goodluck

you had another chance.. but nope you doubled down..

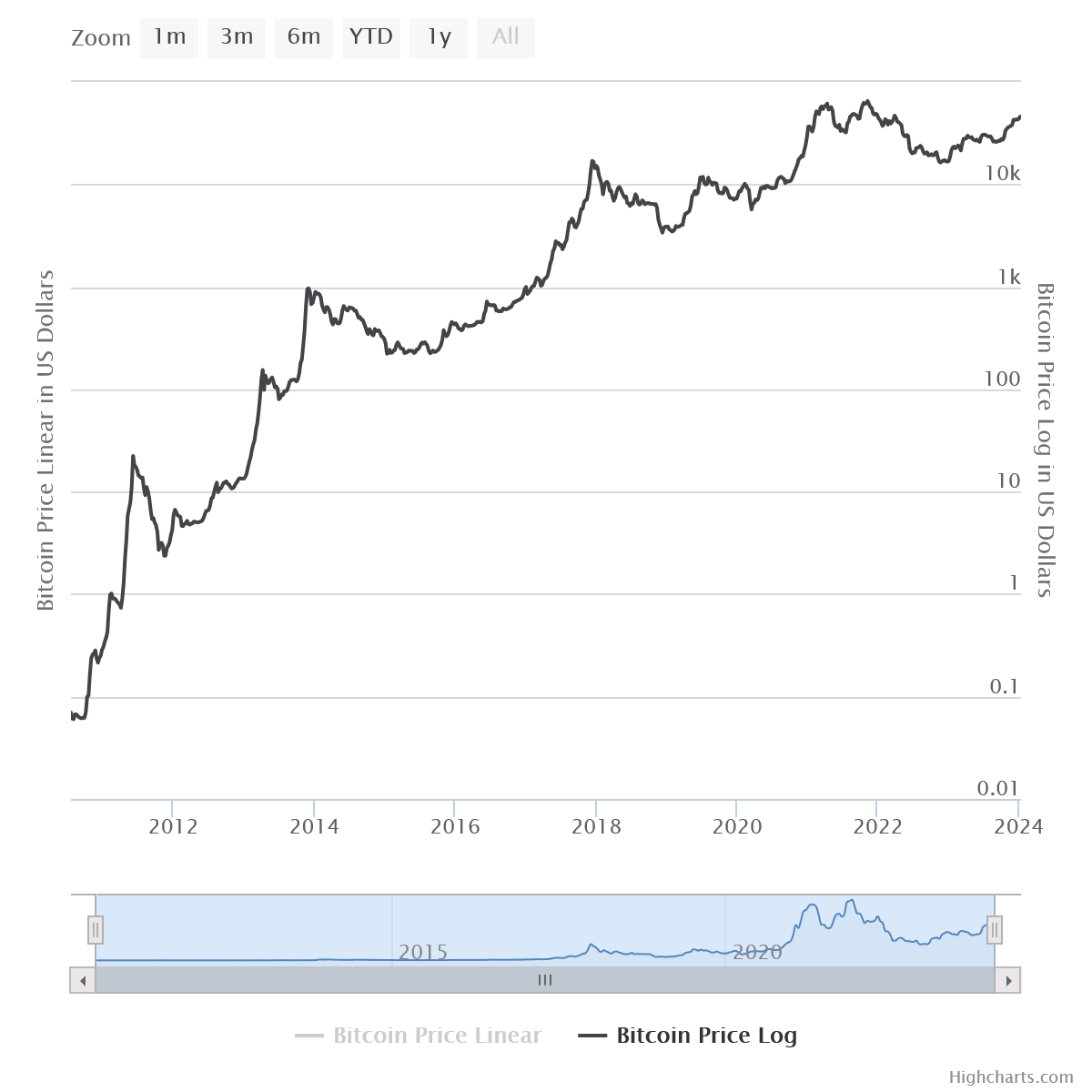

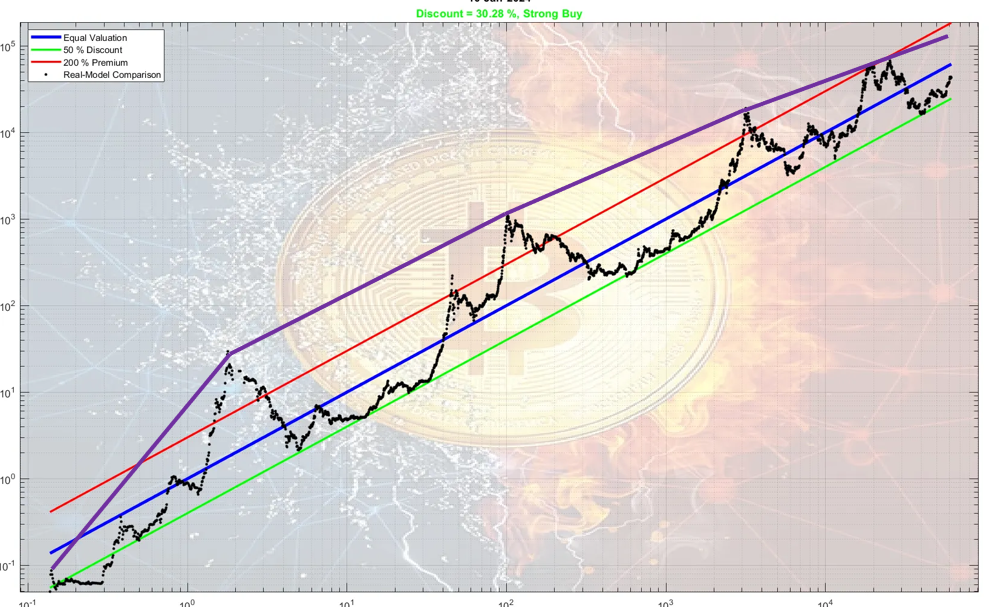

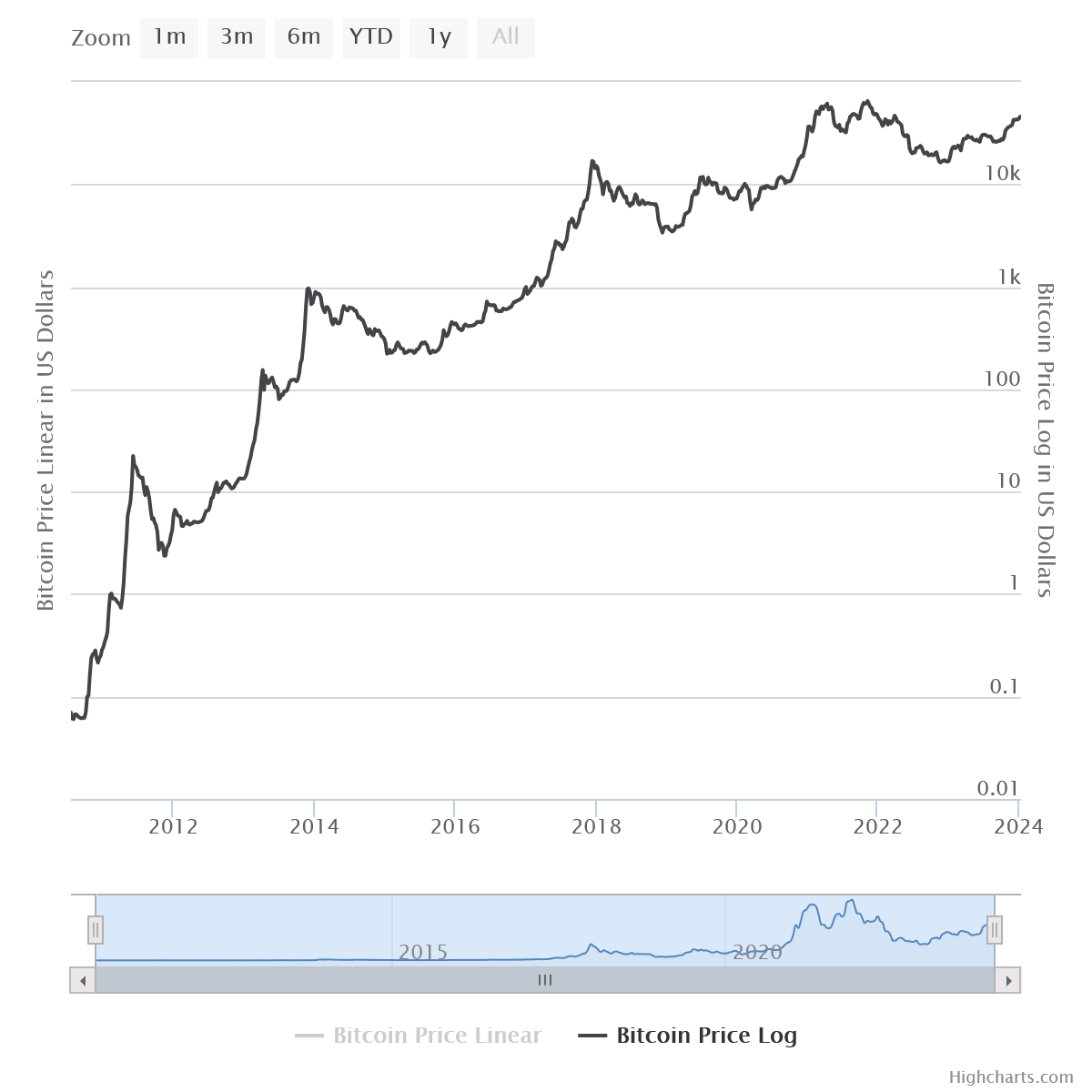

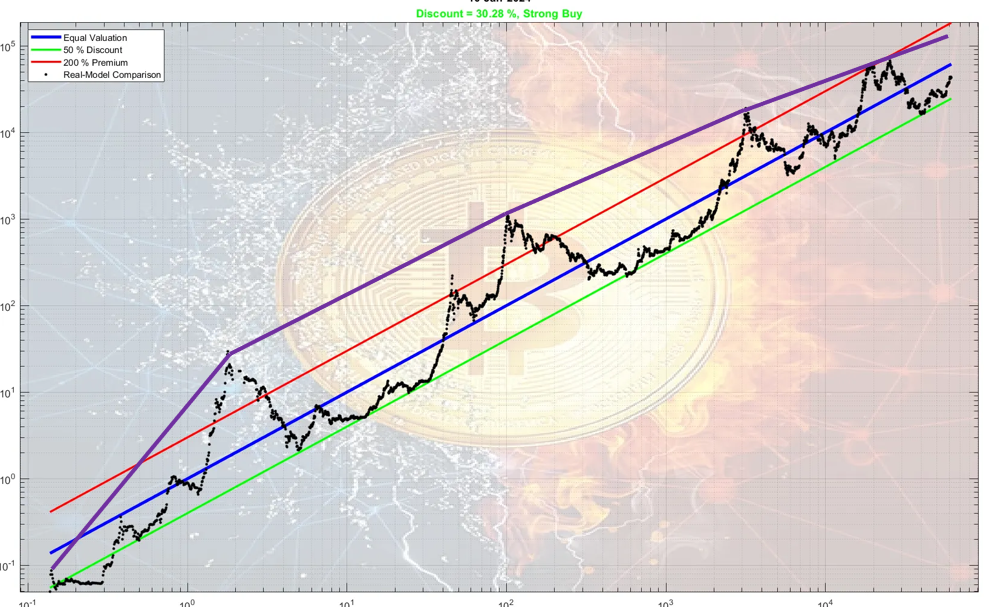

You are funny. I don't need your chances, but you could have learned interesting things if you were open enough and tried to understand the knowledge I shared with you. Thanks for the good luck, you need it too. i understand more then you know. but your choice of log scaling your choice of line positioning does not relate to the actual hard data just check the multiplier per cycle of each halving cycle the multiplier decreases.. thus curve you made a chart to scale in YOUR log dimensions but that scale wont last long because bitcoin wont exponential to the extent predicted in the next cycle i say it wont last long because your references show your straight line was using 5.84509376 now its 5.82 meaning its already slipping out of alignment and needed to change a constant.. thus no longer a constant and thats before even the next market cycle completely messes with your "math" again also even with change.. .. the "explains 92% variance" .. previous references had it at >93%. so your slipping already so even after adjusting you are still less accurate then before which shows the current number is not accurate even after adjusting it to try to bring it back into alignment.. because it didnt achieve its re-alignment even after adjusting the log anyways here is a better log chart  |

|

|

|

If you toilet paper away then people will go grazy tell them stay home and wear masks they don't mind.

Nowdays toilet paper have become very needed asset.

Do you remember? When there was toilet paper shorttages on need? People went panic buying.

