JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10192

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 09, 2022, 06:51:12 PM |

|

Since the poll is still broken, I suggest a mini poll: What will be the top price in the next week. I say 50 750$. Reasons: quite often after a 30%+ dip from the ATH follows a 25% increase from the bottom. I believe 40 600$ was the bottom, hence the number. If this is not the bottom, better prepare your wallets for the brief opportunity to buy below 40K.  high price in the next week? ill go with whatever proudhon says minus one dollar. the minus one dollar thing is because hes so well known to be overly optimistic all the time so.. lowest buy ive hit is 41.4k usd so far. Bitstamp (our default reference in this thread shows $40,517 as it's bottom about 25 hours ago as I type this post. I would like see a bounce too... .. and within a week (if we were to use the weekly candle) which closes today at 00:00 UTC (about 6 hours from the time of this post), a lot of price movement could happen.. a bounce up to $49,500-ish or higher does not seem unreasonable but I am not sure of the odds....maybe 41.41%.. give or take? If we get above $54k or so then we might be able to proclaim that "the bottom is in" which would be a good feeling thing to proclaim.... could take a bit longer for supra $54k to resolve, maybe a month or more? seeing between a $10k to $20k daily candle would be nice, but that seems like a wish rather than anything with high odds of happening.. even though if a lot of shorts are in place, then those shorts would serve as fuel for that kind of short reckening. I am surprised about how much shitcoin talk that Arthur has allowed to get into his discussion points... sure the house of cards smoke and mirror scamming platform shitcoin called ETH may well have good chances to outperform the dollar, but for me, I don't consider them to be a talking point in regards to bitcoin versus macro.. unless putting ETH in its proper place as the scam platform that it is, even if it has been performing well and likely to continue to have decent performance at least relative to the dollar.. and maybe even relative to bitcoin in the short term as it continues to be propped up by various kinds of money printing-oriented entities outside of the dollar. |

|

|

|

|

|

|

|

Every time a block is mined, a certain amount of BTC (called the

subsidy) is created out of thin air and given to the miner. The

subsidy halves every four years and will reach 0 in about 130 years.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

January 09, 2022, 06:53:33 PM |

|

Looking for this... maybe?   Shallower than I expected.. but knocking on heavens door? |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 09, 2022, 07:01:27 PM |

|

|

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 12019

BTC + Crossfit, living life.

|

|

January 09, 2022, 07:09:28 PM |

|

More fine #hopium https://twitter.com/cryptomanran/status/1480063160539402243The majority of the leverage in the market now is large shorts. We know this because price collapsed and the leverage didn’t. If we get a rally it could trigger the mother of all short squeezes. I’m talking $10k candles.

We have had 10k daily drops 10k daily pumps would be appropriate but nothing more. …. Now we want 20k candles |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3848

|

|

January 09, 2022, 07:13:32 PM |

|

Seriously though, any chance we could resume the bull market? Nothing would make me happier, I am doubtful though.

