|

jonoiv

|

|

April 16, 2020, 10:52:23 AM |

|

7th WO/7k again, this is fine.

Nice green dildo, but I'm with LFC_Bitcoin on this: with such fuel 8k may be not too hard to reach today. 5600 is more likely 56000 more like. you've been saying that for the last 5 years. Been in a bear market for 2.5 of those years |

|

|

|

|

|

|

|

|

|

Whoever mines the block which ends up containing your transaction will get its fee.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

bitcoinPsycho

Legendary

Offline Offline

Activity: 2464

Merit: 2071

$120000 in 2024 Confirmed

|

7th WO/7k again, this is fine.

Nice green dildo, but I'm with LFC_Bitcoin on this: with such fuel 8k may be not too hard to reach today. 5600 is more likely 56000 more like. you've been saying that for the last 5 years. Been in a bear market for 2.5 of those years And I stand by it just as I said in 2013 it would hit $10000 "Bear market" holders unaffected good health to you kind sir |

|

|

|

|

Phil_S

Legendary

Offline Offline

Activity: 2091

Merit: 1461

We choose to go to the moon

|

|

|

|

|

|

bitcoinPsycho

Legendary

Offline Offline

Activity: 2464

Merit: 2071

$120000 in 2024 Confirmed

|

|

April 16, 2020, 11:41:16 AM Merited by JayJuanGee (1) |

|

|

|

|

|

|

vapourminer

Legendary

Offline Offline

Activity: 4326

Merit: 3519

what is this "brake pedal" you speak of?

|

|

April 16, 2020, 11:51:14 AM |

|

I am watching for the Western MSM narrative to sour on China in the next weeks, then we will know it is on.

Fox is running with the Wuhan Institute of Virology lab accident angle tonight. So they dropped the "Chinaman fucking a bat" angle? Hm.... what happens in the labs stays in the labs. well, shit |

|

|

|

|

ivomm

Legendary

Offline Offline

Activity: 1852

Merit: 2841

All good things to those who wait

|

7th WO/7k again, this is fine.

Nice green dildo, but I'm with LFC_Bitcoin on this: with such fuel 8k may be not too hard to reach today. 5600 is more likely 56000 more like. you've been saying that for the last 5 years. Been in a bear market for 2.5 of those years And I stand by it just as I said in 2013 it would hit $10000 "Bear market" holders unaffected good health to you kind sir Traders job is to trick weak hands like joinov to sell with the trend in fear of losing. Or even better, to lure them into shitcoins with promisses of better profit. Holders can't be tricked. Bear market bla bla bla. And in several years - boom 50K (at least)! Deja vu. |

|

|

|

|

fillippone

Legendary

Online Online

Activity: 2156

Merit: 15445

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 16, 2020, 12:11:39 PM

Last edit: May 16, 2023, 02:08:01 AM by fillippone Merited by LFC_Bitcoin (2), JayJuanGee (1) |

