionaire status at spot price, then that would have been around 14.5 BTC when the BTC price was $69k, and currently entry level millionaire status, at spot price would be around 62.5 BTC.. Sure, there are some other ways to measure millionaire status besides merely looking at spot price - and then there are ways to consider the same question of the BTC price in March 2020 got down to $3,850, so spot price millionaire status would have been around 260 BTC at that time. And in that regard, the entry level millionaire in March 2020 may well have gotten up to nearly $18 million in November 2021, but now that same person with around 269 BTC would merely be at $4.3 million currently... So, yes a lot of fluctuation - especially for someone who just HODLs the same quantity of BTC and does nothing besides HODL them.. which well might be a pretty rare person... though there are quire a few of us who do some variation that largely amounts to mostly accumulate and HODL... but not easy to speak for everyone or to overly generalize. In yet another indication of how far the crypto market has fallen since Bitcoin’s last all-time highs,

Why is "the crypto market" relevant? Bitcoin millionaires have been seriously feeling the pinch.

Fair enough. Glassnode, which tracks multiple cohorts of BTC wallets, confirms that as of Nov. 25, there were 23,245 with a balance worth over $1 million.

Contrast that with the scene from Nov. 8, 2021, when the tally hit its peak as BTC/USD approached its latest $69,000 all-time high — then, there were 112,898 “millionaire” wallets.

Sounds like a BIG SO WHAT? to me. Another BIG SO WHAT? Without some kind of context, or point, that's not really saying anything. The point is CZ is a snake and he is trying to show how all funds are safu with sleight of hand akin to craig wrong signature scam. CZ is the one who started all this your funds are not backed that started the dominos and as I pointed out a few days earlier he had this all ready to go while he tried to goad armstrong into calling him out. But Jesse Powell (Kraken CEO) is not a fool and a true cypherpunk Idealist who has had his books open and audited for years is calling him out on his little maneuvers. I do agree it is cool to see some info being provided but now is the time to pressure that snake into FULL Disclosure. Especially since he is the one who started it and apparently thinks he has all his dominos lined up. https://www.youtube.com/watch?v=DelF6zEHXpEIt is obvious that he prepared well for this since he started it all himself, but his problem is that CZ considers himself too smart and therefore started a game in which he may not be able to survive. I see in him only cunning and greed, and these are not the best character traits. He wants to show a beautiful picture in which everyone would believe, but there are many people who are smarter than him and see and understand everything. Yes, he is cunning and perhaps he will cause a lot of trouble to everyone who trusts to his exchange, but he is definitely not smarter and hi will need to answer for every act. From what are you basing your information? Have you ever seen or heard an interview with CZ? I doubt that he is even close to as evil as you are making him out to be. the noon wall report at 11:36am ahead one third...take those combers on the bow lads see what other flotsam washes ashore this week likely to see increasing volatility imho dyor D   W  stronghands I thought that we already had three capitulations. In your first chart, above, you are talking about a fourth one.. not a third one.     Even though you are not showing it.. like I am describing it. Like this: 1st capitulation from upper $30ks to lower $30ks 2nd capitulation from upper $20ks to lower $20ks. 3rd capitulation... from $20k-ish down to $15.5k.. so far... You are expecting that a 4th capitulation down to $11.9k-ish could happen.. - it appears...        |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 29, 2022, 05:01:17 AM |

|

|

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 29, 2022, 06:01:20 AM |

|

|

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3710

Merit: 10227

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 29, 2022, 06:39:58 AM |

|

Since SEC is a regulating authority, shouldn't it its decisions be approved by both senate and congress before going public which seems hard to me since they belong to two different parties now?

Generally speaking, Federal Government agencies such as the SEC are run by the executive branch, but they have been established by statute that was passed by the two branches of congress. Of course, congress can pass laws to change the mandates of various agencies and such new laws would need to be signed by the executive (president). Yes, a lot of these matters come off as political because the various agencies will be under pressure regarding if they are exceeding their mandates or if congress or the executive want to change the ways that agencies are run through a variety of tactics, so surely sometimes agencies become overly political too.. because they sometimes are under scrutiny rather than just following their various mandates that may even be internally established within each agency and the agencies are subject to court review, too... and of course, popular pressures and popular input - which is sometimes taken into account (it is supposed to be taken into account) and sometimes popular pressures are skirted too. But the world does care about the US financials including SEC... and FED's hikes clearly show it... unfortunately...