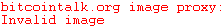

Just for you, since I know you're still holding 75% of stash and therefore hoping for upside. Here are some squiggly lines for you, as if drawn by a child, with volume profile included:  The point beside being a little drunk rn, is that last years move from $30K-$40K (accumulation) to $50K-$60K (distribution) meant very little in the long-term perspective, as price didn't continue higher. Now price has dropped from $69K down to $40K, it again means very little in the long-term, only that it's likely price returns to the accumulation zone. Just like when price returned to the distribution zone, for more distribution. I think despite all the technical analysis, fundamentals, on-chain data and otherwise that vary between bullish and bearish, this is pretty neutral trading right now. Bouncing from above the accumulation zone, prior to further accumulation would be very bullish, but otherwise returning to the accumulation zone isn't as bearish as people consider, as there's nothing unhealthy about long-term consolidation at higher levels. Of course price could drop to $25K, even $20K, but ultimately for the past 12 months this has always been the case. The only difference is that now it's less likely it seems. I'm still pretty bearish short-term, as only see broken support from what turned out to be no mans land (not re-accumulation), but I otherwise struggle to consider that the bear market has truly begun given the healthy accumulation and distribution pattern. Sure it could take some months, maybe even many, but I doubt it will take until 2023, 2024 or 2025 until there is a new ATH again. Nice analysis, but TA cannot include some macro factors like Chinese ban in May 2021. Without it, we would have made the trip to 100K already, most likely. You're right, it can't. It certainly didn't in early 2021 that's for sure. Institutional & whale selling in the $50K-60K wasn't the issue though, but the lack of re-accumulation between $30K-$40K. Possibly also because of this ban I realise. Hash rate was still struggling at these prices so the fundamentals weren't all pointing back to immediate upside. I am generally agreeing with everything, apart from the new ATH in 2022, but, hey, I think that 60K and even a stretch to 65K is possible, so it could be close. That I can understand. Price has been in the same price range for 12 months. It'd be naive to think it can't stay within this range for another 12 months. That said, it's not common for Bitcoin's price movements to remain range bound for such extended periods, so while it's already happened for considerable time, I wouldn't bet on continuation either. Therefore, I think this long-term consolidation at higher levels is much more likely to break to the upside than the downside, simply based on current macro bullish price structure, nothing complicated here. To contrast, you still think that we are in the bull market, whereas I think that prior is either already over or ending with, hopefully, a milder bear (it very well just be a retest of 29K plus minus one-two K). In all honesty, I'm remaining open minded. Based on long-term moving averages like the 50 Week MA @ $48.3K that has now been broken, the bull market has almost ended. But I prefer to stay conservative with my perception of these averages, so only when this MA is sloping downwards will I consider the bull market over, likely with a retest that confirms it as resistance as well. Because in the meantime (many weeks), this MA can still be relatively easily reclaimed if price were to reverse and bounce to upside, as +15% really isn't a big move in Bitcoin world. Notably also for example on the mid-term when the 50 Day MA was broken the mid-term bear trend didn't begin, but when this MA starting sloping downwards instead. This is when we saw the breakdown below $53K. I wouldn't rule out a re-test of $29K, but also think the mid $30K levels will be well defended, given the much larger amount of accumulation at these levels than distribution at higher levels. It looks like that half of these accumulators sold around the $50K-60K distribution level (or on average these accumulators sold half @ 2x), but otherwise the other half didn't (based on volume profile). So I don't believe they will be selling at break even after holding for 6+ months, as it's common for 6+ months hodlers to panic sell at break-even. They are more likely to re-accumulate at lower levels if it comes, or accumulate more in the mid $30Ks imo. To me, there is nothing in current behavior that indicates bull continuation. Alas, if it suddenly turns up, I might consider that the bull is still alive, otherwise I am of the opinion that we are in the new market cycle already with relative flat (or band of 29-60K) continuing for a while.

<snip> If the bull market were over however, I'd consider it to have ended with the original ATH of $64K, as opposed to that of $69K that was merely a fake-out, therefore creating an ATL or new local low in April time (ie 12 months of downside/sideways trading) as opposed to creating a new low in November time at much lower prices, like many are fearing right now. Ie, reversal in a few months at most.The underlying issue I see right now is that open interest is at at time high levels, so in the short-term this is very bearish as traders are trading short-term bearish price movements to the downside. Previously price has always been dominated by miners, now it's clearly derivatives trading as well as futures. But just like when $40K was broken to the upside back in July, this can flip to bullish leverage very quickly. I totally agree with the statement that is now in bold; in fact, I also posted something along these lines...and I also agree that it is perhaps conditional on whether we revisit at least mid 30-ies area. In fact, this is the second best scenario (the best being a simple bull continuation) as it would suggest the lows (or a simple retest of 29-30K) by the Spring and then off we go (bullish period of the next cycle starts). |

|

|

|

|

bitcoinPsycho

Legendary

Offline Offline

Activity: 2464

Merit: 2066

$120000 in 2024 Confirmed

|

|

January 09, 2022, 07:30:03 PM

Last edit: January 09, 2022, 07:40:10 PM by bitcoinPsycho |

|

45K in one hour  this is a request not a prediction this is a request not a prediction |

|

|

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

January 09, 2022, 07:56:57 PM |

|

45K in one hour  this is a request not a prediction this is a request not a predictionComing right up??  |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 09, 2022, 08:01:27 PM |

|

|

|

|

|

|

shahzadafzal

Copper Member

Legendary

Offline Offline

Activity: 1526

Merit: 2890

|

|

January 09, 2022, 08:07:22 PM |

|

There you go CB… let’s go!!!

