flexible block size were proposed, where the maximum weight is adjusted by demand or there are incentives to miners to adjust the blocksize carefully if needed.

This would be better than treating transactions differently, in my opinion. However, it has to be implemented similarly to how XMR does it. Raising the block size would result in a reduction in the block subsidy; otherwise, whatever the max cap is will always be activated by greedy miners. This would lead to larger pools absorbing all available well-paying transactions, leaving smaller transactions with almost nothing. If we have three pools—A (45%), B (45%), and C (10%)—block C, with the current protocol, is almost always guaranteed to mine 10% of the transactions. So, if there are 100 transactions paying 0.1 BTC each, and each block can only take 10 of them, it would, on average, make 1 BTC out of that. However, if pools A and B can increase the limit from 10 to 15, pool C (which only finds 1 in 10 blocks) will be left with nothing but dust. The current way relies solely on luck; a small miner may hit a 5 BTC fee block, whereas large miners who find twice as many blocks may not get 5 BTC combined. In other words, as of now, potential rewards from fees are based more on "luck and market conditions" than your hashrate. The other model will shift that, making it more about your hashrate and leaving little room for luck. However, looking at Suzanne5223's comment above this one, if you read what user Kiba wrote right below Satoshi's post, he said: "If we upgrade now, we don't have to convince as much people later if the bitcoin economy continues to grow." Reading this 13 years later, it certainly makes a whole lot of sense; it's pretty difficult to do now. @philipma1957 I agree that leaving a small amount of BTC for emergency cases like this in somebody else's custody may not be a bad idea. My only issue is with the KYC part; I know many people are okay with KYC-ing themselves, but I try to avoid that as much as I possibly can. |

|

|

|

The main reason I decided to try Ocean Pool was because I liked the idea of transparency with payouts (i.e getting paid directly when each block is found).

So you did this to avoid custody, which is great, I mine on PPS pool that keeps my money for 24 hours before paying me, Ocean now has your money (dust and in form of hashpower) for a few weeks, probably for a lot longer, so the custody aspect is even worse. Also for the 0 fee thing, they censor ordinal transactions, which means if they find a block now, instead of getting say 9.25 btc they would get about 7.75, so in other words, you would lose 15% of your potential profit, the highest PPS fee is 4% so you are paying 11% extra for the time being at least given that ordinals are still a thing. Thank you for answering my question, I wish you the best of luck. |

|

|

|

However: Those who use other scripts than those benefitting from the additional discount would not be punished at all.

It really depends on how you look at it, you may call it a 50% discount or you may call it a 100% tax, being on the "normal transaction" side, it would seem as though you are getting a 50% discount compared to the rest, being on the other side, it would seem that you are paying a 100% tax compared to the rest, if we think of block space as goods sold at the market, at the end of the day, a "normal" person can buy twice as much of those goods with the same money compared to those "weird" people. However, I agree, censorship is probably not the best word to use here, I suppose it's more of a discrimination. Miners would probably not necessarily against such a policy: while the average fees would level down a bit, there are more transactions they could fit in a block, so the total fees collected per block could increase. A

This is a "Chicken-and-egg" debate, and has not been solved, and probably never will, simply because there are two side of the same story, the first one is what you described, in other words, more space = more transactions = same or more profit for miners. The other side suggests a different thing, because you are creating more supply of something, it's most likely the price will go down, and that makes sense because you can't guarantee "demand", you would only speculate the demand will go up, which isn't something you can be sure of, and if demand doesn't increase as much as the demand does, then the overall price of block space will go down enough to bring the overall profit down. people who support this theory have a very good point, and that is, whoever needs to transact on the blockchain would do so no matter what the fees are, and those who don't want to transact on the blockchain -- they won't even if you bring fees down to near zero. The above "theory" suggest that the transaction count is limited, so you could just assume that there would be 100 transactions a day no matter what, if there is enough space for all 100 to be included on the same day, you are simply removing the competition/bidding insetnive, whereby if there is only a place for 10 transactions, those 100 transactions would have to outbid one another, raising the profit of the miners. Keep in mind that in order for profit to be the same for miners in the above example, if you increase the daily block size from 10 to 20, and want to keep the same profit, you would have to increase transaction count by 100%. So 10 space > 100 transactions > profit = 1 20 space > ?? > profit = 1 = 20 space > 200 transactions > profit = 1 anything short of 200 will make profit < 1. And it's not guaranteed (actually probably less likely) for transaction count to do 2x just because fees are down 50%, so this side of the "Chicken-and-egg" theory is more favorable to most miners because they can't control demand, they rather control the supply. |

|

|

|

Thanks to LW's daughter and family for this contest, I hope they are doing better now, of course, not to forget to thank the two of you for arranging this.