Sure.. the whole world might say that they do not care about the US financials, such as SEC, FED hikes etc.. but there are still plenty who follow and use as guidelines.. so your assertion of purportedly "not caring" comes off as mostly lip service rather than actual practices and factual happenings. Then again, I also wondered whether causing an exchange like FTX to collapse could also backfire in many regards concerning his own exchange. People withdrawing assets en masse, massive push for harsh regulation, also massive push for innovation in the DEX space etc.

I doubt that CZ caused FTX to collapse, and it is a good thing that FTX did collapse, since it was quite apparent that they did not have assets to back up their bullshit token, or whatever else they were using to look like assets when they were stealing customers funds and otherwise gambling with customer funds. Fuck FTX and any attempt to blame CZ for their collapse.. that's bullshit. FTX caused its own collapse, and it should not have gotten that BIG in the first place. Regarding whether Binance is solvent, sell your BNB and withdraw all your funds. Let's see what happens. Guess what? Probably nothing is going to happen, since Binance likely was not doing anything even close to as shady as what FTX, SBF and other FTX stooges/criminals were doing.. and still I have not heard of any of the FTX folks getting arrested yet.. even though the evidence is pretty damned clear that they were stealing customer funds... on a broad level, not even just some reasonable amount .. like 30%.. it was way higher stealing levels than that... or do you want to say that they just borrowed the customer money so they could trade with it or buy houses for SBF's parents? or whatever other secret bullshit they were doing with the money that we have not even heard about yet? The funny thing is my guess is he saw Bankman pulling the same shit he did with BNB and wanted to get him before he was able to make his shitcoin FTT market cap liquid enough to survive.

Don't kid yourself.. SBF had no intention of keeping their company solvent. SBF and fellow scammers were busy buying other companies (or entering into "arrangements") in order that they could keep stealing customer funds, while making it appear as if they were solvent. But he has forgotten the glass houses and started a shit storm that has gone deeper into alphabet agencies than he counted on and he may not make it himself.

It's true that the ramifications of FTX falling could affect Binance and CZ.. but I doubt that CZ and Binance are as worried as you are making them out to be or that they are as insolvent as you are making them out to be.. but hey, I don't claim to know much of anything except that CZ has been going through attacks since he started too.. but he had been around a bit longer than SBF and from my viewpoint, CZ also seemed to have been engaging in way more legitimate practices than SBF... . SBF was public because he was a phoney and using influence and appearance of credibility to cause BIGGER sponsorship and investors.. but he was scamming the whole time. The evidence seems to be showing more and more that SBF was not even trying to run a legitimate operation.. a bunch of fucking kids.. with dumb ideology too and sucking regulator dicks to try to gain influence. while stealing money from their clients the whole time..... the FTX guys should be locked up.. but they are not .. instead you and some of the other folks here worried about CZ blah blah blah.. we don't have that kind of evidence on CZ.. .. so too premature.. and better to stay focused on what we know and locking up the FTX criminals instead of losing focus. |

|

|

|

|

ivomm

Legendary

Offline Offline

Activity: 1854

Merit: 2841

All good things to those who wait

|

|

November 29, 2022, 06:46:47 AM Merited by JayJuanGee (1) |

|

The famous twitter "crypto" guru Pomp used to shill lies about blockFi. What kind of idiot one has to be to trust such crooks with their savings? I guess too many. I don't know if we already hit the bottom but until the market is cleansed from such trash, there is no reason to expect some wild bull run. So I keep DCAing but won't risk any extreme investment. At least not yet. https://twitter.com/i/status/1597371512570675205 |

|

|

|

|

|

Gachapin

|

|

November 29, 2022, 06:57:33 AM

Last edit: November 29, 2022, 07:35:08 AM by Gachapin |

|

The famous twitter "crypto" guru Pomp used to shill lies about blockFi. What kind of idiot one has to be to trust such crooks with their savings? I guess too many. I don't know if we already hit the bottom but until the market is cleansed from such trash, there is no reason to expect some wild bull run. So I keep DCAing but won't risk any extreme investment. At least not yet. https://twitter.com/i/status/1597371512570675205fake smile and mental illness eyes... just how I like my gurus...  https://twitter.com/anilsaidso/status/1597371512570675205 https://twitter.com/anilsaidso/status/1597371512570675205 |

|

|

|

|

ChartBuddy

Legendary

Online Online

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 29, 2022, 07:01:16 AM |

|

|

|

|

|

|

|

Poll

Poll