Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

November 19, 2022, 09:22:01 PM Merited by JayJuanGee (1) |

|

I don't know what to make of it.

People are stupid and do not self custody and allow their coins to be used in naked shorting, Fractional reserve banking and participate in derivative never settling markets and then cry they don't know whats happening when its been spelt out to them for years? Nah, thats not it. Edit: got beat to it while spell checking.  Oh, ye, blame others for this...which is especially funny in relation to myself as I have 0% of my bitcoin on exchanges (historically never more than a percent or two). Perhaps, we should say that current bitcoin protocol was not enough to prevent all this calamity and allowed for fractional banking, instead? Are you enjoying the downturn, though? Me neither. |

|

|

|

|

|

|

|

|

|

If you see garbage posts (off-topic, trolling, spam, no point, etc.), use the "report to moderator" links. All reports are investigated, though you will rarely be contacted about your reports.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

November 19, 2022, 09:25:55 PM |

|

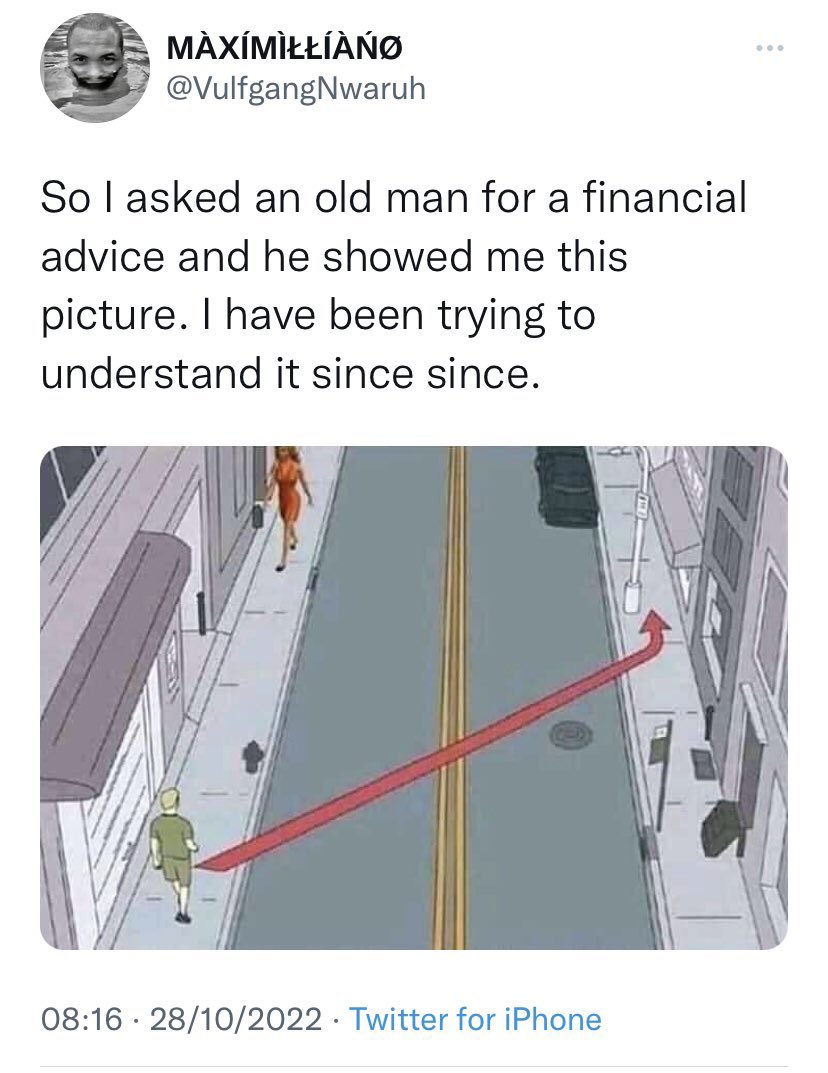

Wondering what exactly is the advice Beware of things that look good at a glance. |

