fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15390

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

March 24, 2021, 11:44:16 PM |

|

DaRude, a simple question for you: do you trade GBTC? I mean do you have any position? Otherwise I fail to get your investment tip. I think the majority here would never put a single cent on GBTC as we are all capable to deal with the real thing. Maybe it is too late in my day and I misread but I am either being curious or a bit picky.  Of course the best option is to run your own full node and hold the real thing in cold storage, but paper BTC has its niche. Realistically speaking, there are people who just don't trust themselves enough to hold the keys or get so anxious that it effects their every day lives. Try explaining to gramma that she needs to safely store her mnemonic backup to her offline cold storage somewhere safe and inaccessible to others yet accessible enough for the inheritance purposes. GBTC used to be my go to alternative recommendation in such cases (now i'm leaning towards Canadian ETFs BTCC/EBIT simply because of their lower mgmt fees). But i believe GBTC is still the only alternative for US retirement accounts. It's just a matter of options, if you're able to do so, buy the real thing, if not it's an alternative that might work for you. GBTC is also a 1000 pound guerilla, a good indicator of markets interest in BTC if you know how to read it Agree. There are a lot of people that do not want or simply cannot touch real bitcoins. People not familiar with the technology, someone who is worried about the custody, as per legal/fiscal and inheritance issues. Or there are many subjects, typically corporates and or investment vehicles, who simply cannot touch any unsecuritized item, bitcoin include. For each of those subject, GBTC is a good option. Above all, if there is a negative premium, meaning that they can purchase bitcoin at discount. The important thing this is opt-in: you still have the default, fuck-the-middleman base scenario. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

