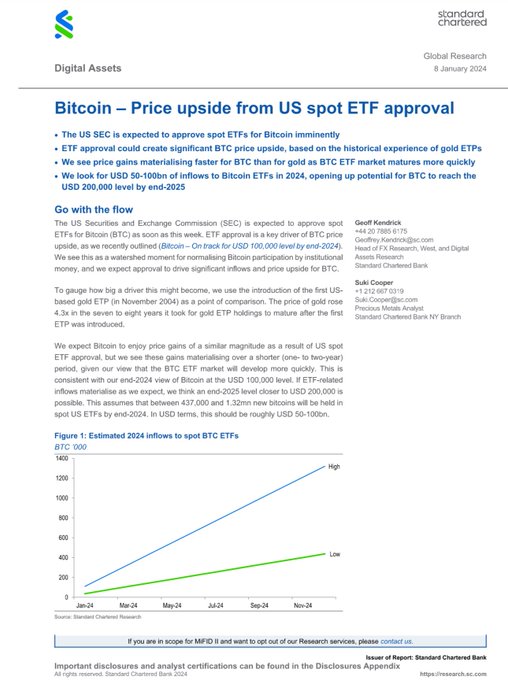

It seems that the situation is getting from bad to worse by each hour. This is not a normal trading, so to speak of any support line is pointless. The support is when the last bitcoin of Greyscale will be sold. I won't be surprised if we see covid like apocalyptic dump. Too bad I don't have any fiat left to buy moar. I guess the plan is to keep the rate 1.5% until the BTC outflows stop. And then lower it to 0.3%. But people are not so stupid to return to Greyscale knowing that they will raise the rate again. So, instead of leading the parade to 100K, Greyscale chose to be the new far more ominous MtGox. Well, it seems that we have to wait a bit longer to see 100K. Honey badger doesn't care.  Dude...why do you care so much about GBTC when the OVERALL ETF flow is positive? Besides, I calculate that GBTC is basically on par with their NAV right now (0.18% discount) All this whining about GBTC is pointless...reminds me about whining about bitcoin's use of electricity. EDIT: to all GBTC fear mongers: compare 5d chart of GBTC vs IBIT. Which one outperforms? Sorry, it is GBTC, haha. Just to clarify GBTC have sold 6% of total since ETF launches. I mentioned on the thread why this isn't a reason to panic, but it is a cause for concern. The upside is there is only 94% left to be sold, it'll hopefully go to new ETFs via OTC to reduce selling pressure on spot market, and otherwise be done within 4 months (based on current estimate and data). Until new data is released, there isn't much else to go on, and sure there is still net positive inflows into the ETFs, so this isn't s disastrous situation what so ever. If I were to "wildly guess" on why price has dumped -15% since ETF launch, it's because many speculated that price would dump after the ETF launch, not much else. But obviously this is wild speculation and calling a local top at $46K after the ETF launches was too early for some, so it does need further confirmation, but otherwise price direction remains pretty clear right now without needing to over analyse. Price is currently moving downwards (convince me otherwise). After the halving, with price stability, confidence in ETFs, I truely believe Bitcoin's price is going to melt faces and reach new ATH before the end of the year. Probably much earlier than the usual 4 year cycle, ie rather than winter probably more likely summer or autumn. With these new ETFs there isn't going to be much of a cap on Bitcoin's price rise (such as retail money), that much is granted, but we're not there yet. I've said it before, but I feel like I realise why Bitcoin's market cap was never sustainable above $1T: because ETFs weren't available. It's all good and well principles such as "not your keys not your coins", which every retail investor should practice, but institutions don't give a fuck about custody of coins. They care about safe investments, with reliable fund managers, in order to preserve capital etc. 2025 will likely be epic. With yesterday's outflow, GBTC have sold 51 000 coins, which is 8.2% of their initial holdings. It is quite possible this will continue at least for a week. Most probably until either they lower the fee, or lose all their customers. Why should one prefer the well established Blackrock, Fidelidy, etc. with their low fees and fair play, over some FTX kinda shady company with high fees? This is a rhetorical question of course. Until this issue is resolved there will be some volatility. And a possibility for some pre halving big dump like in 2020. Don't forget that the traders are stupid. If there are 100 good news and only 1 bad news, they will still dump. Eventually, the price will reflect the supply shock and ETF's probably will have a major influence for that. |

|

|

|

It seems that the situation is getting from bad to worse by each hour. This is not a normal trading, so to speak of any support line is pointless. The support is when the last bitcoin of Greyscale will be sold. I won't be surprised if we see covid like apocalyptic dump. Too bad I don't have any fiat left to buy moar. I guess the plan is to keep the rate 1.5% until the BTC outflows stop. And then lower it to 0.3%. But people are not so stupid to return to Greyscale knowing that they will raise the rate again. So, instead of leading the parade to 100K, Greyscale chose to be the new far more ominous MtGox. Well, it seems that we have to wait a bit longer to see 100K. Honey badger doesn't care.  |

|

|

|

Blackrock iShare Bitcoin Trust ETF has increased their position from $499M to $707M as of 16th January 2024...

