|

I don't think any actual bitcoin hodler is praying to anyone, needless to say, to banks and institutions to start buying.

The question is: What does it matter? We cannot avoid banks and institutions getting in. We cannot avoid they creating futures, to dump the market, then ETFs and BTC settled platforms like Bakkt, to pump into $100,000++. It's just how it goes. If there is a demand for it and there is definitely a demand, these products will arise and will make it easier for people that want to exposure to the market but are too incompetent to deal with private keys.

Only when fiat collapses and people start seeing their wealth lost/confiscated to save banks they will learn about bitcoin and freedom.

|

|

|

|

|

I realized that on the positive side: most competent miners plan ahead, if not all of them, so they should be ready to mine at a loss for a long time, speculating that the price will go up in the future. A lot of them have done this in the past with great results, and there's no reason bitcoin will not go to ATH again since the fundamentals are the same as always, this is just fiat price manipulation as we have seen every 3 years + FOMO.

Also ASIC prices should go down if many miners start quitting as they would be panicking wanting to get rid of all their gear as they would think it would become worthless, so someone else out there would see an opportunity to get these cheap ASICs and start mining.

I think the risk would only be if there was a massive and sudden drop of hashrate, but we have so much hashrate that the losses we've seen don't matter that much.

|

|

|

|

Does anyone have the exact numbers of how much protection you get using a 24 word seed vs using the conventional default standard that shows up automatically when you create a wallet in Electrum?

It's still not clear to me that you can trust this type of wallet, that could be bruteforced and then all of your keys are compromised forever as long as you keep creating them on that wallet. It still seems safer to use a wallet.dat file. I want to see the math.

From what I know, they are safe enough against brute force, some numbers should be on reddit. They say that for 12-word Electrum seed it would be needed about 10 12 years. And from this point I think that 24 words is just extra hassle. Maybe it would even help more to add your favorite word as custom word, but I am no specialist. What about key derivation. What are the chances that one could derive a seed by taking control of a public master key and something else? I've heard some concerns along the lines about key derivation which is why I just would avoid seed-based wallets altogether and would focus on the classic wallet.dat format but I haven't studied the details, I have just heard conflicting opinions. As far as 24 being too much of a hassle.. well I doubt you can trust your memory to memorize 12 words for the long term, so would need to type the seed somewhere, so if you are going to type 12 words you might as well type 24. |

|

|

|

|

Does anyone have the exact numbers of how much protection you get using a 24 word seed vs using the conventional default standard that shows up automatically when you create a wallet in Electrum?

It's still not clear to me that you can trust this type of wallet, that could be bruteforced and then all of your keys are compromised forever as long as you keep creating them on that wallet. It still seems safer to use a wallet.dat file. I want to see the math.

|

|

|

|

|

An interesting statistic would be to know how many downloads happened on that year of the bitcoin binaries, which I think were at first posted on the mailing list, somewhere on sourceforge, and im not sure when the bitcoin.org site started or if it was posted anywhere else.

With that you would get a guesstimate, excluding people downloading the same binaries once, or the same people downloading different updates, but you could extrapolate something useful.

I don't see no other way. I don't think there's a log of amount of nodes of 2009, that would be ideal tho.

|

|

|

|

It's Craig wright. He's the real SATOSHI.

ALL IN SV.

People who say that Craig is Satoshi because he's saying so are incredibly naive. If you all believe that he's your leader why don't you all buy his SV shitcoin. If you all gather up it will go to the moon within days and Craig will make back some of the money lost in the hash wars. Help your leader, buy his shitcoin!  Im pretty sure that he is trolling so you are definitely biting the bait. On a serious note, Craig Wright has only a certain margin to annoy actual Bitcoin with his games. Fiat price falls are tolerated because it doesn't matter in the long term, however decreasing the security of the Bitcoin network is not welcome. Nothing in life comes for free. If these forking guys think they can crash the hashrate without no consequences then they are deluded and someone will prove this point eventually. But in any case Craig Wright has already accepted defeat, he said there wouldn't be a split, and there was a split, he failed. In return, Roger Ver proved the ABC side is also centralized by arbitrarily adding checkpoints. The end result is always the same: Bitcoin wins and scammers go bankrupt. |

|

|

|

This is nonsense, Bcash is in no position to do any serious harm to Bitcoin. If you are worried about a $500 crash, then you are part of the problem - you spread panic and FUD. Satoshi, if he is still alive, had no obligation to do anything, no one has a right to tell him what to do with his coins. Satoshi left us because he didn't want to be a dictator, he wanted Bitcoin to be truly decentralized, so begging for an almighty savior is against the spirit of Bitcoin.

