Yeah I'm a big fan of Taleb. What does this have to do with the topic? |

|

|

|

Its no secret that banks create money from loans (out of thin air). But they don't need FRB to do this, its just a balance sheet operation. And the fact that they do this is NOT bad. In most cases its done cause people need to borrow money. The WORSE thing that can happen is if NOBODY is willing to borrow money and the economy comes screeching to a halt. Read this article to understand how banks create money. From the horses mouth. http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdfNow the idea that FRB creates inequality that's hogwash. Inequality is a side effect of free market Capitalism. The more money you have the harder it is for others to compete w you, every child who has played Monopoly understands this. That's why in places like USA there are anti-trust regulations. I laugh at all the bitcoiner BS here. They are all as greedy as any other Captitalist except they pretend to rail against the "1%" so they can lure the lemmings into driving up price of BTC. If you are really concerned about inequality then you should spend your time figuring how to redirect money flow from rich to poor. Not spew BS about how some banker is stealing your money. Bitcoin is not the answer to any economic problems in the world. It might become a useful tool to transmit money -- and that's all it'll ever be Seeing as you laugh at all bitcoiners here, and one presumes you don't laugh at yourself, which therefore means that you are not a bitcoiner. So mate, what are you??? lol And what are you doing here? lol I'm an options trader w background in economics & finance. I'm here to warn people to stay away cause some bucket shop operation phoned up my very old and retired father to try to sell BTC investments. I get the feeling that the Bitcoin world is full of scammers as bad if not worse than Wall Street. I've seen the same crap in penny stock land all the time. Wolves pumping & dumping on newbies. Like you pumping your ozziecoin Options trader. Haha. You're in the biggest ponzi system on the planet mate. Let me prove it to you: Libor = rigged Metal markets = rigged Short term interest rates = rigged Long term interest rates = rigged FX markets = rigged You worried bitcoin? Seriously??? FRB is stealing from your father by paying him ZERO interest my friend. When we get the ozziecoin blockchain to the Australian public, we're going to have every accountable on the Blockchain. Give up dude. Your too stupid to understand finance and economics. Everything you post sounds like its coming out the mouth of a High Schooler who just watched a Zeitgeist video on YouTube. My father doesn't keep his money in a savings account you fool. He has a income generating portfolio catered towards retirees. |

|

|

|

Its no secret that banks create money from loans (out of thin air). But they don't need FRB to do this, its just a balance sheet operation. And the fact that they do this is NOT bad. In most cases its done cause people need to borrow money. The WORSE thing that can happen is if NOBODY is willing to borrow money and the economy comes screeching to a halt. Read this article to understand how banks create money. From the horses mouth. http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdfNow the idea that FRB creates inequality that's hogwash. Inequality is a side effect of free market Capitalism. The more money you have the harder it is for others to compete w you, every child who has played Monopoly understands this. That's why in places like USA there are anti-trust regulations. I laugh at all the bitcoiner BS here. They are all as greedy as any other Captitalist except they pretend to rail against the "1%" so they can lure the lemmings into driving up price of BTC. If you are really concerned about inequality then you should spend your time figuring how to redirect money flow from rich to poor. Not spew BS about how some banker is stealing your money. Bitcoin is not the answer to any economic problems in the world. It might become a useful tool to transmit money -- and that's all it'll ever be Seeing as you laugh at all bitcoiners here, and one presumes you don't laugh at yourself, which therefore means that you are not a bitcoiner. So mate, what are you??? lol And what are you doing here? lol I'm an options trader w background in economics & finance. I'm here to warn people to stay away cause some bucket shop operation phoned up my very old and retired father to try to sell BTC investments. I get the feeling that the Bitcoin world is full of scammers as bad if not worse than Wall Street. I've seen the same crap in penny stock land all the time. Wolves pumping & dumping on newbies. Like you pumping your ozziecoin |

