|

BlackSpidy

|

|

August 21, 2015, 04:26:16 AM |

|

I've said it before and I'll say it again. There is no excuse to allow the block size to be arbitrarily set whenever the devs feel like. I think it should be an automated process, Satoshi might have been justified in not setting a block size increase like he did with the supply decrease, but we have enough data now. We have enough data to make a reliable model based on empirical data, in order to periodically increase the block size. I think it would have been reasonable to increase the block size to 8mb. Maybe they should have just set it at 4mb and be done with it until the next time we need a block size increase.

I mean, we had 30+ mb block size limit, and we had not big issues then, right?

|

|

|

|

|

|

|

|

Bitcoin addresses contain a checksum, so it is very unlikely that mistyping an address will cause you to lose money.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

ArticMine

Legendary

Offline Offline

Activity: 2282

Merit: 1050

Monero Core Team

|

|

August 21, 2015, 04:53:56 AM |

|

If Bitcoin survives this it will come out way stronger, there is however also a significant chance that block size issue will turn Bitcoin into a failed experiment.

quoted from ArticMine, 2013.

Thanks for the quote. All I can say is that I just finished selling the bulk of my remaining Bitcoins for a mix of 80% CAD (Canadian Dollars) and 20% XMR (Monero) |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

August 21, 2015, 05:02:30 AM |

|

|

|

|

|

|

billyjoeallen

Legendary

Offline Offline

Activity: 1106

Merit: 1007

Hide your women

|

|

August 21, 2015, 05:13:45 AM |

|

If Bitcoin survives this it will come out way stronger, there is however also a significant chance that block size issue will turn Bitcoin into a failed experiment.

quoted from ArticMine, 2013.

Thanks for the quote. All I can say is that I just finished selling the bulk of my remaining Bitcoins for a mix of 80% CAD (Canadian Dollars) and 20% XMR (Monero) thanks for playing. One less weak hand. |

|

|

|

|

ArticMine

Legendary

Offline Offline

Activity: 2282

Merit: 1050

Monero Core Team

|

|

August 21, 2015, 05:44:52 AM

Last edit: August 21, 2015, 05:57:57 AM by ArticMine |

|

If Bitcoin survives this it will come out way stronger, there is however also a significant chance that block size issue will turn Bitcoin into a failed experiment.

quoted from ArticMine, 2013.

Thanks for the quote. All I can say is that I just finished selling the bulk of my remaining Bitcoins for a mix of 80% CAD (Canadian Dollars) and 20% XMR (Monero) thanks for playing. One less weak hand. Everyone is entitled to their opinions. To understand what prompted me in my decision I suggest reading this article https://letstalkbitcoin.com/blog/post/confessions-of-an-r-bitcoin-moderator and the following thread https://bitcointalk.org/index.php?topic=1157912.0. There is a serious sickness in the Bitcoin community which goes far deeper than the fear of a drop in price. The recent closure of the following thread going back to 2012 is a perfect example. https://bitcointalk.org/index.php?topic=68655.0. Edit: This thread has a poll. Let me guess: "CIA" is code for Gavin's proposal, in order to avoid this thread from being closed. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

August 21, 2015, 06:02:32 AM |

|

|

|

|

|

|

Mervyn_Pumpkinhead

Legendary

Offline Offline

Activity: 876

Merit: 1000

|

|

August 21, 2015, 06:17:01 AM |

|

This sickness is caused by greed. Stagnation with bitcoin's technological development has been caused by the greedy get-rich-quick schemers who will start to cry as soon as some new development has been proposed that could cause temporal uncertainties at the market. This has been going on for some time already, only now clashing into a bigger public conflict of interest between different community members. This is why it has been a lot more interesting to observe the coming of new altcoins that are based on the blockchain technology. They are free to use brave and necessary solutions without a pack of monkeys yelling at them, that this could cause their bag to become heavier. |

|

|

|

|

macsga

Legendary

Offline Offline

Activity: 1484

Merit: 1002

Strange, yet attractive.

