Government response to this is will not be to let the system collapse but instead to "put down more concrete". As earnings are eroded governments will simply move on a worldwide basis to supplement the incomes of the newly impoverished masses via redistribution and welfare programs. A small part of this redistribution will occur in the form of significantly higher taxes. However, the lions share will come from increased government debt.

As governments become insolvent they will find markets unwilling to service debt in their home currencies and will be forced to transition their debt to a supranational one (probably SDR's). This will be the only way to continue supportive handouts to dependent populations. Think Greece but on a global scale. Going forward this scenario would result not in immediate catastrophic collapse but rather a slow progressive grind with individual countries going into crisis at different times while being forced to surrender sovereignty.

I believe we are witnessing the gradual but inevitable death of nationalism and the modern nation state.

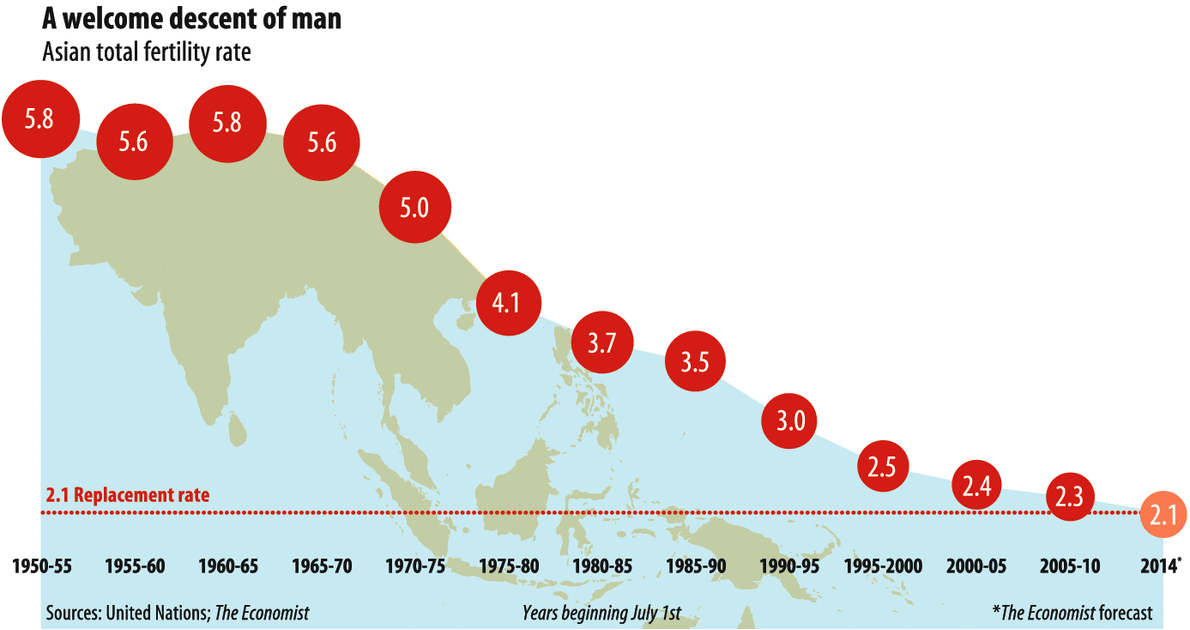

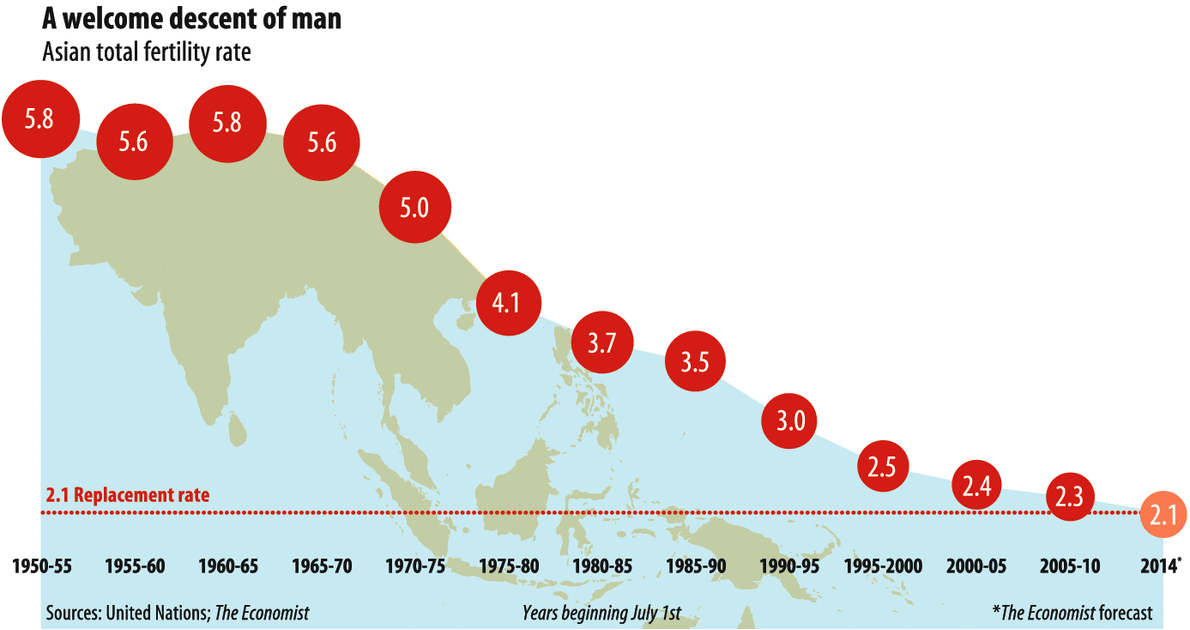

That could stall the collapse for another 20-30 years however it actually won't. You forget that rich people don't pay taxes, at all. No matter how much you force them (as if you could since they own the politicians), you cannot have the rich taxed because they will just outsource the taxes to his employees or customers. Socialism eliminates the middle class, and the middle class is the only class that pays taxes, as poors only receive poor welfare, and the rich receive corporate welfare, bail-in, bail-out money. So even if the robotization would happen, and people would be left with no jobs, the government cannot give them welfare as there would be nobody left to pay taxes. They cant just print money to give welfare because that would be instant hyperinflation. Could be a slave society with food rationing and slave labour for the poor? Maybe. But i`m more worried that eugenics and population reduction is a more likely outcome unfortunately, since war is not on the table anymore. I expect that the rich will be increasingly unable to escape taxation going forward. The wealthy will be tracked and taxed while safe havens and tax shelters are increasingly shut down. Millionaires will be hit hard and even the billionaires take a small hit. As national sovereignty is ceded there will increasingly be no place for them to go. You are correct when you note that this will only stall potential collapse. Down the road we will find ourselves with a massive and inefficient global welfare state that is stagnate and in constant danger of failure. At this point humanity will desperately need a paradigm shift. I believe the knowledge age as outlined by Anonymint in the OP represents such a shift. My exception and hope is that the the current system will survive long enough for the knowledge age to really take off and simply grow us out of the morass. As more people transition themselves from the welfare state to the knowledge age the risk of collapse will decline as the overall size and cost of the welfare state declines to an insignificant portion of the economy. The trend towards future population reduction is already well underway. It seems likely that further population reduction will occur spontaneously as a byproduct of the status quo. http://www.economist.com/news/21589151-crashing-fertility-will-transform-asian-family-baby-boom-bust |

|

|

|

|

You define money to be only sound money.

