serveria.com

Legendary

Offline Offline

Activity: 2240

Merit: 1172

Privacy Servers. Since 2009.

|

|

January 06, 2022, 07:26:44 PM Merited by JayJuanGee (1) |

|

I have said it many times before, but I want to say it again. And add a little current thoughts.

-I think "cycles" are becoming a thing of the past for Bitcoin.

-Bitcoin "cycle thinking" led to the six figure predictions, which combined with the "end of the year" effect led to all kinds of predictions being made about 12/21.

-Now the cycle theorists are revising their theories, and many are coming to the sad conclusion that we have actually done the top this time around.

-This is causing some "I'm a little too late but I am going to do it" sorts of selling amongst "hodlers".

That is happening right now. Of course in the midst of one of the most strange macro backdrops the world has ever seen. And I believe a significant portion of the selling hodlers are going to get to experience max pain in the following way: Just as they were expecting a bigger top in this "cycle" they are likewise predicting another "bitcoin winter". Not everyone is there yet, but lots are from my personal sampling of the twitter/reddit and yes bitcointalk space.

But just as a large part of the hodler herd miscalculated the "cycle top" they are now miscalculating the potential bottom.

I predict that will underwhelm in a similar fashion. Some people will make the NEXT mistake as well in announcing that the cycle is not over yet after all and we are on our way to the blow off top we expected to be here for XMAS.

Now, I think we might see something that looks like a 2013-14 double top cycle, but I think what we are more likely to see is a continued loss of the extreme cycles based volatility. In fact, I think it is entirely possible we see everyone's most important (but arbitrary) 100k price level sometime in 2022 (or maybe not), and though we will almost certainly see something a little frisky happening whenever we DO cross that threshold I still think the big surprise we are waiting to see is the lack of any significant "winter". I think we are seeing those blow offs and brutal 80-90% bears headed towards being over. A thing of the past. There will still be plenty of volatility, but I think it's not as deep or high, and possibly a little more quickly oscillating.

Along with the loss of those bipolar swings we are also giving up the unbelievable gains we saw since 2009. I think we still easily have a 10x or a 100x and more in the cards for the future... but this also pales in comparison of what the years looked like while we were bootstrapping.

And it SHOULD be this way. We are still "early" and there is a lot to gain by getting in RIGHT HERE. But nothing compared to what we went through during the whipsaw years. Half million dollar bitcoin is just a 10x-ish from here. Some of this is reflected in the popcorn markets around dogcoins and NFTs and the like. People want the bitcoin 30000x cargo cult plane to land again... THIS TIME they will be ready! When in reality another 10x or even 100x in the relative short term in Bitcoin is still a real possibility... life changing gains even if you bought your first coins TODAY (though to get more you have to risk more nowadays of course).

So, I think some hodlers get burned trying to catch the bottom of the "coming winter", just like many were burned by "500k by conference day" type shit.

One last thing. None of this means any disrespect to people selling recently. Either to diversify, fund life things, or just avoid having to live through another drawdown like 2017-2020. There is nothing wrong with wanting to lock in gains for really ANY reason. Though defining what "locking in gains" really means is a different essay entirely. But, I just think the idea that we will continue to see a market that looks like the first 10 years is terribly wrong.

NOW if my bottom call (not really, I still think there is more chance we break through it) of 42.5 will just hold I will pour myself a little dram of whiskey. If not? Meh. Maybe not a "winter", but a little cold for my tastes indeed!

***PS EDIT*** I want to seemingly contradict myself hugely by saying one other thing. I do still think a S-curve adoption/valuation supercycle event is a non-zero possibility. It really is a matter of how steep is that curve. Imagine if we see the last 18 months just repeat itslef over and over for about 7-10 years... see what I am saying? I am not sure if my opinion on the likelihood of this has changed in the last 6-8 months... hmm...

Most of the things mentioned in this post are self-explanatory. On the other hand $40k x 1000 is only 40 million so taking into account current and future inflation I wouldn't say it's unreachable.  |

|

|

|

|

|

|

|

You get merit points when someone likes your post enough to give you some. And for every 2 merit points you receive, you can send 1 merit point to someone else!

