Today's Date: 12/4/2020 Today's Time: See Forum Time On Post Above! Current Price: $18,782.62 USD Total BTC Needed: 53.24 BTC Well, not sure how long this is gonna last, usually (at least 3-4 times since I've been on since 2013. note current FUD being tossed about to 'soften' FOMO. https://www.cnbc.com/2020/12/04/top-currency-regulator-says-to-expect-clarity-in-coming-weeks-on-bitcoin.htmlWhenever an All-Time-High the 'vested interests' in the 'status quo' ie: wealthy/bankers/Corporations put 'pressure' on the government to regulate this 'evil' BTC/Crypto! In either an attempt to limit BTC/Crypto's adoption or drop the price to they can more easily get into the action. Those that do not see the virtual currency as a store of value, or how I like to think of it as 'virtual land' limited to 21 million BTC, which reflects the price in the network as ie Bitcoin... due to you can't print any more than 21 million of which 18.5 million have already been made. Thus the FOMO of Grayscale buying 70% to 100% of all the equivalent mined BTC per day. Then double down and add PayPal doing the same, at also around the equivalent of 70-100% mined coin per day. Of course, with NO one really dumping, the FOMO buzzer went off and the regulators were prodded out to speak on such regulations to BTC/Crypto coming in 4-6 weeks or about 5 days before the Biden Administration is sworn in. Thus, in my view, these 'regulations' even in good faith will likely be 'rushed' and need to be tweaked to work over the winter so if, in the past, we might be looking at 13K BTC through winter before the ATH has broken again in say spring 2021. Such stuff can slow BTC/Crypto Adoption down..but can't really kill i I was hoping for 20K BTC ..but I think we won't see that till Spring 2021 after 'digesting' whatever USA regulations coming down the pike.  Sorry end of rant... Brad |

|

|

|

I think it is the same old same old, whenever BTC/Crypto takes a run at All-Time Highs, finance and gov't set in to try and slow it down. Either by regulations to disrupt price or slow down adoption. Rinse/Wash/Repeat. https://blockchain.news/news/coinbase-ceo-warns-exiting-president-trump-may-drop-crypto-wallet-regulation-bombtoday https://www.coindesk.com/brian-brooks-crypto-clarityAnyway, the 'usual' vague or misleading regulations that will have to be tweaked in that will likely will be rushed out as 'un-doable' and will spend 6 months at flat/down or sideways price on BTC/crypto until resolved. I can tell you right now if we have to do KYC on anything going through a USA exchange....well...I'm out and using foreign exchanges with regular KYC then. Seen this tune before, get some fiat together to buy in at the low. How the big money and it link to corporations and powerful...play the BTC/Cryptosystem. In my own view, before the above tricks by gov't and regulating exchanges, we would be over $20k at the end of 2020. As it is now if we just wait say 4-6 months for this all to get resolved in an adult manner my best guess at what is likely to be a confusing or undoable regulation and (hopefully briefly) about $12k BTC. If regulation is 'doable' in some manner BTC'/crypto would bounce right back price-wise. We will see I guess withing the next 6 weeks before the changeover to the Biden Administration...and we get back to ATH areas. So, I'm making the 'call' cheap coin boys....between FOMO and Regulators..I'd settle for 'sideways price-wise till tweaked/resolved) IMHO, the above is 'speculation' but I'm betting a bit more and a bit odd to boot. Shit flows downhill, and BTC/Crypto has 'scared' the shit out of everyone of any wealth/power/banking...so time for the 'traditional' 'for your own good" slapdown! Cheap coins! Brad |

|

|

|

As an aside, I've found another way to mine BTC using Apple IIs...I call it 'Attic Mining'  In other words, I am trying to sell, bit by bit, my attic full of apple 2 stuff on eBay and convert to BTC/Crypto. Now if I'd had done this in 2013 I'd likely have 200 or 300 Bitcoin..so my only hope now that I'm out of both home BTC/crypto mining and data hall mining (the ship has sailed on). This is the ONLY way I can mine anything out of my house that makes sense. Sell stuff in the attic I would otherwise 'die' with and put the proceeds of eBay via Paypal into BTC/Crypto. I figure all the junk of a retro computer and apple 2 types I have well over $5k of crap if I can ever get motivated to do this and piecemeal it out onto eBay. also, if I'm wrong and BTC/crypto goes full 'bennie baby' and worthless...I still have an empty attic and easy rec room and probably increases the worth of my house about $15k. with the now useable attic/rec room.  win/win! So, if you are diligent enough and disciplined to do this 'boring' cubicle type work..go for it..it is a lot less risky than home mining in the past buying ASIC equipment on a hope and a prayer..anyway..those days are lost here is an alternative to get some BTC/Crypto dust!  Brad |

