|

1081

|

Bitcoin / Development & Technical Discussion / Re: The Lightning Network FAQ

|

on: July 16, 2023, 01:38:27 PM

|

OP, probably good to remove BlueWallet and add Mutiny. What is Mutiny? It's the first self-custodial lightning wallet that runs on the web! Control your funds on an open standard that does not depend on Apple or Google app stores. No downloads are needed! We've set out to solve the onboarding problem for Bitcoin no matter who you are, where you live, or what device you are using. And because funds are fully in your control, there's no need to provide identity to a regulated institution. This is what it looks like to make Bitcoin accessible to the 5 billion global internet users with access to a web browser. https://blog.mutinywallet.com/mutiny-wallet-open-beta/I haven't looked closely at all the details on how it actually works but a "self-custodial wallet that runs on the web" means you store your keys in your browser? Probably not a good idea for big amount of Bitcoin. Haha. Although trade-offs taken by their developers does make it easier for new users and does help solve the onboarding problem. |

|

|

|

|

1082

|

Economy / Speculation / Re: Bitcoin - The road to a SIX DIGIT price valuation

|

on: July 16, 2023, 01:22:20 PM

|

~snip~

OK, so the Giga-Chads have already opened a debate about the issue.

There's also another shower thought that I brought up before. What if the banksters and institutions like BlackRock hold more than 50% of the Bitcoin in circulation, and increasing. Could be say that Bitcoin as a currency has failed?