|

|

|

Its no secret that banks create money from loans (out of thin air). But they don't need FRB to do this, its just a balance sheet operation. And the fact that they do this is NOT bad. In most cases its done cause people need to borrow money. The WORSE thing that can happen is if NOBODY is willing to borrow money and the economy comes screeching to a halt. Read this article to understand how banks create money. From the horses mouth. http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q1prereleasemoneycreation.pdfNow the idea that FRB creates inequality that's hogwash. Inequality is a side effect of free market Capitalism. The more money you have the harder it is for others to compete w you, every child who has played Monopoly understands this. That's why in places like USA there are anti-trust regulations. I laugh at all the bitcoiner BS here. They are all as greedy as any other Captitalist except they pretend to rail against the "1%" so they can lure the lemmings into driving up price of BTC. If you are really concerned about inequality then you should spend your time figuring how to redirect money flow from rich to poor. Not spew BS about how some banker is stealing your money. Bitcoin is not the answer to any economic problems in the world. It might become a useful tool to transmit money -- and that's all it'll ever be |

|

|

|

it's fraud and it's bad.

Consider this:

You store $100 at the bank

the bank uses that $100 as a security to grand a $1000 loan to someone else. So the bank magically makes $900 and gambles with your money.

The bank now also expects the $1000 'back' (while it was never their possession in the first place) and on top of that they also charge interest on it.

So they actually make money on money that never existed in the first place. That's pretty much counterfeiting.

Umm. Thats not how modern banks work though. Besides if they don't do this then how do people get loans? |

|

|

|

It's fraud because you're lending out money that you're also making available for withdrawl simultaineously. If too many people exercise their rights to deposits the whole system falls apart, That's exactly like a Ponzi.

Is insurance fraud too? No, because insurance payouts involve meeting the criteria of the policy, and there is nothing to stop insurance companies from borrowing money to meet unexpected obligations, much like for example any other company responding to a sharp unexpected increase in costs. In the case of regular banking, all deposits are liabilities that the depositors are entitled to collect at any time. It's not necessarily fraud for a business to find itself in a situation where it can't meet all its liabilities. But banking is actually designed from the ground up such that they intentionally can't meet the liabilities they've explicitly accepted. Say what? If a bank takes in your deposit and loans out 900% of that as FRB. The loan is an asset-no? BTW this is not how it works. But I'm trying to use YOUR logic. How is it you think banks are designed not to meet liabilities if their assets exceed liabilities due to being able to create new money |

|

|

|

It's fraud because you're lending out money that you're also making available for withdrawl simultaineously. If too many people exercise their rights to deposits the whole system falls apart, That's exactly like a Ponzi.

Is insurance fraud too? |

|

|

|

So what? And lots of smaller banks became insolvent throughout history. Most people rather give bail out than Great Depression 2.0. Dont get your point. You act like FRB is some big secret. Then you conclude banks make money "without lifting a finger". Either cause you don't understand what the business is or you're trying to scare suckers into your Ozzie coin |

|

|

|

Isn't that just a thesis paper? The guy describes how to apply ANN to price prediction and concludes that its fairly accurate. But nowhere in the paper he gives evidence

I looked on your site where you compare 24h results compared to actual price and none of the data points were exact. Most of your predictions were below the actual price. Only one or two times you got it right. How can you claim that you predicted anything?

More importantly how can someone make money trading this info?

Read the paper again, they describe experiments that they ran to predict stock prices on a data set. If this study doesn't satisfy you just choose one of the dozens of others on the same subject. You really expected the predicted prices to be EXACTLY correct? I never claimed this to be true and, in fact, the average margin of error implies that the exact opposite is the case. I've never claimed that you can make money predicting with the data on my website, nor have I claimed that it is always accurate. I've explicitly said multiple times (and on the website itself) that I don't know whether or not you could make money trading based on this model, and that the predictions are not always right. I really don't know what point you are trying to argue here (not that this is even an argument). I've explained to you why you are wrong about prices being unpredictable and I've explained to you why we know with certainty that there are patterns in the data. It seems like you are just trying to argue about my site for the sake of arguing yet you don't really have any points, so I don't know what you are doing here. You haven't shown prices are predictable. Nobody has. If somebody could do this theyd win a Nobel Prize |

