|

Either it is just starting... or this is the weakest weekend pump ever!

|

|

|

|

Of course his post was complete nonsense, but the real gamechanger at play really is nothing what either of us mentioned so far. It's what the unit of account is for world energy prices. You're currently living in a completely delusional, nonsensical, unsustainable world because the unit of account for oil is dollars. This means you can print something imaginary to conjure something real out of thin air - or better explained, it's real purpose is to steal resources from other countries.

The dollar is a mechanism for stealing, both from other countires and it's own people. International banking has Jewish roots, so nobody is spared from the theft. On a finite planet, it's not really possible for a scheme like this to last for long. Eventually something finite and linked to physical reality has to be linked to something else finite to be the unit of account. So then you have a situation of someone claiming "oh, the cost of production for gold is like $1100 and $15 for silver with the majority of it's price being derived from things like diesel fuel".

Now, answer me what is the cost of production for gold and silver if purchasing the oil that makes up the majority of it's cost of production price has to be paid with gold and silver instead of dollars?

I don't know why would someone have to pay oil with gold and silver instead of dollars... But, since you insist that the cost of production is what marks the price bottom and also that oil is the most important factor of that cost of production I will tell you "the real gamechanger at play really is nothing what either of us mentioned so far": OIL PRICES ARE GONNA DUMP HARD IN THE NEXT DECADES. FUCKING HARD. MORE THAN YOU CAN EVEN IMAGINE. So there's that. |

|

|

|

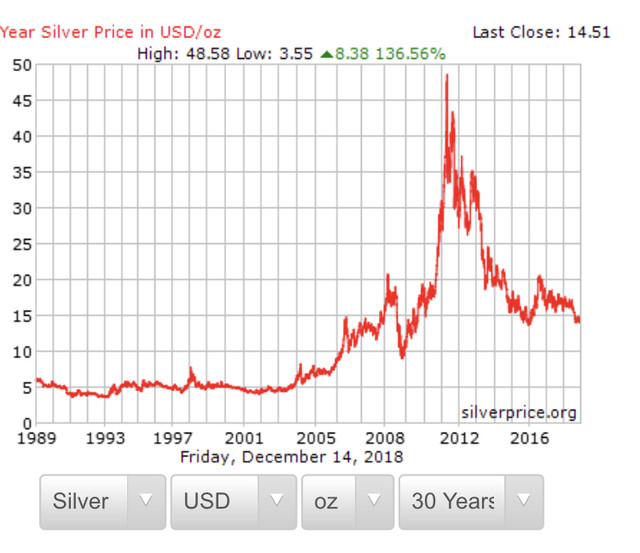

Roach you may have just persuaded me to short the fuck out of physical silver. That silver chart is completely broken. Any rally will get crushed by sellers trying to exit their bags. I assume that's why you are here. Trying to flog your bags of shit coins.

Do people with any significant holdings actually hold physical silver? Or is it just paper-silver? That's a very interesting question I once asked to r0ach. I was arguing about the poor value/weight relationship of silver. Storing a single million $ would weight around 2 fucking metric tonnes! He then started arguing about the absurdity of my example, and that it was because silver was so fucking cheap at this time and blah blah blah.... so I let it go. The FACT is that you can not reasonably use physical silver to store a sizeable amount of money. Not to even mention about mobility..... |

|

|

|

Silver bubble continues to break downwards from blow off top in 2011 (when Roach bought the top because he’s dumb and greedy). Edit: Good support at $5 / ounce so price due to fall another 66% then stabilize  Maybe you just want to piss r0ach... but you are completely ignoring the support and potential trend reversal at $10. $5 would be THE ultimate bottom. Not gonna happen, and even if it does, it would take 10-15 years to reach that low. |

|

|

|

|

Even if your theory about Bitfinex and Bitmain rigging the price might make some sense, you exaggerate your "analysis" to fit your narrative.

First, Bitmain started selling vast amounts of their BTC reserves in August 2017. Most of the parabolic BTC pump came later than that... while they were burning BTC to increase their BCH stash up to a ridiculous 1.5M+ coins. So no, it wasn't Bitmain. Maybe on the contrary.