|

|

|

|

|

sirazimuth

Legendary

Offline Offline

Activity: 3346

Merit: 3485

born once atheist

|

|

January 09, 2022, 08:08:27 PM |

|

45K in one hour  this is a request not a prediction this is a request not a predictionComing right up?? <chart> .img Paging Llama Llama. We need confirmed sources... |

|

|

|

|

Richy_T

Legendary

Offline Offline

Activity: 2422

Merit: 2113

1RichyTrEwPYjZSeAYxeiFBNnKC9UjC5k

|

|

January 09, 2022, 08:27:43 PM |

|

Here's the thing. I am. And still I think it's better than his shitty fiat. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10192

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 09, 2022, 08:31:01 PM |

|

Year on inflation in December 2021 6.4% in The Netherlands.

Note that house prices rose beyond 10% last year and one of the leading banks in The Netherlands expects another 12.5% increase this year.

With these figures anyone who complains that "but how can BTC be fair when those who got in early will have massive gains." is a fucking fool OR is purposefully trying to distract from the biggest problems. I want to buy a house and not only did the price rise like crazy the last couple of years, but what I'm looking for isn't even on the market anymore : a basic/average house with a large plot of land. Now to get the large plot of land at a similar or worse location, I need to literally double my budget and fork for a nicer/bigger house that I don't need (and would also cost a lot in taxes, maintenance etc.). From ~350000€ to 700000€ in one year. For 350K I get a literal ruin. I understand that it sucks that certain kinds of assets, and maybe personally tailored property is amongst the most egregious in terms of its price rise have gone up stupendously in comparison to various fiat currencies, yet it seems to me that bitcoin has gone UP way more than property in general, but maybe not so much in terms of the personally tailored properties - yet we should attempt to recognize the whole relative appreciation of assets/property/bitcoin matter within an appropriate timeline (talking about measuring bitcoin's performance from September 2020 - which seems to be a very representative starting base point, but also you could measure a longer period of time too, when it comes to recognizing BTC's price performance.. such as going back 5 years or more for your starting point and measuring from there... do I need to go through the actual numbers?), and even if property is also an asset that is greatly propped up by fiat debt, it is likely going to outperform a lot of other assets, except bitcoin... even though the personally tailored properties might have even greater performance than property generally speaking. So when do you (we) want to get that "dream" house? It seems to me that we should be attempting to consider the "when" to get the "dream" house in terms of when have we either reached fuck you status or are clearly en route to reaching fuck you status, and if in part we are able to use debt to get such dream house (if that's what we want?), then we might want to use that kind of resource that's potentially at our disposal if we feel that the terms are suitable to our overall plans. There seem to be several individualistic aspects in answering those kinds of questions and figuring out what some of the tradeoffs might be to attempt to enter into a trade of bitcoin for personalized dream property or the use of some bitcoin allocations to get redirected into personalized dream property. Of course, this thread is mostly about bitcoin, so sometimes we could get a bit too distracted if we get too distracted into some of the particular trade-offs of real estate, yet we still know that bitcoin is not an abstract topic, and it's value needs to be measured in accordance with various investment or consumption preferences that any of us might have, and surely if you have a kind of personal dream property that you want to keep as your target trade-off asset, then you can attempt to measure such values and strategize your timing or your entrance into such trade, and of course, if we are going to talk more generally about those kinds of ideas, then I still think that we end up getting into some discussions of considering how close you might be to fuck you status, rather than the fact that some kinds of assets/properties may well be appreciating way more than other kinds of assets/properties. I doubt that you are as prejudiced as you seem to be making out the situation to be by having decent amounts of value in bitcoin, except if you are looking at short-term timeframes, then surely you can spin historical performance of certain kinds of properties (as compared with bitcoin) if you want to perceive negatively in a timeframe that makes you depressed, and surely we cannot really make any kind of certain predictions regarding the future of the assets or the comparison of assets, even though bitcoin has performed quite well against the dollar in at least 4-year investment timeframes, but there are going to be some assets, even specific kinds of more scarce assets, such as personalize real-estate or even art or other assets/investments that might have better than bitcoin performance... so we cannot really know with certainties how to place our values in terms of specifics - even though many of us longer term bitcoiners in this thread would likely argue