Looking at the weekly chart of BTC the nearest major resistance line is at $48,200, I believe that by January 9th we will be battling that line or at least close to it, so my prediction would be Good luck to everyone. |

|

|

|

I will need some time to create LTC wallet, anyway, if the fees are set to 126 sats/Vbyte, I think they will likely go through this weekend. your experience working with me I only ever worked with you in the current Yomix campaign, but my experience was great, I think you are generally a nice person. |

|

|

|

...

كل ما ذكرته يمكن أن يساهم في التقليل بشكل بسيط في الرسوم و يمكن أن يقلل بشكل كبير في ذلك أيضا.

في الواقع هده التدابير سوف توفر الكثير ويجب ان يتم فهم التحولايت بطريقة تامة للوصول الى افضل نتيجة. اولا يجب ان نعرف ان اي تحويل يحتوي على 3 مدخلات اساسية (جميع الوحدات في الاسفل هي vByte او بايت افتراضية ولكن سأكتبها ك بايت لتسهيل الفهم) 1- قيمة تابتة (لاداعي لشرحها ولكن حجمها 10 بايت) 2- input 3- output لنأخد على سبيل المثال تحويل بسيط يحتوي على input 1 و output 2 وهوا التحويل الاكثر شيوعيا, فمثلا ان كنت تمتلك Input قيمتها 1 بتكوين وتريد ان ترسل منها 0.6 فسوف تقوم بانشاء عدد 2 مخرجات او outputs واحدة بقيمة 0.6 للشخص الاخر والاخرى بقيمة 0.4 وهي باقي القيمة التي سوف ترجع لك مرة اخرى. في حال كنت تسخدم عنوان تقليدي يبدا برقم 1 input = 148 output =68 طبعا 34 لكل واحدة الاجمالي = 226 بايت , فمثلا لو قمت بتحديد الرسوم على 200 يعني انك سوف تدفع 200 ساتوشي لكل بايت, يعني باجمالي 45,200 ساتوشي, اي بالبتكوين 0.000452 اي حوالي 19$ في حال استخدام عنواين native segwit التي تبدا ب bc1 input = 68 output =62 طبعا 31 لكل واحدة الاجمالي = 140 بايت, في 200 ساتوشي يعني 28,000 او 0.000028 بتكوين او 12$ يوجد فقط شي اخير يمكنك محاولة الوصول ايه لتقليل التكلفة وهو ارسال ال input كاملة بدون "فكة او رصيد" وهدا سوف ينتج عنه output واحدة فقط لكي يكون input = 68 output =31 طبعا 31 فقط بحكم وجود مخرج واحد الاجمالي = 109 بايت وهنا ستوفر ماقيمته 31 بايت اي 0.000062 بتكوين ليكون اجمالي التكلفة 0.000218 بتكوين او 9.5$ للتحويل. طبعا يمكن زيادة هده التكلفة في حال وجود اكثر من Input فثلا انت استلمت 0.1 بتكوين و 0.2 بتكوين والان ريد ارسال 0.25 يعني انك تحتاج لدمج المدخلات مع بعض للحصول على 0.25 والباقي 0.05 يتم ارساله مجددا لك فهما سوف يكون لديك عدد 2 مدخلات و 2 مخرجات وهدا يجعل حجم المعاملة كالاتي input = 136 طبعا 68 لكل واحدة فالان لديك 2 output =62 طبعا 31 لكل واحدة الاجمالي سيكون 208 بايت ضرب 200 ساتوشي = 0.000416 بتكوين او 18.304$ بدلا من 12 دولار في حال استخدام مدخل واحد. ايضا يجب التنويه ان قول الاخ خالد اولا، علك ان تقوم دائما بادماج عملات في عملة واحدة و هو ما يعرف ب consolidating UTXOs. يقصد ان تقوم بذلك عندما تكون الرسوم رخيصة, الغرض من هدا هوا دمجع مثلا 5 مخدلات او Input وفي واحدة فبدلا من ان يكون حجم المعاملة مثلا 500 بايت يصبح فقط 140 وهدا يعني ان ارساله لاحقا سوف يكون ارخص من النصف, تذكر انك تدفع الرسوم بناء على حجم التحويل وليس قيمته لذلك كلما صغر حجمه بالبايت كلما كان التحويل ارخص. و لا أعلم إن كان إستخدام عناوين تابرووت سيعود بالمنفعة من ناحية الرسوم. هل قام أحدكم بإستخدامها أم أن الغالبية هنا تحب السيجويت.

