|

1

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: [ANN] Zclassic, Zcash Fork No Premine, No 20% Founders Tax

|

on: November 10, 2016, 06:50:44 PM

|

Don't buy this shit.... miners will dump all their coins and reward increase all the time, so basically you are fucked when you buy it... Don't get fooled. Pure scam.

Classic talk from someone trying to accumulate, nice try. Lets put some facts here ZEC started at 3299 BTC  ZEC went to 1000 BTC  ZEC went to 200 BTC  ZEC went to 30 BTC  ZEC went to 5 BTC  ZEC went to 3 BTC  ZEC went to 2 BTC  ZEC went to 1 BTC  ZEC went to 0.50 BTC  ZEC went to 0.40 BTC  ZEC went to 0.251 BTC  ZEC is being pumped to 0.45 BTC so ZCL will go the same way... I don't tell me that it is wrong... this is just a higher reward dumping shitcoin like ZEC. And ZCL is just away to steal some more money... i don't think it will go the same way, because zcash reward was very high at the beginning and now is higher, and so the price tanked, but with zclassic the price was normal from the beginning, and the reward also was constant, very different cases imho zcash reward was very low artificially boosting price short term... that is why you seeing the most epic crash in crypto history I think it was artificially pumped. Who was paying 3299 BTC/ZEC when it was obvious the price was going to go down when the miners had started to accumulate coins? It was obvious it will never go back up to 3299 BTC/ZEC. The only people making big buys at that price were buying off themselves to trick others into buying in on day one. |

|

|

|

|

2

|

Alternate cryptocurrencies / Mining (Altcoins) / Re: Zcash Minus 20% "Genius Tax"

|

on: October 31, 2016, 08:59:08 PM

|

this is really so easy? why wouldn't miners do this. and what happens afterwards? what will the devs do after the hard fork? The founding devs would most probably stop working on zcash, but there would be new ones queuing up to do a takeover. The ethereum devs were greedy, but 20% is so greedy that zcash probably won't have much of a future if it isn't changed. I first heard zcash has a new fangled alternative to POW and POS that was touted as assisting decentralization. If GPU mining it through pools has given one pool over 51% of the mining power the new algo hasn't helped decentralization at all. |

|

|

|

|

3

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: October 17, 2016, 06:43:03 PM

|

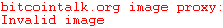

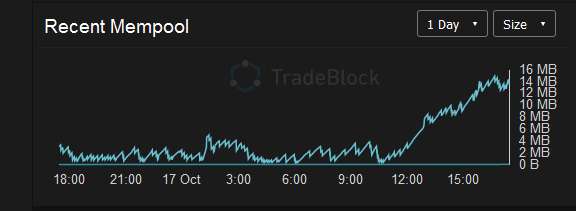

jam traffic on monday ? that's new ...  I would say that they went all back to work  but this will not answer it this time. Can be just a one-off: let's monitor how this continues. It would seem strange after all, unless new people are awakening their dormant coins.  It's reducing back downwards in size now. The mempool size won't alter the price, it's been far above 10MB before and the price stayed steady. We all know you only have to pay a higher fee for fast confirmations if the mempool is bigger than normal. The mempool's size doesn't frighten us.  |

|

|

|

|

4

|

Economy / Speculation / Re: Is see the new pump is building up, $660 in 2 weeks

|

on: September 28, 2016, 10:04:15 PM

|

I think the next new pump will be of higher value i mean price may jump to over $700 looking at the trend price have recently.

I think it will pump above $800, and maybe above $1000 before next March. It might carry on flat for a few more months though. Predicting the exact timing of pumps is impossible, but the trend has been up all this year, and it will probably carry on up all next year. |

|

|

|

|

5

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: September 02, 2016, 05:06:56 PM

|

Good morning Bitcoinland.

No change... $580 on Bitcoinaverage.

When this thing finally breaks, it should be fun to watch. In the meantime, yawn.

