|

982

|

Economy / Speculation / Re: [WO] A cure worse than the disease

|

on: October 06, 2020, 05:02:03 PM

|

Crypto derivate issuers can go f*ck themselves with a length of rusty pipe, imho. Perpend the reality that the derivatives are being regulated, not banned. What, do you suppose that CME is being banned? The upshot is that those who obey buy the regulators can fuck our Bitcoin markets with a rusty pipe—you know, the fine folks who are “too big to fail”—while everybody else is denied permission to do what they want with their “permissionless” bitcoins. Just like the dollar markets, but with Blockchain! |

|

|

|

|

983

|

Economy / Speculation / Re: [WO] PSA: Universal suffrage means vote-inflation

|

on: October 06, 2020, 04:45:48 PM

|

FTFY.

May be a NO IDEA option needed  How about a “DON’T CARE” option, because it really will not make any long-term difference. Or perhaps an option marked: WTF?

That’s just a don’t vote Dude, there’s my option! as there are clearly only 2 options if wanna vote   Voting votaries at the altar of democracy should pause to excogitate on the implications. Don’t make life to difficult for our headmaster of the WO  Eh... If he wanted a poll that would keep people excited, I suppose that he succeeded. |

|

|

|

|

984

|

Economy / Speculation / [WO] Wrong and wronger do not make right.

|

on: October 06, 2020, 08:59:26 AM

|

McAfee Wrong... international arrest warrant for tax evasion ...and wronger. Do not make right. He should have stayed in a country that is a bit less a puppet of the US. LOL. Which? Neither of them would want him; and one is overtly Communist. |

|

|

|

|

985

|

Economy / Speculation / [WO] too much too many from this edition

|

on: October 06, 2020, 08:48:30 AM

|

meme USG paid thug edition We need a dedicated forum for that. Or at least, a dedicated thread moderated by someone smart, who does not sometimes disappear for indeterminate times. Really, it could be a whole forum. Who is Fleetwood Mac?

I meant to thank you for this; but my response became a wordy-man essay, which in turn grew into the rough draft of a twelve-volume series:I always knew that the Communists hate me! The enmity is requited. |

|

|

|

|

986

|

Economy / Speculation / Re: [WO] A cure worse than the disease

|

on: October 06, 2020, 03:32:00 AM

|

If it is not something that can be done safely in an unregulated market, then maybe you shouldn’t be doing it in an unregulated market. Don’t try to create the clusterfork of the bank-run financial markets in Bitcoin. Thus concluded a post which began, with large boldface in the original: Who appointed the United States and its institutions to supervise Bitcoin? Bigger and bolder type he is your answer: TrumpIf that is all that you got out of what I wrote, well...  You fancy that Bank-Owned Megalomaniac Biden (Diet Pepsi, (D)) be better than Bank-Owned Megalomaniac Trump (Coca-Cola, (R))? (Or to others: Vice versa?) Protip: They are both Americans. They would both happily firebomb the whole world to smouldering rubble at the drop of a hat—or regulate Bitcoin into another bankster playground—or do whatever else the owners of the United States may desire. Oh, this needs for me to pause from spending too much forum time in WO, and finish that thing that I have been intending to toss into P&S. Meanwhile:Universal suffrage is vote inflation. Making everybody “free” by giving everybody a vote is like making everybody “rich” by printing lots of money.Yes, that is an original observation on my part. Analogy credit: nullius.[...] |

|

|

|

|

987

|

Economy / Speculation / [WO] A cure worse than the disease

|

on: October 06, 2020, 03:15:17 AM

|

Damn... Something about that photo makes me feel that I need a bath... First LFC, then this thing in juxtaposition... oh, the ugly mental images... Thanks; now, I need to squirt bleach into my eyes to stop the pain. I think that I will start calling McAfee the Shitcoin Bill Clinton. He reminds me of Clinton, for some strange reason. But if possible, even more pathetic emetic. Wrong and wronger don’t make right. Ugly mess from start to finish... Just lock that degenerate up alone in a room with a few kilos of the finest cocaine, and nothing else to do. It will be a self-solving problem.

Why yes, let’s create a highly regulated derivatives market (replete with regulatory capture by the biggest and worst criminals), in which highly profitable (and oftentimes massive-clusterfuck-crash grade risky) financial products can be offered by those who (have teams of lawyers to pretend to) obey the (loophole-ridden exact letter of the) regulations. Let’s create a regulated “digital assets industry” (in which the sharks with big money and big lawyers can just eat everybody else alive). While we’re at it—let’s recreate the fractional reserve central banking system! You know, as long as this MAX_MONEY thing is in place, Bitcoin will always be subject to more or less price volatility. A beneficent central bank is like the governor on the economic engine—or like speed limits...

So, why do we have Bitcoin?