The problem is not the price, fiat is infinite, so suppression of the price is just temporary, the actual problem that could piss of actual OG Bitcoin whales is the decrease of hashrate. Bitcoin holders that are here for long term don't give a fuck about fiat prices, but they do care about hashrate numbers, since the higher the hashrate the more secure the network becomes. If idiots like Craig Wright and Ver want to play around with their altcoins by stealing hashrate from Bitcoin, there is a certain margin that you can do that until unfortunately some hardcore Bitcoin whale puts a price on your head. |

|

|

|

It's Craig wright. He's the real SATOSHI. ALL IN SV.  Lol. If at least he started posting in arabic, japanese, and Fortnite gifs or whatever the fuck these cartoons are, hours before the p2pfoundation satoshi profile "nour" post happened, he could have hinted that he controls p2pfoundation profile (which was hacked years ago, so it would just proved that the bought the account from hackers, once again, just like he recently bought the @satoshi twitter handle (and got banned)  He likes to talk about proof of social media, and it's all he does. |

|

|

|

|

This is how easy it is to trick noobs into thinking satoshi is back. If you lurk around and research, you will find out the fact that this email accounts have all been hacked. Even his bitcointalk was considered compromised and closed. his vistomail and the gmx accounts also were hacked (and by the way, never use gmx, they are the worst shit imaginable, your accounts will stop working out of nowhere and you will lose anything attached to them).

The only way to prove someone is satoshi, is to move genesis coins, if they can't do it, it's nonsense. And even if they can, it would just mean whoever did it has access to said coins, it wouldn't necessarily mean he is the original coder.

|

|

|

|

|

If there is a demand for bitcoin, there will be transactions on the mempool ready to be mined. If you are not doing it, then I will do it an get the rewards, and if it's not economically viable for me, then someone else on the planet will find profit. Bitcoin is a global phenomenon, there's 7 billion people out there. Some of them will always find themselves in a position where they find profit by getting the job done of mining these transactions. Hashrate may go up and down as price fluctuates but I don't see how it can collapse, since as I said someone will always find profit.

As far as the end of rewards, i've seen something proposed that satoshi's bitcoins are re-introduced into the economy by adding them in the next million blocks, so that's 1 extra bitcoin from satoshi's coins for the next million blocks, so you get rid of the "satoshi is moving coins" FUD.

Of course there will be heavy resistance to such a proposal, since the main point of bitcoin is that coins never move unless owner wants to. It's a tricky situation.

|

|

|

|

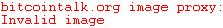

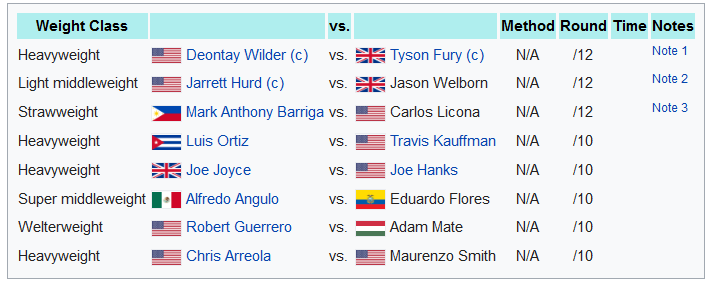

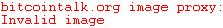

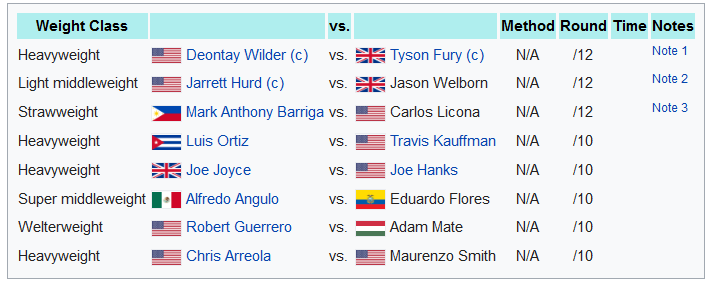

I don't really watch or stick my nose in a heavyweight division fight, But after seeing on who's gonna fight now I could say that Deontay Wilder will sure do a beating to Tyson Fury and this fights gonna be a fast one for Wilder, I could say that this may be finished in a one straight punch of wilder, I would say he has the upper hand because of his Built, Speed, and Power he may land a KO on Fury in this upcoming match.

