No stretching block time to six years a ½ ing then 8 years a ½ ing . okay

This would break expected behavior of bitcoin transaction/address which use block height as it's timelock, including LN. [1] https://en.bitcoin.it/wiki/Principles_of_BitcoinI believe that Phill meant here is to stretch the halving periods, in other words, to slow down the supply cut until BTC has matured enough and grown large enough in market value, this solution will just delay the inevitable event of when mining rewards will depend more the fees than the block reward itself. Is it nonsense to say Ordinals is an attack on bitcoin today or is it nonsense to say "eventual disappearance of block subsidy that takes place in 100 years from now should be addressed now by spamming the blockchain today"?!

The 100 years is just a theory on paper, the actual time of when shit could hit the fan is "unknown", let's do some simple math. As of right now, the amount of money that miners can extract every 10 mins or so is 6.25 + fees * $20,000 = $125,000 assuming no fees, so it's fine now, that much value is enough to keep 350EH worth of hashrate securing the network. A year later, the halving happens, BTC MUST be worth $40,000 for the blockchain to be as secured as it is today, or fees need to be 3.125 BTC to offset that. There is a good chance that the halving hits, while BTC is even lower than $20,000, so now it's only 62.5k to be extracted, this won't keep 350EH securing the network, a huge chunk of it will need to shut down. 4 years later, with just 1.56 BTC rewards, if we are still at 20k, it will hardly keep 20-30% of that 350EH and you will have a ton of ready-to-be-used hashrate that can attack the weak blockchain. Now 8 years from now and BTC at 20k is obviously unlikely, but it could happen, it could be the year 2036 when block fees are just 0.7812500, where you need BTC to be trading at 160,000$ to maintain that 350EH, and suddenly some economic turmoil and BTC drops to 60k making it very unsecured with all the hashrate that leaves it. We don't know at what stage fees will be critical, a sure thing, not 100 years, in just 13 years the block rewards will be BELOW 1 BTC a block, in 21 years the rewards will be LESS than a quarter of BTC, if BTC isn't in the sub million zone, things are going to look pretty mad without large fees feeding the miners. |

|

|

|

الامر يعتمد بالدرجة الاولى على كمية الاحتياط وجودة الكود وسرعة تصرفه في حال انهيار احد الاصول, عملة داي اتبت جودتها لسنوات ولم تفقد اترباطها بالدولار حتى عند هبوط الاصول 20-30% في يوم واحد, طبعا هدا لايعني انه لايمكن ان تنهار, خصوصا وانه وللاسف حوالي 40% من اصول عمله DAI مبنية على USDC وهدا شي سيء نسبيا لانه في حال انهاير USDC سيكون من الاستحال حفاظ DAI على قيمتها 1:1, ربما تحتفظ بقيمة 1:2 نظرا لوجود عملات اخرى في الارصدة مثل البتكوين والايثيريوم, ولكن تبقا هناك خطورة على اي حال.

وهدا للاسف تماما مايحصل الان لعملة DAI, فعند اغلاق بنك SVB التي تعتمد عليه عملة USDC في ابقاء قيمتها مساوية للدولار بوضع حوالي 3 مليار دولار فيه, الان مصير تلك الاموال مجهول فما حدث هنا هوا انخفاض قيمة USDC مقارنة بالدولار, مما يعني ان احتياطي سلة العملات لعملة DAI فقد جزء من قيمته, عملة DAI الان تعادل 0.92 دولار بينما عملة USDC تعادل فقط 0.90, الفرق هنا طبعا ان DAI لديها احتياطي من عملات اخرى والتي للاسف ايضا فقدت جزء كبير من قيمتها (مثل الاثيريوم والبتكوين). اعتقد ان هدا الامر سيكون بمتابة درس جيد لعملة DAI واعتقد ان من يمتلكون القرار في اختيار سلة العملات الخاصة بالعملة عليهم التفكير مليا في جدوى وجود عملات مستقرة متل USDC داخل سلة عملات DAI, حيت ان وجود هده العملات يزيد من سيولة العملة وسهولة تداولها والاقبال عليها بشكل ما, الا ان الضرر الذي ينتج عنها اكبر من كل المنافع, وخير دليل هوا مايحدث الان لو كانت سلة العملات تتكون فقط من بتكوين وايثير لما كانت عملة DAI لتفقد ارتباطها بادولار. |

|

|

|

Shouldn't difficulty adjustments take care of that, though? I.e. big miners go offline, difficulty goes down, home mining gets profitable again, and mining continues on.

I forgot to comment on this till I saw Phil's reply. I am pretty sure you understand how mining works, but just to shed some light on this subject, the difficulty adjustment is there to keep a pre-determined supply, everything else happens as a result and not a purpose. When we say that the more the fees the more secured bitcoin is, we actually mean it, the "explain like I'm five" for this is to imagine that you want to secure a bank, you would hire everyone who is capable of using a gun, and the contract states that the rewards will be split between all those guards depending on how much the banks make every day. The bank has a small garden at the bank, people pay some fees to enter it, so at around midnight, you collect all those fees, and split them between all those guards, when someday the bank makes only 100$ and you got 1000 guards outside, you will give each one of them 0.1$, what is going to happen the next day is that many of them will not show up, because the bus ride costs more than 0.1$ to 90% of them, so only 10% of them will show up the next day, and by the end of the day, each of them will receive 1$ which is good enough for the remaining 10 guards (difficulty drop), but not for the bank, because the bank now has only 100 men guarding it as opposed to 1000, it's more subject to attacks than it was a week ago when the bank made 1000$ a day and gave 1$ to each guard. Keep in mind the garden is pretty small and can only accommodate a certain number of visitors, so visitors need to bid on the ticket prices to enter, what's ironic here is that you got some bank clients who want to hire an extra guard to stop people wearing blue from entering the garden despite the fact that they are willing to pay well and probably going to make the bank net 2000$ and end up hiring 2000 guards, they want only people wearing green inside the garden because they "assume" the blue color shirts will ruin the garden. |

|

|

|

if a 30 watt s19 j pro makes $1.50 at six cent power it has not quite bottomed out on the mining end.

