GBTC Liquidity, Trading and ShortingBI ETFs, Global Dashboard

GBTC Shrugs Off OTC Label, Signaling Demand for U.S. Bitcoin ETFContributing Analysts Eric Balchunas (Strategy)

(Bloomberg Intelligence) -- The Grayscale Bitcoin Trust (GBTC) dominates trading among global cryptocurrency funds despite being listed over the counter, indicating to us that a U.S. spot Bitcoin ETF would be an immediate success. GBTC's structure has left it at a discount for months, meaning it no longer acts as a leveraged bet on Bitcoin. (09/30/21)

1. Volume Dominance Despite OTC TradingGBTC dominates Bitcoin funds globally, with more than $400 million in average daily notional trading in 2021, despite its over-the-counter status. BTCetc-ETC Group Physical Bitcoin (BTCE GR) is a distant second at $35 million a day, followed by Bitcoin Tracker One (COINXBT SS), the first Bitcoin exchange-traded product, at $15 million. Bitcoin ETPs are available in Brazil, Canada, Switzerland, Sweden and Germany. 3iQ's Bitcoin Fund (QBTC/U CN), a closed-end fund, has surrendered the trading lead in Canada to Purpose Bitcoin ETF (BTCC CN), which launched Feb. 24. GBTC's volume indicates to us that a U.S.-listed spot Bitcoin ETF would likely dominate global cryptocurrency-fund trading. The SEC has repeatedly rejected ETF proposals, citing concerns about market oversight, but may approve a futures-based ETF in 4Q. (09/30/21)

|  |

| Bitcoin Funds Trading Turnover ($ Volume) |

2. No Longer a Leveraged Play on BitcoinContributing Analysts Eric Balchunas (Strategy)

A limited supply of shares amid surging demand underpinned GBTC's historical premium, causing it to act like a leveraged bet on Bitcoin, but that trend ended this year as the fund descended into a discount. In six of the seven biggest peaks to troughs (and vice versa) from 2017-21, GBTC's swings were more extreme than Bitcoin's. From March 2020 through early 2021, GBTC had its most extreme divergence, beating Bitcoin by 181 percentage points. GBTC underperformed by 41 points from late January to mid-April, though, and has since traded close to the cryptocurrency. If GBTC can convert to an ETF, it could again be used as a leveraged play as the discount closes to zero. (09/30/21)

|  |

| GBTC's Return vs. Bitcoin's |

3. Collapsing Short Positions and No OptionsShort interest in GBTC has plummeted to 0.3% after rising steadily since its public listing in May 2015 to a peak of 9.74% in April 2020, during the height of coronavirus-related volatility. The ability to short a fund adds to its appeal for some investors -- especially hedge funds -- but borrowing GBTC was expensive. It cost 5.5-15% in 2020, with an average of 10.74%, according to S3 Partners data. Since June, though, the rate has averaged only 1.3% as GBTC traded at a steep discount. GBTC lacks options, limiting its liquidity and the ability of market participants to hedge risks.(09/30/21)

|  |

| GBTC Short Interest as % of Shares Out |

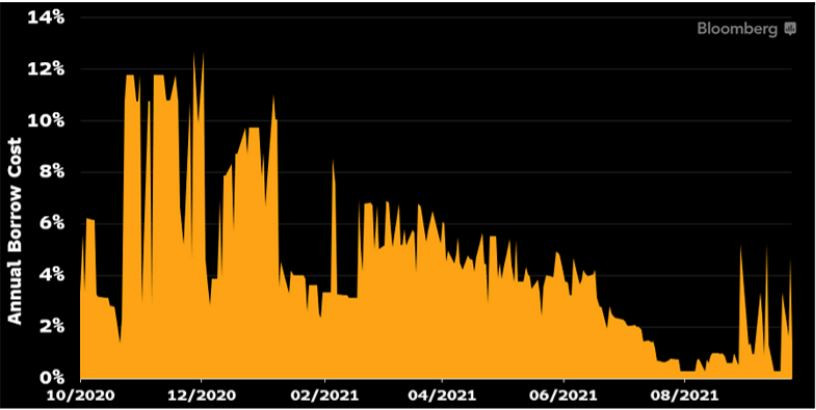

4. Historical Cost to Short GBTC Varies Wildly(09/30/21)

|  |

| GBTC Borrow Rates |

Costly GBTC Beats Bitcoin-Fund Competitors in All But Tracking The Grayscale Bitcoin Trust (GBTC) has maintained its global dominance in Bitcoin-fund assets and liquidity in the absence of a U.S.-listed cryptocurrency ETP, but that could change as more competitors enter the market. GBTC trails Bitcoin performance by thousands of percentage points over the past five years and charges a relatively high 2% fee. (09/27/21)