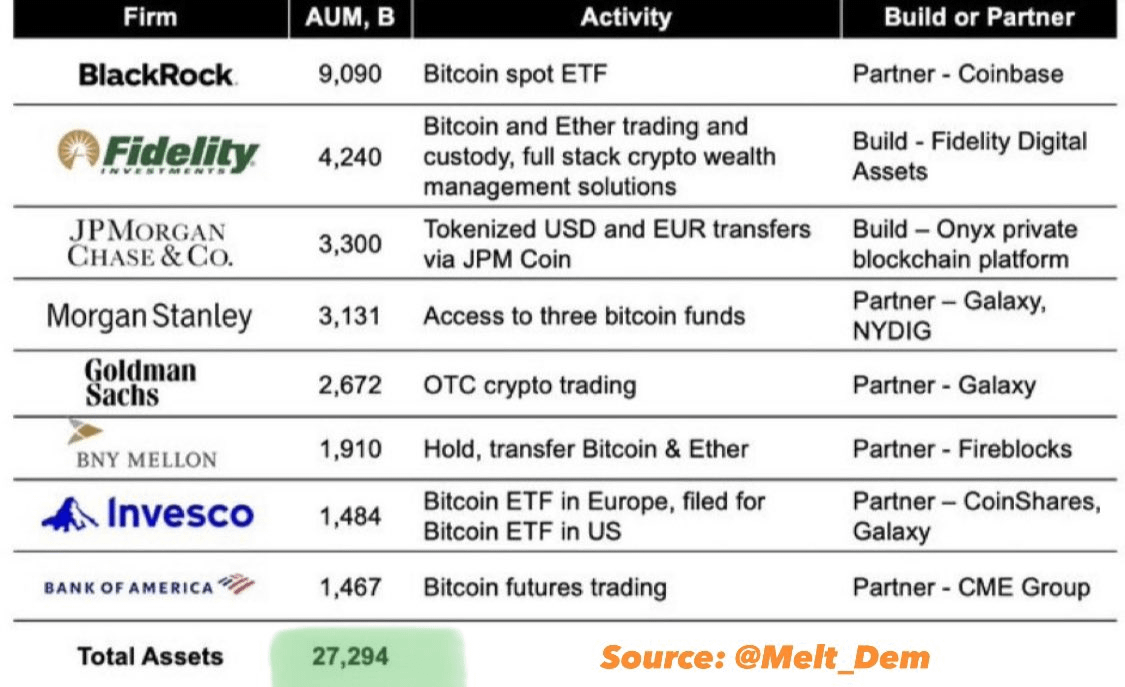

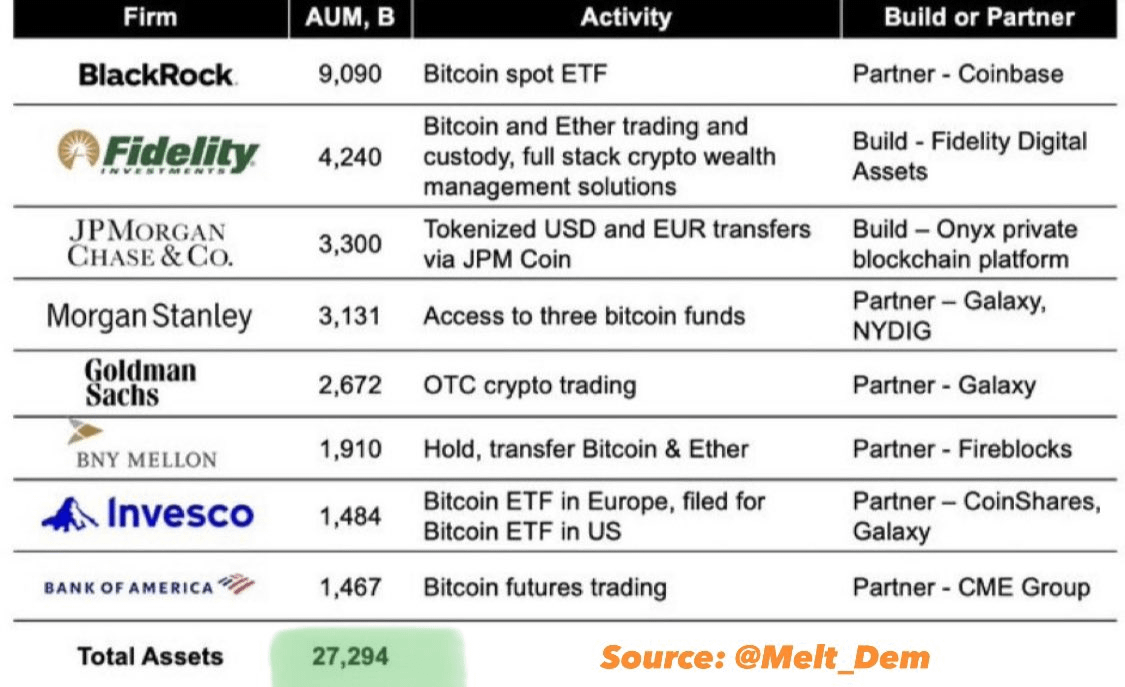

Bitcoin will always remain available to ordinary people even in the event that someone owns 50% or more coins, and that means that the idea on which Satoshi designed the whole thing will still exist. As for the question of whether Bitcoin has failed as a currency, it's highly debatable, but I believe we can agree that most people don't perceive it that way. It remains to be seen what effects the possible spot BTC ETF will produce (short-term or long-term), but I personally hope that there will always be a certain percentage of people who will follow Satoshi's vision and will not deviate from the basic ideas - which means that Bitcoin will always represent what it represents today. But how high is the threshold before it truly becomes concerning? More than 80%? 90%? Bitcoin is a limited resource and there's twelve out of twenty of the biggest investment banks and asset managers in the world that wants to gain custody of Bitcoin in some form.  Altogether they control TRILLIONS of wealth. It's probably why Bitcoin developer Peter Todd has currently been saying that he's open to the idea of an inflationary cryptocurrency. |

|

|

|

|

1083

|

Economy / Economics / Re: "Prepare for deflation in 2023"

|

on: July 14, 2023, 07:46:35 AM

|

|

To all those people in the topic who mentioned that inflation is still high in their particular countries/regions, my reply for that I would say wait for two things.