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

OutOfMemory

Legendary

Offline Offline

Activity: 1540

Merit: 3007

Man who stares at charts

|

|

January 06, 2022, 07:42:21 PM |

|

Just thinking aloud here, god awful price. Really looks like someone is just trying to push the market down time and time again. In the mean time on-chain data is still pretty positive, how long can this divergence last I wonder. Keep thinking we should see a move in January at least, but the price isn't making much sense to me anymore.

I don't know, wasn't the 2013 top in November and the 2017 top in December, that would place the next top in January. I'm not ready to give up the four year cycle theory just yet, If we still haven't had a blow of top in march I'll abandon it, but not before that. It took three weeks to go from $40k to $65k, after half of china dropped out of the market. Imho this is doable, but the series of pullbacks is already lasting for two months now, which just don't show the same dynamics compared to September (-$10k in 23 days). To me it looks like we're already out of cycles quite a bit, so a delayed 2022 bullrun to or over $100k would be in the cards as well. I don't expect anything but not to fall much under $30k, but you know King Daddy, doing what nobody was expecting him to do... @Bob: Year of the crab? Waddayamean? |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10218

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 06, 2022, 07:46:33 PM

Last edit: January 06, 2022, 07:57:06 PM by JayJuanGee Merited by shahzadafzal (2) |

|

I don’t know but I’m on that stage of bitcoin where “buying the dip” is no more exciting.

Reason, it’s effecting my “average buy price”… feels sad kind a seeing my average buying price goes up with every now and then so called dip. Is it really a dip when it’s still > $40k?

Well, it seems to me that you cannot really rush your BTC accumulation stage (if that is where you are at in your bitcoin journey?) without getting into a lot of risk, so surely there are peeps who complain that their average cost per BTC is going up.. but if they are in BTC accumulation, they cannot roll back the clock and buy at pre-2021 prices, those pre-2021 prices might be gone forever.. not guaranteed but they might be. As a reference, remember that BTC prices passed over $20k in December 2020, and then pretty much went straight up to $42k by early January 2021 but then corrected back down to $30k-ish in January, and yeah of course, we had some revisiting of the lower $30ks and even some brief visiting of the upper $20ks in May/June/July of 2021... so even if we suggest that both upper $20ks and lower $30ks still have a chance, it does not seem to be a good bet to be waiting for those kinds of prices, but just to stack what you can and when you can, and surely $42k is about as low as we have gotten so far, which is a 39% correction from our $69k top on November 9. It just seems that you do what you can, and surely sometimes if you had already bought several BTC (satoshis or whatever) in the mid to lower $40ks in recent days, then you may well have used up your cash for purchasing BTC and you are not really wanting to buy any more unless either we have more dip (sub $40ks as you mentioned) or just the passage of time might allow you to have more cashflow come available for the purchase of BTC. Regarding average price per BTC, I believe that you should not get too caught up upon if you might be raising your average price per BTC, because when push comes to shove, it may well be way the hell more important to have accumulated a decently sized stash of BTC rather than just sitting back with a mediocre sized stash.. so surely Michael Saylor and MSTR could have sat back on its laurels with an around 45,000 BTC in its coffers (combination of Saylor's stash and MSTR's stash) with an average buy price that was around $10k to $11k per BTC, and surely they would have been looking decently pretty in terms of their percentage of profits, yet I bet that they are way more powerful with around 124k BTC, and an average cost per BTC of almost $32k, even though they are suffering from more volatility and even getting into current BTC price territories where their profits are not very high (in terms of percentages) (and even they are using various kinds of debt instruments to subsidize their leveraging into bitcoin), but I get the sense that in 1-8 years from now, they are going to be looking quite pretty... including that they are likely going to be continuing to be buying more BTC between now and 1-8 years from now.. Sure, Saylor and MSTR can do what they like in terms of managing their BTC portfolio or even their decisions whether to continue to accumulate BTC at whatever happens to be the ongoing cost of BTC, but it seems to me that they are not too discouraged by the mere fact that their average cost per BTC happens to be going up. Maybe another example could be helpful here too... Let's consider a hypothetical person from 2015 who has around $6,000 that he has chosen to invest into bitcoin, and he also has around $100 per week of extra income that he could invest into bitcoin. If he just buys bitcoin with the initial lump sum of $6,000, he gets 20 BTC at an average cost of $300 per coin. I would argue that if he continues to buy BTC with $100 per week for the next 7 years until now, he is way better off with around 54.3 coins (20 BTC initially purchased + 34.3 BTC acquired through DCA, costing $36,600), even though his average cost per BTC has gone up to $785/BTC ($42,600/54.3 BTC). Sure maybe your numbers are higher given your forum registration date of January 8, 2018 (nearly a four year anniversary), but it seems to me that the passage of time will allow you to perceive likely greater and even compounding performance with the passage of time. O.k.. I will do a similar exercise with your chronology.. just to throw out some ballpark ideas.... let's say that you had fucked up a few things, including that your initial budget was around $10k, and you ended up buying 1 BTC with your initial $10k, so therefore you have an initial cost of $10k per BTC. If you had continued to DCA $100 per week for the next 4 years, then you would have spent an additional $20.9k, and accumulated around an additional 2.23 BTC... so you would have gotten up to 3.23 BTC in total. So instead of having a $10k per BTC average, your average with the DCA supplement would have been $9,566 per BTC ($30.9k/3.23)... which actually is not really that much different than $10k per BTC, but you end up with way more BTC and you are not likely as stressed with ongoing DCA strategy so long as you are not overdoing your budget too badly. |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3752

