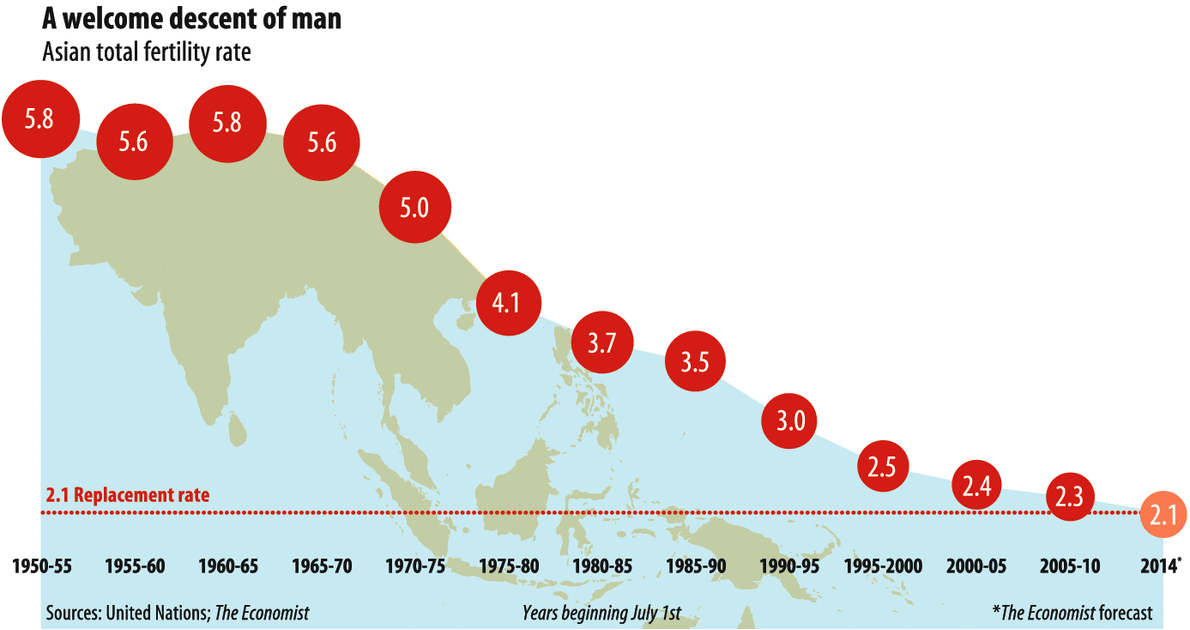

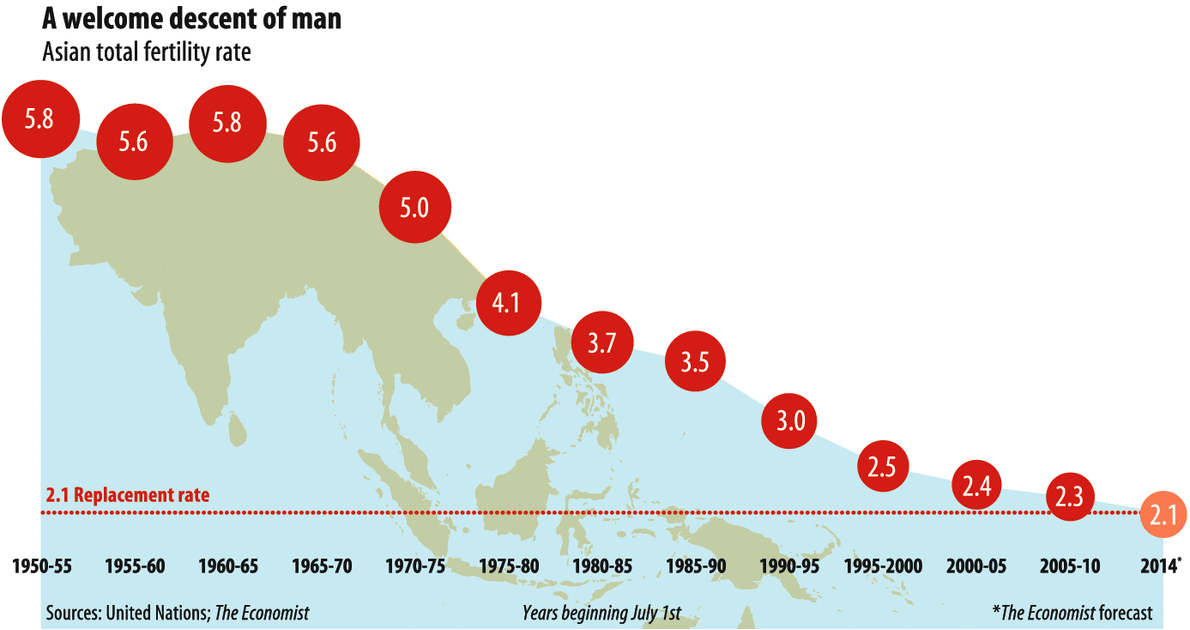

here is the explanation for your low iq problem  That particular graph of the population projection for Africa is not that enlightening. Africa does have a higher population growth rate but it appears to only be lagging the general trend not defying it.  Looking at African population projections in the context of the entire world provides a much better idea of what the future may hold.  The is no reason to think that Africa will be immune from the worldwide trend towards lower fertility rates. Once they start to decline the process can proceed rather quickly. Look at what happened in Asia over the last 50 years.  I have seen no data to convince me that Africa will not follow the rest of the globe into lower fertility rates.

your analysis would make perfect sense to someone with a marxist world view that ignores nations and borders and sees the importing millions of blacks and muslims to reduce global inequality as a normal thing.