|

|

"You Asked For Change, We Gave You Coins" -- casascius

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15390

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

March 26, 2021, 12:14:24 AM

Last edit: May 16, 2023, 12:16:10 AM by fillippone |

|

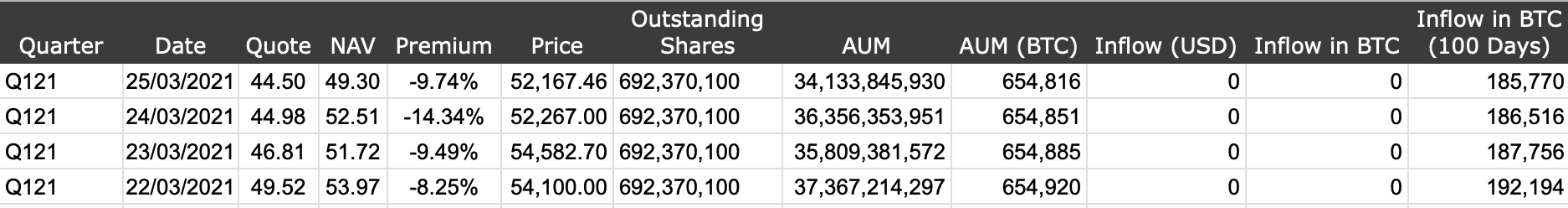

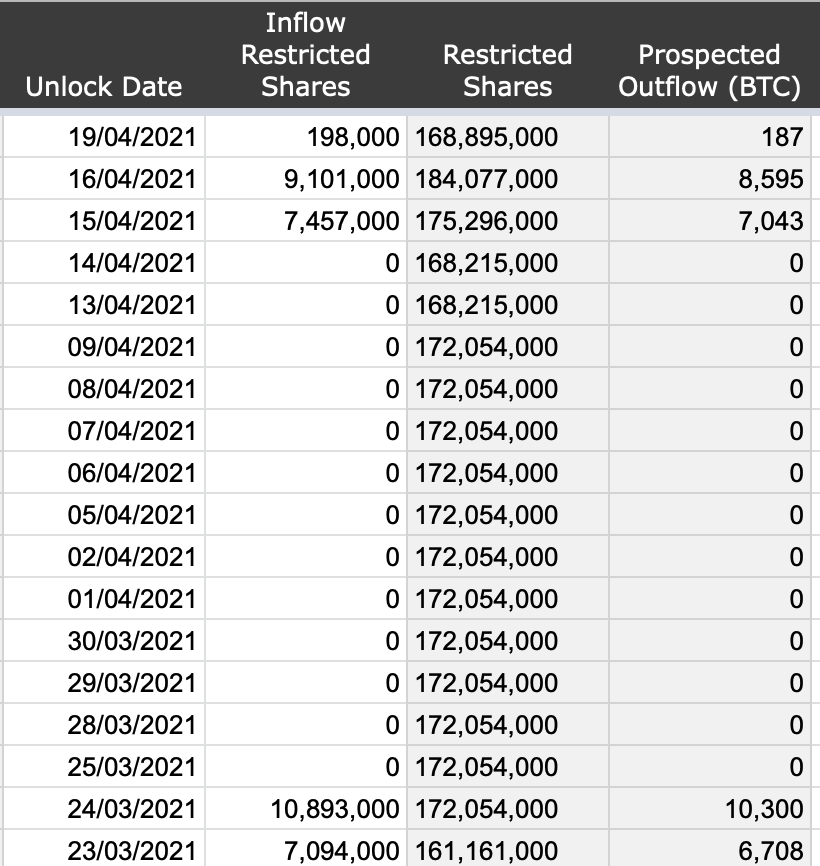

Another day, another (negative) day for Grayscale:  The premium is now constantly in the -10% zone, with the other day a new record of -14% premium.  I guess this is becoming tempting for an arbitrageur to play, but the lack of support makes me think I am missing something. Well, I guess that we will know more by reading their usual End of Quarter Newsletter. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

mcun2000

Jr. Member

Offline Offline

Activity: 32

Merit: 29

|

|

March 27, 2021, 04:40:36 AM

Last edit: March 27, 2021, 06:18:10 AM by mcun2000 Merited by fillippone (2) |

|

.... But i believe GBTC is still the only alternative for US retirement accounts. It's just a matter of options, if you're able to do so, buy the real thing, if not it's an alternative that might work for you.

GBTC is also a 1000 pound guerilla, a good indicator of markets interest in BTC if you know how to read it

[/quote]

@cryptoboss2020, THIS!!

I am in the US, and have retirement accounts that I want to have exposure to bitcoin. I can't buy bitcoin directly in those accounts, so GBTC is the only way at the moment.

I mean I could also invest bitcoin indirectly, by buying MicroStrategy, Riot Blockchain, and such other stocks, but these do not necessarily track bitcoin price movement. And they are highly speculative. I was a miner once, and mining goes through BIG boom bust cycles, and I think you would be crazy to put money into public crypto mining companies at their current prices unless you want to speculate. MicroStrategy is interesting, but I have no idea where they are going...are they pivoting from a Business Intelligence software firm (with declining revenue mind you) to something in the blockchain space? If so how will they do it and how will they get past the current shortage of crypto software engineering talent?