Here are some key facts about three full days of trading in the books as of the close of business on Tuesday: - net inflows into the spot bitcoin ETF appear to be about 21,000 bitcoin (BTC), or $894 million at the current price of $42,600.

- BlackRock's iShares Bitcoin Trust (IBIT) leads the way by adding 16,362 bitcoin.

- Second is Fidelity's Wise Origin Bitcoin Fund (FBTC) with 12,112 bitcoin.

- Sizable exits from Grayscale's Bitcoin Trust (GBTC), which has lost about 25,000 bitcoin, brought down the overall industry inflow.

https://www.coindesk.com/markets/2024/01/17/bitcoin-etf-net-inflows-near-1b-after-three-days/Eh...so, like, is that all? Really? Small potatoes. Shit, Elon Musk bought $1.5B worth of BTC all in one go not too long ago. Just for the Lulz. These ETF trust guys are amateurs.  This is just the beginning, young padawan. If buying spot ETF's stopped there, this statement would make some sense. But it is more than clear that it will not stop. If 5,000 BTC are net bought per day, this makes 500,000 BTC in 100 days, almost as much as Greyscale has. After another 100 days, the reserve of the SB will dry up. I don't know why everyone measures the reserve of exchanges in general, since all ETF's only draw from CB (with one small exception). This means that the effect of the supply shock will be very substantial, significantly greater than the halving. But skeptics who look at the price cannot do this elementary calculation. So I expect this Greyscale flop to lead to a more significant momentary dip below 40K. I hope I'm wrong because I don't have money to buy now. It's clear that Greyscale is trying to milk their customers with this high rate. IMO the majority are not selling for a profit or a smaller loss, but to buy back other ETFs at a lower rate. This will further accelerate the effect of the shock supply. So I expect within 2 months at most, the price will start to recover steadily and grow into the usual exponential bull run. |

|

|

|

|

What a day the 11th Jan was for me! I entered into possesion of my the new apartment, got my office equipment and optical Internet. At the end of the day finally came the long-awaited news about the approval of all ETFs! Remarkable months await us. I never doubted for a moment that there would be a at least a 10-15% dump from the peak, which in this case was 49K. For those of us who have been around here for at least 4 years, this was no surprise. It doesn't matter if it's a Greyscale sell-off or a massive long liquidation due to excessive leverage. If we recall the previous halving, although Greyscale pulled 650K bitcoins from the market, the price increased not until the end of 2020. And that was because of the unexpected news about PayPal. So it will be another year before the combined effect of the halving and withdrawal of bitcoins from ETFs is felt. And then once it starts, no one can predict where the price will go. But 1 year is a long time and anything can happen. I would be happy if the price continues to grow like last year without major corrections, but it may not happen exactly like that. We must be ready to endure anything in order to enjoy the reward afterwards. Remember those fallen comrades who believed too much in charts, experts and their own wisdom. #don'tbelikemindrust