|

|

|

Ok...gonna go with an actual way/timeline here, in this order. 1) Continue to clam, without evidence and the lack of support by the FBI, AG Barr and your own Justice Department, that the election was rigged and stolen! I myself am awaiting the 'Our Soon To Be Alien A.I. Space Robot Benovelent Overlords' argument myself!  2) Pardon Everyone (more or less) in his Trump Administration. Or at least the 'enablers of your Trump Presidency, so you can at least get some 'good vibes' cover in their Tell All Bood deals! Also remember, Trump can pardon anyone, and maybe himself and just not 'tell' anyone. Thus at any time he was convicted of a Federal Crime, he could simply show a notarized previous pardon he did before he left office, yanked out of his safety deposit box, and mooting any such 1-2 year investigation, and have a good laugh.  Indeed, he can 'secret pardon' folks who can wait till convictions of pre-Jan 2020 Trump Administration antics/crimes and use this as a 'get out of jail card' if needed. Again, nothing says that Trump has to tell anyone he pardoned someone. 3) Continue your utter disregard and destruction of the Republican Party by saying NOT to vote in the Georgia Senate Elections. Indeed, toss the party in front of a bus to save your delusions. 4) Continue to do dubious executive orders such as holding up the defence appropriations bill on how you are treated on social media. 5) Force an Over-ride from the Senate on passing a lame-duck Covid-19 relief package and also extending the budget extension .just so you can prop up your announcement of 2024 run for President again. This is to show the 'dark state' thwarting above his will, or so he will say on 2020-24 run for the Presidency again. 6) Trump could simply write a letter and walk out the door, today, leaving the country would have to swear in V.P. Pence for a month, (I think that is how this works?) even if not coordinated by Trump/Pence do you really think V.P. Pence would NOT pardon Trump, if surprised and thrust into office? It is NOT like you can force Trump to not just walk out the door before Biden Administration is sworn in on January 20th? Just a letter on a desk and be gone the next day tossing the USA under the bus. 7) Trump will announce is Presidential run for 2024 while skipping the Inauguration of the Biden Administration while playing Golf on January 20th, 2020. We will see how much of the above I have correct. But I long for the days of like 5 years ago, when none of the above could even be in an Al Frankin Comedy Novel as being too impossible. Brad |

|

|

|

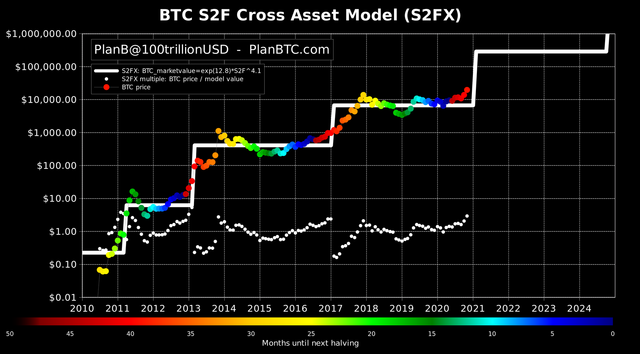

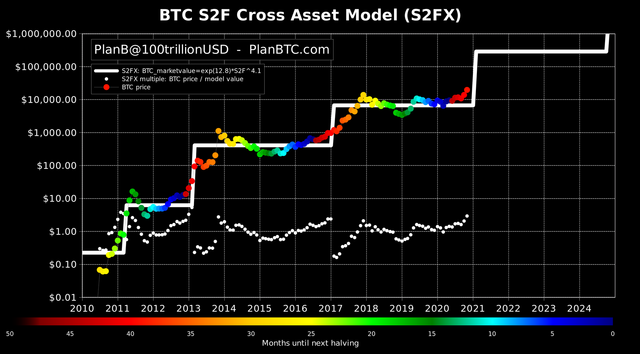

Hmm...I look at the ATH today being broken..and reflect on my start as a newbie in BTC in 2013. and it suddenly is starting to dawn on me this whole concept of 'more money than god' 'stupid rich' and of course 'my ship came in' dangerous thoughts...(slaps self in head) ...better to continue to do as I have in the past and think of all this BTC/Crypto as rainbows/fairy-dust/imaginary inet money/unicorn perfume farts/ etc. Was damn easier on 12/24/18 at $3,900 BTC and such. I know this because I cracked and sold 13 BTC that night of which I have recovered 5 BTC..which is 8 BTC down.  The date lives in infamy!  I mean that is almost 1 month short of 2 years ago! Frack! Acceleration at that level in the next 2 years and my eyes will bleed.  This whole 'reality' thing is getting weird/odd and a bit unnerving...if not frigging scary!  (Never satisfied...always have to look under the rock..sheesh! Scared Self!)  Brad sheesh...such pretty, pretty charts!    |

|

|

|

Why is there no electric costs in that part of Serbia? Are the miners simply doing like China in the rainy season and swapping 1/2 coins a month for free electricity per the the month off of hydro/dams or something? How tough is it to get Bitcoin/Crypto Miners into Serbia? Is there a VAT or Tariffs or both? Man, I'd love to get in on such action, but utterly clueless American and have heard bad stories about sending miners to far off places never to be heard from again to the 'supposed' far away data hall. I'd have to be married to your Sister or something...hmmm....ya got a Sister? (damn, I miss BTC/Crypto mining..all the little bright LCDs and whirly fan noises) sigh!  (It's cold up here in the sports stadium in the bleaches watching you play...also 'splinters' in my ass..I miss my miner 'newbie' youth)  brad |

