ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 25, 2022, 07:01:16 PM |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

"This isn't the kind of software where we can leave so many unresolved bugs that we need a tracker for them." -- Satoshi

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

HI-TEC99

Legendary

Offline Offline

Activity: 2772

Merit: 2846

|

Not one mention of Bitcoin in that article. Unfortunately many people still confuse Bitcoin and "crypto". The referenced article do says few negative things about bitcoin : " Between 2010 and 2022, bitcoin recorded 29 episodes of drawdowns of 25% or more. By comparison, equities and commodities recorded just one each. Even in the pandemic-related market sell-off of March 2020, bitcoin suffered significantly deeper drawdowns than conventional asset classes such as equities or bonds.

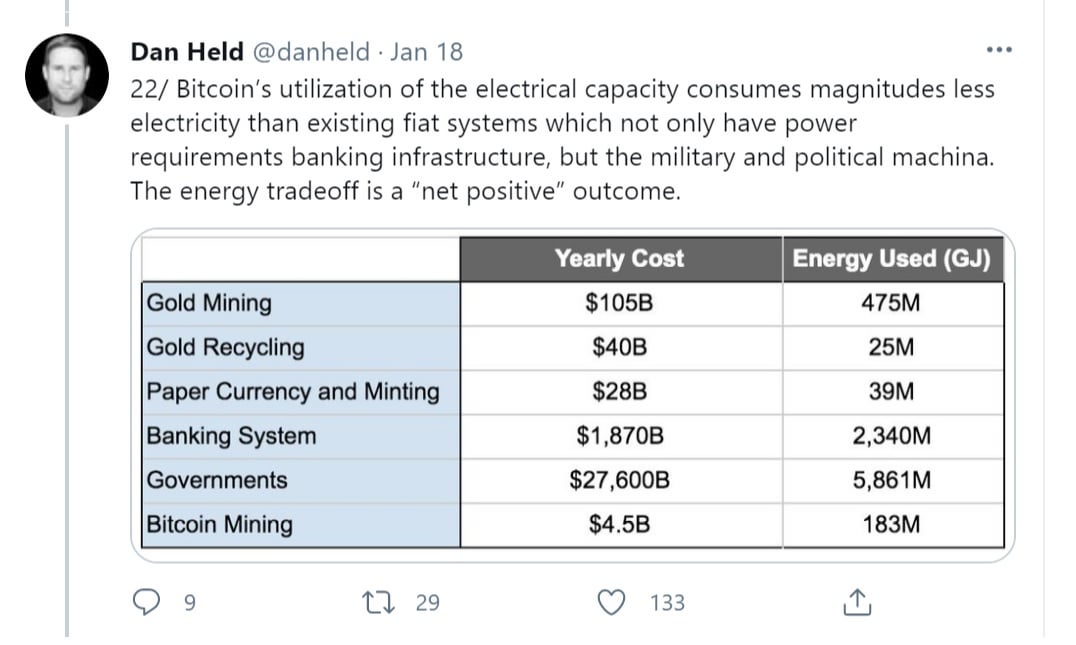

Environmentally, even if the transition from proof-of-work to proof-of-stake that ethereum is spearheading reduces the massive energy consumption underpinning crypto mining and validation, bitcoin — which represents about 40% of current cryptocurrency market cap — will continue to use a validation process where a single transaction requires enough energy to power the average American home for two months. " IMO these are just what people are saying about bitcoin since its inception. They saying how many times bitcoin fell not how many times it went up. If lying about Pow vs Pos was properly punished the Piece Of Shit that wrote this would suffer the torment of Prometheus 3 fold in that their liver and their testicles (or ovaries) would be devoured and regrown every day for all eternity. https://en.wikipedia.org/wiki/Prometheus the story is on wiki Banking uses more energy than bitcoin mining.  https://cointelegraph.com/news/banking-uses-56-times-more-energy-than-bitcoin-valuechain-report https://cointelegraph.com/news/banking-uses-56-times-more-energy-than-bitcoin-valuechain-reportA research report published by Michel Khazzaka, an IT engineer, cryptographer and consultant, calculates that Bitcoin payments are a "million times more efficient" than the legacy financial system. Plus, the banking sector “uses 56 times more energy than Bitcoin.”

The report compiles almost four years of research and suggests a new calculation for estimating Bitcoin's proof-of-work energy consumption. |

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7768

'The right to privacy matters'

|

|

November 25, 2022, 07:35:44 PM Merited by vapourminer (1) |

|

Oops. Totally missed the part after the annoying ad.

