[quotations trimmed]

I'm not sure of the specific beairsh theory, but I don't see it as being laughable to be objective and consider "shit, maybe we are all wrong".

You may have been misunderstanding the kind of disagreement that I was having with goldkingcoiner, because initially, when he posted his chart with down arrows and he proclaimed that he thought that we might be in 2018 - I thought that perhaps he had just made a mistake or perhaps a joke.

Yes I did misunderstand the disagreement, based on not knowing what it was at all. This was admittedly part of the intent in order to get such an awesome organic response from you, as well as pretending you are perma-bull when I know much better 🙃 Currently out of merit as shat it out in speculation board, but have bookmarked. Also in order to likely return to as a useful text to return to in the near future for a reminder of your insight.

I'm well aware of your relatively conservative analysis and strategy, and personally felt in need of it (alternative analysis and indicators) while Bitcoin price is fucking around at the 200 Day MA in an indecisive way

Similar to LFC's emotional response indicator, the length and energy you put into your replies appears to be a good emotional indicator for your underlying confidence in my opinion, also quite helpful. I hope you don't feel manipulated by elements of my intentional ignorance, I'm quite the antagnostic at heart I know. If I had simply asked you "Hey wordy, what you fink right now then?", the reply wouldn't have been no where near the same. After all, we are just people on the internet having a discussion I'd like to think. I apologize if my actions were out of line though, I don't mean to offend