There is something to be said for a worldview that looks beyond the arbitrary construct of national borders. Sometimes it is worthwhile to remember that we are all in this together trying to eke out living on the same pale blue dot.  Does this mean be stupid ignore reality and the flaws of others to your detriment? Not at all, I personally would not be all that interested in a large number of uneducated low IQ individuals moving into my neighborhood regardless of their race ethnicity or nationality. The best approach to these problems is to look at the world as it is, acknowledge politically inconvenient and unpopular truths and then do what we can to develop global solutions for global problems. Racism is counterproductive.  A political cartoon from 1882, showing a Chinese man being barred entry to the "Golden Gate of Liberty" following the passage of the chinese exclusion act. The caption reads, "We must draw the line somewhere, you know." |

|

|

|

This guy became a very wealthy man while the Russian people struggled to survive.

We are now supposed to believe him.

If you take Khodorkovsky words as a true window into the thoughts of those that oppose Putin then one can infer the following. 1) That Putins opponents think sanctions will fail. 2) That they do not see a way to remove him from power in the short term 3) They believe the can destabilize Russia in the medium term leading to civil strife and presumably the breaking away of portions of the country. Alternatively, Khodorkovsky could just be saying provocative things to get attention. |

|

|

|

I always experience a twinge of annoyance whenever I see a link like this. Hey check out my cool idea. Click link... Critical Error ... You lack the skills necessary to continue. I strongly suspect that when I am 80 people like me will be like the old folks of today who cannot figure out email. Coding appears well on its way to becoming a basic primary skill alongside reading writing and arithmatic. For us older "illiterate" folks in established careers the best approach to this problem is likely an acceptance of our pending obsolesce coupled with an investment in our children and grandchildren. I put my kids in the following program. https://www.codingwithkids.com/#Coding with Kids programs advance students from the beginnings of computer programming to full mastery of computer science needed for the high school AP exam and beyond. They are designed to accommodate children of various experience levels and learning capabilities. Through our programs, we strive to inspire children to become innovators and creators in order to be successful in the STEM careers of tomorrow.

|

|

|

|

i don't expect you to relate them to the people you've known i expect you to accept the overwhelming statistical evidence that blacks and muslim immigrants have a greater propensity to violent and sexual crimes and maybe go a step further and agree that welcoming millions more of them into your country isn't the smartest idea. but that's something else. stereotypes might be exaggerations and assumptions but they have to be based on real things that exist or they wouldn't be offensive. calling a jew stupid and lazy doesn't have the same ring to it as calling him fagin or shylock.

I would not dispute this. Different populations of humans are different for both genetic and cultural reasons. I would very much disagree with anyone who goes from there to say that we have a Black, or a Arab, or a Jewish problem. Humanity as a whole has a violence problem, we have a rape problem, we have collectivism problems, and fiat problems and perhaps biggest of all we have a low IQ problem. These problems are distributed among the entire human population and by no means are they unique to any skin tone or ancestry. Like all human traits these problems are not necessarily distributed equally among us. Focusing on skin color or racial purity is not only not helpful it obscures the larger issue and distracts from the development of solutions. i can say that if the good are outweighed by the bad it is better to have none

There are very likely other forms of life in the universe more advanced than us. This same line of violent thought could easily be applied to humanity as a whole. Ask yourself if you would accept being judged by them in the same fashion. |

|

|

|

I am now thinking perhaps anonymity is not the ticket (yet continuing to develop and consider it, as an option) and instead massive volume of micro-transactions might be more liberating. In short, to pursue my Knowledge Age theory of breaking the Theory of the Firm down to individualized production. In short, death the corporation as being too slow to even effectively use the data it is accumulating. Transparency aids competition which accelerates knowledge creation. The government can't tax to death a populous activity without declaring a global Dark Age.

…

It seems anonymity for money is mostly focused on the concept of obscuring large monetary wealth

…

I am hedging my bets by still pursuing anonymity, but I have deprioritized it somewhat (not entirely) to focus more on micro-transactions.

Edit: I am contemplating whether it is possible that fungibility could be orthogonal to anonymity.

…

So instead of just anonymity designs, I have also been thinking a lot about how to insure block chain inclusion remains permissionless.

I posit that the paradigm of wealth stored in forms that others can easily emulate, tax, and expropriate is dying.

…

Also I admit there will perhaps be a transitional phase from the economy we have to the Knowledge Age (and perhaps a totalitarian interlude, but isn't that my point about what is dying), so I have not yet tossed aside anonymity entirely. But I am increasingly seeing it as an albatross around my neck as it seems to mess up everything with scalability and still not give the assurances I wanted when I was originally so concerned about needing anonymity. i am still working through the details of it all, so let's see where I end up with my conclusions. If there is useful anonymity that integrates holistically with scaling, then I will be more positive about adding it so people who feel they need it can. But I also worry that they are creating for themselves a false sense of anonymity (and may be later shocked that their actions were not anonymous).