Yes the top tier gears are still in the positive zone for those with 6 cents power rate and below, we also know that some of those large farms are still deploying, what is going to happen now is that many S17s, M20s are going to have to shut down, and a dozen of the overclocked gears will need to adjust, so there is without a doubt some sort of capitulation after a massive 24% in profit. So now it's a matter of how fast are the large players stacking gears, can they bring online enough gears to offset every miner that isn't profile after a 24% drop, my guess, is that they will not be able to and we would see a drop in difficulty. So the adjustment was +1.15%, so far the pace is 146% lol, just imagine for one second that we could get such a spike at the current hashrate I wonder if that's even physically possible for this to happen in a few weeks periods, you are going to need an unlimited supply of money and a ton of luck to bring online 150E worth of hashrate. Latest Block: 780212 (3 minutes ago)

Current Pace: 146.6769% (21 / 14.32 expected, 6.68 ahead)

Previous Difficulty: 43053844193928.45

Current Difficulty: 43551722213590.37

Next Difficulty: between 43860108450321 and 65913689416046

Next Difficulty Change: between +0.7081% and +51.3458%

Previous Retarget: Yesterday at 11:43 PM (+1.1564%)

Next Retarget (earliest): March 20, 2023 at 12:48 PM (in 9d 10h 41m 19s)

Next Retarget (latest): March 24, 2023 at 9:30 PM (in 13d 19h 23m 52s)

Projected Epoch Length: between 9d 13h 4m 29s and 13d 21h 47m 2s

|

|

|

|

Good counter-argument. I do think though that it is much harder to tell who is sending money to whom (even harder if we got L1 privacy, which I also advocate for) than to tell whether a document is classified or not or whether it is for a different reason illegal and immoral to store and distribute a certain file. That's true, but hopefully, there would be an easy way out of this at the software-level. Interesting perspective. To me, it perfectly fits the principles, because Lightning helps Bitcoin be a global payment method by scaling it and increasing the throughput. It reduces mempool congestion while allowing for more payments, meanwhile Ordinals increase the congestion and do not scale Bitcoin in the process. Lightning is P2P e-cash too, just in a slightly different way. Makes perfect sense, but still, LN takes away from BTC, the original version of Bitcoin was for everything to sit ON the blockchain, not for a dozen transactions to happen elsewhere and then store only the final settlement on the blockchain, nonetheless, LN is a great idea, people will use it to transact faster and cheaper, now with NFTs being stored on the blockchain it doesn't mean the normal transactions can't happen, it just means people need to pay more and compete because this is a free market. Not saying all these arguments against NFTs are invalid, but the common logic here is that people don't want blocks to be full because they want to be able to transact at close to 0 fee, from your individual point of view, if fees are high, how does it matter if it's because people buying some stupid NFTs or paying for their coffee and tea as far as the fees you have to pay? it doesn't matter, does it? you are still forced to compete against other transactions regardless of their purposes. I mean if we were to stick to this logic, then eventually when people start using BTC for daily payments, some people will be mad and accuse them of congesting the blockchain and increasing fees and that they must use LN or use their credit cards and leave the blockchain alone. This whole idea of "I want transactions to be cheap and blocks to empty so I can transact for cheap whenever I want" is just stupid at best because it doesn't matter what the other transactions are about, people are still going to be pissed because they have to pay a higher fee, this is one attribute of communism where a group of people think they can (or even need) to tell the rest of the people how to do certain things like how they should spend their money, and it's all based on self-interest. with all due respect to everyone here, I am sure the vast majority of people talking shit about NFTs do it because they want to be able to transact for free, most of them don't even own a node to be concerned about the extra capacity they need to provide or anything like that, it's just solely based on the principle of "I want the blockchain to work in my favor, I need to eliminate competition", sticking to that logic, we will have the same debate in the future, of people who use BTC to buy coffee vs those who use it buy tea, the coffee group will be trying to censor the tea group because they think they coffee is more important than tea (I agree with that tho  ). See I know this is NFT vs Transactions, but it's the principle of rejection and elimination that is there to stay if we would allow it, the coffee vs tea debate is just an extreme exaggeration, but I am sure you get the point. Now furthermore, if the NFT market makes it to the point where it actually makes all blocks full, and fees sky high, those users themselves will have to solve that "issue", it's not just you people that want cheap transactions, everyone else does, even if they pay 2k for some funny jpeg, they would want to store it for 1$ instead of 20$, it's not like those folks have an unlimited supply of money and will keep raising fees to infinity. They will need to figure out some shit, just like they did with ETH, and look at all the projects built to solve that issue, tens of billions of dollars were injected into the ETH ecosystem, all kinds of different layers and protocols, which all add to the value of ETH as a whole, without all those NFTs, Metaverse and whatnot, ETH wouldn't have grown this large, so why not give these folks a shot with BTC, see what they can build, and eventually the fee/blocksize issue will be figured out one way or the other. |

|

|

|

I'm honestly mostly worried about storing people's potential illegal files and serving them like a webserver to the public. The moral and legal aspects of it, both.

Ok that's another valid point against Ordinal, and I enjoy hearing different opinions that I think are valid, however, there is a counter-argument to this, you take the same legal risks running a full node and not banning a dozen of addresses and countries (one large U.S based mining pool already does that), if your node/miner happened to process illegal transactions it's probably the same thing as storing a legal file on your node's server. Every tool or a system is created for a clear purpose and when you use it for anything else, that is abuse If that's the case then almost everyone is abusing the system by treating bitcoin as a store of value and not a means of payment, also, I didn't see the same folks complaining about Ordinals now complaint about LN, where does LN fit into the root principles of Bitcoin? why do we need a second layer, why not have every payment on the blockchain? turning BTC from P2P e-cash to a mere "final settlement layer" is also an abuse using your logic. I obviously love the idea of LN, and despite why it doesn't fit perfectly in the original purpose of BTC, it actually does provide a great utility, it uses the blockchain to achieve something of value, Ordinals might be capable of doing the same, or it could be just a short-lived hype that would die sooner than most people think, I won't be bothered to see it fade on its own after proving it has no real value, but not by banning it before seeing what it can/can't do. |

|

|

|

Or, the not so funny one, an S19 is making you 8$ a day, as in 30 minutes of flipping hamburgers on minimum wage at McD.