|

|

|

|

|

mcun2000

Jr. Member

Offline Offline

Activity: 32

Merit: 29

|

|

March 29, 2021, 05:57:12 AM |

|

Guys, I'm beginning to have second thoughts about investing in GBTC. Consider this scenario: Grayscale never converts GBTC to an ETF, never adds a process for bitcoin redemption, and keeps its massive 2% fee. They make noises about hiring ETF expertise, looking at ETF conversion when the SEC allows it, and looking into someway for bitcoin redemption, but in the end they don't have to do any of that. The bitcoins are locked in the trust, and Grayscale can just sit and eat 2% per annum. This will imply the negative premium will be permanent. No new institution will put money or bitcoin into GBTC. People would not buy GBTC on the secondary market except at steep discount. This $250 million share repurchase will probably not do anything to reduce the discount. Credit to poster below for this scenario: https://seekingalpha.com/article/4415487-greyscale-bitcoin-trust-buying-bitcoin-at-a-discountAuthor, I would say I highly doubt your premise and do not begin to understand your logic. This statement "I suspect we will get an ETF eventually - hence the case GBTC will trade at a steep premium is effectively dead, in my opinion" seems quite backward. Why? Essentially, Grayscale has no incentive, no motivation, no reason to convert to an etf. Why would they? All 650,000 bitcoin are locked into their fund with no way out. They get paid based on a percentage, as you noted a very HIGH percentage, of the underlying bitcoin. The ETF landscape is cutthroat, low-margin, and destined to be filled with competition. Even if they were to retain 100% of their bitcoin under management (BUM), they would only stand to get a fee of perhaps .3% (the rate NYDIG has promised), for a whopping 85% reduction in fees. However, if they just stand pat, they will continue raking in 2% or 13,000 bitcoin per year, for doing nothing other than filing financial statements. Sure, no one will buy shares from them directly anymore, and any new Trust they set up is unlikely to gain much momentum, but who cares? They are highly unlikely to be able to build ANY alternative revenue stream that would ever begin to approach 13,000 bitcoin per year. If hitcoin hits $1,000,000 in 2025, that is $13 Billion for filing financial statements. So, in my view, Grayscale is now an anomaly. GBTC might eventually be the largest single investment holding anywhere, but it will forever trade at a significant discount. They simply have no reason to convert. Sure, they might offer a separate ETF, hell, they could offer it for free and coast on the revenues they get from GBTC, but GBTC will forever be a trust and just sit there leaking bitcoin in fees. FWIW, here is Michael Sonnenshein craftly saying no way we will reduce our guaranteed fee. www.coindesk.com/... |

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15390

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

March 29, 2021, 10:54:38 PM |

|

Guys,

I'm beginning to have second thoughts about investing in GBTC.

Consider this scenario:

Grayscale never converts GBTC to an ETF, never adds a process for bitcoin redemption, and keeps its massive 2% fee. They make noises about hiring ETF expertise, looking at ETF conversion when the SEC allows it, and looking into someway for bitcoin redemption, but in the end they don't have to do any of that. The bitcoins are locked in the trust, and Grayscale can just sit and eat 2% per annum.

This will imply the negative premium will be permanent. No new institution will put money or bitcoin into GBTC. People would not buy GBTC on the secondary market except at steep discount. This $250 million share repurchase will probably not do anything to reduce the discount.

Mhhh implausible scenario. Ok, everything you say has a logical meaning and could probably become true. But the question is: why? Why should Grayscale kill their own goose that lays golden eggs? They have been running their business since a few years ago: they know what they are doing, and they simply won't let it slips out of their hands. They are I think they are actively bribing the G-men to delay as long as possible the EFT approval so that they can be running their high fees business for longer before they will convert their GBTC trust. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