Bitcoin just loves...I mean loves....SIDEWAYS price action....(btc you merciless bitch! pump already damn it)  It loves sideways price action so much that it's not going to stop for a few more dull months. It makes the vertical pumps more exhilarating when Bitcoin finally gets round to them. I estimate nothing will happen until October or November, then there will be an exhilarating pump. |

|

|

|

|

6

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: August 05, 2016, 06:48:31 PM

|

Thanks for that link ECB... The post pretty much states that Bitfinex is going to make a more official update tomorrow, but in the meantime, like you said, Bitfinex is considering a way to socialize losses amongst Bitfinex BTC holders. I don't really have a problem with socialized loss in the sense that Bitfinex would later pay back those "losers"... yet, I believe that they are not considering paying back the "losers"... I think that it is a bit irresponsible to cause the users to hold the bag... and even though we are finding out some details, we still have to wait for more specifics, which seems to be scheduled to come out tomorrow. Really the best option for everyone. Other option is to go belly up and then after 4yrs and a bunch of attorney fees you might see some distributions (see Gox). Assuming there'd be a full investigation and it wasn't internal job etc... We are likely a bit too much speculation regarding various details at the moment because Bitfinex has only provided a rough outline of their intentions - and they also provided one side of the balance sheet without providing some kind of indication of the other side of the balance sheet, which would likely be disclosed in more detail later today. I guess part of what I am saying, here, is that in order to attempt to achieve more confidence from current account holders and future account holders, they have to disclose enough details in order to inspire some confidence that they are being reasonable. I don't think that we can come to any kind of conclusion regarding what is best if we do not have some more disclosure, and likely, since they are not a public company, they are going to be somewhat sparse with the level of their disclosure... in other words, they will be disclosing mostly from an attempt to retain business rather than any kind of actual obligation to disclose. One last point, Bitfinex is already somewhat known for being a bit shady; however, so far (at least up until this latest incident), their shadiness had not prevented them from accumulating a lot of bitcoins in their trust and to build a large volume of USD/BTC trade. Maybe some of that trade is fake, but it is likely a lot more representative of reality than some of the other chinese exchanges (Ok coin and Huobi, for example). So, their known shadiness causes me to speculate that they are continue to be less than fully transparent, and so no matter what there are going to continue to be theories and speculation regarding whether some of this is an inside job, and perhaps if they do not propose some kind of publicly acceptable plan forward with sufficient details, their history along with this latest incident and perhaps inadequate plan will contribute towards their demise. I remain with my proposition that the most likely appropriate plan forward is to at least attempt to show that they are coming really close to fully compensating all affected users - otherwise they will lose credibility from the big investors. They don't actually have to carry out such plan, merely just put forth such plan to create such an impression that they plan to fully compensate (or close to fully compensate) everyone who was negatively affected. They really don't have many option. Coins are gone, either they make everyone whole, compromise, or declare bankruptcy. Those are really all your options. As far as compromise need to find a thin line between appeasing pissed off investors and staying solvent. They were THE LARGES BTC/USD exchange by volume so all that talk about loosing trust is irrelevant/FUD sure some trust was lost but clearly not enough to have much effect judging by their volume which i believe to be pretty accurate. As far as giving everyone a haircut without issuing IOUs or finexcoins with a plan to repay is also suicidal, that's pretty much a definition of being insolvent. So naturally come to the same conclusion as cryptsy in the similar situation. Everyone gets an IOU coins Bter gave everyone IOU coins to cover the losses from its hack. Unfortunately it only made one or two tiny repayments then stopped paying people back. It's still running but it has very low volume now. Finex might find it can't afford to buy back IOU coins if it loses volume. It could become a zombie exchange like Bter. |

|

|

|

|

8

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 15, 2016, 11:37:12 PM

|

It depends how you classify low volume. I can see two big bars on the Bitfinex 24 hour chart, and each of them is above 1000 Bitcoins and mostly buying. Is buying possible without selling? No but if the ask side gets eaten into it's considered buying and selling if the bid side gets eaten into. Ah, gotcha. How does one tell if the ask side got eaten into by looking at the volume bars? Check the 1.5k volume bar on this chart. You can see the price going up in almost a straight line during that trading period. I assume that means the ask side got eaten into. If the price had gone down in almost a straight line I would assume the opposite.  |

|

|

|

|

9

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 15, 2016, 10:23:59 PM

|

Does the low volume means no one is spending or buying coins? Also, if the volume is so low why does it not affect the price?