سيقويت ارخص من تاب روت, بارغم ان حجم ال input اصغر الا ان حجم output اكبر اي ان الاجمالي اكبر input = 57.5 output = 43 اي ان اصغر تحويل سيكون اجماليه 110.5 بايت, طبعا بفارق 1.5 بايت عن سيقويت ** للتذكير كل قياسات الحجم في الاعلى هي عبارة عن بايت افتراضي او Vbyte. |

|

|

|

Does luck generally average out over time with smaller pools? Ocean found 2 blocks pretty fast, but looks like the third one is averaging out. Sitting at 2.57 times expected currently. Generally what would be a worse case between blocks? I’m pretty new to mining just wondering how bad could it get?

Things average out almost perfectly when measured against infinity, any thing short of infinity is unlikely to get you at 100%, I could throw some random numbers like every 7.4 blocks a block would take double the time, i.e 200%, and then again 1000% in 20k blocks or something, ya, and half the time every 1.6 blocks or so, but these are random figures and only start to average out over a very long period of time when the sample size is large enough. It’s difficult hanging around when you have the electric bill to pay. Indeed, which is why I have been always under the impression that eventually, only PPS pools would survive, not because they pay more "actually they pay less due to fees", but because not everyone can handle the variance, I don't want to give you the bad news, but given the size of the pool, it won't be out of the ordinary if you had to wait for a few more months, it could hit 2 blocks tomorrow, you just can't tell. This may be a personal question or slightly off-topic, but I would love to know the reason why you decided to use Ocean pool. |

|

|

|

Tier 0: Simple payment transactions (weight in vBytes = 0,5 * weight in bytes), i.e. they would have a weight of half of the Segwit witness data*

Tier 1: Other Segwit witness data (weight in vBytes = weight in bytes)

Tier 2: All other transaction data (weight in vBytes = 4 * weight in bytes)

This would be viewed as censorship by many people, you do know that Ordinals are also Segwit transactions, the Segwit upgrade was widely accepted because it gave everyone the same chance, to change your address -- you get the discount, but with this approach, you are not separating Segwit transactions into two groups, one that gets a discount (because some people want that) and others who don't (again, because some people don't them to). This would be the equivalent of those Ordinals folks asking for a discount for their Segwit transactions only, many people won't welcome that idea, will they? This also opens the door to other types of transaction-biased discounts, transactions of >x amount should get y discount and the others won't, it's like creating a VIP membership on the blockchain. Your idea would make perfect sense if what you guys call "not normal" or "spam" was universally agreed upon, which isn't, it seems like there are no more than a few folks here and on Reddit that are mad about these Ordinals, I mean, with all honesty who gets to say "Yes let's change the protocol"? - Mining pools - Nodes devs (mainly Core) - Exchanges - Wallets Out of these 4 groups, probably only some Core devs are annoyed, mining pools are certainly happy and don't consider Ordinals spam (ya except for Luke's pool which is a drop in the Ocean 'no pun intended'  ), Exchanges are having the best time of their life with all the volume surrounding those shit Ordinals coins, Wallets would be like "What spam" ? lol. In addition, block propagation become easier with existence of compact block where node doesn't broadcast whole block since most other node already have TX data on their mempool.

compact blocks are a part of the relay networks that mining pools use, even with blocks being as small as 4MB large pools don't count on the P2P network to propagate blocks, given the amount of money at stake, they consider the P2P network to be risky, and they operate outside of it to ensure none of them loses half a million $ due to some latency issues every other day. Mining has changed a lot, it's no more thousands of nerds on their PCs where nobody knows who sent the block, it's now a group of multi-billion $ companies who think of BTC mining as nothing but business, Foundry sends the block hash to Antpool using their private relay protocol, Antpool won't even bother checking shit, just start constructing an empty block while dealing with their mempool, so added verification time isn't going to hurt those pools, and let's be honest, only mining nodes matter here, the other nodes would just set tight till the big boys handle their business and they would always follow the longest blockchain. So even at a 1GB blocks, it's unlikely that miners would be affected by any means (ya maybe more empty blocks here and there and that's all about it), it's us the average joe who would need to refresh their wallets twice while waiting for transaction confirmation which has already been included 2 minutes ago.  Obviously, small miners/pools who can't get a seat in those private relay networks will have to rely solely on the P2P network, and every % of network delay added is a potential loss for them, in other words, those 2 mins they spend working on a block that has already been solved and passed to other miners, will be a loss for him, a heavy 20% loss in this example, but ya 2 mins is just an extreme example. But with all honesty, small miners are more likely to vanish due to the difficulty affect caused by large miners growing too large than to face issues with network delays. Savage!!!  Fudge! I'd like to make it clear that those aren't particularly my arguments nor counterarguments. I mean, they have been floating around forever. Just thought I'd sum them up for those interested. And, as I said, every argument and its counter do make sense. I could just argue that I want 0.1MB blocks because I live somewhere way too far and only have access to a 500kbps connection. I want to mine BTC with the same chances that a European person like yourself has. So, raising blocks to 20MB is racial discrimination, which is terrible for Bitcoin. What say you? You may say it's b.s. "it is " but many others would find it a perfectly valid argument. |