The article just telling one side of story: With more than $2 trillion in cryptocurrency value wiped out since the 2021 high-water mark https://www.cnbc.com/2022/11/25/cryptocurrency-hasnt-been-a-smart-investment-for-a-while.html It completely missed out the other part aka how the market cap of crypto reaches 2 trillion and how much profit it gave to investors? If lying about Pow vs Pos was properly punished the Piece Of Shit that wrote this would suffer the torment of Prometheus 3 fold in that their liver and their testicles (or ovaries) would be devoured and regrown every day for all eternity. https://en.wikipedia.org/wiki/Prometheus the story is on wiki I read somewhere very early that PoW and PoS are two ways of climbing the same mountain. May be someone agree too or correct me. Except POS has nothing to do with climbing the same mountain. It is at best simply a centralized unsecured unregulated bond based on code. POW is a power conversion based system that uses energy, code and hard gear. It is also decentralized. POS does not belong in the crypto space. Only decentralized Pow coins qualify. Not an opinion just factual. So under 100 coins qualify as crypto. POS should be under codo coins. But I have lived long enough to know that is not going to happen. @ JJG don't bother complaining that btc is not crypto. It is under the catch all of crypto. the true issue is POS vs POW I am a POW maximalist. I rule out all POS I like a few POW coins. much like our great buddy ELON MUSK I hedge between BTC+DOGE |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 25, 2022, 07:42:10 PM |

|

Who else was blessed enough to buy this 2022 dip?

For sure, I am not opposed to this kind of a question, and many of us likely recognize and appreciate that those who are bitcoin believers with fewer coins and less time in bitcoin are quite likely going to be more excited about the dip and/or being able to buy BTC on the way down.. whether that might be rightfully categorized as blessed or not. I surely do not intend to be overly-simplifying the matter because there could be bitcoin believers who either developed systems of selling BTC on the way up or who otherwise ended up selling on the way up who either still have cash from those sales because they did not buy back too soon or that they just got lucky to still have cash (maybe referred to as "blessed"?) because they somehow were not able to buy on the way down to these current BTC price levels. Another category of person able to either buy BTC or to keep funds in BTC are those who have ongoing cashflow that exceeds their expenses - whether that cashflow is from cash or BTC regularly coming in. I waited for this for months but didn't expected it to go below $18k. I think that I was like a decent quantity of BTC believers who considered that in November 2021 we were still on the way up and that any downward correction had greater than 50/50 odds of going up as compared to going down.. so every time that the BTC price crossed below lower and lower price points without recovering upwards caused more and more worries - so I considered the likelihood of going beliw $28k and/or staying below $28k to be lower than 50/50... However, crossing down below $35k in May 2022 caused me to worry.. and I likely had to reallocate "buying on the way down" money several times - including that several times I was put into a position to consider to add more money (that had not been previously assigned to BTC) to buy on dips, and likely most, if not all of the money that I have been using since buying at $17k-ish would be considered "new money" rather than "already in the system" money. I feel that it sucks, rather than feeling "blessed," even though I do still have money coming in that I am able to use, and I even have some money sources that have either dried up or have gone to very low amounts just like the pressures that other normies are feeling with either expenses going up or just that other people around me are tightening (or running into cashflow issues, or even having had fucked up their finances) which causes less money to come in my direction. I don't really feel blessed about this, even though surely it could be worse in terms of more of my incoming money potentially drying up or even additional expenses as a lot of us seem to be having to face. I don't want the whole world to blow up, even if I feel that aspects of my moat and my cushion had been greater than a lot of my peers, but I am suffering too.. and not really feeling as blessed as I had been feeling prior to May 2022. Prior to May 2022.. I likely felt blessed, even during some of our then negative BTC prices... which are not even seeming negative, relative to our current state of affairs in BTClandia. Simple math, If you buy today BTC worth $1k, it will be worth $2k when BTC goes 50% down from ATH ($33k)  Fair enough. I doubt that it is even necessary to have 100% up in order to feel better.. so even if it were to take 3 years to slowly get back to $33k, it probably will not feel so bad, as long as we do not have further down, but so many of the current prognostics are expecting further down.. so shouldn't we attempt to prepare for either BTC price direction? In other words, with your self-described "simple math" how long is it going to take for our lil precious to get back to $33k? |

|

|

|

|

goldkingcoiner

Legendary

Offline Offline

Activity: 2030

Merit: 1656

Verified Bitcoin Hodler

|

|

November 25, 2022, 07:45:55 PM |

|

The gays have taken over Bitcoin TA while we were too busy shitposting. Bob, did you do this? Gaycentralised. I do however believe this is the best TA. |

|

|

|

|

ImThour

Copper Member

Legendary

Offline Offline

Activity: 1400

Merit: 1512

Bitcoin Bottom was at $15.4k

|

|

November 25, 2022, 07:48:48 PM |

|

Who else was blessed enough to buy this 2022 dip?

