The Gold Standard didn't have a supply crisis.

It had a inflation crisis, when governments printed receipts for more gold than they had in the coffers.

The governments, simply, engaged (like today) in massive counterfeiting and manipulation.

Thats same as a supply crisis. Same thing when Greece couldnt print their own currency to pay debts because they use Euros |

|

|

|

|

Same reason we still have landlines, vinyl records and fax machines

|

|

|

|

I explained wealth inequality as a relation between return on capital and economic growth.

No one cares about that. We all know, the money supply is being tampered with. The FRB is creating copious amounts of M3, advantaging the wealthy to the disadvantage of the poor who have no assets. Are you representing the interests of those that have assets and are wealthy? How can you justify this?!? Are you saying screw the poor? THESE ARE GENUINE QUESTIONS! I'm not representing anybody. I just think your thesis is barking up the wrong tree. To give rise to middle class you need to destroy capital and at the same time have growth. Growth could be birth growth. I never say screw the poor. But your idea of poor and mine are totally different. I don't want to limit money supply. I want the poor to have access to money supply. In order for someone w no assets to have assets they need access to loans & credit. That requires FRB. |

|

|

|

Where is your explanation Twiifm? I still don't see one. Your own charts show that the rich have stayed rich. This is what you say yourself: I'm not going to argue that FRB expands money supply because that's what it does. It is true that current wage inflation aren't in line w currency inflation. And thats why people feel pinched. That's because the money supply is being inflated to high heaven. And it is showing up in inflation AND rising asset prices. See London, New York and Beijing! Are you blind? or just working for the 1%? This is NOT rocket science. So, where is all that money going? Asset prices, that's where! What about the people who have no assets? And the middle income earners with debts? Why should rich people benefit at the expense of the rest of us?!? I explained wealth inequality as a relation between (R) return on capital and (G) economic growth. I'm a little drunk to explain. But you are too obsess w FRB when you should compared historical data of wealth inequality and historical data of FRB. See if you can spot any trends or correlations |

|

|

|

@acoindr the purpose of war is NOT to end it quickly. The purpose is to have victory over your enemies and make them legally comply by your demands afterward. That might take years so money is needed. No general can accept defeat because he didn't have enough money to win. I don't understand the basketball analogy at all. Economies need money and if money is limited economies cannot thrive. This is simple Viet Cong won the "American War". Vietnam became a Communist state after that. The deterrent would be a treaty. An agreement that we will not go to war. Something like NATO You overlooked my example of Pikertty research. Wealth inequality happens when R (return on capital) is greater than G (growth). pls refer to his research of empirical data  The middle class benefitted from post WW2 because the war destroyed capital and it reset the wealth distribution. I don't get what you are trying to say but hope these few lines emphasize what I'm saying |

|

|

|

The irony is the OP was lucky to be born in Australia. If you were born in a Third World Country you have no choice but to be poor.

At least in Australia you can work your way up the economic ladder.

No mate. The system here is also loaded up with debt, causing social breakdowns and wealth inequality. The system in the US, UK, Europe, China and Japan is worse because people don't understand FRB and they haven't been selling iron ore to china. I'm doing my bit to dispel any notions that FRB is meritocracy. No, FRB is purely aristocracy. Those new to this thread, please read the first post. No the irony is in Cambodia theres a guy saying the same thing about Aussie tourists. Your idea of "poor" is a gross distortion of reality from the point of view of someone who is actually poor. What you don't get is that FRB is doesn't cause poverty. Its not having access to money that keeps people from getting out of poverty. While you run around ranting about limiting money. Some poor schmuck in a Third World Country wishes money would flow more freely. What you really want is to monopolize money because you think rich people don't deserve to be rich. You're no Robin Hood, you just want to steal from the rich and give it to yourself. Don't pretend you care about inequality one bit It is a world wide problem when your currency is worth less each day. Some people are lucky enough that even at reduced value they still have it pretty good compared to poorer countries. That doesn't make any less of a crime. I will not happily take a punch in the face simply because other people have to take a kick to the groin. It is theft and the more vulnerable you all ready are the more it hurts. Its only a problem if money inflates when nothing else in the economy does. It is true that current wage inflation aren't in line w currency inflation. And thats why people feel pinched. However, the forces that contribute to this are not solely FRB. But other macro factors I have contention w the OPs thesis. He is basically saying financial capital earns more than labor capital. I don't disagree w this at all. What I disagree his he uses this fact to frame an erroneous political agenda. And then he portrays his crypto "ozziecoin" crypto as solution addressing the problem. What looks altruistic seems like a off handed way to promote and pump his own ozziecoin |