An S19 makes you 1$ at 6 cents/Kwh, remember when it first hit the market and people were buying it for half a bitcoin?  Probably, it seems like it's slightly deflating even now, but still, a lot of mining companies are going to have some long meetings full of silence today!

Well profit is down 24% it makes perfect sense for diff to start slowing down at least, current numbers are Latest Block: 780164 (8 minutes ago)

Current Pace: 101.2055% (1989 / 1965.31 expected, 23.69 ahead)

Previous Difficulty: 39156400059293.19

Current Difficulty: 43053844193928.45

Next Difficulty: between 43586727751245 and 43586824534449

Next Difficulty Change: between +1.2377% and +1.2379%

Previous Retarget: February 25, 2023 at 3:27 AM (+9.9535%)

Next Retarget (earliest): Today at 11:27 PM (in 0d 4h 26m 47s)

Next Retarget (latest): Today at 11:27 PM (in 0d 4h 26m 49s)

Projected Epoch Length: between 13d 19h 59m 52s and 13d 19h 59m 54s Not much time left to make any considerable changes in the retarget, so 1.15% or anything pretty close to that. |

|

|

|

The price of bitcoin dropped 16% over the past 14 days, a pretty huge drop as far as miners are concerned, add to that the 9.95% increase we had in the previous epoch. So we went from 24k and 39.16 T difficulty to 20k and 43.05 T, that's 0.075$/th down to 0.057$/th, that is a massive 24% decrease in profitability in just 2 weeks. As of now anything of 9-10 cents/Kwh and above is mining at a loss except for Antminer S19 XP which is making a shy 1.2-1.5$ a day at 8 cents only XP or S19 J pro, the 19 pro hardly makes 40 cents a day. at 7 cents you need S19 and above, and that's making only 0.25$ a day, 0.30$ a day for M30s++ at 6 cents, anything of 40w/th and better makes some profit, the XP makes 4$ a day, XP sells for 6.5k that's 1,621.5 ROI without taking the halving into account, add the U.S tax, and that gets you to 2,400 days at 6 cents, a very solid deal.  Diff is still at a positive pace Latest Block: 780096 (6 minutes ago)

Current Pace: 101.7286% (1921 / 1888.36 expected, 32.64 ahead)

Previous Difficulty: 39156400059293.19

Current Difficulty: 43053844193928.45

Next Difficulty: between 43810965584755 and 43812680272390

Next Difficulty Change: between +1.7585% and +1.7625%

Previous Retarget: February 25, 2023 at 3:27 AM (+9.9535%)

Next Retarget (earliest): Today at 9:45 PM (in 0d 15h 33m 51s)

Next Retarget (latest): Today at 9:46 PM (in 0d 15h 34m 37s)

Projected Epoch Length: between 13d 18h 17m 26s and 13d 18h 18m 12s

nearly 15 hours to go for another positive 1.3 - 1.9% which will make the above numbers look even worse, my guess, the next epoch will be a negative adjustment if the price doesn't rally back. |

|

|

|

I know I have had a few S19APro 110TH units fail on me under warranty. They drop down to 2/3 hashboards just like appears to be happening with the units mentioned above.

I keep hearing that the "A" version of the 19 pro series is terrible, I have always questioned why people sell it at cheaper prices than the other ones, pretty lame to have a gear that expensive die on you in a few months, reminds me of the 17 series. I don't know the implications of that aluminum board, they say that Whatsminer is already using the same design but the PIC thing seems tricky It's not just the aluminum board, it's how everything works together, based on my own personal experience nothing beats Whatsminer in terms of durability, people who had enough experience with both brands will understand that it's the reason why Whatsminers sell for almost the same price as Antminer despite being slightly less efficient, it's the extra quality you pay for, of course, Whatsminer is far from perfect and there is some stupid stuff in the design which pisses people off and should have changed years ago, but just like Bitmain they don't seem to care. |

|

|

|

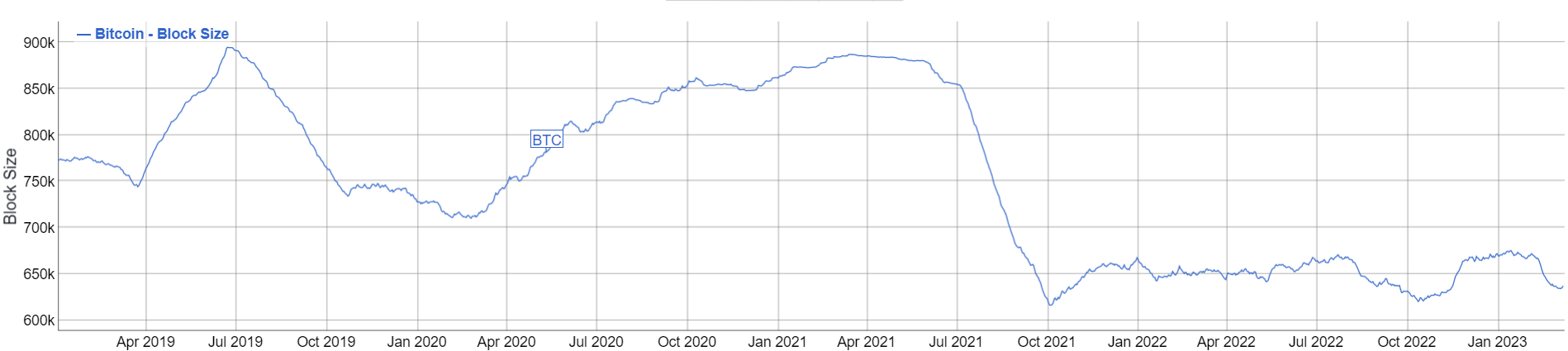

When you use a broken tool you'll get broken results. The chart is most probably the result of running an old client that is no longer "full" node (is ignoring SegWit so they have been receiving "stripped blocks" that are smaller).