similar to yours truly in terms of attempting to figure out your own various values in terms of bitcoin generalities and then you are likely not going to be prejudiced by having a decent amount of your wealth in a seemingly ongoing liquid asset like bitcoin that seems to continue to have a lot of upside asymmetry, at least generally speaking and generally compared with various other asset classes.. including property generally speaking. So maybe a personally-situated question that you are facing currently is whether you should FOMO into real-estate that meets your personal requirements/preferences or to hold off on that for a while longer including that you remain unclear about bitcoin's shorter term price performance in the coming year or even in the next few years... no one can really answer those kinds of questions for you including how much bitcoin you might need to have in order to maybe be shaving some off in order to acquire your dream property that may well continue to go up in price/value in the coming years... perhaps? perhaps? Maybe we still also get back to the extent that you might have already reached fuck you status.. or if you might not quite be there yet, then you may be engaged in an exercise of futility (at least premature assessment) if you had not been ready to pull the trigger on those kinds of "dream" properties that you describe.. but surely if you are on the cusp of being able to pull the trigger on those kinds of "dream" properties, then you may merely be witnessing them to have escaped your grasp in the short-term, but whether they have escaped your grasp in a longer timeline is likely still be determined... ....again getting back to figuring out what constitutes the reaching of fuck you status... and if you do not have enough coins now to be in something close to fuck you status how many coins are you going to need in the next few years.. and again, I personally prefer to attempt to look at time frames that are in 4-year increments, so either 4 years out or 8 years out, but if you are figuring out your quantity of bitcoin that you need for fuck you status, and currently that might be something like 105 BTC, but if you were to end up needing to spend something like 700000€.. or maybe $800k (which would currently be around 19 BTC), then that brings your stash down by 19 BTC, and surely if you are not even close to having 105 BTC currently, then you are striving to figure out if you are ever going to get to fuck you status)... Surely, I am not really proclaiming that I have all or even most of the answers, but I see from my chart of the expected 208-week moving average in the coming 4 years that 19 BTC will be well over the fuck you status that is then projected in such chart, so spending 19 BTC currently might not be so good as making sure that you have 19 BTC in your BTC holdings in the next 4 years, and you would be reaching fuck you status with that quantity of BTC within 4-5 years - again the chart is a delayed-indicator projection, so for sure there are no guarantees.. and the chart will need to be adjusted with new data.. especially if the 208-week moving average does not continue to move up in a straight line but kind of slopes off - which causes me to consider that I need to cause my chart to have a sloping off of the rate of increase of the 208-week moving average rather than showing it as a constant.I guess that part of the point that I am trying to make here is for you to assess how many BTC that you have versus how many BTC that you are going to need at certain future timeline points in order to attempt to figure out if it would be worth it for you to shave off something like the equivalent of 19BTC now for such dream home or even shaving off such 19 BTC in the projected future, and would you still have enough BTC in your BTC portfolio to justify such trigger pulling action now, or at some time in a future that you can reasonably end up plugging such "dream" home into your own holdings of assets versus BTC. For sure, even if you attempt to maintain some relatively conservative projections regarding how much value you currently have in BTC and how you believe that value will continue to grow, even in shorter time frames, you could end up having some additional luck too.. in terms of being able to play some kind of an exponential UPwave in bitcoin, if such a thing were to happen in such a way to meet some of your "additional sell thresholds" goals. So, in that sense, personally I have preferences to attempt to play BTC price performance conservatively, but I am not going to poo-poo anyone who takes advantage of some short-term exponential BTC price appreciation when it happens.. so long as they are also recognizing that they may well have not shaved off at any kind of top and the BTC price might well keep going UPpity, even if they were able to shave off some BTC profits during what seemed to have had been an exponential price rise period. |

|

|

|

|

Richy_T

Legendary

Offline Offline

Activity: 2422

Merit: 2113

1RichyTrEwPYjZSeAYxeiFBNnKC9UjC5k

|

In some ways it's hard to say what they might do because they have painted themselves into a corner. Crashing the already limping enconomy in the name of stopping inflation? Or keep printing and shift into negative interest rates causing absolute explosions in risk assets and making a can of beans cost $4.