5. Competing With Bitcoin Funds Outside U.S.The SEC has repeatedly rejected Bitcoin ETP proposals since the Winklevoss twins filed the first in 2013. The lack of a U.S.-listed ETP has helped GBTC approach $30 billion in assets despite trading over the counter and charging 2% annually. GBTC launched in September 2013 as a private trust and has benefited from that first-mover advantage. It dominates in assets and liquidity globally, even though Bitcoin ETPs available in Europe and Canada offer a more efficient structure. GBTC's fee is substantially higher than the average ETP's yet in-line with other older publicly traded Bitcoin funds. Bitcoin ETFs launched in Canada in February and have attracted billions in assets, with two funds nearing $1 billion each. GBTC's inefficient structure has underpinned its poor performance in 2021. (09/27/21)

|  |

| Traded Bitcoin Funds -- Tale of the Tape |

6. Retail Competitors Available in U.S. But IgnoredIn the U.S., many private equity funds and hedge funds invest directly in crypto assets, but GBTC was the only Bitcoin fund that retail investors could buy until February, when the Osprey Bitcoin Trust (OBTC) began trading. It now has $120 million in assets. In July, Stone Ridge and ProFunds launched open-end funds that hold Bitcoin futures, but neither one has attracted much interest. Investors may prefer an ETF (or at least a tradeable fund) and funds that hold Bitcoin directly, rather than futures. Institutional Bitcoin products launched by Stone Ridge and VanEck in 2019 failed to gain assets and liquidated. Wilshire Phoenix, after its planned ETF was rejected, submitted an S-1 proposal that could be a direct competitor to GBTC. (09/27/21)

|  |

| Public U.S. Bitcoin Funds -- Tale of the Tape |

7. Tracks Bitcoin Poorly Despite High CorrelationGBTC holds Bitcoin directly yet doesn't replicate its price moves. The gap has widened in 2021 as GBTC collapsed into a persistent discount. From 2016 through 2020 the fund had an 85% daily and 75% weekly correlation to Bitcoin's price, while maintaining a daily beta of 1.052 to the cryptocurrency. Bitcoin returned about 2,900% in the period, and GBTC roughly 2,600%. This year, Bitcoin is up 54% and GBTC just 12%, despite maintaining a 90% daily correlation and a beta of 1.04. These differences add up: Since 2016, GBTC has trailed Bitcoin by more than 4,000 percentage

points. (09/27/21)