How are you going to stop those kinds of BIGGER players from coming into the space? I don't see how we can necessarily have our cake and eat it too... One of the network effects in bitcoin is the increased financialization of the asset, and sure there might be attempts to denigrate bitcoin or to use bitcoin in the same kinds of ways that they have fucked up other asset classes, but you and I both recognize a distinguishing feature of bitcoin that changes the dynamics, and that is to be able to immediately claim possession of it. [...] I am saying that they can’t have their Bitcake and eat it, too. I don’t fancy that I could stop “those kinds of BIGGER players”, a.k.a. massive financial manipulators, from creating risky derivative clusterfucks. I have said that a few times, in various places here. My point is about regulation—especially, but not only, extra-jursidictional regulation by the Americans!In the long term, the financial instruments and practices that I criticize can survive only in a regulated environment— viz., in the type of systemically corrupt-by-design regulatory environment at which Americans most excel (although with the advanced Progress™ of the current year, no country is very much better in that regard). There, they are protected from natural consequences. Quotable nullius: In the soil of regulatory corruption, the seeds of folly grow “too big to fail”. You know the end of that road! “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” Right back where we started. Bitcoin can get along much better without Nanny American-CFTC pretending to protect it, and actually doing the long-term opposite. Let people do things that I dislike with Bitcoin; no matter how I may wish that I were Imperator, dictator perpetuo with the power to stop them, it seems that I’m not, and I can’t. And they are not protected from failing. Ultimately, when the moral hazards created by regulations go away, people must learn to stop doing the hazardous things—or else, the people creating the hazards just go bankrupt. As I have said before, in Bitcoin, the risk is not systemic. —Unless, that is, Bitcoiners get the attitude that we need to recreate the exact same financial system that we are trying to escape. But now, with Blockchain™! “The Times 03/Jan/2029 Chancellor on brink of second bailout for Blockchain banks” Damn, on which point did I recently find myself quoting Karl Marx!?Blockchain needs Blockchain regulation for Blockchain banks to Blockchain innovate Blockchain in the Blockchain digital assets market Fintech Blockchain Blockchain Blockchain Blockchain Blockchain Blockchain B̵͚̪̼̦͝l̶̝͈̀o̴̯̮̓̇̽̽c̵̝̪̘̜̊̄̎k̴̹͔̝̺͋̾̋̀̾͠͝ͅc̷̛̣͐̐͗͆̎̅h̶̢̭̥̻̘̔́̒͐̈͂̐͜â̴̧̼͈̼̦̅͝i̸͇͈͚̚͘n̸̜̤͙͌̊͛ ̴͕̗͍̜͈̤͓͑͝B̷͎͍̤̥̥̲́̅l̷̛̙̐̉̃͋̕͝ǒ̷̼̹͇̱̳̒c̶̥̯̋̃ḳ̷̑ĉ̵̱͑͛͝h̵̳̦͚̣̓̂̚ͅa̵̹̿͗̀͜͝i̶̢͎͎̺͎̩̪̋̏̔̚͠͠n̶̟̟̯͓͇̘̖͒͊̅̓̄͝ ̶̨̲̪̟̘̫̀B̵̞̲̮͚͈̾͂̈́̊̆͜͠l̸̙̠͈̗̖̫̥̊̔͑́͘̕͝o̷̢̜͍̟̬̍͘͠č̸̘͠k̶͎̜͎̔͛̈́̾̚c̸͈͆h̷͚̞͍̞͛̾̉̈̓̆ͅa̴̫̬̱͖̩͓͒̒̈́̅̈́̅̕ͅì̷̢̪̻̄̒͊n̴̨̛̹̭̙̜̋́̌́͂ͅ ̴̗̪̰̤͙͇́̆͒͒B̵̳̘̄l̸͕͓̣̈̑͗̊͘͘ơ̷̧̻̠̞̫̈́͗c̸͍̠̮̪̟̪̽̓̃̒̾̕k̸̠̯̤͈͎͚̮͘͘č̴̗̼͍̒̈̃͠ḧ̸̨̗̩̠̫̀͑̐̚a̶̯̺̤͍̰̽ȋ̵̡͓̤͈͍̞̘̇̕n̴̨̢̢̟̪̫̾͒̈̒͝ ̸̩̟̥̆ͅB̶̨̨̰̯̮̪̣̏͊̊l̶̢̡̛̻̱̄͛͝͝ǫ̶̺̦͌̈́̕c̸̪̈́̅͒̋̕͘͜ͅk̸̛̺͐c̷̢̛̻̽͊̍́̋͝ͅh̵̢̻̣̰̪͕̜̄͑â̸̯̠i̶͖̣̺͗̈́̈́̓͒͝n̴̖̘͂ ̶̠̠̭̞̕B̸̹̘̑l̷͙̘̻̺̥̤̋̈́̀ơ̷̳̮̅̾̽̅̑c̷̡̦̘̖͛͐͆̃̚͜ͅk̷̃̃̑͋̕͘͜ç̸̣̽͐͐h̴͈̻̳͂̓̔͋́̋ậ̵̞̪̼̈́̏͋́̚͠i̵͔͖͉̾͌͆͆̈́̑ͅn̷̛̠͓͔̦̪͌́ͅ ̷̨̖̺̫̺̄B̴͓̣̬̮͚͓̓̽l̵̼̟̻̰̥̫͛̏̓̕ǫ̴̡͕̝̤̩̌ͅc̵̫̭̝̉̃͌̕͝k̴͈̥̹͚̞̥̉͂̑ċ̷̪̮̘̈́͠h̷͇͋̐͗͜a̵̛̲͗̊͌ï̷̡̯̟͔͠ň̶̺̥͍͕͎ͅ ̶̡̡̝́̋̌͒́ͅB̵̨̭̣̮̯͑͜l̵̬̣̻͔͖̈́̀̂͗͝͝ơ̵̢̘̯̰̎͐̑̃c̸͉̼͚͎͔͓͌̃̕ͅk̶̎̀̍̃̊̌͜c̷̖̋̋h̶̗͚̮̱̞̹̑̎̌͝a̷̧͇͚͓͆̅̚ȉ̶̳̽͒̓̈́̿ǹ̴̫̼̰ ̵̲̮͈̜̪̜̇̉̃͛͝B̷̧̖̰̽̎̋̎̔̈́͠l̸̖̬̩̏͌͛̈̀̄o̴̰͙̅͒͌͆̄̓͜͝ċ̷͓̊̄͌̉͠k̷̢̪̰̙̝̀̏c̵̲̳͔̹̽̍͒̑͜ḣ̴̪͎̱͍̭̋̀͒̅a̵̝̭̻̰̟̋͌͝i̴̯̜̦̻̓̀̓̍͌̀͝n̷̡͚̦̖͊̈̏ ̶̧͕̜͛̀̀̓B̷̧̭̠̦̮̋̓͝l̶͔̻̂͐̃̒͝ȍ̶͖̼͉̣͛̃̈̽c̵̫͈̹̫͚͔̊̆͋͐͜ķ̴̧̰͋̿̑c̴̨̛͕̠̯̱̣̭͂̑h̶͙͈̙́ͅa̴̞̱̟̩̞͈̝͋͝i̵̧̪̰͆̀̃ņ̵͍̞̝̀͐̚ ̴̖͒́B̴̬̐̆͐l̶̢̧̲̤̰͖͐̂͐̽ǫ̵̧̰̥̗̰̃c̷̬̫̹̫̈́̓͋́̋k̵̪̮̉c̶̹͂́͐̉̅̅͝ͅẖ̵͕̖͙̖̪̆̓̉͒̅̓̌ǎ̴̛̫̼̩͙̓͒̈̑͝i̸̜̝͍̻͐̓̿̈́͜͠ṋ̴̨̫̭̟̔̕͜ ̷̤̘̘̙̝̽͛͑͆̂̚͜B̸̢̪̳̰̐͋́̅͐̚͘l̶̼͔͈̜͌̏ỏ̴̞͜c̴̭͙̞̜͊͂̈̈́͑̕k̵͔͕̞̳̂̈́͒͗̎c̵̡̟̥̝̏h̴̖̩̫͑͠ä̶̢̡̛͙̲̦́̐̽̑͘͝į̷̩̯̩̹̈́͊́͘n̸̳̠̅̑