DaRude

Legendary

Offline Offline

Activity: 2778

Merit: 1790

In order to dump coins one must have coins

|

Guys, I'm beginning to have second thoughts about investing in GBTC. Consider this scenario: Grayscale never converts GBTC to an ETF, never adds a process for bitcoin redemption, and keeps its massive 2% fee. They make noises about hiring ETF expertise, looking at ETF conversion when the SEC allows it, and looking into someway for bitcoin redemption, but in the end they don't have to do any of that. The bitcoins are locked in the trust, and Grayscale can just sit and eat 2% per annum. This will imply the negative premium will be permanent. No new institution will put money or bitcoin into GBTC. People would not buy GBTC on the secondary market except at steep discount. This $250 million share repurchase will probably not do anything to reduce the discount. Credit to poster below for this scenario: https://seekingalpha.com/article/4415487-greyscale-bitcoin-trust-buying-bitcoin-at-a-discountAuthor, I would say I highly doubt your premise and do not begin to understand your logic. This statement "I suspect we will get an ETF eventually - hence the case GBTC will trade at a steep premium is effectively dead, in my opinion" seems quite backward. Why? Essentially, Grayscale has no incentive, no motivation, no reason to convert to an etf. Why would they? All 650,000 bitcoin are locked into their fund with no way out. They get paid based on a percentage, as you noted a very HIGH percentage, of the underlying bitcoin. The ETF landscape is cutthroat, low-margin, and destined to be filled with competition. Even if they were to retain 100% of their bitcoin under management (BUM), they would only stand to get a fee of perhaps .3% (the rate NYDIG has promised), for a whopping 85% reduction in fees. However, if they just stand pat, they will continue raking in 2% or 13,000 bitcoin per year, for doing nothing other than filing financial statements. Sure, no one will buy shares from them directly anymore, and any new Trust they set up is unlikely to gain much momentum, but who cares? They are highly unlikely to be able to build ANY alternative revenue stream that would ever begin to approach 13,000 bitcoin per year. If hitcoin hits $1,000,000 in 2025, that is $13 Billion for filing financial statements. So, in my view, Grayscale is now an anomaly. GBTC might eventually be the largest single investment holding anywhere, but it will forever trade at a significant discount. They simply have no reason to convert. Sure, they might offer a separate ETF, hell, they could offer it for free and coast on the revenues they get from GBTC, but GBTC will forever be a trust and just sit there leaking bitcoin in fees. FWIW, here is Michael Sonnenshein craftly saying no way we will reduce our guaranteed fee. www.coindesk.com/... Not following how you managed to come to that conclusion. Premium ultimately comes down to demand on the secondary market, if there's net demand there will be premium, if for some reason demand disappears then there will be discount. For demand to disappear there must be another more lucrative alternative for US retirement accounts to get exposure to BTC. Without US ETF GBTC still seems to be the only play in town. From the article The annual 2% fee is egregious compared to ETF alternatives which place the GBTC at a competitive disadvantage. https://seekingalpha.com/article/4415487-greyscale-bitcoin-trust-buying-bitcoin-at-a-discountBTCC fee is 1% https://www.purposeinvest.com/funds/purpose-bitcoin-etfThis sounds like shitty journalism is 2% really "egregious" compared to 1%? |

"Feeeeed me Roger!" -Bcash

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15390

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

March 30, 2021, 08:59:56 PM Merited by JayJuanGee (1) |

|

This sounds like shitty journalism is 2% really "egregious" compared to 1%?

Just remember we are talking about passive investments funds. Many of those types of funds in traditional finance have commissions up to 0.25%. Many of them are actually free, as they are building block for more complex products, or are actually used to lure customers into an investment relationship. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15390

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

March 30, 2021, 09:26:41 PM

Last edit: May 16, 2023, 12:15:27 AM by fillippone Merited by JayJuanGee (1) |

|

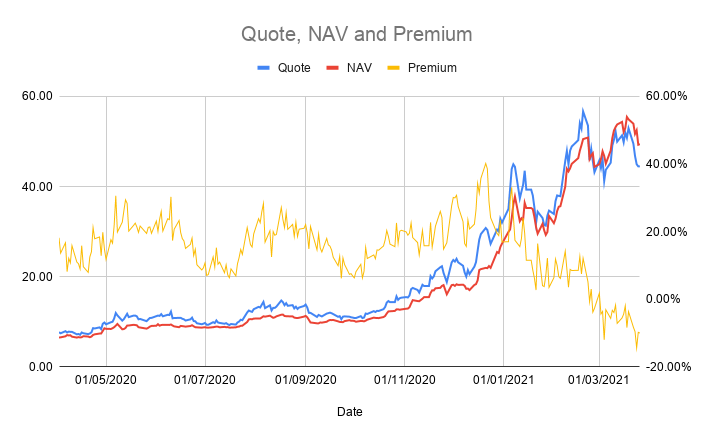

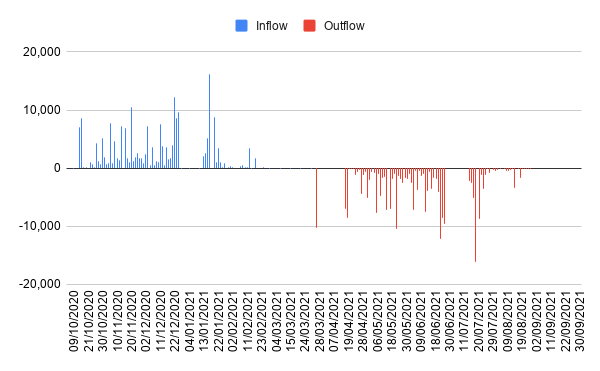

According to my computations, we should now enter a few easy days for GBTC. Looking at the inflow/outflow Graph we see that there aren't any big outflow forecasted in the next few days:  Actually, looking at the table, we see that six months ago they temporarily stopped their subscriptions. As nobody could but six months ago, now no-one is being released from their lock-out period in the next weeks.  We will see if and how much this will impact the negative premium. Selling pressure should resume about mid-April. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