|

|

|

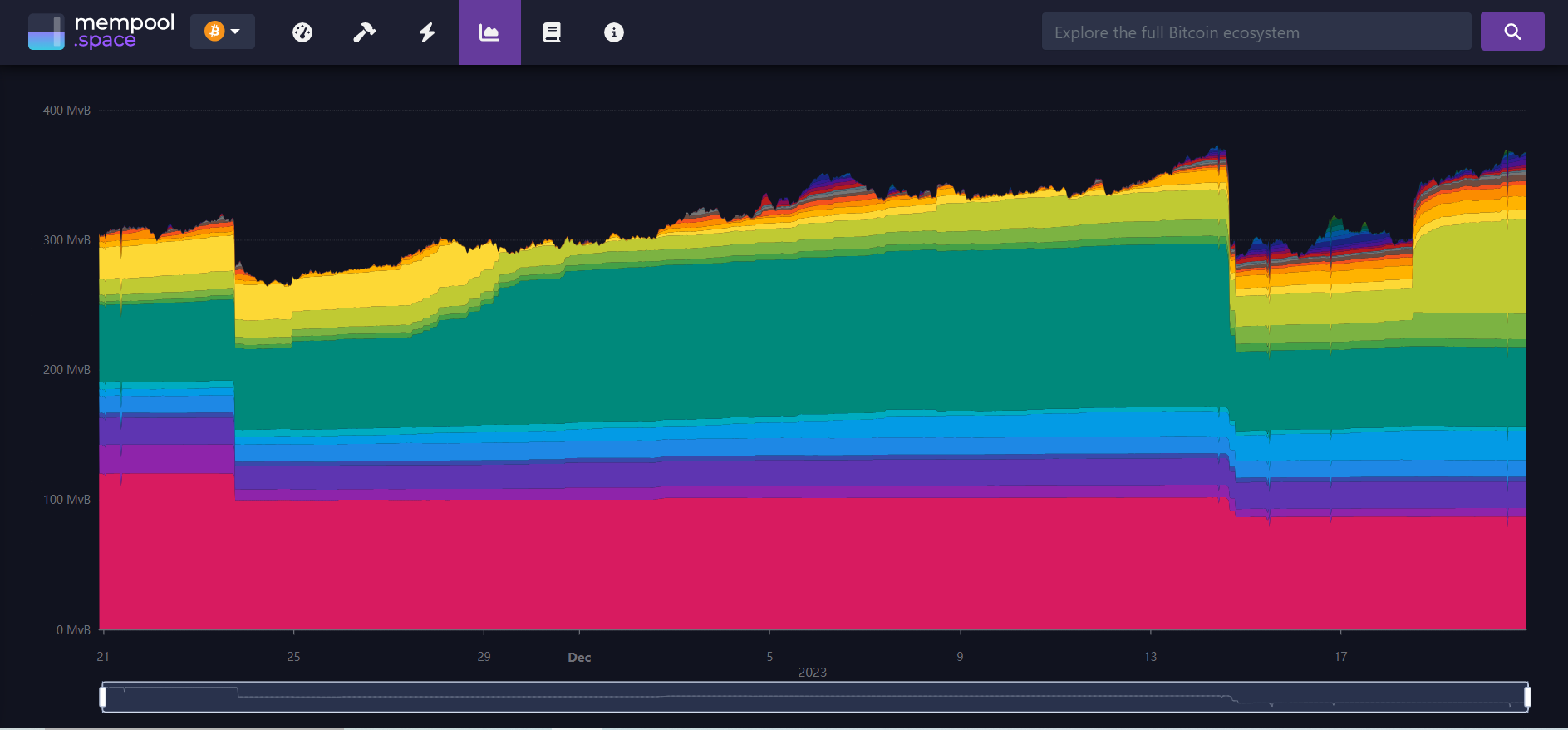

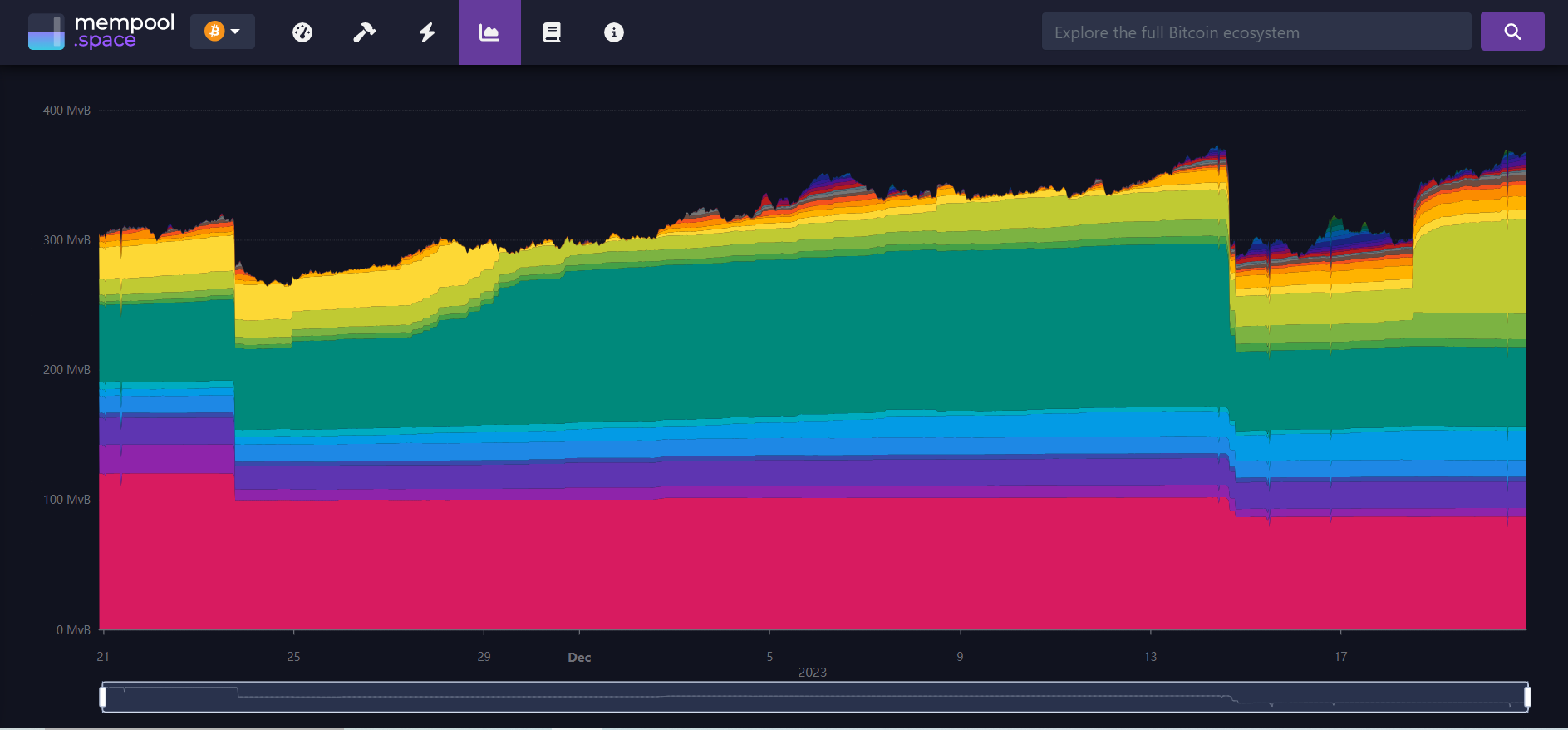

There are less than 20vMB till under 100sat/vb, no major fee wall, This reminds me of the other discussion we had on the other part of the forum about where did that wall of 10 sat go, I said they could be preparing for a new wall, we now have a very similar wall at 2x the fee of that wall.  Just count foundry over last 3 days they should do 48 x 3 they did a ton more.

12 of last 40 is 40% not 33% 822097 to 822126 I will look for more

Foundry mined 35 blocks on 13, and the same on 14 dec, and then 50 blocks on 19 dec, you might be onto something here, but it's too early to judge if this is the result of intentionally downclocking gears to jam the network and then overclock to get the big blocks, this could work but needs some serious math. So pretend I have 50% of the network hashrate, fees are 0.5 BTC/ block, I run S19 at 5 cents kWh My daily expense for power is 3.6$ , I net 8$ (assuming fees are low and are only 0.5 btc or 8% of the block) Now let's say I underclock my gear 30% down, I spend 2.52$ on power and net 5.6$, I need 2.4$ more profit for this to breakeven, % wise I need blocks to go from 6.75 btc to 8.775 BTC to break even. Actually, at this point I am beyond break even, because there are other factors that I didn't take into consideration such as 1- I spend less on cooling 2- I actually net more than the above calcs given that my S19 would run more effienct at 70% than 100% (which I didn't do above because it's not simple and not worth the efforts)  3- I increase the service life of my gears since now they run at a lower clock But ya, let's just say I am at break-even, didn't gain anything if I manage to keep block fees at 8.775 BTCWhen fees go even higher, and blocks are now 10 BTC a block, I go nuts and overclock gears, so that I get 60% of the network share, but then, 60% doesn't mean i am up 10% from my previous hashrate due to more cooling needed and less efficiency so let's say it's 5% more so at stock settings my S19 now that blocks are 10 BTC would make 12.16$ (vs the previous 8$), with my overclocking I could end up making 14$ on it, which 75% more profit than without this whole game. Of course, I could point to a few things that would make such plans fail, but we shall get to it later after hearing fellow miner's thoughts. |