|  |

| GBTC vs. Bitcoin Performance |

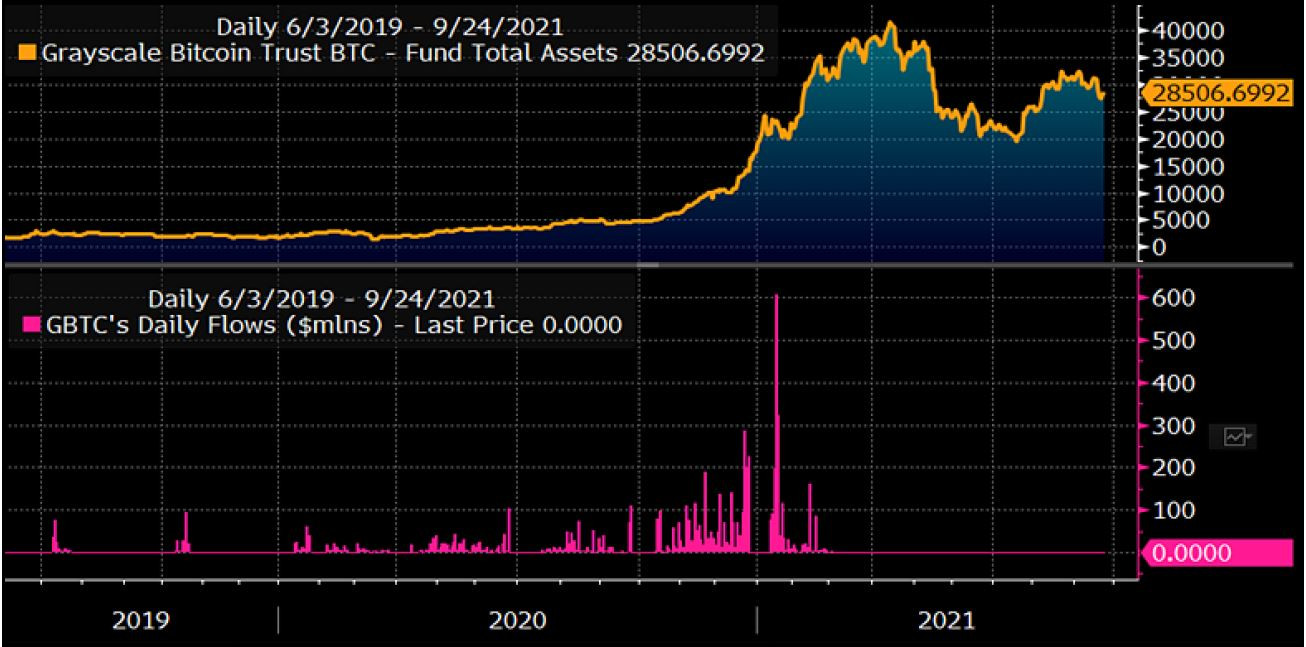

8. Unhindered by Price Swings, InefficienciesBitcoin's price affects the value of GBTC's assets, but the trust pulled in money amid all market conditions when it was still open to new investors. With no redemptions allowed, GBTC's assets grew faster than Bitcoin's rate of return, highlighting demand for access to the cryptocurrency within the traditional financial system. Daily inflows peaked at more than $600 million on Jan. 19, shortly before the fund was closed to new investors. Bitcoin's December 2017 price of about $20,000 coincided with GBTC assets of $3.2 billion. The cryptocurrency's price has since more than doubled, while GBTC's assets have swelled about ninefold to nearly $30 billion after reaching $40 billion (09/27/21)

|  |

| GBTC Assets & Flows ($ Billion) |

9. Suite of Crypto Trusts Continues to ExpandGrayscale has a suite of 15 trusts, with 13 focused on individual crypto assets and two holding baskets of cryptos. Each is at a different maturity and not all trade over the counter. The largest after GBTC, the Grayscale Ethereum Trust (ETHE), operates identically to its sibling, but holds Ethereum instead of Bitcoin. It has a history of even more extreme premiums than GBTC, peaking at 2,022% when it began trading, but now stands at a discount, like many of Grayscale's products. Grayscale's other single-asset trusts hold Bitcoin Cash, Ethereum Classic, Horizen, Litecoin, Stellar Lumens, Zcash, Filecoin, Decentraland, Livepeer, Chainlink and Basic Attention Token. The Grayscale Digital Large Cap Fund holds six cryptos, with 92% in Bitcoin and Ethereum. The Grayscale Defi Fund holds 10 defi-focused cryptos. (09/27/21)

|  |

| Grayscale's Second-Largest Crypto Fund (NAV<Go>) |

Gold or Bitcoin? Store-of-Value Debate Rages as Bitcoin GrowsContributing Analysts Eric Balchunas (Strategy)

The debate between gold bugs and Bitcoin believers over which is the better store of value will likely persist as prices for both rise. The gold camp cites the metal's long history vs. Bitcoin's instability and lack of regulatory support. Grayscale and Bitcoin backers see the cryptocurrency as "digital gold," with superior efficiency and potential. (09/22/21)

