JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10241

Self-Custody is a right. Say no to"Non-custodial"

|

|

October 03, 2018, 09:08:34 PM |

|

Personally, I believe that a person can be into bitcoin for what they believe the technology to be without really understanding a lot of the details, and largely relying upon the representations of folks who they believe to be credible and more technologically astute than themself. Of course, there is some necessity to have some skills in terms of attempting to suss out bullshit, and attempting to learn from experiences and to recognize contradictory information. By the way, there is a certain degree of relativism in terms of understanding technology, and there are some folks who seem to be very technologically advanced, relatively speaking, but will exude a certain level of modesty in their discussion and even assert that there some parts of the technology that they do not understand, in spite of their relative high level of technical expertise. |

|

|

|

|

|

|

|

|

|

Each block is stacked on top of the previous one. Adding another block to the top makes all lower blocks more difficult to remove: there is more "weight" above each block. A transaction in a block 6 blocks deep (6 confirmations) will be very difficult to remove.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3808

Merit: 4904

Doomed to see the future and unable to prevent it

|

|

October 03, 2018, 09:11:39 PM |

|

Poll reset  Damn, I'm farther off every month!  I never click/tap Twitter links. Far too much hassle and my device wasting time to show a merely 140 character message. And not even counting going back to this thread.

It is a pain, I have to get redirected to the non Js version as well. Hey mindrust, no need for name calling. Some of us are not young anymore. We no longer trust our memory like we used too.

LOL, unfortunately this is true.  Is this a bad thing?  |

|

|

|

|

|

|

|

Spaceman_Spiff_Original

|

|

October 03, 2018, 09:58:33 PM |

|

spiff

long time no see

welcome!

Thanks jojo! I have been lurking of late, but didn't really feel the need to chime in. No clue where the price is gonna go either. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10241

Self-Custody is a right. Say no to"Non-custodial"

|

|

October 03, 2018, 10:09:15 PM |

|

Do people like these sentiment updates or are they dumb?  I like them. Perhaps make them a tad bit smaller might be more comfortable for folks who might be reading the thread on a mobile device. Something like width=300, like I did above, might be more user-friendly? Edit: I that abvoe, v8 suggested making smaller (but he also said that the information was not useful). I also see that you said that resizing is not easy for you to do.. hm? Personally, I think that even if you cannot resize them to be smaller, the information is still helpful, and I appreciate your going through the fairly regular posting effort - even if it is not hourly, like our once upon a time buddy, "chart."  |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10241

Self-Custody is a right. Say no to"Non-custodial"

|

|

October 03, 2018, 10:21:32 PM |

|

link or it didn't happen.   |

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

https://twitter.com/bitfinex/status/1047461223762153472Bitfinex will be undergoing infrastructure maintenance tomorrow, October 4th, between 06.00 UTC and 18.00 UTC. The exact time will be disclosed 30 minutes prior to the start of the upgrade. Please keep this in mind for all open positions you may have.mind the gap

|

|

|

|

|

d_eddie

Legendary

Offline Offline

Activity: 2492

Merit: 2940

|

|

October 03, 2018, 10:51:06 PM |

|

So by the bitfinexed theory, some significant price movement is to be expected.

|

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

October 03, 2018, 11:12:54 PM |

|

So by the bitfinexed theory, some significant price movement is to be expected.

meh fuck bitfinexed, they're a USG asset now. anyway, last time the downtime was a surprise. a few shorts were squeezed after.  https://bitfinex.statuspage.io/history?page=1 https://bitfinex.statuspage.io/history?page=1 @arjunblj |

|

|

|

|

jojo69

Legendary

Offline Offline

Activity: 3164

Merit: 4345

diamond-handed zealot

|

|

October 03, 2018, 11:18:00 PM |

|

at least I ain't a quitter...

Bob

|

|

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3808

Merit: 4904

Doomed to see the future and unable to prevent it

|

|

October 03, 2018, 11:41:43 PM

Last edit: October 04, 2018, 01:32:44 AM by Hueristic |

|

Do people like these sentiment updates or are they dumb?  I like but you could shrink it just a bit.