I strongly agree with your recent line of thinking especially the parts I selectively highlighted above. |

|

|

|

Why is it I think they are the same guy? Equally stupid?

I would agree with equally stupid.

The world does not have a Jewish Problem. We have a big fiat problem and a big collectivism problem but there is no Jewish problem.

The Jews have been harshly winnowed over the centuries for IQ and thus have (for now) the highest average IQ of any group in the world. Because of this and historical accident they were first movers and took advantage of the massive scam of fractional reserve banking and later fiat currency better than any other group.

Fiat and fractional reserve banking is a lucrative scam. It is an economic niche that exists only due to the overall stupidity of humanity. If there were no Jews some other groups would simply have risen to occupy that unfilled role. The Germans and the Dutch have the next highest average IQ in Europe so it would probably have been one of them. Focusing on race is counterproductive other then to acknowledge that Jews may be more likely to support the status quo and oppose reform because the Jewish elite tend to dominate the status quo.

|

|

|

|

For those who do are not familiar Khodorkovsky was the richest man in Russia in 2003. Forbes placed him 16th on its list of the world’s wealthiest people, with a fortune estimated at $16 billion. He was the chairman of Yukos Oil Company at the time one of the world's largest non-state oil companies. At age 23 Khodorkovsky graduated with a chemical engineering in 1986. Both his parents were engineers in Moscow who spent their entire careers at a measuring-instruments factory. Only one year after his graduation at age 24 Khodorkovsky founded the Bank Menatep one of the first private banks in Russia. How Khodorkovsky obtained funding to do this at the tender age 24 is unknown. Bank Menatep was used to buy Yukos from the Russian government during the controversial "loans for shares" auctions of in the mid 1990s. Khodorkovsky purchased Yukos for $309 million in 1992. He was 29 at the time. It is not public knowledge where the $309 million dollars to purchase Yukos came from. One major clue, however, can be found what happend shortly after Khodorkovsky arrest in 2003. Shortly after Khodorkovsky's arrest on tax evasion, fraud, and other economic crimes, but before it was clear that Russia was going to nationalize Yukos the following undereported news item broke. Control of Mikhail Khodorkovsky’s shares in the Russian oil giant Yukos have passed to renowned banker Jacob Rothschild, under a deal they concluded prior to Mr. Khodorkovsky’s arrest. Voting rights to the shares passed to Mr. Rothschild, 67, under a “previously unknown arrangement” designed to take effect in the event that Mr. Khodorkovsky could no longer “act as a beneficiary” of the shares. Mr. Rothschild now controls the voting rights on a stake in Yukos worth almost $13.5 billion, the newspaper said in a dispatch from Moscow http://www.washingtontimes.com/news/2003/nov/2/20031102-111400-3720r/#! According to Khodorkovsky putin will succeed in freeing russia from sanctions but Khodorkovsky implied that if Putin stays in power there is a significant chance russia will not survive in its current form with its current borders. "If you are asking whether Russia will survive in its current borders when Putin goes, then I would say the chances of it surviving if he goes in the next five to eight years are bigger than if he goes in the next say 15 years"

...

Russia's political and economic situation was not tense enough for a revolution in the short term as living standards have not fallen steeply enough to anger the population.

...

Just by the time when the reserves will be running out, sanctions will be lifted on Russia

...

I cannot give you short-term forecasts about Russia but if we are talking about the next 10 years then we should expect revolutionary changes.

http://www.ntnews.com.au/business/putins-russia-is-stagnating-khodorkovsky/story-fnjbnvte-1227629505979In addition to opposition from Khodorkovsky and one would presume Billionare Jacob Rothchild, Billionare George Soros is on record for his outspoken in his opposition to Putin. Putin’s Russia has challenged both the prevailing world order, which depends on the Western powers for support, and the values and principles on which the EU was founded. Neither the European nor the American public is fully aware of the severity of the challenge.

...

the Syrian crisis deteriorated when Putin’s Russia and the Iranian government came to Bashar al-Assad’s rescue

...

I argued that sanctions against Russia are necessary but not sufficient. President Vladimir Putin has developed a very successful interpretation of the current situation with which to defend himself against the sanctions.

...

Soros calls for radically boosted western support of Ukraine with an “immediate cash injection of at least $20bn with a promise of more when needed” to help write off public debt, and help to reform the country’s energy sector to make it less dependent on Russia. http://www.nybooks.com/articles/2015/07/09/partnership-china-avoid-world-war/http://www.zerohedge.com/news/2014-10-23/george-soros-slams-putin-warns-existential-threat-russiaMr. Putin it seems has some powerful adversaries. |

|

|

|

...

I believe we are witnessing the gradual but inevitable death of nationalism and the modern nation state. A developing unity through debt if you will.