|

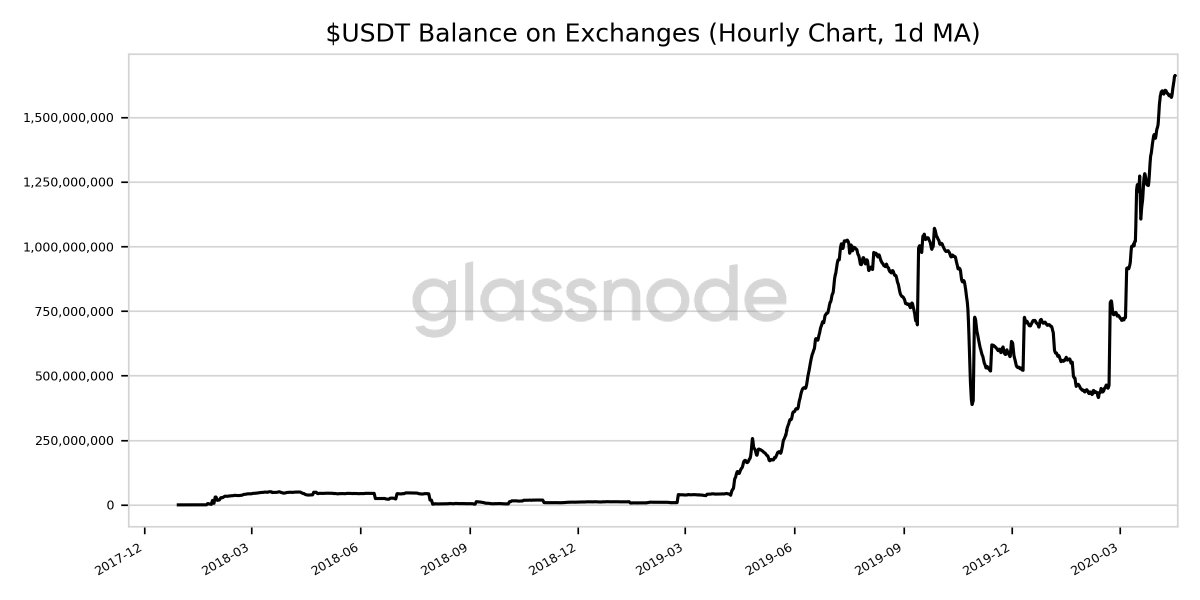

Some dislocations: Chart with upwards trend $USDT Balance on Exchanges (1d MA) just reached an ATH of 1,661,769,830.684 USDT Previous ATH of 1,661,209,417.084 USDT was observed on 15 April 2020 View metric: https://t.co/Hpeb0LFt3p?amp=1 https://twitter.com/glassnodealerts/status/1250655522044477440?s=20 https://twitter.com/glassnodealerts/status/1250655522044477440?s=20So someone is amassing powder into the exchange, ready to fire a big cannon. Also. Very nice read I found: Nothing new, but well written and forwardable to any nocoiner yet to be converted.

Money Is Losing Its Meaning (Bloomberg Opinion) -- Doing “whatever it takes” to save the global economy from the coronavirus pandemic is going to cost a lot of money. The U.S. government alone is spending a few trillion dollars, and the Federal Reserve is creating another few trillion dollars to keep the financial system from collapsing. A custom Bloomberg index measuring M2 figures for 12 major economies including the U.S., China, euro zone and Japan shows their aggregate money supply had already more than doubled to $80 trillion from before the 2008-2009 financial crisis.

These numbers are so large that they no longer have any meaning; they are simply abstractions. It’s been some time since people thought about the concept of money and its purpose. The broad idea is that money has value, but that value is not arbitrary. Former Fed Chairman Paul Volcker once said in an interview that “it is a governmental responsibility to maintain the value of the currency they issue. And when they fail to do that, it is something that undermines an essential trust in government.”

The dollar has no real intrinsic value, backed only by the full faith and credit of the U.S. government. Under a fiat currency system, the government says that a dollar is a dollar. Its value relative to things such as other currencies and gold is determined on global markets. Gold is considered to be an objective store of value, and the metal’s rise in dollar terms can be expressed another way, which is that the dollar fell in gold terms. That implies the market has rendered a decision on the value, or rather, the purchasing power of the dollar.

The three main functions of a currency are as a unit of account, a medium of exchange and a store of value. It is that last function that is most important. Ideally, a central bank would want its currency to retain its value over time. The era of flexible monetary standards, however, allow central banks to manipulate a currency’s value to help fight recessions as well as smooth out and lengthen business cycles at the expense of inflation. But even low inflation, say on the order of 2%, will greatly erode the purchasing power of a currency over time.

And if there are too many dollars in circulation, the monetarists would say that the value of those dollars has diminished, eventually leading to higher prices for things. That theory hasn’t worked too well in the last decade, because inflation has been low and stable, but it is too soon to declare it discredited. The transmission mechanism that results in inflation is not well understood, even 45 years after the last great period of inflation.

It took a while, but it seems as though the U.S. government has decided that it has no constraints on its spending, as long as the Fed continues to monetize government borrowing by purchasing the debt issued to finance expenditures. It’s not crazy to think government spending may reach $10 trillion – for just one year! And the numbers will go up from there.