|

|

|

|

OutOfMemory

Legendary

Offline Offline

Activity: 1526

Merit: 2994

Man who stares at charts

|

|

November 19, 2022, 09:46:12 PM |

|

Wondering what exactly is the advice I think it's obvious and simple, but i'm not sure if it isn't meant as a joke: WOMEN ARE EXPENSIVE  Sorry for the caps, but this pic is straight yelling this at me  EDIT: Elaborating. When you are with a woman, this needs time, effort and money, which is spent on relationship "stuff", common interests, daily life, later on on kids, home, home for the (grown up) kids... I'm not a sexist. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 19, 2022, 10:01:16 PM |

|

|

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7765

'The right to privacy matters'

|

|

November 19, 2022, 10:13:23 PM Merited by vapourminer (1) |

|

I don't know what to make of it.

People are stupid and do not self custody and allow their coins to be used in naked shorting, Fractional reserve banking and participate in derivative never settling markets and then cry they don't know whats happening when its been spelt out to them for years? Nah, thats not it. Edit: got beat to it while spell checking.  Oh, ye, blame others for this...which is especially funny in relation to myself as I have 0% of my bitcoin on exchanges (historically never more than a percent or two). Perhaps, we should say that current bitcoin protocol was not enough to prevent all this calamity and allowed for fractional banking, instead? Are you enjoying the downturn, though? Me neither. This is possible to do with all hard "real" pow assets. Look at the top ten coins how many are real "pow" 2? 1 Bitcoin $320,185,195,784 = real pow 2 ETH $148,188,578,600 3 USDT $65,890,071,958 4 USDC $44,401,870,087 5 BNB $43,568,946,124 6 BUSD $22,897,001,328 7 XRP $19,356,328,672 8 Cardano $11,311,438,510 9 DOGE $11,210,115,494 = real pow 10 Polygon $7,654,550,420 See above 8 truly fake coins and only 2 pow coins. As long as you have all those pos coins BTC will be leached from. Now maybe 'BTC' banks get born with hard BTC and that's all. But now we could hodl all btc in our wallets and not know if all that the exchanges have are pos coins and zero btc. This is what we are up againstit is a very hard nut to crack. POS is the true enemy more than any other problem. POS stains POW time and time again.as it should because they are "piece of shit" and designed to stain the name of BTC |

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

November 19, 2022, 10:46:53 PM

Last edit: November 20, 2022, 12:48:07 AM by cAPSLOCK Merited by El duderino_ (10), Hueristic (1) |

|

Sorry for the caps, but this pic is straight yelling this at me  I will forgive it this time. I think it's obvious and simple, but i'm not sure if it isn't meant as a joke: WOMEN ARE EXPENSIVE  We poker player have a saying... "In life... Women are the rake." |

|

|

|

|

HI-TEC99

Legendary

Offline Offline

Activity: 2772

Merit: 2846

|

|

November 19, 2022, 11:00:10 PM Merited by JayJuanGee (1) |

|

We just had a small pump. If this keeps up we can be like this on Monday.  |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 19, 2022, 11:01:16 PM |

|

|

|

|

|

|

BTCaesar

Member

Offline Offline

Activity: 108

Merit: 23

|

|

November 19, 2022, 11:15:42 PM |

|

This bear market hurts and is obviously pain in the ass. As much as the previous bull run was different (TM), this bear market must be equal to be treated different as well. (Yeah the down trend sucks since the last 12 months!)

My current concerns:

1-) about lightening which is quite recent and affects miners (imo), so does it mean that they could not make any profit since then? Will this affect the next bull run (i hope there will be one such as earlier runs)? or the miners would decrease their costs on hardwares or give up on mining?

2-) Celsius, FTX and other bitch 'not existed anymore' exchange platforms. The shit heads such SBF, Do Kwon etc... are still walking freely. I think the governments make this on purpose and let these thieves go as they have never wished their folk to invest its money on BTC and other shitcoins. It also makes strong their theory on 'BTC is a ponzi scheme since its existence...' to scare the people.