|

|

|

Well, what do folks on this Litecoin thread think of the coinbase CEO's rumor of BTC/crypto regulations requiring exchanges to know the ins/outs of KYC for not only an account but you prove? somehow your paper wallet or Trezor or whatever and keep track of all addresses in/out with KYC? (I assume that is the crux of this stupid supposed regulation? Correct me if that is a few steps beyond what it is really) indeed..impossible indeed..it would be the same thing as China tried to do more than a few years back and all the China exchanges just picked up and left...then views changed and all came backM Indeed, I can easily go to an exchange in Canada and use KYC and skip the entirety of the above regulation....I assume this is just another 'burnt earth' policy of dubious regulations left by the Trump Administration to make things difficult for the incoming Biden Administration and will..if implemented by Trump Administration would be overturned promptly. (knock wood)  But, indeed, IF such a rule was made...Mimblewimble would be soooooo beyond dead in the water for Litecoin as to be 'undo'able' IMHO even if all the exchanges did leave the USA for What do you think? Not a slam, just saying, if it stands, the next shot would be against Mimblewimble and anon coins IMHO. Again, I can't see it working..in that it is a USA law only, but damn I can see it slapping the price of BTC/Crypto down to sideways or much lower sideways on the next year into 2021 as this is addressed by Biden Administration and threats of US exchanges bailing out of the USA ASAP.  Anyway, thoughts on how you think this all will shake out? I myself would be my own money that Trump Administration, like Coinbase CEO says, will do this rule before Biden Administration takes over. Likely, with a 'timeline' impossible to do by say Jan 1st, 2021. Sh*t, this will be quite the clusterf**k...I hope I'm dead wrong, but dubious Trump Administration rules seem to be the way of things till Biden Administration takes over, so I hope not in this case...but with all our success this year, we would be a likely target of such idiocy IMHO.  Again, beat me up, give me some hope, say I'm wrong on my view it will go through and will get fixed by Biden Administration eventually but making 2021 more uncomfortable than it otherwise would be price/regulation wise.  BTC/Crypto/LTC always drama!  Brad centralization is good for you ? No, but if regulations come along to micromanage exchanges on in/out by address and KYC..what chance does Mimblewimble have to be allowed by the powers that be? Indeed, I keep expecting a ban on anon blockchains....perhaps I'm too harsh...but...there is always pushback when we are close to ATH and/or FOMO IMHO by some regulation or govt attempt to centralize stuff...how successful they are is debatable. Just wool-gathering here, but seems a lot of stuff in play with anonymous blockchain concerns and just about that time every couple of years where a mess of really stupid crypto controls are attempted by many to be put in place...sure they are likely to be modified and slapped down. But 'supposedly' these govt studies always think they can control decentralized coins much more than is possible. It is like each attempt they forget everything they learned that did not work from previous attempts and simply go with the heavy-handed approach of ban or some other silliness. whatever, I see a new crop of this kinda FUD on the horizon the bigger the FOMO the bigger the FUD from what I've seen in the past. Brad |

|

|

|

Sorry, just as an aside...I can't flip BTC for equipment anymore at that level of play..I'm out....big boy games (or guys with solar farms whose name I should not mention) can do such...but I mean EVEN if we had BTC/Crypto prices at the same level of risk/reward of say 2017...I just could not pull the trigger on such equipment..at current price of btc/crypto and the equipment investments...even if I had insider cheap kWh in the USA. (by the by what is the best rate in USA 4c kWh?) There comes a time, when you not only find yourself shocked by the price of BTC/Crypto from when you were a newbie and started...to now..when I'm shocked at the investment of BTC/Crypto into mining/equipmetn units...even if I had a 'legit' return on investment...too old in crypto..I am afraid I can't pull the trigger on this kinda thing anymore....like my newbie days of like the ancient 4 years ago..alas, I miss my 'newbie' BTC/Crypto big brass ones...seems at $18.5K I've become a conservative HODL'er ....ie or no more 'big brass ones' like back in the day. I hope the newbies of today can see this post like 4 years from now and at 100k BTC and realize the same. Sorry had to post this, in that Philipma1957 at least can 'casually' toss about infrastructure costs for equipment like this..me..on top of $18.5K mining equipment prices...It just has got to the point on both..that from back in the day...it boggles my mind...and can't get my head around such. I'm out..just reading the above on other's actions and/or contemplations above on getting such.....no matter how good the hardware/return on with using these and mining with a cheap kWh rate...freaks me out and gives me the shudders. Bitcoin mining has now moved from my little Eskimo rowboat to commercial whale mining..so I'm out...Though it is good to reminded on every ATH or close to such or every pump/FOMO and equipment innovation or so...I get this slammed into my head with the above reality. Your OLD, crypto wise, no longer BOLD, crypto wise, so you can just only HODL now, crypto wise! Time to hang up the mining spurs  I'll be on the 'sidelines' in the bleachers waving at the playing field from now on.  Brad |

|

|

|

s

again, that is also what I said, except, I did say that I think the regulation will go in place in that it has been worked on and it is already mostly done

Well, now that we're in agreement then that it's baseless speculation, never let me pass up an opportunity to agree with anti-crypto conspiracy sentiments. I have found that there is 'baseless speculation' and there is 'speculation' by people that have more info (power/whales/or whatever) so it is speculation..it is not Baseless in that 1) the Coinbase CEO felt moved enough from what he has heard to comment on such and 2) it is well known that this is being worked on with the Treasury Dept and the Trump Administration to 'firm up' rules about BTC/Crypto. This is from Feb 2020. https://news.bitcoin.com/mnuchin-cryptocurrency/As to (maybe too fine a point) to go along with some basis for this speculation..is the 'other' dubious and likely, IMHO, to overturned fast track executive orders and dubious regulation tweaks that seem to be coming out in mass. I have seen such announcements (speculation on rumors) stop some really, really stupid laws and regulations back in my early days of 2013...as simply being brought out in the open and on confrontation..of 'are you doing this' (pick a govt) and shown how it was not doable...be fixed/discarded or modified in some manner...or will it be un-workable? So 'speculation' or rumors that match actions are helpful IMHO, to 1) find out if they are true (a simple denial) or 2) that people are looking at how you (pick one here) govt may be approaching such. This is much, much better than again IMHO being caught flat-footed by the IRS that dropped their 2014 IRS rule on to the crypto world...as you can imagine..that went over like a ton of bricks out of the blue. So if this is 'fake news' I'd expect the Treasury Department to comment on such, if not, they are still working on something and I doubt whatever that may be they will simply NOT release this 'modified' rule for exchanges...simply because... Again, my speculation is, the Treasury WILL release a more or less 'unworkable' rule about BTC/Crypto in that they are NOT a fan....and this is an easy way to just wrap up the project and shoot it out the door. The Biden Administration (IMHO) is likely to toss this 'WHEN THEY GET AROUND TO IT" which again IMHO, may take months of WTF in the BTC/Crypto Exchanges in the USA (only would affect them I think) and sow confusion on the rest of us. I will gladly post a picture 'happily' eating a large dish of 'crow' on this if I'm wrong....but seen this kinda song and dance moves before...the old FU before your out the door kinda logic. I look forward to eating crow on your being correct...until then and if there is a stall in price and adoption because of this or other actions by the outgoing Trump Administration...well 'cheap coins' is the way to wrap your mind around it and trudge merrily along with that in mind. Some regulations on crypto, again outside of the rumor by the Coinbase CEO above are going to be put in place before the Biden Administration takes office and the political appointees of the Treasury are removed. Good/Bad/Ugly. I'd bet my own money on that. So we will see, I am not hopeful such regulations will make any sense or actually be able to be implemented with decentralized BTC/crypto. But I shall remain hopeful that the regulations are not too dire...and or that they never come to pass...and await my eating crow feast with great and happy excitement. (crosses fingers)  Brad |