It will not happen even in at national level (as was the original claim i think), at least not forced to do so as long as they have CB backing. In Yourope it could happen I guess if ECB decides to destroy the banking system of e member, but I don't think that likely, as it will certainly be the last act of ECB. Not only is the ECB fully capable of destroying the banking system of a member it has utilized this power very recently on your own country when it threatened the destruction of the Greek banking system unless Greece capitulated politically. There will be no more emergency lending to Greek banks if the country's government fails to secure a bailout deal with lenders, European Central Bank Governing Council member Christian Noyer said on Wednesday. Speaking on French radio station Europe 1

After this threat was leveled Greece immediately capitulated and a bailout deal was announced the next day. Emergency lending assistance (ELA) from the ECB is the functional equivalent of discount window lending by the FED. It is the mechanism put in place following the Great Depression to prevent the bank runs from causing bank failures. For banks under systemic stress like those in Greece being cut off from ELA means immediate insolvency. The conditions demanded of Greece was the surrender of some 50 billion of state assets as collateral the agreement that it's bailout debt would be subject to European not greek law and the surrender of Greek control over its banking sector. One of the preconditions imposed on Greece for a deal is that it signs into law European rules that would put euro zone authorities at the ECB and in Brussels, rather than Athens, in charge of identifying and closing or breaking up sick banks.

This in turn could lead to a shake-up of the sector that could see some banks close, with losses pushed onto bondholders and possibly even large depositors. In such circumstances, there would be little that Athens could do to prevent this.

http://www.zerohedge.com/news/2015-07-13/greece-just-lost-control-its-banks-and-why-deposit-haircuts-are-still-comingThe cap on ELA aid to Greece is now being reduced in preparation for the next crisis. ATHENS Oct 7 (Reuters) - The European Central Bank on Tuesday lowered the ceiling for emergency liquidity assistance (ELA) Greek lenders can tap from the Greek central bank to 87.9 billion euros from 88.9 billion euros

http://mobile.reuters.com/article/idUSA8N11H01220151007The reduction in ELA will give the Greek government less room to maneuver when the next downturn becomes yet another banking crisis. Further concessions and transfers of sovereignty will occur at that time in exchange for another deal to kick the can further down the road. I mean no disrespect when I say this but I believe your country is rapidly transitioning from the Greek nation state to the European state of Greece. The reelection of Syrzia indicates that the majority of the Greek population is either unwilling to disrupt their dependence on government profligacy or afraid of change and will choose to continue surrendering sovereignty rather then face a economic pain. There is nothing unique about the Greek situation. All of Europe is essentially in the same boat and I fully expect Greece will soon be joined by the European states of Portugal and Spain followed by the rest of Europe. Eventually I suspect the same forces will force a consolidated Europe to surrender sovereignty to some larger supranational government. Political consolidation will not change the underlying instability or viability of the fiat system, but it may buy time and prevent widespread war. I don't think that nationalism will be dead, instead it will be on the rise, because lets face it, we are in a class war, and the last thing TPB want is to unify the people, so they are going to divide and conquer by playing the nationalist card.

Conflicts between the relatively rich and the poor certainly look like they will get worse in the near future as enraged and impoverished masses turn on both the productive elite and especially their governments demanding further assistance. Governments response (more debt) will prove ineffective and the nation state will be held up as incompetent and incapable of managing basic governance. I suspect supranational organizations will be widely promoted as the superior and only solution. The long term goal of TPTB is not to divide but to unify people under a system they control. Strong nation states and nationalism are an big obstacle to realizing this goal. As a thought experiment I suggest reading the news with the inkling that that their may be powerful actors seeking to undermine the internal cohesiveness of all nation states. No one can truly know exactly what will happen in the future but the above scenario is how I think the coming sovereign debt crisis will play out. Modern finance seems to be progressively undermining the nation state and driving political consolidation across national borders. Perhaps this will allow us to more quickly transition to something better. I certainly would not defend the track record of the nation state and strong government. A close look at WWI and WWII would disabuse any rational observer of that notion.

|

|

|

|

Ok we have gone to deep in the rabbid hole,

Banks will not call back loans en mass as a means of a "neutron bomb" trying to control us. Banks calling back loans as they learned in the 20's is the fastest way to close down shop, it signals that bank has essentially lost control and is on the brink of bankrupcy.

So it's not a choice that they will make hence my "banks never never ever call back loans"

The banks creates loans as a battery creates potential to drive a circuit, when it stops to do that it means you need to change the battery.

No one ever said banks are going to call back loans en mass globally that would be counterproductive. Selectively cutting off access to the financial markets to rogue nations that threaten the status quo, however, is a powerful tool of control and there is little reason to think it will not be used. As you noted above government response to this is will not be to let the system collapse but instead to "charge the battery" via more debt and spending. As earnings are eroded and the economy stagnates governments will simply move on a worldwide basis to supplement incomes and stimulate growth via spending, redistribution, and welfare programs. A small part of this redistribution will occur in the form of higher taxes. However, the lions share will come from increased government debt. As governments become insolvent they will find markets increasingly unwilling to service debt in their home currencies and will be forced to transition their debt to a supranational one (probably SDR's) subject to the jurisdiction of a foreign court. This will be the only way to continue supportive handouts to dependent populations. Think Greece but on a global scale. Going forward this scenario would result not in immediate catastrophic collapse but rather a slow progressive grind with individual countries going into crisis at different times while being forced to progressively surrender sovereignty. I believe we are witnessing the gradual but inevitable death of nationalism and the modern nation state. A developing unity through debt if you will. |