So it is important.

toilet paper craze of 2020 didnt last long when people heard "flu" and "pandemic" they imagined runny noses.. as soon as news reported coughing but no runny nose symptoms no one raced to grab toilet paper again.. the toilet paper craze died off. in weeks but then people started stocking up on food due to stay at home rules. stocking up months of food food storage craze lasted longer then toilet paper craze |

|

|

|

|

if the concern is toilet paper.. then the fear is mild.

id move to washing my butt if retail superstores stopped stocking certain items.

in real times of crises food is more essential. meat and potatos become king currencies

in times of national security crisis. weapons, shelter become crucial..

toilet paper is not top of the list. its more of a convenience/luxury, not a life survival necessity

ud be better off stocking up on tinned veg and tinned meat

in last couple years alone tinned soup in the UK went from 40p (50c) to £1.30 ($1.50)

so thats a 3x mark up

toilet paper didnt really get hit hard by inflation.

(£0.38p a roll to £0.42p a role over same time scale (0.1x))

|

|

|

|

|

MONEY for millenia has been the patent of the ruling elite (religion, land barons, government)

minting coins and printing bank notes have been the norm for centuries

bartering community currency was never a big thing

money being government licenced had rules applied of who deserves it, what tax ratings for it were. how it should be distributed and inherited and clawed back in debt/fines etc

..

bitcoin came along to disrupt that. offer another option.. not to replace fiat patented money. but to offer a second choice.

however. in 2013 countries like the EU/UK/US got lobbied into "mainstreaming bitcoin" basically turning bitcoin from a private property class currency into a government recognised currency.. whereby government jurisdiction then applied to businesses and citizens using it.

this was mainly done unseen but in the background of instantaneously banning and then permitting it under government recognition.

the most viewable example was the NY bitlicence, most other methods were less observable

other countries banned it but not overnight re-permit it under government recognition.. most viewable example is china

the ban then subsequent permit. is how governments gain jurisdiction over something previously outside of their remit-grasp-control

..

with bitcoin recognised as currency this did mean traditional fiat money rules started to apply at the gates in and out of bitcoin and slowly sinking its claws and fingers deeper into more aspects of bitcoin

|

|

|

|

|

here is the way to imagine it

swap bitcoin for wheat

swap SEC for EPA

swap CEX/de-fi for local/independent farms

swap ETF for big agri

swap AP for industrial farms

swap asset for commodity

now here is the story

big agri commodity traders want to control wheat trade deals. control the price and such. so they lobby the EPA to restrict family farms from doing trade so that big-agri can have advantage. they want to unnaturalise wheat into two categories. dirty wheat and clean monsanto wheat

they send inspectors out to advertise people should clean their wheat and offer services. but then once clean they then claim the family farms are using wheat tainted with plague or not registering their wheat seed with monsanto as legitimate so sue the family farms. the EPA also come along and require family farms to meet higher standards of processing wheat than big agri. because big agri can self regulate

industrial farms wants the commodity wheat exposure for trading but doesnt want the local independent farms wheat as they sees it as dirty unregistered stuff

wheat is not fraud. it suppose to be natural and un-patent-able... but in big agri eyes they see it as plague wheat or monsanto wheat. both of which they dont want independent farms trading without their permission and higher standards and inspections

make sense?

the game is not new

|

|

|

|

|

many were expecting the social drama media frenzy triggered FOMO pump

however their are many levels at play

firstly the bitcoin spot market is artificially being held under a $47k resistance wall this week

most of this is caused by FUTURES contracts. as soon as they conclude and participants win. those participants will stop using their separate stash on the spot markets to keep the price artificially below the $47k

you can recognise the signs

first of all. bitcoins trading usually is not so stable in a free un-manipulated market..

secondly you can see on the ETH-USD that eth is staying 98% within range of a btc1:17eth

by seeing eth peg 98% to bitcoin at 17 eth to 1 btc..

it shows many trades are happening on bitcoin to dollar, then dollar to eth, then eth to btc (to keep price below $47k)

it shows many trades are happening on bitcoin to eth, then eth to dollar, then dollar to btc (to keep price above $46k)

if things were truly "free market" "independent"

ether-bitcoin would not be pegging at a 98% where ether shadow traces bitcoins price wiggles at a 1:17 rate

if things were truly "free market" "independent"

ethereums price(different community of utility and sentiment) would chart completely different wiggles to bitcoin market movements

so by seeing the arbitraging going on. shows whales wants to keep prices within a certain range

...

