ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

February 18, 2022, 01:01:22 PM |

|

|

|

|

|

|

|

|

|

|

|

If you see garbage posts (off-topic, trolling, spam, no point, etc.), use the "report to moderator" links. All reports are investigated, though you will rarely be contacted about your reports.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

February 18, 2022, 01:39:50 PM |

|

Bitcoin is really something Unique (more than any NFT), although it is fungible.

Actually, since it's pseudo-anonymous, Bitcoin is not really (100%) fungible... I will expand on this because the sooner we Bitcoin folk get our heads around this the better. Not only is Bitcoin NOT fungible it is ABSOLUTELY NOT fungible from a pure mathematical aspect. EVERY satoshi has a pedigree. You can trace it's origin all the way to the coinbase it was initially realized in. And you can see the trail of addresses it is passed through to wherever it currently rests. Before you get all mad at me, and Batslap me... I am NOT making a case for a shitcoin. I am just being honest about a feature of bitcoin that we need to come to grips with, and the sooner we do the better. The FBI, for example seems to have figured this out. https://bitcoinmagazine.com/markets/fbi-forms-new-bitcoin-unit-as-doj-taps-new-crypto-headBitcoin is a completely open book. This is a tradeoff that Satoshi realized the downside of fairly early as he talked about address reuse. And as we cheer the world waking up to what bitcoin is in the wake of the bank account seizures we also have to see that the satoshis donated to the protesters recently have mostly been flagged, and it will have created a challenge for the users to deal with. So, there is the growing school of people that preach an amazingly difficult sort of privacy hygiene for Bitcoin, and it surprises me that these folks do not see that they are essentially just making their coins ready for a "list". We are already seeing exchanges treat these coins differently. Accounts get closed, and transactions are refused. Plus the trouble to which one must go to keep their Bitcoin private is beyond the skill level of even very technically adept people. It is unrealistic to "make every transaction a coinjoin" currently. This is ON TOP of the fact that it also might be a bad idea. And frankly the idea that we can add enough privacy features to bitcoin at this point is VERY dubious in my opinion. There are certainly some ways it can be done... BIP 47 is a HUGE improvement, and I hope we see that implemented more widely (currently only as PayNyms in Samourai), and layer 2+ can be built to be much more private. Liquid for example has some of Monero's mojo in it. Anyway. I think this needs to be a much wider discussion in the Bitcoin community since we are already seeing government organizations use bitcoins transparency, and they are only going to get better at it. Ultimately Bitcoin's fungibility is as good as we make it as the users. Do we care about what satoshis we are paid with? I think that is part of the answer... I just don't know how we all get there. It's an interesting problem. |

|

|

|

|

LoyceV

Legendary

Offline Offline

Activity: 3290

Merit: 16557

Thick-Skinned Gang Leader and Golden Feather 2021

|

|

February 18, 2022, 01:54:47 PM |

|

Old Trudeau is a bit of a fuckface isn't he? ~ "Hey you with that truck over there honking all the time, you are a terrorist so I'm taking your Bitcoin."  Just another politician who shows his true colors when people disagree with them. Or as I read elsewhere: If you manage to piss off Canadians, you know you fucked up big! |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

February 18, 2022, 02:01:22 PM |

|

|

|

|

|

|

Richy_T

Legendary

Offline Offline

Activity: 2422

Merit: 2113

1RichyTrEwPYjZSeAYxeiFBNnKC9UjC5k

|

Not only is Bitcoin NOT fungible it is ABSOLUTELY NOT fungible from a pure mathematical aspect. EVERY satoshi has a pedigree. You can trace it's origin all the way to the coinbase it was initially realized in. And you can see the trail of addresses it is passed through to wherever it currently rests.

