I can't express how grateful I am for this great invention and for all brothers in WO who encouraged me by their posts to become a degenerate hodler!   I don't see how you could have had become a degenerate BTC HODLer, since you are constantly talking about how many expenses that you have and how you are spending large quantities of your BTC.. .. so it would seem difficult to either meaningfully stack or get to a place in which it would become justifiable to start shaving off your stash, such as if you were at or near fuck you status.. which surely could be described in a variety of ways.. but someone who is constantly bragging about the ways that he is spending his coins would hardly even be i a status of having had either accumulated many bitcoins and/or to have been able to advantage from multiple compounding effects from the value doubling several times. I know that I'm not in your stash league, but still for my country I consider myself to be in FU status. If you followed my posts, you would know that I am using long term loans to buy these things. I have more than enough Bitcoins to buy them now, so there is no risk in this strategy. I have a salary which covers 100% of my monthly loan payments, so I have to spend only the 15% of the loans (3 so far) with my savings. So may be we are talking about less than 10% of my stash for all of it. This number might be higher or lower, for OPSEC I won't share it. But you get the idea. Even if it goes to 15-20% for other expenses in the next 25 years, I'm OK with it. And in the case of a job loss, I will have enough in Bitcoins so that I won't lose my property. |

|

|

|

Two funny things happened to me today. The first is that I ordered a brand new mercedes SUV as if I ordered a pizza. I didn't give much thought about it, it was impulsive because of my current needs for a reliable 4x4 car. And this is just after I changed radically my life with buying an appartment in a closed complex, where the richest guys live. The city is so developed that there are next to zero houses for sale, only appartments. The second funny thing is that in the last few weeks I completely forgot that the fiat value of my stash is a certain number in euro, not in the local currency, which is 50% of the euro! I've discovered the mistake by chance and of course I was happy and more relaxed to buy this car. This never happened to me before! It shows how happy I am with my new life because of my choice to invest all in Bitcoin in the first half of 2017. I just don't care about the fiat value anymore. I care only to buy things that are good. My next goal is to buy a beach house in Greece and a small yacht to sail between the counltess islands during the summer. I can afford it even now, but I will wait for the coming price action, which will be mind blowing. Without Bitcoin, I could only dream of a second hand VW and live the same old boring life until I die. I can't express how grateful I am for this great invention and for all brothers in WO who encouraged me by their posts to become a degenerate hodler!   |

|

|

|

|

6 hours left until you lose half of your Bitcoin.

|

|

|

|

|

Finally, I've moved to my new appartment with a great view of the mountains and near a river. It is situated in one of the most ancient and developed cities in Europe. Thanks to Satoshi (my financial Saviour) and Jesus (The Saviour of my soul), I have had the courage to leave my old boring lifestyle and practicaly to restart my life.

|

|

|

|

Oooor, it is a headline from the near future with a 0 missing: gold-could-start-to-overtake-bitcoin-as-the-cryptocurrency-stalls-at- 700000-says-wolfe-research.html |

|

|

|

This is from 18th March. Now Coinbase Pro balance is -20K BTC down to 327K BTC. There is a free real time tracker of all exchanges balances: https://www.coinglass.com/Balance. Since Coinbase Prime buys mainly from Coinbase Pro, it is clear that the ETF's will cause a supply shock very soon. |