It's possible that it ends like that, but let's not forget that Tyson Fury was the only one that carried Klitshko into 12 fights with superior boxing (even if it was not a very popular fight spectator wise because it was extremely technical) Anthony Joshua was able to TKO him but it wasn't easy at all, then again Wilder doesn't have the technical skills of Joshua. Throwing big bombs for 12 rounds is just not possible for a heavyweight even if you are slim like Wilder, I don't believe in that, so he must be able to do it within the first 6 rounds or Tyson's superior skills may be able to outbox him for next half. Tyson also seems to be in shape this time unlike when he fought Klitshko which was literally fat. |

|

|

|

I was surprised to see that no one has created a predictions thread for such an iconic fight. This is going to be the most important boxing fight in a long time, specially for the heavyweight division. The full card:  Odds are on Tyson Fury winning. If I was going to bet, I would most likely go with the trend and bet on a Tyson Fury 12 round of technical boxing superiority. But it is insanely risky, it just takes Wilder to launch one punch and it's over, no man has been able to survive his rockets. However, Wilder has never taken such a challenge... Is anyone going to bet BTC or fiat for this one? |

|

|

|

|

After Ngannou's latest performance, Dana White was extremely pissed off at how both guys basically didn't throw a single punch for the duration of the fight. It must have been the most boring fight ever. Very disappointing to see Ngannou basically on shock that night, unable to get anything done.

Win draw or lose, if Ngannou isn't able to put on a good show tonight and delivers another snorefest, I think Dana White is going to fire him and give up on him being a HW prospect.

|

|

|

|

The document is interesting and somewhat makes sense. They talk about a potential KYC requirement when more than $10k in equivalent for transferred, for instance, and I think it is totally fair. What I hate is when KYC is needed for minor things like a couple of hundreds of dollars. I think that something similar should hold for taxation. When someone has a big amount of money, it makes sense that this person should explain where it came from as well as pay taxes for the income. However, why should the government care about some minor transactions and income that is, say, less than $400 in developing countries and $1k per month in the developed countries? The gov won't lose much from not getting these taxes, while for the earners they might be a big burden (unless we are talking about less than 5% taxes, but unfortunately that's not the case where they get implemented). As for the general idea - well, they make some good point on the benefits for the regulated crypto market, but the big loss in the key idea of decentralization, of freedom. It's hard to say that we should give up this freedom.

Governments can implement KYC on exchanges, and are already doing so on all mayor exchanges. Nowadays they all require endless proof of identity. Most ask for phone, address, full name, and even a picture of yourself holding your ID which is extremely risky since that can be cloned a million times and spread around the net, which is why I have always opposed to do such thing, you never know where that picture would end. I did read that pictures like these were being sold on the dark web so I got scared and pretty much left all exchanges because I saw such requirement coming on Poloniex which is were I traded the most. Back then everyone was using fake names and stuff, it was riskier to give some unregulated exchange your real details. Anyway, what I don't understand is: How are they going to implement KYC for actual bitcoin peer to peer transactions? As far as im concerned, that is impossible, which is what ironically makes BTC so undervalued at any rate. |

|

|

|

My prediction calculation is $1400 USD, about the same as an ounce of GOLD. Which would be fine with me if BTC just settled in parity with GOLD.

Bitcoin isn't going to magically settle with 1:1 parity with gold, simply because bitcoin at gold's value is tiny, too tiny, and looks too much like an ideal entry point after such a crash, so a ton of money will come in, it would be a flash dip to sub $2k if we see sub $2k at all, then we are going up again and the next ATH cycle begins. But forget about the price staying that low for a long time, there's too few bitcoins out there. There's enough for everyone, it's just a function of price. The whales are NOT done unloading, the whales are NOT idiots, HODL is for morons, billionaires ( whales ) didn't get rich by being morons.

We don't know that. Most likely everyone that had to sell already sold, and those that still want to sell will wait for a dead cat bounce, whales aren't indeed morons so they know this price is way too low. Whales also got rich by holding since 2011, ignoring the million times that they were told to dump because "it was crashing":  So most whales do know about holding. Also notice that fiat whales don't matter. Real scorecount is BTC, simply because there's infinite fiat and finite BTC, and the features of BTC are desired, so all price suppression of BTC against fiat are only temporary, so any fiat whale that wants to become a BTC whale must buy in bigly as much as they dump when they consider it overvalued, and there's blood on the streets so gambling with lower prices may be a mistake. |

|

|

|

This is going to be tricky. Governments need compliance and regulation to exercise control and power. Recognizing bitcoin to this extent means loosening of that power over its own citizens. The biggest worry for developing countries at least is the implications on money laundering. As far as developed countries are concerned, their too the governments don't stand to gain anything by legitimizing bitcoin.

Japan and Korea seemed to be very accepting of Bitcoin, till the hacking drama with exchanges and involvement of officials. Now we have the regulators jumping in. The problem for the governments is recognizing its importance.