Nobody really knows how this is going to turn out. In smaller economies, runaway government spending has resulted in hyperinflation and social unrest, such as well-documented cases in Venezuela and Zimbabwe. Many think that wouldn’t be possible in the U.S. given the dollar’s role as the world’s primary reserve currency. Perhaps, but it’s not one of those questions we’d really want to experiment with.

If all this money that’s being created does spark inflation, or at least boost inflation expectations, it will be difficult - if not impossible - to reverse. Inflation rates soared in 1979, but that was during a time, unlike now, when most government officials believed that balanced budgets and careful spending were important. A blistering series of interest-rate hikes pummeled inflation expectations, but the result was a hurricane-force recession. Argentina, which has more or less been practicing MMT for some time, proves that it’s hard to put the inflation genie back in the bottle. Argentines have been hoarding dollars—the only practical store of value, other than gold—for decades. They probably view recent events in the U.S. with some trepidation.

The counterexample to all this is Japan, which historically has had the most debt relative to the size of its economy and the most radical monetary policy, and yet has a peaceful, productive society with scant inflation. Demographics explain a lot about inflation and inflation expectations, and Japan’s steadily declining and aging population has put downward pressure on prices for years in spite of all the printing. Economists and central banks generally fear deflation more than inflation because it can hinder investment. History has shown that persistently high inflation rips societies apart; in deflation, people band together.

Throughout Venezuela’s economic crisis, we saw images of ordinary Venezuelans tossing their useless bolivars in the streets. That is what happens when money has lost all meaning; it is in jeopardy of becoming a commodity when it is supposed to be a scarce resource. There are a million reasons why the U.S. will never meet the same fate as Venezuela, but you still don’t want to tamper with people’s perception of the value of money. After you throw a few trillion dollars around, people start to believe that it’s all a big joke.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Jared Dillian is the editor and publisher of The Daily Dirtnap, investment strategist at Mauldin Economics, and the author of "Street Freak" and "All the Evil of This World." He may have a stake in the areas he writes about.

For more articles like this, please visit us at bloomberg.com/opinion

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P. |

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3528

Merit: 9525

#1 VIP Crypto Casino

|

|

April 16, 2020, 12:18:37 PM |

|

@fillippone

Hmmmm lots of USDT, ready & waiting to spark a significant pump. It’s too quiet atm isn’t it, feels like the calm before a storm. This faux battle at $7,000 seems insignificant. All the weak hands are getting shaken out every time we go below $7,000. I expect a violent surge upwards before the halving. It’s been a long time coming.

|

|

|

|

|

fillippone

Legendary

Online Online

Activity: 2156

Merit: 15445

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 16, 2020, 12:19:44 PM |

|

@fillippone

Hmmmm lots of USDT, ready & waiting to spark a significant pump. It’s too quiet atm isn’t it, feels like the calm before a storm. This faux battle at $7,000 seems insignificant. All the weak hands are getting shaken out every time we go below $7,000. I expect a violent surge upwards before the halving. It’s been a long time coming.

My body is ready. |

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3528

Merit: 9525

#1 VIP Crypto Casino

|

|

April 16, 2020, 12:21:06 PM |

|

@fillippone

Hmmmm lots of USDT, ready & waiting to spark a significant pump. It’s too quiet atm isn’t it, feels like the calm before a storm. This faux battle at $7,000 seems insignificant. All the weak hands are getting shaken out every time we go below $7,000. I expect a violent surge upwards before the halving. It’s been a long time coming.

My body is ready.  |

|

|

|

|

ivomm

Legendary

Offline Offline

Activity: 1852

Merit: 2841

All good things to those who wait

|

@fillippone

Hmmmm lots of USDT, ready & waiting to spark a significant pump. It’s too quiet atm isn’t it, feels like the calm before a storm. This faux battle at $7,000 seems insignificant. All the weak hands are getting shaken out every time we go below $7,000. I expect a violent surge upwards before the halving. It’s been a long time coming.