|

|

|

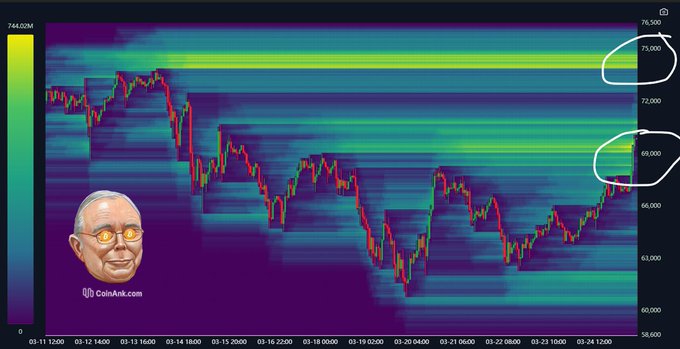

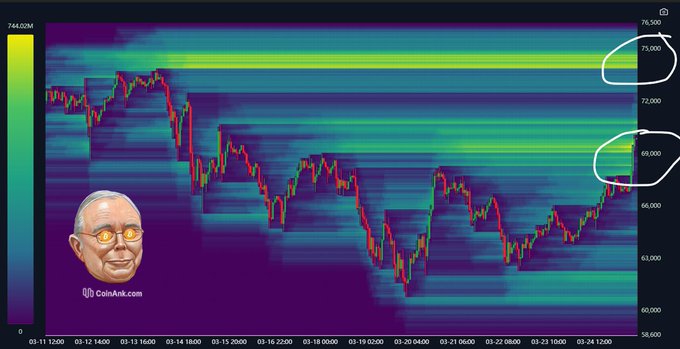

#Bitcoin cutting through the first liquidation zone like butter. This is still just an appetizer to the $74k shorts. Price will go absolutely vertical to new highs once those shorts are rekt. Tick tock!  https://twitter.com/bitcoinmunger/status/1772299166317748674 https://twitter.com/bitcoinmunger/status/1772299166317748674JUST IN: South American gold miner, Nilam Resources to buy 24,000 #Bitcoin ($1.7 billion). https://twitter.com/WatcherGuru/status/1772358085253779789Remember, starting next week, institutional investment managers will file their 13F forms with the SEC. This means we'll start to get a look at who's been buying the Bitcoin ETFs. A few points: 1. These filings will start with a trickle next week, then pick up after that and run well into May. 2. The most interesting names could come later in the filing process, since some funds like to wait as long as possible in order to not show their hand before the mid-May deadline. 3. If you're a fund whose ownership of the ETF will make headlines and potentially impact price, you're probably going to want to top off your position before filing your 13F. Again, I expect some surprises. Watch this space for names. https://twitter.com/MacroScope17/status/1772366841727373749 |

|

|

|

Another $440 million outflow from you know who... 50 dumps of Grayscale.  So another day of -1%, leaving them with ~58% from what they started with on 11Jan. Speculators will speculate on how low they'll go, and how fast they'll get there, but it won't be too long before they fade into history. The CEO claimed that once outflows hit $12 billion they will lower the ETF fees. I believe they are close to/over that mark now. Something to do with covering probable fines or whatever. You can find the details if interested. Whatever happened here exactly, we will probably find out eventually. Usually, someone ends up behind bars it seems.  The behaviour of those who run away from the high fee is completely understandable. The funny thing is that the individual wisdom of running away from 1.5% fee leads to collective stupidity causing the current stall of the bull run. But I am not convinced that the fee is the main reason for these outflows. I've read some opinions that most of them didn't go in any other ETF company. May be the reason is that there are many people/companies that have had their funds locked up for years at a loss and are now rushing to release them at a very good profit. A while back I quoted a long twitter thread where some pretty shady dealings of DCG/Genesis, investigated by SEC were discussed. It was funny for me that Boidom refuted them, as made up by me?!? Then what about the hundreds of pages on Internet? Are they also made up by me? I will add just one quote from the many written on the matter: Back in November, DCG's CEO Barry Silbert seemed optimistic that the company could weather the storm. Since then, however, things seem to have gotten worse because the company is under investigation and it has closed down its wealth management division called HQ this month. Moreover, Genesis sent home 30% of its staff this January after making a 20% employee cut in August last year. https://www.bankfrick.li/en/news-and-insights/the-dcg-genesis-and-grayscale-saga-explainedBut of course for each train there are passengers. There will be people, (later Boidom confessed he is a Greyscale investor), who will keep money in Greyscale, believing everything is fine. So, Greyscale won't go down to 0 BTC, probably. The real bull run will start when they stop flooding the market with thousands each day. |

|

|

|

Saylor’s $500,000,000 offering closes today. We should see another smash buy sometime in the next couple of days that sends BTC to another peak. That would probably make a good short term selling opportunity for traders, but the big boom is still ahead of us. I think by Halloween we should be sitting above $100,000, but I wouldn’t be surprised if we revisited $50K first.