|

|

|

I wish twwifm would provide an EXPLANATION to the QUESTION. But he/she/it can't. All this person ever says is that FRB is not the problem. We have EVIDENCE! You have accusations and you sound like a lunatic. I want people to reclaim their money, in an economic system that does not benefit the 1%. My Chinese friends, I want to share something about what your money supply looks like. This is not a Western problem but you already knew that.  This is how the the illusion of wealth was created. And if you haven't read it, this is my explanation why: My explanation All that money has to go somewhere. You don't have evidence that FRB causes inequality you just have charts that show expansion in money supply. I'm not going to argue that FRB expands money supply because that's what it does. You want people to reclaim their money? What does that even mean? So you think you are entitled somehow? OK, heres a different thesis for you since you seem to be interested in econ but you don't really understand the economists you keep name dropping. Fist, you must forget about your fixation on FRB. Thomas Piketty just released a book about wealth inequality. His thesis is that when (R) return on capital exceeds (G) growth, the wealth consolidates because the wealthy make earnings on their capital. He came to this conclusion by collecting data over a span of about 200 years and graphed it. In 19th Cent, (G) was minimal (almost zero) and (R) was about 5%. Then inequality grew until WW1 & WW2. These events destroyed capital. In the period post WW2, we had low (R) and high (G). The effect of these forces compressed inequality and created more even distribution of wealth ushering in a larger middle class base. Then after 1970s to current again we have experience a greater divergence and record high levels of wealth inequality. Here are the some charts of his research:      |

|

|

|

How man people live to 100?

Wheres the chart of salary inflation?

Wheres the chart of housing prices?

Plenty people live long enough to lose money this way. The 100 in cash benefits your parents effectively give you when you are born is just 2 by the time you pass it on to your grandchildren. Some people would prefer if that wealth was still 100, they should not keep dollars then. Almost anything lasting in comparison looks better then 100 to 2 yet this is how gov alleges tax is due, by just keeping capital its avoiding inflation tax This is a system opposite to capitalism which is capital controlled by the people, it is now controlled in a centralised system I don't know anyone who keeps cash. Like in a mattress? Most people have an IRA or they have assets like real estate |

|

|

|

Baby steps. I mean can we at least get rid of the penny?!?! I mean seriously, if it can't buy anything, and no vending machine accepts it, get rid of the damn thing already. Even Japan, they have a 1 Yen coin. 1 Yen, what the hell can you buy with 1 Yen? At least that coin feels like a piece of plastic, the penny costs way too much to manufacture. And don't even let me get started with Canada. Oh fuck you Canada and your loonie and toonies. Nothing worse than being a man, buying something from the store, and getting a half pound of coins as change.

If you find 1909-1982 pennies you can arbitrage it. Collect them and sell it for the copper weight |

|

|

|

Yeah but you can't single out War Financing. If the govt cannot print money then nothing else can get financed (or limited financed).

Then how did the U.S. survive prior to 1913 when the Federal Reserve was created? Govts don't want the power to print money in order to engage in war. They want that power to finance whatever they want to finance

Governments want ability to print money to do whatever they (and their special interests, including war profiteers) want to do. This includes financing popular social programs which help politicians win election, but put a costly drain on the economy. Also you & Stefan are conflating separate issues. Wars still occurred when money was backed by gold. WW1 & WW2 are examples of huge wars that occurred when currencies backed by gold

That's our point. Governments did suspend gold standards and inflate for those wars. Check out the following: http://www.zerohedge.com/article/war-causes-inflation-and-inflation-allows-government-start-unnecessary-warsFrom Wikipedia: https://en.wikipedia.org/wiki/Gold_standardImpact of World War I

Governments with insufficient tax revenue suspended [gold] convertibility repeatedly in the 19th century. The real test, however, came in the form of World War I, a test which "it failed utterly" according to economist Richard Lipsey.[4]