If you didn't know which way this was gonna go, you probably wouldn't be in Bitcoin. |

|

|

|

|

Richy_T

Legendary

Offline Offline

Activity: 2422

Merit: 2113

1RichyTrEwPYjZSeAYxeiFBNnKC9UjC5k

|

|

January 09, 2022, 08:44:04 PM |

|

|

|

|

|

|

Richy_T

Legendary

Offline Offline

Activity: 2422

Merit: 2113

1RichyTrEwPYjZSeAYxeiFBNnKC9UjC5k

|

|

January 09, 2022, 08:46:15 PM Merited by JayJuanGee (1) |

|

The plan has always been to inflate the debt away. But to do that in the "normal" way, you need to check your deficit, especially when there is growth, and only grow the debt in bad times. The US has stopped doing that, it was particularly glaring under Trump, crazy deficit despite an overheating economy (that was before COVID). I don't get why people "in the know", regardless of cryptos, are not feeling very uncomfortable with what's going on. It's clearly the case of the Fed, that why it's becoming hawkish, but if only the Fed is concerned, it won't be enough.

Feels to me like they know the train is coming off the rails soon and just want to loot as much as possible while there's looting to be had. The people behind all this will not be in the country when people come looking for them.

sure the house of cards smoke and mirror scamming platform shitcoin called ETH may well have good chances to outperform the dollar,

At this point, a 2x4 will outperform the dollar. Handily. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10192

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 09, 2022, 08:51:32 PM

Last edit: January 09, 2022, 09:04:12 PM by JayJuanGee Merited by Hueristic (1), sirazimuth (1), bitebits (1) |

|

Well fuck, that shit is gonna screw my algorithm!  I'll get u for that! I'll get u for that!Whoa, that's awesome! I never knew the vid of my class musical I starred in would be posted on YT!  You can clearly see from my amazing choreographed moves, I was Michael Jackson's main influence... Opsec sirazimuth!!!!!!!     otherwise you are egging to get a batslappening, even if you had happened to have been a child prodigy.         I am always trying to attack my biases. And right now I am biased towards us not entering a crypto winter, as I have recently posted. BUT. I think I have found a scenario that might tend to undo my optimism... https://www.wsj.com/articles/fed-minutes-reflect-growing-unease-over-high-inflation-11641409628Inflation has the us Federal Reserve talking seriously about quantitative tightening. This means higher interest rates. And I think that could mean a few things: 1. The stock market is a goner if they do this. The reason we continue to see crazy upwards stonks is in great part due to the fact that they keep printing money and lowering interest rates. This could take some of the wind out of those sales. And those prices are so bubblicious already that it's hard to imagine anything but a bloodbath. 2. Bitcoin is currently seen (by most) as the king of risk investments still... so I would expect Bitcoin might follow the stock market. In some ways it's hard to say what they might do because they have painted themselves into a corner. Crashing the already limping enconomy in the name of stopping inflation? Or keep printing and shift into negative interest rates causing absolute explosions in risk assets and making a can of beans cost $4. Hmm... I kind of wish I had not had this thought... I was preferring the bullish mania I was in before...  Yeah well, this is why bitcoins exists...so Bullish as usual. your getting trapped in short term thinking.FTFY - Hueristic;..... your font-size needs to be seen.. especially when you are making a very good point. Over and over we have witnessed a whole hell of a lot of short-term correlations in bitcoinlandia, and sometimes peeps (even bitcoin OGs) want to analyze such short or even medium-term correlations to death, and it is not like those correlations are not true or that they are making invalid points, even while in the longer term, we see that bitcoin is going to eat the lunch of a lot of the short to medium-term correlations.. In other words, the short to medium-term correlations may or may not even end up playing out .. and the more important analysis happens to be various other price dynamics of bitcoin including stock to flow, 4-year fractal and exponential s-curve adoption based on network effects and Metcalfe principles, so even if you want to poo-poo those three mentioned price dynamic model considerations and give them less weight because you believe they are broken because they did not follow your short-term expectations to a "t" (not referring to you Hueristic).. you better still be considering some kind of a similar framework to those above-mentioned credible BTC price models without running the risk of getting ur lil selfie reckt as fuck because being too distracted by various short to medium term macro correlations can reck a guy (or a gal)... anyhow.. seems to be too risky to even attempt to be placing any kind of meaningful/substantial bet on those kinds of potential short to medium-term macro-correlation nonsenses. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1759