- Aggressive rate hikes that would bring forth Deflation or a Recession

OR

- Aggressive price increases which would bring forth Stagflation, then rate hikes, then a Deflation + Recession AKA Depression

OR

The Cabal responsible for your country's monetary system might be "wizards" and everything will be solved without any serious issues. Haha.

|

|

|

|

|

1084

|

Economy / Speculation / Re: Bitcoin - The road to a SIX DIGIT price valuation

|

on: July 14, 2023, 07:21:17 AM

|

It isn't realistic in the long term, or for just the next bull cycle? If your answer is a "No" for both, then I can't say that I agree. I believe QE/Brrr-Money-Printing, the possbility of multiple ETFs, and the Market Mania by investors during the next bull market in 2025 will all be enough to make Bitcoin surge to $500,000. If I'm wrong, OK. But it wouldn't be wrong to keep buying the DIP NOW, and HODL. Plus I wouldn't trust Robert Kiyosaki and other book sellers like him. Most of the time, they're merely there to sell their books. There could also be another hash war and if BlackRock and its cartel of ETF issuers have the same proposal in each of their registration statement, they may have some impact of their own on what's to be considered "The Bitcoin". Because they could follow one fork and threaten to dump the other side of the fork. What if the other side they plan to dump is Bitcoin, BTC?

I understand people who think that the spot BTC ETF should have a positive effect on the price, but apparently there are very few who think at all about the far-reaching consequences when it comes to such big predators as BR or Fidelity. I have never read the requirements for the BTC ETFs in detail, but it would be interesting to find out if any other company had a similar text in its conditions, or is this something that BR did first? There is an old post on Reddit written by admin @theymos 4-5 years ago on the subject of BTC ETF, I have quoted it several times on the forum, and somehow it seems to me that it could be the closest to the truth. Agreed, an ETF will almost certainly turn into a disaster at some point. The coins will be stolen, forks will be handled controversially, there will be issues with fungibility (eg. someone will "trace stolen coins" to the ETF's stash), the world will freak out when a bunch of retirees lose their life savings after doing the equivalent of buying BTC at $20k, etc. etc. It'll also get the sort of people who love regulation more into BTC, which is never good.

But investors want it, so it'll probably happen eventually. In particular, I totally condemn trying to get regulators to interfere in the free market more than they already do by blocking any ETF. (When the SEC was last looking into this, I had actually written a long document that I was going to send to them in order to comment on many technical issues with their proposed Bitcoin ETF regulation, but I decided not to send it because I don't want to have even the slightest hand in regulations.)

An ETF probably will increase the price a lot (until the ETF suffers its near-inevitable catastrophe), which has some pros and cons.

Note that an ETF can't affect Bitcoin itself, just the ETF investors and the market. There is no voting of any sort in Bitcoin, so it's not as if holding a lot of BTC gives you any power over Bitcoin, for example. I do agree with Andreas that the creation of a "corpo-Bitcoin" seems probable, perhaps after the ETF loses a ton of BTC and wants to undo it. https://bitcointalk.org/index.php?topic=5153962.0OK, so the Giga-Chads have already opened a debate about the issue. There's also another shower thought that I brought up before. What if the banksters and institutions like BlackRock hold more than 50% of the Bitcoin in circulation, and increasing. Could be say that Bitcoin as a currency has failed? |

|

|

|

|

1085

|

Bitcoin / Bitcoin Discussion / Re: Bitcoin documentaries that worth to watch

|

on: July 13, 2023, 08:51:59 AM

|

It will no longer be educating newcomers about bitcoin and its awareness without supporting it with documentary movies so that they can gain a thorough understanding of what they need to know more about. I now have a collection of documentaries that I can share with others and store for individuals who might be interested in learning more about bitcoin in the future. thank you all for sharing these documentaries, folks. I don't know how to express my gratitude to you all Documentaries are good, but the community shouldn't stop guiding newbies by providing them the right information, and having them listen to the right people. Anti-Bitcoin trolls, and their sock puppets, are always playing 4D Chess, pretending to be "good" when in fact they spread misinformation. Some good blogs for newbies to start reading are, - https://medium.com/@beautyon_- https://murchandamus.medium.com/- https://notgrubles.medium.com/ |

|

|

|

|

1087

|

Economy / Economics / Re: "Prepare for deflation in 2023"

|

on: July 12, 2023, 03:00:14 PM

|

|

Bump. CPI is 3% for the month of June, the lowest inflation since March, 2021.