|

|

|

|

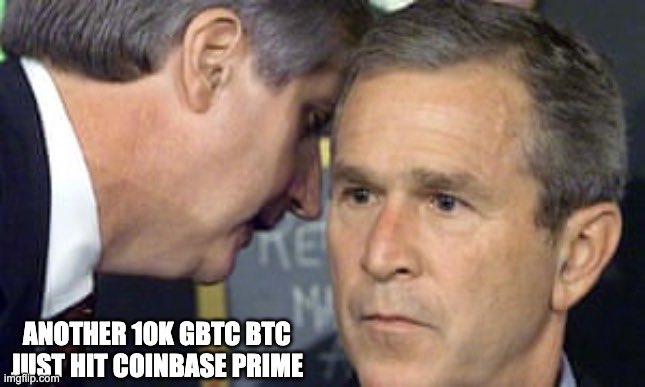

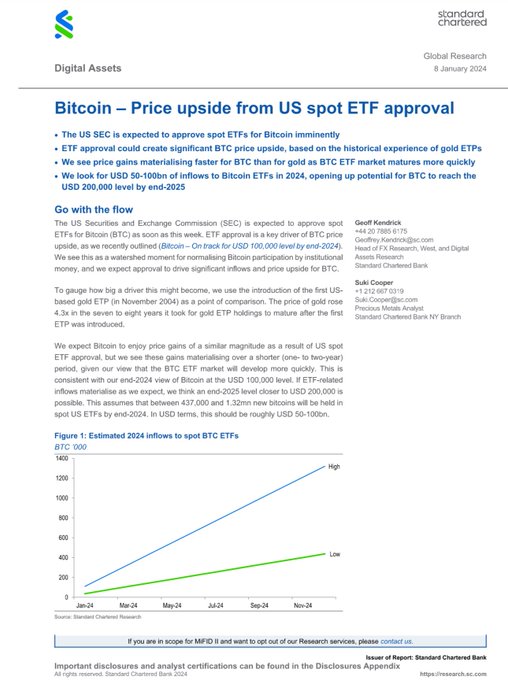

For some it may look bearish, for others bullish, but I think this is unusually realistic prediction, provided there won't be a black swan event. Mike Alfred @mikealfred Standard Chartered just put out a note saying that we could see $50-100B of spot Bitcoin ETF inflows in 2024 and a BTC price of $200,000 by the end of 2025. This is a big traditional bank, folks. The whole world is about to wake up on this.  https://twitter.com/mikealfred/status/1744381807091490836 https://twitter.com/mikealfred/status/1744381807091490836 |

|

|

|

Nice...tell us more about a "supercomputer"  Going from keys on Wednesday to paying off mortgage at 130K...wow. It totally makes sense to pay off a 6-7% mortgage, though..as long as it's only a portion (or a small portion) of your bitcoin. The bank will get only several thousand euro from me provided that I pay off my mortgage in less than 2 years. I needed this appartmen for my work this year, and at the same time I wasn't comfortable to sell a big part of my stash. I've sold only what is required from the bank as my personal participation in the deal. Even that was somewhat hurtful for me. My way of thinking is to keep as much of my stash as possible, but when I have the opportunity to change my life for the better like this, I should sell what is needed. Provided that I will keep most of my stash intact. Regarding the PC, actually it is more like a gaming/office setup with chair, desk, color printer/scanner, ups. The pc will be with the latest components, like cpu intel 14900kf, 192G RAM, 3SSD, Nvidia 4090, water cooled case. I am content with my current monitor Samsung 34" Odyssey OLED G8 so I ordered the same. The funny part is that the girl from the bank asked a lot of stupid questions for approval of the loan, like "for what will you use the computer?". I said "For checking my email." This answer obviously didn't satisfy her and she went on and on, and I was giving the most ridiculous answers I could figure out.  I would just have been honest with the bank and said "For endless, hardcore porn." In fact, I was momentarily tempted to tell her the same thing, but held it back because it's almost a 9K euro loan and I didn't want to risk it and have to sell bitcoins. So I continued with nonsense like "using word, excel, powerpoint" until she filled enough information in her form. In total, I've lost tens of hours on the phone answering mostly stupid questions for 2 weeks. What gave me motivation to endure this nazi interogation was that I would keep my bitcoins.  The funny part is that the girl from the bank asked a lot of stupid questions for approval of the loan, like "for what will you use the computer?". I said "For checking my email." This answer obviously didn't satisfy her and she went on and on, and I was giving the most ridiculous answers I could figure out.  Fuck those nanny state banker cocksuckers! Should have said "I like my porn in high quality, whats your onlyfans page?". *as a funny aside in the early 90's I upgraded a buddies computers GPU just for his porn collection.  Nah it's time these modern women are completely invalidated. Lots of free porn readily available and with modern upscale tools even older content is looking magnificent. Or switch to VR. The novelty does wear off, but it has to be far better than paying for watching a woman to undress, who in the real world would hate you anyway. Even that useless rapper Iggy Azaela does that crap now because... well she is useless. Or hire a professional. No shame. Women even encouraged that carry on. I reckon a real life professional will respect you and your hard earned money FAR more. Above all, let Only Fools die. It's a bit of a trigger to me this because knowing that the marketcap of BTC is about the same as how much stupid men are spending on OF EVERY YEAR is fucking madness! Buy BTC and ditch OF subs immediately! I admit that I have had periods when these things tempted me as a substitute for real sex. VR in particular is a pretty good alternative to the dangers of infection, extortion, theft, and similar problems in the real world. But I don't like any of the current models. I like the older generation beauties like Cassia Riley. Besides, I'm far from my 20s, and to be honest I've been more interested in the cooking channels recently. There are so many amazing meals served in the hundreds of restaurants in this city, which I will explore in the years to come. |