There is noting wrong with doing it that way. However, I think it may be easier for most people to understand if allow the definition of money to include what most people consider to be money and subdivide it into two groups. Sound money = your definition and unsound money = fiat and its derivatives.

I agree with you that our system is fundamentally different (mostly much worse) than traditional fractional reserve banking with sound money and deserving of its own name one that highlights its unique excesses.

|

|

|

|

@minor-transgression I more or less agree with most of your post above. You appear to be arguing that our current banking system is not a fractional reserve system because historically traditional fractional reserve banking was done with sound money gold or silver. This seems to be a debate over etymology. Do you feel my actual conclusions are inaccurate? If so put your penny down and state where and state where and why. Edit: I see you started a new thread on this topic so I will reply there. I do think you have a good point we you argue that our current system is fundamentally different then the classic fractional reserve banking of old and thus deserving of its own name. I will link to your post below. https://bitcointalk.org/index.php?topic=1165896.0 |

|

|

|

There is a 500 year financial pressure buildup we are talking about, and in our lifetimes the dam will break!

How do you know it will happen in our lifetimes? ... This time its different... 1) If they put more concrete, a.k.a. print money and buy all bubbles up, then eventually the leaked inflation becomes so big that the real earnings of the populus will be detrimentally hurt. If the inflation increases more than your earnings, and drastically more, then eventually you will starve to death as you cannot even buy the food in the stores, despite the food supply being constant. RealBitcoin you are not accounting for the predictable government response to spill over inflation. I agree with you when you say there will be spill over inflation which combined with technological progress will progressively undercut the real earnings of the majority. Government response to this is will not be to let the system collapse but instead to "put down more concrete". As earnings are eroded governments will simply move on a worldwide basis to supplement the incomes of the newly impoverished masses via redistribution and welfare programs. A small part of this redistribution will occur in the form of significantly higher taxes. However, the lions share will come from increased government debt. As governments become insolvent they will find markets unwilling to service debt in their home currencies and will be forced to transition their debt to a supranational one (probably SDR's). This will be the only way to continue supportive handouts to dependent populations. Think Greece but on a global scale. Going forward this scenario would result not in immediate catastrophic collapse but rather a slow progressive grind with individual countries going into crisis at different times while being forced to surrender sovereignty. I believe we are witnessing the gradual but inevitable death of nationalism and the modern nation state. |

|

|

|

A rather uninteresting article came out on Singapore in this weeks edition of the Economist. What was interesting, however, was one of the comments that was much more informative than the actual article. As I previously mentioned Singapore as a potential safe haven i have copied the interesting parts. Tonys View

Singapore has held elections every 4.3 years on average (the PAP has won 13 straight general elections in the 52 years between 1959 and 2011). Indeed, one election every four years is also the most common interval between elections (it happened 7 out of 12 times).

