cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

September 13, 2018, 04:57:01 PM |

|

https://www.worldcryptoindex.com/creators/roger-ver/At age 16, he had a falling out with his father over a property dispute concerning the Ford Mustang. His deeply religious parents did not approve of the purchase and his father attempted to sell the car by placing an advertisement in a local Newspaper. Roger responded by calling the police who threatened to arrest him if he didn’t withdraw the ad. This dispute led to Roger moving out of the family house. He then attended a community college in Cupertino, California called De Anza College for a year before dropping out. After dropping out of college, Roger elected to pursue a number of small business interests. Almost every man I've met in my life that has had a similar adolescent backstory and history with their parents has turned out to be a reckless Narcissist sociopath as an adult. With a constant history of making brash, miscalculated mistakes. Usually involving personal relationships, money/business ventures, or both. They blame everyone else and society for their problems and ill-fate. They usually end up alone, broke and heavily in debt, or both. You nailed it. |

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 12009

BTC + Crossfit, living life.

|

|

September 13, 2018, 05:18:00 PM |

|

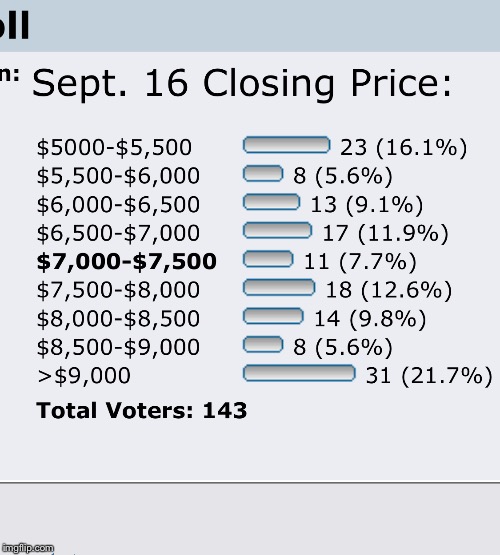

Some people just vote for the highest (mic!) or lowest (r0ach) option every time. I just kind of ignore those when looking at the polls.

There you got me wrong  (Inf!) Didn’t vote the highest  , Just don’t dare Fucking around with the POLL   via Imgflip Meme Generator via Imgflip Meme Generator |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 12009

BTC + Crossfit, living life.

|

|

September 13, 2018, 05:19:37 PM |

|

^ I actually can have iT right  gogo btc gogo mic |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 12009

BTC + Crossfit, living life.

|

|

September 13, 2018, 06:36:00 PM |

|

|

|

|

|

|

BitcoinNewsMagazine

Legendary

Offline Offline

Activity: 1806

Merit: 1164

|

https://www.coindesk.com/landmark-crypto-crime-case-ends-with-jail-sentence-for-gaw-ceo/Josh Garza, the CEO of the now-defunct cryptocurrency mining company GAW Miners, has been sentenced to 21 months in prison after pleading guilty to a wire fraud charge.

Garza was given six months home confinement as part of a 3-year probationary period following release.

Thursday's sentencing caps a years-long saga that began in 2014, with allegations that GAW was functioning as a Ponzi scheme by selling more cryptocurrency mining processing power than the firm actually possessed. Garza had good legal representation as he got off with a light sentence. His was the number one cryptocurrency scam I wrote about back in 2015; Litecoin GEAR came in second place. |

|

|

|

|

Raja_MBZ

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

|

September 13, 2018, 07:22:02 PM |

|

|

|

|

|

|

cAPSLOCK

Legendary

Offline Offline

Activity: 3738

Merit: 5127

Whimsical Pants

|

|

September 13, 2018, 07:47:12 PM |

|

https://www.coindesk.com/landmark-crypto-crime-case-ends-with-jail-sentence-for-gaw-ceo/Josh Garza, the CEO of the now-defunct cryptocurrency mining company GAW Miners, has been sentenced to 21 months in prison after pleading guilty to a wire fraud charge.

Garza was given six months home confinement as part of a 3-year probationary period following release.