Extra boldface has been added to this post, because I’m afraid the size=smaller parts of my above-quoted post were too shy to get attention.

N.b., I am NOT a follower of Rand, or Rothbard, or Mises, any of those schools of thought that are so popular in this space. I don’t idealize Capitalism—to the contrary; as a modern dogma, it is the flipside of Communism. ( Title of Marxist Bible: Capital.) I am not a votive at the altar of the Invisible Hand of the Free Market. I do not fancy that market economics could create Utopia (or, for that matter, that Utopia would not actually be Dystopia). I simply realize that at this point in history, the very best that we can do is to NOT take “cures” that are worse than the disease. Hailing the intervention of the American CFTC in the Bitcoin markets outside American jurisdiction is like infecting yourself with HIV because you are worried about Covid. You still have the original worry—and now, you have a much worse problem! I said earlier in this thread about BitMEX, in reply to ivomm’s speculation about CME (so to speak), with boldface in the original: If it is not something that can be done safely in an unregulated market, then maybe you shouldn’t be doing it in an unregulated market. Don’t try to create the clusterfork of the bank-run financial markets in Bitcoin. Thus concluded a post which began, with large boldface in the original: Who appointed the United States and its institutions to supervise Bitcoin? |

|

|

|

|

988

|

Economy / Speculation / [WO] “Land of the Free”, Part 10^n (with large n)

|

on: October 05, 2020, 10:24:49 PM

|

John McAfee arrested in Spain on tax charges in the U.S.  Maybe he’ll get to eat dick after all (just not his own).  Presuming homosexual bodily violation of the prisoner to be a part of the sentence—is that an American thing? I think it’s written into the laws there, or something. Of course, it also happens in other places; but I don’t know anywhere else that people so casually joke about it as if it were normal , except, I suppose, very Americanized places. Cf. the acceptability of railroading a targeted individual with trumped-up tax charges. I am NOT commenting either way on what’s happening with McAfee, whom I have just kind of ignored for years. (Except to say that even a mentally retarded gasbag and shitcoin freak does NOT deserve to be targeted with one of the American “justice system’s” favourite weapons—whom did he piss off?) I am simply remarking on an American phenomenon that started with Al Capone—a bloody gangster, whom the bribe-taking American police were too corrupt to arrest for his many actual crimes (ordering murders, etc.). Whence it became socially and politically acceptable for the government to target people with tax evasion charges driven by ulterior motives—oftentimes, to target political dissidents who are exercising too much freedom of speech. And targeted tax charges are only a common manifestation of a deeper problem: “We’ve got to get him for something!” is a real Americanism. “#MAGA” |