By the end of 1913, the classical gold standard was at its peak but World War I caused many countries to suspend or abandon it. It was the newly created Federal Reserve in 1913 which inflated for WWI leading to a bubble facilitating the "roaring twenties". The subsequent popping of that bubble caused the stock market to crash in 1929 ushering in the Great Depression. World War II cost the U.S. 15 times more gold than it had in Fort Knox and the Fed. OK I get your point now and perhaps you are right. I'm glad you debated me. I had to go back and watch that video again and ignore the distraction of his political ranting to figure out what point he is trying to make. Still i think he must be some kind of nutcase to want to LIMIT money supply. Again, my point is you can't single out war finance when it comes to economics. And I don't agree that you can arrive at simple conclusions like "If we only limited money then the wars would only last a few months" If history has proven anything is that once war is engaged there is no stopping til someone wins. And the state will do whatever it takes to win. So I think he has the cause & effect backwards. Its not that govts print money because they want to wage war. Its that once war is engaged you have to print money to win at all costs. Imagine if you were Churchill, would you let Hitler occupy the UK cause you couldn't come up w couple hundred billion pounds? But as a argument for BTC I think war financing is a weak argument. Because if you limit money supply you limit ALL economic activity. I could easily make a counter argument that Federal Reserve System was necessary for the Industrial Revolution & the Information Revolution to happen because it modernized banking. But I won't because thats also a simplistic economic view In his talk Stefan longed for the "good old days" of the 19th Century. I don't know why he thinks times were better back then. Wealth inequality today is at historical highs since levels of 19th century. The wealth distribution was most even post WW2. So perhaps prices were more stable back then but less people had access to wealth. If you don't know about this economist, Thomas Piketty you should check out his work. He writes about wealth inequality. He actually says that WW1 & WW2 destroyed capital & reset the wealth inequality. If you look at empirical data -- these wars HELPED the middle class http://www.hup.harvard.edu/catalog.php?isbn=9780674430006http://www.businessinsider.com/charts-on-us-inequality-2014-4I think all this talk about gold standards & fractional reserve banking are all smoke and mirrors used by people who simply want to transfer wealth from one population to another --namely themselves. If you limit money supply then it becomes easier to one class to monopolize money supply. No difference than when Marxists tried to convince the proletariat to uprise against the bourgeois. If you want to stop wars then create stronger treaties. If you want to balance out wealth inequality then limit wealth monopoly thru progressive taxation. If you want to avoid systemic risk then regulate banking. Its not like these issues aren't being discussed and debated all the time by super smart people. Maybe the solution is already out there but there is no political will to make the changes necessary. In any case changes have to made made from within the system not by creating noise outside the system. BTC is a non-solution as far as I'm concerned because it ignores existing institutions that built over long spans of history. Maybe that's why Communism also failed. It doesn't work so lets destroy everything and start over is just crazy 20th Century 'tabula rasa' ideology. Who the hell wants to experience that again? |

|

|

|

The irony is the OP was lucky to be born in Australia. If you were born in a Third World Country you have no choice but to be poor.

At least in Australia you can work your way up the economic ladder.

No mate. The system here is also loaded up with debt, causing social breakdowns and wealth inequality. The system in the US, UK, Europe, China and Japan is worse because people don't understand FRB and they haven't been selling iron ore to china. I'm doing my bit to dispel any notions that FRB is meritocracy. No, FRB is purely aristocracy. Those new to this thread, please read the first post. No the irony is in Cambodia theres a guy saying the same thing about Aussie tourists. Your idea of "poor" is a gross distortion of reality from the point of view of someone who is actually poor. What you don't get is that FRB is doesn't cause poverty. Its not having access to money that keeps people from getting out of poverty. While you run around ranting about limiting money. Some poor schmuck in a Third World Country wishes money would flow more freely. What you really want is to monopolize money because you think rich people don't deserve to be rich. You're no Robin Hood, you just want to steal from the rich and give it to yourself. Don't pretend you care about inequality one bit |

|

|

|

|

Peter Schiff is annoying. He's just a gold peddler. I don't know why people let him speak on air.

|

|

|

|

|

The irony is the OP was lucky to be born in Australia. If you were born in a Third World Country you have no choice but to be poor.