3-) according to number 2 concern; the people could not trust on existed platforms anymore as their (lifesaving) money could be at risk if they would like to buy BTC (and-/or other shitcoins) in case these exchanges do not give their money back or any similar case such as if they do not let the users to make any other transaction...

Have a nice weekend!

|

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7765

'The right to privacy matters'

|

|

November 19, 2022, 11:50:09 PM |

|

This bear market hurts and is obviously pain in the ass. As much as the previous bull run was different (TM), this bear market must be equal to be treated different as well. (Yeah the down trend sucks since the last 12 months!)

My current concerns:

1-) about lightening which is quite recent and affects miners (imo), so does it mean that they could not make any profit since then? Will this affect the next bull run (i hope there will be one such as earlier runs)? or the miners would decrease their costs on hardwares or give up on mining?

...

snip...

Have a nice weekend!

I have concerns about LN as a miner. I can tell you we have not had a 1btc+ reward since LN fired up in spring of 2021--- likely to be 99% true not 100% Yeah LN was around before spring of 2021. But in spring of 2021 the memory pool had big back ups. Now one could argue it was because China trashed the hashrate. wait for more. but look here. https://jochen-hoenicke.de/queue/#BTC,all,weightset to all view the backup from Jan 2021 to May 2021 we had huge fees and we had the first 60k + prices. LN got much more active in April and May of 2021. and fees suck since then for the miner that is. Do I know the long term effect IE BTC in 2060 nope. But I fear that BTC will suffer a lot as we approach that time. But I also thought that the iPad was a terrible idea doomed to fail.  |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 20, 2022, 12:01:20 AM |

|

|

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

November 20, 2022, 12:51:46 AM Merited by JayJuanGee (1) |

|

This bear market hurts and is obviously pain in the ass. As much as the previous bull run was different (TM), this bear market must be equal to be treated different as well. (Yeah the down trend sucks since the last 12 months!)

My current concerns:

1-) about lightening which is quite recent and affects miners (imo), so does it mean that they could not make any profit since then? Will this affect the next bull run (i hope there will be one such as earlier runs)? or the miners would decrease their costs on hardwares or give up on mining?

...

snip...

Have a nice weekend!

I have concerns about LN as a miner. I can tell you we have not had a 1btc+ reward since LN fired up in spring of 2021--- likely to be 99% true not 100% Yeah LN was around before spring of 2021. But in spring of 2021 the memory pool had big back ups. Now one could argue it was because China trashed the hashrate. wait for more. but look here. https://jochen-hoenicke.de/queue/#BTC,all,weightset to all view the backup from Jan 2021 to May 2021 we had huge fees and we had the first 60k + prices. LN got much more active in April and May of 2021. and fees suck since then for the miner that is. Do I know the long term effect IE BTC in 2060 nope. But I fear that BTC will suffer a lot as we approach that time. Then I think you will be OK mining either BCH or BSV. They have no lightning network. But I also thought that the iPad was a terrible idea doomed to fail.  Well... there's that... Also - Did you read my last post to your mining worries? You are living out a famous Yogi Berra quote... "No one goes there anymore... it's too busy". |

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4102

Merit: 7765

'The right to privacy matters'

|

|

November 20, 2022, 12:51:57 AM |

|

BUDDY FUCK OFF relentless mofo that you are.

Mmmm a BTC wannabe?

@ caps

well my data set on large fees for miners is correct.

Since you do not think it is harmful and I do think it may be harmful.

Only time will tell if LN means btc works or not.

2060 we will have a pretty good idea.

If I am alive by then I will buy you a drink or two. Even if I am right and you are wrong.

|

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10155

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 20, 2022, 12:58:54 AM |

|

I just came by to say hi.