Bitfinex? Well, we have theorised many times about the relevance of Tether in the pump and subsequent dump. We haven't been able to reach a convincing conclusion.

Will Bitmain going belly up have a negative impact on price? Most probably, at least in the short term. Same goes with Bitfinex.

But in either case I don't think the impact will be critical for Bitcoin and unless you have some way to quantify it, it is all mere speculation.

|

|

|

|

|

Also... *40* fucking years cup and handle? WTF?!

|

|

|

|

In fact I am wondering if there is any correlation between hodlers and cat owners which would make this discussion perfectly on topic  Rick and I own at least two socialized cats. Also care for a few other feral and semi-ferals that we trapped and rescued to give a good life to, indoors. The ferals are complete assholes, and don't allow us any social contact. Wrangling them for vet appointments is a carefully choreographed routine that Rick and I have developed, which basically involves herding them into one room, closing the door, and then find a way to drop a towel on them so they chill out enough for me to to scruff and carry the little fuckers into the carriers. Also, I am officially numb to the Bitcorn prices. Stopped myself at 5 beers today before I recognized I just wasn't enjoying 'em. Trying to motivate myself to finish editing a project I've been working on for the last couple months, and just ended up with a headache. Fuck 2018, man. What a shit year. That's some serious cathodling power  How comes the feral cats haven't been able to socialize? Maybe they were already adult ferals? Were the two socialized ones also feral before? I mean.... maybe some had a more social character or were more adaptable than others? I got my cat from the street but she was only around 4 months old so I guess that helped socialise her. It is a pretty intelligent cat, it behaves in many ways like a dog... She knows and reacts to several different orders and when she was younger I would throw paper balls and she would go get em back to me (rarely does it anymore for unknown reasons). Yeah, 2018 has been a nightmare as much as 2017 was an awesome dream. Let's just hope 2019 will be a good year and 2020 even better! |

|

|

|

For the idiots high on hopium:

Past Performance Is No Guarantee of Future Results

Past Performance Is No Guarantee of Future Results

Past Performance Is No Guarantee of Future Results

R0ach alt? Nah. Even r0ach knows that Bitcoin at this prices has a lot more upside than downside potential. If he had any FIAT available (which he doesn't because of... silver, you know) he would probably be buying with both hands. |

|

|

|

First and foremost, when the time comes take some fucking profits.

This is what I must regret. If I had take 10-20% profil I would had recover almost all my investment and would be relaxed now. Possible buying more. Never try that. Never sell until and unless they're worth enough to make you rich. That's what I've learned from an epic bull run of 2017. I was almost 90% out of crypto by August-November 2017 because I "took profits at 1.5x to 2x". Maximize your greed, if you're ready to spend a few years in waiting. I would say you are on the other side of the balance than most people here. I mean... who would take profits at a mere 2x? And *90%* out? Many people here were at more than 20x profit (at ATH) and didn't take a cent out or just very little in proportion. Going all-in or all-out like that is just crazy gambling. |

|

|

|

I'd say though that people should decide on a price and proportion of coins that works for them and get rid no matter what the market looks like it might do once those targets are hit.

Yeah, don't back-pedal on your targets when the time comes and don't fall into the trap of reinvesting what you intend to keep out.

Having said that, Bitcoin is always one step ahead of the game... Yup, that's a great advice. Only reinvest what you plan to reinvest and keep out what you plan to keep out. In "practical sense" only what you take out for good should be counted as profit taken. Other than that is just "trading". |

|

|

|

Excellent post, please give him some merit I have been out of merits for months. This post is going to be a very helpful guide during a bull run.

I'd like to add that with all the nocoiners asking you for advice and talking about it more and more. During the last bull run I had the feeling bitcoin adoption suddenly had skyrocketed. Meaning that my view of adoption was completely delusional because of the sudden increase of price. Which resulted in me barely selling any coin and not having extra fiat to buy back during the bear market. The price attracts a lot of people but that's not adoption, adoption is the people who are leftover after the attraction of the price. This is how I see it.