they want to play the futures markets and win bets on bitcoin price to multiply(futures leverage) more coin to then put into baskets to then play around on ETF

all the shrimp and fish that bet(futures leverage) bitcoin would FOMO pump this week will lose. meaning the whales controlling the resistance of spot market will win the losers coin+more

just wait until these contracts end and you will see the resistance walls collapse and a bit of natural freemarket movement where people will be buying actual bitcoin. and .. well back into another session of contracts at the next level

if you zoom out of the market charts enough you will start to see a 'step stone' effect of

,~~^~~

~~v~~'

|

|

|

|

|

anything a CPU can do a asic can do better

even if mining changed to a 11 algo technique. ASICS can just have 11 varieties of chips each performing each algo and end up doing more hashes than a CPU/GPU

the only reason many of the multi algo mining methods altcoins dont have asics is because they are crapcoins so no one cares to design asic chips to mine those crap coins

its not a techical problem, its a lack of interest problem

..

end result if bitcoin changed algo is:

if the difficulty the day before algo changed stayed at todays asic rated difficulty number and had to step down periodically

the network would have needed many years of not solving blocks due to how long one cpu would take to solve a block at current difficulty

it would take years for a CPU to solve 1 block let alone get 2016 blocks to then trigger a difficulty step down.. and then still years to step down enough to then be cpu attainable mining...

but within that time if the community had not abandoned bitcoin already. smarter minds would have made an asic to out achieve solo mining CPU. so you wont see thousands of solomining users winning blocks per month..

if as part of the algo change they used a CPU level difficulty start point on D-Day

users would already be trying to pool multiple CPU/GPU

and within days solo mining is gone again..

and if bitcoins market, utility has not already been lost due to this silly idea.. smarter minds would ahve designed asics to outperform GPU

and we would be back to ASIC farming again and the silly idea would have been a waste of a couple years of annoyance.. for ultimately nothing

|

|

|

|

|

goodluck

you had another chance.. but nope you doubled down..

|

|

|

|

Thank you for the summary. You seem to know a lot more than I do about this. Do you have any idea if there is a right for the buyers of the Bitcoin ETF to ever request their Bitcoin be withdrawn? Here in Europe, in some countries at least, if you purchase Gold on paper only from a Bank you can request the physical Gold be given to you. No idea if that is an ETF or Gold Stocks or what ever. define buyers under examples of blackrock ETF blackrock trades with AP(authorised participants(agents/brokers)) not end investors(customers/citizens) lets use "jane street group llc" as a example AP with blackrock blackrock total holdings is (as of yesterday) ~$10m (~227btc)= 400,000 shares total =10 baskets(40,000share ~22.7btc per basket) janestreet can and does own shares, as of yesterday 12,355 shares totalling ~$329k a basket is 40,000 shares totalling ~$1m (pegged to ~22.7btc) meaning janestreet only has ~33% of a basket the AP(jane street) needs to accumulate 40,000 shares total to get a voting right to dissolve/redeem those shares off market. and have blackrock signal to coinbase to unlocked reserves from coinbase custodian to then be sold OTC for cash to then give to janestreet cash. whereby blackrock has less coin in custody and less shares to offer.. but jane street would be given cash not coin so in short no jane street cant get coin this way jane street wont self custody or be delivered actual bitcoin via blackrock or coinbase as custodian dissolving/redeeming shares is not a method to get bitcoin from blackrock. nor is it even the best way for jane street to even cash out to then buy bitcoin elsewhere also to note if it ever were a case of "in-kind" redemption its not like end use investors/citizens can ask for 1 share worth of coin either. .. dissolving shares (redemption) is not in the best method of getting in and out of blackrock. whereby needing to buy another 27645 shares to get a voting right full basket to then dissolve/redeem shares to unlock coin custody just to then cash out.. they might aswell just sell 12,355 shares to another willing AP within blackrock. to whomever wants to take control of the shares and use cash from sell to buy coin elsewhere / enter another market |

|

|

|

Would be of tremendous help had you included at least a very brief summary of the information provided by the video.

it just starts with saying gensler approving 11 ETFS mentions some price movement reactions middle part says that its a ETF like gold etf backed by the underlying asset and nothing to do with future contracts the ETF allows financial advisers and brokers exposure to bitcoin price activity streamline process allows those involved access to bitcoin prices without complexities of self-custody coin management analysts predict $200k by 2025 gensler had to call out previous days false announcement .. basically not really a deep dive, just the usual talking points |

|

|

|

I was reading some of the filings. My understanding is that each fund allocates a third party Adminstrator. For e.g the Administrator for ARK 21 Shares and Blackrock iShare is The Bank of New York Mellon. The Administrator then calculates the NAV of the Trust once each Exchange trading day after closing of trading - 4pm using CF Benchmarks Index for up to date Bitcoin price. The NAV provides investors and shareholders with an idea of the number of Bitcoins in the fund and the inflow and outflow.