|

|

|

Here, I found this from literally 10 seconds of Googling, most of which was typing in the search query: http://www.cs.berkeley.edu/~akar/EE671/report_stock.pdfThe predictions are absolutely not consistently wrong, as is proven by the charts showing predicted prices against actual prices. And even if it were consistently wrong, this would be just as useful as if it were consistently right. If it were consistently wrong, how would the 24 hour prediction have an average error of under 1.3%? Edit: Seriously if you just google this there are tons of other studies and articles on the subject as well. Isn't that just a thesis paper? The guy describes how to apply ANN to price prediction and concludes that its fairly accurate. But nowhere in the paper he gives evidence I looked on your site where you compare 24h results compared to actual price and none of the data points were exact. Most of your predictions were below the actual price. Only one or two times you got it right. How can you claim that you predicted anything? More importantly how can someone make money trading this info? |

|

|

|

Isn't it the fact that because of the way fiat currency is structured it needs to be centralized or else it fails. If it isn't backed by gold or something else it's intrinsic value will always go to 0. I hope you guys understand what Im saying (I'm Dutch and have some problems with my English).

Yes that's how Central Banking works. Banking has evovled to this state. Its not perfect but better than the decentralized systems we had in past |

|

|

|

WTF? You going on about. I own 3 building in Brooklyn. My point is if he thinks being a landlord is "a guy who makes money w/o lifting a finger", then he is a naive child. Being a landlord is A LOT of work.

Sorry mate, you do not even rate on the scale of landownership: http://www.businessinsider.com.au/worlds-biggest-landowners-2011-3?op=1 Below those people are the aristocrats. Below them are other very large land owners. Then maybe you fit in below them. Then the ordinary workers who have zero chance of getting anywhere. Please, less personal insults. It's a sign of maturity. Who said I was an aristocrat? You say landlords don't need to work. I'm saying they do. Banks also take risk when they create loans. There is few instances where people make money without lifting a finger. Maybe BTC speculators can be said to do that. But they'll tell you they are taking risk as early adopters You just sound envious |

|

|

|

I thought he wanted his BTC to stay the same value in the future. That's why I said collar.

But they're not his bitcoins. He sold them. He wants to buy them back at a guaranteed price in the future. Hence a call option is the way to go. oh OK i was confused. yeah buy a call at a $10 strike |

|

|

|

You can use logic to determine markets are random walk/ unpredictable. Markets can be broken down to individual players. Each player only has 3 possible moves sell-buy-hold. All players play to make profit. The players only choice is follow trend, be contrarian or neutral. Any given day more players join or leave. The only time anything is predictable is when you get a volatility spike or dip and volatility always revert to mean. This usually happens on significant news. Most experienced traders know this from trading everyday.

Or you can also just use Occam's Razor. If markets were predictable then everyone would be doing it. If everyone did it there would not be a market.

Since I first commented in your thread a month ago I tried to Google "neural networks" and market prediction. Seems like this was tried for a while in late 80's wary 90s but no big firms believe in this method. The big trading firms have all the money to hire the best scientists & mathematicians in the world. If they don't believe in it then it probably doesn't work. Most of the "quants" in Wall Street are hired to calculate statistical probabilities. They make trading decisions based on long term statistical strategies like "statistical arbitrage" or they try to determine if the derivatives are correctly priced or not using concepts from Game theory, Kelly criterion gambling, etc.. This is not the same as price prediction! I only see some fly-by-night amateur website or youtube channel claiming to be able to predict price using "neural networks". And from what I've seen it's just some lame technical indicator.

What I learned about "neural networks" is that its mainly used to teach computers to recognize patterns. Things that humans have no problem doing like speech recognition. Seems to me like you are misapplying "neural networks" here. First you claim that computers are better at recognizing patterns than humans. This first point is already debatable. Second you argue that there are patterns in market prices. This is the Technical Analysis argument. There might be some patterns occurring some of the time but its not consistent enough to create a complete trading system. And since most trading firms are moving away from technical analysis and towards quantitative analysts, it should tell you that quantitative trading is far more profitable than technical trading. Fundamental analysis is still dominant for the "investing" world though.