At least in Australia you can work your way up the economic ladder.

|

|

|

|

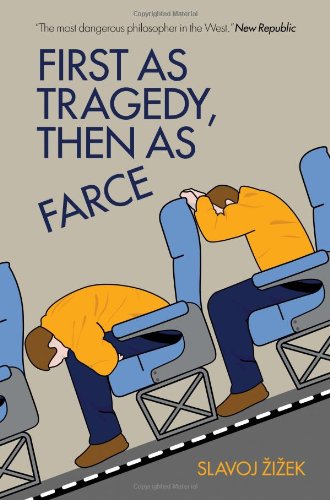

But a charity is more honourable Charity within capitalism is unethical, for the same reason that the WORST slave-masters were those who treated their slaves well! In doing so, they create the illusion that slavery is a tolerable condition. It's not! Likewise, wage-slavery exploitation is NOT a tolerable condition, and the only way we're going to get everyone to wake up to this reality is to STOP softening this horrible brutality with the breadcrumbs and blankets of charity! Damn, am I the only one here who actually reads?  OMG Zizek?? Didn't you get the memo that Post Modernism is passť now? |

|

|

|

The market operates following certain rules. You can exploit the temporary distortion in the market. The rigging of the system costs the ruling class a great deal money. The 2008 financial crisis is more like shark eating shark rather than shark eating small fish. Remember, being poor implies you have nothing for them to steal. Mo money. Mo problems -- Notorious B.I.G. |

|

|

|

|

Yeah but you can't single out War Financing. If the govt cannot print money then nothing else can get financed (or limited financed). Govts don't want the power to print money in order to engage in war. They want that power to finance whatever they want to finance

Also you & Stefan are conflating separate issues. Wars still occurred when money was backed by gold. WW1 & WW2 are examples of huge wars that occurred when currencies backed by gold

The flaw of his arguments goes like this:

Wars cost money

If money is limited then war is limited

Therefore, to limit war we should limit money

I could try to make a similar illogical argument

Wars are fought by soldiers

If less soldiers then less wars

Therefore, to limit wars we should limit soldiers

It seems to me he had a hypothesis about war finance & banking. Then he tried to connect BTC to that somehow. Poor academics for a guy who claims to be a "philosopher"

|

|

|

|

Borrowing, lending, and credit doesn't require fractional reserve banking. Now if you are a banker there is nothing better than lending someone elses money and keeping all (or almost all) the profits but it isn't a requirement.

If I have 1 BTC and I lend it to you that was done without fractional reserve banking. If someday Bitpay floats a 20,000 BTC, 10 year bond @ 3.5% interest that would be another form of lending that doesn't involve fractional reserve banking.

Lending doesn't require FRB but FRB frees up liquidity constraints. Modern banks create the loans first then they find the reserves afterwards to close out their balance sheets end of day. They either get the reserves from intrabank lending or if no other banks lend to them to go to the Central Bank. I agree w you there are a lot of examples of non-commercial bank lending. And there is a lot of "shadow" banking outside the Federal Reserve System. But I seriously doubt modern economies can run without FRB. The liquidity constraints would drive interest sky high |

|

|

|

|

Isn't SolarCity already doing this w rooftop panels?

|

|

|

|

Deathandtaxes did such a great job of explaining banking.

Just wanna add something to the topic. Even if BTC replace fiat USD, there will always be need for FRB banking services. The simple reason is most credit is for business rather than individuals.

Suppose you invented a widget. You save up a bunch of money by working and create a prototype. Then you get orders in the form of invoices. How are you gonna buy the supplies & and pay the labor to produce that order?

People will always need credit. Money has always existed as credit whenever there was an economy. Gold came after credit money. Then later gold proved to to inelastic when economies expanded quickly and demand for money outpaced supply