Not really. When you combine inputs you make the source indeterminate. Coins may taint coins they're mixed with if you want to take that view but that's something different. |

|

|

|

|

Paashaas

Legendary

Offline Offline

Activity: 3424

Merit: 4344

|

|

February 18, 2022, 02:46:30 PM |

|

|

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

February 18, 2022, 02:49:56 PM |

|

Not only is Bitcoin NOT fungible it is ABSOLUTELY NOT fungible from a pure mathematical aspect. EVERY satoshi has a pedigree. You can trace it's origin all the way to the coinbase it was initially realized in. And you can see the trail of addresses it is passed through to wherever it currently rests.

Not really. When you combine inputs you make the source indeterminate. Coins may taint coins they're mixed with if you want to take that view but that's something different. I appreciate the nuance. |

|

|

|

|

Hhampuz

Legendary

Offline Offline

Activity: 2842

Merit: 5914

Meh.

|

|

February 18, 2022, 02:50:06 PM |

|

|

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3542

Merit: 5039

|

.... Hint: freedom doesn't look like wall-to-wall surveillance, propaganda, lies, riot cops in jackboots and balaclavas, secret contracts between multinational corps and govt, banks doing law enforcement .... these are traits of facist totalitarianism, unholy marriage of power between big corporations and big govt

I have heard some folks denigrate protest on one side versus applauding protests on another side - and the existence of riot cops does seem to be an ambiguous thing - because I cannot really blame status quo officials from striving to engage in some combating of protests and to label protests as something other than what they are.. sometimes protests become too powerful too.. so the use of trucks may or may not be legitimate, but you can appreciate the obstacles that such largess presents towards any government that might attempt to control such. By the way, bitcoin can help us in these regards, but cannot necessarily fix matters when people are not sufficiently practiced in how to use it effectively.. so anyone can make mistakes, even very smart people.. and when those smart people are known.. they become actual targets that may well not be ready, willing and able to sacrifice their lil selfies for the cause... even if they say that they are willing.. it's not easy for someone who might be in his/her late 20s or early 30s to become willing to get locked up "out of principle." We are not even going to necessarily agree with some of the substantive issues of some of the protests.. even though there is a lot of legitimacy that those kinds of dynamics can and should exist in "free" societies.. and this imagination of the government disappearing or everyone getting an island or a citadel is just not realistic.. there has to be some governance of public goods/services.. and part of the messy part is that we might not even be able to get two people to completely agree, so in some sense, some of the actual implementations of public goods/services policies/procedures/laws are going to end up having a lot of compromises... and hopefully somewhat representative of the overall population preferences rather than getting diverted into too much weight going to small groups that end up not really representing the overall better way of going forward involving not everyone getting their way..and maybe the structure ends up somewhat in order to NOT infringe too much either... but not forgetting about providing opportunities for normies and maybe some folks who seem undeserving, too. Agreed. Protests CAN work, if the goal of the protesters is reasonable/just and true democracy is allowed to prevail.  |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