For sure, I am not opposed to this kind of a question, and many of us likely recognize and appreciate that those who are bitcoin believers with fewer coins and less time in bitcoin are quite likely going to be more excited about the dip and/or being able to buy BTC on the way down.. whether that might be rightfully categorized as blessed or not. I think Twitter is better platform to ask this rather than WO thread on Bitcointalk filled with whales like you  I waited for this for months but didn't expected it to go below $18k. I feel that it sucks, rather than feeling "blessed," even though I do still have money coming in that I am able to use, and I even have some money sources that have either dried up or have gone to very low amounts just like the pressures that other normies are feeling with either expenses going up or just that other people around me are tightening (or running into cashflow issues, or even having had fucked up their finances) which causes less money to come in my direction. Not sure why you ignored all the signs and even my shit TA but in the end, it was correct and the stupid logics of mine and ideas literally worked. Nothing surprising though, it was more like 4 year cycle being played out. Simple math, If you buy today BTC worth $1k, it will be worth $2k when BTC goes 50% down from ATH ($33k)  In other words, with your self-described "simple math" how long is it going to take for our lil precious to get back to $33k? No idea mate, I am enjoying my HODLing session and working real hard IRL on my professional job. I wish to retire by 2025 though, long way ahead. BTC |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 25, 2022, 08:01:17 PM |

|

|

|

|

|

|

eXPHorizon

Full Member

Offline Offline

Activity: 1176

Merit: 132

Precision Beats Power and Timing Beats Speed.

|

|

November 25, 2022, 08:05:31 PM |

|

Banking uses more energy than bitcoin mining.

How much are you willing to bet on that ? |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

November 25, 2022, 08:55:32 PM |

|

Not a very exciting game...it is probably still too hot there.

England had three good chances, US maybe two (hit the bar).

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 25, 2022, 08:56:02 PM

Last edit: November 25, 2022, 09:17:26 PM by JayJuanGee Merited by vapourminer (1), AlcoHoDL (1) |