If you Googled neural networks then you should have found the numerous studies where they were used for stock price prediction successfully. Neural networks were not used much at all in the 80s. They were first created in 1943 and then barely used again until the 1990s/2000s. But this is irrelevant. You are not the first person to make the statement "If price prediction were possible, everyone would be doing it". I'm sorry to be a dick here but this is just an extremely stupid statement. There are tons of things that are possible that not everybody is doing. One project that I was thinking of doing at one point was writing a mobile app that could recognize and identify bird calls (which there is a high demand for actually, and does not yet exist). I didn't follow through because I didn't have the data that would be required, but it is absolutely 100% doable. If we can recognize human speech and we can recognize music then we can definitely recognize bird calls. The statement that everybody would be doing this makes the false assumption that everybody knows how to do this and has the resources to do so. That is obviously false. Furthermore, as someone who has a much better understanding of neural networks and their uses than you do, I can assure you that they do things that humans can't even come close to doing. Yes, they are used for speech recognition. They are used for computer vision as well. In fact, the first time I created a neural network was to recognize hand-written digits. It performed better than a human. Neural networks can solve the traveling sales person problem, which humans are obviously very bad at. They can be used for image compression. They can be used for countless other applications. As I've mentioned, commodity price prediction is also one of the standard uses of neural networks. This isn't something I'm inventing. However, I'm trying to be innovative in the manner in which I am applying neural networks. This is far from a "misapplication". You argue that there are no consistent patterns in price fluctuations. The mere existence of my project 100% proves this wrong. My software finds patterns in the data, and these are patterns that no human could ever find. You are basing your arguments and assumptions here on what you see and believe as a human looking at an insurmountable amount of data. If my software was not finding consistent patterns, it would not be able to attain the average error figures that it does. It seems like you are just dismissive of neural networks because you don't understand them. It is one thing to be a bit skeptical, but don't judge something unless you understand it. I can tell that your "research" of neural networks was extremely limited, so I recommend actually learning a bit about them if you are going to try to make an argument against their effectiveness in this application. Hey I'm open minded so show me a link where neural networks were used as successful trading system. If your program can find these patterns then why are the results consistently wrong? Either there is no pattern or the patterns are too inconsistently occurring to generate a useful prediction |

|

|

|

If you had stock you could do a "collar" with options.

No, a collar is where you hold the asset, but don't make or lose money if the price changes, which isn't what the OP wants. Though either strategy requires an options exchange, and there isn't one for bitcoins as far as I know. If I understood correctly, you could do this with a service such as btc.sx.

Explain how. They only do leveraged trading as far as I can tell, not options. I thought he wanted his BTC to stay the same value in the future. That's why I said collar. |

|

|

|

Nobody gets rich without lifting a finger except lottery winners.

Banks take on a lot of risk to give loans. If the lender doesn't pay the banks can go insolvent

I can name at least three groups that get rich without lifting a finger: 1. The aristocracy/landlords 2. The resource owners - oil, water, various monopolies and oligopolies (who are also often owned by the aristocracy) 3. Bankers who basically shuffle paper to create loans and money out of thin air Seriously, it does not take a genius to calculate credit scores and lend out money. All that infrastructure was built decades ago. Ha! You think it's easy to be any of these things? Keep dreaming. I own 3 apt buildings and it's a lot of work. I have to maintain my property, chase down late rent, taxes, stressing about about my mortgages and falling real estate prices. I deal w all kinds of unexpected sh*t. Are you a slum lord in Detroit or something? There's many people here on Bitcointalk (and in society as a whole) who either own rental units or buildings, and nobody shares your opinion. If you hate chasing down junkies who are late on their payment, then get a building manager. As for taxes - most of here are presumably adults and file taxes (including tax on rental income). If you hate doing your taxes then seek a CPA or tax accountant like a normal sane person. Though if Bitcointalk is any indication - there's always been a minority of money nutters here who think of crazy ways to save money, when they're only stressing themselves out over a few bucks. WTF? You going on about. I own 3 building in Brooklyn. My point is if he thinks being a landlord is "a guy who makes money w/o lifting a finger", then he is a naive child. Being a landlord is A LOT of work. |