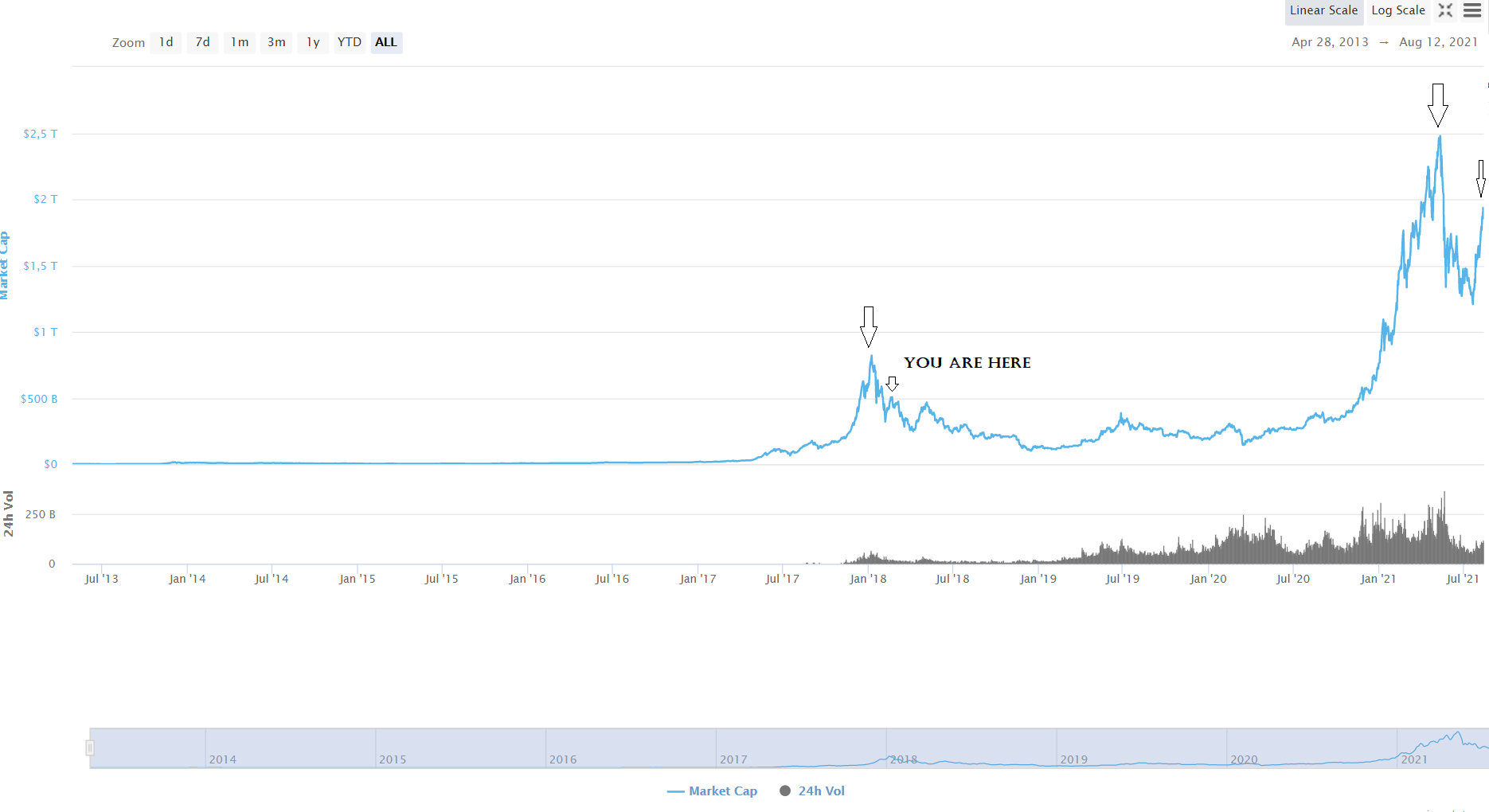

I've noticed the volatility of BTC used to be way scarier than this in the past. However I am seeing some eerily similiar patterns from 2018. Market Cap drop to $1T soon?

Hahaha I remember a friend pointing me to a chart like this that were spreading like a virus among newbies it seems, the $30-65K crowd basically. There were also quite a few varieties if not mistaken. Personally I wasn't paying much attention, instead staying away from the short-term noise, instead focusing on the 50% discount opportunities around this time. I won't mention what they were, as was shitcoin orientated, but fuck did it pay off nicely for satoshi profits. It was otherwise when the market was in extreme fear if not mistaken though. For me when my friend showed me this I literally said "it's a buy signal". He obviously didn't understand why, but I elaborated that long-term analysis done in linear is always untrustworthy (should be in log for starters + proper chart ideally), followed by the fact that suddenly LOADZ of people had decided they had become experts in technical analysis overnight, whereas before their reasons for buying Bitcoin was "cos price go moon". No wonder the shakeout was so aggressive.

I then showed him a log chart of Bitcoin, and drew some crude arrows to the upside in random fashion and asked: "do you believe this TA?". He obviously didn't, so instead I helped him set a big buy order for second round of $30K and stuck to the plan: buy fear

Like you, he's just stacking sats whenever there is a discount, this after buying up bear market dips followed by leaning into early momentum. I advise him to take some partial profits in order to "feel a bit better" about his investments, in case he has any doubts, but his response is always "nah". He's got his 10 year plan and sticking to it (2019-2029). The hardened investors will always be the ones who outperform traders. It's such an emotionless state, one I am not able to fully achieve personally.

So, initially, I was just seeking clarification including my assertion that it's not too likely that we are in 2018... . but instead of explaining himself, goldkingcoiner went into combative mode including wiffle waffling all over the place and even changing his position... and even waffling more when the BTC price went against his nonsense.

Oh, one of those analysis types. Good to know

So frequently, I am criticizing others who are coming out with high levels of certainty, and I have even criticized you on that basis a few times - which surely is one of the risks that can come about when you plot price predictions on charts because they might start to imply higher levels of confidence than what you had even originally intended to communicate.

For sure you have, and it's always been appreciated, even if slightly frustrating as is often misunderstood to some degree. Being 95% confident doesn't necessarily mean I'm betting 95% on a price move, at most I'll be putting 5% of my portfolio into a decent dip, otherwise trading with 1-2% capital at a time. This I think you know and I've clarified for you. Being wrong 20-30% of the time with my positions doesn't effect me. I've learnt from previous mistakes of over-leveraging, to the point of under-leveraging, and now I've found the statistical balance for maximum gains that I am able to achieve.

That said, as you might remember, since $10K I was "all in" with 99%, eventually trading up tax costs to $20k. I've kept that down to 95% of wealth now, as it's emotionally healthier. Many say "fuck that's way too much", but I always remind them "never bet more than you are willing to lose". Being willing to lose it all and start again from scratch doesn't bother or concern me. Sure it would be a bit annoying, but my 95% confidence means I'll always want to be 95% in, otherwise I'm not putting my money where my mouth is. I wouldn't call it certainty though, that's an impossibility based on the definition of the term;

n. The fact, quality, or state of being certain, especially:

n. Inevitability.

n. The quality of being established as true.