|

|

|

|

989

|

Economy / Speculation / Re: [WO] BitMEX

|

on: October 05, 2020, 10:06:43 PM

|

Battles for the mindspace can take a lot of time, Indeed. That is why it is important to discuss these issues publicly. What happens if nobody steps up and says it? * nullius is nobody. Of course, in some sense, you are preaching to the choir, nullius. With you, perhaps, and with a good number of WO regulars. I think that you and I are in basic agreement about many of these issues, although I think that perhaps here, I needed to clarify a few points on which you may have slightly mistaken my own position. But then, there is that “mindspace” thing that you mentioned. Why yes, let’s create a highly regulated derivatives market (replete with regulatory capture by the biggest and worst criminals), in which highly profitable (and oftentimes massive-clusterfuck-crash grade risky) financial products can be offered by those who (have teams of lawyers to pretend to) obey the (loophole-ridden exact letter of the) regulations. Let’s create a regulated “digital assets industry” (in which the sharks with big money and big lawyers can just eat everybody else alive). While we’re at it—let’s recreate the fractional reserve central banking system! You know, as long as this MAX_MONEY thing is in place, Bitcoin will always be subject to more or less price volatility. A beneficent central bank is like the governor on the economic engine—or like speed limits... So, why do we have Bitcoin? |

|

|

|

|

990

|

Economy / Speculation / [WO] Business sense, and unmarketable nonsense

|

on: October 05, 2020, 09:14:06 PM

|

I was offered sex today, by a 21 year old girl. In exchange for that, I was supposed to advertise some kind of bathroom cleaner to my friends. Of course I declined because I am a person of high moral standards with a strong willpower. Just as strong as Ajax, the super strong bathroom cleaner. Now available scented with lemon or vanilla.

You declined a favourable trade. It seems that your business sense is no better than your market sense: I would like to buy Bitcoins at the price of 2013-14 to gain back the lost Coins. If Bitcoin is not possible to be bought than maybe Litecoin? Dogecoin? Please, i need your aid my friends. You are all i have left.

My story is that i want my Coins from Mt. Gox back. It is a must , i wanna get them back or Buy them back at the Stolen Value point.

Not your keys, not your coins.This time, try keeping your money in your own wallet instead of on a centralized exchange. This is easy to use, even for beginners, and has good privacy features: Wasabi Wallet ( Tor onion site) Be your own bank. PSA. How many times do we need to say this. (Royal “we”, and also “every Bitcoiner with even so much as an ounce of sense ‘we’”.) |

|

|

|

|

991

|

Other / Beginners & Help / Re: Bitcoins, and the safekeeping thereof

|

on: October 05, 2020, 09:01:52 PM

|

I would like to buy Bitcoins at the price of 2013-14 to gain back the lost Coins. I just want back something that originaly belongs to me  I lost them with the Exchange crash(Mt.Gox,BTC Market).. In other threads: My story is that i want my Coins from Mt. Gox back. It is a must , i wanna get them back or Buy them back at the Stolen Value point. I was offered sex today, by a 21 year old girl. In exchange for that, I was supposed to advertise some kind of bathroom cleaner to my friends. Of course I declined because I am a person of high moral standards with a strong willpower. Just as strong as Ajax, the super strong bathroom cleaner. Now available scented with lemon or vanilla. Not your keys, not your coins.This time, try keeping your money in your own wallet instead of on a centralized exchange. This is easy to use, even for beginners, and has good privacy features: Wasabi Wallet ( Tor onion site) Be your own bank. |

|

|

|

|

992

|

Economy / Speculation / Re: Wall Observer BTC/USD - Bitcoin price movement tracking & discussion

|

on: October 05, 2020, 08:48:19 PM

|

Jeff Bezos is an “asset”?

Much improvement in btc chart since bitmex "happenings"...those fuckers were causing this endless barting-debarting.

Is there a potential causation or at least correlation? We shall see in 1 mo. If Bitcoin cannot survive without being tied to Mommy American-CFTC’s apron strings, then you should sell right now because it’s worthless. |

|

|

|

|

993

|

Economy / Scam Accusations / [BSV scam] Strategic Provocation 101

|

on: October 05, 2020, 08:43:37 PM

|

Note that BSV has been deployed for almost 2 years.

That sounds to me like an admission that BSV was not deployed on 3 January 2009. Unless my maths be off a bit. Perhaps I should ask Dr. Faketoshi for arithmetical assistance; I hear that he is some sort of a genius.

What do I need to do to get sued by faketoshi? Provoke his attorneys in some personally humiliating way that underscores their own helplessness. It is more likely to incite a disproportionate response. Think on the same psychological principle as ridiculing the lawyers’ penis sizes, but classier. Speaking from experience that I will not dox here—a stereotypical lawyer who feels humiliated by you, especially from a challenge seen by others, will take up the cause with all the obsessiveness of Captain Ahab, and all the refined gracefulness of a toddler throwing a tantrum. If I had more free time, I might try something like the below on the Faketoshi legal team. Combined with a statement on Faketoshi’s crimes, and my judgment of his character. Just for the amusement of watching them send subpoenas to Tor exit nodes. LOL. Bragging about a legal warchest on a cypherpunk forum founded by a Tor user who invented a new form of permissionless money. Few affronts are as frustrating to a man as demonstrating to him the limits of his own power.I suspect that in large part, this is why Faketoshi and his clique tend to froth at the mouth against anonymity: Their litigious lawyers are powerless to terrorize people who cannot be located. Mr Bear, I can’t speak for anybody else, but I have some news for my own part: Your legal “war chest” is a contemptible joke, insofar as I am concerned. I am above your corrupt laws, and untouchable to your corrupt courts.[Mine] is the anarchy of the good who, being good, hold fast to honour out of pride: For the most sincere morality is the self-glorification of the proud, whose judgments of others honour the best of what they see in themselves. It is they who would embrace death before the self-negation of dishonour—not as a sacrifice, but as a supreme act of pure selfishness...