During the day ARK also has some means to provided and intraday indicative value of the same using the previous days NAV and updating this based of changes in BTC price and changes in the trust's underlying assets which I didn't quite understand. Something about using Solactive to calculate IIV?

simplified ark21: 1 share = ~0.001 btc peg blackrock: 1 share = ~0.000569 btc peg Solactive will calculate and disseminate throughout the core trading session on each trading day an updated intraday indicative value (“IIV”). The IIV will be calculated by using the prior day’s closing NAV as a base and updating that value during the trading day based off of more recent bitcoin pricing information to reflect any changes in the value of the Trust’s underlying assets and, therefore, the Trust’s NAV. the IIV is not used on ARKS public market intraday NAV chart its used within brokers order creation where those AP wanting to make an order get a price from IIV that lasts 15 seconds to accept or reject ... its worth noting that the ETF are not selling direct to end user investors. this principle nav and more intuitive IIV "real time" nav is between ETf and brokers.. the demand of end shares for investors is secondary market stuff between brokers and their customers.. so the IIV and principle NAV will be more stable then the trades of end users with the brokers on secondary markets |

|

|

|

Warren isn't as powerful as she may seem to some. Even lobbyists in congress are more powerful than her. If she is indeed a boss to Gensler, then she is a weak boss. Gensler voted in favor of spot ETF approval not just of one but all 11 of them. His final vote could have prevented all of them.

if you read what i said you would see that gensler didnt push extra rules to appease warren.. however he did recite her rhetoric as a footnote. which was to not go full native and appearing to cut his strings of his puppet master of the laws he has to follow brought in by committees the puppetmaster is part of. i never said he went full warren and added in all warrens drafts into ETF requirements i simply said that he secured his job continuance by reciting her mantra to not appear as going against her. thus still kissing the ring to save face there is a difference between a knight that fights for his king by slaying the villagers.. vs a jester that keeps his head by kissing the ring and entertaining the king, repeating the kings remarks |

|

|

|

these days though electric cars are £$50k+ and fuel to electric cost per mile are equal

Not yet, in most countries but if the demand for electricity increases then eventually the electricity bills will be higher than what we used to be unless we find better and more efficient power plants, and electricity generation with renewable sources is still a joke... Tesla Cyber Truck is the talk of the town and Elon really knows how to advertise his products and make people to pay and wait for years to get the actual products.  a basic car i know of does fuel 40miles per gallon = 8.8miles a litre UK fuel £1.40 a litre = £0.159 a mile a EV car can do 3.5miles per KWH UK residential electric is £0.40/kwh=£0.114 a mile (Electricity unit: 28.6p/kWh standing rate: 53.4p/day) kw house use (single person) 5kwh = 28.6*5 + 53.4/5 = average kwh 39.28p (if only driving like 7 miles a day you are only topping up charge by 2kwh. thus effectively 40p kwh along with house electric) uk electric 5 years ago used to be £0.14daytime £0.07nighttime with 30p daily standing rate =day car charge topup £0.057 a mile =night car charge topup £0.037 a mile .. public EV charging stations used to offer free charging now its more expensive than home charging even at latest home charging new expense rate all i am saying is the economics of EV has broke their promises of "save the planet save the pocket" |

|

|

|

In biblical times, the term "wine" (Greek:"oinos") was used to describe a range of fermented grape beverages, which could vary in alcoholic content. It's believed that the wine Jesus created at the wedding in Cana was likely different from the wine we typically think of as alcoholic today. It is important to interpret these biblical events within their historical and cultural contexts.