|

|

August 21, 2015, 06:17:11 AM |

|

Since you're long enough here to judge from a advantageous POV, here's a thought you might want to read: Trying to understand how the world runs on its wheels, nobody should disagree, that these wheels are called "money". Regardless of what people think about Bitcoin, it's a new set of wheels & suspension system at the same time. Technology wise, it's nowhere near whatever all these hundreds of years of civilization has presented so far. It's ingeniously engineered, wisely implemented and uses scientific concepts that nobody would've thought about 20y ago. Now, there's the current "system" that several people (you can use the word "corporations" here) have been using to control their field of interest, whether this is medical, IT, Engineering, Communications etc. They will simply won't let their car on some other hands other than their own. At least, not without a fight. Funnily enough, it seems that the world is running out of time (monetary wise). So, a federalization model for the whole planet that would use the old driver, seems to run to an end. Some say a few months, others say less than a year - doesn't really matter. This is over. Coming to the present day, I've written elsewhere, that "Everybody Has His Price". If the XT fork is orchestrated by a fraction of people that want control over BTC, then it was only a matter of time to "pwn" its "chief scientist". We're talking about the next wheels here. MORE car - MORE secure - FASTER than ever. So, no; this won't be the end of Bitcoin. Forked or not, there are more than the half of coins mined so far. If the consensus won't come, TPTB can keep the remaining ones and still be happy. I *still* don't know if we should be happy with it though... |

|

|

|

|

hdbuck

Legendary

Offline Offline

Activity: 1260

Merit: 1002

|

|

August 21, 2015, 06:42:45 AM

Last edit: August 21, 2015, 07:07:55 AM by hdbuck |

|

Anyone in support of a blocksize increase is a moron, a plague to Bitcoin. 1) Bitcoin block rewards will eventually become infinitesimal, at that point transaction fees will be the only rewards miners get. Right now transaction fees are around 0.1-0.5 BTC per block, which is nowhere near enough funding to secure the network by itself. We need transaction fees to go up, and the only thing that will force them up is the blocksize limit. Increasing block size might cause fundamental damage to Bitcoin due to this.2) Currently average block size is less than 0.4 mb now that the stress test bullshit is over. Gonna be a long time until we even hit the 1 mb limit.  3) Once we hit the 1 mb limit free and nearly no fee transactions will be forced off chain. There is TONS of dust, spam, and gambling that can be done off chain. Over half of all Bitcoin transactions right now are basically dusty junk. This will make plenty of room for legitimate transactions. 4) Once almost all the junk is forced off chain the rise in fees will be very gradual, and it will take a long time for the fees to become an issue for people. In any case the blockchain will function perfectly fine regardless of transaction data volume, fees will simply rise. If fees ever do get too crazy I'd support a block size limit increase too, but I don't expect that to happen for over a decade if ever. 5) Hard fork of Bitcoin is dangerous and can result in mass confusion, double spends, and loss of Bitcoins. It will damage the value of Bitcoin at least temporarily. 6) We need to maintain a group of scientists which reach a consensus, not just centralize Bitcoin under a couple of developers. Feel free to add if I missed any. So please feel free to go f#ck yourselves along with gavin and mickey the usurpers. Anyway, such fork will just never become reality, as miners wont simply let their revenue crushed. This my last post on the matter. Moving on. (sry OT, needed to let it out one last time) ps: will put any whining blocksize increase noob on ignore from now on. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

August 21, 2015, 07:02:47 AM |

|

|

|

|

|

|

|

Feri22

|

|

August 21, 2015, 07:21:06 AM |

|

Anyone in support of a blocksize increase is a moron, a plague to Bitcoin. 1) Bitcoin block rewards will eventually become infinitesimal, at that point transaction fees will be the only rewards miners get. Right now transaction fees are around 0.1-0.5 BTC per block, which is nowhere near enough funding to secure the network by itself. We need transaction fees to go up, and the only thing that will force them up is the blocksize limit. Increasing block size might cause fundamental damage to Bitcoin due to this.2) Currently average block size is less than 0.4 mb now that the stress test bullshit is over. Gonna be a long time until we even hit the 1 mb limit.  3) Once we hit the 1 mb limit free and nearly no fee transactions will be forced off chain. There is TONS of dust, spam, and gambling that can be done off chain. Over half of all Bitcoin transactions right now are basically dusty junk. This will make plenty of room for legitimate transactions. 4) Once almost all the junk is forced off chain the rise in fees will be very gradual, and it will take a long time for the fees to become an issue for people. In any case the blockchain will function perfectly fine regardless of transaction data volume, fees will simply rise. If fees ever do get too crazy I'd support a block size limit increase too, but I don't expect that to happen for over a decade if ever. 5) Hard fork of Bitcoin is dangerous and can result in mass confusion, double spends, and loss of Bitcoins. It will damage the value of Bitcoin at least temporarily. 6) We need to maintain a group of scientists which reach a consensus, not just centralize Bitcoin under a couple of developers. Feel free to add if I missed any. So please feel free to go f#ck yourselves along with gavin and mickey the usurpers. Anyway, such fork will just never become reality, as miners wont simply let their revenue crushed. This my last post on the matter. Moving on. (sry OT, needed to let it out one last time) ps: will put any whining blocksize increase noob on ignore from now on. I want to raise the block size just because of your post |

|

|

|

|

600watt

Legendary

Offline Offline

Activity: 2338

Merit: 2106

|

|

August 21, 2015, 07:55:06 AM |

|

If Bitcoin survives this it will come out way stronger, there is however also a significant chance that block size issue will turn Bitcoin into a failed experiment.

quoted from ArticMine, 2013.