Merit: 3868

|

|

January 06, 2022, 07:52:42 PM |

|

USA, what happened to you guys?

haha "Why do you see the speck that is in your brother’s eye, but do not notice the log that is in your own eye?" |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 06, 2022, 08:01:28 PM |

|

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10218

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 06, 2022, 08:22:25 PM |

|

I don’t know but I’m on that stage of bitcoin where “buying the dip” is no more exciting.

Reason, it’s effecting my “average buy price”… feels sad kind a seeing my average buying price goes up with every now and then so called dip. Is it really a dip when it’s still > $40k?

On top of what somac. says I would add that it depends on your stash. Let's say you have 100 or 1000 BTC, maybe buying 0.1 or 1 BTC at current prices is not "useful". If you can do something else with the fiat, of course. Buy something you need, go on vacations, buy something nice, or invest in a bit of non crypto stuff "to be safe". I don't have 100BTC and still want more so I'd buy a bit, but I'm not swimming in fiat so I'm keeping powder for some lower price, don't want to be thinking about taking a loan if it goes to 25k. Even though currently, 100 BTC may well feel like a good current quantity of BTC to have and to feel sufficiently comfortable being in entry-level fuck you status. My chart of the 208-week moving average's projection of the number of coins required for entry-level fuck you status is going down quite well in the coming years, so in 4 years, you may well ONLY need around 31 BTC to comfortably be in entry-level fuck you status, and in 8 years, you may well ONLY need 2 or 3 coins. Of course, BTC price performance is not guaranteed, but if you are continuing to accumulate BTC over the years, there are decent chances that you are going to find the convergence of the number of coins that you had been accumulating to have had sufficiently reached fuck you status in order for you to feel more comfortable with both what you had done to get to that status and also to feel more and more comfortable to shave off whatever number of coins (sats presumably) that you might need from time to time to support your acquired lifestyle.. and whether you choose to continue to work or not.. and surely one of the advantages of being in fuck you status is that you likely are able to choose not to work.. or at least to work way less than you had been doing prior to reaching fuck you status. I don’t know but I’m on that stage of bitcoin where “buying the dip” is no more exciting.

Reason, it’s effecting my “average buy price”… feels sad kind a seeing my average buying price goes up with every now and then so called dip. Is it really a dip when it’s still > $40k?