Certainty implies, by default, being 100% sure about something. I always say nothing is inevitable, even if I base my decisions on extremely high probabilities. I've never been 100% certain, only 99% at best, which while this was completely irrational at the time and deep down was more like 95%, I felt the need to take as much risk as possible at the point in time that offered the best reward and only comes around every 4 years: confirmation of the end of the bear market. Simply because it felt right, an emotional confidence booster. I wanted to pay half price on taxes, knowing that I could take the hit if I would be wrong. It wouldn't be so much of a "hit", much more likely taking profits at an inferior price, which would feel a bit degrading but needs must etc.

Correct me if I'm wrong here, but you can't have a

level of certainty, as would be a contradiction. As defined above, it's effectively a constant (static), not a variable (fluid). You probably mean high levels of confidence, or outright certaintityy for example. It's like saying "high levels of inevitability". If it's inevitable, there can't be a variable to that inevitability. It's a binary concept, surely. 0 or 1.

I was 95% sure the bull-run would continue, which very much appears to be the case now fortunately. I'd still put a 1-2% chance of being wrong however, as nothing to is a guarantee in life. It'd be naive to consider the statistical or data science models, whether that be log growth or stock to flow, to be right 100% of the time. That's how you can get completely rekt long-term.

Again.. you seem to be assigning way higher levels of confidence than me, and those are the kinds of confidence levels that I will usually criticize the fuck out of, whether to the UPside or the DOWNside, even though I do let a lot of what I perceive to be the overly bullishness towards the UPside slide more frequently than I would for the same overly confident DOWNside assertions (and I believe I have good reasons to do that.. because no matter what, we have the underlying UPside price pressure dynamics, especially the exponential s-curve adoption aspect, whether peeps want to believe or acknowledge or not.

For sure, criticize away. With the probability I'm playing with I'm always able to be wrong about it 5% of the time without losing money in the long run. I always have a backup plan, even if it's not what I'd want to implement, it will happen if necessary. Like if price does break below $30K again after getting rejected from $50K, I'd take the necessary profits, and accept the fact of being relatively wrong, with the possibility of spending more years accumulating, also fine by me. Knowing that 1 in every 20 times I'm 95% sure, the chances are that I'll be wrong. I also do prefer the bear market / accumulation part of Bitcoin's current cycle. I love the fear, as well as they theory that time is your friend when it comes to investing, as well as reliable constant discount on offer.

But in this we are very different I know, I'll never DCA unless price is at a discount. Likewise I prefer as much time as possible to accumulate, even if acutely aware when time is running out. The bull market bores me to be honest! I found it a lot more interesting when prices dropped 50% and there's actually some thought provoking analysis rather than the rocket ships and moon memes. But sure, I'm a bit weird like that, as for me it's not about the money: It's about learning and doing the best I can in life.

How can I learn when price is just on a steady uptrend? Bores the fuck out of me to be honest. I don't trade against strength and I'm not trying to sell the top either.

Once If new ATH is made this year, I'll likely be taking a break from TA again

Call me not a "true believer" or otherwise, but I just stick with the probabilities rather than the prophecies, as they appear more reliable to me.

Your confidence numbers seem to be way higher than mine... but maybe it also could be depending upon the question that might be presented..sometimes if we are talking time and how much movement, we are going to get very different confidence levels depending on how far we might be moving from our current position - whether referring to time or to quantity of movement.

For sure, I'm

only 95% on new ATH this year (ish). Whether we make a new annual low this year is a different story, but wouldn't effect my analysis in a hurry either. If we don't make a new ATH this year, I'll be fucking panicking trust me. It would invalidate all of my long-term projects and opinion. The idea that the 10 year bull market is over, and for sure a 20 year bear market could occur with high probability for me personally. But ultimately, I only put this down to a 5% chance. I'd go from uber bull to uber bear in a hurry basically. I'm always able to change my perspective quickly if I'm wrong, otherwise I would only end up getting stuck in my incorrect outlook. That's the ultimate way to get rekt in any market, not being able to accept being wrong basically and changing perspectives based on this.

Fortunately as I trade time rather than price these days, the probability of the 12th year of Bitcoin being different from the other 11 had a simplistic 8.3% chance to me (1/12).

Seems like an error to me to be considering the matter like that. Bitcoin is not a mature asset, and there seem to be a considerably great need to account for exponential s-curve adoption and also consider how networking effects are playing out..which includes considering Lindy effects.. and also includes considering metcalfe principles, too.