In the 2011 elections, the PAP won 60.1% of the popular vote on a 93.2% voter turnout. The PAP had similar numbers in the 1991 elections (61%) and 1997 elections (65%) -- but this improved in the 2001 elections to over 75%. Most political leaders can only dream of such voter endorsement.

The last time a British political party managed to win 60% of the vote was almost 150 years ago -- in 1868, by Gladstone’s Liberals! In 2015, Cameron’s Conservatives won only 36.9% of the vote on 66.1% voter turnout – in other words, Britain is being ruled by a party voted in by only 24% of eligible voters. Singapore is being led by a party voted in by 56% of eligible voters (who also happen to be among the best educated, smartest and most successful citizens in the world).

Singapore's election results are not surprising since polls indicate that four out of five Singaporeans have confidence in Singapore’s government, leaders, elections, judicial system and police. Google “Singapore Challenges the Idea That Democracy Is the Best Form of Governance” and see Table 5: 2014 polling data on satisfaction with government.

E.g., in response to the Gallup World Poll question “do you have confidence in your national government”, 84% of Singapore citizens polled answered affirmatively. This is the most positive perception in the entire developed world -- compared to 47% for British, 35% for Americans, 17% for Japanese, 42% for Germans, 44% for French, 23% for Koreans, 42% for Australians, 52% for Canadians, 40% for OECD average.

When asked about the Singapore government’s performance since the 2011 general election, 87% of the respondents surveyed by Blackbox indicated they were satisfied (64% said it was “good” or “very good”; and 23% felt it was “okay”). Only 10% said it was “not so good or poor”. |

|

|

|

A couple of quotes that apply to us all.  Once you stop learning, you start dying In times of change, learners inherit the earth, while the learned find themselves beautifully equipped to deal with a world that no longer exists |

|

|

|

This back an forth is uninteresting and can be simplified mathematically to the following. F(x)=  CoinCube: For any finite value of x the function is not 0

TPTB_need_war: The answer is 0

CoinCube: For a finite value of x the function is greater than zero

TPTB_need_war: Why do I have to repeat myself the answer is zero

You have a blind spot when it comes to economics. If the opportunity cost of not joining the Knowledge Age is say 10 - 100X greater than remaining in the financed NWO morass, the profit margins of the financed world go negative (in fact this has already happened in China in the export manufacturing sector!) because you have too many competing for the same small bounded value (relative to the Knowledge Age value and the unbounded opportunities for growth). Thus collapse to 0. That collapsed financed NWO system will try to survive by TOTALITARIANISM and eugenics. Q.E.D. You are arguing that the profit margins from finance will go negative and this will accelerate the trend towards a future knowledge age and the eventual elimination of finance. Are you making the case that the profit margins will go negative over the near to medium term due to an artificial bubble in finance created by current market conditions? If that is the case then I would agree with you. Or are you arguing that the profit margins from finance will go negative for the rest of human history? If so than you have yet to make your case to my satisfaction. There will always be a human desire and market to push forward consumption and a potential profit to lenders who can satisfy this demand. Since I have no reason to think that the current bubble in finance will continue indefinitly the profit margins of meeting this demand should eventually turn positive once more. Perhaps future profits from finance will follow a damped sine wave model?   |

|

|

|

CoinCube the only flaw I find in your last post is what minor-transgression points out, that if everyone is loaning money at interest, then the money supply and/or velocity of money must grow compounded.

Thus I say debt demands fractional reserves (booms, busts and dominance by an oligarchy whether it be 100% reserves or not is irrelevant, except that if you can enforce 100% reserves the booms and bust are much more contained).

Debt is pulling demand forward thus creating a vacuum of demand in the future because it proposes to assume that guaranteed production can predict the future. It doesn't anneal.

If the act of lending was seperated from the process of money creation pulling demand forward would be constrained by natural market forces. No systemic risk would develop as the cost of borrowing would rise quickly as more people borrowed. Interest rates would be set by the time preference of the market plus a risk premium. For demand deposits (funds that are available for withdraw at any time) 100% reserve would essentially require banks to hold onto these funds and not lend them out. For these deposits banks would simply to act as a secure storage area and would of course charge a fee for this service. Financial transactions could be accomidated by non demand deposits where a depositor seeking interest could be paired up with a borrower screened by the bank. Lent funds of this nature would not be available for immediate withdraw but but would be returned to the depositor as the debt was repaid or potentially not returned to the depositor if the borrower defaulted. In this model the depositor is taking the role of an investor in the borrower and assuming risk. There are legitimate and rational reasons to pull demand forward in certain circumstances . The problem arises when the process of lending is allow to pull demand forward systemically and in the process fraudulently debase the money supply. It is the inherent instability of fractional reserve that leads to the boom and bust cycles. The publics general failure to understand the problem leads naturally to the abandonment of sound money which is incompatable with the underlying fraud. |

|

|

|

BldSwtTrs I have addressed your queries below. In the interest of clarity and brevity I have reordered and condensed some of them. I suspect we are going to agree on very little but I will point out where I believe your reasoning to be flawed. Rothbard demonstratation is completly false on that point. He wrongly thinks fractional reserves are a steal. All his hostility comes from the fact that he mixes up of a free market operation and a steal…

***You are describing a system where a Central Bank exists. That system is fucked up, we agree. But you don't explain why fractional reserve without central bank would sucks.