It may not be so exciting to BTFD now, but it will be very exciting when the dip is over and UPpity resumes. It's always been like this. I remember buying at $1200 and wanting to kill myself when it dropped to $800, in early January 2017. Ain't that the truth. Remember that was around the time that Vinny Lingham was going around on his little soap box about how so many BIG players were getting rid of their BTC, but they were going to be willing to back the trucks up at sub $500.. blah blah blah.. and quite a few folks believed him and even sold some coins expecting to be able to buy back below $500. Did not work out too well for those folks. |

|

|

|

|

Mbitr

Legendary

Offline Offline

Activity: 1932

Merit: 1321

Bitcoin needs you!

|

|

January 06, 2022, 08:41:06 PM |

|

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10218

Self-Custody is a right. Say no to"Non-custodial"

|

|

January 06, 2022, 08:48:00 PM |

|

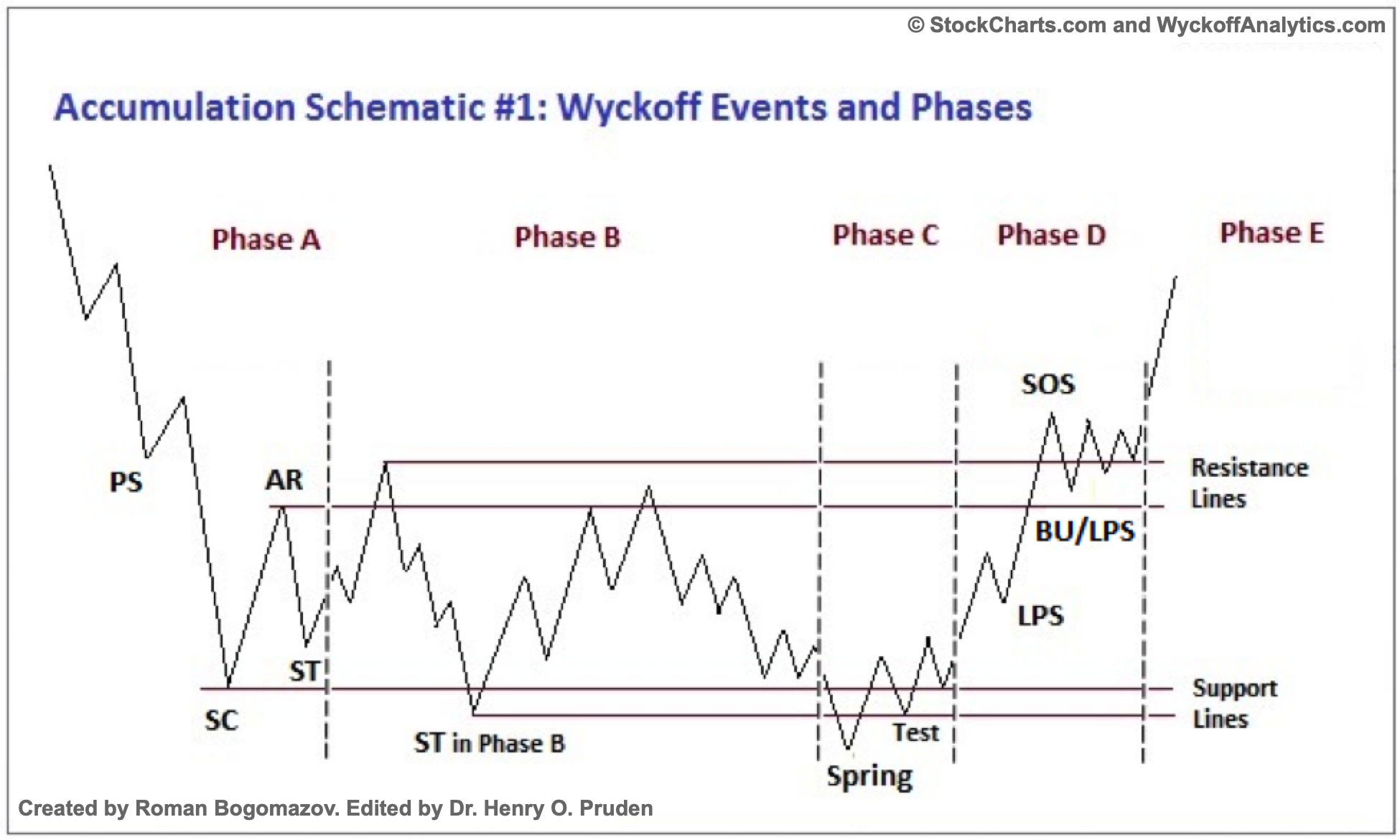

Remember all those wyckoff accumulation charts we saw in last year's mid year dip. It proved to be correct, I haven't seen any such analysis getting around now but things look similar. Has anybody seen any of that analysis done on this dip?