Right. This isn't an existential threat (yet), but it does show just how long core devs have been squabbling and their inability to reach their beloved consensus. I don't know the players or the code well enough to know who wants to scale slower and who is merely using this issue to obstruct any improvement, but the status quo clearly will not do. I suspect Core devs have until the end of the year at the latest to release their counterproposal until the major players defect and go to XT. If the price continues to tank, they'll have far less than that. ironically one of bitcoins strengths - that it can be viewed in so many different ways (currency, store of value, payment system, digital gold, speculation vehicle, etc., etc.,) turns out to be something that makes consensus upon devs, users, start-ups, etc. difficult. bitcoins versatility boosts the fantasy of people with a wide range of different agendas. scalability and versatility seem to get into conflict. poor devs... |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

August 21, 2015, 08:02:28 AM |

|

|

|

|

|

|

hdbuck

Legendary

Offline Offline

Activity: 1260

Merit: 1002

|

|

August 21, 2015, 08:17:08 AM |

|

|

|

|

|

|

|

8up

|

|

August 21, 2015, 08:42:47 AM |

|

Anyone in support of a blocksize increase is a moron, a plague to Bitcoin. 1) Bitcoin block rewards will eventually become infinitesimal, at that point transaction fees will be the only rewards miners get. Right now transaction fees are around 0.1-0.5 BTC per block, which is nowhere near enough funding to secure the network by itself. We need transaction fees to go up, and the only thing that will force them up is the blocksize limit. Increasing block size might cause fundamental damage to Bitcoin due to this.2) Currently average block size is less than 0.4 mb now that the stress test bullshit is over. Gonna be a long time until we even hit the 1 mb limit.  3) Once we hit the 1 mb limit free and nearly no fee transactions will be forced off chain. There is TONS of dust, spam, and gambling that can be done off chain. Over half of all Bitcoin transactions right now are basically dusty junk. This will make plenty of room for legitimate transactions. 4) Once almost all the junk is forced off chain the rise in fees will be very gradual, and it will take a long time for the fees to become an issue for people. In any case the blockchain will function perfectly fine regardless of transaction data volume, fees will simply rise. If fees ever do get too crazy I'd support a block size limit increase too, but I don't expect that to happen for over a decade if ever. 5) Hard fork of Bitcoin is dangerous and can result in mass confusion, double spends, and loss of Bitcoins. It will damage the value of Bitcoin at least temporarily. 6) We need to maintain a group of scientists which reach a consensus, not just centralize Bitcoin under a couple of developers. Feel free to add if I missed any. So please feel free to go f#ck yourselves along with gavin and mickey the usurpers. Anyway, such fork will just never become reality, as miners wont simply let their revenue crushed. This my last post on the matter. Moving on. (sry OT, needed to let it out one last time) ps: will put any whining blocksize increase noob on ignore from now on. What's the worst about self-censorship is, that one can easily lose connection to reality. Most of the big miners and exchanges already announced they will support 8MB. XT is something different. IMO: We will get a Bitcoin Core implementation of either 2 or 4MB until the beginning of 2016 -> Dispute will be settled by then. Market uncertainty will be replaced by euphoria and fully supported by global markets trending down. |