I know that Saylor has been a good advocate for Bitcoin in recent years. But is he really better than Rojer Ver, and others like him? Of course, he is way too smart to fall into the trap of creating his own shitcoin and losing money trying to pump it. Instead, he is riding on the wave of Bitcoin by creating some kind of a ponzi. Below are some tweets from a long thread, describing in detail what is going on. Michael Saylor is pumping Bitcoin on the media every single day & selling convertible notes to buy more $BTC. So why is he then selling 5000 shares of his $MSTR stock everyday for a cumulative $195m of stock sold YTD? This is almost a $1bn annual run rate fwiw. In September 2023 Saylor filed a 105b1 plan to regulary sell his shares. As you can see on the chart in the last thread he is selling at very regular intervals. So why is he issuing convertibles to buy more Bitcoin and simulataneously pushing up the price which then pushes up his stock price? Namely, because MSTR equity trades at an insane premium to its underlying Software business + BTC After-Tax holdings of 120%. So this implies that for MSTR to trade at NO PREMIUM to its BTC holdings at $68k price the price of BTC would need to be $157,000 - 130% higher than last price I checked this morning. This has true blue ponzi / reflexive / flywheel dynamics in that Saylor issues converts to buy Bitcoin, drives up the price of Bitcoin, which drives up his equity value, then he sells his own stock, and then does it again. Guy has down two converts for $1.4bn in the last two weeks. Tbh, he should just keep doing them as long as the market will bear it. Just be weary when the arbitrage breaks down, as it always does. Then we could see some real unwinds. Probably need to look at the options market for clues as to when the protections will unwind. https://twitter.com/BenBrey/status/1769737363280822381 |

|

|

|

It sucks to wake up and see that you've lost 10% of your networth overnight, because of some gambling morons. But the real loss is for them, not for us. It is impossible to have a vertical line up forever  And for the last 16 months it was mainly up, very rarely sideways. Meanwhile, going further down into 65s. Oh, well, I guess today we won't see another ATH.  |

|

|

|

|

-9.6% from the ATH. Perhaps Binance/Bitfinex longs squeeze? At least I don't see anything suspicious about Coinbase or ETF outflows. But there always will be manipulators in these two exchanges specifically, perhaps related to the 'house'. It has to be someone familiar with all complicated positions/options, etc. It is funny that there will always be plenty of victims who manage to lose big amount of money even in the most stable and long bull run in the history of Bitcoin. Imagine if these billions of fiat lost each day were invested at the price of 15K a year and something ago. That would be 4.5x profit. But the lack of knowledge and wider perspective leads to gambling and always losing.

|

|

|

|

Btw these rallies are they more exciting for last cycle newcomers

Or for the more OG multiple cycle hodlers?

For example I see some cheering from people buying 20-30-40-50k coins but the feeling for true OG’s is little more life changing somehow?

Also been through some aweful bears, still being here, believing, knowing what we have in hand and ultimately being strongly rewarded etc

Success just needs stamina. GrayScale selling hopefully slowing down.

Only 560 BTC transferred today.

About -$40m. Yesterday: -$80m Monday: -$494m Only in the first two days of sport ETF trading Grayscale had less than three digit $m outflow (-$44m and -$22m, respectively). EDIT: source https://farside.co.uk/?p=997May be it is related to this news: It’s happening! @Grayscale just filed to launch the “Grayscale Bitcoin Mini Trust” expecting this to have a competitive fee. It will trade under the ticker $BTC and will come from a spinoff from $GBTC. This means $GBTC holders will get some % of holdings spun off into $BTC. https://twitter.com/JSeyff/status/1767531434258964630Here’s the language around the spinoff. There is no fee disclosed yet orrr what % of $GBTC will spin off but pretty sure this will be a non-taxable event for a chunk of those shares to get into a cheaper and cost competitive product. https://twitter.com/JSeyff/status/1767531941060804830 |