Hi. It's been a busy 10 days for me with a business trip. I had made some plans during the last bull run and I started pursuing them. Firstly, I realized that no matter how rich I'm, I will need to have a job for various reasons. For example monthly expenses, retirement and so on. And my job is very good, it is like a hobby - part time with above the average salary and 5 months of paid vacation yearly.

"no matter how rich I'm, I will need to have a job" I doubt that is true. Let's take a hypothetical. What if you currently owned somewhere in the ballpark of 800 BTC? Would you do the same things as you do now? Would 800 BTC be enough? A day or two ago, Philip was telling us that a 5o year old guy who were to have 100 BTC better get worried about selling some of his BTC, as if having 100 BTC for a 50 year old would be some kind of burden. I mentioned that even having 50 BTC at 50 years old right now would be in a pretty good place, but having 100 BTC or even having 800 BTC right now would likely put any guy in a pretty good place, and should be enough for a lot of people - I guess unless you might be in your early 20s, and you feel that you need to make a name for yourself, then maybe 800 BTC is not enough? I am not sure how to come to those kinds of conclusions, and maybe a guy is going to find ways to lose his money if he cannot be clear about how he even got that money (value). I entered Bitcoin world thanks to the gpu mining and soon after I became a strong hand Bitcoin hodler. At times being more than all in. I was confident when we fell to 3K in 2018 that I even took a bank loan to add some more corn to my stash. But now the mining is not profitable and I use my rigs only for heating. Since I continue buying Bitcoin, I decided to look for a better job in a bigger city which is one of the most beatiful cities in Europe btw. Luckily I was approved and I went to sign the part time contract for the first year. If everything is OK, I will sign a permanent contract next year. In the meantime I will keep my current job, which means some travel, but I'm okay with that. I transferred some cash before my travel, and each day I bought some. I didn't care what was the reason for the drop, I always buy first and then read. (FTX, what the heck is that, I don't care!) Every crash empties the exchanges and opens the door for the next massive bull run.

In general I follow the DCA strategy, but if shits hit the fan, I buy more. For example, my ratio Bitcoin/total savings is currently 77% and I plan to reach 79% in the next 2 years. If shit gets bigger, I can get close to 90%. I have the firm belief that in the next bull run, no matter when exactly it will happen, the price should reach 150K. My SOMA prediction is 168K top of the next cycle. Anyway, I know that the good things won't last forever, so the usual stuff will happen after some time in ATHs territory - Chinese communist clonws will pannic and start spreading their FUD banning Bitcoin, putting in jail the users of VPN; Feds and EU bankers banning Bitcoin for its POW; the new harvest of fools trusting crooks with their savings will emerge again, new shitcoins pumps and so on. And then new bankrupts will come starting the next bear cycle with lows under 100K.

Fair enough regarding your rendition of possible cycle behaviors in the next cyccle.. even if it sounds as if you are overly allocating to BTC in terms of unduly causing yourself more volatility than necessary, and I am not against high allocations into bitcoin, especially if they come from BTC price appreciation.. but I have more difficulties with the idea of purposefully trying to allocate with those high levels of currently 77% and then trying to reach a higher level of allocation.. just based on BTC appreciation as compared to the likely appreciation (or lack thereof) of other assets will likely contribute to your BTC allocation increasing naturally.. But hey, what do I know? But no matter what the top will be, I will sell some of my stash above 110K with a gradual percentage increase to have enough to buy a house in the new place. I can always buy a cheaper one or postpone the buying and use half of the fiat to rebuy back the same amount of Bitcoins if the price falls 50%.

I never really expect to be able to buy back any BTC that I sell, even though I understand that sometimes the buying back will end up happening. .. or being able to happen just buy selling on the way up and buying on the way down, and sometimes it ends up that you are able to buy everything back.. so what you are saying would not be totally unrealistic as a possibility. I just would not bank on any likelihood of being able to buy back sold BTC. I developed a software that helps me a lot in all kinds of market scenarious.