Plus a new narrative if we can call it that - Apollo's Chief Economist, Torsten Slok, says that because Federal Reserve rate hikes take 12 to 18 months before its real effects could be seen, he theorizes that a recession is a more probable result than a soft landing.

I actually thought we would see reinflation happen for June after Jerome Powell paused for that month. Perhaps now we might see deflation happen earlier than expected if Slok is right?

|

|

|

|

|

1088

|

Economy / Speculation / Re: Bitcoin - The road to a SIX DIGIT price valuation

|

on: July 12, 2023, 01:43:44 PM

|

Struggling to come up with anything new to say about ETFs, but the first response to your OP covers the main meat. Institutions aren't sitting around waiting to get into Bitcoin, they already did. OTC has always been enough to sate institutional appetites, and even without ETFs, there are numerous ways to bet on Bitcoin without owning any (that satisfies what institutionals want anyway).

They wanted to bet on price, not own any. ETFs may have been the easiest route but the emergence of CME CBoE etc proved that the demand wasn't as the door-pounding ravenous hunger that we were told to expect.

Why should this be any different?

Point taken, I'm just making a simple comparison with Gold when it first had an ETF during 2003 and how it might probably end the same way with Bitcoin. If you didn't do it yet, do max zoom out on Gold's chart and look at the price movement starting in the year 2003.  I admit that I might be wrong, but with just 21,000,000 Bitcoins in existence partnered with an increasing money supply, it's hard not to see SIX DIGITS. |

|

|

|

|

1089

|

Economy / Economics / Re: The precondition for knowing when the Federal Reserve stops raising rates

|

on: July 11, 2023, 02:55:04 PM

|

I don't think Powell wishes to break things to bring the inflation down, with him not getting the desired results this present a big dilemma for both the FED and the Government, it is not a good sign knowing fully well that the election is coming, if the economy is not doing well what are they going to use to campaign, but the job of the FED is to make sure they have the monetary system under full control. I have a feeling they are going to raise the interest rate by 0.25%, the last time I checked there is 85% chance of this happening before the next quarter and with rumour of Ukraine-Russia war coming to an end we are likely to inflation coming down and likely doge recession

I believe no one wants to break the economy to bring inflation down, but the same as the other economic events when inflation went high, causing a recession through monetary policy was necessary to curb demand and bring inflation down. It's something like an economic reset to flush the economy of excess money in circulation. Smaller money supply = smaller economy, then it rebuilds and grows again as the Federal Reserve expands the money supply through QE. If Powell refuses to tighten and just leave inflation to be always high, then inflation will cause a recession for him as it slowly exhausts the people's savings until they are left with none. That would be a worse kind of recession because inflation is still high = Stagflation. But it won't end in Stagflation because Powell still needs to curb inflation. If he tightens during a time when people don't have any savings, then that could cause the worse economic condition = Depression. It would he harder to rebuild from such a condition. It's better to cause a recession now while the people still have their savings. |

|

|

|

|

1090

|

Economy / Speculation / Re: Bitcoin - The road to a SIX DIGIT price valuation

|

on: July 11, 2023, 02:30:43 PM

|

I respect your opinion and you have a point, but I can't entirely agree. Bitcoin is a blackhole for fiat currencies. If the Cabal behind the Central Banks print more, Bitcoin will absorb more and add to its market value. It's currently right there happening in front of us, and the ETFs will make the trajectory to six digits steeper and faster. Plus wait for QE when there's more liquidity available in the system. It might be "Oh My God It's Christmas" during March of 2025.