My body is ready.  The USDT market cap has increased with 1.7 Bil up to 6.3 Bil, since 29th March. With an average price of 9K, this would mean 150K bitcoins. We don't know the intentions of the USDT buyer(s), but it is possible that some good part of it will go into Bitcoin. Not that I believe 100% in that. I just won't be surprised if Bitfinex returns with some 2017 style pumps. |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2506

Merit: 12027

BTC + Crossfit, living life.

|

|

April 16, 2020, 01:07:06 PM |

|

ReFuel rePump

|

|

|

|

|

|

bkbirge

|

|

April 16, 2020, 01:29:14 PM |

|

It just goes to show how incredibly hard it is to be a hodler and how few can do it.

It sounds easy, but in practice, only a person who sees more bitcoin as the goal rather than more fiat can do it.

Taking profits means getting more bitcoin, anyone thinking the other way will not make it to the holy land. There are many more tests ahead.

I don't know about the rest of the WO, but I can't sleep if I have fiat, it's too risky.

Love that point of view. I simultaneously cringe and rejoice when it goes down, watching my holdings in red and buying more. Same when it goes up because I can buy less for same amount of fiat. I've been practicing disciplined DCA'ing though to combat my natural FOMO temptations on either side of the rise/fall curve. |

|

|

|

|

Phil_S

Legendary

Offline Offline

Activity: 2091

Merit: 1461

We choose to go to the moon

|

|

April 16, 2020, 01:37:56 PM |

|

I am watching for the Western MSM narrative to sour on China in the next weeks, then we will know it is on.

Fox is running with the Wuhan Institute of Virology lab accident angle tonight. guess what https://edition.cnn.com/2020/04/15/politics/us-intelligence-virus-started-chinese-lab/index.html(CNN)US intelligence and national security officials say the United States government is looking into the possibility that the novel coronavirus originated in a Chinese laboratory rather than a market, according to multiple sources familiar with the matter who caution it is premature to draw any conclusions. |

|

|

|

|

Globb0

Legendary

Offline Offline

Activity: 2674

Merit: 2053

Free spirit

|

|

April 16, 2020, 01:43:09 PM |

|

They had a few months by now to shred any evidence

|

|

|

|

|

AlcoHoDL

Legendary

Offline Offline

Activity: 2366

Merit: 4148

Addicted to HoDLing!

|

A hacker is exploiting trust in well-known brands by creating fake cryptocurrency wallet extensions for Google Chrome that trick victims into disclosing sensitive information.Harry Denley, director of security at wallet provider MyCrypto, who identified the fake wallet extensions, said in a report Tuesday that Google has so far removed 49 extensions that purported to be well-known crypto wallets from its Chrome Web Store.

The fake extensions are basic phishing plays. Posing as legitimate wallets, they leak personal information inputted by users, such as private keys and passwords, to the hacker, who can then drain balances in a matter of seconds.

The fakes detected have so far claimed to be wallets such as Ledger, Trezor, Jaxx, Electrum, MyEtherWallet, MetaMask, Exodus, and KeepKey. Test amounts of crypto sent by Denley have not been picked up, suggesting that either the hacker has to manually empty wallets or that they are only interested in comparatively large balances. https://www.coindesk.com/mystery-hacker-tries-to-steal-crypto-through-fake-google-chrome-wallet-extensionsDiscovering Fake Browser Extensions That Target Users of Ledger, Trezor, MEW, Metamask, and Morehttps://medium.com/mycrypto/discovering-fake-browser-extensions-that-target-users-of-ledger-trezor-mew-metamask-and-more-e281a2b80ff9 It's all good. Those who enter private keys and other sensitive information about their Bitcoin into any Chrome extension applet that asks them to, do not deserve to own any BTC. It's the laws of nature at work: Bitcoin (and other objects of value) naturally flows towards the smartest owner. Remember Peter Shiff? “My #Bitcoin mystery is solved. I mistook my pin for my password. When Blockchain updated their app I got logged out. I [tried] logging back in using my pin, which was the only ‘password’ I had ever known or used. I also never had a copy of my seed phrase. Honest but costly mistake!” Yeah, right. Fuck you, Peter. And thanks for distributing the value of your coins evenly to all of us Bitcoin HoDLers... This is fine. HoDL. |

|

|

|

|

Phil_S

Legendary

Offline Offline

Activity: 2091

Merit: 1461

We choose to go to the moon

|

|

April 16, 2020, 01:54:50 PM |

|

It's just a false correctness. Strictly people are dying from heart failure, all sorts of multi-organ failures etc. Viruses just replicate.