|

|

|

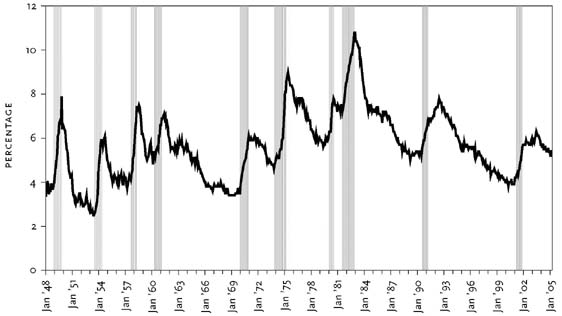

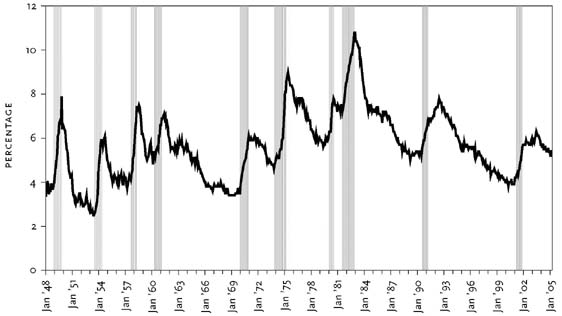

Historically, banks do call back loans. In the US the signal to do this is a rise in the federal funds target rate. This target is set by a meeting of the members of the Federal Open Market Committee occurs eight times a year. The federal funds target rate essentially determines the federal funds rate which represents the cost to the bank of procuring more reserves. Typically this rate is increased in response to inflation. The empirical evidence is strongly on the side of the view that deviations from full employment are often the result of spending shocks. Monetary policy, in particular, appears to have played a crucial role in causing business cycles in the United States since World War II. For example, the severe recessions of both the early 1970s and the early 1980s were directly attributable to decisions by the Federal Reserve to raise interest rates. On the expansionary side, the inflationary booms of the mid-1960s and the late 1970s were both at least partly due to monetary ease and low interest rates. The role of money in causing business cycles is even stronger if one considers the era before World War II. Many of the worst prewar depressions, including the recessions of 1908, 1921, and the Great Depression 1930s, were to a large extent the result of monetary contraction and high real interest rates. Figure 1: Unemployment Rate and Recessions  Government does step in to clear up the mess. This is the expected outcome of our current system. Responding to public demand government steps in and tries to halt finance induced crashes. However, government does not simply print money to mitigate the cyclical monetary crunch. True money printing would harm vested financial interests and is taboo. Instead government enters the arena meekly as the sucker borrower of last resort. Once government is ensnared the triumph of finance is complete. Government debt is paid via taxation and taxation primarily targets the upper class. Thus with the capture of government finance gains the ability to siphon wealth from the upper class.

A time honored strategy in war is divide and conquer. It is easier to subjugate a people who are fighting amongst themselves. Finance and fractional reserve divides the public into two competing blocks of victims. The poor as we have seen become ever poorer with each "business cycle". They look at the relatively well off and cry Thief! The entrepreneurs and productive increasingly suffer under ever higher tax burdens. They point to government and the welfare recipients and cry Thief!

Government does not handle this conflict well. Unable to decide between competing citizen demands it waffles. It spends to support the poor but does not raise taxes. The result is ever larger government debt. Each attempt by government to buffer the finance induced downturn simply delays the liquidation of middle classes assets by transferring that liability to the government and eventually to the upper classes via increased taxation. Bailouts are thus a transfer wealth from the productive upper classes to well-connected financial interests. Finance uses the business cycle to harvest the poor, and bailouts to harvest the rich.

The long-term costs of all this are borne out by the majority of the ill-informed public who are too busy fighting over a myriad useless conservative versus liberal disputes to address the root cause of their suffering. Meanwhile government in its misguided attempt to "help" becomes so indebted that eventually it can no longer service its loans.

Now will loans to insolvent governments be called in? Probably not as long as those governments do as they are told. It is the threat of insolvency and being cut off from future loans that will ensure these governments toe the line. |

|

|

|

I personally think you need to deposit to be able to leverage as a bank, and paying off a loan is different.. Any link to show this is not the case?

Anyways as you can see M2 hasnt actually been following the rate drop as if should, since velocity hasnt been rising deflation is set up in an economy which expects it to move afted stimilus. When it does start bonds will heavily skew and rates will have to rise fast because inflation will be rising too fast. Not sure at what point the pain threshold of the system is breached.