Seems to me that if you even try to treat subsequent years in similar ways to earlier years, then you are lacking in some of your appreciating for some of the real world underlying dynamics of bitcoin including that bitcoin is no run of the mill asset class, either. It involves the addition of a new asset class that is paradigm shifting (meaning that we never ever ever had such an asset class in the past), and bitcoin has inspired all kinds of imitators and snake oil salesmen and a lot of noise and misleading aspects around it, but the fact that bitcoin is NOT broken in spite of ongoing attacks against it (sure frequently subtle), creates a kind of unpredictable aspect in terms of the "gradually and then suddenly" component to it, as well... so in that sense, all years cannot be treated the same, even if you are trying to be objective about it, you are missing the point by trying to apply a mathematical model that is failing/refusing to account for on the ground realities.

I've emphasized what I said, to avoid any price-based confusion. For sure every year in Bitcoin is different and unique, I was intending to refer to the overall picture of a 4 year cycle, whether price goes to $100K or $1m by end of year is irrelevant to this theory, which also for now remains 100% in tact as far as I can tell. The recent 50% drop in price did nothing to change any of this in my opinion, it only changed some price-based predictions I imagine. You're completely right though that many other factors could play a big role in changing this 4 year cycle; but I still only give this a 8.3% chance - until proven otherwise. I go with statistical evidence I can verify, rather than speculative theories that remain (for me at least) as conspiracies for now. Whether that's a rational outlook or not doesn't concern me, as for now it's been working for me. It's how my brain works, I'm not going to re-train it to operate in a way that reduces it's functionality.

Within this 8.3% chance, I'd put higher weight of a type of super cycle that breaks this trend, as after the third halving it's becoming a bit repetitive already. It does seem much less likely that Bitcoin's fourth cycle will follow the same time-frame as the previous three, as it'd simply be too easy. That said, I feel the change would be more likely during a bear market than end of bull market if a top is coming in over winter, exactly when time traders such as myself will likely be cashing out, anticipating another 80% drop like clockwork followed by 3 year long accumulation period. In reality, ideally these 4-year cycles do come to an end with upside benefit, as otherwise the potential for a 20 year long bear market becomes incredibly likely for me. I'd for sure be extrapolating what happened to Gold onto a Bitcoin chart, but for now there is clearly no need! Breaking this cycle in a bear market could be somewhat catastrophic however (panic could really set in if we don't bottom when time anticipates), hence hoping it will be broken during the bull market.

I'm well aware this sounds mad, but I'll shy away from fundamentals and stick with the math when they become no longer applicable basically. Knowing that Gold had a 10 year long bull market for 25x gains until 1980, followed by a 10 year long bear market and taking approximately 30 years up until 2010 to move higher than previous ATH of $875 (3x as long to recover being a spooky correlation too). This idea genuinely scares the living shit out of me, so I try not to think about it unless I need to, even if only theoretical. For sure I make no comparisons for now, there is no data to suggest Bitcoin would go this way, but I give it a 2-4% chance none the less (without wanting to study the probability too much). To me, at the end of the day, large influential investors will trade risk/reward over fundamental and emotional sentiment any day of the year.

As long as the hands of the clock keep going around at the same pace and the same direction, I won't be changing my perception over wild speculation in a hurry.

Add in something else like stock to flow and the macro bullish uptrend of the Weekly/Monthly chart, I could easily drop this % in half to <5%. But I still had my objective reservations as a natural skeptic. I also almost

took a short as a hedge given the descending triangle pattern, while hodling the rest of my stash, but in the end after further analysis I realised the times when these patterns don't break bearish is often during the 1-year up trends. So the idea of it having a 80-90% chance of breaking down with another 50% drop became completely invalidated for me. It did

remind me of 2019 however, even if the pattern not so clean (also looked like a broadening wedge), so I considered it more of a bear trap - which it turned out to be.

Fair enough that hedging sometimes can be helpful...and also making comparisons can be helpful too, if you are able to make reasonable comparisons rather than finding a pattern that looks the same but might still fail to account for some broader underlying principles in terms of how that previous pattern might have gotten there in the first place.