|

|

|

Nice...tell us more about a "supercomputer"  Going from keys on Wednesday to paying off mortgage at 130K...wow. It totally makes sense to pay off a 6-7% mortgage, though..as long as it's only a portion (or a small portion) of your bitcoin. The bank will get only several thousand euro from me provided that I pay off my mortgage in less than 2 years. I needed this appartment for my work this year, and at the same time I wasn't comfortable to sell a big part of my stash. I've sold only what is required from the bank as my personal participation in the deal. Even that was somewhat hurtful for me. My way of thinking is to keep as much of my stash as possible, but when I have the opportunity to change my life for the better like this, I should sell what is needed. Provided that I will keep most of my stash intact. Regarding the PC, actually it is more like a gaming/office setup with chair, desk, color printer/scanner, ups. The pc will be with the latest components, like cpu intel 14900kf, 192G RAM, 3SSD, Nvidia 4090, water cooled case. I am content with my current monitor Samsung 34" Odyssey OLED G8 so I ordered the same. The funny part is that the girl from the bank asked a lot of stupid questions for approval of the loan, like "for what will you use the computer?". I said "For checking my email." This answer obviously didn't satisfy her and she went on and on, and I was giving the most ridiculous answers I could figure out.  |

|

|

|

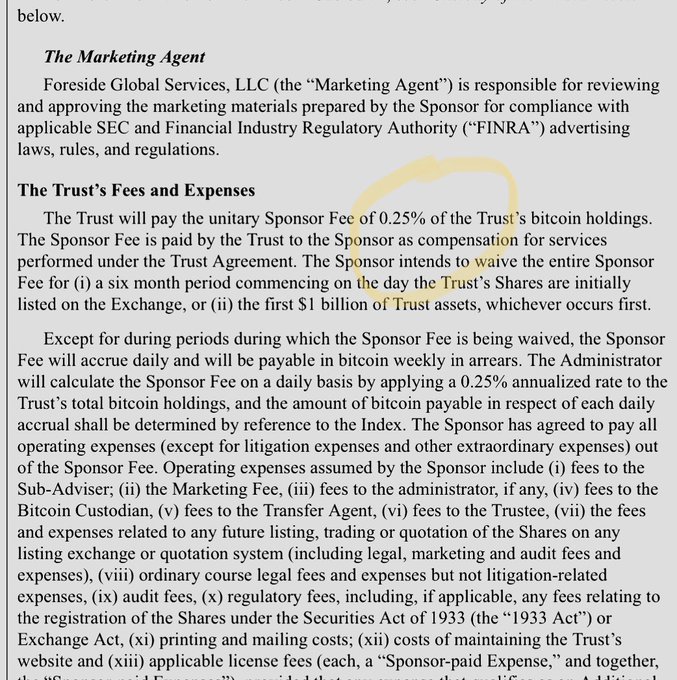

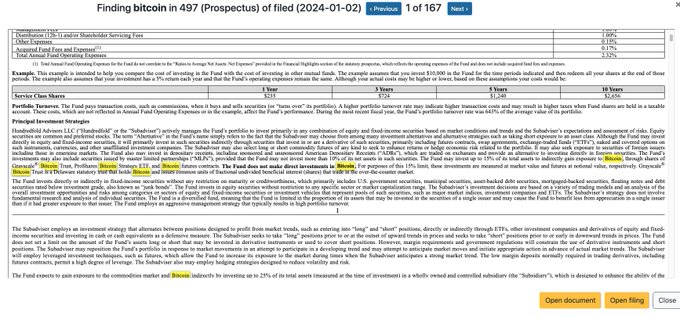

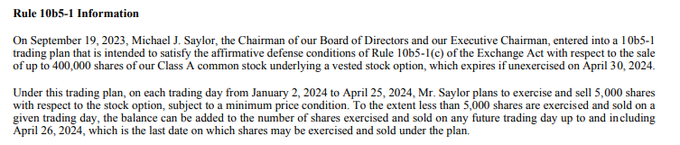

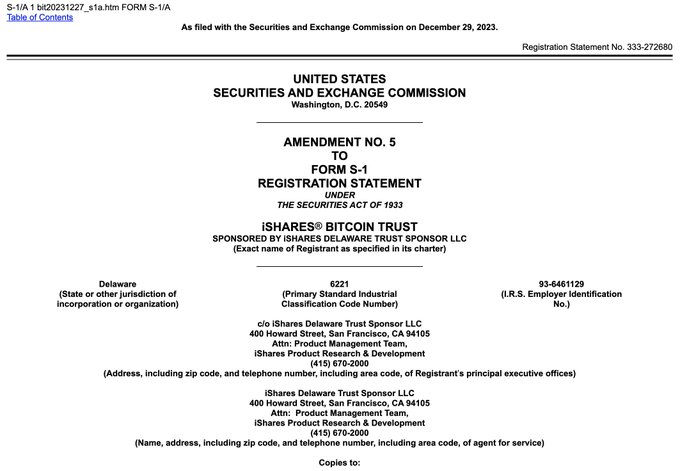

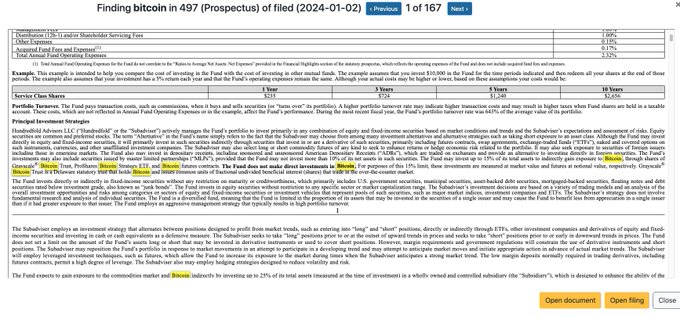

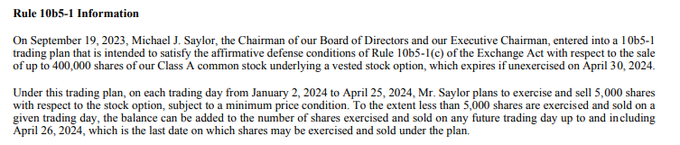

@MorganStanley registers new N-CSR (Annual shareholder report) for their traded Morgan Stanley Opportunity Fund with new text that they can allocate 25% of the fund to Bitcoin through @Grayscale $GBTC. 