wine is wine EG GRAPE juice as oppose to vodka EG potato juice as oppose to cider EG apple juice thus calling it wine means grapes were added specifically (grapes can naturally ferment on the vine or in buckets without added yeast.. potatos and apples less much, so easy to understand why they would suggest wine as oppose to vodka) alcoholic or not, the sci fi story says he made water into grape juice(min standard) aka wine if you take unwatered grapes fermenting in the sun and throw them into water. it creates wine if you throw grapes into water to then ferment, it creates wine if you throw grapes into water, add yeast to then ferment, it creates wine all methods are true but 'alcoholic proof %' vary.. the former would be low % giddy, the later would be pure alcohol that can knock someone out and maybe blind them if not controlled all this sci-fi book suggests is the main character put some fermented grapes into water and people got giddy drinking it .. if we really want to get specific about versions of the story imagine servants on vineyard using feet to squish fermented grapes(standard old practice) thus having highly fermented grape juice on feet now imagine they ceremoniously wash feet in trough near church flavouring the water (mmmm wine and cheese(feet sweat)) now imagine jesus asking people to take the water from the trough and then hand around.. ok now read "Nearby stood six stone water jars, the kind used by the Jews for ceremonial washing, each holding from twenty to thirty gallons." i personally prefer the version where jews also ceremonially wash feet.... and genitals in said water, due to jews teachings from the torah of "genital discharges" which would be thrush which is yeast to make the grape fermented/flavored water even more potent but you do gotta love the evolution of pairing cheese and wine (feet sweat cheese flavour and squashed grapes underfoot from traditional vineyard practices) it wasnt where originally someone drank some pure filtered wine and separately ate dairy cheese at the same table and thought "nice combo" it was the unfiltered mix of cheesy feet flavour of traditional foot squashed wine people prefered over hand/stone pressed wine. only later did hand/mechanical pressed wine and separate dairy cheese become paired to try to get the same old stimulation |

|

|

|

nice try, but no.. try again. you got 2 more chances to get it right before i laugh you want to make it look exponential because YOU chose to display the data in log format naturally its not log format. YOU just the scaled it in YOUR chosen scale of log. thus YOU are manipulating the results and YOU drew the lines ontop the chart to make YOUR (empty) point however real world data is more of a curve where the multiplier per cycle DECREASES good luck with your attempts, but dont waste too much time on it.. because ultimately you dont decide the data path.. the data does its own thing also.. you got black chartlines outside(below the bounds) of the green min lines YOU drew you got black chartlines outside(above the bounds) of the red max lines YOU drew thus rendering your lines void of sticking to data mins and max's here.. even i can use your chart and create a purple curve  which sticks more to the "max"'s than your line (how many times does YOUR red line touch the max... once, at the end) (how many times does my purple line touch the max... six, start to end) |

|

|

|

I don't share it. It's not as if Elizabeth Warren is some kind of boss to Gensler. There's a power play and Warren is but a single player. She's not the most powerful there is in the game that Gensler had to please. Gensler's job isn't dependent on Warren's pleasure. Elizabeth's ring needs kissing but it's not the shiniest of them all. Larry Fink's ring is a lot more powerful. So whether Gensler personally favors Bitcoin or not isn't the point. He had to vote for its approval because the kingmakers ordered so.

E warren has been continuously been trying to rewrite the financial laws which SEC have to manage under. thus if she writes "jump" and it becomes law. the SEC then has to jump Committee on Banking, Housing, & Urban Affairs

As a member of the Senate Committee on Banking, Housing, and Urban Affairs, Senator Warren works on legislation related to financial services and the economy, housing, urban development, and other issues, and participates in oversight of federal regulatory agencies.

Subcommittee Assignments:

Chair, Subcommittee on Economic Policy

Member, Subcommittee on Financial Institutions and Consumer Protection

Member, Subcommittee on Securities, Insurance, and Investment

Committee on Finance

As a member of the Senate Committee on Finance, Senator Warren works on policies concerning federal tax and revenue, including oversight of the Internal Revenue Service (IRS). She prioritizes reforms like passing a wealth tax, improving our trade policies, expanding Social Security, Medicaid, and Medicare, bringing down drug prices, advancing racial equity, and better enforcing our tax laws.

Subcommittee Assignments:

Member, Subcommittee on Health Care

Member, Subcommittee on Social Security, Pensions, and Family Policy

Member, Subcommittee on Taxation and IRS Oversight

see how many strings ABOVE the SEC she can pull via her 'committee' involvement the SEC is not just about "running a clean business" its about auditing businesses for tax too and clamping down on tax evasion EG the "in-cash" vs "in-kind" ETF discussions were literally about taxes |

|

|

|

But in such case ARK would sue since it was their final deadline and they'd probably accept the others on the 15th. It would be stupid of the SEC to deny 1 applicant and approve the rest a few days later if all of them wanted the same thing, which is why I'm a bit surprised that 2 people voted to deny. Maybe they wanted this to look like a split decision for the media?

firstly ark21 was the only january final deadline (legal repurcussions) blackrock, bitwise vaneck, wisdomtree, investco, fidelity, valkery had final deadline set for march globalX final deadline set for april hashex final deadline set for may note how hashdex had a mid deadline of jan 1st. but didnt shout lawsuit due to no decision on jan 1st note how globalX had a mid deadline of november2023. but didnt shout lawsuit due to no decision in november secondly in politics you can never tell via what media say. most of politics is bribed lobbying and siding with your group even if you disagree I'm sure there's more to it than we know from the media. For instance, the SEC allows companies to snitch on each other and pays them some of the profits from fines if the information leads to such fine.