Does this mean people are just hodling?

Just trying to work out the whole low volume thing.

There are around 1600 BTC being generated every day, so people must buy BTC to price don't drop. The miners won't just hodl everything because they have to pay bill and taxes. And low compared to what? Volume is lower than before the halving because the halving was a hyped event, now things are back to normal It depends how you classify low volume. I can see two big bars on the Bitfinex 24 hour chart, and each of them is above 1000 Bitcoins and mostly buying. That's low volume by Bitfinex standards, but it's eaten the 1600 BTC generated today. After the volume increases again the price will probably increase, this low volume's enough to keep the price reasonably stable. |

|

|

|

|

10

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: July 01, 2016, 10:09:41 AM

|

To the minute eh? The rumors/posting were out hours before the jump, and the lack of any denial from the miners escalates the chance these events were correlated.

p.s. *gasps

Possibly, but the timing no longer coincides well. Also, such a development would surely instill uncertainty, which is not bullish. p.s. /me performs a tracheotomy to aid your breathing. A year ago uncertainty was scary, 6 months ago uncertainty was scary, 4 months ago... "individuals" said some nice things and took some pictures, and made a deal they don't intend to keep. Now... well... hell, it almost feels like a relief someone is calling the big bluff. P.S. murder isn't cool you two Your version of history is a whole hell-of-a lot of nonsense spinning and grasping at straws. The reality of the matter is that what had happened 6 months ago, is that BTC prices shot up from $200 to $500.. and this shooting up was in part because of ongoing BTC price suppression that had lasted more than a year, and the price shot up because the bears couldn't really keep it down anymore, inspite of attempts to spread nonsense.. then after the price shot to $500 and came back down a bit of price battling back and forth settled back down into the $360 to $460 range. I would hardly call that scared uncertainty in the bitcoin space, even though a lot of FUCD was being spread around during those few months that BTC prices floated largely in the $360 to $460 range. Yeah, sure, four months ago, we got some additional FUCD spreading... coupled with rage quitting and hyperbole.. . but really, by the time mid-to-end of May came along. ... and even with the fairly heavy Ethereum pumping, folks began to realize that bitcoin really is not broken as had been hyped and continued to be hyped by marginal loud mouth nonsense spreading shills... Anyhow, in late May, we broke passed $500, and there is considerable amount of difficulties for bears and anti-bitcoiners in attempting to put the genie back in the bottle and to attempt to get BTC prices to go back down, below $500 would be good for these kinds of anti-bitcoin folks... So, upward we go, and upward pressure we continue to experience, and surely it wouldn't be a good time to be a bear under current market upwards price pressures, no? Something to add to the picture is that with all the talk of the halving, EVERYTHING to this point and till the halving is speculation. The real halving will occur when the daily supply is halved. So, the months following Friday the 8th or so, will really show us the affects. We have to consider if selling of existing coins will be able to make up the difference in the lowered supply and I really really doubt it will. Who will sell their stored existing coins shortly after halving day when they know they will get a better price by holding them for a few months? The only people selling shortly after halving day will be the ones who need to pay bills and don't have any other savings. Everyone else will be holding. |

|

|

|

|

11

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: June 09, 2016, 03:33:10 PM

|

Good morning Bitcoinland. Still battling over $580 I see.  Coiling for the next big leg up, presumably. Past $610 this time? It will only take a 7k pump on Bitfinex to get the price up to $600. Great big buys like that were fairly regular a few weeks ago. We had a lower volume gap for a week or two, and the high volume buys might start again soon for the next big leg up. The low volume trading can't last forever. |

|

|

|

|

12

|

Economy / Exchanges / Re: MtGox withdrawal delays [Gathering]