|

|

|

|

Elwar

Legendary

Offline Offline

Activity: 3598

Merit: 2384

Viva Ut Vivas

|

|

August 21, 2015, 08:52:11 AM |

|

Anyone in support of a blocksize increase is a moron, a plague to Bitcoin. 1) Bitcoin block rewards will eventually become infinitesimal, at that point transaction fees will be the only rewards miners get. Right now transaction fees are around 0.1-0.5 BTC per block, which is nowhere near enough funding to secure the network by itself. We need transaction fees to go up, and the only thing that will force them up is the blocksize limit. Increasing block size might cause fundamental damage to Bitcoin due to this.2) Currently average block size is less than 0.4 mb now that the stress test bullshit is over. Gonna be a long time until we even hit the 1 mb limit.  3) Once we hit the 1 mb limit free and nearly no fee transactions will be forced off chain. There is TONS of dust, spam, and gambling that can be done off chain. Over half of all Bitcoin transactions right now are basically dusty junk. This will make plenty of room for legitimate transactions. 4) Once almost all the junk is forced off chain the rise in fees will be very gradual, and it will take a long time for the fees to become an issue for people. In any case the blockchain will function perfectly fine regardless of transaction data volume, fees will simply rise. If fees ever do get too crazy I'd support a block size limit increase too, but I don't expect that to happen for over a decade if ever. 5) Hard fork of Bitcoin is dangerous and can result in mass confusion, double spends, and loss of Bitcoins. It will damage the value of Bitcoin at least temporarily. 6) We need to maintain a group of scientists which reach a consensus, not just centralize Bitcoin under a couple of developers. Feel free to add if I missed any. So please feel free to go f#ck yourselves along with gavin and mickey the usurpers. Anyway, such fork will just never become reality, as miners wont simply let their revenue crushed. This my last post on the matter. Moving on. (sry OT, needed to let it out one last time) ps: will put any whining blocksize increase noob on ignore from now on. What's the worst about self-censorship is, that one can easily lose connection to reality. Most of the big miners and exchanges already announced they will support 8MB. XT is something different. IMO: We will get a Bitcoin Core implementation of either 2 or 4MB until the beginning of 2016 -> Dispute will be settled by then. Market uncertainty will be replaced by euphoria and fully supported by global markets trending down.Ideally a 2MB bump by 2016 with some serious vetting viability of the lightning network. |

|

|

|

|

fairglu

Legendary

Offline Offline

Activity: 1100

Merit: 1030

|

|

August 21, 2015, 08:53:39 AM |

|

I personally think the limit to block size is not the one in code, but mining and propagation.

Larger blocks are slower to propagate, and have a greater chance of being orphaned. SPV mining and 1 transactions blocks are already regular.

IMHO that's where there is the greater risk in terms of bitcoin scalability: it is currently risky (in terms of profit) to pack too many transactions in a block, as block rewards go down, all low-fee tx will be filtered out by miners, and they will strive to make small blocks packed with high fee tx.

It just does not make sense (from a miner PoV) to have large blocks (higher risk of orphans) unless fees are sufficient.

So the blocksize may ultimately be irrelevant in terms of fees, propagation speed will be the name of the game (at least for profit-oriented pools).

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

August 21, 2015, 09:02:29 AM |

|

|

|

|

|

|

Gyrsur

Legendary

Offline Offline

Activity: 2856

Merit: 1518

Bitcoin Legal Tender Countries: 2 of 206

|

|

August 21, 2015, 09:03:30 AM |

|

Ideally a 2MB bump by 2016 with some serious vetting viability of the lightning network.

to lift the blocksize to 2MB may be enough for the next years. a automated lift mechanism in the code may not be suitable because of the fragility of the economic parameters. this should be watched by humans. |

|

|

|

|

rebuilder

Legendary

Offline Offline

Activity: 1615

Merit: 1000

|

|

August 21, 2015, 09:35:27 AM |

|

1) Bitcoin block rewards will eventually become infinitesimal, at that point transaction fees will be the only rewards miners get. Right now transaction fees are around 0.1-0.5 BTC per block, which is nowhere near enough funding to secure the network by itself. We need transaction fees to go up, and the only thing that will force them up is the blocksize limit. Increasing block size might cause fundamental damage to Bitcoin due to this.