Excel works out pretty good too as long as you are able to think through a few scenarios and project them out. The trick is to re-finance my Bitcoin debt by DCAing with the new income no matter the price. Despite rebuyng higher in the last year, now I buy lower, i.e. I would have more bitcoins with my current fiat, although I spent some to buy a lot of stuff - computers, music gear, etc. And this is quite a new and pleasant experience for me  And as a priority, Bitcoin will always be first, compared to fiat. So I prefer increasing my stash than having some spectacular savings. With the exception of the fiat for the future house of course. None of this sounds wrong. Usually the idea of DCA is buying at any price, so we could have some quantities of DCA that we buy at any price and then another quantity of that we buy on dips, so the buying on dips is a bit of a different concept than DCA, even though historically in bitcoin, if we ONLY DCA, the whole DCA'inc practice will usually end up working itself out so that we end up being profitable, since overall BTC prices do seem to end up going up.. even if there are also decently long periods of BTC prices going down, so that by the time the BTC prices end up going up, sufficient quantity of BTC have been accumulated on a regular basis that so far BTC has tended to become profitable with the passage of time, even if we should realize that there are no guarantees that such patterns of BTC profitability will continue into the future. P.S. I'm sorry for the JJG style post, but it won't happen again soon, I promise!

No need to worry. JJG Style posts are a virtue not a bug. Don't you know nuttin? And I had to patiently read 40+ pages backlog, so I'm excused  If you are a "true bitcoiner," then you cannot excuse yourself. It is not possible. Sorry about that.   As someone mentioned, thanks to exphorizon etc. ignored spammers for making my task a bit easier.

That's true. he makes the thread look longer than it is, and then when you get down to it, you end up finding that there are a lot of posts that can be completely skipped. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 20, 2022, 01:01:16 AM |

|

|

|

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 20, 2022, 02:01:16 AM |

|

|

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10155

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 20, 2022, 02:07:38 AM |

|

At this stage of the market, everyone has their prediction, so the predictions even confuses us, Pantera gives his own prediction that in 2024 March is the time of the ATH of $149,000. As it is I am really worry of the market right now because I bought Bitcoin at the time of 21$ and I want to use the money for the Xmas. Though it is not much but at least it can but small things, I was planning to hodle it till the next bull.

Is it that the fall of FXT is the cause of this 16$ for this long period it time?

How does investing in bitcoin work? Personally, I have frequently asserted that you should not be expecting to even think about getting any money from your bitcoin investment for 4-10 years or longer, so I don't know why you are telling us that you invested in the past few weeks and you are expecting to use that money for christmas shopping. Fuck that nonsense. You are gambling. I am not clear about when you got into bitcoin Agbe, but your forum registration date is December 2021. So if you started buying Bitcoin at or near the top, and maybe you are dollar cost averaging into bitcoin, or not? Any money that you invested in the beginning would not become available until some time between 2025 and 2031, and any money that in invested in the past 3-6 months would not come available until 2026 to 2032.. or maybe longer.. So your talking about using some of that money for christmas seems as either unrealistic or gambling. Let's say that you started investing in bitcoin in late 2021, and you decide that you are going to DCA invest for 5 years, so maybe some of the money that you invested earlier in your BTC investing might start to come available 2025 or 2026, but you are likely still needing to consider the advantages of compounding value. There are so many people who get into an investment (even something like bitcoin) and they start to get all excited to cash out their investment because it happens to be in profits, and sure you are in charge of your own investing and your own destiny and your own management of your investment portfolio whether your investment portfolio has bitcoin included in it or not, but if you are so excited to cash out prior to years of compounding value, then you are likely short-sighted and have pretty decent odds of having fun staying poor in the never ending ratt race that will keep you working until you keel over.. if you are lucky enough to live until an old and ripe age. I am not even going to say that there are any guarantees of anything, but it can take a whole hell of a long time to get to fuck you status, and surely if you come into bitcoin and you had money that you can transfer (or reallocate) into bitcoin from your other investments, then you may well have a leg up regarding your timeline for investing into bitcoin or your waiting for your bitcoin investment to compound, as compared with someone who might come to bitcoin and not have had built any investment portfolio in anything prior to beginning with bitcoin as his/her first investment asset. In any event, even with bitcoin in your investment portfolio, it can take a while to get to entry-level fuck you status, and the first years of building your investment portfolio can feel as if it is taking a long time to make any progress; however, part of the power of compounding value is that after many years investing, frequently the value will start to compound upon itself, but it ONLY will really compound upon itself if it has the benefits of time.. and maybe even the benefits of ongoing investing into it with reasonable and perhaps even somewhat aggressive (without being too aggressive) prudence.  Wondering what exactly is the advice woooo looking good looking good. Stay focused. Stay focused.  Wondering what exactly is the advice I'm pretty sure it's advising you not to place yourself in a situation where you might encounter a single lady. You could start talking to her, then she becomes your girlfriend, then you get married, then she steals all your wealth. Pretty simple. Unless she has Bitcoin. That girl no doesn't have no bitcoin, even though she does appear to have udder assets.  Whatever the ultimate bottom is, I expect "only" 5-10X in the next cycle (from the bottom).