February 18, 2022, 03:01:27 PM |

|

|

|

|

|

|

|

poldanmig

|

|

February 18, 2022, 03:36:10 PM |

|

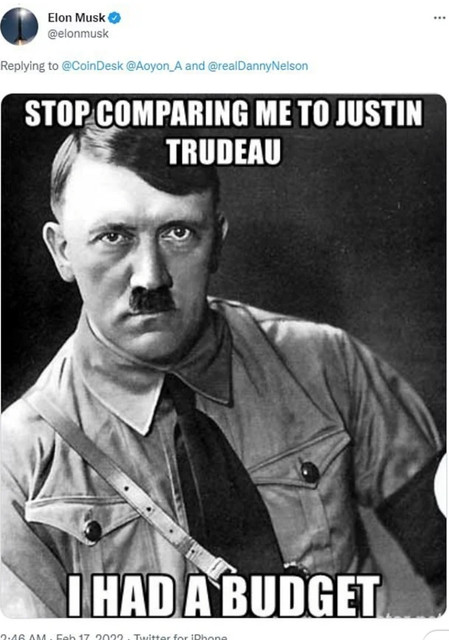

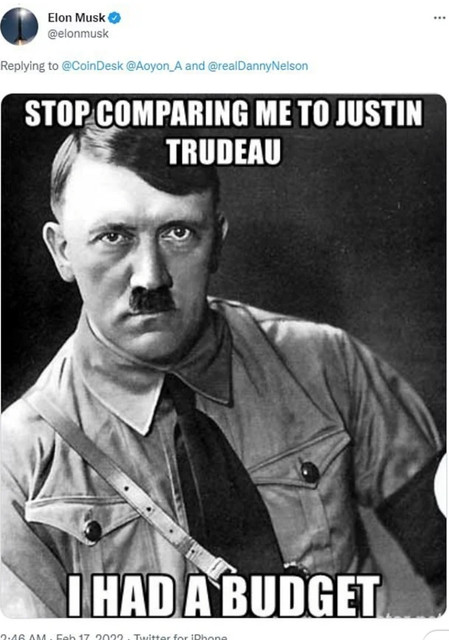

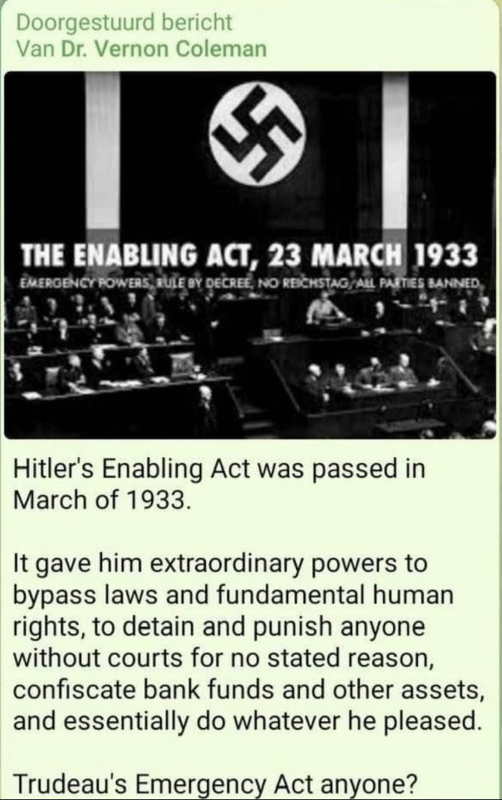

Old Trudeau is a bit of a fuckface isn't he? ~ "Hey you with that truck over there honking all the time, you are a terrorist so I'm taking your Bitcoin."  Just another politician who shows his true colors when people disagree with them. Or as I read elsewhere: If you manage to piss off Canadians, you know you fucked up big! Politicians nowadays are starting to show their true form who are starting to suck the blood of their own people no matter what, the Trudeau government has ordered banks to cut funds to the protesters and it's the same as starving the people, I think it's not wrong if Elon Musk compares Trudeau behavior with the government Hitler in the nazi era in his tweets.  |

|

|

|

|

Tash

Sr. Member

Offline Offline

Activity: 1190

Merit: 305

Pro financial, medical liberty

|

|

February 18, 2022, 03:44:26 PM Merited by JayJuanGee (1) |

|

Old Trudeau is a bit of a fuckface isn't he? ~ "Hey you with that truck over there honking all the time, you are a terrorist so I'm taking your Bitcoin."  Just another politician who shows his true colors when people disagree with them. Or as I read elsewhere: If you manage to piss off Canadians, you know you fucked up big! Politicians nowadays are starting to show their true form who are starting to suck the blood of their own people no matter what, the Trudeau government has ordered banks to cut funds to the protesters and it's the same as starving the people, I think it's not wrong if Elon Musk compares Trudeau behavior with the government Hitler in the nazi era in his tweets.  It's not like the world already knows about emergency powers, and what it means.  |

|

|

|

|

cygan

Legendary

Offline Offline

Activity: 3136

Merit: 7707

Cashback 15%

|

|

February 18, 2022, 03:48:56 PM |

|

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

February 18, 2022, 04:01:21 PM |

|

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

February 18, 2022, 05:01:22 PM |

|

|

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3542

Merit: 5039

|

|

February 18, 2022, 05:32:34 PM

Last edit: February 18, 2022, 05:46:08 PM by Torque |

|

https://twitter.com/rfreedomconvoy/status/1494494256978972674?s=21So I guess Canada is just going to arrest peaceful protesters now without cause or justification? Congrats Canada, you are now a communist country. 👍 👏👏👏 Covid is apparently so deadly and contagious and the vaccine mandates so needed there, that the arresting officers can't even be bothered to wear masks. Lol, what a fucking joke this shitshow has become.