DaRude

Legendary

Offline Offline

Activity: 2778

Merit: 1790

In order to dump coins one must have coins

|

|

March 30, 2021, 09:28:58 PM Merited by fillippone (2) |

|

This sounds like shitty journalism is 2% really "egregious" compared to 1%?

Just remember we are talking about passive investments funds. Many of those types of funds in traditional finance have commissions up to 0.25%. Many of them are actually free, as they are building block for more complex products, or are actually used to lure customers into an investment relationship. Oh i'm all for it, and think now would be a perfect time for GBTC to drop their fees to say 1%. Sure we can talk about averages in traditional finance, but in BTC realm the reality is the current alternatives Canadian ETF BTCC, and EBIT charge 1% and 0,75% respectively, which as i understand are not even alternatives for US retirement accounts. Until we see US ETF with 25 basis points in fees GBTC (after current glut of primary shares in 6month pipeline are absorbed) will continue on with their premiums |

"Feeeeed me Roger!" -Bcash

|

|

|

DaRude

Legendary

Offline Offline

Activity: 2778

Merit: 1790

In order to dump coins one must have coins

|

|

March 30, 2021, 09:37:27 PM Merited by JayJuanGee (1) |

|

According to my computations, we should now enter a few easy days for GBTC. Looking at the inflow/outflow Graph we see that there aren't any big outflow forecasted in the next few days:  Actually, looking at the table, we see that six months ago they temporarily stopped their subscriptions. As nobody could but six months ago, now no-one is being released from their lock-out period in the next weeks.  We will see if and how much this will impact the negative premium. Selling pressure should resume about mid-April. Think it's safe to assume that hedge funds that played on the premium are sophisticated enough to spread their sales. Doubt they sell all the shares the day they become unlocked. I'd expect their exit strategy to stretch well into September when current stoppage of share issuance will materialize. Edit: Even with the stoppage it still averages out to BTC1800/day. It'd be insane for anyone to expect any other outcome when they see that thousands of BTC will be unlocked every single day, by allowing that to happen GBTC did a disservice to the market and their customers |

"Feeeeed me Roger!" -Bcash

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15390

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

March 30, 2021, 09:42:54 PM |

|

Think it's safe to assume that hedge funds that played on the premium are sophisticated enough to spread their sales. Doubt they sell all the shares the day they become unlocked. I'd expect their exit strategy to stretch well into September when current stoppage of share issuance will materialize.

Of course, it is an oversimplification, and those dates should be taken as vague references to the selling pressure that should be luring in the market around those dates. Even that selling pressure is not guaranteed to materialise, as there are more sophisticated ways of playing the "squeeze the retail" game. One of those being the hedge with futures, as I explained on my thread: Everything you wanted to know about BTC futures but were afraid to ask! |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

mcun2000

Jr. Member

Offline Offline

Activity: 32

Merit: 29

|

This sounds like shitty journalism is 2% really "egregious" compared to 1%?

Just remember we are talking about passive investments funds. Many of those types of funds in traditional finance have commissions up to 0.25%. Many of them are actually free, as they are building block for more complex products, or are actually used to lure customers into an investment relationship. Seconding fillippone, 2% is absolutely obscene for a passive fund. Also, over time a 2% decay vs a 1% decay is a massive difference for long term shareholders. My guess is that US ETF's, whenever they come, will have fees less than 1% and more than 0.25%, just because they will have to factor in the cost for safe custody of bitcoins. @DaRude Without US ETF GBTC still seems to be the only play in town.