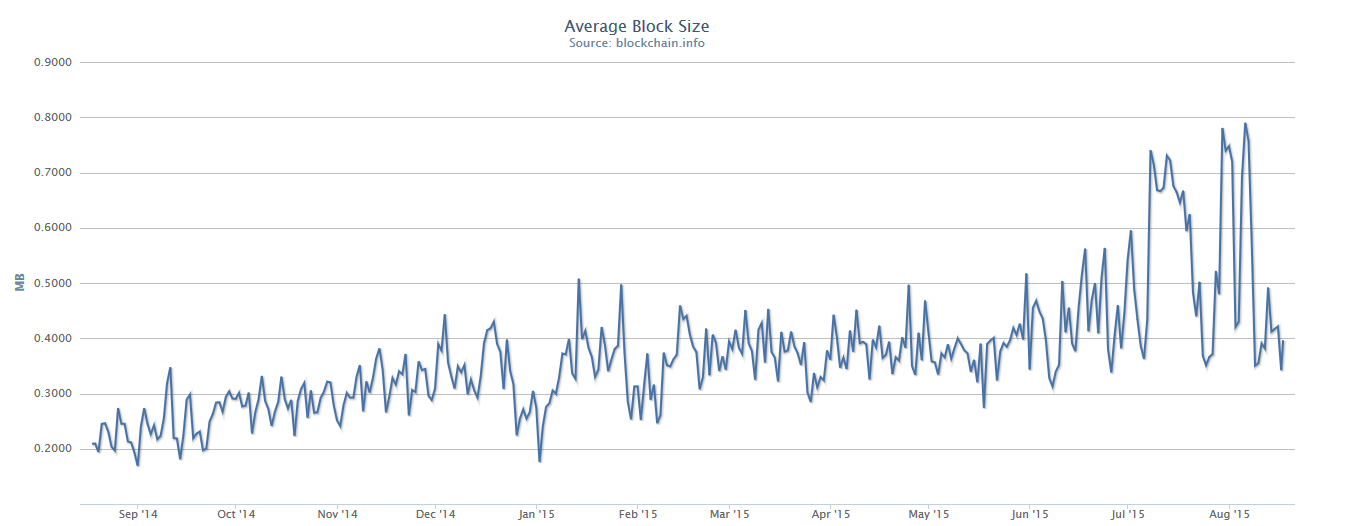

2) Currently average block size is less than 0.4 mb now that the stress test bullshit is over. Gonna be a long time until we even hit the 1 mb limit.

[Snip chart, you've seen it already...]

3) Once we hit the 1 mb limit free and nearly no fee transactions will be forced off chain. There is TONS of dust, spam, and gambling that can be done off chain. Over half of all Bitcoin transactions right now are basically dusty junk. This will make plenty of room for legitimate transactions.

4) Once almost all the junk is forced off chain the rise in fees will be very gradual, and it will take a long time for the fees to become an issue for people. In any case the blockchain will function perfectly fine regardless of transaction data volume, fees will simply rise.

If fees ever do get too crazy I'd support a block size limit increase too, but I don't expect that to happen for over a decade if ever.

5) Hard fork of Bitcoin is dangerous and can result in mass confusion, double spends, and loss of Bitcoins. It will damage the value of Bitcoin at least temporarily.

6) We need to maintain a group of scientists which reach a consensus, not just centralize Bitcoin under a couple of developers.

Feel free to add if I missed any.

1: A limited block size is not the only thing that can force fees up. Miners can choose to not process 0-fee transactions, and likely would if they find rewards aren't sufficient to cover their costs. That's the whole idea, isn't it? Miners choose what fees they require and the market sorts it out. The block size limit was put in to prevent bloating of the blockchain itself. Setting a hard limit on transactions per second was not the goal. 2: From that chart, and the longer-term version of it, it looks like we'll probably hit 1 MB some time in 2016, assuming the rate of growth remains the same. 4: I'll address this more generally below 5: Hard fork isn't great, I think we can agree on that. Consensus would be better if it can be found. 6: The problem is, there's no consensus on design goals: How many transactions per second should Bitcoin support? Should it be a backbone for serious financial industry or a payment network for Joe Q. Public? Lacking a common vision on that, it's no wonder there's difficulty agreeing on engineering solutions. I'd recommend reading these posts by DeathAndTaxes and jl2012: https://bitcointalk.org/index.php?topic=946236.0 - DeathAndTaxes :"Permanently keeping the 1MB (anti-spam) restriction is a great idea, if you are a bank." https://bitcointalk.org/index.php?topic=1054482.0 - jl2012: "What is the optimal block size" The more salient points: -currently the network supports about 2.3 TPS. 7TPS average is an estimate based on every transaction being the smallest possible size, which doesn't happen in real life. -If you wanted Bitcoin to grow, say, to half the size of PayPal, you'd need it to handle about 70 TPS. -Given we're likely to hit or get close to the 1 mb ceiling within a year or so, and given you really want to have a solution that's announced well in advance and tested thoroughly, it seems time to start doing something. Another point that relates to miner costs is that currently blockchain maintenance costs (as per DeathAndTaxes) roughly 10% of the Bitcoin market cap, each year. Maintaining that cost does not seem like a good goal. The question is: How secure does the network need to be? Currently, looking at the amount of money spent securing it vs. the valuation of the currency, it seems pretty damn secure - but is there any reason to assume we're at an optimal point? Why should we try to keep miner profitability up if the result is decreased cost-efficiency? Efficiency is supposed to be a main marketing point for Bitcoin, right? Satoshi's vision originally was that eventually block subsidies and fees would likely not cover the costs of mining, but that institutions with an interest in keeping the network secure would spend funds to secure it. Even so, 10% of market cap yearly seems like an unreasonable cost. The end user must pay that in the end. |

|

|

|

|

|

Poll

Poll