|

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

February 18, 2022, 05:36:01 PM |

|

.... Hint: freedom doesn't look like wall-to-wall surveillance, propaganda, lies, riot cops in jackboots and balaclavas, secret contracts between multinational corps and govt, banks doing law enforcement .... these are traits of facist totalitarianism, unholy marriage of power between big corporations and big govt

I have heard some folks denigrate protest on one side versus applauding protests on another side - and the existence of riot cops does seem to be an ambiguous thing - because I cannot really blame status quo officials from striving to engage in some combating of protests and to label protests as something other than what they are.. sometimes protests become too powerful too.. so the use of trucks may or may not be legitimate, but you can appreciate the obstacles that such largess presents towards any government that might attempt to control such. By the way, bitcoin can help us in these regards, but cannot necessarily fix matters when people are not sufficiently practiced in how to use it effectively.. so anyone can make mistakes, even very smart people.. and when those smart people are known.. they become actual targets that may well not be ready, willing and able to sacrifice their lil selfies for the cause... even if they say that they are willing.. it's not easy for someone who might be in his/her late 20s or early 30s to become willing to get locked up "out of principle." We are not even going to necessarily agree with some of the substantive issues of some of the protests.. even though there is a lot of legitimacy that those kinds of dynamics can and should exist in "free" societies.. and this imagination of the government disappearing or everyone getting an island or a citadel is just not realistic.. there has to be some governance of public goods/services.. and part of the messy part is that we might not even be able to get two people to completely agree, so in some sense, some of the actual implementations of public goods/services policies/procedures/laws are going to end up having a lot of compromises... and hopefully somewhat representative of the overall population preferences rather than getting diverted into too much weight going to small groups that end up not really representing the overall better way of going forward involving not everyone getting their way..and maybe the structure ends up somewhat in order to NOT infringe too much either... but not forgetting about providing opportunities for normies and maybe some folks who seem undeserving, too. Agreed. Protests CAN work, if the goal of the protesters is reasonable/just and true democracy is allowed to prevail.  Just to pick a nit. If you put people in jail for blocking roads in India... Well, there ain't enough jails is all I am saying. |

|

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3794

Merit: 4872

Doomed to see the future and unable to prevent it

|

|

February 18, 2022, 05:39:21 PM |

|

Unless they make their way to the top, have an affair with the King, become another Queen, and then can move and kill any which way. Although this would make a good Marvel movie it is not realistic. It would of course beat having a Hissyfit and inserting a agent provocateur. Also when replying try to resize the quoted jpg. |

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7765

'The right to privacy matters'

|

|

February 18, 2022, 05:44:42 PM Merited by JayJuanGee (1) |

|

https://twitter.com/rfreedomconvoy/status/1494494256978972674?s=21So I guess Canada is just going to arrest peaceful protesters now without cause or justification? Congrats Canada, you are now a communist country. Covid is apparently so deadly and contagious and the vaccine mandates so needed there, that the arresting officers can't even be bothered to wear masks. Lol, what a fucking joke.  The truckers are lucky they have not been machined gunned to death. I not saying killing them is appropriate I am saying they could have been blown away legally as the powers granted to the prime minister include that. Most people simply do not realize most of the civilized world is a police state. Do a disturbing enough protest and you get blown away. It is the trade off for quote un quote a civilized world. Not saying I approve or disapprove simply saying it is what it is. |

|

|

|

|

|

Poll

Poll