All you need to do is to satisfy the regulatory hurtles required to access interbank lending at the federal funds rate. It is true that this typically, but not always, requires you to be a depository institution. You asked for a link showing that it is possible to to leverage as a bank without accepting deposits. Banking is shrouded in secrecy and such information is deliberately hidden from the public but here you go. Goldman Sachs & Co., a unit of the most profitable bank in Wall Street history, took $15 billion from the U.S. Federal Reserve on Dec. 9, 2008, the biggest single loan from a lending program whose details have been secret until today. http://www.bloomberg.com/news/articles/2011-07-06/goldman-took-biggest-loan-in-fed-programIt is important, however, to keep the charade going. It would not do to have people question why banks can access funds at an artificially low cost. So with some reluctance Goldman later decided that they are in fact going to offer some token banking services. Just so you don't waste your time trying to open a Goldman Sachs passbook savings account, understand that this new bank is solely for Goldman's wealthiest customers. "It's a private bank. We can afford to do that," CEO Lloyd Blankfein told The Journal, "because we have the contacts and the balance sheet." http://www.fool.com/investing/general/2012/07/20/goldman-sachs-returns-to-classic-boring-banking-so.aspx |

|

|

|

no, when you pay off debt you deleverage and remove purchasing power from the economy. Deflation ensues.

I agree that paying off debt potentially removes some purchasing power from the economy. The amount removed is the amount of debt paid off minus the increased reserves automatically reinserted back into the economy by the FED via their manipulation of the federal funds rate. However, paying off debt in no way constrains banks from simply making more loans and adding that purchasing power back into the economy as new debt. McLeay M, Radia A, Thomas R. Money creation in the modern economy. Bank of England Monetary Analysis Directorate Quarterly Bulletin 2014 Q3Deflation ensues not from the removal of purchasing power as that can easily be resupplied at will by the banks. Deflation instead is the natural result of massive malinvestment induced by artificially low interest rates. When interest rates are kept artificially low, entrepreneurs are led to believe the income they will receive in the future is sufficient to cover their near term investment costs. In an environment where the money supply is continually expanding via debt, entrepreneurs mistakenly conclude that investments are really available for long term projects when in fact the pool of available funds has come solely from artificial credit creation. Entrepreneurs see spending in the economy and assume consumer demand exists for their projects when in fact consumer demand is artificially and unsustainably elevated. Artificially low rates produce a period of wasteful malinvestment, a "false boom" where the investments undertaken during the period of fiat money expansion are revealed to lead nowhere but to waste, overcapacity, and eventually insolvency. |

|

|

|

What happens when you service your mortgage through payments? Your saying that its not paying anything off at all? Are you not removing money from circulation?

...

Fact: paying a loan removes money from circulation. Thats common sense.

Fact: a new loan entitles the certified borrower of a state to further leverage that loan with a new one to a certain percentage. This is based on the fact that not everyone will go bankrupt or claim their stake all at once.

Fact: payment of all loans does not equal leverage of new loan entitlements, resulting in a net debt service environment. This is a delicate balance based on supply and demand with interest rates globally. This is why nash said fed controlled rates are the best we got right now until we reach asymptotically ideal money.

Sidhujag, I would challenge both your first and third "facts" above as both appear to be false. 1) You state that paying a loan removes money from circulation but while this may have been true under a historical gold standard it is not really true today. Your first "fact" follows from the concept of money multiplier. If bank lending is constrained by reserves then paying down debt would remove some multiple of that debt from circulation unless the paid funds were immediately reissued as new debt. This conceptualization of the money multiplier is an inaccurate model of our current system. In no way does the aggregate quantity of reserves directly constrain the amount of bank lending or deposit creation.

The reality is that under the modern system the amount of bank reserves do not constrain lending. Paying down debt does not lead to a sustained decrease in circulating currency. Instead as debt is paid down there is a transient dip in circulating currency and some banks may find themselves short on reserves. To replenish these reserves these banks simply borrow the needed reserved from other banks. This rate of interbank lending is called the federal funds rate. If enough debt is paid off the demand for reserves may cause the federal funds rate to climb via simple supply and demand. However the federal funds rate strictly controlled by the FED which sets a target for what this rate should be. If the federal funds rate starts to climb the FED simply drives it down to its artificial target again via open market operations. Thus the currency that was removed by paying down debt is simply reinjected back into the economy by the FED. The end effect of paying down debt is not a change in circulating currency but an increase in the central banks balance sheet. I wrote the following post exploring this in more depth and it's ultimate instability. Finance Part I: Understanding the Parasite3) In your third "fact" you state "payment of all loans does not equal leverage of new loan entitlements" You seem to be saying that debt can be paid off without more debt being taken out elsewhere in the economy. I would challenge this as also false. The only real method of getting rid of debt in our current system on a macro level is some form default with subsequent seizure of the collateral underlying the loan. Simplistic flow scenarios such as Sally owes John $100 who owes Tom $100 who in turn owes Sally $100 represent a very small portion of total debt. The article linked below does a nice job of explaining why it is mathematically impossible to pay off the national debt. http://www.zerohedge.com/news/2015-05-22/it-mathematically-impossible-pay-all-our-debt |

|

|

|

Assuming the doxer isn't a reverse troll/shill, and poopchop really is this "Izabella Kaminska" person.

Not that I really care as I only rarely stop by this thread and it's somewhat unique banter but why in the world would you assume that. This is what I remember from the last time I visited this thread. Is that dear NotPorkChops? I don't know what to believe any more...  Oh, the burn... lol Now everyone knows who I am   Thanks for outing me, Jimbo  |

|

|

|

European Union countries plan a crackdown on virtual currencies and anonymous payments made online and via pre-paid cards in a bid to tackle terrorism financing after the Paris attacks, a draft document seen by Reuters said.