|

|

|

...I won't place links here, but from what I remember, there is the likelihood of the Coinbase CEO being correct and a Treasury rule to track all Crypto Exchange BTC/crypto by

wallet addresses with KYC at each end..which..is IMHO damn near un-doable...

I'd assume the Biden Administration and Treasury Yelin would basically kill this rule when taking over ASAP.....

No, you won't place links, because what you just said was 110% fabricated, wasn't it? ... the fact that such things are being discussed with this outgoing Trump Administration... so again, IMHO, it is likely to happen...but it is just as likely that the Biden Administration (eventually) will toss the works...... Baseless speculation on your part. again, that is also what I said, except, I did say that I think the regulation will go in place in that it has been worked on and it is already mostly done (another rumor) the results of such are my speculation above  Brad |

|

|

|

What do folk think of the likelihood of Steven Mnuchin of the Treasury Department under the lame-duck Trump Administration and Coinbase CEO's concern? of them putting in place a requirement that any crypto going in/out of a USA exchange must have KYC to custodial wallets and/or where ever. In other words, I would have to do a KYC on the fact I own my wallet in some manner. I've no frigging idea how that would work on my paper wallets. https://www.btctimes.com/news/us-treasury-may-crack-down-on-self-custodySo a couple of things come to mind. 1) Treasury Department does above, the next Biden Administration simply undoes the requirement from this lame-duck attempt by Truwhip Administration. 2) Treasury Department does above, and as some commentators have suggested only a legislative fix (hard if Republican Senate) could undo such. Thus, if gridlock was to ensue...would take years to undo this. 3) The next Biden Administration, lets it stand, or can't undo such without bi-partisan legislation (gridlock likely under current Senate)  Obviously, this is much like China tried to do with their exchanges back in the day, and backed way off and undid most of their rules eventually, IMHO, to me it would just mean USA exchanges would be 'dead' to me and I'd do my 'legal' KYC stuff with an exchange in another country that did not require this extra USA step. What do you think of all of this? I think the odds of this are quite high, Trump has been doing dubious things with pardons and executive orders I don't think he is even fully warmed up yet. Also, IMHO, if this was to stand for any length of time I'd think we'd probably be back to $9-10K Bitcoin again or lower..just from the clusterf*ck or damn near impossible enforcement if you wanted to stay a USA exchange. If such came to pass, and the Biden Treasury department left this in place, it would be easier IMHO for Coinbase www.coinbase.com to locate out of the USA, then for them to keep track of every address on your Trezor wallet for in/out dust of any BTC/Crypto. Add, hopefully, more information you come across on the thread take the poll on BTC price if this was to be implemented likely date of Jan 1st, 2021 if I was putting it out on the world in a lame-duck administration. so it goes Bitcoin/Crypto always drama! Take the poll on what you think BTC price would be if the above was implemented. Brad Its so simple Trump administration was giving out big money. And Biden administration Will just take it from You. So simple  It is more likely that the 1.2 Trillion dollar tax cuts to the rich on the so-called 'economic' trickle down and massive spending by Trump Administration would be overturned if the Democrats had their way. Thus, such money would likely still be spent on the current economic crisis and/or social policies to the middle class and some other widespread ills of the USA. You are right, neither party will actually stop spending money..it is how politics work now with the Supreme Court and Citizen's United Case saying 'unlimited' political contributions are allowed. Thus them 'pesky' 2 party system leadership have no control of their own representatives in Congress or wherever..because the more 'radical' you are on the left or right the more outside your state special interest $$$ you can get..so why compromise as your party may want you to? So if both parties are gonna blow $$$ like drunk sailors, I'd prefer my tax $$$ to be spent on the social safety net and other programs and not deficit spending to the top 1% and corporate welfare as it has been the last 4 years. So it is a matter of politics, where the money is gonna get spent. Now that Trump has driven out all the 'fiscal conservatives' from the Republican party and such...well, the economic 'pie' of the USA grows...the 'pie' gets better for everyone as the economy expands or we are so screwed... for the economy to 'grow' ourselves out of this economic deficit hole due to above and pandemic...economic expansion is the only protection against this deficit and the likely inflation and IMHO recession around the corner. BTC/Crypto may do well in such, not so much everything else if this does not pan out, IMHO. This must happen or the USA will have a fun time like Japan and struggle the next decade to get any kind of traction in our economy or growth. Dark Times. Not that I know squat...but did not see a lot of trickle-down from the beneficiaries of the previous Trump Administration tax cuts and corporate welfare as I viewed such...so going with option B above and get rid of the above Trump tax cuts and spread it around more in society instead of..a select few. Again, not that I know squat, but how all this seems to be shaking out for the next 4 years or more. We have to revive the economy out of recession, tame pandemic, figure out how to grow economy to overcome things we need to do and pay for in society as well as plan for the deficit...and also, at least in Biden Administration's view, get the country to do a complete 180 on almost all Trump Administration policies in the last 4 years. Man, why anyone would want to be President of the USA, I've no idea! Daunting tasks ahead as a society here in the USA. Brad |