Without a central bank, banking become basically like any business. A bank provides what the market wants: liquidity. Central banking fucked up the market because it basically subsidy the offer of liquidity.

But without central bank, the offer of liquidity depend on the demand of liquidity

Fractional reserve banking is theft and not understanding this appears to be a fundamental misconception on your part. There is a strong market demand for liquidity and fractional reserve banking has profitably exploited this demand worldwide. However, the relevant question is what competitive advantage allows fractional reserve institutions to so thoroughly dominate the market for liquidity. Fractional reserve wins the competition for one simple reason. It has lower costs. A lender participating in fractional reserve is able to lend money they do not have. They do this by promising their depositors that funds can be withdrawn anytime on demand while simultaneously lending those very same funds to the broader market. By creating multiple and therefore fraudulent claims on each unit of currency a bank is able to meet the market demand for liquidity at a lower cost than competing methods of finance. In any other industry making promises you cannot keep would be considered fraud. In this particular instance fraud is very profitable so multiple quaint but false justifications have been developed to defend it. Central banks arise naturally due to the instability created by fractional reserve banking. Fractional reserve banks are prone to failure. Everything is fine until enough people start to call in outstanding claims. Bank runs naturally arise from fractional reserve and a devastated public demands action making central banks an easy sell to an angry public. This is not rocket science and economist used to understand this. Shortly after the last wave of massive bank failures in the great depression a number of influential economists recommended the Chicago Plan. It was ignored in favor of massive government subsidy of banks via FDIC. Chicago Plan

The Chicago plan was a collection of banking reforms suggested by University of Chicago economists in the wake of the Great Depression. A six-page memorandum on banking reform was given limited and confidential distribution to about 40 individuals on March 16, 1933. The plan was supported by such notable economists as Irving Fisher, Frank H. Knight, Lloyd W. Mints, Henry Schultz, Henry C. Simons, Garfield V. Cox, Aaron Director, Paul H. Douglas, and Albert G. Hart. Suggested reforms included the abolition of the fractional reserve system and imposition of 100% reserves on demand deposits.**I know pretty well the Austrian Business Cylcle Theory and I don't think it's the main cause of the booms and busts like you seem to think. I think boom and bust might indeed be partially caused by the distortion of the money price, itself caused by fractional reserve and central banking, but it's only one part of the problem (and the main culprit is not fractional reserve but central banking.

Central banking arises naturally from the economic booms, busts and bank runs inherent in fractional reserve economics. It should not be looked at as fundamentally separate from fractional reserve but as logical growth of a fraudulent business. Much like the mob benefits from taking over the police fractional reserve banks benefit from central banking. ****You are saying that fractional reserves kill the midde class. Why in such country as China -where fractional banking exists- the middle class is expanding fast?

If you are arguing that oligarchy with fractional reserve banking is better than communism you will find no argument here. *I think you are making a mistake when you say that there is not enough money to repay the existing debt plus the interests.

Debt is a stock and money is a flow. One bank note can be used to pay a lot of debt, it just needs to circulate.

You are focusing on mutual obligations and creating an overly simplistic model. You appear to be envisioning a simplistic flow scenario such as Sally owes John $100 who owes Tom $100 who in turn owes Sally $100. Yes there is likely some overall debt that could be satisfied in this manner. However, this is a very small portion of total debt. I suggest you read this article on why it is mathematically impossible to pay off the national debt. http://www.zerohedge.com/news/2015-05-22/it-mathematically-impossible-pay-all-our-debtOur current system of coining money creates principle without creating the interest this results first in the financial impoverishment of the masses and later the impoverishment of governments. I think you are overestimating A LOT the role of finance in the world's woes, and are underestimating the role of governments (you almost describe them as victim of the evil finance) and human psychology.

On the contrary I think I have accurately described the role of finance in today’s economy. I am less certain that it will be harmful in the long run. Modern finance seems to be progressively undermining the nation state and driving political consolidation across national borders. Perhaps this will allow us to more quickly transition to something better. I certainly would not defend the track record of the nation state and strong government. A close look at WWI and WWII would disabuse any rational observer of that notion. |

|

|

|

...These conditions will never be met and thus finance will never cease to exist...