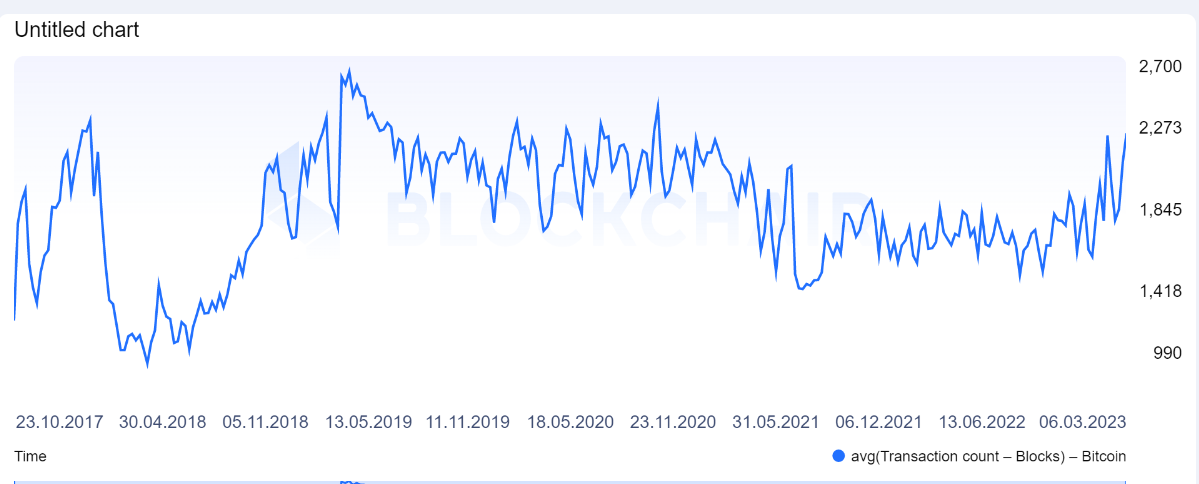

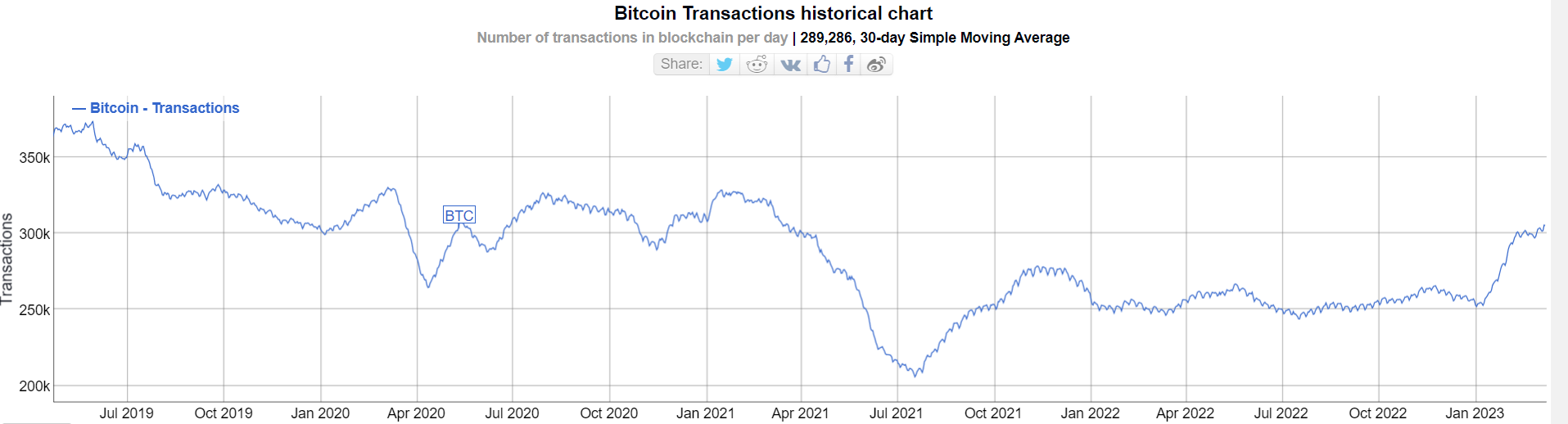

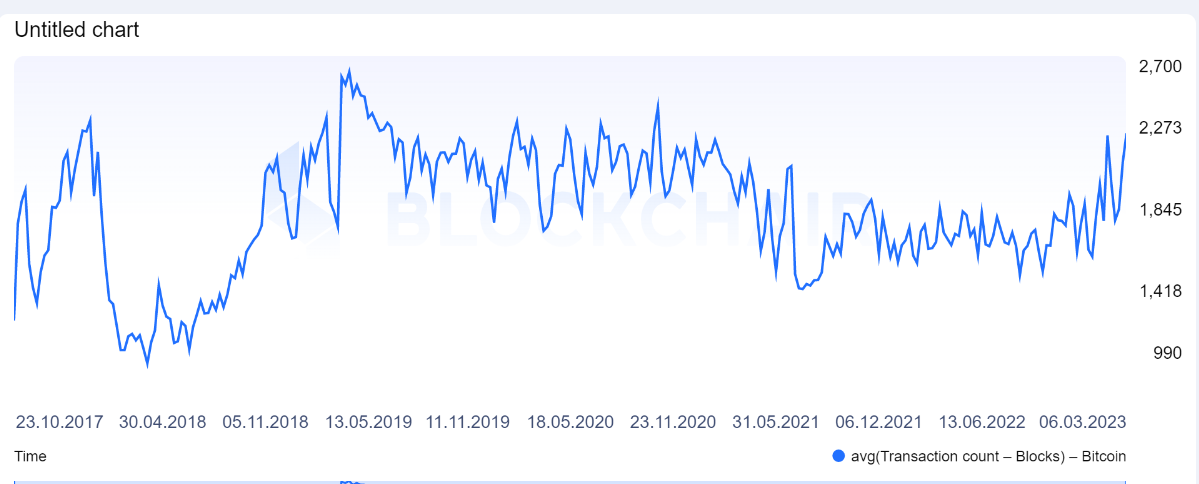

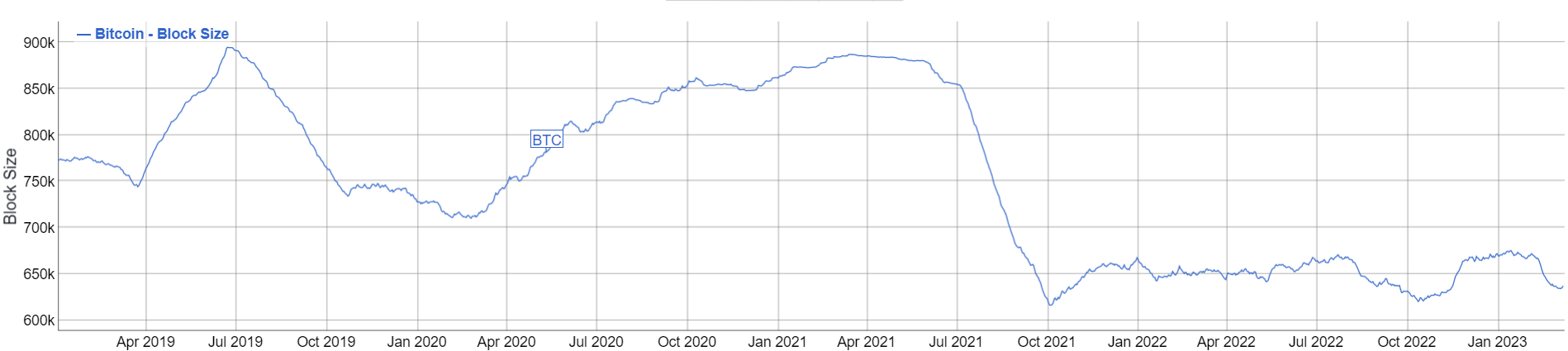

Alas, but even your chart isn't showing any "full blocks", block 748918 which was mined long before these Oridnals has a size of 2.77MB, in fact, in theory, if all transactions were just witness data blocks should be 4MB, but given segwit adoption, blocks should be AT LEAST 2MB for us to call them "full", in the chart you posted, most blocks are close to 1MB than to 2MB, so closer to 50% than to 100% as per the first assumption I made prior to diving into all of this. This shows that there is a lot of room to be filled, people are not using it, and someone else now is, which is why we started to have nearly full blocks now. Oh and by the way, here is another chart from Blockchair that shows the transaction trend and how it has been in a downtrend and fewer and fewer transactions are happening on the blockchain from 2019 to date.  Anyway, my question to you, and I hope you answer reasonably, aside from the fact that you think this is "useless data" stored on the blockchain, what other reasons do you have to support the exclusion for Ordinals? let's just assume everyone who agreed with you gathered together and you are going to start lobbying to ban Ordinals, you are going to have to convince mining pools, exchanges, the devs, nodes operators, and a few others, what proposal do you have for them and how are you going to convince those people to ban Ordinals? Up to this point, and after a few discussions with different people, if I were to start lobbying against Ordinals, the only single valid point that I would use would be the point that you pointed out here. in another possible scenario when the spammers will have had filled each block with "cryptokitties" and increased the fees the