|

|

|

Ta the End of the january btc Price might be 30k+

Many Will Buy then and its a tax trap!!

Indeed, in 2014, after going to my CPA for my taxes to get done for 2013, I started mining like hell as a BTC newbie in my basement from Oct 18th, 2013 onward till 2014 and had accumulated a hoard of BTC. Anyway, got my taxes done by her (the CPA) in February 2013. Then the IRS, being the assholes, that they are, in frigging 10 days...I remember looking was announced 10 days before taxes were due for 2013 the IRS added the mining rules as income and the rest of such. https://www.irs.gov/pub/irs-drop/n-14-21.pdf At the same time between Feb 2013 and May 2013..my Banker ...saw I had used a wire xfer of over 10k for BTC miners overseas, and informed SEC that I was an 'evil' drug dealer or something because in 2013 all BTC was 'evil' to bankers. I got out of such after the banker tried to screw me with prison while the SEC guy was on speaker-phone by saying he bet I did not do taxes. Thus the CPA tax saved forms above saved my ass again! Fun times, called him an asshole and slapped down revised Taxes for 2014..the SEC guy was why am I here? Anyway, sometime before the banker showdown, I go back to the CPA....she reads rules and starts laughing and keeps saying I'm like a Farmer..yeah, I was confused...but the IRS rules state sure I had to treat mining as income (unlike before when you just had to HODL and pay zip on my previous unmodified tax return already in)...but I also got to take equipment depreciation and she set me up as a business...so anyway at the end rather than pay no taxes...I got like $4k back in tax refunds as the small business angle...no cap gains, because I held on to BTC....so trying ....as hell..it worked out, If the CEO of Coinbase is correct and this dubious rule does come to play to regulate KYC via exchanges on addresses etc, it also IMHO will work out but will be the usual cluster***k of confusion like my above issues..for more than a few months till resolved in 2021 is my guess. Anyway, my point is, lots of FUD, stuff, IRS and other things COULD be tossed out in as little as 10 days or less before the Biden Administration comes into office in 2021 just to play monkey wrench in the BTC/Crypto world and to make the Biden Administration deal with this. I myself, again, IMHO, think that it is likely the CEO of Coinbase is right..and his rumor is likely true (hope I'm wrong though) and such a cumbersome tracking KYC overreach is likely to be put in place..but again, IMHO, it will be more likely to be killed eventually by the new Biden Administration..though that may take time..and this FUD may affect BTC price recovery (like in 2014 with IRS rule) for the first 6 months of 2021. So BTC/Crypto prices could just sit on hands and go sideways for a few months, again, till resolved by real adults. So remember, I've seen this probably 1/2 dozen times since 2013...governments may not be able to stop BTC/Crypto..but they have and probably will use FUD and dubious regulations and laws to muddy the waters on occasion and indeed this will always affect the price of BTC/Crypto with the uncertainty..so if I am correct and such as the Coinbase CEO says these rules come into play well... expect a stall in price or dump of price and play the game 'cheap coins' till it is resolved is gonna be my game ...if such is the case... This use of FUD as a way for big money/govt/super-rich to 'tweak' the BTC/Crypto ecosystem in either a vain attempt at control or a vain attempt to limit the price pump and speed/or speed of adoption and or influence of BTC/Crypto in the future...always fails. It sucks and is painful and sometimes scary though. So FUD and FOMO will always be with us, though again, if they pass this regulation it will be a lot more blunt and obvious what the goals are, IMHO, then in past cases of this kinda thing..at least since I got into BTC/Crytpo in 2013. Bitcoin: Always doubters...Always drama!  Brad |

|

|

|

...I won't place links here, but from what I remember, there is the likelihood of the Coinbase CEO being correct and a Treasury rule to track all Crypto Exchange BTC/crypto by

wallet addresses with KYC at each end..which..is IMHO damn near un-doable...

I'd assume the Biden Administration and Treasury Yelin would basically kill this rule when taking over ASAP.....

No, you won't place links, because what you just said was 110% fabricated, wasn't it? a simple google search of all above is pretty simple to check...just pick your topic above you disagree on...to prove or disprove the talk of such things but if you don't agree with the Coinbase CEO being correct that the U.S. Treasury is going to put these silly rules in place..that is fine...but does not negate the fact that such things are being discussed with this outgoing Trump Administration...so to disagree with me on what I think is gonna happen is one thing but...that seems to be what is happening from what I can tell, again too lazy to cite all the links with a quick google search lookup in my above post what bugs you and pick it apart...the fact is these 'rumored' rule changes for BTC/Crypto they are pretty much the rules that you have to follow declaring BTC/Crypto when you enter the USA with a Tor or USB drive...such you must declare... so again, IMHO, it is likely to happen...but it is just as likely that the Biden Administration (eventually) will toss the works..but they have other things to fix so such a rule will likely hang around to confuse the issue for a few months in 2021... Anyway, my view is that it is 'more' than a rumor with all the dubious 'regulations' and executive orders being tossed out and about to mess up the next administration and neither Trump nor his head of Treasury is a big fan of BTC/Crypto...you can google that too...I'm too lazy  brad |

|

|

|

I think it's a crazy idea and very unfair to Bitcoin holders. Then again, I don't think they'll be able to enforce it because there are international exchanges where people would be able to exchange their BTC without confirming the ownership of the wallet.