I seem to remember someone posting about it some days ago, basically saying that it looks good. I was posting about it before when it looked like wyckoff accumulation on the 4hr chart, though unconfirmed, but this structure has now been broken with the recent drop: Posting this again for some New Year Hopium. Recent bounce from $46K still looking like a "spring" for Wyckoff accumulation, even more so after creating new closing low on 4hr:  Based on the current price structure, it doesn't look like wyckoff to me, at least not on a line chart. On a candle chart, we'd be in Phase B at best, prior to creating a lower low:  As for current outlook, I'm personally not seeing $40K-$46K range as providing much support given the volume gap, even if a dead cat bounce could occur from here at any moment:  The $42.5K level is merely a "last line in the sand" before lower lows, similarly to how $46K acted as such after failing to find support and getting rejected by $48K MA support. The 0.236 fib retracement around $38K where volume lies and previous VPVR point of control around $33K-35K is more likely where a macro higher low would form imo, while taking more weeks to get there. Daily RSI is bearish, but not even oversold yet (like back in May) for reference sake, the Weekly RSI hasn't even turned bearish yet, as food for thought. There's plenty for room to the downside if price strength continues to weaken basically. Ultimately price closed below the 50 Week MA again and the bears followed through, breaking both support trend-lines, as well as MA support. Doesn't look great to me anymore to put it simply. At least the on-chain data still looks good, but price structure looks pretty f**ked now. Truth is, Bitcoin has never been continually traded below the 50 Week MA within a bull market, so best to hope for in the mid-term would be further consolidation at higher levels. Still not seeing any argument for $20K-$25K levels, even if entirely possible now (70% drop from high to low), but otherwise not seeing any buyers at current prices either. Ideally price drops hard and we get the crash over and done with as quickly as possible, somewhat regardless of how low it goes, rather than f**king around in no mans land. Just my opinion anyway. Hahahahaha I sent you a merit anyhow, even though I believe that you are overly pessimistic regarding the power of king daddy and the various fake outs.. ... and sure, you gave some good descriptions regarding your views and how you arrived at your views.. nonetheless, it seems to me that we have been here so many damned times that it is not even funny, and even AlcoHoDL's earlier post comparing early 2017 sentiment seemed to have similar kinds of technical arguments going on regarding the ONLY way is down.. blah blah blah.. I recall similar in April/May 2020 too (including the well-reasoned arguments that we would not likely see supra $10k for a couple more years).. and those guys did not do too well in terms of supra $10k coming a few months later, and then we know what ended up happening between September 2020 and April 2021, right? Anyhow, fuck that nonsense regarding price analysis is bleak blah blah blah.. but yeah, if it goes down, buy some more (if you dare).. and even buy some here (if you dare), it will likely pay off quite well in the coming 1-9 months, and if 1-9 months does not work out, at least it should be good 4-10 years down the road (as a back up plan in case the next 1-9 months do not work out so well). So I'm watching as the price keeps bouncing off the $42.5k support level. When things are going the other way and repeatedly bouncing off a resistance level, it means to sell at that resistance expecting to buy lower because it's very likely to break through and leave you holding less.

Am I reading this wrong in thinking I should hold off a bit longer to buy a dippier dip? My DCA isn't due until tomorrow anyway, so kinda asking for support for resisting a reverse FOMO buy. (I have occasionally pulled the trigger on DCA buys a day early beat out a weekend pump) I'm just not used to Downs yet as I'm still a bit new at this.