Free yourself first from the moral authority of the mob. You owe nothing to mass opinion; therefore, the laws which rise on mass opinion have no proper authority over you. You do not consent to be governed by the votes of millions of anthropoid livestock who want to be bound in chains—who eagerly embrace those chains just as long as they remain warm, fed, and adequately entertained. You are a law unto yourself.

Wherefore “anarchy” as to the masses and their so-called “governments”, which are in truth no more than the largest, most well-armed organized criminal gangs. Don’t reject authority: Be your own authority. Rankles a bit, does it not. The rattling of blunt sabres doth not impress. It is inadvisable to try this with anyone who has access to classified national intelligence agency resources, etc., etc. |

|

|

|

|

994

|

Economy / Speculation / Re: [WO] BitMEX

|

on: October 05, 2020, 06:38:07 PM

|

Reply to Jay is below. First things first... https://twitter.com/stephendpalley/status/1311694266389929986BREAKING: CFTC sues Bitmex, Arthur Hayes "to enjoin their ongoing illegal offering of commodity derivatives to U.S. persons, their acceptance of funds to margin derivatives transactions from individuals and entities in the U.S., & their operation of a derivatives trading platform yay the drama we need BitMEX CTO got arrested. (etc...)Smooth move. I have noticed that many sites nowadays ban Americans together with the slaves “citizens” of other notoriously “free” countries, such as the Democratic People’s Republic of Korea. I always get a laugh when I see the United States on one of those “rogue state people, go away” TOS lists. Too bad—it must pretty much suck for any sane individual Americans and/or North Koreans. BitMEX and the mobile apps issued under BMEX are wholly owned and operated by HDR Global Trading Limited, a Republic of Seychelles incorporated entity or its relevant authorised affiliates. BitMEX did not offer anything to “U.S. persons”!Pre-blowup archive for reference: https://web.archive.org/web/20200930062121/https://www.bitmex.com/app/termsYou are not allowed to access or use the Services or the Trading Platform if you are located, incorporated or otherwise established in, or a citizen or resident of: (i) the United States of America, the province of Ontario in Canada, the province of Québec in Canada, the Hong Kong Special Administrative Region of the People’s Republic of China, the Republic of Seychelles, Bermuda, Cuba, Crimea and Sevastopol, Iran, Syria, North Korea or Sudan; Perhaps the people cheering this personally abide by all North Korean laws and regulations?

Whereas if jurisdiction is lacking, then why should a defendant suffer trial before a court lacking proper authority, for alleged violation of laws that do not bind the defendant?

Of course in the law, there are various issues that are considered threshold issues, and of course, jurisdiction is one of those areas. [...] Sometimes attorneys will argue issues that are further up the ladder because if they end up losing on some of the more foundational / threshold issues and they present NO arguments on the other matters, then they would end up losing everything merely based on losing on the threshold issue. Some lawyers and clients are going to be more willing to stick to ONLY arguing the one issue - but many times, they do end up arguing the other issues, too, while at the same time NOT waiving their right to be totally correct on the foundational/threshold issue that allows the bringing of the case in the first place. [...] The law can be pretty god damned crazy, sometimes, because it is NOT really uncommon for attorneys to make internally inconsistent arguments, just to make sure that their bases are all covered - but frequently also, they will make their strongest arguments first, and sometimes cut off weaker arguments in order to NOT seem to be grappling at straws ... but I would think that the vast majority of western judges are well able to accept that parties will sometimes make inconsistent arguments... but still tactically, sometimes, it may well be better to just stick to the stronger arguments and to eliminate the weaker and inconsistent arguments or the non-threshold arguments - like you seem to be suggesting. Of course, I did not intend to suggest what the BitMEX legal strategy should be. When the client’s life, liberty, and/or property are on the line, then unless the client wants to take a huge legal risk merely to grandstand, it would be negligent malpractice for an attorney to omit such arguments in the alternative as may be available to him. “This jurisdiction’s laws do not bind my client, and this court lacks proper authority to try my client—but dear honourable court of improper authority, here is why my client did not even violate the laws that do not bind him.”It looks damn sleazy, and it is—but the legal system is sleazy. The problem is institutional and systemic. There is no reason to make a martyr of oneself by pretending that it isn’t. Whereas this forum is NOT the court. And I am not an attorney-at-law representing the BitMEX (HDR) corporation and/or its executives. Thus, I will take a stand and say, first of all, explain just why the fuck the United States is pretending to have jurisdiction here. What is the American CFTC, a god?