rest of the bitcoiners would abandon bitcoin and dump their coins which would crash the price. While this is a great argument to start with, I am afraid it isn't enough, we are going to need to find more "value" in banning those "spammers", if not, people will just nag about it for a few weeks and then let it slide forever, or until it dies on its own. |

|

|

|

You are making a wrong conclusion based on false data. In 2017 bitcoin was experiencing the biggest spam attack of its entire history (biggest until today too). The number of transactions then can not your baseline.

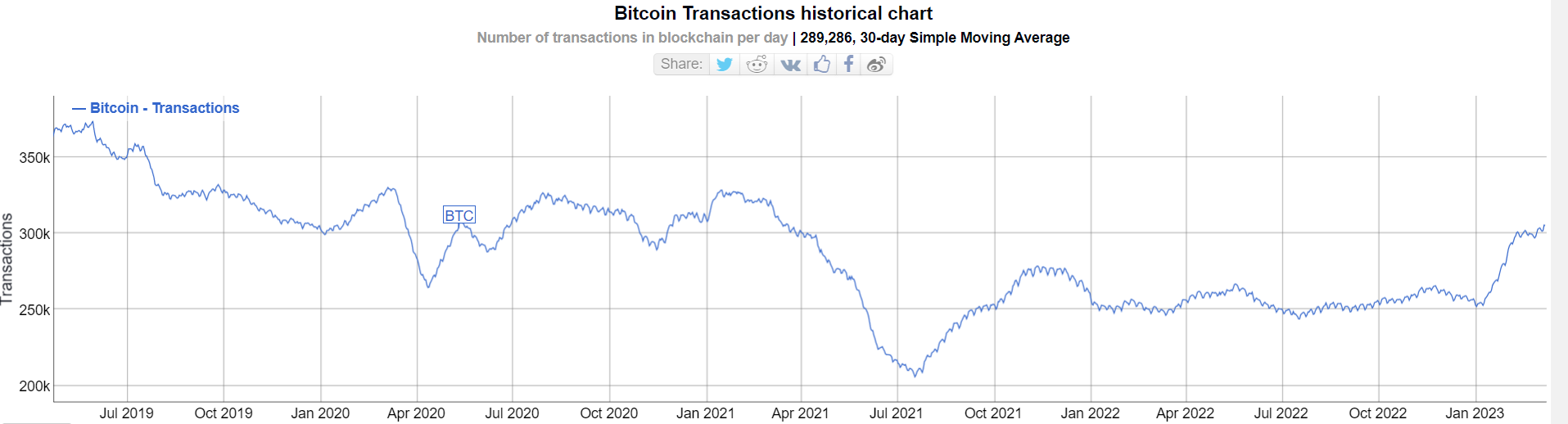

Oh ok then it's even worse, taking 2017 out of the equation means the number of transactions per day/month had no real growth from 2015 to 2023. In reality if you check the stats rarely released by payment processors, check out number of merchants that are accepting bitcoin each year, countries adopting bitcoin as legal currency, legal tender, reserve currency, for international trade and a lot more you can clearly see that usage of bitcoin as a currency has been increasing by a lot. So ditch the on-chain data and find reliable info on the news websites? doesn't seem like something I'd do, furthermore, your claim was that number of people using bitcoin as payment has been ever increasing, that's different from how many countries taking BTC as a legal currency, and the only valid source for such a claim is on-chain. Here is a chart of Bitcoin transactions, each input is the average 30 day transaction (30 days worth of transaction / 30)  This is 4 years' worth of solid on-chain data which clearly shows no sign of transaction growth, in fact, it's showing the exact opposite of what you claim, during the 4 years we had all kinds of bull and bear markets, nothing affected the overall direction of the trend. Lets fact check your assumption.