Sorry but this bolded assumption is myopic and exemplifies you still haven't grasped my conceptual insight entirely. The more that final production moves closer to the individual with lower startup costs, the more uncertainty and risk decline. When a human can fully leverage his knowledge creation, he earns such an enormous ROI that several iterations of failure between each success are a non-risk and a no-brainer decision versus slaving away as an employee. Trust me, everyone who has made this leap has never gone back. I certainly never will work for financier nor employer ever again. I mean how obtuse is it really? If you try to swat a fly 10 times before you succeed does that require finance?  To the degree this is increasingly true how is it incompatible with what I wrote above. I imagine that even in a future knowledge age there will be some projects with such a low chance of success with correspondingly high reward that it would not be feasible for an individual to pursue alone and that some form of finance would be used. Change 10 times to 10 thousand times and you have a situation that may call for finance providing the payoff justifies the investment. I don't know why I have to repeat myself. What you keep forgetting CoinCube is that relative size can force an withering paradigm into waterfall collapse into extinction. Refer the math I provided in the post about relative rate of growth.

Maybe you thought you were providing a counter-example by stating that some high ROI project might have too large of an economy-of-scale (risk of failure isn't a finance problem if the scale is small, remember my fly swatting analogy), but the entire point is the Knowledge Age will destroy the need for economies-of-scale because the production is becoming more fine grained and modular (e.g. designs for 3D printers, 3D CNC mills, 3D house printers, my work on complete solution to the Expression Problem for software fine grained modularity, etc). This back and forth is uninteresting and can be simplified mathematically to the following. F(x)=  CoinCube: For any finite value of x the function is not 0

TPTB_need_war: The answer is 0

CoinCube: For a finite value of x the function is greater than zero

TPTB_need_war: Why do I have to repeat myself the answer is zero

*** Do you understand why he doesn't have a right to demand my time (especially I am battling Multiple Sclerosis, am 4 days into fasting, in a deep financial hole, and risking it all to make sure we all have the cryptocoin we desperately will need). I think I do, but it is your decision to interpret a challenge in this thread as a demand on your time. Challenges can also be ignored or addressed at a later date. The primary purpose of this thread after all is to challenge and explore your thesis. |

|

|

|

Sorry but this bolded assumption is myopic and exemplifies you still haven't grasped my conceptual insight entirely. The more that final production moves closer to the individual with lower startup costs, the more uncertainty and risk decline. When a human can fully leverage his knowledge creation, he earns such an enormous ROI that several iterations of failure between each success are a non-risk and a no-brainer decision versus slaving away as an employee. Trust me, everyone who has made this leap has never gone back. I certainly never will work for financier nor employer ever again. I mean how obtuse is it really? If you try to swat a fly 10 times before you succeed does that require finance?  To the degree this is increasingly true how is it incompatible with what I wrote above. I imagine that even in a future knowledge age there will be some projects with such a low chance of success with correspondingly high reward that it would not be feasible for an individual to pursue alone and that some form of finance would be used. Change 10 times to 10 thousand times and you have a situation that may call for finance providing the payoff justifies the investment. My own experience has been that name substitution does not further constructive dialog. BldSwtTrs has been polite in his posts. Far better to drill down to the core of the differences in opinion and leave it at that. My best guess is your bias is you want so much to believe that your world won't radically change. My bias is I want the world to change, and I want the areas where I am strong to be strong.

Perhaps I would certainly benefit from continuation for the status quo for as long as possible. However, I do expect change to be gradual. My suspicion is that time will prove you correct but not in the time frame you hope to see as the majority of the economy transitions from one fiat global currency to another perhaps SDR's. Time will tell, however, and this is not a point I have much interest in debating. |

|

|

|

We disagree regarding fractional reserve. I think fractional reserve are fine as long customers are aware of it and free banking exists (ie. theere is fractional reserve in a free market environmet). But I will take time to read the link you provide later to understand the rationale.

Regarding the declining of uncertainty, I think the exact opposite will happen. More the technology improve and more the world is complex. And more complexity leads to more uncertainty.

In the Paleolithic it was easier to forecast what would happen the 10 next years (ie. not much) than it is today (despite TPTB need war's overconfidence in his ability to do so).

Regarding the increase of the longevity, I agree that we will live longer. But that could mean that the saving rate will go up and in that case there would be more resources (relative to the production) to invest via capital markets (ie. more finance).