I use to believe this as well, and I guess I still do for a direct bitcoin play, but now I cannot ignore the risk of a permanent 2% fee and what it implies. I need to investigate if there are other options. I could try to open a Fidelity account, and move some funds there. They seem to offer BTCC to US clients. Or invest in indirect instruments, such as Microstrategy. (which I did, and believe MSTR is now fairly valued and have since moved 1/3 of my GBTC to MSTR) This will imply the negative premium will be permanent

... Not following how you managed to come to that conclusion. Premium ultimately comes down to demand on the secondary market, if there's net demand there will be premium, if for some reason demand disappears then there will be discount. For demand to disappear there must be another more lucrative alternative for US retirement accounts to get exposure to BTC. Without US ETF GBTC still seems to be the only play in town.

I think the risk of a permanent negative premium is high because investors in secondary market will be more cautious at buying GBTC. Investors see that an ETF is on the horizon, or find some way to invest in the Canadian ETF's (Fidelity seems to offer it to US investors), or do what I did and put some money into an indirect bitcoin vehicle for now, like Microstrategy, or they can wait. This will remain unless Grayscale reduces its fee. |

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15390

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

March 31, 2021, 05:34:10 AM |

|

Seconding fillippone, 2% is absolutely obscene for a passive fund. Also, over time a 2% decay vs a 1% decay is a massive difference for long term shareholders.

My guess is that US ETF's, whenever they come, will have fees less than 1% and more than 0.25%, just because they will have to factor in the cost for safe custody of bitcoins.

Absolutely. Something must change in order to have a 0.25% fee on a BTC ETF. At the moment I think the cost of custody of professional solutions, the only viable option for an institutional investor (TLSA and MSRT are doing differently, but they are not financial investors), is in the 0.5%-1%. This is massive, and ample space to decrease to to the peculiar feature of BTC: contrary to everything else in the world, storage cost are not proportional to the quantity of the gold, oil or soybean to be delivered, but it has a flat cost: securely storing 1 bitcoin cost exactly as much as storing 10,000. And as you said, cost of storage is the “floor”, the minimum fee amount for any financial product. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15390

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 04, 2021, 09:10:12 PM Merited by JayJuanGee (1) |

|

I don't know why, I missed this interview to Michael Sonnenshein, Grayscale CEO, about current situation in GBTC and future views. Grayscale’s Sonnenshein Addresses GBTC’s Collapsing PremiumGrayscale CEO Michael Sonnenshein said the crypto asset management company is taking a wait-and-see approach to filing for a bitcoin (BTC, -0.22%) exchange-traded fund (ETF). Quite interesting. Just remember that both Coindesk and Grayscale belong to Digital Currency Group, so for sure, this interview was another "tool" for Grayscale to communicate with investors and pour some water on some hot topic around GBTC (fees, competition, negative premium, ETF approval etc) |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

mcun2000

Jr. Member

Offline Offline

Activity: 32

Merit: 29

|

|

April 05, 2021, 04:05:40 PM |

|

As a GBTC shareholder, I just received an email from grayscale stating their intention to convert to an ETF. Maybe they are really serious about turning the trust into an ETF. The big question then is what will their fee be when it does happen. In case you missed it, we released a communication today regarding Grayscale’s intentions for a Bitcoin ETF ( https://go.grayscale.co/e/652383/for-a-bitcoin-etf-b11e4faf4c05/bnbhz/239595549?h=VQssTGl7o1CsRdCXWN9pgUulF29V5XvSrzO16OVrCuQ) and our initiative to convert Grayscale Bitcoin Trust (GBTC) into a Bitcoin ETF. As a summary, this reiterates that: We are 100% committed to converting GBTC into an ETF, as well as bringing all of our other products through the full lifecycle of our business model, iterated below, when permissible. The timing will be driven by the regulatory environment. When GBTC converts to an ETF, shareholders of publicly-traded GBTC shares will not need to take action and the management fee will be reduced accordingly. For more information, we invite you to read the blog post, also referenced in the 8-K we filed today. All the best, Grayscale Investor Relations Team |

|

|

|

|

Oshosondy

Legendary

Offline Offline

Activity: 1428

Merit: 1123

...gambling responsibly. Do not be addicted.

|

|

April 05, 2021, 04:55:16 PM |

|

In recent months there’s been a growing number of questions around the possibility of a Bitcoin ETF in the US, and we’d like to take the opportunity to provide clarity and context on what such a development would mean at Grayscale and for Grayscale® Bitcoin Trust (Symbol: GBTC).