Thursday's sentencing caps a years-long saga that began in 2014, with allegations that GAW was functioning as a Ponzi scheme by selling more cryptocurrency mining processing power than the firm actually possessed. Garza had good legal representation as he got off with a light sentence. His was the number one cryptocurrency scam I wrote about back in 2015; Litecoin GEAR came in second place. What a douchnozzle:  |

|

|

|

|

StartupAnalyst

Sr. Member

Offline Offline

Activity: 728

Merit: 317

Crypto Casino & Sportsbook

|

|

September 13, 2018, 08:22:59 PM |

|

I give. Which suit is the crypto trader? Obviously not the older one)) |

|

|

|

|

Kylapoiss

Sr. Member

Offline Offline

Activity: 616

Merit: 292

I don't know where I'm going, but I'm going.

|

|

September 13, 2018, 08:35:42 PM |

|

Theres some merit for you, gave you everything I had  |

|

|

|

|

|

|

Deeyoh

Member

Offline Offline

Activity: 258

Merit: 14

|

|

September 13, 2018, 08:50:41 PM |

|

https://www.coindesk.com/landmark-crypto-crime-case-ends-with-jail-sentence-for-gaw-ceo/Josh Garza, the CEO of the now-defunct cryptocurrency mining company GAW Miners, has been sentenced to 21 months in prison after pleading guilty to a wire fraud charge.

Garza was given six months home confinement as part of a 3-year probationary period following release.

Thursday's sentencing caps a years-long saga that began in 2014, with allegations that GAW was functioning as a Ponzi scheme by selling more cryptocurrency mining processing power than the firm actually possessed. Anyone want to buy a couple Gridseed miners? LOL, I still have 2 sitting in boxes. |

|

|

|

|

|

kirreev070

|

|

September 13, 2018, 08:58:21 PM |

|

A little better, but still expensive  |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 12009

BTC + Crossfit, living life.

|

|

September 13, 2018, 09:00:09 PM |

|

Theres some merit for you, gave you everything I had  its tough always sitting on the edge of Smerit isn't it..... just to much things there to MERIT around here .....  but i did like that video .... and i'm not 1 of those fallen idiots  |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 12009

BTC + Crossfit, living life.

|

|

September 13, 2018, 09:01:25 PM |

|

A little better, but still expensive  will not PAY in BTC otherwise walking with a 20K phone in Xmonths ..... |

|

|

|

|

|

kirreev070

|

|

September 13, 2018, 09:04:03 PM |

|

A little better, but still expensive  will not PAY in BTC otherwise walking with a 20K phone in Xmonths ..... Yes it happens. My friend bought an iPhone 7 Plus almost for 2 bitcoins in 2016 |

|

|

|

|

Kylapoiss

Sr. Member

Offline Offline

Activity: 616

Merit: 292

I don't know where I'm going, but I'm going.

|

|

September 13, 2018, 09:10:28 PM |

|

Theres some merit for you, gave you everything I had  its tough always sitting on the edge of Smerit isn't it..... just to much things there to MERIT around here .....  but i did like that video .... and i'm not 1 of those fallen idiots  I don't know about sitting on the edge, this was my first time to give them out and I gave them all  but true, most of the posts in this thread deserve merits. Yeah, I hope I'm not falling too, not sure about the idiocracy  |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 12009

BTC + Crossfit, living life.

|

|

September 13, 2018, 09:21:18 PM

Last edit: September 13, 2018, 10:24:39 PM by micgoossens |

|

Saw on Twitter somewhere  via Imgflip Meme Generator via Imgflip Meme Generatorsaw this one on twitter to..... thought it needed a bit of correction FOOLS will be FOOLS offcourse |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 12009

BTC + Crossfit, living life.

|

|

September 13, 2018, 09:30:59 PM |

|

i do not mind suffering but i was lucky coming in BTC when the price started the reversal @ 350-ish so i started in the maximum uptrend ..... and was able to build a stash @ cheap prices @ that time (also bought my 5-6-7-till 12k coins .....) bust 80% under 1K |

|

|

|

|

Wekkel

Legendary

Offline Offline

Activity: 3108

Merit: 1531

yes

|

|

September 13, 2018, 09:46:04 PM |

|

A little better, but still expensive https://ibb.co/kKMUFU][img]https://preview.ibb.co/dj7fN9/2018_09_13_23_57_19.png Only Apple goes on stage with up to 2 year old models. "Hé, we are Samsung. We've got this shiny new Galaxy S10 thing that can do tons of cool new stuff..... but you can also buy our Galaxy S8 from 2017 for $800...."  Android users are awake  |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 12009

BTC + Crossfit, living life.

|

|

September 13, 2018, 09:46:29 PM |

|

^ Thats true but fun as well sometimes..... Going to bed hoping to dream of an extension of today (reversal extentions ) Let see what the morning gonna bring , for those that forgot to BUY the DIP or waiting for lower prices , just buy Some now (never No) and bob we didn’t saw 6700 yet  |

|

|

|

|

|

Poll

Poll