👀👀 The Fund may invest up to 25% of its total assets in a wholly-owned subsidiary of the Fund organized as a company under the laws of the Cayman Islands, Europe Opportunity Cayman Portfolio, Ltd. (the "Subsidiary"). The Subsidiary may invest in bitcoin indirectly through cash settled futures or indirectly through investments in Grayscale Bitcoin Trust (BTC) ("GBTC"), a private offered investment vehicle that invests in bitcoin. The Fund is the sole shareholder of the Subsidiary, and it is not currently expected that shares of the Subsidiary will be sold or offered to other investors. The consolidated portfolio of investments and consolidated financial statements include the positions and accounts of the Fund and the Subsidiary. https://twitter.com/martypartymusic/status/1742245177971089417https://www.sec.gov/Archives/edgar/data/860720/000110465924000182/tm2331287d1_ncsr.htmBreaking: A pattern is emerging. Other funds registered as securities already trading on the NASDAQ are ammending their prospectuses that they can now expose 15-50% of their AUM to Bitcoin, through the Spot Bitcoin ETFs. @saylor called it. Here we see Advisors Preferred Trust (Filer) CIK: 0001556505 can now hold 15% AUM in Spot Bitcoin 👀 through @Grayscale $GBT. "The Fund may invest up to 15% of its total assets to indirectly gain exposure to Bitcoin, through shares of Grayscale® Bitcoin Trust, ProShares Bitcoin Strategy ETF, and Bitcoin futures contracts." I predictaed $1 quadrillion of Spot Bitcoin and crypto derivatives stacked up by 2030 - this is proof its about to begin.👀  https://www.sec.gov/Archives/edgar/data/1556505/000158064224000013/0001580642-24-000013-index.htmlhttps://twitter.com/martypartymusic/status/1742251784566112588 https://www.sec.gov/Archives/edgar/data/1556505/000158064224000013/0001580642-24-000013-index.htmlhttps://twitter.com/martypartymusic/status/1742251784566112588@saylor will sell 315,000 $MTSR shares (worth ~$216m), filing shows. This was previously announced on Nov 1, 2023 (but now officially as form 144 in SEC filings.) Saylor will sell 5,000 shares every day until April 25, 2024.  https://twitter.com/btcNLNico/status/1742302411585429813 https://twitter.com/btcNLNico/status/1742302411585429813 |