|

on: May 29, 2016, 06:10:34 PM

|

That reassures me that the receiver won't dump the Bitcoins on exchanges or auction them. Liquidating assets and paying creditors back in fiat was standard procedure in all Japanese bankruptcy cases until this one. This is the first time assets get returned instead of fiat. Most of the creditors want Bitcoins and it's good news the receiver listened to them. |

|

|

|

|

13

|

Bitcoin / Bitcoin Discussion / Re: Memory is cheap -

|

on: May 11, 2016, 09:26:43 AM

|

I think the larger problem is network bandwidth rather than hard device capacity. Even with high speed Internet connection (> 20 Mbit/sec) it can take a couple of days to download the block chain from scratch.

lol. You only have to download the chain one time - forever. People sit in their living room all over the planet streaming movies every night and you worry about 2MB every ten minutes? Clearly you failed your math A levels. No you don't just download the chain and be done with it. A full node does not only download blocks - it also receives and relays unconfirmed transactions and sends out blocks to other SPV clients. Your node could easily send out terabytes of data in 1 month if you don't restrict it. This node has been up for only 6 days and has already sent out 144 GB. How do you restrict the amount of data a node can process? I want to set up a node but the location I live in has poor internet connectivity. The only way I can set up a node is through a server hosting provider. There's a limit on how much data I can afford to pay for each month, so I want to put a cap on my monthly data. |

|

|

|

|

14

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: May 03, 2016, 02:26:47 PM

|

wright is NOT satoshi...100% bullshit, if im wrong ill dump all my BTC forever  quoted for evidence  double quoted , lol what do u think...wright is satoshi? lol yes * yefi puts on his gorilla suit If he publicly and verifiably signs a message from the genesis block, I'll give your newbie butt 1 shiny bitcoin. Quote it. Craig Wright says he will move a coin from an early block in the next few days. The BBC says "that should convince many of the doubters". I say he should sign a message with both his PGP key and a Satoshi Bitcoin, and move some early coins (to my Bitcoin address). That would convince me. You can give my senior butt 1 shiny bitcoin if he does it, but I'm too poor to return the favour if he doesn't. http://www.bbc.co.uk/news/technology-36193006The man who has identified himself as the creator of Bitcoin plans to provide further proof to his claim.

Craig Wright's spokesman told the BBC that he would "move a coin from an early block" belonging to the crypto-currency's inventor "in the coming days".

*snip*

This morning, I have managed to reach Jon Matonis, who is at a cryptocurrency event in Kenya. He remains absolutely convinced by Craig Wright but agrees that the blog hasn't helped his case.

"It needs to be amended because it's not conclusive for the general public. But that does not take away from what I saw in private," he explained.

As far as I can see it, if Dr Wright can move one of Satoshi's bitcoins - as promised - that should convince many of the doubters.

It would constitute proof that he is who he says he is - although one suspects that even then some will never believe his story. |

|

|

|

|

16

|

Economy / Exchanges / Re: Bittrex disappeared my history

|

on: February 10, 2016, 10:00:21 AM

|

it's normally friend, i get it too...

this feature released arround 6month ago, before it i can see any deposit history and trade history from my bittrex account

That's weird. Why would they delete history, I have an account there but haven't logged on in a while since I don't trade alts anymore but will check if they have cleared my history as well. OP have you asked the support about this? I guess new trades would show in my account's history, but like you I hadn't logged in since last Easter and haven't traded there since then. Support seems the only option for getting my history back. They might have deleted it because my account was inactive for so long, but it's weird. |

|

|

|

|

17

|

Economy / Exchanges / Bittrex disappeared my history

|

on: February 09, 2016, 09:52:17 PM

|

|

Bittrex disappeared my trading and deposit history. I hadn't logged in for months on end, and when I had a look all my balances are there but my entire trading history has disappeared. Have others had the same experience?