|

|

|

It is not about storage. It is about verification time. I

Hmm i disgree, notice that i mentioned handling and propagating blocks only for miners, because for a non-miner node there is no "rush" to download or verify a block, storage is more important. But anyway, for a good hardware it takes about180 seconds to do all of this - Download a 2MB block - Empty some space if need -Verify all transactions -deal with the mempool and construct a brand new blocktemplate. A non-mining node doesn't need much processing for a block, and should be able to process a block size of a few hundred MBs in no time, this is only a sub-issue for miners not all nodes. |

|

|

|

You think people really understand how anything they use really works, let's say phones, computers, internet, or anything else?

No, most of them don't have a clue and they don't care, so you can't expect them to understand bitcoin fees.

Alas, I don't understand much about cars, and I still drive them, but one would expect that at least when it comes to 'money,' one should try to understand the basics. It's like going to the bank, receiving your credit card, and not knowing how to use it. People are not supposed to understand all the technical aspects behind bitcoin, but at least understand how fees work. However, you are right; some people are naive enough to think that Binance or Coinbase are 'wallets' they can trust with their holdings. I shouldn't expect them to know that increasing fees won't magically create a bitcoin block for their transaction |

|

|

|

|

There are good arguments for every point people make about block size; let's break some of them down.

Argument 1: "Increasing block size would lead to centralizing Bitcoin in terms of nodes."

In theory, this holds. The larger the blockchain, the more expensive it is to store the data.

Counter-Argument: This is B.S. Storage drives are pretty cheap. If someone can afford $50 a year for a node, they could afford $60. Storage is only getting cheaper as we move forward.

Argument 2: "Increasing block size would lead to centralizing Bitcoin in terms of mining."

In theory, this holds true as well. The average miner would safely download or propagate a 4MB block but will have a difficult time handling a 40MB block. This means only large miners would survive, leading to centralization.

Counter-Argument: This is B.S. 99% of blocks are found by mining pools that spend thousands of dollars a month on operating nodes across the globe, running on a gigabit fast internet connection. They could handle a 40MB block just as easily as they handle the 4MB block.

Argument 3: "Increasing block size would reduce miners' rewards, leading to less security."

Again, holds true in theory. Miners want people lining up, outbidding each other so they can make the most profit. The more profit to be extracted, the more hash power we can have, and thus, the more secure the blockchain is.

Counter-Argument: This is B.S. Just because you build a small road for a highly populated city doesn't mean you increase toll revenue; you are just forcing poor people to stay off the road. The argument suggests that if blocks were 8MB, there would be 2x more transactions paying 50% the fee, which means cheaper transactions for everyone but the same profit for miners.

Argument 4: "1st rule of programming: If it works, don't touch it."

As a programmer, I confirm this. I look at some messy code I wrote years ago, and I find it so hard to risk the change. The code works, and I know for certain that if I touch it, no matter how careful I am, I could end up breaking things. Core devs did everything they could to increase the block without a hard fork; there may be left some 5-10% optimization, but past that, you are going to need a hard fork. A hard fork is like jumping off an airplane without a parachute, counting on your buddy who is jumping off another plane to come and catch you—you could end up recording the best video of your life, or you could fall on your head and make a 50m deep hole.

Counter-Argument: We had many forks before; this won't be the first one. Let's just do it. Let's save the poor folks who want to pay 1 sat/Vbyte to pay for their Starbucks that tastes like horse shit.

Every argument and counter-argument is valid depending on how you view them. Many people avoid getting into these discussions because many in the crypto community are narcissists and want BTC to be what they want it to be. If you speak for larger blocks, they accuse you of being CW's puppet; if you advocate for smaller blocks, you are now Core's pawn.

So now you need to be realistic with yourself and ask: Why would this change?

Miners are content with people competing to get into the block.