|

Not one mention of Bitcoin in that article. Unfortunately many people still confuse Bitcoin and "crypto". The "problem" issue seems to be getting worse and even more convoluted - because in recent times, it is starting to feel more difficult to figure out what kinds of matters are causing BTC's price to experience so many downward pressures, and it might not even seem like a bitcoin versus crypto problem, and instead seems to be a problem that is embedded into the fiat debt system that allows for gambling on BTC and gambling on "crypto" and the fact that BTC and crypto are relatively liquid, some of the "crypto" aspects start to seem as if they might be innocent - because the weakness seems to be coming from a slightly different angle in which even the supposed "responsible" bitcoiners (such as miners and financial institutions like GBTC some others) had gotten wrapped up in various kinds of debt relations in which bitcoin ends up appearing to be part of the problem because people are playing around with bitcoin that they do not have and some of us bitcoiners had been thinking that some of those practices were potentially o.k (at least something that we are not so easy to escape such usage).. but then now we see contagion everywhere... . ....but still I am not going to be giving up on the need to at least clarify what the fuck they are talking about when they refer to "crypto." Are they talking about bitcoin or not? And if so how much of it is related to bitcoin and how much is some other topic, that might not be irrelevant, but they still should be trying to clarify what the fuck they are talking about exactly, because even if they might think that we know what they mean, if they do not define it then how are we going to know because many of us bitcoiners realize that there is no such thing as "crypto" even if really smart people insist on using that term. I recently had someone (in real life) go a bit ape shit on me because I asked him what he meant by "crypto," and when I told him that I did not know what he was talking about, he told me that he would "use whatever word that he likes," even if I don't like it. So I did not give up even though he was bordering upon actual violence, even though he was being quite confrontational about his wanting to use that word, and I continued to say that I am not going to know what he is talking about if he keeps saying "crypto" merely because everyone else uses the term, but he is actually talking about bitcoin or something else. If he is talking about "bitcoin" then he should say that is what he is talking about. He did give in somewhat.. but really seems to not want to use the word bitcoin for some reason. It seems to me that there are some people who are starting to fight back in terms of their insistence upon using vague words and refusing to use the word bitcoin, and so I suppose if they continue to say that they are going to keep using those kinds of vague words, and we do not know what they mean, then it seems that we have a duty to make sure they specify what they are talking about.. even if it might lead to violence and we might not be able to walk away.. what if we start getting beaten until we allow them to say what they like? Should we continue to insist so that if they use the term crypto and define it, then we know if they are talking about bitcoin or something else, and if they are talking about bitcoin, then why not just use the word, "bitcoin"? If we do not insist, then we are also going to get lured into such sloppy references, and even we will not know what we are talking about either if we are using such term without specifying it on a fairly regular basis. There is no real short cut if we really want to have some kind of a meaningful conversation rather than just spouting out vagaries. If lying about Pow vs Pos was properly punished the Piece Of Shit that wrote this would suffer the torment of Prometheus 3 fold in that their liver and their testicles (or ovaries) would be devoured and regrown every day for all eternity. https://en.wikipedia.org/wiki/Prometheus the story is on wiki I read somewhere very early that PoW and PoS are two ways of climbing the same mountain. May be someone agree too or correct me. If I am following you WatChe, you lost me.... How could it be that POW and POS are merely just different but similar systems? Bitcoin's POW is an invention of something new.. so probably you need to understand what POW is and what it invented if you are going to compare POW to some random other system in order to understand if the other random system (in this case POS) actually brings any value or is comparable. It seems to me that there is nothing new with POS. It is not really inventing anything - except perhaps trying to convolute matters and to appear as if there is some kind of an innovation when it is just largely perpetuation of various status quo systems, but instead shifts power to people who are staking. ....and how does that empowering of stakers do anything except for maintain a status quo group that is in power or just switch the group in power in status quo institutions to another group that is created under the POS system (which if we are referring to ethereum, then that group of centralized stakers get control). The whole POS thing seems like a kind of digital pyramid program in which the early stakers are nearly impossible to change.. .. it is like a self-referencial oracle that refers to the status of truth to the incumbent power holders (the ones with the most stake) including that with ethereum specifically, there is a lack of transparency in terms of the total number of ethereum that had ever been in existence in the first place, so it is quite difficult to even know what the value of the numerator is (staked versus circulating) when we cannot even know how many coins existed in the first place... and then if you do not know the starting point of how many coins were invented, then how are you ever going to be able to establish if coins are not just being created randomly at various strategic points in time and benefiting the early-stakers (coin holders) as compared to the late arriving patsies (suckers, gullible ones)... you never know because you cannot even verify the whole number of coins.. so that non-verification goes beyond the idea of POS.. It's giving me a headache.. again to feel that there is any need to even go down this road.. .. there is no there there, but you (WatChe) still want to somehow suggest that POS is actually adding something of value? @ JJG don't bother complaining that btc is not crypto.

Why would I complain (do I look like a complainer?) about a true statement (in the form of a question) that you just made? Or you are saying that you can say whatever the fuck vague thing that you want and expect people to understand, recognize and appreciate what you are talking about? I would suggest if you feel that you "need to use" the word "crypto" that you at least clarify what you are talking about. Once you clarify what you are talking about, then you have conquered at least half the battle, and one you have clarified what it is that you are talking about, then you might decide that you might not even need to use that vague-ass word, aka "crypto," in order to say what you are wanting to say. Go figure. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 25, 2022, 09:01:24 PM |

|

|

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

November 25, 2022, 09:24:26 PM

Last edit: November 26, 2022, 02:35:07 AM by Biodom Merited by vapourminer (1), JayJuanGee (1) |

|

I dunno...Saylor was considered a role model, but he borrowed "through the nose" to buy most of his bitcoin.

I guess people just can't get rid of "leverage to the hilt" mentality.

Maybe we all, as 'investors', can never have a true bitcoin mentality, hence the volatility.

I was one of "them" back in 2000 when I thought that my margin borrowing was safe...proceeded to almost zero out a significant brokerage account (sold to at least not owe any money) .

No leverage for me since (albeit i dabble in small bets on options).