First and foremost we wish to make clear: we are 100% committed to converting GBTC into an ETF.

In fact, GBTC today remains one of only two crypto funds in the world with the distinction of being an SEC-reporting company. The other fund is the Grayscale® Ethereum Trust (Symbol: ETHE).

Although only GBTC and ETHE are currently SEC-reporting companies, Grayscale uses the same business model for all of our existing products:  Each Grayscale product is at various stages of this lifecycle and our intention has always been to convert these products into an ETF when permissible.

We understand that for many, the public discourse around ETFs may seem novel and impactful, but this is a subject that Grayscale has been examining closely from both a commercial and regulatory perspective for several years.

Today, we remain committed to converting GBTC into an ETF although the timing will be driven by the regulatory environment. When GBTC converts to an ETF, shareholders of publicly-traded GBTC shares will not need to take action and the management fee will be reduced accordingly. https://mobile.twitter.com/BarrySilbert?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1372173279742545928%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fwww.coindesk.com%2Fgrayscale-offers-new-trusts-to-invest-in-five-more-cryptos-including-filecoin-chainlinkhttps://grayscaleinvest.medium.com/grayscales-intentions-for-a-bitcoin-etf-b11e4faf4c05 |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10153

Self-Custody is a right. Say no to"Non-custodial"

|

As a GBTC shareholder, I just received an email from grayscale stating their intention to convert to an ETF. Maybe they are really serious about turning the trust into an ETF. The big question then is what will their fee be when it does happen. In case you missed it, we released a communication today regarding Grayscale’s intentions for a Bitcoin ETF ( https://go.grayscale.co/e/652383/for-a-bitcoin-etf-b11e4faf4c05/bnbhz/239595549?h=VQssTGl7o1CsRdCXWN9pgUulF29V5XvSrzO16OVrCuQ) and our initiative to convert Grayscale Bitcoin Trust (GBTC) into a Bitcoin ETF. As a summary, this reiterates that: We are 100% committed to converting GBTC into an ETF, as well as bringing all of our other products through the full lifecycle of our business model, iterated below, when permissible. The timing will be driven by the regulatory environment. When GBTC converts to an ETF, shareholders of publicly-traded GBTC shares will not need to take action and the management fee will be reduced accordingly. For more information, we invite you to read the blog post, also referenced in the 8-K we filed today. All the best, Grayscale Investor Relations Team Well one thing is "being serious" about converting GBTC into an ETF - but another thing is getting approval - which has been being requested by a variety of companies since about 2014-ish - starting with the Winklevoss petition and many subsequent denials.. . sure, maybe "this time is different", and there is a certain amount of arrogance (or is it telegraphing of confidence?) in regards to Grayscale obtaining approval amongst some other possible equal if NOT some superior competitors - which yeah, some of the latest speculations have seemed to suggest that the US govt has waited so damned long in making any kind of approval that they would likely be forced into approving several ETFs at once and letting the various ETFs providers fight it out (again assuming that Grayscale might have some insight into some kind of pending approval(s) in the ETF direction in the USA). We surely live in interesting times no matter the direction of ETF approvals in the USA, whether it is: 1) ongoing delays in approval (which likely is going to cause more and more traction of BTC ETF products in other countries - which surely would be an uncomfortable USA position), 2) denial of BTC (and presumably providing some kind of rationale that makes sense - which likely leads to similar problematic situation as described in scenario 1 above), or 3) approval of one or more ETF(s)... (another uncomfortable position in terms of how much control the US Govt might have in terms of the signal that such an approval would give - including likely outrageous BTC price appreciation - which the US Govt is NOT very comfortable with such a scenario, either). No matter what happens, it seems, US Govt is likely uncomfortable with this BTC asset class that is continuing to grow into some kind of asset class that cannot be kept off the radar. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

Oshosondy

Legendary

Offline Offline

Activity: 1428

Merit: 1123

...gambling responsibly. Do not be addicted.

|

|

April 06, 2021, 06:53:11 PM Merited by JayJuanGee (1) |

|

No matter what happens, it seems, US Govt is likely uncomfortable with this BTC asset class that is continuing to grow into some kind of asset class that cannot be kept off the radar.