So there’s a chance the numbers being reported by the UK Gov on COVID19 deaths are inflated by non COVID19 deaths? Do you think elderly people (I think past the age of 80 don’t require postmortems) who die in hospital of pneumonia or flu type symptoms are being recorded as COVID19 to inflate numbers & maintain a level of fear amongst the general public to ensure lockdown rules are followed? There's a 0.1% chance of that. It's 99.9% likely the covid death numbers have been systematically under-reported unintentionally or negligently. The fear is just a handy byproduct and much exaggerated by people's words, but not by these stats. Hmm... https://abcnews.go.com/Health/wireStory/us-virus-numbers-now-include-probable-cases-tests-70170223US virus numbers now include probable cases without tests

The U.S. tally of coronavirus cases and deaths might jump, because federal health officials will now count illnesses that are not confirmed by lab testing https://www.reuters.com/article/us-health-coronavirus-usa/new-york-city-posts-sharp-spike-in-coronavirus-deaths-after-untested-victims-added-idUSKCN21W20GNew York City posts sharp spike in coronavirus deaths after untested victims added

WASHINGTON/NEW YORK (Reuters) - New York City, the hardest hit U.S. city in the coronavirus pandemic, revised its official COVID-19 death toll sharply higher to more than 10,000 on Tuesday, to include victims presumed to have perished from the lung disease but never tested. |

|

|

|

|

lightfoot

Legendary

Offline Offline

Activity: 3108

Merit: 2239

I fix broken miners. And make holes in teeth :-)

|

|

April 16, 2020, 02:10:30 PM |

|

Looks like the Trump Bump airdrop is finding its way to Bitcoin. Good.

Or bad. I need to get this crap into bitcoin and by the time I get the money cashed and put into the bitcoin machine it will probably be way high.

Bitcoin ATM machine goes Brrrrrrrrrrrrrrrrrrr

|

|

|

|

|

fillippone

Legendary

Online Online

Activity: 2156

Merit: 15445

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 16, 2020, 02:34:07 PM

Last edit: May 16, 2023, 02:07:56 AM by fillippone |

|

GreyScale Digital Asset Investment Report Q1 2020First Quarter of 2020 (“1Q20”) Highlights2

• Total Investment into Grayscale Products: $503.7 million

• Average Weekly Investment – All Products: $38.7 million

• Average Weekly Investment – Grayscale Bitcoin Trust: $29.9 million

• Average Weekly Investment – Grayscale Ethereum Trust: $8.5 million

• Average Weekly Investment – Grayscale Products ex Bitcoin Trust3

: $8.8 million

• Majority of investment (88%) came from institutional investors, dominated by hedge funds.

LINK: https://grayscale.co/wp-content/uploads/2020/04/Q1_REPORT_2020.pdfUsual reasoning: USD Greyscale investment: USD 503,700,000 USD Bitcoin Price (Q1 Average): USD 8,273 Greyscale investment in BTC: 60,855 Total BTC Mined during this quarter: 12.5*6*24*30*3=162,000 Greyscale Investment equal to roughly 37% of the new mined BTC. Of course it is naive to think they bough only from new coinbase, rather than addressing the enormous quantity of BTC whales out there sitting on thousands of Bitcoin bought when it was worthless. But alas, it's a huge buying pressure. And don't forget this percentage will double in a little less than a month with the halvening! Alo worth noticing that the fall in market price didn't spur any redemption in the fund, on the contrary, the inflows have been steadily growing!

|

|

|

|

|

|

JohnBitCo

|

|

April 16, 2020, 02:47:20 PM |

|

Looks like the Trump Bump airdrop is finding its way to Bitcoin. Good.

Or bad. I need to get this crap into bitcoin and by the time I get the money cashed and put into the bitcoin machine it will probably be way high.

Bitcoin ATM machine goes Brrrrrrrrrrrrrrrrrrr

Don't go out for an AtM machine......  |

|

|

|

|

|

Poll

Poll