As much as we'd like this to happen, I doubt this is gonna happen in the near future. Then again, wouldn't people like the twins and entities like coinbase become too strong in their own right? How would the lawmakers come to term with that?

But if X country starts using it, X country will start benefiting from clearing transactions saving a ton of money instead of clearing transactions in gold which is very expensive, and they will also benefit from seeing a mass exodus of bitcoiners that go there to pay taxes instead of being seen as criminals, meanwhile country Y is losing on all of these positives. It's again game theory similar to benefits of low taxes (all big companies go there to pay taxes). If they control the exchanges and add KYC there shouldn't be too much money laundering happening. Most criminals don't eve use bitcoin because there are high chances of screwing up and getting caught, criminals are still using cash. As far as Winklevoss brothers becoming too powerful... well, just like Zuckerberg became too powerful, it's how capitalism goes. Coinbase doesn't own all these coins they are holding, they just make money on fees. |

|

|

|

Just like they are holding big amounts of gold and displaying amounts that I think may be approximate amounts:  Could we see this in the future? I think it's a matter of time. If a country starts accumulating a lot, at some point other countries will not be able to keep ignoring it, and I believe you can't ignore Bitcoin just like you couldn't ignore powder, you must be in. Most likely they hold some already but aren't disclosing it. |

|

|

|

|

It depends on who you ask they will tell you a different outcome. If they are pro-EU then you will hear FUD, and independents will tell you leaving EU will be the second coming of Jesus Christ with bitcoins for everyone.

Anyway, as always there is common ground, pros and cons. I believe short term UK will suffer after leaving EU, but long term, if the forecasts of some analysts become true, EU will go into a deep recession and UK may be able to dodge that bullet.

The worst part for me would be lose the easiness of movement across EU as an UK citizen because sorting visas is a pain in the ass, the good part would be to avoid EU conglomerate clusterfucks that can always happen and escalate into the rest of the nations. Italy is still saying that they don't care about the central bank requirements and they are doing their own thing. Salvini may push Italy into a bridge like what happened with Grece, but Italy is not Greece, it could be a big mess.

|

|

|

|

Im interested in knowing if OP ever cashed out some of his bitcoin gains obtain through signature campaign participation. He is still active, he was posting 2 days ago.

I would like to know how it went for you, which information did they request when you cashed out and when filing taxes (how did you prove licit origin of funds). Also did you get hit by any penalties for not paying taxes before or something? Let us know.

Maybe needed a little help on telling him about this thread that he did create thru Pm'ming clarifying on whats the solution he had made on such situation.This is already an old thread and 4 months since on the last reply and was supposed to say that this is necroposting but basing on such question it is really considerable for us to know on what did really happen for him to get out. I don't believe it's necroposting. As far as I know this is the most active thread on the subject of signature campaign taxes. Why create another thread for the same subject. Anyway, if you get a reply from him via PM then tell him to check out the thread and hopefully he can reply. His last post is on 15th and he is wearing a signature so he is still getting payments I presume. I wonder how he solved his situation or if he just decided to hold it all to not risk getting in trouble with the taxman without everything ready when they ask for details. |

|

|

|

So I have a question: Isn't the state of Ohio going to want to know how you acquired those bitcoins you're paying your taxes with? Won't they wonder if you earned them through a sig campaign which you never reported in your tax filing? And stuff like that? I know a lot of folks here are anti-tax and there are a lot of anti-government cryptoanarchists, and I fully respect that. I'm wondering if it's a good idea to pay your taxes with bitcoin. I'm kind of leaning toward it being kind of a setup. It's a nice way for the government to sc00p d3m ch3ap coinz  And then there's that, but I highly doubt the state plans to keep any of the bitcoin. They'll probably use a payment processor that converts bitcoin to fiat just like most merchants use. If they don't do that, they're being completely irresponsible with taxpayer funds given the volatility of bitcoin. I have asked this in the past and so did a lot of other people. There was no consensus. It also depends a lot on your jurisdiction. Some guys from the US said that the government will not care were the money comes from as long as you pay taxes. I find this hard to believe. In other countries you are basically a criminal by default, you must be able to prove origin of funds with receipts and whatnot. Of course since bitcoin jobs like signature campaigns has no receipts and its all anonymous I wonder what kind of information one could provide when asked. Screenshots of payments? addresses signed? Do the government even know about that? Anyway, states accepting bitcoin as taxes is always good. I wish all states in the world accepted bitcoin, so they wouldn't force people to sell for that, which is always risky since I just cant trust any exchange. |

|

|

|

|