I intentionally chose 2015 to 2017 because the end date is approximately when the spam attack gets worse and also the huge bull run and the bubble has not yet started. The window from 2017 to 2019 isn't that better though (~1400 ie. ~55% reduction) which proves my point about increasing adoption as a payment network. Here is another chart showing the average 90 days block size  More blocks that are almost half empty than blocks that are almost full, in 2022 the average blocksize was 630kb, which is closer to 50% than to 100% as per my previous "assumption", in fact, we can still smooth out 5-6 years worth of data regarding blocksize and it's more likely than not for this assumption to hold, unless we would cherry pick periods of when blocks were almost full. And by the way, you seem to confuse adoption with usage, just because more people adopt bitcoin and buy it, doesn't mean there are more transactions, the adoption per see has without a doubt increased it can be seen through the increasing value of Bitcoin, but that doesn't mean everyone who buys bitcoin will transact it, most of it will just sit there. Miners are already "extracting fees" they don't need Ordinals for that unless you mean spam attacks like 2017 which artificially inflate the fee is a "good thing"!

We need every bit of value we can extract, you will have very hard time finding a miner who would mind getting paid more be it the result of spam or NFTs. which is to use a side-chain. The NFT folks can tell you the same thing, you can use a side-chain for payments as well, LN works great. You are forgetting that SHA256-ASIC and Scrypt-ASIC are different and you can't use one for the other. In simple terms bitcoin's hashrate can not "slide" to shitcoins like LTC and Doge.

If we go with your logic the hashrate should slide into another SHA256 coin! I am pretty sure he is talking about money flowing to those altcoins, not the miners themselves, someone who wants to invest 1m in mining gears would rather buy those Scyrpt miners and extract more money, a valid point on Phil's behalf, look at all the money we let go to those shitcoins just because we don't want to allow anything to be built on BTC blockchain. That is still much less than any VAT, taxes, card loading fees, 3rd party commission fees, etc. that you can get charged with with fiat money.

Indeed, I am not arguing that it's using your credit card is cheaper than sending a transaction on bitcoin (although most of the time it is), the point is, that a tiny transaction is going to sit on the blockchain forever, despite the fact that many people would label it as "useless". i knew miners didn't give a damn about what bitcoin is used for as long as they can collect their fee. they would be happy to see transaction fees skyrocketing if the blocks can still stay full.

Not sure why you quoted tromp on that, it was actually me who wrote that and yes, as a miner I can confirm that I will be very happy to see transaction fees skyrocket, but miners do care about the well-being of bitcoin probably more than anyone else, miners have so much lose, they put billions of dollars at stake, build infrastructure, hire people, go through the legal process, having to fight against those who think Bitcoin is useless and is wasting energy resources, Bitcoin is worth nothing without miners securing it, not sure why many people want to label miners as "devils". In fact, Bitcoin users should make sure that miners are always "happy" even if they dislike them or hate them, they are keeping your money safe and the fees you pay are not charity work it's for the work they provide, if you are not happy about it, start mining your own bitcoin and code your software to reject what you think of as "spam" and save Bitcoin from the devils. But no, most people don't contribute anything to bitcoin, they don't mine bitcoin, they don't code shit, don't even run a full node, they just want to buy cheap bitcoin, send it for free to their hardware wallet, wait for the price to increase, send it back to the exchange for 1sat/vbyte and sell it to fiat and still want to boss around people telling them how to use the blockchain.  I see a bit of extortion happening here Mikey, should I power back (of wait, first buy back) a few of my miners to try to offset this?   Ya bro, sharpen your miners, looks like the NFT market is going to bring you back to business, you are getting back your devil title soon.  |

|

|

|

Lowering the cost of mining Bitcoin is not a positive impact on the currency. This is because it will increase the amount of Bitcoin in circulation greatly therefore causing the price of the crypto currency to drop which will result in great loss for those hodling Bitcoin before the incident. The currency has to be difficult to mine in other to protect it's value.

This is my idea

No such thing can happen, there is something called "difficulty" in mining, it doesn't matter how cheap it becomes to mine bitcoin or how many people mine it, the protocol will always keep the average block time at 10 minutes, ya not 100% adjusted but overall perfectly aligned. I don't think it's wise to buy all 30 ASIC units from Bitmain you can get cheaper from Canaan units if you are planning to lower the cost.

Here is a fair warning, the recent gears made by Canaan are of very low quality, it's probably why they had 80% drop in revenue in Q4 last year, it's either Bitmain or Whatsminer, the former for better efficiency, the latter for better quality. And the main part of lowering the cost is the Electricity rate but I think you can only get cheap power in 3rd world country.

The United States has 50% or more of the current hashrate, and it doesn't fall into the 3rd world country (I hate that term anyway).

OP, the first thing you need to check is the power rate, anything above 6 cents is risky, 7 cents is maybe doable but you will need a lot of luck, depending on your power cost, you pick the right piece of gear, where do you buy the miners from also matters, which country do you come from? if you are in the U.S., it's cheaper to buy miners from other resellers than to buy them straight from the factory. |

|

|

|

We should aim to get the best outcome for it together and not by fighting each other or threatening Bitcoin's destruction.