The problem is that labor, supplies and pay will never accept a debt BTC and if they do, we come back to the same cycle that sparked our today's situation that BTC wants to avoid. If there is credit between suppliers/business or employee/employers it will be because employee or suplliers believe in the project. And will be compensated for the risk they take, nothing like what we have today. In other terms, employee or supplliers might get paid in colored coins instead of BTC, which would be a very interesting application of it. You are right. Credit is a type of risk. So before banks give credit, the borrower has to show that they are credit worthy. You can put up collateral have co-signer, credit history/ rating, etc... I see the problem in this forum is that most people think of money in terms of commodity but in practical applications money is more like stock & flow. Economies can be broken down to goods - services - finance. Then you have govt as a regulator. Its impossible to remove finance & banking from the economy. So you are correct we always end up at the same place. But theres nothing inherently "bad" about this. You could create a banking system w colored coins representing convertible notes based on a BTC reserve. But in order to get to this point you have to convince people BTC is at the top hierarchy of money. In the past gold was at the top. The reasons are historical. But in modern economies it doesn't work like that anymore. In MMT the explanation for why fiat has value is because the govt demands taxes in form of legal tender. Fiat can collapse if the issuing state collapse. But as long as the state doesn't collapse then fiat is what everyone will use BTC derives value from speculation so if the speculation collapse the BTC will collapse. This is one reason why in its current state BTC is not useful as money. |

|

|

|

1. He claims "Historically, politicians have always fought for the power to create money out of thin air, so they can increase their spending without having to directly increase taxes."

Wrong -- Most wars are over land disputes, ideology, religion, economics or a combination. ...

Stefan didn't say politicians have always fought wars for the power to create money. You implied that. There are many ways to gain political objective without fighting war. ... Please name one war fought over the issue of printing fiat. He certainly didn't ...

The Iraq War. Was Operation Iraqi Freedom fought over land dispute? Ideology? Religion? Economics? That's certainly not what we in the U.S. were told. Iraq is nowhere near our borders. We were specifically told it was over weapons of mass destruction (WMD), and further we knew where they were. Although I wouldn't hold my breath for an official government explanation of what went wrong let me propose a guess. Let me first remind viewers Americans in general didn't seem to be clamoring for war over WMD. There was also the Rwandan Genocide in 1994 where 500K to 1M were killed with no intervention from the U.S. If we are so concerned for the well being and slaughter of distant people, why not? The real downfall of Saddam Hussein was interests of a powerful nation (the U.S.) were aligned against him. An empire the size of the U.S. which doesn't produce much domestically needs something else to export to sustain a debt fueled economy: war. The Iraq war cost over 2 Trillion dollars of additional U.S. debt. Second, as Stefan mentioned there are those who do profit from war and somebody got paid from those dollars. Third, Saddam proposed selling oil for euros which threatened the petrodollar. While Iraq wasn't the world's biggest oil producer, others could get ideas and Iraq was small enough to be made an example of. Combine all this with the fact Saddam wasn't the most saintly ruler and you probably have the real basis for that war. Now that explanation I'd argue makes far more sense, and is certainly about the ability to continue printing fiat (the U.S. dollar). ... 2. Trotsky, Lenin, Pol Pot, Mao Zedong, Ho Chi Minh, Pinochet, Castro, etc.. These guys had nothing to do w banking. They are astute politicians and fierce military guys. Their power didn't come from raising money but politics and convincing people to follow them.

I'd agree with the fierce part. ... 3. Limiting money limits govt from printing to pay for war. Wrong again. Govt borrow money for war by selling (war) bonds. Or maybe raise taxes. Or they might borrow it from foreign banks. No govts can just print money for no reason. They can increase money supply in form of gov debt though.

You're missing the point. It's not printing money that restrains government. It's cost. The two are not the same. If the barometer for what people use as money is gold, something which government can't simply create to dish out, then people will feel the cost of things like war in a more pronounced way, rather then gradually over years by inflation. ... Anyways it was a goofy speech. ...

Maybe the speeches of George W. Bush in the lead up to the Iraq War were more to your taste. I took that quote right off the youtube page. Iraq War was about economics and land grab of oil reserves and strategical positioning in Middle East. If you follow the careers of Bush-Cheney-Romsfeld & PNAC you can see where the ideology comes from. But besides the point it has nothing to do w his speech. BTC would have not prevent Iraq, cause Iraq has nothing to do w whether Fractional Reserve Banking exists or not His speech was about how the power of govts to print money and in return this pays for wars. This hypothesis is so wrong because he is drawing causation where there is none. Wars existed before the Govt could print money. Wars don't have to be paid by govt money. Most Communist uprisings aren't paid for by govts or bankers He tries to portray that he discovered some "alternative" view of history that's somehow hidden from the masses. However, his views is not supported from rigid research. Maybe it appeals to you, but to me it's very weak academics. The guy is a shock jock. He's not as bad as Alex Jones and that ilk. I'll give him that. |

|

|

|

|