Exchanges are satisfied because there's more incentive to keep your BTC in their custody for cheap internal exchange and transfers, or to exchange your BTC for other coins when making smaller payments.

Most users don't seem bothered; we see people paying 8000 sat/Vbyte when potential fees are 300 sats/Vbyte.

People pay millions to mint some ugly JPEGs, and those who call themselves 'normal users' pay even higher fees than them to transact.

If you think BTC isn't working, then you need some fact-checking. It is working, it's in high demand, and the world doesn't give a damn about the 100 folks who want to set their fees at 1 sat/Vbyte to get into the next block. Sad fact? Indeed. Will it change anything? Hell no.

So, given the above and considering the risks involved in the transition, and the fact that people didn't give up on BTC despite high fees, it would be foolish for anyone to think that a block increase is going to happen anytime soon.

|

|

|

|

I went ahead and just ordered a Bitmain PSW7. Says it runs about 46dB. We'll see.

Why oh why, that S9 SE is worthless, and so will be the PSU, you should have invested a little bit more and got a good PC PSU like EVGA, those run a lot quite and could be useful later on. But ya, anyway, the 6pin wires on that APW7 are long enough and you would probably be able to reverse the PSU, these PSUs are designed in a way that if you put them too close against the wall they would still be able to suck air in from that little gap, as opposed of pulling air from the other direction where the hot air would be trapped near the wall and kaboom. |

|

|

|

So my nicehash account is kyc and shows about 1000-2000 a month income which sits as btc.

Using nicehash wallet for LN payments is a great idea, except for the fact that they require KYC which is a big no-no for many people including myself, I still think nicehash are "hard to trust" with money, let alone personal identity, I would be careful using them to be honest, I hope that other services would offer the same services without KYC.

Current diff status Latest Block: 822010 (15 minutes ago)

Current Pace: 106.0090% (1499 / 1414.03 expected, 84.97 ahead)

Previous Difficulty: 67957790298897.88

Current Difficulty: 67305906902031.39

Next Difficulty: between 71191491601169 and 71481990238286

Next Difficulty Change: between +5.7730% and +6.2046%

Previous Retarget: December 10, 2023 at 5:31 AM (-0.9592%)

Next Retarget (earliest): Saturday at 10:28 AM (in 3d 9h 16m 56s)

Next Retarget (latest): Saturday at 11:43 AM (in 3d 10h 32m 5s)

Projected Epoch Length: between 13d 4h 57m 15s and 13d 6h 12m 24s Looks like we are going to get a huge jump. @stompix, you see now why we celebrate any negative adjustments? it's because when they don't show, you are likely to be slapped with an increase like this one.  |

|

|

|

My guess is the wallet is under attack from a sweeper bot and it kept replacing the transaction to avoid the owner finding out and spending it.

It is possible, no way to tell for sure, but i assume that someone who knows how to code something like that and get to infect real users, would know that there is no point in overpaying the transaction as that won't speed things up. It would make sense if someone else was spending the same inputs, i.e both trying to outbid each other, but clearly that isn't the case. So ya, even if we would assume it is a bot, whoever wrote it should change his code to stop overpaying.  |

|

|

|

It's pretty disappointing that some people don't understand how BTC works, I will show you a great example of how someone could lose a lot of money just because they don't understand the basics of the asset they invest in. This guy created a transaction right after block 821856 was mined, he set 648 sat /Vbyte ($30) as his fees even though 387 sat/ Vbyte is almost guaranteed to get him into the next block 821857 (has not been mined yet at the time of writing this), but that is fine, if I was rushing and fees are unstable I might have done the same thing if I had no way to replace the transaction, although he had that option but anyway. Here starts the misery: A few seconds later he RBFed the transaction with 1116 satNo confirmation yet? let's pay more to confirm the transaction A few seconds later he RBFed the transaction to 1,293**As am typing this Foundry saved that guy and mined block 821857  He kept raising his fees every few seconds till he stopped (more so till the transaction was confirmed)at 8125 sat/ Vbyte, he was lucky enough that Foundry didn't [1]see the last transaction and ended up adding the one prior to it which was broadcasted a few seconds earlier, which paid 7,895 sat /VbyteSo, long story short, he paid $367 when he could easily get away with $30. All he had to do was understand that his transaction needed to be in a block. Blocks take time to happen, and always watching the mempool status to gauge the bidding is crucial. Paying fees without checking the market is like blindly bidding on something without considering other bidders—you might just outbid yourself for no reason. [1]. It's possible that Foundry received it, but the block template was already generated, and they found the block before they could reconstruct the new blocktemplate. But yeah, that saved him $10. |