Thanks! Yes, I thought the same. Probably everyone did.... but all that people that clogged the exchanges during the last stages of the bubble were just ignorant FOMOers. We should have known better. And the same happened in 2013, exchanges had a very long verification queue. Bitcoin was in the news, maybe not as omnipresent as in Q4 2017 but still a big change from almost 0 presence to some important presence. China FOMOed strongly into the hype.... until they didn't. It imploded and most of the FOMOers were gone for good. The bolded part sums it perfectly! |

|

|

|

I have decided to write about what have been my errors during the past bull run and subsequent downtrend till now.

Brilliant post. I'd say though that people should decide on a price and proportion of coins that works for them and get rid no matter what the market looks like it might do once those targets are hit. If you can't bring yourself to do that then you either have the wrong price or proportion. At the $10-15,000 level loads of people will be back in the black and it may sit there and not do much. That's a humongously more relaxing time to do to. Yes, setting milestones is very important and everyone should do it in some percentage but, even if someone hasn't reached those milestones or extracted enough... when the obvious signs of being in the final phase of the bubble come it is the time to FUCKING HURRY UP  Also, when taking profits, it is extremely important to really "take them" I mean, if you just leave them on the side, you will be very tempted to use them at the very next dip. So, either extract them for good or, at least, set another milestone in which you will use them to rebuy (ie, at half the price you sold, etc) and stick to the plan. It is of course possible, to decide some percentage to be taken "for good" and some higher one for trading/rebuying in the bear market. That's a nice price target to get some percentage of profits during the next bull run, yeah. I suspect (as d_eddie already suggested) the next bull run will have different price dynamics and much more people will be taking profits on the way up than this time so the uptrend will be smoother and more prolonged in time.... until the final stage that most probably will be as explosive and short as every single time in the past. Thanks for the comments and positive feedback! When I finish my posts writing about my mistakes I will try to combine it all in one single text and include some of this suggestions. Might come handy during the next bull run. |

|

|

|

|

MY MISTAKES (Continuation)

Hedging with alts:

No, I am not going to say hedging with alts is essentially wrong. It makes some sense... but you have to also recognise when to take profits and other things.

First, what are the reasons to hedge with alts? :

- In case Bitcoin has a catastrophical failure (ie. a security vulnerability that that gets exploited). Yeah, it makes some sense to hedge against this scenario but you have to take into account that many other crypto coins share most of the Bitcoin code so, depending on what the catastrophical failure is, it may also affect those coins you are supposedly hedging with.

Also, if Bitcoin were to crash to the absolute ground due to some technical failure, the entire crypto market would become affected. Confidence in crypto would be severely undermined. Don't fool yourself into thinking that would not happen. Everyone will be thinking the same could happen in the future to whatever the "next" coin is.

- For bigger profits. Yeah, during crypto bull runs some coins provide (way) better returns than Bitcoin, at least in the short term. In the long term, that is highly questionably with only a few exceptions. Also, they get (much) more severely impacted in each dip and major corrections. Don't forget that second part.

And here comes the point where I made my mistake: Those previous points are sort of incompatible. I mean, if you hodl something as a hedge you should keep it, more so when your main bet (Bitcoin) is now so much valuable that you feel it needs some "insurance", Right? Wrong!

Yes, you may need the insurance/hedge... But if your hedge has skyrocketed so much (probably even more than Bitcoin) you fucking need to take profits too!

The argument of "Ok, I made so much on this altcoin that even if it goes to the ground it will also be much more valuable than when I bought it" or "As soon as Bitcoin keeps pumping I don't care what happen with my other shitcoins" are complete and utter nonsense.

First because as soon as the bull market is finished both Bitcoin and your silly "hedge" coins will go to the ground, so you will lose profits for both. Second because when that happens they will be even more severely impacted: There's no fucking inverse correlation in bear markets! It all goes to the fucking ground! And your "hedge" will become almost worthless!

Ok, so then.... How can I better manage my "hedging" altcoins and still keep hedging?