EU interior and justice ministers will gather in Brussels on Friday for a crisis meeting called after the Paris carnage of last weekend.

They will urge the European Commission, the EU executive arm, to propose measures to "strengthen controls of non-banking payment methods such as electronic/anonymous payments and virtual currencies and transfers of gold, precious metals, by pre-paid cards," draft conclusions of the meeting said.

...

Never let a good crisis go to waste. Jamie Diamon (JPMorgan chairman) says that bitcoin will be stopped and Axel Weber (UBS chairman) says Bitcoin has no future. http://www.financemagnates.com/cryptocurrency/news/jpmorgans-jamie-dimon-bitcoin-will-be-stopped/http://www.cityam.com/228544/bitcoin-has-no-future-says-ubs-chairman-axel-weber-at-bank-of-englands-open-forumWhat this means is that the banking elite have decided that cryptocurrency is a threat and that they will use their control of government to suppress that threat. It is no coincidence that you suddenly see talks of a crackdown less then a month after powerful bankers make public denunciations. Bitcoin will be corralled and the exchanges increasingly brought under regulation and control. This will allow systemic de-anonymization. Virtual currencies resistant to de-anonymization will be outlawed entirely and their use made illegal. Tax laws will be harshly enforced and excess regulatory requirements created making transactions in cryptocurrencies more costly than fiat. The pressure will be deliberately and continuously ratcheted up depressing both growth and adoption of crypto. The near term future will be dominated by electronic centralized fiat probably SDRs and all competitors can expect to be actively suppressed. All of this is to be expected. Expectations Bitcoin rising exponentially are in my opinion optimistic. Although very large short term gains are possible and even likely between now and when government pressure is applied in earnest a crackdown is inevitable. The interesting question is what happens after the crackdown. Worldwide SDR fiat will buy time maybe even a generation or two of kicking the can but it will eventually fail for the very reasons our current nation-state fiat system is failing. For bitcoin to reach the lofty heights so many here dream of I believe the following conditions must be met. 1) Bitcoin must maintain enough decentralization over time to avoid outright government seizure. The more centralized bitcoin becomes the more vulnerable it becomes to an attack by centralized interest. In the immediate future governments will likely settle for suppression via de-anonymization, costly regulations, and taxation. Should bitcoin become centralized enough to allow the network to be taken over by a few court orders and a handful of police you can be confident that those court orders will materialize. 2) Everyone buying or mining bitcoins right now must die of old age. The volatility inherent in having massive sums of bitcoin in the hands of a so few gives bitcoin aspects of a pyriamid structure. This structure has been useful in motivating individuals to spread bitcoin and is in fact instrumental in bitcoins success. However, it is also a determent to confidence and long term investment. As early investors and their descendants die off the pyramid structure will progressively fade away. As coins become increasingly distributed over time the problem will fade. 3) Bitcoin must maintain technological relevance. Powerful competitors to bitcoin will arise. Such competitors will not only need to overcome bitcoin's network effects but they will also need to maintain decentralization over time. Probably the biggest advantage of the current bitcoin distribution is the huge amounts of bitcoins that have been mined by a technologically savvy and very libertarian leaning population. This gives the community an inherent resistance to centralization that is likely to be far stronger than that of any future competitor. I have seen many argue that bitcoin will either going to "the moon" or going to zero over the next few years. Personally I expect a very different outcome. I believe we are in for a short (few years) of bull run followed by a prolonged and sustained multi decade stagnate market as bitcoin is actively and successfully suppressed. Only as the yet to be born worldwide SDR fiat regime starts to crumble will bitcoin have a chance to reach "the moon". |

|

|

|

NO! Gawd  If every race is identical, why do races outside of Africa have Neanderthal DNA? Why do blacks have 20% higher blood testosterone level? Why do Asians seem to test lowest for psychopathic character traits? Even men and women from the same ethnic group aren't similar. Claiming people from different groups are identical is just hilarious. It's always the far leftists pulling this crap too. A bias to support their ideology of collectivism. Nevermind the fact that liberalism is inherently a mental disorder based on inferiority complex where you can only relate with groups deemed weak, inferior, or underdogs in general. It's a shame the political and social narative of the modern world is shaped entirely by people with mental disorders. A fucking good post and I agree with everything you said! Now, if only the world could sort out it's Jewish Problem once and for all! The world does not have a Jewish Problem. We have a big fiat problem and a big collectivism problem but there is no Jewish problem. The Jews have been harshly winnowed over the centuries for IQ and thus have (for now) the highest average IQ of any group in the world. Because of this they were first movers and took advantage of the massive scam of fractional reserve banking and later fiat currency better then any other group. Banking is a lucrative scam. It is an economic niche that exists only due to the overall stupidity of humanity. If there were no Jews some other groups would simply have risen to occupy that unfilled role. The Germans and the Dutch have the next highest average IQ in Europe so it would probably have been one of them. Focusing on race is counterproductive other then to acknowledge that Jews may be more likely to support the status quo and oppose reform because the Jewish elite tend to dominate the status quo. |