Sure, sometimes I may well talk a decently big game about patterns and underlying principles, but I hardly ever change my largely blind system of buying on the way down and selling on the way up, including allowing the BTC price to come to me, and also with the passage of time, both my spreads and my increments have gotten much BIGGER - even though this latest correction from $64,895 to $28,600 and the bouncing around within such correction had caused my increments to largely shrink back to their $1k intervals - but I kept my spreads the same (at around $6k) even though I had been somewhat tempted to shrink those too.. because as you can likely appreciate a spread of $6k in the $30k territories ends up being 2x as BIG (in terms of percentage) as it is in the $60k territories, but I just allowed the whole spread matter to stay in place as a kind of convenient excuse that just allows my longer term goals to become more and more realized in terms of permitting (or causing) the spreads to get BIGGER and MOAR BIGGER with the passage of time, including BTC price increases and even accounting for percentages, too - even though many of us should be able to appreciate that even if we have perceptions of bitcoin having a lot of ongoing and inevitable volatility for many years to come, such volatility is still likely (and perceptibly) reducing with the passage of time, too..even though BIGGER players are coming into bitcoin and attempting to play with BIGGER numbers and hopefully getting reckt MOAR worser, too. hopefully.

This is definitely a smooth strategy, not one I engage in personally, though I do trim based on time rather than price. I generally averaged my way in on time, so I've taken some tiny percentages out based on this too, which is usually more the partly satoshi profits from alts trading (that wouldn't have been made if I wasn't spending an abusive amount of time aggressively doing so etc). But otherwise I generally hodl the fuck out my coins and keep it simple now we are up-trending. Always knowing I'm "buying Bitcoin" at the "wrong time/price" from altcoin profits, but completely indifferent as prefer to completely avoid trading btc/usd in a bull market unless necessary, instead trade btc/alts and focus on stacking sats this way (each to their own though huh).

For now my analysis is more confirmation of hodl stack remaining in tact, rather than averaging further in with fiat. Though that said I do scrape around for more altcoin profits when the time is right, or I want some fancy food

Overall I was more convinced that with the 50+% correction, price therefore had more of a chance to go higher than initial expectations of $100-150K, as it looked more similar to 2012 than 2018 for sure, or a completely different uber bullish longer term trend we have never seen before (something WIlly Woo recently touched upon, the "super cycle" possibility). That and

looking at analysis from over a year ago, this really helped rationalize the situation for me. For sure price got over-extended too far too fast, but ultimately we remained on track regardless.

I understand that Willy Woo is not much of a fan of Stock to flow, but surely Willy does have a lot of great analysis, too.

Naturally any hedge wouldn't have been for $ gains, it would of simply been an attempt to increase BTC holdings, with ultimately still the projection of Bitcoin price making new ATH high this year anyway. So I never actually considered the bear market had come, this seemed high unlikely to me, but I didn't rule this out or the idea of another fake-out.

Sure, there were a lot of seemingly premature proclamations that we had entered into a bear market, and part of the rationale was having a greater than 30% price correction, and in early 2021, there was a shit-ton of bullshit assertions that greater than 30% price corrections were no longer possible or some nonsense like that, and we even got quite a bit of that baloney in this thread, and so as soon as BTC corrected more than 30% many folks started either predicting doom and gloom or accepting the various doom and gloom theories including quite a few smart peeps with decent analysis, too.

Damn right there was! I was around 90% confident we wouldn't drop >35%, I remember when we did and thinking "ah shit, oh well". I also remain 90% confident that we won't drop >50% again however

How is this even possible to remain this confident?

Probability. With about a dozen pull-backs only ever reaching 35% within a bull market, with the exception of 2012, this was simple quick mafs. Fortunately I wasn't aggressively going in with fiat around this price, as accumulate in bear markets and recoveries, never during the uptrend, but instead did take tonne of altcoin profits back to Bitcoin (thanks ETH!) that for sure would have been better staying around a $50K price level

So you can imagine that if 30% was the threshold of entering into a bear market, then more than 50% correction put nails in the coffin to "unambiguously" confirm the three year or whatever bear market bullshit propaganda.. and of course, we may well know that there were a decent number of folks who wanted to perpetuate such nonsense in order to get some shakening of the coins from folks who otherwise were NOT too likely to be easily shaken from their coins... but surely a lot of folks did get shaken.. those gullible fucks.

People are weird, that's all I can say. Just because there's a 90% chance it won't happen, they suddenly get confused when 1 in every 10 times it actually happens

It's literally what you'd expect from statistical probability

We were

over-extended by far, I saw this from $50K when trimming on a time-based scale.