Take a look at the post I wrote on finance above. If we still disagree after that I am happy to discuss fractional reserve further. In regards to the paleolithic world being less uncertain I would disagree. It was very difficult for an individual to forecast would would happen in the ancient world. You are looking at the issue globally rather than from the prospective of an individual living in those times. Today, I am confident that barring a rare tragedy all of my young children will grow into adulthood. Furthermore I am confident that I will likewise will live to an old age. There are no guarantees but the odds are good. Society is more complex but complexity does not necessarily equal uncertainty. Life expectancy in Rome is thought to be somewhere between ages 20–30 due to high infant mortality. If a child survived to age 10, life expectancy was an additional 37.5 years, a total of 47.5 years. Rome was advanced civilization compared to the paleolithic era. Humans, are not fundamentally biologically different than we were in Roman times indicating profound uncertainty with significant early death and demise. Finance is primarily a tool to push forward consumption and disperse risk. As risk declines the need for finance declines. Whether an increase longevity alone will drive a decline in finance is difficult to say. Humans will always want to push forward consumption often to the point of self harm. This in many ways this has been hard wired into us as we have come to exist in an environment where the future was uncertain and life was short. Cokayne, Karen (2013-01-11). Experiencing Old Age in Ancient Rome. Routledge. p. 3. ISBN 9781136000065. |

|

|

|

Finance doesn't exist because of the physical economy. Finance exist because of the time and uncertainty exist. "Finance is a field that deals with the allocation of assets and liabilities over time under conditions of certainty and uncertainty." https://en.wikipedia.org/wiki/FinanceTo prove that finance will lost its importance you don't need to prove knowledge will be increasingly more important and physical economy be increasingly less important, it's a trivial demonstration (and it's very embarassing to see the ego inflated guy thinking is the only one understanding the exponential function). To prove that that finance will lost it's importance you need to prove that: - uncertainty will disappear - humans will escape from spacetime Or alternatively, that humans will stop caring about the passage of time and uncertainty Until that, you have only showed something that everybody already knows. The ego inflated guy thinks because the barriers to entry are lowered by innovation in some markets that somehow prove his point. He doesn't understanding that his anedoctal evidence isn't symptomatic of a new broad trend in the economy: since the dawn of the markets the innovation have lowered barriers to entry and have shaken the structure of existing markets. He has just identified the byproduct of a recurring pattern and mix it up with a paradigm shift regarding the role of financial services. To sum up, finance doesn't exist because of physical economy, it exists because of human psychology. Showing that physical economy is declining is orthogonal to the fact that finance will decline. (Btw finance is part of the knowledge economy). When talking about finance it is important to make a distinction between two very different methods of finance. Method #1 Traditional finance were a group of investors jointly invest in a project to pool risk. Method #2 Modern finance where a bank is given the authority to expand the money supply via fractional lending when it identifies a profitable opportunity. Finance via fractional reserve is a theft paradigm. It leads naturally the abandonment of sound money and later to the destruction of the currency system involved. I have documented the reasons why I believe this is the case here. Finance Part I: Understanding the ParasiteFinance Part II: The Parasitic CycleFinance Part III: Divide, Conquer, EnslaveI would agree with you when you state that proving finance will vanish entirely requires you to prove that 1) uncertainty will disappear and 2) humans will stop caring about the passage of time. These conditions will never be met and thus finance will never cease to exist. However, lets exam the conditions needed to ensure not the elimination of finance but rather its gradual and relative decline. To prove finance will decline longer term requires you to show: - uncertainty will progressively decline - humans will care less about the passage of time Assuming we as a species continue to advance and progress one would expect both our knowledge to increase and our uncertainty regarding outcomes to similarly decline. I would also expect our longevity to increase. The conditions of technological progress lead naturally to the decline of finance by undermining the need for it. |

|

|

|

|

@BldSwtTrs my thoughts on the matter are as follows:

TBTP makes a strong argument that the physical economy will decline into relative insignificance over time. Obviously the physical economy will never disappear entirely. It is important to note that even if a full blown knowledge age occurs one would expect the increasingly insignificant physical economy to continue to grow only at a lower rate. The physical economy is never going to disappear and there likely remain great fortunes to be won by pioneers in the physical economy. In theory, however, these fortunes will decline along with the overall importance of the physical economy leaving the greatest fortunes of the future to be won in the knowledge economy. Similarly, one would expect financing to never disappear entirely but instead to follow the trajectory of the physical economy and grow at a lower than rate than the overall economy resulting in the gradual reduction of finance into relative insignificance (over an unknown and perhaps very long period of time).

Will the physical economy collapse with a global debt bubble bursting in 2018? Let assume for the moment that such a collapse occurs. This does not indicate an immediate transition of the physical economy into insignificance. Presumably the physical economy would bottom at some (much lower) level and then gradually start to grow once more. One would expect finance and financial instruments to follow a similar trajectory.

It may well be that only over a much longer time horizon long after our current asset bubbles and difficulty with fiat currency is ancient history that the predicted decline of the physical economy into insignificance will occur. I suspect both the physical economy and finance are both going to matter a great deal over the near term (the relevant planning horizon for those of us around today).

@TBTP as you said you have contributed the lions share to this thread. If you want it to fade away I suspect just ceasing to post in it will be sufficient to accomplish that. I am too busy at the moment to keep up in the forum so I won't be keeping it alive. I started this thread as an open forum to critique and analyze your writings and the thread appears to be serving its purpose. I think everyone understands you have limited time and resources and cannot respond to all challengers.

|

|

|

|

...

Today the knowledge share of the GDP has never been higher yet we don't see the trend of the decreasing importance of finance you are prognosticating because of the rising importance of knowledge.

...