It could push the price down significantly, but only temporarily. Bitcoin would recover anyway, as it always does.

But I hope the US won't go for it or it would get overruled by the new administration.

In all fairness, I can't see the rule if it passes to by the U.S. Treasury under the Trump Administration to do this as actually staying in place when the Biden The administration is sworn into place. However, the rule could sit there for quite a while and 'confuse' the BTC/Crypto Universe just by oversight or neglect on fixing such by the new Biden Amdinatraion. It is not like they don't have a lot of other stuff, in their view that they want to address ASAP!  So, we could be in for some 'neglect' on this and 'confusion' before something was resolved on such idiocy. I mean so many of these 'dubious' regulations and executive orders with the main goal of just messing up the Biden Administration taking over the Executive Branch....we could be in for more that a few months wait ..till this would be 'likely' overturned/resolved.  Brad |

|

|

|

Well, currently, IMHO, it seems that the Trump Administration is on a 'tear' to make the transition (if you can call it that) as 'burnt earth' as they possibly can for the soon to be Biden Administration's taking over in 2021. I won't place links here, but from what I remember, there is the likelihood of the Coinbase CEO being correct and a Treasury rule to track all Crypto Exchange BTC/crypto by wallet addresses with KYC at each end..which..is IMHO damn near un-doable. It would be IMHO, easier for coinbase to just pick up and go over to Canada than do this. Indeed, I can do just the same KYC on a legit exchange not in the USA, and be legal...so, if this would stand, I'd assume like China a few years ago no exchanges until minds were changed. I'd assume the Biden Administration and Treasury Yelin would basically kill this rule when taking over ASAP. The other one was getting out of Afghanistan and Iraq in the method and in a hurry done 5 days before Biden takes office. Yeah with such an obvious timeline that is not gonna end well militarily for those countries. Trying to get Iran to do something stupid so the Trump Admin and Israel will slap them down. Getting rid of the open sky treaty to allow satellites to fly overhead and see the USSR and USA military bases etc, etc. Trying to slam through firing squads to kill 1/2 dozen inmates on death row ASAP before Biden Administration comes in Gutting Civil Service rules by making 80% or more no longer civil servant benefits and protection...effectively gutting the civil service like he did the post office and state department So, trump will leave after making things so messed up, the next 2 years of the Biden Administration with a staggering economy and pandemic and the above idiocy..in 2 years.... then the Republican's will somehow blame Biden for all the ills of the world and such. Also in Trumps mind, he can have his TV channel Trump T.V. and make up new lies to sell to the silly masses. Trumps leaving the white house may be messy and vindictive ..but that does not mean that even if he does not show up for the Biden inauguration...that it is not to say it is not a shrewd plan for keeping power in the Senate in 2 years and expanding such and then run again for President in 4 years...somehow .... I suppose claiming deficits again and the rest blaming Biden for not doing anything 'fast' enough. But from my childhood and an evil cartoon villain point of view from my youth, it seems to be the big-lie works! And of course him self-pardoning himself and anyone who is gonna write a book about his administration....forgot that above...very likely to stand on a Supreme Court challenge now. This is well played, well played indeed...if you don't give a flying f*ck about the recession, the pandemic and all the other executive special interest executive orders or the planet.  I mean really, in 4 years more lies and wind up the Circus again is the plan?...And people that still believe in Trump! That's it, I have to leave! Bunch of hairless, clueless primates, hooting and shambling about tossing poo....humans, at the trailer park of the Universe....Some UFO get me off this planet!  Brad |

|

|

|

Is there a link that PayPal has someplace or someone on how to see how much BTC/Crypto coinbase is buying a day and compare such to the amount of BTC/crypto that is mined by the 4 cryptocurrencies that PayPal supports? That being ETH/BTC/LTC/BCH? I am curious to see if PayPal folks buying in on the platform, both institutional and individuals are still at least in some FOMO on this and between PayPal and say Grayscale Trust investments combined are still buying more BTC at the very least, than is being mined per day in the world. In other words, a place or site I can track such to see just what FOMO...of the 2 is happening? I have had some calls from newbie friends that have said they finally bought some paypal BTC due to the hype and the price dumping...not a lot..$100 here and there but hey...around 4 people and some of that was significant lawn mowing summer money..which is real $$$ to a 14 year old. Anyway, sources for above ould be appreciated to track the ebb and flow of paypal jumping into the BTC/crypto kiddie pool please!  Some sites that track this kinda thing would be helpful to post here... google is not cutting it. Brad |