I post from mobile so a pain to resize. May just post substantive moves rather than jiggery pokery.

Ahh, that explains it. we do like them just like bob's REKT updates , and where just waiting when fear turns into that green zone .... keep posting them from time to time  True that, Bobs been a little slacking in that department lately. Must be the booze.  There are more Coinbase accounts than Bitcoins

Fake accounts scamming referral money. We already have a sentiment indicator: Rosewater Foundation

He's more colourful, more accurate and much easier to read.

Bitcoin doesn't give a fuck what regulations we put on it. If it ever does, we'll just use Monero.

laws always work better for the ownership class

just make sure you land on the right side of the fence

QFT TIME TO BUY !!! Never going to catch up with this thread.  |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10241

Self-Custody is a right. Say no to"Non-custodial"

|

|

October 03, 2018, 11:53:07 PM |

|

There is almost no scenario in which the price would go straight up, for example to a new ATH within a day or even within a week. I'm not even sure whether an ETF approval would cause that, or some kind of news that some country has made bitcoin it's official currency. Perhaps, but I have real doubts about such sudden exponential movement without any correction. On the other hand, it is not likely, but we could get 100% or 200% within a week.. or we could get a kind of gradual UP and then, BAM, a sudden 100% to 200% UP within a week. Is that what you mean by one of these days, moon? Is moon past the previous ATH or is it some other number? Where is "moon" exactly?  if ((amount of btc * btc price) > target net worth) then MOON O.k. Fair enough that moon is a number that would be somewhat individually tailored - and sometimes, members might need to disclose where that point is for themselves, and sometimes just thinking about "where is moon" can be a psychological well-being point. Part of the reason that I frequently express so much content, even though we are still bouncing around in a 66.6666% correction arena, is that I had considered $3k to $5k to have been the top of the 2017-2018-ish bubble - meaning the next bubble that was coming after the 2013 ATH of $1,163. Accordingly, thereafter I had expected the top to have been in the $3-$5k range and then a correction into the $1k to $3k range. Therefore, it seems to me that there is still a lot of icing on this particular cake, and it kind of already seems, to me, that a variation of moon has already arrived. All of what I am saying does not mean that I am bearish or that there is froth in this market, but a peak that goes to $19,666 remains in the approximately 5x area higher than expected and the correction back to $6k-ish remains in an area of about 5x higher than expected - and even with all of that 5x higher than expected, there seems to be plenty of upside potential, still.... because bitcoin continues to be in a very low adoption level - even with a lot of peeps coming into bitcoin, the numbers still remain trickles in comparison to the world population and in comparison to what is possible based on the ongoing good news in bitcoin, in terms of developments and the seeming solidity of the tech (and computing power for that matter - including bitcoin's continued winning of various infighting). Sure there remains a question about whether alts are coming with on the next journey up, and so that could be the $1,000,000 question about how long any kind of continued correction goes on further or just drags out longer.... let's see, let's see... So even if we are at a kind of moon..., "When next moon?" might be more poignant of a question, perhaps? As much as I want it to be different, a new moon will take a lot of time to materialise. The grind up to 20k will be long and hard, with tons of resistance levels established by previous run-up. Once we pass 20k, price discovery starts again and we are in uncharted waters. Right JJG, I share your sentiment about btc adoption and also did not expect previous top to be this much of an overshoot. I'd caution everyone to be rather conservative in setting any sort of timeline for a next run, my experience has learned me this is always further away than one expects, especially after such a massive year for crypto that we had. Still BTC and perhaps some other alts are terrific buys at this level from a long term perspective thats why I am hodling and accumulating, just as all you smart and fine gents in this thread  Whoaza!!!!! I consider myself to be fairly conservative in terms of both my BTC predictions and my expectations, but in some respects, your above post is coming off as a tad bit more bearish than me, at least in terms of BTC's shorter term dynamics, what is at play in the short term, and the timeline for any possible explosive UPWARDS movements. Let me attempt to explain, and attempt to clarify which might seem to be internal contradictory comments from me. I would also like to modify some of my retrospective views (somewhat based on hindsight is 20/20 rather than being caught within the moment in which thinking/vision is more muddied). In other words, I am kind of modifying my statement of what my then (2017) expectations were to have likely been a bit more bullish than what I have subsequently characterized them to be. First, certainly, I am asserting that BTC's about mid-November 2017 to mid-December 2017, BTC's price performance was much beyond the greatest of expectations that I had, and even though I had anticipated the most reasonable upside to be in the $3k to $5k price territory, I was willing to accept that prices could spike up to $8k or so. Accordingly, in mid-November, when BTC prices went above and beyond $8k, we seemed to have gotten into a kind of "beyond the wildest dreams" price territory. So, yeah, you know (like man), we went about 2.5x beyond $8k, so that was a quite stupendous set of scenarios that seemed to have allowed for that to happen - maybe even an alignment of various happenings, market resolutions and momentum. Even saying all of that, and based on both BTC fundamentals and the price foundation that allowed BTC to rise over more than 2 years in order to be ready for the exponential upwards price run, I am still of an ongoing tentative conclusion that $19,666 was not sufficient to constitute a blow off top. Therefore, I remain tentatively unconvinced that this current price run up can be categorized as "over" or that the now more than 9 month price correction and even largely bouncing back and forth in the sub $10k price territory and even in the lower $6k arena, constitutes anything more than an extremely long and large BTC price correction in the midst of an upwards price run. In other words, after having said all of that, I am not of the conclusion that we can have any kind of confidence that either BTC prices are going down from here or that the road past $20k is going to be a long and drawn out battle. Sure it seems feasible to shake out a few more hands, if that is possible, and I have no doubt that BIG players will attempt to shake, if they can, and if that seems to be the path of least resistance. So, chartalists and fractalists and other folks attempting to overlay 2014/15 patterns over bitcoin or some other similarly bearish pattern in order to suggest that from our current position they can see either what has to happen or what is more probable to happen being either down or a drawn out flat BTC price period, are likely going down a road too far in their assertion of what has to happen or what they consider to be most likely, from my humble bumble perspective. |