Since several decades the bulk of the value added is produced by medium and small size companies, which don't need high fixed capital investment, which are hiring an increasing number of knowledge workers and which happen to have financial needs.

...

This is a fair challenge. TPTB often argues that his predicted future is happening now with the implication that we will see its fruition in our lifetimes. I tend to think that he is right in that he has identified a ongoing trend but that it is happening much more slowly then the time-frame implied in some of his writings. Finance is obviously not going to vanish going forward. Similarly the majority of knowledge workers are going to continue working for a salary for the foreseeable future. However, the pertinent question is will the relative value of financing decline as knowledge production becomes an ever larger share of the economy? I think he makes a case why this may be so mainly: 1) The value of hard resource production declines progressively over time with technological progress. 2) Improving production requires knowledge production . 3) Knowledge production increasingly cannot be entirely financed. So how do we square that with the fact that financing is obviously not decreasing across the larger economy at present? This could be accounted for by three possible explanations: A) The thesis is incorrect B) Financing is declining in relative importance but its decline is masked via debasement of the currency unit. C) We are in a transient period of atypical financing (a bubble) that will eventually resolve itself and results is atypically high levels of financing. I tend to think the answer is a combination of B and C. That the value of financing is declining gradually over time, and that this decline is masked by a massive burst of financing as policy makers are forced to react to the end of our current monetary order via competitive global rounds of QE and debasement. |

|

|

|

High IQ men that mate with average IQ women, often produce high IQ offspring so it doesn't really matter if the high IQ women select themselves out of the gene pool.

The men drive evolution. That is why we feel the urge to impregnate many women.

I read that most men in certain parts of Asia have Genghis Khan's genes.

If the State wasn't dictating to men that they have to give up an arm and a leg for each child they produce, men would be much more reproductive.

Men used to be the primary drivers of evolution via sexual selection but this is simply no longer the case. Most men in certain parts of Asia do have Genghis Khan's genes. Genghis Khan lived in a time when your statements above were true. Today it is women who drive evolution and unless there is a dark age where we return to tribalism (unlikely) this trend will continue for the foreseeable future. The state requiring significant child support and providing basic resources to single mothers certainly cements and accelerates this trend but it would exist even without state involvement. In the past being physically intimidating, success at combat and violence, and multiple brief "romantic" conquests were huge selective advantages that would result in offspring. Today their importance is rapidly diminishing. Female fertility and reproduction is now completely under the control of females and this represents a profound and under appreciated shift in selective pressure. Today it matters little how many romantic conquests a man has and expending significant amounts of time and energy to secure multiple brief conquests provides little reproductive advantage and may even be detrimental. This article provides a snapshot of what today's dating scene is like for many young people. http://www.vanityfair.com/culture/2015/08/tinder-hook-up-culture-end-of-datingMarty, who prefers Hinge to Tinder (“Hinge is my thing”), is no slouch at “racking up girls.” He says he’s slept with 30 to 40 women in the last year: “I sort of play that I could be a boyfriend kind of guy,” in order to win them over, “but then they start wanting me to care more … and I just don’t.” An individual able to sleep with 30-40 women a year in the ancient world would have been setting himself up genetically as the next Genghis Khan. Today it is quite possible that Marty has no children. The selective pressures have dramatically changed. Compare that with this blog by a women named Julie who has six kids. It is obvious from the article that she decided to do so because she loves children and likely has identified a mate that helps her support this many children. http://www.huffingtonpost.com/julie-cole/6-reasons-to-have-6-kids_b_4182276.htmlWhen people hear that I have six kids, the reaction is usually entertaining. Sure, there are some days when I wonder what I've gotten myself into... But most of the time, I just celebrate how awesome it is to have six kids. It is women like Julie not men like Marty who will drive human evolution over the next several generations. |

|

|

|

It's also noted that nerds, are underisable for women, yet they have the highest IQ, so it's obvious why humanity is so stupid, because nerdness is not sexually attractive. So they wont reproduce.'

While big macho grunts with no brains are attractive to women, and they will have 5-10 children, so the gene pool gets downgraded.

This is incorrect. The selective pressures going forward will increasingly favor nerds over "grunts" http://www.dailymail.co.uk/news/article-1375720/What-women-really-want--money-Research-finds-women-look-paid-job-partner.htmlWomen may say they are looking for tights abs or a sense of humor in their man, but he had better have a health bank balance to go with it.

According to new research published yesterday in Germany, more women are using money as overriding criteria for choosing their partners. http://bigthink.com/dollars-and-sex/do-women-really-value-income-over-looks-in-a-mateFor women though, if the man in the bottom ten percent in terms of looks earns more than $248,500, they will prefer him over the more attractive guy earning $60,000. |

|

|

|

My whole point is that the wealthy decide the future of humanity weather you like it or not, and they, do not like low IQ people.

…

So either nature will eliminate low IQ or the elite will.

What that means is that you and no one else can top-down decide which individuals in which situations will be worthwhile. It won't depend on just one metric such as IQ. Life is much more complex, chaotic, and higher entropy than just IQ.