|

|

|

Well, what do folks on this Litecoin thread think of the coinbase CEO's rumor of BTC/crypto regulations requiring exchanges to know the ins/outs of KYC for not only an account but you prove? somehow your paper wallet or Trezor or whatever and keep track of all addresses in/out with KYC? (I assume that is the crux of this stupid supposed regulation? Correct me if that is a few steps beyond what it is really) indeed..impossible indeed..it would be the same thing as China tried to do more than a few years back and all the China exchanges just picked up and left...then views changed and all came backM Indeed, I can easily go to an exchange in Canada and use KYC and skip the entirety of the above regulation....I assume this is just another 'burnt earth' policy of dubious regulations left by the Trump Administration to make things difficult for the incoming Biden Administration and will..if implemented by Trump Administration would be overturned promptly. (knock wood)  But, indeed, IF such a rule was made...Mimblewimble would be soooooo beyond dead in the water for Litecoin as to be 'undo'able' IMHO even if all the exchanges did leave the USA for What do you think? Not a slam, just saying, if it stands, the next shot would be against Mimblewimble and anon coins IMHO. Again, I can't see it working..in that it is a USA law only, but damn I can see it slapping the price of BTC/Crypto down to sideways or much lower sideways on the next year into 2021 as this is addressed by Biden Administration and threats of US exchanges bailing out of the USA ASAP.  Anyway, thoughts on how you think this all will shake out? I myself would be my own money that Trump Administration, like Coinbase CEO says, will do this rule before Biden Administration takes over. Likely, with a 'timeline' impossible to do by say Jan 1st, 2021. Sh*t, this will be quite the clusterf**k...I hope I'm dead wrong, but dubious Trump Administration rules seem to be the way of things till Biden Administration takes over, so I hope not in this case...but with all our success this year, we would be a likely target of such idiocy IMHO.  Again, beat me up, give me some hope, say I'm wrong on my view it will go through and will get fixed by Biden Administration eventually but making 2021 more uncomfortable than it otherwise would be price/regulation wise.  BTC/Crypto/LTC always drama!  Brad |

|

|

|

How are they going to prove that someone owns a private wallet, even if they used coinbase at some point in time? You had money coming from a wallet to coinbase? Someone you don't know was sending you money for some job done online. You had money going from coinbase to an address? That's not your address, you were sending coins to someone that you don't know, but that person did some work for you, or had a birthday coming, or whatever. Whoever discloses all their addresses to the government just because they say so is a moron.

In the USA such 'proof' is the responsiblyt of who the regulations effects...dumb regulation or law or whatever in 2014 like 10 days before the IRS deadline for taxes the previous year..the IRS decided it was gonna make a statement and 'slap down' that pesky Bitcoin. So I was required to write down 'every day' the LTC I mined and total LTC...on paper (nothing existed to do this like excel spreadsheets) then go through my main wallet and print it out and highlight with a note where it went...this was guite challenging because some of the miner groups and exchanges that existed went away along with any proof I mined the BTC legally. I also in 2014 had my banker sic the SEC on me because BTC was illegal....and showed up with my CPA taxes done and shot him down...not to mention the plumber I wanted to have stuff done in my basement in 2013...and he asked about the KNC Jupiter BTC Miner and I told him it 'mined' Bitcoin..he said, that is for drug dealers right, and walked out my door never to be heard from again. fun times not. NOW my CPA says that IF I was ever audited they have to be 'specific' and the IRS has since said that good faith records from that time period were fine....so if I was audited..i can follow my massive paper trail down to whatever I did back in the day (less exchanges and miner pools that went poof) So, indeed from like 2013 to 2016 or so ...if I would have been audited I would have been screwed after 2016 with enough snafus/mess-ups like coinbase forms mistakes at IRS telling people they owed IRS by the IRS when it was the other way around...they were asking taxes on bought btc/crypto..well less so after 2016. so if this rule of a USA exchange MUST track the in and outs of every transaction per each address being KYC at each end..(fine...you have my name and KYC to look at for that.. BUT if they insist that it goes for sellers of goods and every frigging address spinning out and away like ..what...forever? one of 2 things will happen 1) Biden administration and new treasury head will kill this obvious WTF rule ASAP...and that will be that. or 2) Biden administration will let it stand and that means coinbase and all the USA exchanges will threaten to leave the country as it being unmanageable to do....wait 2 years as this was done in china and all the exchanges left...and then an adjustment like china for USA exchanges this time around and times move on again. At best would be an 'uncomfortable' 2 years or price and BTC/crypto confusion. So, if it stands IMHO with above confusion ...we could be looking at 9k to 13K coin and the past returns with BTC/Crypto going sideways in price for a bit...fomo price pump etc effectively killed..we have seen BTC/Crypto do the sideways price thing in the past after the 2014 IRS rules....it would be the same IMHO. I myself, am beginning to think that every time BTC/Crypto starts to look like it is really going to put the moves on gold/silver/fiat currency/stock market returns etc Suddenly, dubious regulations pop up to cool BTC/Crypto's price jets for a period of time. BTC/Crypto making big money/govt/power/corps nervous...Indeed the returns this year from $7,200 or so Jan 1st, 2020 to the high of what $18,500 this month...well...that needs to be stopped is the consensus in the Trump Administration..it Never works long term. But I suppose if you are conspiracy minded it lets the traditional money and powers that be catch up, and buy in at much lower prices, to the crypto revolution and buy in at a much cheaper rate than $25k to $35K coin..if such FUD/Regulations and the rest were not added to the mix. I myself, expect this indeed to be done by the Treasury Secretary....before years end...would even bet my one $$$ this will be so... that the rule will demand ALL crypto going to any BTC address empty or trezor or not must have a KYC at each end...and addresses KYC. that should liven things up some huh? So look at it as 'cheap coin' because if such regulations can put the btc/crypto back in the toothpaste tube after getting out..well...BTC/crypto is doomed anyway. But again, cooler heads should prevail as soon as someone (adult) in the Biden Administration is shown the how addresses used or not are generated on the fly in trezor's and etc all over the place and they are in a sense asking the equiv of USD dollar users to keep track of the serial numbers on your fiat money and when buying something make sure the other person is legit in his use of the USD as well...as you check his USD registration numbers on his cash too boot. Funny, if this rule goes through, or even before..if someone was to sell their BTC/Crypto HODL for say 2 million USD....the only thing coinbase would be know your customer and an expectation that you pay 15% - 20% cap gains and maybe your states income tax on such..paper on such will go to IRS 1099...once it hit your bank and you put it in a suitcase and wandered off to spend it on hookers and blow..the tracking would stop....in that USD would not be under these rules. The Secret Service in court cases in the past has always said USD bills are much more hard to trace than BTC/crypto in illegal acts and such. Again, just another way of the use of regulations and FUD to keep BTC/Crypto prices down and muddy the waters...and such will work IMHO..so 'cheap coin it is" I guess and moving on.  Again, power concentrates with wealth, power/influence and traditional finance...in that Voting by mail as an example of 'decentralized' power and labor unions (or something equiv) as push back against corporation's sometimes illegal greed and now BTC/Crypto...I guess we should just get used to the fact that every time we get near an ATH or too much 'noise' in how well BTC/Crypto is doing vs traditional centralized wealth and power etc. This kinda stuff is gonna happen 'regulation' wise to slap our uppity decentralized project down some..at least in the short term and in price. So cheap coins everyone, if not cheap coins as a concept..and they win..well...the BTC dust I will accumulate from now till then won't matter compared to my hoard so I may as well go down fighting such. BTC/Crypto...always drama! (sorry end of rant..i type really fast...bored...pandemic and all and have seen this kinda thing above at least 3 or 4 times since 2013) Brad |