|

|

|

As the father of 3 mixed children myself (wife is Asian and I am white) I have to call you out on this. You misquoted me entirely. I said both Caucasian and Asian genes are recessive compared to African genes. You being white and marrying an Asian woman (wow, who would have guessed nerdy white guys obssesed with Asian women on a Bitcoin forum???) doesn't really have anything to do with what I typed. There's plenty of half white, half asian girls that can pass for full white or full asian. Neither group's traits completely obliterate the others making one of the participants seemingly function only as junk DNA. You still have no idea how recessive and dominant genes work. Maybe you should do some reading. And stop being an asshole. No, I think you have no idea how anything works, keep trying to push your cultural Marxism though, claiming everyone that walks the earth is identical little clones. Every group is different from both physical and behavioral aspects, because that is the purpose of evolution, to create differences, not to create Marxism. You should really go join the fiat world where your delusional view is commonplace. Who said anything about little clones? The children of born of mixed couples are far more varied genetically than the offspring that result inbreeding small groups. Such children are about as far from little clones as you can get. You seem to be confusing "racial purity" with genetic diversity when such purity is in fact the polar opposite of diversity. If anyone is closer to a "little clone" it is small groups wall themselves off genetically refuse to consider mates beyond their local group. Such inbreeding allows both recessive traits and recessive diseases to cluster. When this happens you will see more pure ebony Africans and more blond blue eyed Europeans but you will also see more sickle cell anemia and more familial dysautonomia (recessive diseases of Africans and Ashkenazi Jews respectively) |

|

|

|

Two of my children have a brown hair as opposed to my wife's black and though all three of my children have brown eyes they are a far lighter shade of brown then that of my wife. People often ask my wife if her husband is western after seeing my children as they can tell they are mixed. ^^ DNA testing?  jk. Just a real world example of Intermediate Expression and Polygenic traits. There are many exception to simple autosomal dominant inheritance. The model of hair and eye and skin color as dominant and recessive is an oversimplification. http://anthro.palomar.edu/mendel/mendel_3.htm |

|

|

|

...

Since the Caucasian genes are recessive, this is how it turns out nearly every single time in these kinds of offspring, the child looks nothing like the white parent. From a strict biological and natural selection point of view, the purpose of reproduction is solely to spread your genes into the future. In the scenario above, what she has done is basically pass on her genes as non-influential junk DNA, while the African genes determined almost the entire outcome of the child where it doesn't resemble one of the parents at all.

Of course there will be tons of Marxists coming along to claim that mentioning African genes are dominant and Caucasian and Asian genes are recessive is "da raycism", because it doesn't take a genius to figure out that whatever genes compromise the recessive groups would basically be made extinct by full integration between all groups. This infuriates the common Marxist because it blows the lid off their fake narrative where those groups of people tend to constantly push for things like conservation of variety in animal species, yet they would be pushing for the exact opposite in this case, the extinction of the recessive human groups on purpose.

As the father of 3 mixed children myself (wife is Asian and I am white) I have to call you out on this. Despite my own very recessive traits very light brown/dark blond hair and blue eyes and my wife's "dominant genes" dark black hair and dark brown eyes my genetic contribution is quite obvious. Two of my children have a brown hair as opposed to my wife's black and though all three of my children have brown eyes they are a far lighter shade of brown then that of my wife. People often ask my wife if her husband is western after seeing my children as they can tell they are mixed. There would be no "extinction" of certain features in the case of complete mixing of the population. Recessive traits would simply get increasingly rare and only up to a point. For example, blue eyes would get rare but would not vanish completely. As they are considered by many to be attractive the reproduction advantage of having them would increase as they became increasingly rare causing blue eyes to gradually spread through the population over time. The largest advantage of marrying someone that is not similar to you genetically is the dilution of harmful recessive genes. Mixed children have been shown receive both a height and an IQ advantage which is thought to be due to the dilution of harmful recessive genes. http://www.dailymail.co.uk/sciencetech/article-3146070/Mixed-race-relationships-making-taller-smarter-Children-born-genetically-diverse-parents-intelligent-ancestors.html |

|

|

|

The social safety net was always an illusion, and the illusion kept people in line, once people realize that it is an illusion (because it is: pension funds unfunded, printed money based welfare ,etc.) they will be angry and start to smash things.

The corporations will fight hard to mantain their power, and I see the corporatocracy strengthrening while this phony socialist economy will really bite the dust.

Either it falls into total communism, or it will fall into total fascism, but there is hardly any other choice.

The current social safety net is obviously unsustainable and promised benefits will not be paid or more more likely will be paid in devalued currency. However, it does not follow that billons will therefore starve and there will be mass population reduction. Paying for education, health care, disability benefits, and housing, for each citizen is quite expensive. Paying for food assistance much less so. The argument for mass starvation implies a complete collapse of economy and the government along with a total inability to either tax or fund anything at all. Fascist governments are not historically associated with mass starvation. Even communist USSR which did suffer from mass starvations early on eventually figured out how to manage basic food supplies and there were no further mass starvations after 1947. I am not convinced the NWO is going to be as powerful as you guys might imagine and consume the entire globe in totalitarianism with billions dead.

Agreed |

|

|

|

|