So in your opinion the main driving force of btc pump to 6 digit will be QE and ETF will only facilitate the migration of capital. Am I right? I can definitely agree with that. Plus the fact that there's only a limited supply of 21,000,000 Bitcoins in total, making it a scarce asset that's attractive as a long term hedge against inflation. To all those who read my opinions in different topics, you know that I'm cynical towards BlackRock's Bitcoin ETF because of the vague wording used about hard forks in their registration statement.

I found it and read it, and I have to admit that what is written there does not look good at all, because the fact that it is written there may mean that they (BlackRock) actually have the idea to make a fork in the future, and to use their influence and money, of course, to create its centralized version of BTC. There could also be another hash war and if BlackRock and its cartel of ETF issuers have the same proposal in each of their registration statement, they may have some impact of their own on what's to be considered "The Bitcoin". Because they could follow one fork and threaten to dump the other side of the fork. What if the other side they plan to dump is Bitcoin, BTC? |

|

|

|

|

1091

|

Bitcoin / Bitcoin Discussion / Re: "Not your keys, Not your coins" is not enough

|

on: July 11, 2023, 11:41:38 AM

|

So, we find out that centralized exchanges are necessary too.

Eeehhh.... kinda. For now, and only if you're a frequent trader (my guess is that at least half of CEX users don't actually need to use CEXs). Technology improves over time. DEX will get better and will have fewer trade-offs as things develop. I hope to see a time where centralised exchanges are consigned to the history books, where they belong. They're antiquated, vulnerable and on borrowed time. It's not going to be simple in my opinion, and I believe many users will be put off by the trade-offs they need to accept in a "decentralized-only" world because they have to take absolute responsibility if they indeed choose to participate. We're seeing it in the Ethereum community's "DeFi movement". Their DEXs are being hacked, being scammed, with the bad actors running off with the "bounty", and with the users given no hope for compensation. Technology improves, but does the security assurances improve side by side with it? That's a question open for debate. |

|

|

|

|

1092

|

Economy / Speculation / Re: Bitcoin - The road to a SIX DIGIT price valuation

|

on: July 11, 2023, 06:55:56 AM

|

To tell you the truth, I personally am more skeptical that this ETF will give as much to Bitcoin as it did to gold. Gold is hard to buy, hard to sell, each transaction carries the risk of fraud (fake gold), requires a physical transfer to the mint/store and has a huge spread. Gold ETF solved all these problems and made it possible for you to buy physical gold in 2 clicks from home. The same cannot be said for bitcoin, because bitcoin is like gold with build in ETF. It's easy to buy, easy to sell, divisible to cents. And it's not like the ETF will open doors to big institutions either. Microstrategy didn't need an ETF to buy nearly 1% of all bitcoins.

I respect your opinion and you have a point, but I can't entirely agree. Bitcoin is a blackhole for fiat currencies. If the Cabal behind the Central Banks print more, Bitcoin will absorb more and add to its market value. It's currently right there happening in front of us, and the ETFs will make the trajectory to six digits steeper and faster. Plus wait for QE when there's more liquidity available in the system. It might be "Oh My God It's Christmas" during March of 2025. |

|

|

|

|

1093

|

Economy / Speculation / Bitcoin - The road to a SIX DIGIT price valuation

|

on: July 11, 2023, 06:24:56 AM

|

To all those who read my opinions in different topics, you know that I'm cynical towards BlackRock's Bitcoin ETF because of the vague wording used about hard forks in their registration statement. I want to get that out first before making the "shower thought" for the topic. From an investment perspective, OK, I'm curious if anyone knows, when was the first modern ETF for Gold issued? Wikipedia says it was during 2003. Zoom out Gold's chart to the maximum and look starting at 2003. Merely my two sats, but believe it will be the same for Bitcoin. It will have one of its greatest price trajectory we have ever seen during the next real bull cycle. Perhaps the same as 2015 - 2017, perhaps more? I know franky1 doesn't believe it, we have debated about it before. Although he made a good point, he didn't consider the Cabal's long term, and possibly unlimited, printing of fiat.  On the road to $500,000 On the road to $500,000. |

|

|

|

|

1094

|

Bitcoin / Development & Technical Discussion / Re: NFT Idea: Prove Funds to Mint

|

on: July 10, 2023, 03:47:38 PM

|

Why would someone buy this?