Exactly, which is why I don't understand why many people would reject any change to the protocol or even a new use case for the blockchain, people opposed Segwit, LN, Taproot, Stratum V2 and etc, the majority of those things are now alive and still running, why? because more people wanted them than not, up to this point many people say that Segwit coins are not Bitcoin, did that change a thing? no. Do I like NFTs? hell no, will I be happy paying ten times the fees because my transaction has to beat some ugly Ape image? of course not, but I am also not happy having to download a 6000 sats transaction because uncle joe wants to see if his wallet works fine and can receive Bitcoin before he goes ahead and transfer the remaining 12k sats, do I have the right to censor uncle joe just because it bothers me? probably not. To me VALUE is key, the majority of people who oppose bitcoin say that it uses a huge amount of unnecessary energy, thus raising the electricity cost for those who need it to keep their house warm, so the conclusion is (Bitcoin is evil and we should ban it) this is exactly the same logic that states "Storing ordinals on the blockchain makes the other normal transactions more expensive and we have to ban it". People seem to ignore the fact that Bitcoin mining extract value, the demand for what they think is "wasted energy" creates more jobs, pays more tax, and overall benefits the economy in general, even if you have to pay $120 a month as opposed to $100 without the miners' demand, the value that has been made in the process is going to circulate back into the economy for a greater good, we can apply the same logic to these NFTs, let's just assume everyone who trades NFTs is a "retard", so 1 million "retards" buy Bitcoin and increase its value by x%, that x% is very likely to offset the extra fees you need to pay when competing against those "retards", anything that adds any sort of value to the economics of any project is good as long as it isn't a serious threat against its existence. Are there any serious threats on Bitcoin with Ordinals/NFTs? anything vital? or it's just "No, I don't like them, kick them out of here"! |

|

|

|

This doesn't justify why Bitcoin isn't account-based but output based. Ethereum does have account-based model for example.

Indeed it doesn't,my understanding of OP's question is how these outputs are handled, his question didn't seem like he wanted to know why Bitcoin isn't account-based in the first place, he just wanted to know "why do we use them in this way". It's a great sign that forum members are so eager to help, we go as far as guessing what the question is, and as for the Stackoverflow guidelines, it's actually almost always a wording issue, the chance of someone coming up with a question that has not been asked before are pretty slim, it's safe to assume that a large chunk of the data on the internet is redundant, OP could have found the answer if he know that "batches" are called "outputs", but how on earth would he know that?  . In fact, if you check the recent answers on StackOverflow, especially for programming languages that have been there long enough, most of the solutions point to some years old question which is pretty similar to the current question, but the vocabulary differs and the user had no luck in finding answers, leads him to think that nobody has ever asked the question, happens to me all the time to be honest.  |

|

|

|

We haven't established that bitcoin has shifted away from its principles. The number of people using bitcoin for payment has always been increasing regardless of how many "investors" exist who don't. That means bitcoin has never shifted away from those principles to begin with.

Maybe you haven't, but many others had, and no, people using bitcoin for payment have not been increasing, it's actually the opposite, there were more transactions in 2016 and 2017 than were in the last 3 years, take a look at the transaction count, to be very generous and not call this a downtrend, it's flat at best. Do you know what is actually in an uptrend? it's the number of BTC going out of circulation buried in the "hodlers" wallets for god knows how long, if you were to check the average block size for the past 3 years, it would be closer to 50% than to a 100%, there are days where blocks barely had any transactions, the worldwide percentage of people using bitcoin to transact rounded to the nearest whole number is exactly zero, and it will only get worse over time, the more valuable BTC become the less people will transact it. Besides it still doesn't justify spamming the blockchain with useless data and use it as personal cloud storage. Someone could make the same argument about someone else making a transaction for a cup of coffee, a few sats worth a transaction that is going to sit on thousands of hard drives forever, it's pretty difficult to define what is useless and what's not. We can't because these are not "tokens", they are not even smart contracts, they do not transfer anything to anyone They do add value to the users who want to own those sats that point to something of value to them, furthermore, they add value for miners to extract as fees. , in another possible scenario when the spammers will have had filled each block with "cryptokitties" and increased the fees the rest of the bitcoiners would abandon bitcoin and dump their coins which would crash the price. In which case the miners would be the first to see the consequences. The token hype dies like it died in 2018 and bitcoin wouldn't even be used for that anymore. This sounds a lot more like a reasonable argument against Ordinals, a much better one than "hey they are spamming the blockchain". the counter-argument to this however has been discussed, these NFTs have a huge market, probably worth a dozen times more than the average joe paying 1 sat per byte to transfer his 0.01 BTC, the value extracted by those interested in these things could very well pass the value of the users who shares your view, of course, it could also be the other way around, we don't know what we don't know, but I would not mind sucking all the value from all those altcoins into BTC, if that's what the people want -- why not? |

|

|

|

No, we should call on nodes to reject spam transactions that are abusing the system and never relay such transactions. This is in accordance with the principles of bitcoin, the peer-to-peer electronic cash system and is against the principles of bitcoin, the permit anything file storage system.