I do not think US government is uncomfortable with BTC asset class. Grayscale seek for Bitcoin ETF in 2016 but withdrew because of the US government stance about it. In 2016, bitcoin marketcap was within $300 million to around $2 billion and highly volatile, bitcoin is not as strong as it is now as at then. If US government turned down bitcoin ETF at the time, it should not be a surprise. But with the marketcap of over a trillion, Grayscale that withdrew from what they wanted (bitcoin ETF) in 2016 is now being positive about it. Bitcoin having a marketcap of over 1 trillion is a certainty that the first bitcoin ETF in USA will soon be in existence. According to the news I have read about this, Grayscale are so positive about this, which I believe it is as a result of positive feedback from US government. Total AUM: $46.1 billion |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15390

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 06, 2021, 11:16:45 PM |

|

As I have been busy with IRL stuff, it's nice to see that someone else kept the thread updated with latest news. Regarding the conversion I would like to signal a recap by the obvious Coindesk: Grayscale ETF Announcement May Shore Up GBTC Discount, Analysts SayGrayscale Bitcoin Trust shareholders now know they’re not going to be left behind in the bitcoin (BTC, -1.4%) exchange-traded fund (ETF) race, and that may help alleviate the discount at which GBTC has been trading for over a month, some analysts say.

On Monday, Grayscale, which is owned by CoinDesk parent company Digital Currency Group, announced it would convert GBTC into an exchange-traded fund when the U.S. regulatory environment warms to bitcoin ETFs.

The conversion would mean GBTC shareholders would no longer have to put up with a six-month lockup or 2% annual management fee. The news could bring GBTC more in line with the net asset value (NAV) of bitcoin, or at the very least put a limit on how steep the discount might go, said James Seyffart, ETF research analyst at Bloomberg Intelligence. (Currently, GBTC is trading at -5.64% to NAV, according to data from CoinDesk subsidiary TradeBlock.)

Of course, Coindesk has to show all their support toward GBTC, being part of the same group. My guess on this matter is that of course, Grayscale is converting to an ETF, but it will happen just before the SEC authorizes the first of such vehicles quoted on markets. Grayscale has the obvious incentive of being the first to be quoted, just to avoid a dramatic outflow from the fund, but also to try staying in the status quo as long as possible to maximise the fees. So my guess is that they will be leveraging a good part of their massive income (it's 35 bitcoin daily, we are talking about) to delay as much as possible the ETF approval. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15390

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 06, 2021, 11:23:17 PM |

|

Not everyone was actually satisfied thou of the negative premium: Grayscale Bitcoin Trust Assailed by Investor Over DiscountAn activist family office that owns shares in Grayscale Bitcoin Trust is demanding a tender offer to boost prices that had fallen about 8% below the value of the digital assets it holds.

As of March 31, the share price represented a $3.1 billion loss to shareholders compared with the Bitcoin it holds, according to a letter that Marlton LLC sent Tuesday to the board of Grayscale Investments LLC, the trust’s parent. Marlton declined to say how many trust shares it holds.

Wealth For You

Help us deliver more relevant content for you by telling us about yourself. Answer 3 questions to tailor your experience.

Get started

Marlton said Grayscale wasn’t doing enough to increase shareholder value. Digital Currency Group Inc., which controls Grayscale Investments, authorized the purchase of as much as $250 million of trust shares last month in an effort to buoy prices. Grayscale Investments said on Monday that it intends to reapply to the Securities and Exchange Commission to convert the trust into a Bitcoin exchange-traded fund, a process it abandoned in 2017.

If I were a family hiring a family office to buy GBTC shares I would be ashamed of my gullibility. Pretending the management to do something in favour of someone as stupid as buying a 2% passive tracker fund. Sadly for this family office, there is nothing the management can do, not I think it would be within their management to pick winners and losers within their shareholder base. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|