People who see your NFT will know that you're hodling a lot of Bitcoins. Why would I want to put a digital target on my back saying I own or have owned at least 1000 bitcoin recently? Would you want to walk down a street holding a sign saying you are rich or have a lot of gold in your house? Many bitcoiners want to remain anonymous and not draw unnecessary attention to themselves. They also wouldn't care about hyped digital waste known as NFTs that could maybe have one or two useful application with the rest being garbage. I am sorry, but I don't think many would be interested in this. Why do people buy designer clothes? Why do they wear million-dollar watches? That also puts a literal target on your back, you just have to make sure your security is on point. Yes many bitcoiners love being anonymous. But also we are people, we like to announce to the world what we are proud of. We like to announce to the world that we believe in Bitcoin, and also the fact that we have made it big at the same time. It's a different culture with Bitcoiners compared to your community of people who wear designer clothes. Bitcoiners are more interested in tools that make people more ungovernable, although I believe none would admit it to avoid Big Brother's eyes probing over them. Haha. Plus your idea is probably good for younger Bitcoin HODLers who want to flex their wealth, but such a project could also be a government honeypot. It's not good for OPSEC. |

|

|

|

|

1095

|

Bitcoin / Bitcoin Discussion / Re: Do you think at some point government will change its stand and adopt Bitcoin?

|

on: July 10, 2023, 03:28:59 PM

|

My perspective

Just as the future is uncertain and no one can predict the future, The government may seem aggressive today on Bitcoin and cryptocurrency adoption, and tomorrow change their stand due to high pressure and demands from their citizens to use a technology like Bitcoin in the coming years.

It's going to be laughable if the U.S. government actually bends to the pressure because if they understood the true nature of the technology, they would be thinking that they should have shut the network down while it was still small and still very possible to stop. They would have made a greater effort of finding Satoshi if they knew Bitcoin would be as unstoppable as it is today. But the people doesn't have to demand anything from the government to be allowed to use Bitcoin. It's permissionless, and it's censorship-resistant.

If BlackRock CEO criticized Bitcoin in the past and later turns to embrace what he kicked against, the government may do so because the government is run by friends of these individuals or people who own these companies, and they may have influence When it comes to government matters.

BlackRock will influence the government if WE should be allowed to use Bitcoin, and how to use it? Don't trust BlackRock. https://bitcointalk.org/index.php?topic=5456494.msg62452869#msg62452869https://bitcointalk.org/index.php?topic=5456494.msg62417885#msg62417885

El Salvador is a leading example of government in the front run of Bitcoins adoption and when more countries' governments follow suit in the race, other ones will not want to be left behind, they too will join the queue.

Let's have a general discussion, what is your standpoint?

Bukele wanted to go against the IMF, and what's the best tool to use? It wasn't merely a choice. It was necessary. |

|

|

|

|

1096

|

Bitcoin / Bitcoin Discussion / Re: Education and money as the key to Bitcoin adoption.

|

on: July 10, 2023, 11:33:53 AM

|

In the context of "not overselling" to onboard people, it's also very important to tell people Bitcoin's limitations and how ownership of Bitcoins require total responsibility from the person himself/herself. Lose your keys, then you lose your Bitcoins. ¯\_(ツ)_/¯

People should be ready to take responsibility to own their first coins because if they can't, they shouldn't own Bitcoin OR they should probably start wih a very small amount.