But bitcoin is no longer a "peer-to-peer electronic cash system" as far as the majority of people are concerned it became more like a "store of value", there are fundamental aspects of Bitcoin that keep it from being a perfect "peer-to-peer electronic cash system" like the average block time and the value instability, it's not useless in that regard, but it's far from perfect, which is the reason why things like Lightning Network came to existence. In fact, it's almost impossible for bitcoin to become what i was intended for, that's not anybody's fault, Bitcoin turned out to be too good to be spent, and since "bad money drives out good." it's safe to assume that BTC will work better as a store of value than anything else. Now that we shifted way too far from any "principles", it's probably a good idea to reconsider who are the real users of BTC? you can argue that the real users are those who just use the blockchain for regular transfers, to many others, the real users are the ones who contribute value to the blockchain, at this point, the exact definition of "spam" is going to be lost. I never liked NFTs, never believed they had any value to me, even the ones that sell for 100k I personally wouldn't pay a penny to buy them, but that's just me, however, maybe we can consider these Oridnals as an added value to the blockchain, at least from the security side of things. I could be biased as a bitcoin miner, but do hear me out, what gives bitcoin any value to start with, what is more important to bitcoin, my miners or me wanting to keep the system NFT-free? it's without a doubt that my miners are more important, they secure the network, and my thoughts on what should be on the blockchain have exactly no value. I hope we all agree that the more valuable bitcoin is -- the more it is secured, there is a direct correlation between (how much value the miners can extract from the blockchain) and (how secured the blockchain is), the more value -- the better for BTC. As of today, that might not be so crucial, but at some point in the future, the block rewards will hardly keep "enough" miners online, to them, it doesn't matter if they are getting paid by someone transacting value or sending some arbitrary data, as long as all "users" are competing and paying high fees -- miners will stay online. We were discussing the hashrate trend in the mining section a few days ago, and it does seem like there is enough room for more growth given the average worldwide power rate, but that growth can't be sustained, at one point the network will be saturated and no further growth can happen, when we arrive at that equilibrium, every drop in BTC price will result in a drop in the hashrate and thus a drop in the overall security of the whole system, and all of this could happen while the block rewards are at 6.25 BTC, when those are halved a few times over the years, we are going to need BTC to be worth a few millions of dollars to keep it as secured as it is today. eventually, BTC's price will have to settle at a very narrow range just like anything of a value does over time when it grows large enough, every halving that occurs then will have a major impact on BTC's security, that "lost value" needs to come from somewhere, if it can't come from the average user who transfers ones a month paying 1 sat/vbyte, it has to come from elsewhere, be it someone paying 100 sats to transact or to store their naked picture is somehow irrelevant to the miners and the security they provide for the system. I also understand that the average user who doesn't mine BTC, doesn't consider the hashrate to be the #1 aspect of value to BTC, and isn't into all of this NFT stuff wants to be able to transact at the cheapest possible, so ya, it's pretty difficult for anyone to convince anyone else as to what's best for BTC! |

|

|

|

lets see 6400 usd plus 33% tax = 9600 or more like 0.4 btc 0.00000287 x 141 = 0.00040467 btc a day. lets argue that diff goes 2x over 1000 days. so 0.00020233 by day 1000

average may be 0.0003 btc a day so .4/0.0003 = 1333 days or more with free power.

pretty amazing.

I think you forgot to add the halving to the equation, just so we don't re-do the math, let's take the last part, 1333 days - 400 (till halving for simple math) so 933 days will be post-halving, I would say 2000 days or anywhere between 5 to 6 years assuming it doesn't die or lose any hashboard in the process, to me, that's more like 'never'. You can buy other gears that are less efficient, and still hit ROI faster despite the power rate, I am sure many folks don't run the math and they will be more than happy to pay 0.4 BTC for this miner. |

|

|

|

And why is it necessary to send and receive data in batches when other options are available?

It is necessary because in Bitcoin unlike banks there is nothing actually stored in your account, all you have is ownership proof of some "batches" stored inside the blockchain. In the traditional banking system, it's fairly simple, like say there are only 3 folks in the bank, so 3 accounts in total, the starting balance of each account is $10, if person A sends 5$ to person B, the bank can just take 5$ which is sitting in A's account and move it to B's account, so now B has 15$ while A has only 5$, and of course, C still has 10$. Now turn this bank into a blockchain, there is no starting balance, and there is no other bank that would give you the 10$ to deposit it in your account, however, the bank will print new money every 10 minutes, the rule states that the bank must print a unit of 10 (currently 6.25 for block rewards but 10 is easier to work with), so the bank prints 10$ and assign a signature to it where the 10$ can only be unlocked and sent by A, so now A, B, C and the bank acknowledge that this 10$ belongs to A, but don't have the means to send it to A's account, it's just that everybody knows it's his. Now A wants to send 5$ out of that 10$ which "again" isn't in his account, so he will go to the bank and show a signature that proves his ownership to that 10$, and he says, I want to pass the ownership of 5$ out of the 10$ to person B, the bank will say, ok! but yours is 10$ whom should we give the other 5$ to? he would tell them to pass ownership of that remaining 5$ to him, so the bank will "destroy" that 10$ and print 2*5$ each with its own owner/signature. As we move forward and that 5$ is going to be split into a dozen bills, it creates the "batches" you are talking about, of course, you can go back to the bank and tell them you want to combine/consolidate every single batch you want, so you sign those 100 batches, the bank "destroys" them and issues a new piece which can be only be unlocked by your signature. So bitcoin works more like "Cash" rather than "Banks", if you check any random wallet, you will see a few 10s, a couple of the 20s, a few metal coins, the wallet has 77$ in it, but it's made up of many smaller "batches", Bitcoin beats the cash system in this aspect tho, because you can't take 77$ of mixed "batches" and ask the bank to give you one 77$ bill, with Bitcoin, you can. Any chance you actually mean blocks (that are processed / mined roughly every 10 minutes)? Because that's what your original post sounds like to me.

The first question is a bit confusing, but it became pretty clear to me after reading his second question, I am pretty confident he is asking about how "outputs" are managed. |

|

|

|

nobody really cares about a few bitcoin mining companies going broke, it's just a few tens million

I think it's more like hundreds if not thousands of millions at stake already, but you are right, in the grand scheme of things, the whole mining business is just a drop in the ocean. ROI is more like never, at least as far as BTC roi is concerned, I can tell you that this miner will never make 0.3 BTC during its lifetime, it's more likely to get hit by a lightning strike than make 0.3 BTC. |

|

|

|

Now (2023) bitcoin is on the bottom, it is better to take it if in the long term.

The worst thing to do is invest in mining equipment when you think this is the bottom just to sell it later on, the price appreciation on mining gears is a lot lower than on the coin itself, due to the following reason. 1- Difficulty rises, the profitability doesn't increase proportionally with price, and thus the miner's value doesn't too. 2- The miner loses value due to the efficiency race, right now his miner is one of the most efficient gears, a year later, it won't be, which makes it lose value as well. 3- The miner's age, the longer it sits there, and the more value it loses. Of course, this changes if it's a matter of selling the miner and keeping the fiat, assuming this is the bottom, then keeping the miner will outperform keeping cash, but if it's the bottom then BTC > mining gear. |

|

|

|

|

).

).