10. Complementary Assets in a PortfolioContributing Analysts Mike McGlone (Strategy)

Rather than positioning Bitcoin and gold as polar alternative assets, we think they can complement each other in a portfolio. Gold has better applications in some cases, and Bitcoin in others. Bitcoin is more transportable and divisible, and more applicable as a currency. But gold is more stable, with a proven track record. Both offer virtually no correlation to traditional asset classes, with gold's correlation at 0. Still, Bitcoin is currently most aptly characterized as a speculative asset. For these reasons and due to the potential for Bitcoin to eventually become a store of value, many institutions and investors are converting at least small portions of their gold positions to Bitcoin as a hedge and diversifier. (09/22/21)

|  |

| Comparison: Bitcoin vs. Gold |

11. U.S. Tax Rates More Favorable for BitcoinContributing Analysts Mike McGlone (Strategy)

Gold and Bitcoin have different long-term U.S. tax rates (on investments bought and sold over more than one year). For short-term capital gains (on investments bought and sold within a year), both are taxed at the individual's income-tax rate. Bitcoin is taxed in the same way as stock ownership, with a long-term capital-gains rate of 0-20%, depending on income level. Gold is taxed as a collectible and therefore carries a long-term rate of 28%, irrespective of an investor's income.(09/22/21)

|  |

| Bitcoin vs. Gold Long-Term Tax Rate |

12. Limited Supply and Fixed InflationBitcoin is already a store of value within the world of cryptocurrencies and could be embraced on a wider scale. Gold has been accepted as a store of value globally for centuries, but the amount available on Earth is finite and the mining rate has been relatively stable, with World Gold Council estimates of above-ground supply increasing about 1-2% a year. Bitcoin's limited supply and controlled inflation are its monetary backbone. The last Bitcoin is expected to be mined in 2140 (coded to a maximum of 21 million coins), according to a fixed, disinflationary schedule. Gold supply theoretically could jump from the discovery of a massive deposit or the advent of space mining, though either is unlikely. Potential concerns for Bitcoin include a blockchain hack via quantum computing and government bans. (09/22/21)

|  |

| Bitcoin vs. Gold: Supply & Inflation |

13. Medium-of-Exchange Edge Goes to BitcoinBitcoin is superior to gold as a medium of exchange or form of payment. Unlike gold, Bitcoin is a fixed unit of account and easily divisible and transportable. Gold isn't easily divisible on the spot, and there are potential issues with purity and verification. The ability to trace Bitcoin on blockchain ledger technology will likely prove to be a substantial advantage, especially in cross-border transactions. Digital currencies are starting to be accepted as a form of payment with vendors and retailers. Many working in the crypto community are paid in cryptocurrencies such as Bitcoin. In addition, a growing number of professional athletes and others have signed up for services that automatically convert income into cryptocurrencies upon fiat payment. (09/22/21)

|  |

| Bitcoin Easier to Use as Currency Than Gold |

14. Superior Stability, Smaller Declines for GoldBitcoin's price volatility and history of drawdowns limit its use as a store of value, and even as a form of payment. Gold supporters contend that an asset can't be a store of value when it's capable of declining 80% in 12 months, as Bitcoin has. Yet gold isn't entirely immune -- from September 2011 to December 2015, for example, the metal fell about 45% in U.S. dollar terms. Bitcoin's volatility is another concern. Since launching, prices have been 4-5x as volatile as gold's, making it difficult for merchants to accept the cryptocurrency as payment. Bitcoin's average intraday price change in the past three years has exceeded 5%. That's down from 6.4% a few years ago, while gold's volatility has been relatively stable. (09/22/21)

|  |

| Bitcoin vs. Gold-Price Volatility & Drawdowns |

15. Gold a Better Store of Value for NowContributing Analysts Mike McGlone (Strategy)

Bitcoin is still best characterized as a speculative, risk-on asset. As Tyrone Ross Jr. of Onramp Invest told Bloomberg Television in 2019, "Bitcoin is a call option on a store of value." Though some of Bitcoin's characteristics give it store-of-value potential, others currently make that non-viable. For example, since 2013, Bitcoin's value has swung by thousands of percentage points, while gold has been comparatively steady. Bitcoin enthusiasts view its payoff scenario as similar to a call option with asymmetric upside potential. (09/22/21)

|  |

| Bitcoin vs. Gold-Price Percentage Changes |