|

|

|

|

It took less than 3 months in 2017 to reach 20K starting below 4K. And then everyone knew CME and CBOE won't buy actual bitcoins. Now it is different. It is hard to predict what will happen in the next few months. It depends how quickly the main ETF buyers will adapt to the new opportunity to buy bitcoin ETF's. May be there will be a rush, may be not. And may be some will be dissapointed by the slow start and dump their coins. But in the long run the supply shock will make the difference of course.

|

|

|

|

MicroStrategy has acquired an additional 14,620 BTC for ~$615.7 million at an average price of $42,110 per #bitcoin. As of 12/26/23, @MicroStrategy now hodls 189,150 $BTC acquired for ~$5.9 billion at an average price of $31,168 per bitcoin. $MSTR https://twitter.com/saylor/status/1739995636953485547 |

|

|

|

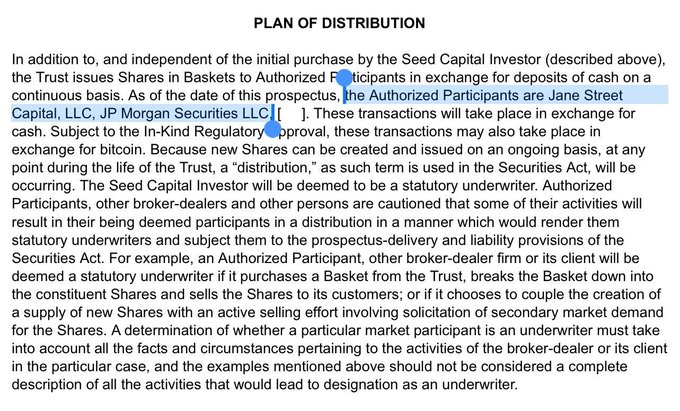

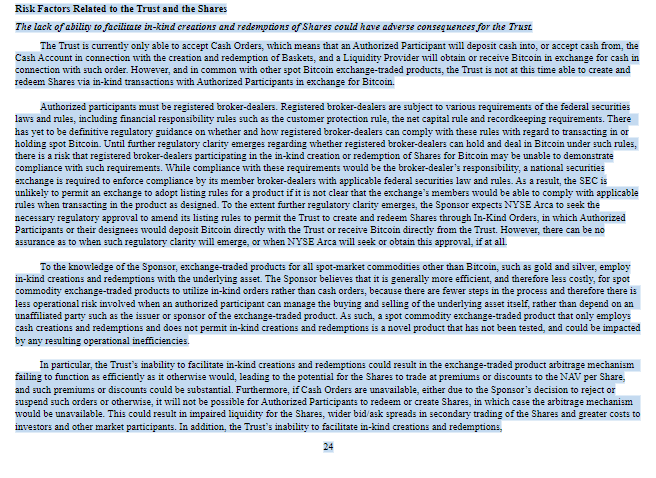

"Grayscale's amended S-3 gives a nice little background on the key sticking point for in-kind creation/redemption. The SEC promulgated rulemaking for digital asset safekeeping. Despite the fact that BDs and exchanges apparently believe they could comply with the rule and offer in-kind, the SEC will refuse to approve amendments to exchange rules that would allow this because they're not convinced that it is possible to comply with their rules. And despite the SEC being tasked with investor protection, this results in..... less protection for investors via a wonderful new novel product. Hey, but at least you get a new risk factor protecting you by informing you that, despite all other spot commodity ETFs operating with in-kind models, this must be done in a novel way via cash and who knows if that will work! I've never seen such dripping disdain for the SEC as I've seen in the disclosures from these issuers. SEC wants to firewall off digital assets from the tradfi ecosystem as much as possible. If BDs are making money working with these assets, then its harder for the SEC to push draconian rules. Is my guess."  https://twitter.com/SGJohnsson/status/1739807878372827507 https://twitter.com/SGJohnsson/status/1739807878372827507 |

|

|

|

|

Merry Christmas! Jesus came to this world so that we can receive the salvation of our souls. For some this is just a legend or a wishful thinking. But for me this is a reality which I continue to experience every day in my life on this Earth. Let the new year bring to my bitcoin brothers more happiness, health and bitcoin price skyrocketing!

|

|

|

|

|