That said, when we finally did reach a 50% drop I was relieved, prior to the price even bouncing back to be honest. It confirmed for me the possibility of much higher highs than previously anticipated or projected

By the way, I am not even asserting that we might not be in a bear market, even though to me the odds seem against it. I am not even saying that the top of $64,895 might not be in, even though to me the odds seem against it. We cannot really know for sure if we are in a bear market or a bull market until after the fact, and surely I cannot even see that the stock to flow or the 4 year fractal models have been broken, so you are not going to so easily cause me to concede that we are enterring into a bear market, even though there was some time that the odds were not looking good for staying in a bull market - especially when we were getting into the low $30ks and staying there a long time (including the temporary dips into the upper $20ks).. but yeah, it is not over until it is over.. even though I probably had less than 50% confidence that the $28,600 bottom would hold when we were in the sub $31ks, but when the BTC price got back into the mid $30ks my confidence went back into the 51%-52% territories, and then when it went into the upper $30ks my confidence bounced around 55% and when BTC prices got over $46k, my confidence went from about 56.5% to about 62.5%, and currently my confidence is around 63.5%.. hahahahahaha.. which is pretty fucking high for me, so I might have to take a chill pill and bring down my expectations a wee bit more.

I'm totally with you on this, you won't find me easily conceding over the idea of being in bear market, not this year at least. Even if we drop down lower to around $20-25K in the near future, prior to around October: good luck with that.

The exception to the rule will be if the number of days in a year get's recalculated and no longer remains 365.25. Then I'll seriously have to re-evaulate everything. Kind of like if 0 and 1s changed their values. Holy shit, it's panic time!

Even when we were down at $30K, I remained 95% confident to be honest. I probably "felt" 80% confident, but reviewing the statistics confirmed that nothing had changed my outlook what so ever. It only reinforced it.

Just my wealth dropped in half temporarily, that was a bit annoying for the short-term

Actually, it seems better for me to attempt to gravitate back towards 50/50 ideas in regards to short term BTC price directions - but again, surely my level of confidence is going to depend on the questions that are being asked in terms of if the $28,600 bottom is in or what are the chances that we break above $53k or what might be the other resistance points, because in some sense, if the BTC rice is allowed to get avove a certain threshold, such as $53k or something else, then it is going to be a whole hell of a lot more difficult for beartwats to actually keep the BTC price from making new ATHs.. and in that regard, you are probably of a similar mind as me in terms of the difficulties to stop the momentum once the BTC price gets above certain price points, but even then we might get into upper 60% territories in my mind, but you might start assigning way higher odds such as in the upper 90%s which I would consider to be gambling (or pie in the sky) rather than being realistic (with yourself).

Ah no, fear not. I'm nowhere near 90% on the immediate uptrend returning quite yet! I'd give it 66% at best that we don't make lower lows this year, while price is above the accumulation zone. I'm simply 95% of new ATH by end of year, not much else. I also agree above a vague $50-55K level being breached increases my %, previous support turned resistance as well as mid-level of log growth, and therefore I can't really be more than 70% confident of much until then.

Ultimately it can all lead to a macro lower high that's indicative of a downtrend (at least in the short-mid term), likely meaning price would re-test the 50 Week MA support line (long-term uptrend) that's fast moving upwards, currently $34K. That said, I just noticed most volume in past 6 months on Bitstamp/Coinbase is still around $56.5K, notably higher than the past 8+ months of volume at $38.5K. To me this indicates the bulls may need to build a bit more volume in this support zone in order to shift this VPVR point of control to recent support and away from resistance, in order to inspire a bit more confidence in being able to get back above $60K in the near term. But overall, twice as much volume between $30-40K than $50-60K is a great sign, now price is above.

I'm otherwise unable to trust the price right now until it actually moves above the 200 Day MA, knowing that we already failed to do this after a few days above it. I don't think we're likely to achieve it this second time round either, the declining volume concerns me a lot as makes the probability of anything much more difficult to determine (a whale/entity can simply step in to move price in either direction right now imo). Falling below $38.5K and back into the accumulation/distribution zone put's me back to 50-50 that we don't make new lows this year, below $35K I'd probably be 60-40 that price will make a new low. Returning to the accumulation zone after failing to move above it will be similar to the 2020 scenario, that of distribution not accumulation.

Nice chatting with you again

Edit:

Edit:I'll otherwise make it clear when I'm back to full-blown bull on all time-frames and therefore unlikely posting TA:

Credit: xhomerx10

Poll

Poll