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 09, 2022, 09:01:35 PM |

|

|

|

|

|

|

sirazimuth

Legendary

Offline Offline

Activity: 3346

Merit: 3485

born once atheist

|

|

January 09, 2022, 09:12:49 PM |

|

......

You can clearly see from my amazing choreographed moves, I was Michael Jackson's main influence...

Opsec sirazimuth!!!!!!!     ..... ...... You didn't think I was actually serious did you? lol. Then again, I showed vid to my daughter with same tall tale and I almost had her believing for like two seconds. lmao! (the ginger hairdo mop got her thinking) Well, if being a rambunctious know it all brat, and pissing off one's parents and all one's elementary school teachers with silly shenanigans, are attributes of a child prodigy, then I'm guilty as charged... Better give me a good batslappening Jay...  |

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

January 09, 2022, 09:30:47 PM

Last edit: January 09, 2022, 09:40:54 PM by cAPSLOCK Merited by Hueristic (1), JayJuanGee (1), bitebits (1) |

|

Yeah well, this is why bitcoins exists...so Bullish as usual.

your getting trapped in short term thinking.

FTFY - Hueristic;..... your font-size needs to be seen.. especially when you are making a very good point. Over and over we have witnessed a whole hell of a lot of short-term correlations in bitcoinlandia, and sometimes peeps (even bitcoin OGs) want to analyze such short or even medium-term correlations to death, and it is not like those correlations are not true or that they are making invalid points, even while in the longer term, we see that bitcoin is going to eat the lunch of a lot of the short to medium-term correlations.. In other words, the short to medium-term correlations may or may not even end up playing out .. and the more important analysis happens to be various other price dynamics of bitcoin including stock to flow, 4-year fractal and exponential s-curve adoption based on network effects and Metcalfe principles, so even if you want to poo-poo those three mentioned price dynamic model considerations and give them less weight because you believe they are broken because they did not follow your short-term expectations to a "t" (not referring to you Hueristic).. you better still be considering some kind of a similar framework to those above-mentioned credible BTC price models without running the risk of getting ur lil selfie reckt as fuck because being too distracted by various short to medium term macro correlations can reck a guy (or a gal)... anyhow.. seems to be too risky to even attempt to be placing any kind of meaningful/substantial bet on those kinds of potential short to medium-term macro-correlation nonsenses. I actually had the same thought... that most of the time having the punchline as size=1 is fun, but that one is too important for people to have to go to the extra trouble to decode it.  NOW. I want to clear my name. If one were to look at my trading history (not aptly named), one would never say I was a short term thinker. Although I did NOT buy any in the 40k realm. But that is more because I am just broke, rather than I don't think this is a bottom. I am actually mixed on the idea that this could be a bottom. But I do think we are sitting on a pretty strong contender. If there is more to go? Well, it is what it is, and hopefully I will have some extra dough to throw at the corn in the 30s. That said... short term price predictions and the like are the very soul of wall observing, right? I mean... this thread would be MUCH more boring if it was called "The Long Time Preference Holding No Matter What Observer". Right? Speaking of which... I am looking at TWO nice looking bullflags in a row on a SUNDAY no less. If this is a bulltrap it will be very well played...  |

|

|

|

|

|

Poll

Poll