Why am I so vehement about this? Besides general principle, that is. On the other hand, it is possible that you and I (or one of us) might find out that Bitmex's behavior was more egregious than we had earlier considered, and we might adjust our opinions or maybe the strength of our opinion(s) might change with the learning of new facts and logic. I do NOT like scammy exchanges. Indeed, earlier this year on this forum, I got booted out of DT2 because I was gunning too hard for Yobit. (A DT1 who was previously on good terms with me suddenly ~attacked me in another thread within 2 hours of starting to defend Yobit from me; the timestamps make the motive quite transparent.) Now, that is a scammy exchange—but I digress... BitMEX has always had a sterling reputation. Now, due to this American action, I suddenly see people convicting them in the “court of public opinion”—it seems just because “American CFTC said so”. If BitMEX were doing something really wrong, and if the evidence were brought out, then I would be the first to condemn the wrongdoing. (Whether or not the Americans have the right to prosecute it would be another matter—they are NOT the world-police.) But that is not what I have been seeing, these past few days. Meanwhile, just yesterday, I popped into the BSV thread for the first time (Loyce.club archive, just in case). And today, what do I there behold? Third post by a “Newbie” account, obvious shill:Re: [ANN] [BSV] BitcoinSV - Satoshi's Vision for Bitcoinhttps://coingeek.com/coingeek-live-2020-regulating-the-digital-assets-industry-is-key-to-future-growth/ CoinGeek Live 2020: Regulating the digital assets industry is key to future growth The days when digital assets were considered a lawless wild west which was beyond the reach of regulators is way behind us. On Day 1 of the CoinGeek Live conference, some of the leading minds in the legal industry discussed the regulation of the digital asset industry, letting us in on how to build a compliant Bitcoin business in the U.S., Japan and the European Union. While regulators started off on the back foot in policing the digital assets industry, most of them are now catching up, Joshua Ashley Klayman told the virtual audience. Klayman is a senior counsel at Linklaters LLP, a London-based law firm with over 3,000 lawyers across the world. Based in New York, Klayman works with digital asset companies that are seeking to get into the U.S. market. “It’s been said many times that there’s a lack of regulatory clarity. I think at this point, that’s just an excuse. I think if you engage with the regulators, you can find a path forward,” she remarked. [...] The subject is interesting, without trust no regulation... without regulation... no state therefore no existence. All open and in conformity with the laws. This is not the case for many other coins.Bitcoin is a 'common good'.

Bitmex was damaging it by 100x margin, as easy as this.

btc going down 1% wipes out the 100X long position.

can a 1btc account spoof? No. can a 10K-100K btc account do the same on mex? Absolutely.

We have speed limit signs on most highways, right? Same idea.

Bitmex is no autobahn.

I would not shear a single tear if mex is gone or curtailed (after allowing outgoing btc transfers, of course). Resistance to the “ZOMG we need to regulate it!!! kowtow to the regulators” attitude is a major Bitcoin issue—and resistance to American world-police megalomania is a major issue to anybody who does not want to be a slave. |

|

|

|

|

995

|

Economy / Speculation / [WO] Fungibility, Payjoin, and CoinSwap

|

on: October 05, 2020, 03:37:07 PM

|

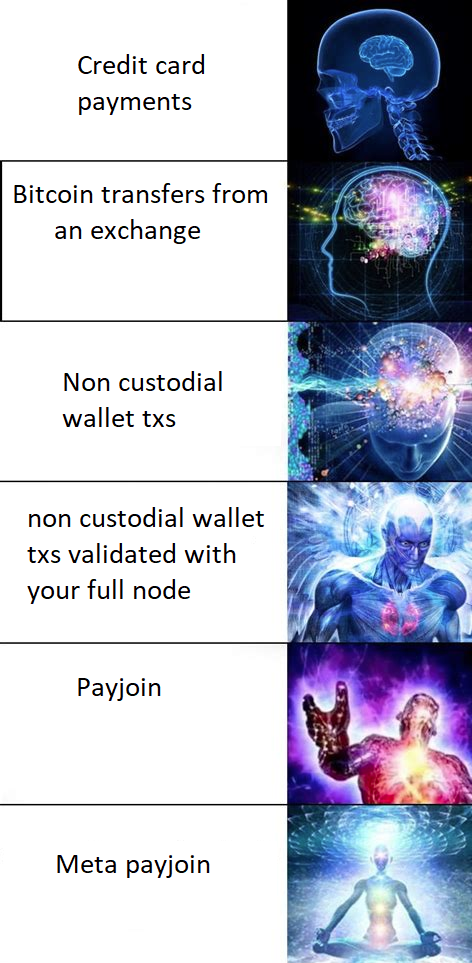

Cross-chain analysis trivially links transactions in which people swap Bitcoin → [X] → Bitcoin; and due to subset sum analysis and timing correlations, it is surprisingly difficult to avoid all practical potential of linkage or probabilistic linkage.