Therefore the SEC allows these companies to manipulate the market. Company A gets some information about shady tactics at company B for instance from a former employee. That employee gets paid for snitching, company A reports to the SEC. The SEC checks the information and contacts company A about planned enforcement. Company A shorts B stock with leverage. The SEC goes public with the investigation, the stock falls. If B is found not guilty, A gets to keep profit from shorts. If B is found guilty, its the money from shorts plus the SEC pays A for the tip. A win - win situation for the snitch.

as for manipulation and such the SEC is not a pre-crime investigator. they are not pro-active.. they are a reactive. they wait for reports after the fact and then investigate in short. a. you are innocent until proven guilty b. you are only investigated if caught meaning its only a crime if you are caught .. its literally what regulations are if a MSB does laundering for a criminal without report it. the criminal can get away with it if no one finds out however if criminal act is found out, the MSB also gets law thrown at them for not reporting it so if a MSB reports on the criminal the criminal gets caught. but the MSB is not fined for facilitating it because they reported on the criminal, the MSB gets rewarded for informing on the criminal |

|

|

|

|

firstly the article is not about bitcoin scaling. its about bitcoin price

secondly the chart is an illusion because it depicts a straight diagonal using "log" chart to pretend price goes exponential. yet thats just manipulation of the axis

(using rough numbers from memory. not exact)

low high low

we are no longer in the first halving cycle where the market went from $0.03 to $30 to $4 1000x max

we are no longer in the second halving cycle where the market went from $4 to $1200 $450 300x max

we are no longer in the third halving cycle where the market went from $450 to $20k $2.8k 44x max

we are near end of the fourth halving cycle where the market went from $2.8k to $70k $15k 25x

as you can see each cycle the multiplier declines. and things get less volatile

thus the chart should not be manipulated as straight diagonal exponential line. but instead natural form of a curve

if you put a knee on a weight scale (change the axis of chart) you change the physics of law and change the perception of reality

|

|

|

|

|

liquidity is also still about the ease of sale to cash.

i think the words you are looking for is "circulating utility", "available utility", "open use"

here are some idea's of how utility can change due to ETF

lets use the lobbying that big-agri done to wheat farming due to commoditising of wheat

(something else that was years ago free, open and un-patent-able, after all wheat is wheat right. no one should control wheat, its natural)

once big agri gained a stake in commodities of wheat they then lobbied EPA to implement farming restrictions on independent farmers to no longer farm. so that only big agri can farm

remember how the EPA and gov said how they restrict farming to control the manipulation of commodity markets

notice how small independent family wheat farmers were sanctioned, restricted, sued and bought out from operating/owning their own wheat farm, unless they met some EPA permit standards.

things even went to GMO tactics tainting the seed to then recognise certain seedlings to then sue those using certain seeds. the lull independent farmers into using GMO seeds. to later sue them for using GMO seeds outside their purview

translation to crypto

ETF institutions can then lobby SEC to put more restrictions on spot CEX, and any service business transferring crypto(MSB) to not be so open to individuals, and even make it restrictive to openly advertise/offer coin swap services via de-fi without such de-fi having permit X

then blame market manipulation on individuals using spot CEX. to restrict independent access to spot markets unless you meet conditions

then we move to the coin tainting game by getting individuals lulled into using mixers. thus lulling them into tainting their own coins as suspicious to then lock them out of transferring between retailers

(take note J dimon is a AP of blackrock and said he would "take bitcoin down")

|

|

|

|

I don't know why they'd vote against, knowing that it would mean a number of lawsuits

only ark21 had final deadline on the 10th ark21 could have been made to wait another month (without acceleration) they other dozen could not have sued to get all dozen approved and accelerated is best case.. not minimum expectation to avoid lawsuits |

|

|

|

|