Also I noticed there is a new section where you can verify your identity. Is it compulsory to fill it in, or can we leave it blank?

|

|

|

|

|

18

|

Economy / Service Discussion / Re: bitcoins not arriving in account

|

on: January 22, 2016, 12:12:42 AM

|

if you look fo the TX id you will be able to find if you send it to the right address. If you sent to the right address you need to see if you paid the Tx fee and if you paid it... well in that case probably the site to where you send the coins is a scam...

Either that or its wallet's out of sync and not showing the latest transactions. I have known block explorers to do that sometimes. If the OP has a transaction ID he should send it to their support and ask if they can see it in their backend wallet, and if they can't point them to a link to the transaction in a block explorer. |

|

|

|

|

19

|

Economy / Exchanges / Re: [OFFICIAL]Bitfinex.com first Bitcoin P2P lending platform for leverage trading

|

on: January 21, 2016, 11:24:20 PM

|

BITFINEX !!!

I have most of my coins there and need to trade right now and I get this stupid message

"Your account is currently on withdrawal hold. Your withdrawal(s) will be locked in a Pending Approval state until the hold is lifted."

I can not move any of my coins IM so furious this site went to crap.

withdraws take over 12 hours to get processed the past times for me.

I did NOT change my password nor changed anything !

That's frustrating. A year ago my withdrawals there were processed immediately, but last summer it took twelve hours for one withdrawal. I checked their terms and the small print says they are allowed to take 12 hours to process a withdrawal. Since that experience I started trading on other exchanges because the price crashed while I was waiting. |

|

|

|

|

20

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: January 21, 2016, 10:31:30 PM

|

Deomocracy, in the sense of one person one vote for control over pooled resources, is inefficient because there is no way to communicate the intensity of one's preferences. That is one objection. That is true, and it is one of the reasons why "democracy is the worst form of government there is". But other methods of reching "consensus" are not any better in that regard, often much worse; hence the other half of the saying. While democracy does not directly account for intensity of desire, it has some indirect ways. For example, if the majority chooses laws that are too unfair to some minority, the latter may resort to crime to make ends meet, or to terrorism and other anti-social behavior, in spite of the penal deterrents against such acts. Then the majority, if it is not too stupid, will usually ease the plight of that minority, enough to keep those reactions down to a tolerable level. Democracy, like anything else, will function better if most of its citizens have more knowledge (especially of other societies, past and present) and more intelligence (especially the social intelligence I mentioned: awareness of the reactions that other people may have to one's own actions, and to the actions of the government. The fair treatment of minorities, above, is an example of decision that a majority will take if it has a minimum of those qualities. That is one reason, by the way, why even the richest classes should want a good public universal education: because their welfare never depends only on their own qualities and actions, but always depends on the state of the society around them. for example, if you don't have the right to take by force from your neighbor because you need his property more than he does, then you don't have that right even if the majority of voters decide that you do.

As I said in another post, "right" is a meaningless word if there is no government to decide who has it. Property is not a "natural right": you property is what your government thinks it is. There is no other useful way to define it. You grow a crop on the land that is property of someone else: who owns the harvest? You may have signed a contract giving 90% of the harvest to the landowner, but if the alternative was to sign the contract or die of hunger, is that any different than him taking your harvest by force? You buy a stolen car without knowing that it was stolen; is it your property, or still the property of the victim? If you trace the history of a land plot back in time, you will almost always find that it was originally taken by force from the previous owner; so, is the present holder really the rightful owner? In those and many other examples, there is no "natural" answer to the question. In each case, if the property right is disputed, the laws of the country will give general rules that say who has the property rights; a court would have to decide how to apply those laws to the specific case; and a government will have to forcibly enforce the court's decision, if the affected party refuses to accept it. In the case where a country is at war the government can commander any private property it wants, and there's nothing the owner can do to stop it. The government can commandeer your house, your car, or the iron railings outside your house to make shells out of. The government decides whether you still own something when it's at war, and will use force to take it off you if you resist. |

|

|

|

|

but this will not answer it this time. Can be just a one-off: let's monitor how this continues. It would seem strange after all, unless

but this will not answer it this time. Can be just a one-off: let's monitor how this continues. It would seem strange after all, unless