Isn't that much more difficult to do for the average, non-government, or non-ciphertrace / chainalysis group? There is open-source software for this, available to any competent amateur (or organized crime group... or really, any highly-motivated malicious party). I will omit a length explanation, due to haste plus a desire not to put up a “wall of text” diverting attention from the important information below. Of course it can not be "proven" if there is indeed a link since they are cross chain. This is the same problem as with “plausible deniability” idiot-bait: The real world does not work this way! In the real world, if an investigator gets a 90% probability, or even a 10% probability linking transactions, then that is what is called an “investigative lead” to be pursued and confirmed with other evidence. Or maybe just used in other ways, if someone who wants to get you just isn’t too picky about “proof”. By the way: Monero peeps, that is the value proposition of CipherTrace for police agencies. If they can get a 90% or even 10% probability linking transactions, then that gives the cops a clue to place you under targeted surveillance, get search warrants, hack your computer, beat you with a proverbial $5 wrench, weave a bullshit story for a prosecutor stack charges and threaten you with 100 years in prison to coerce you to plea-bargain even if you are completely innocent (most specifically in “the Land of the Free”, many innocent people are in prison for exactly this reason!), etc. For someone who is acquainted with reality, it is very irritating to read all the discussions poo-pooing the probabilistic grouping of transactions and partitioning of anonymity sets. Most Internet-armchair security “experts” have no fucking idea how detectives actually work. Evidence does NOT need to be “proof” to be very, very useful. You mention PayJoin and CoinSwap, are those different from CoinJoin and the other things Wasabi (the wallet) are trying to do, or doing? PayjoinPayjoin standard: https://github.com/bitcoin/bips/blob/master/bip-0078.mediawikiWasabi Wallet does Payjoin! This is separate from, and additional to, their CoinJoin implementation. https://docs.wasabiwallet.io/using-wasabi/PayJoin.htmlWorks with BTCPay Server on the merchant side: https://docs.btcpayserver.org/Payjoin/JoinMarket also does Payjoin: https://github.com/JoinMarket-Org/joinmarket-clientserver/blob/master/docs/release-notes/release-notes-0.7.0.md#user-content-payjoin-bip78-type-on-command-line-and-guiThese are new developments. I hope to see more widespread implementation of Payjoin. Meanwhile, Wasabi Wallet is already a user-friendly way to do Payjoins right now! CoinSwapOriginally invented here on this forum, by (who else?) Greg Maxwell; but it has suffered some implementation difficulty. CoinSwap: Transaction graph disjoint trustless tradingAlice would like to pay Bob, but doesn't want the whole world (or even Bob) tracing her transactions. Carol offers to receive Alice's coin and pay Bob with unconnected coin, but none of these parties trust each other— and Carol being able to steal coins makes Carol into a systemic risk, since the need for trust means that there can't be many Carols and Carol could be earning income on the side spying on Alices, or could get robbed, etc.

Oh, and they don't want to invoke novel cryptography or change the Bitcoin protocol.

Here I present a protocol where Alice can pay Bob by way of Carol where Carol can not rob them. Now being implemented! The links in this quote are recommended: https://bitcoinmagazine.com/articles/the-human-rights-foundation-is-now-funding-bitcoin-privacy-development-starting-with-coinswapThe Human Rights Foundation Is Now Funding Bitcoin Privacy Development, Starting With CoinSwapby Aaron van Wirdum June 10, 2020The Human Rights Foundation (HRF) was already promoting Bitcoin’s privacy features. Now, it will also fund the development of them. HRF, the New York-based nonprofit that promotes and protects human rights globally, has launched a fund to support Bitcoin developers who make the Bitcoin network more private, decentralized and resilient. The first grant, worth close to $50,000, has been gifted to London-based Bitcoin developer Chris Belcher to realize an implementation of his CoinSwap protocol. A second grant of the same size will be announced soon. [...] Belcher, one of the world’s foremost experts in Bitcoin privacy, recently published a detailed outline of how the CoinSwap technique could, in fact, be done right. The developer — who previously authored the Bitcoin privacy guide and helmed development of both JoinMarket and the Electrum Personal Server — addressed a range of potential privacy leaks, and envisioned a JoinMarket-type of liquidity market to mix coins. (Additional solutions include multi-transaction swaps to counter amount correlation, transaction routing to avoid single points of trust for privacy and fidelity bonds to make denial-of-service attacks costly.) A working CoinSwap implementation would represent another big step forward for Bitcoin privacy. Although tools like CoinJoin are out there, and do offer privacy, these do often still reveal that the tools themselves were used. CoinSwap transactions, in contrast, could be made indistinguishable from regular transactions. This not only benefits CoinSwap users themselves, but everyone else too, as blockchain analysts could no longer safely assume that regular-looking transactions were in fact regular transactions — they might just as well have been CoinSwap transactions. That last point is important; and it applies to Payjoin, too. If a significant number of people were to use Payjoin and CoinSwap, Chainalysis would be sad because their heuristics would become generally unreliable. Mass-surveillance would be more difficult, and fungibility would be improved. It would not be perfect— far from it—but this is a huge step in the right direction! |

|

|

|

|

997

|

Economy / Speculation / Re: [WO] it could be read two ways

|

on: October 05, 2020, 02:30:59 PM

|

Can I borrow your girlfriend on margin to short her?

Mmmm, 100x leverage.

Pro tip: Go long  If your girlfriend has sufficient market depth, I will make her have liquidity. For the power of my scalar private key is a discrete log. I do point multiplication with her elliptic curves.

Do I retain custody of the magic beans?

Only if I - physically - do the escrow.  And custody of the girlfriend? If she’s of a cryptokinky bent, get her into the blockchain per consensus rules.