Easy, and obvious too, when you feel they have pumped way beyond your expectations just sell them for FIAT or stablecoins and keep that as a hedge.

You may even convert some of the profits to increase your BTC stash too. But keep as much in fiat or USDT as you feel confident as a hedge.

Why I didn't? Well, there are risks both for keeping FIAT on exchanges and for trusting a stablecoin. I probably overvalued those risks and undervalued the bigger risk and devastation of an incoming bear market. I did a poor risk management there based on wrong perceptions.

So... if you want to hedge it is ok to have some FIAT (preferably diversified over several exchanges) and some stablecoins (which you can store by your own).

Diversifying into alts does NOT protect you at all from corrections/bear markets. So, periodically take profits too and invest them into UNCORRELATED hedges if you really want to have some insurance against an incoming bear market.

Managing a crypto basket is not an easy task. And I don't think there are any "magical" tricks. On the contrary it is something that needs to be continually and actively evaluated and you better know what you are doing and why you are doing it. Just don't forget what your goals are and try to act accordingly and timely. Otherwise just skip alts altogether and stick to your main bet (presumably Bitcoin).

(Will continue)

|

|

|

|

|

I have decided to write about what have been my errors during the past bull run and subsequent downtrend till now.

First and foremost, when the time comes take some fucking profits. It doesn't need to be huge and it certainly would vary depending the individual circumstances but take some. It will make you feel better during the bear trend. It may be as low as 5%, 10%.... maybe a bigger amount if you plan to "gamble" on rebuying later in the downtrend.

How do you know when the time has come? Well, hitting a perfect top is just a matter of luck but, hitting somewhere NEAR the top is much more easy:

- You start receiving calls from nocoiners that are now suddenly interested in investing. They usually ask you for advice on what coins are a good buy... because Bitcoin is already too expensive you know....

- Exchanges can't cope with the demand. The trading engines not only lag extremely, but the verification queue for new users are weeks or even months long. Some even stop accepting new users.

- You start to feel that the rise has reached completely ridiculous levels and it should implode.... But since you already thought that a few thousands ago... why would it not keep pumping much more? Yeah, you feel like you are going to be richer than your wildest dreams!

- You start to feel not only as if you did a great investment but as if you had just hit some fucking and totally undeserved big lotto prize.

- You feel that the price has come so much higher than you would have expected (in that short timeframe) that, even when the necessary "correction" comes, the bottom will still be so high that you won't care about not having sold ANY... Because, you know, this time (tm) Bitcoin is so well known and popular that price would not decimate, maybe not even halve (and of course that $10K you never expected to be broken so soon nor so easily will act as an ultimate support in the worst case, yeah!).

I could add more signals of when the top has been reached or is very near, but I guess that's more than enough to get the idea.

This is getting long, so I think I will better be writing this as a series of posts... Some ideas I have in mind about more mistakes I did and how to improve on them are:

- Realising you are in a clear downtrend and what to do during it.

- Hedging with alts during the bullrun, near the top, and on the downtrend. Hedging with stablecoins (ie USDT).

- Managing exchanges and FIAT ramps for profit (diversify risk and get them all ready well in advance)...

- Lending

I am writing this as advice for my future self, but hope it gets useful to someone else. Will continue.

|

|

|

|

Fortunately it all looks so doom. It must be harder to trick people by dumping it lower as people are coming to expect it.

In the meantime, what we can do is prepare some good fiat stash for when/if that doom scenario happens. Buying right now, not so sure. Buying soon, most certainly. |

|

|

|

|

If we don't see a bounce, this place will soon be known as the Wailing WALL.

|

|

|

|

|

^$1731? Ugh.... That doesn't look good at all.

|

|

|

|

Sometimes i think it only needs 17 millions people to buy one bitcoin and hold, and then the price seems strangely ridiculously low

Yes... but I am sure currently there are MUCH less than 1 million people hodling a minimum of 1BTC. OTOH there are people with thousands BTC to compensate for that current lack of adoption. |

|

|

|

|