|

|

|

|

لا يوجد اي دليل يمكنك ان تقدمه للمنصة يتبث ملكيتك لتلك الامول, وحتى ان كان هناك دليل فهو بكل تأكيد ليس دليل قطعي لانه بمجرد اختراق محفظتك تتساوى انت والسارق في امتلاك الادلة فكل منكم يستطيع ان يتبت انه مالك المحفظة, تخيل ان يقوم السارق بمراسلة منصة اخرى مثل باينانس كنت قد حولت لحسابك بها بعض الاموال ويطلب منهم تجميد حسابك ويعطيهم بعض الادلة التي تتبت انه مالك المحفظة (وهوا بالفعل مالكها في هده اللحظة) فهل من المنطقي ان تقوم باينانس بتجميد امولك واعطاءها للسارق؟

|

|

|

|

On another note, things not looking so great for Ocean: https://ocean.xyz/dashboardWith the hashrate they claim to have they should be finding around one block a week, but it's been 15 days since their last block. Seems like a number of their miners are giving up on them and their total hashrate is gradually falling. Their average hashrate for the past few weeks or since they started is below 400PH since they had a while of below 300PH, but let's just assume it's 400PH since the 28th of last month since that's when they first got above their first peta, that would be 20 days in total, so up to this point their luck/pace sits at about 100% with nothing out of the ordinary. Given that 1 in 7.4 blocks would have 200% difficulty, it's pretty normal for said pool to go on without having a block for another 10 days, in fact, if anything, it's astonishing how they managed to get those 500PH on board, comparing them to another pool like Kano that has been there for way too long and doesn't censor transactions but struggles to go above 50PH. However, as I said when they first launched this pool, it would be only a matter of time before it collapses, as it stands right now, they sell it as the anti-censorship, decentralization savior mining pool which clearly isn't the case, not to mention how it's almost certain that all non-PPS pools will vanish in a few years from now. That's a loss of 0.5 BTC per block. When you have not even mined a single block in 15+ days, that's a significant amount of fees to be throwing away through your censorship policies.

He was very kind to pick that blocktemplate, It would been even worse if he picked the blocktemplete they generated for block 821596. |

|

|

|

I've said for years that if more user-friendly solutions emerge for running your own pool, many would do this, and the network would look very different in a very short space of time, I believe.

You have been wrong for so many years then, sorry to be the one to tell you the truth, but ya, none of what you suggested would fix anything, because there is nothing to fix in the first place, you are framing this situation to be an attack against BTC where large pools are double spending or doing some weird shit, but that's not the case, the case is -- miners are trying to maximize their profit, it doesn't matter if you have 5 pools or 500 of them they will ALL want the same thing which is more profit. The notion that everyone will run their own pools is funny, it doesn't make sense, this is not how Bitcoin works, if this was about decentralizing potatoes, it would work, everyone plants a couple of potatoes in the backyard and the big factories could go bankrupt, but the key to mining is "variance". I am probably one of the largest miners around the forum and it would be so stupid of me to run my own pool. Even if I were to partner with everyone else here, we would hardly hit 50ph, without any technical issues, no difficulty increase, none of us leaving halfway, and 100% luck, we need 75 days of mining before any of us can get a dime in their wallet, with 200% luck for a single block which is pretty possible, we could sit there for 150 days waiting to get paid. Also, given that we are nothing but a bunch of poor guys who can't afford to run our dozen nodes across the globe, it would still be very possible to lose that block after 150 days, so who in their mind is willing to take that risk when they can get paid by share or mine to large PPLNS pool? nobody would do that with 50PH, let alone a single miner with 2*S19 who needs 52 years to mine their first block.  What makes me laugh are the fools that think ordinals are to blame. they are a mere tool.

Actually, the 'normal' transactions folks pay 150% more than the Ordinal folks do, fees could still be this high even without ordinals on the blockchain, they may not say as high as 300 sat/Vbyte but it's almost sure that the 1-2 sats days are gone, people should accept that and start looking for an alternative way to move value, something that makes economical sense, but many people just want to use the little space on the main chain and are fighting everything that raises the fees. |

|

|

|

|

Price list update 18/12/2023

Whatsminer:

M50 118-120TH 12.5 U/TH

M50s 132-138TH 23.U/TH

M50s++ 21w 154-162 25.5 U/TH

M60 170-174TH 26U/TH

Antminer:

Stock

S19kpro 115T 16U/T

Future:

January Batch S21 200T $23.5/T

|

|

|

|

|

), Exchanges are having the best time of their life with all the volume surrounding those shit Ordinals coins, Wallets would be like "What spam" ? lol.

), Exchanges are having the best time of their life with all the volume surrounding those shit Ordinals coins, Wallets would be like "What spam" ? lol.