Why? Prior cycles:

$2 bottom, then $1160 top or 580X

$175 bottom, then $19780 top or 113X

$3100 bottom, then $68900 top or 22X

As you can see, the multiple keeps decreasing drastically (by a factor of about 5) in each consecutive cycle.

Accordingly, the next number for a top is roughly 5X of the bottom, but due to some variability, perhaps up to 10X is possible.

Currently, this would mean either $77.5K (which would be a GREAT disappointment for almost everyone) or up to, perhaps, $155K, which could be OK.

I am ok with x5 of the current price that would be close to doubling my investment but 100k per Bitcoin is my goal so if you are predicting x5 being the lowest I probably would achieve my goal if your calculations are proven right. Not sure I share the optimism because recovering in time for the next cycle and hitting 5x-10x looks very difficult right now. We will probably go through multiple waves of it going up and down before that 5x is possible. Assuming the current price is the bottom. During each BTC cycle, it "feels" that reaching the previous ATH is nearly impossible. So there is that angle, too. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

November 20, 2022, 03:01:20 AM |

|

|

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10155

Self-Custody is a right. Say no to"Non-custodial"

|

|

November 20, 2022, 03:25:08 AM |

|

Whatever the ultimate bottom is, I expect "only" 5-10X in the next cycle (from the bottom).

Why? Prior cycles:

$2 bottom, then $1160 top or 580X

$175 bottom, then $19780 top or 113X

$3100 bottom, then $68900 top or 22X

As you can see, the multiple keeps decreasing drastically (by a factor of about 5) in each consecutive cycle.

Accordingly, the next number for a top is roughly 5X of the bottom, but due to some variability, perhaps up to 10X is possible.

Currently, this would mean either $77.5K (which would be a GREAT disappointment for almost everyone) or up to, perhaps, $155K, which could be OK.