|

|

|

Like new ATH 73053?  |

|

|

|

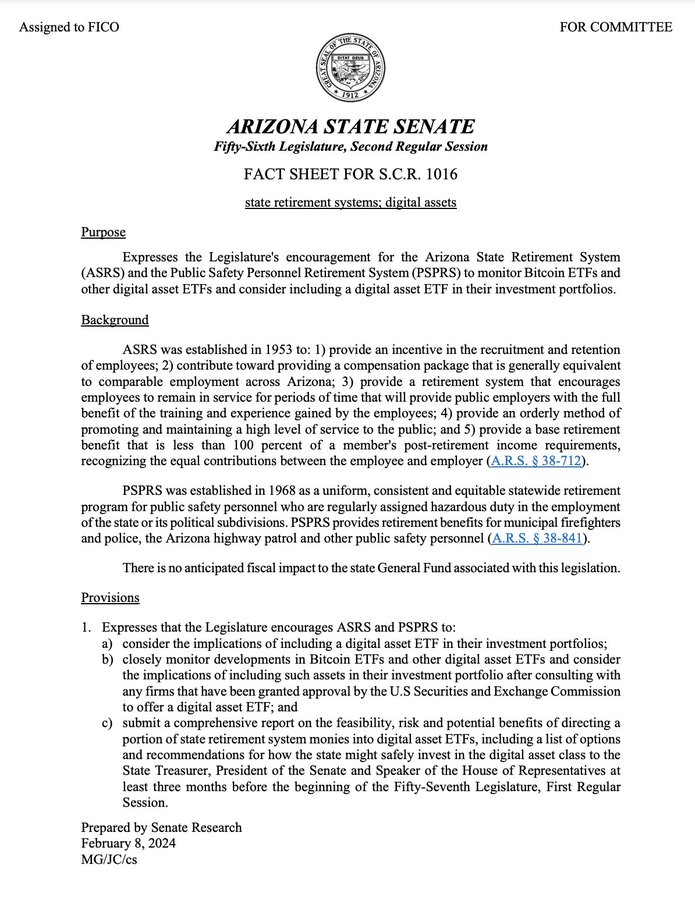

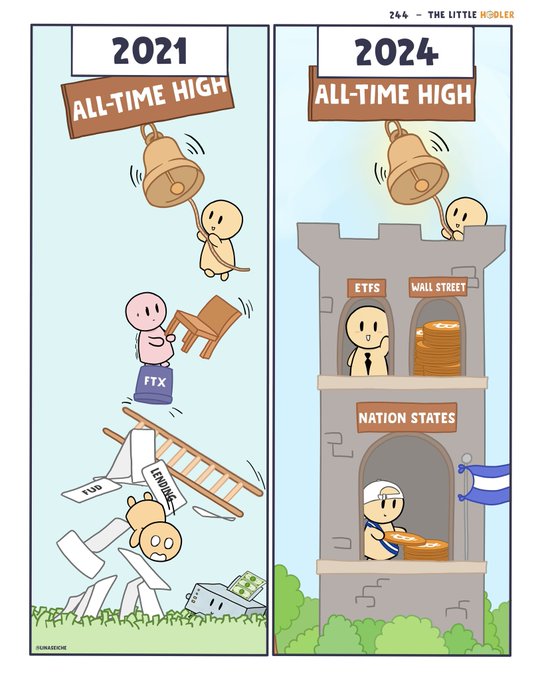

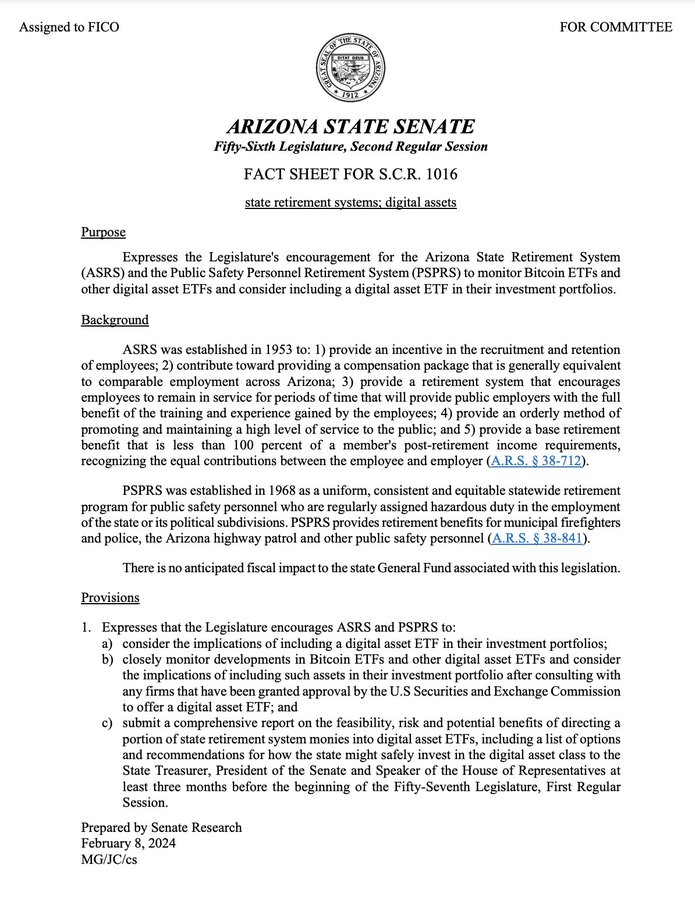

The common mistakes which the ill informed make: 1. Bitcoin price is so high, who will buy and drive the price up from now on? Therefore, it is better to find another project which has a lot of potential. -Answer: Both statements are awfully wrong. First of all, the market cap is the real measure, not the price of 1 Bitcoin. And the market cap will compete soon with gold's for sure. As for the second statement - there is no 2nd best. Everything else is made by some individual or a group of individuals, who seek only their own profit. Decentralization is nothing but an outright lie. 2. The institutions can run out of money and stop buying Bitcoin ETF's anytime soon. -Answer: According to Bitwise CIO Matt Hougan recent interview in CNBC ( https://youtu.be/VmmrLxfdHxk?t=75) the profile of Bitcoin ETF buyers is almost 100% retail. After the interview, he is going to meet of the the largest institutional consultants about Bitcoin ETF's... This is a $100B+ category market. So, it turns out institutions haven't even started yet! Among the first is the Arizona State Senate which is adding #Bitcoin ETFs to its state retirement portfolios.  And of course BlackRock has filed with the SEC that it will buy #Bitcoin ETFs for their own funds. They have $10 Trillion in assets under management. Another $20 Trillion of funds use their Aladdin platform to make portfolio allocations. BlackRock has stated that the optimal Bitcoin allocation is 84.9% of a portfolio. Of course, few will do this, but we now have the world's biggest fund manager telling investors to get off zero. Ernst & Young estimates $200 Trillion of Institutional assets could not touch Bitcoin until an ETF was approved. https://twitter.com/BTC_Archive/status/1766038008589869360 |

|

|

|

Where do all these ETFs buy their bitcoin. If OTC, where do the OTC desks source it ?

They buy from OTC desks. The OTC desk is in contact with miners, whales or other entities holding hundreds, if not thousands, of bitcoins. The OTC desk agrees on a transaction at a spread over the reference rate between buyer and sellers. Then they cross the order on the market. So the transaction actually happens on the market (e.g. Coinbase) even if the price hasn't been formed on the exchange itself, but Over The Counter (OTC).

There are several ETPs though. Is that a possiblity?