I doubt that any of us can really know with any level of high confidence.... although admittedly I am likely NOT the best person to ask .. even though I have my systems for buying, when I am in buying mode... which is a tendency to spread things out.. but of course, if you had not bought for a while, then you might get nervous about not having had bought any in the lower $40ks... or only bought a little. Sometimes if you are worried, then you might just do half or a third of the amount that you expect early.. just to hedge. |

|

|

|

|

|

log2exp

|

|

January 06, 2022, 08:50:52 PM |

|

In which country it is already Jan 8th, 2022, as of right now, it's only Jan 6th 3:50pm EST. Is he a time traveler? |

|

|

|

|

Mbitr

Legendary

Offline Offline

Activity: 1932

Merit: 1321

Bitcoin needs you!

|

|

January 06, 2022, 08:58:02 PM |

|

In which country it is already Jan 8th, 2022, as of right now, it's only Jan 6th 3:50pm EST. Is he a time traveler? Nice spot  They must be time travellers  Still time to apply for a job  |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 06, 2022, 09:01:37 PM |

|

|

|

|

|

|

psycodad

Legendary

Offline Offline

Activity: 1604

Merit: 1564

精神分析的爸

|

|

January 06, 2022, 09:04:04 PM |

|

@Bob: Year of the crab? Waddayamean?

Not trying to answer on behalf of Bob, but I understood it as reference to the sideways movement of crabs.. Ever seen Dr. Zoidberg getting agitated? That's where I myself learned about it   |

|

|

|

|

serveria.com

Legendary

Offline Offline

Activity: 2240

Merit: 1172

Privacy Servers. Since 2009.

|

|

January 06, 2022, 09:14:08 PM |

|

In which country it is already Jan 8th, 2022, as of right now, it's only Jan 6th 3:50pm EST. Is he a time traveler? FUD fail  |

|

|

|

|

suchmoon

Legendary

Offline Offline

Activity: 3654

Merit: 8922

https://bpip.org

|

|

January 06, 2022, 09:44:43 PM |

|

In which country it is already Jan 8th, 2022, as of right now, it's only Jan 6th 3:50pm EST. Is he a time traveler? Nice spot  They must be time travellers  Still time to apply for a job  It says nothing about posting Bitcoin-related memes, so most people in this thread will be fine even after Jan 8. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 06, 2022, 10:01:27 PM |

|

|

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3752

Merit: 3868

|

|

January 06, 2022, 10:08:41 PM |

|

|

|

|

|

|

matt4054

Legendary

Offline Offline

Activity: 1946

Merit: 1035

|

|

January 06, 2022, 10:17:22 PM |

|

In my experience, when the prices are falling all around the place, developers wake up from natural bull-market-induced laziness and come up with great new products. Not only ideas and hype, but actual implementations. I for one am looking forward to ETH2 going live, and all the rest of the major milestones to come in 2022. Keep your spirits high folks  |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2170

Merit: 1776

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

January 06, 2022, 11:01:27 PM |

|

|

|

|

|

|

|

Gachapin

|

|

January 06, 2022, 11:44:01 PM |

|

In my experience, when the prices are falling all around the place, developers wake up from natural bull-market-induced laziness and come up with great new products. Not only ideas and hype, but actual implementations. I for one am looking forward to ETH2 going live, and all the rest of the major milestones to come in 2022. Keep your spirits high folks  Wow...that's cool. I didn't know ETH - Swiss Federal Institute of Technology is opening a 2nd campus... Valuable info, thanks !  |

|

|

|

|

matt4054

Legendary

Offline Offline

Activity: 1946

Merit: 1035

|

|

January 06, 2022, 11:48:31 PM |

|

Wow...that's cool. I didn't know ETH, Swiss Federal Institute of Technology is opening another campus...

Valuable info, thanks !

Just to be clear I'm talking about ETH2, the next gen evolution of Ethereum that will make it scale like big time! I don't want to say more since you might be familiar with it already, I guess most readers of this thread are, but if you don't, it's worth a few minutes to Google it  About the ETH, I know we like on the same spinning rock of the milky way, but are you from Switzerland by any chance?  I am developing something right now which will hopefully eventually turn out just great. Cheers! |

|

|

|

|

|

Poll

Poll