That would mean BTC can never exceed gold. I doubt that this progression will be valid forever...  Many of us already have a pretty good sense that bitcoin is many multitudes, likely magnitudes and probably around 100 to 1,000x more valuable than gold. So it hardly makes any sense to either stay below gold's value or to even stay around gold parity... so just for reference sake bitcoin would need to reach about $500k to be at gold parity, and currently bitcoin is less than 1/20th the price of gold... It can take a while for these ideas to sink in and/or to be reflected in the BTC price, but it seems as if there are quite decent odds that bitcoin will achieve the parity of gold this cycle or the following cycle, and then start to exceed it by many multitudes and even magnitudes in the subsequent cycles.. And, surely these kinds of price rises can happen a lot faster than expected - even if in the short term, there are some of us bitcoiners (and even potential investors into bitcoin) who are having existential crises involving how much bitcoin's value has been being diluted by various kinds of fractional reserve practices, including but not limited to the ability of folks to buy bitcoin exposure, but the third parties are in the practice of not even buying bitcoin to make sure that they are adequately able to cover that bitcoin exposure that their clients thought that they had purchased. It remains difficult to know about the solution regarding whether scaring institutional investors away might be helpful when various states seem to be sponsoring these kinds of attacks on bitcoin, even though many of us envision situations in which those naked shorted BTC end up getting reckt as fuck because they do not have the BTC that they claim to have - while at the same time, many of us still are likely suffering from doubts about whether the theory can get put the practice when the third parties are not holding the BTC that they claim to hold. I did recently go from having about 10-11% of my BTC on exchanges, and now I have around 8%-ish on exchanges. I might remove another 1-2% in the coming week. I am still working out some of my books - and some of my storage mechanisms.. adding some new features.. so maybe even I will end up continuing down the road of less and less exchange (and third-party) exposure, while at the same time, there still can be some issues regarding how to manage being able to cash out.. whether just converting into cash or being able to spend in various areas and even being able to have interchanges with various people directly... so I am not inclined to completely sever my relationship with various ways that I might interact with third parties, while at the same time, many of us know that they deserve to be able to profit from providing services for us, but not at the expense of running off with our bitcoin.... or NOT having our bitcoin when we want to claim possession of it. Whatever the ultimate bottom is, I expect "only" 5-10X in the next cycle (from the bottom).

Why? Prior cycles:

$2 bottom, then $1160 top or 580X

$175 bottom, then $19780 top or 113X

$3100 bottom, then $68900 top or 22X

As you can see, the multiple keeps decreasing drastically (by a factor of about 5) in each consecutive cycle.

Accordingly, the next number for a top is roughly 5X of the bottom, but due to some variability, perhaps up to 10X is possible.

Currently, this would mean either $77.5K (which would be a GREAT disappointment for almost everyone) or up to, perhaps, $155K, which could be OK.

That would mean BTC can never exceed gold. I doubt that this progression will be valid forever...  there is a bit of a paradox in bitcoin behavior so far. Let me formulate it: Bitcoin's bull stages appear to be progressively shallower from the bottom (at depicted above-from 580X to 113X to 22X), but downward plunges changed only marginally; from -94% to -87% to -84% to, currently, -77.5%. Therefore, if the trend continues and our next top is, say, 150K, then -70% down would be 45K and if only a marginal top in 80K vicinity, then $24K bottom in 2026-2027, which would be quite brutal in comparison with even the 2021 top. I don't know what to make of it. I always thought that IF bulls were to become shallower, then bears would be as well, but SO FAR, it did not really happen (at least not as much). Anyone with an explanation? TL;DR If bull parts of the cycle became shallower, why bear phases are almost as relentless as two cycle ago? Yes.. I will agree that we cannot really know what the fuck is going to happen. But still, you seem to be way overly formulaic with your attempts to apply technical analysis to BTC price performance cycles, and king daddy could give less than two shits about your limited math applications... even if they are "logically correct," so far. You seem to be acting as if BTC has discontinued to be an paradigm shifting phenomena and stopped traversing through exponential s-curve adoption. To me.. bitcoin seems to be continuing to be growing and all of its network effects seem to be continuing to grow, even if there are some set backs here and there and even if its price has not been performing very greatedly in the past 6 months or so. [edited out]

maybe because "we will tame Bitcoin".... Were "they" "taming" my lil precious very well between September 2020 and November 2021? I'm not a sexist.

You sexist!!!!      @ caps

well my data set on large fees for miners is correct.

Since you do not think it is harmful and I do think it may be harmful.

Only time will tell if LN means btc works or not.

2060 we will have a pretty good idea.

If I am alive by then I will buy you a drink or two. Even if I am right and you are wrong.

You better have your drinks delivered to your private Island, since you might not be able to walk very well at 103 years old. Hopefully, your 0.21 BTC stash lasts that long. |

|

|

|

|

|

Poll

Poll