|

|

|

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3808

Merit: 4904

Doomed to see the future and unable to prevent it

|

|

October 04, 2018, 01:06:39 AM |

|

I'm afraid once fiat conversion is unnecessary, they'll move the tracking to the actual goods, as they're already doing for assets with substantial value, e.g., cars, real estate etc - as pointed out several times in recent posts.

Exactly. And they'll even apply it retroactively: http://www.cityam.com/264481/mystery-bankers-wife-losses-anti-corruption-order-appealThe high-rolling wife of an anonymous banker has been defeated in her push to overturn efforts by the National Crime Agency (NCA) to make her reveal how she was able to afford properties in Britain worth £22m.

A High Court judge overturned an attempt by the woman, identified as Mrs A, to block the NCA’s use of one of its first-ever “unexplained wealth orders” (UWOs) – new powers to battle corruption which force owners of assets worth £50,000 or more to prove they acquired them legitimately.

The NCA’s order said that Mrs A – who is the wife of a banker from a non-EEA country – had to reveal the source of her income, or face having the properties taken away from her.

The new orders – which reverse the burden of proof, forcing those suspected of gaining assets through crime to prove they were legally obtained – came into effect in January.

The court was told Mrs A had made lavish purchases, including spending over £16.3m over a decade at luxury department store Harrods, and has access to fine wines, private jets and luxurious properties. So conflicted on this.  Well that just means that Petro has some functionality. What would happen if White House applied the same rules for Bticoin?