|

|

|

|

no that's a graph of CONSOLIDATION not CENTRALIZATION

|

|

|

|

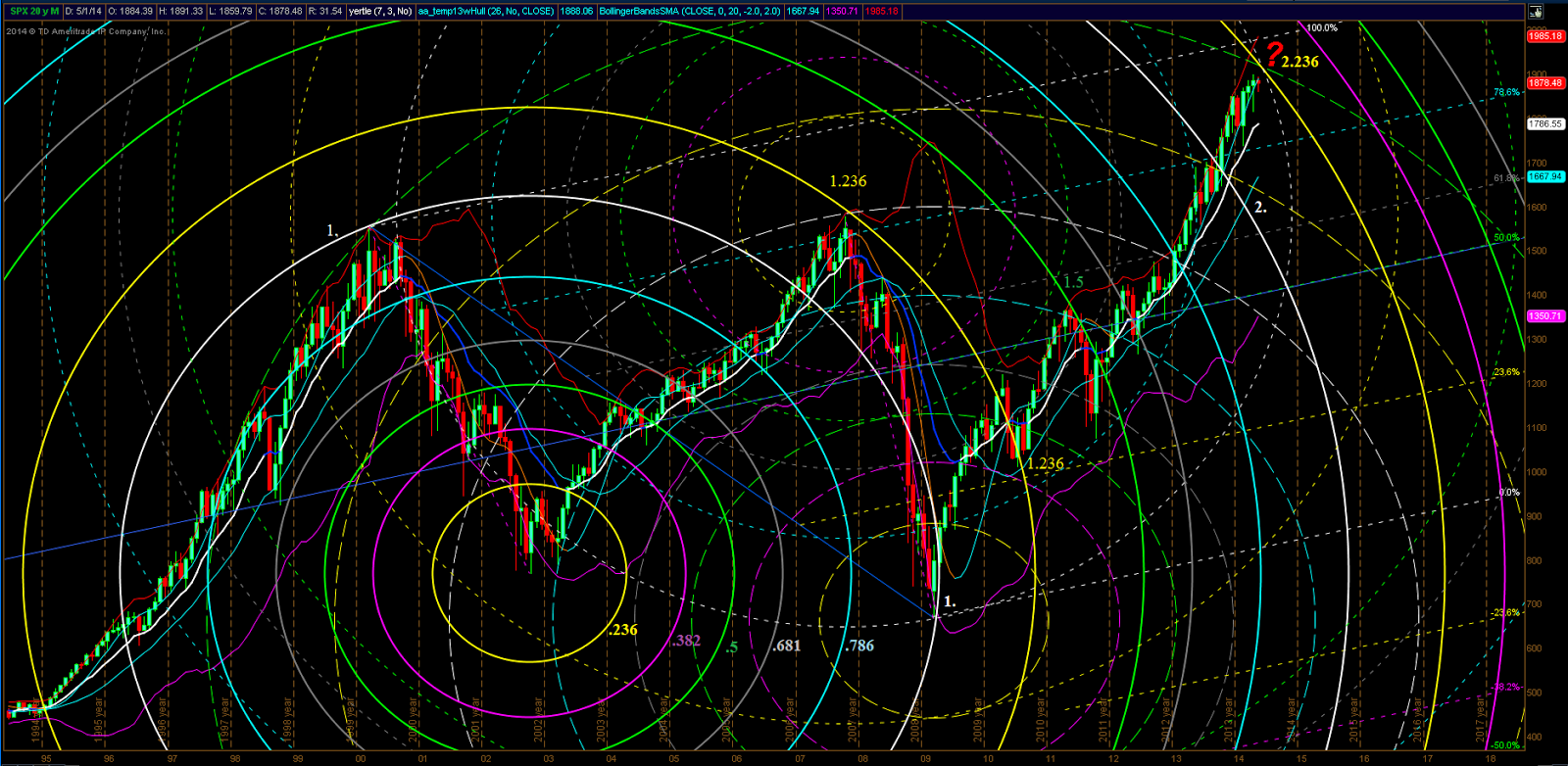

Speaking of fringe... hope I don't make anyone dizzy with my chart correlating this current May's price action on the S&P500 according to fibonacci arcs. I have been watching this pricepoint & month for a long while on this chart and now that it's all but completed, I'm waiting for enough information to pick new targets.  BTW how to you use Fib Arcs? I use Fib retracements and extensions all the time. Never use the arcs or time series |

|

|

|

|

Everyone is expecting a correction. Crash? Not unless WW3 or something of that magnitude happens

|

|

|

|

|

Unfortunately there's no way to do that. If you had stock you could do a "collar" with options. Mark Cuban did this w Yahoo stock ages ago

|

|

|

|

|