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 25, 2022, 10:01:17 PM |

|

|

|

|

|

|

OutOfMemory

Legendary

Offline Offline

Activity: 1526

Merit: 2995

Man who stares at charts

|

|

November 25, 2022, 10:03:54 PM |

|

Who else was blessed enough to buy this 2022 dip? I waited for this for months but didn't expected it to go below $18k. Simple math, If you buy today BTC worth $1k, it will be worth $2k when BTC goes 50% down from ATH ($33k)  I did. Not on the very low, but at levels slightly above of what we are today. I had a little cash and no use, before the astrography camera incident, so i was lucky not to spend it all, while i was speculating on another V (leg down, leg up), but so far ir didn't come. |

|

|

|

|

BTCaesar

Member

Offline Offline

Activity: 108

Merit: 23

|

|

November 25, 2022, 10:23:51 PM |

|

What i have experienced during my HODL Journey till now is when the big players talk about BTC positively, there is always a big down trend after then. I wonder now how dip we will go from here?

A-) $14,5k

B-) $12K

C-) lower

or

D-) is it already the end of bottom line?

|

|

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3794

Merit: 4874

Doomed to see the future and unable to prevent it

|

|

November 25, 2022, 10:33:36 PM |

|

I dunno...Saylor was considered a role model, but he borrowed "through the nose" to buy most of his bitcoin.

I guess people just can't get rid of "leverage to the hilt" mentality.

Maybe we all, as 'investors' can never have a true bitcoin mentality, hence the volatility.

I was one of "them" back in 2000 when I thought that my margin borrowing was safe...proceeded to almost zero out a significant brokerage account (sold to at least not owe any money) .

No leverage for me since (albeit i dabble in small bets on options).

The only way it will drop to his liquidation level is if the fuckery is so high it can be easily exposed. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 25, 2022, 11:01:16 PM |

|

|

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7768

'The right to privacy matters'

|

|

November 25, 2022, 11:57:11 PM |

|

What i have experienced during my HODL Journey till now is when the big players talk about BTC positively, there is always a big down trend after then. I wonder now how dip we will go from here?

A-) $14,5k

B-) $12K

C-) lower

or

D-) is it already the end of bottom line?

10k will be really hard to go under. You would need 1 or more exchanges failing Now New York Passed a BTC mining law that has some restrictions on new miners. ie any new large mine must use renewable energy. So Niagara falls = yes Solar = yes Wind mills = yes all other = no this could prove to be an interesting twist for mining if it catches on in the USA. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 26, 2022, 12:00:07 AM |

|

Who else was blessed enough to buy this 2022 dip?