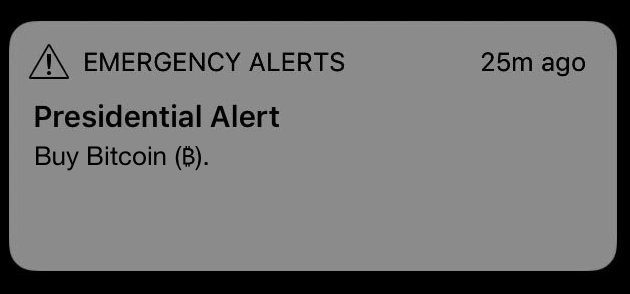

Revolution.https://twitter.com/bitfinex/status/1047461223762153472Bitfinex will be undergoing infrastructure maintenance tomorrow, October 4th, between 06.00 UTC and 18.00 UTC. The exact time will be disclosed 30 minutes prior to the start of the upgrade. Please keep this in mind for all open positions you may have.mind the gap  Very cool, might be photoshopped. we do like them just like bob's REKT updates , and where just waiting when fear turns into that green zone .... keep posting them from time to time  True that, Bobs been a little slacking in that department lately. Must be the booze.  In my defense, it's hard to have wanton carnage and destruction of shorts in this muddling sideways action. I'm keeping my eyeballs peeled tho ! Keeping fingers crossed  |

|

|

|

|

|

Bitcoinaire

|

|

October 04, 2018, 01:07:34 AM |

|

Nice pump! Finally, some action!

|

|

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3808

Merit: 4904

Doomed to see the future and unable to prevent it

|

|

October 04, 2018, 01:12:12 AM |

|

One of those "Ask and Ye Shall Recieve" deals I see.  |

|

|

|

|

infofront (OP)

Legendary

Offline Offline

Activity: 2632

Merit: 2780

Shitcoin Minimalist

|

|

October 04, 2018, 01:41:02 AM |

|

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10241

Self-Custody is a right. Say no to"Non-custodial"

|

|

October 04, 2018, 01:49:30 AM |

|

^ with jjg i try my best with english....  but learning and learning BETTER AND BETTER  THATS what BTC is given me , a better currency, english lessons, computer skills, security skills etc.... haha ( sometimes when i'm @ a friends place and making a post he correct my writing.... ,getting lessons from everybody these days) micgooss is @ learning stages my GF also always complaining with my english writing, so pffff gotta do my best and improve on that. also you've acquired subtle pastiche skills of his waffly meaningless drivel Speak 4 u r selfie, V8, u selectively judgemental fuck.  |

|

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

October 04, 2018, 01:56:25 AM |

|

It’s not a capitulation until everyone despises everyone else

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10241

Self-Custody is a right. Say no to"Non-custodial"

|

|

October 04, 2018, 01:57:31 AM |

|

Still, (I think) Bitcoin was not meant as a way to evade tax or capital controls but to be your own bank by having direct control of your money.

BTC might initially have had those former uses, but is steadily moving away from its experimental past, and that is a very big positive. Regulations treating BTC as a mainstream asset, including AML and institutional KYC, are already essential at the fiat interface, but the treatment of transfers in crypto alone are a different question. On one level, regulations about crypto transfers are defacto recognising it offically as money. That may not be a route that monetary authorities want to go down at present. In most juristictions, all valuable assets are required to be registered in some way,and that usually is a positve in terms of ownership law and security. If BTC is outside that system it will always have a deficiency in terms of adoption and mainstream recognition. I would envisage BTC and some other cryptos eventually coming within all of that, with most others remaining in the grey zone ,with the concomitant freedoms and also drawbacks of that status. Surely the primary facet of cryptos (and the one for which BTC was born) is to provide a parallel monetary store and exchange system, as a refuge from the eventual insolvency of the current fiat regime ? Over the long term, the free market should decide whether that is a worthy, recognised or necessary function. You eloquently make a lot of great points here, and I would emphasize that bitcoin will likely continue to serve as a kind or free market experimental case in that due to its proclaimed (and seemingly practiced decentralization) it remains the most difficult to change, and therefore, peeps are gonna have to adjust to bitcoin, rather than the other way around, and therefore peeps gonna identify use cases and gravitate into various use cases that bitcoin provides (and will continue to provide and develop) and some of those use cases are foreseeable - and others may involve a few battles, and perhaps adjusting and yielding that comes from status quo institutions rather than from bitcoin, though some of the degree of adjusting is yet to be seen and might be subject to battles that are difficult to perceive, exactly, in this moment (as we type our anticipations and predictions). |

|

|

|

|

|

Poll

Poll