Edit: even if were true that low IQ individuals are worthless to society, then they will be culled by nature and evolution will raise the IQ levels rapidly with natural selection. Nature is not as helpless as you seem to imply with your top-down proscriptions.

One-standard-deviation increase in childhood general intelligence (15 IQ points)

decreases women’s odds of parenthood by 21–25%... dysgenic fertility among women is

predicted to lead to a decline in the average intelligence of the population An interesting back an forth. This is a deep and complex issues that is complicated by the horrible history of eugenics. TPTB is correct in that no individual, government, or IQ test can top-down decide which individuals in which situations will be worthwhile. This was the primary failure of Nazi Germany. They top-down defined what was superior "tall, blond, blue eyed and Aryan" and top-down decided that everyone else was inferior slated either for servitude or liquidation. The Nazi's subsequently liquidated millions of very high IQ Ashkenazi Jews, millions more high IQ "inferior Slavs" and their actions in the end lead to millions of German deaths. It is interesting but not surprising that everyone advocating for "elimination of the undesirables" places their group in the role of the superior cast. Today we have vast social welfare systems that discourage productive work and encourages government dependence. A single mom in the US is better of earning a gross income of $29,000 then to earn a gross income of $69,000 due to the government benefits provided to low income mothers.  Our system discourages work and encourages government dependence. There are undoubtedly some individuals living off of government who are entirely incapable of a productive contribution to society. There is likely a much larger portion that is capable of some contribution to society who are currently following the logical path of government dependence as this is easier, less risky, and involves less work. The argument that socialism is eliminates natural selection on the population is flawed as it assumes that our current models of welfare will continue as they are today. This will not happen. Social Security and welfare in the US date back to 1935. Medicare and Medicaid are far more recent and date back to 1965. These are historical blips. These programs are unsustainable and thus will end or more likely be significantly changed long before they result in a significant effect on population genetics. As government finances deteriorate they will continue to pay these obligations but will do so with increasingly devalued currency reducing the overall subsidy over time. In regards to dysgenic fertility in high IQ women I believe this will also prove to be a transient phenomena. Right now we are living through perhaps the most profound shift in natural selective pressure since the development of agriculture 8000+ years ago. In 1960 the birth control pill was approved by the FDA. Since that time women who wish to control their fertility do so and women who do not desire children do not have children. This is unprecedented in human history and represents a profound shift in selective pressure from males to females. We have decoupled sex from reproduction and in doing so have displaced male success at sexual relations as the primary driver of human evolution. Today the primary driver of human reproduction is the desire of women to have children. A substantial portion of the female population is not adapted to the new environment and are in the process of selecting themselves partially or completely out of the gene pool. After a few generations this will leave us with a population that prioritize children and I believe that the trend towards dysgenic fertility will dissipate. |

|

|

|

Yep, socialism is a collective of lazy thieves that like to steal from more productive others. While thieves take their own risk at stealing and being caught. Socialists eliminate the risk of theft by using the government as their tool to get what they want. More welfare? More subsidy? More Pensions? More child subsidy? More unemployment benefits? More free stuff? No problem there is a taxman, that does all that job for you, and you dont have to worry of beight caught stealing. It a very horrible upside-down world we live it, but that is where democracy leads. "The People" only want to steal from eachother.

I guess theft is a basic human instinct  In addition to the masses using socialism to steal from the productive. You also have the financial elite 0.01% stealing from everyone via debasement of the fiat currency and the use of 0% interest loans to capture desirable income producing assets. It is natural for members of the lower classes to argue for redistribution when they (correctly) see that they are being stolen from by powerful economic players and a system that favors existing capital over labor. The desire for more socialism and more redistribution is a natural backlash to a fraudulent economic system. We live in a system designed to redistribute wealth away the masses. The subsequent demand for more socialism and redistribution is a sad but predictable response. Theft is not a universal human instinct but revenge is. The masses are not entirely stupid. They realize they are getting screwed over by the status quo. They just do not understand how or why so they reach for socialism as a form of justice. “We don't realize we are stealing from each other (and ourself) via failure of fitness when we pool and centralize our capital with debt, bonds, insurance, and centralized governance, then we are astonished that the system steals, express consternation, deny culpability, and thus reach for ‘solutions’ which are more of the same poison.”

Fiat based economics and fractional reserve facilitates a failure of fitness and enables centralization of capital at the expense of labor. This position of concentrated capital and economic power allows for the capture of government and regulatory bodies. This capture grants the ability to deter economic threats that would otherwise disperse and degrade sclerotic capital. The masses respond to their subsequent poverty by demanding more government aid and more redistribution which weakens potential opposition from the productive upper middle class and lower rungs of the wealthy. The net result is the destruction of political opposition and a strengthening of the tools available to cement oligarchic control. The natural outcome appears to be significant suppression of economic growth, accelerating transition to oligarchic control, bankruptcy of the nation states, and forced political consolidation across national borders. |

|

|

|

|