There are a lot of illiquid and tax-inefficient ETPs in Europe, correct. Most of the ETF's buy/sell from Coinbase Prime, which is an OTC. Coinbase Prime in turn buys/sells only from the US based crypto exchanges - Coinbase, Kraken and Gemini. All this is written in the ETF documentation. They can also avoid spot market if buy/sell ETF's arrive simultaneously from different ETF companies. So, most of Greyscale sells for example go directly to Blackrock buys without touching the spot market. |

|

|

|

our friend @rdluffy shared it on the Portuguese local board... Someone retired yesterday. Bitcoiner since 2010. 1000BTC -> $65.000.000 Certainly enough fuck you money for a retirement... My bet would be on someone that already "retired" long ago using newer coins and is now reaching deeper in his pockets and into older coins for whatever dreams he is now pursuing. Or, just ran out of patience. Several more months and that sum would have been at least doubled. Hodlers are also humans and make mistakes. Fiat is the loser and BTC is the winner. Why should anyone convert to the loser and put big amounts of fiat in the bank accounts? This is stupid. Fiat is a liability, not a benefit. Unless he tries to time the top of the cycle and rebuy lower, which obviously is not the case. |

|

|

|

We finished Tuesday (UTC) well over where we started Monday... one day up, one day down but basically up.

I can't believe how many crybabies seem to think it was some horrible big dip. It was just a little short-term long squeeze. No big deal.

The ETF boys are not going to stop accumulating bitcoins just because some fools prefer fiat currencies or like gambling with leverage.

More ATHs please.

Theoretically, when we hit a new ATH there is absolutely no one in a loss. But the stupid traders ALWAYS find a way to screw themselves. Over $1B longs were liquidated during this 14% drop. This is a rare talent! Respect! In less than 12 hours the price recovered 10% of this drop, so even today we are again in a position for a new ATH. |

|

|

|

Gentlemen,

We are part of a wealthy elite.

It has been a pleasure a hodling with you.

|

|

|

|

|

And for the last 16 months it was mainly up, very rarely sideways. Meanwhile, going further down into 65s. Oh, well, I guess today we won't see another ATH.

And for the last 16 months it was mainly up, very rarely sideways. Meanwhile, going further down into 65s. Oh, well, I guess today we won't see another ATH.