The first education should be on how to secure their wallet's private keys. Because beginners can buy a lot of Bitcoin with their savings and even become big investors but still lack the security knowledge that must be done. Many can buy it, but few can keep it safe. Maybe buying small amounts first like you said would be a good experiment, because while learning how to invest in Bitcoin properly and safely. That's expected. The actual point of my post was for the newbie's willingness to be personally responsible for absolute control of his/her own wealth. Because if a newbie is repelled by the fact that he/she could really lose his/her whole savings if he/she HODLed them in Bitcoin, then that person probably shouldn't own Bitcoin yet. |

|

|

|

|

1097

|

Bitcoin / Bitcoin Discussion / Re: Robert F Kennedy Jr a Bitcoin Holder

|

on: July 10, 2023, 05:36:41 AM

|

https://twitter.com/CryptoKingKeyur/status/1677914373614891008/photo/1 https://twitter.com/CryptoKingKeyur/status/1677914373614891008/photo/1In a recent news, financial records of Robert F Kennedy Jr shows that he is a bitcoin holder, and reported to have own between $100k and $250k worth. And that's why recently you will hear him to be a bitcoin supporter and attacking Biden and his cohorts for being anti-bitcoin or anti-crypto. Which brings up the question, "Did he become a Bitcoin supporter because he understood the technology and how it could weaken political strongholds, OR, did he simply become a supporter because he's holding Bitcoin"? I want to believe he is one of us, but him being a politician with an agenda, it's hard not to be a cynic.  I would probably believe Robert Kennedy if he was deeply tied financially with Bitcoin like Chad Saylor. Haha. |

|

|

|

|

1098

|

Economy / Economics / Re: The precondition for knowing when the Federal Reserve stops raising rates

|

on: July 09, 2023, 04:30:59 PM

|

Bump. This is the schedule of the Federal Reserve's monthly CPI reading until the end of the year.  This month's reading will be an important one because the Federal Reserve "paused" rate hikes last month, and because of that pause, some analysts are projecting that there's a higher probability that inflation might start to go up again. The "reinflation" narrative. Moreover, unemployment numbers are still very low, which means that demand is still high, which also means that inflation might not go down to the Federal Reserve's target of 2%. I believe they might make the most undesirable decision = higher and longer rate hikes. Perhaps going back to +50 BPS by September. |

|

|

|

|

1099

|

Bitcoin / Bitcoin Discussion / Re: "Not your keys, Not your coins" is not enough

|

on: July 09, 2023, 02:09:10 PM

|

My point is :

-Your CEX is hacked : risk for your funds + risk for your personal data

-Your non-KYC service is hacked : risk for your funds

A CEX is more risky from my point of view

And about Bisq, apart if the user downloads a fake software of Bisq, I don't really see what could go wrong ? its way of functioning is very protective of user funds

When a centralized exchange is hacked, they compensate their users instantly or gradually. When a decentralized exchange is hacked, who will compensate you as a user? Nobody because it is decentralized and I am talking about really decentralized exchanges, not what are called as DEX with public founder teams. Like if Bisq is hacked because that software is exploited, who will compensate you? There are pros and cons for both centralized and decentralized exchanges, and it's for the user to decide if he or she is willing to accept the trade-offs of each. But if some users don't want to accept the cons of using a decentralized exchange, it shouldn't suggest that development for them should be discouraged. There should be at least one that exists, like there should be at least one censorship-resistant cryptocurrency existing. It doesn't need to be a better alternative than its centralized counterparts, just a dependably working one and robust. |

|

|

|

|

1100

|

Bitcoin / Development & Technical Discussion / Re: Application of ChatGPT on Bitcoin Transactions and Lightning Network

|

on: July 09, 2023, 09:59:55 AM

|

If you look at the pic in the tweet. It pretty much states how ChatGPT is going to help. CHAT-LN as it's called will be specialized in Bitcoin and LN development.

It will have nothing to do with sending LN transactions or performing BTC transactions. It will mainly be used for scripting, troubleshooting, providing examples of working code etc.

No, I believe it does. Read the whole thread, https://twitter.com/roasbeef/status/1677031256134152192I will not pretend that I understood all that, but it's obviously saying that developers could connect AI to Lightning and allow pricing for APIs and have the AI make transactions, receive and hold Bitcoins. Quote from the link,

to fill this gap, we've also created a series of "tools" using the

@OpenAI

function call API and

@LangChainAI

that enables the agents to directly hold, manage, and spend BTC (on chain and via LN!)

|

|

|

|

|