If I am present in a thread, the probability of that thread turning to Ciphersex™ converges on 1. |

|

|

|

|

998

|

Economy / Speculation / [WO] Virgin coins for fungibility

|

on: October 05, 2020, 01:53:31 PM

|

meanwhile a hilarious and very dry pastiche of shitcoin blogs https://medium.com/@sixtenhodler/intolerant-zeal-5b5b1dd6ec0ehttps://archive.vn/dScZjMany haters will claim that Zcash is just for criminals. This is prejudice — block chains matter. What makes Zcash unique is its purity. Each cybercoin, each commitment, is unblemished. One cybercoin is perfectly interchangeable with another — they are all clean. Thanks to state-of-the-art zero-knowledge proofs, every ZEC is just as innocent as another. No other asset comes close to providing the same level of pure nobility and cleanliness. Every zatoshi is a virgin. The metaphor is sensible, although it could be better stated. Within the shielded pool, each note commitment/nullifier pairing has, in practical effect, no prior history. (Unless you can break the cryptography: The Zcash designers gave up the statistical hiding of Zerocoin for computational hiding. But then, an attacker who could break Zcash’s cryptography could probably also break an awful lot of other cryptography, and thus violate my privacy in total.) No taint tracing (double entendre here). No blacklisting—no Mike Motherforker Hearn jerking off all over your coins. No Chainalysis doing a genetic analysis of every transaction that has fucked your coins before! Each transaction is indeed the spend of a metaphorical virgin. Bitcoin is not perfect. Among other things, it has serious problems with fungibility—and with privacy. We need to be able to discuss that, without the kind of groupthink “cult mentality” that anti-Bitcoiners accuse Bitcoin of having. I’m a believer (LOL), but I am also a freethinker. Zcash does have the very best currently-available technology for fungibility and privacy. (Yes, Heuristic. When I use Monero, I avoid, and have always avoided coin merge. I never touched Monero before it got both Confidential Transactions and mandatory ring sizes; and strictly avoiding coin merge always been my policy. If I understand correctly, this makes me immune to the sort of statistical analysis that CipherTrace is doing, or trying to do; but total avoidance of coin merge is very difficult, and rather impractical. On this and other points, I do things with the Monero CLI wallet that >99.9% of users will not do.) Zcash is still the only real-world deployed coin with which, for fully-shielded transactions, I don’t even think about coin control! Unfortunately, as I myself discovered the hard way, technology alone does not make the coin. For privacy, the only right way to use Zcash (or Monero) is to hold it: Cross-chain analysis trivially links transactions in which people swap Bitcoin → [X] → Bitcoin; and due to subset sum analysis and timing correlations, it is surprisingly difficult to avoid all practical potential of linkage or probabilistic linkage. Well—speaking from experience, if you want to hold Zcash, prepare to lose significant wealth—as you hold something that’s not even very useful, in terms of “where can I spend this?” In Zcash, that problem is even worse if you want to make fully-shielded transactions. Monero has thus far much better market acceptance, albeit still not much at all compared to Bitcoin. Bitcoin is also by far the most decentralized coin. Zcash and its future are basically controlled by a small group of people. Monero is a bit better. Whereas Bitcoin is probably about as close to ungovernable as we can realistically expect. So... What can we do to improve Bitcoin’s fungibility? Much to my dismay, we seem to be stuck with transparent on-chain transactions; and the only virgin coins are coinbase. PayJoin and CoinSwap are helpful; but in my vehement opinion, we really need to move most transactions off-chain: Lightning Network, among other things. Nobody can do taint tracing on an atomic multipath transaction with onion routes, or whatever else the Lightning wizards magic up. And there is thereby no global, immutable, transparent database of all transactions, publicly available for anonymous download. (The thing that made me run away screaming in horror when I first saw Bitcoin. Wherefore I am not Bitcoin-rich, but I sleep quietly without worrying about someone tracing my early transactions.)

Disclosure: I still have a small amount of Zcash—within the Sapling shielded pool, of course! It’s small enough that I really will not get rich if it moons—from an investment perspective, it is downright trivial; and I am anyway under no illusions about the power of one of my posts to influence the market. Same with Monero. (Same with fiat...) My modest Bitcoin holding is overwhelmingly larger in current market value— Bitcoin is where I store value. And I don’t day-trade. I have no vested interest in pumping anything here, but I very much do have a personal self-interest in improving Bitcoin’s privacy and fungibility. |

|

|

|

|

999

|

Economy / Speculation / Re: [WO] it could be read two ways

|

on: October 05, 2020, 02:59:34 AM

|

Oi. Most times trading the cow for magic beans does not work well..... Can’t... resist... – Boyfriend doesn't have enough money, so he trades GF for 1 BTC. Clearly sometimes, it works well. Reminds me of margin trading. Can I borrow your girlfriend on margin to short her? Mmmm, 100x leverage. |

|

|

|

|

1000

|

Economy / Speculation / [WO] it could be read two ways

|

on: October 05, 2020, 01:36:57 AM

|

Oi. Most times trading the cow for magic beans does not work well..... Can’t... resist... – Boyfriend doesn't have enough money, so he trades GF for 1 BTC. |

|

|

|

|