For sure, I am not opposed to this kind of a question, and many of us likely recognize and appreciate that those who are bitcoin believers with fewer coins and less time in bitcoin are quite likely going to be more excited about the dip and/or being able to buy BTC on the way down.. whether that might be rightfully categorized as blessed or not. I think Twitter is better platform to ask this rather than WO thread on Bitcointalk filled with whales like you  Do we (royal perhaps?) have to pull out the fish chart again? not that I would be able to exactly figure out which fish chart should be used as "currently applicable" to our current times. Also, not that I have suggested that I have been able to accumulate much more than the 0.63 BTC that I have admitted to .. even though I have proclaimed that I have been accumulating sats, so those sats do end up adding up.. by definition, the more you stack, the more you end up having. So.. besides what I have already said, I still consider that time in the market does provide a lot of opportunities to stack sats in such a way that the longer that we have been in, then the more likely that we are going to be in profits, too. It surely is possible that even someone who has been into bitcoin for 5 years, might not have been able to keep his/her costs below current prices if s/he bought at the wrong time and did not buy consistently, and also even a consistent sats stacker who got into bitcoin after mid-November 2020 might have pretty high likelihood of currently having his/her BTC stash in the negative.. even by pretty large percentages of greater than 30% in the negative... devils in the details.. which is one of the stressful aspects of our current price position for those who might have stacked big earlier and who might be running out of money to stack currently, but still if they had not been into bitcoin for very long, there are still possibilities, then they could feel sufficiently o.k. about stacking sats while their overall holdings are in the negative in order to bring down the average cost per BTC for those BTC that are held. Maybe even you, ImThour, fit in the category of those who really did not get into serious stacking until around that late 2020 time.. and I think that you even had proclaimed as much, even though you also proclaimed to have had made some decently good (or lucky?) trades that would have had the net advantage of both bringing down your cost per BTC and allowing you to stack more sats than you had originally speculated that you were going to be able to stack.. and sometimes even those "good" or "lucky" plays might not even be seeming as great since buying on the dip does not seem to feel as good when the dip keeps dipping. I waited for this for months but didn't expected it to go below $18k. I feel that it sucks, rather than feeling "blessed," even though I do still have money coming in that I am able to use, and I even have some money sources that have either dried up or have gone to very low amounts just like the pressures that other normies are feeling with either expenses going up or just that other people around me are tightening (or running into cashflow issues, or even having had fucked up their finances) which causes less money to come in my direction. Not sure why you ignored all the signs and even my shit TA but in the end, it was correct and the stupid logics of mine and ideas literally worked. Nothing surprising though, it was more like 4 year cycle being played out. Hm? You want to suggest that you had some kind of idea that this correction was coming, even though it corrected "a bit" more than you expected. I would suggest that my system does not really attempt to fuck around with trading or trying to time the BTC price - so I don't understand why you would be trying to attribute those kinds of practices to my approach. Yes, I have a system that sells on the way up and buys on the way down, and yeah, maybe I could attempt to tweak it to attempt to sell a bit more or to buy a bit more, but any tweaks that I do are not generally playing around with selling in order to buy lower.. so in that sense, if I am selling, I am selling on the way up.. not in order to buy back lower, and if the price ends up going lower, then I buy if I have money. I am not unhappy with my whole approach. It works for me, and fits all of my various parameters quite well... even if there could be moments of ":could have done this or could have done that" but overall it seems to work quite well in account to my whole financial and psychological situation.. and also, if you had not noticed, I do not tend to be very receptive to very many of the TA calls, unless they are famed in somewhat humble ways.. historically, your calls have not been framed very humbly.. even though it is possible that you could get better in that direction.. even though you are still trying to suggest that you "knew" or "felt" that the price would be going to the places where it has ended up going... which leans in the annoying.. rather than humble direction.. but hey.. not everyone is humble, and so sometimes there will be clashes.. including with me, when I see guys going overboard in that direction.. and sure it is somewhat subjective.. including that if someone has a pretty long posting history here, and they have some periods of NOT acting humble, I won't even say anything until it gets to a certain irritating point.. and so yeah, I admit that there is some subjectivity involved.. including that mature people do not tend to be braggers anyhow.. and maturity is not ONLY about age, either. You might say that I am guilty of the same "non-humbleness" that I am accusing others of demonstrating, and sure, there might be some evidence of that.. or it might appear to be that any of us is presenting ourselves and our ideas with too much arrogance, and you are free arrive at your own conclusions in that direction... it is NOT always clear in regards to "who started it," and sometimes some level of arrogance is needed.. especially when dealing with trolls, shills and twats .. so.. it is probably better to leave it there for now.. and maybe you get what I am saying, and maybe you don't.. Simple math, If you buy today BTC worth $1k, it will be worth $2k when BTC goes 50% down from ATH ($33k)  In other words, with your self-described "simple math" how long is it going to take for our lil precious to get back to $33k? No idea mate, I am enjoying my HODLing session and working real hard IRL on my professional job. I wish to retire by 2025 though, long way ahead. BTCSometimes we talk about retiring as a another way of suggesting getting to entry-level fuck you status.. so there are a variety of ways to measure that, especially if BTC is part of the package of what will be kept within a retirement planning package.. or if there might be ideas that retirement includes getting out of BTC.. So I am not exactly sure what you mean, and sometimes people might consider that they wind down their work, rather than completely stopping their work - which is also a way of suggesting that they are in a "kind of fuck you status" in which they are more able to pick and choose whether to work and the quantity of work if they choose to work... or whether they take on projects. There is no real way to measure 2025 as being longer than 3 years - ish if you are talking about retiring by the end of 2025.. so three more years can fly by pretty quick, and I would imagine anyone who is currently working and planning on transitioning into NOT having to work within 3 years would be in a position in which they are getting pretty close to being able to pull the trigger to get into such status.. so most of the ducks are already mostly in a row. Of course, prior to March 2020, I had been using a quasi-liquid investment portfolio of $1 million for consideration of entry-level fuck-you status (so that is considering having a passive income of $3,333 per month or $40k per year), and after March 2020, I have been using $2 million (which is double the expected passive income), even though I have heard several folks use differing target amounts in regards to what they believe that they will need - even if they are trying to speak generally in terms of something like a western lifestyle.. so of course, there can be quite a bit of variation in regards to how much is needed, how such an investment portfolio might be allocated in order to allow for not having to work and even being able to sustain the lifestyle that a guy/gal is used to or whatever level of lifestyle s/he expects to have through living on that investment portfolio (and perhaps retaining work as optional rather than something that has to be done). |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 26, 2022, 12:01:22 AM |

|

|

|

|

|

|

|

Poll

Poll