|

|

|

replies------------- They can not control the bitcoin wallets (non-custodial wallets I meant) so that they won't be able to force KYC all wallets (then all addresses, LOL) of bitcoiners. ------- But they can control the in and out ramps if you want to convert your BTC to $$$ via an exchange like www.coinbase.com in the United States. There is the rub. My view is they don't want to 'enforce' such per say...but hey want to slow down (by they centralized gov't/banks/centralized wealth) they will make an 'unreasonable' regulation...a 1/2 year or more will be spent 'watering it down' all doing what the powers that be (wealth/power/corporate/govt) and slowing the FOMO and such of BTC/Crypto....maybe if for no other reason for others to get on the parade float..I'm sure a lot of banks and say Amazon were caught flat footed with PayPal taking Bitcoin...so now it is catch up or at least slow down..if not the 'futile' attempt IMHO to kill BTC/Crypto....all part of the plan. Those who see a concentration of wealth (Bitcoin/Crypto) not in centralized control, will attempt to stop/slow or otherwise impede such. Just look at the Trump Administration currently futile attempt to get rid of the decentralized option of voting in a Presidential Election, by trying to get all 'mail in ballots' tossed. -------- I heard about Quantum computers that created massive FUDs on bitcoin market years back and now another more stupid things are touching us. KYC on all bitcoin addresses. If it happens, bitcoin will be destroyed because its main and most important technical function will be cracked down. Some new-generation of digital currency will make another evolution and take over the role of bitcoin. ---------------- maybe but most all BTC/Crypto coders say they will see such coming and change the code of whatever BTC/Crypto well ahead of time on such happening. Just saying, what they've said on this topic. I myself await with baited breath our star trek space robot alien benovelent masters with Quantum A.I's to take over running the Earth....(as future minion plug here ...references available per request) god knows we are doing a crummy enough job!)  -------------------------------------- BUT (a big BUG), it won't happen (such KYC and such bitcoin collapse) Lastly please read a chronological change of minds from Janet Yellen on bitcoin: In Her Own Words: Here’s What Janet Yellen Has Said About Bitcoin]----- That would be the ultimate test....the treasury puts through these dubious changes..and the Biden and Yellin Treasury..in 2021...don't do squat to change such while pushing to centralize govt digital and banking coins liked to fiat like Libra and govt banking stake coins. Decentralize BTC/Crytpo scares the crap out of the powers that be as another avenue of 'decentralized' wealth vs the good old 'centralized' version, with all them 'handy' controls by the folks with influence/power and wealth (you steal it/you inherit it/you are Bezo's smart and out play everyone....Amazon style) or in our case with BTC/Ctypto you offer a version of wealth increase by 'crowd-sourcing' the hell out of the concept of a decentralized method of money. Why I'm surprised every time there is FUD around the ATH just makes me realize how 'clueless' I am on WTF is going on in the world of finance and btc/crypto... jeez....not like I've not been around since 2013 on here. Live an Learn I guess....what is also funny as hell, is the previous last weeks high was all, IMHO, FOMO by institutions and Big Dollars. The speculators and small fry newbies had not even jumped in yet! Again, IMHO. so it goes brad |

|

|

|

but the module upgrade and price improvements of never having to buy a complete machine again..just cards or modules from 5nm now to 1nm and all hot swappable and less space and water-cooled and mix/match etc etc etc...if people move at large data halls 1/2 way around the world for a 2c kWh electric improvement...that would correspond to that kinda savings IMHO at least for all the next equipment of a big data miner guy going to this format for any expansion.. too much in the way of hidden profits and upgrade to not do so I parsed out from all the crypto algos available from 5nm to 1nm say with a calc of 3=5 years averaged out in the future. Also probably only need water cooling and ant racks about 1/4 of the space of traditional miner setups and cooling issues. again, too many things that save money combined for this not to be how everyone will do their pow machines in the future anyway, you can see if I'm right or not 2-3 years from now from this post but that is my view now...combined with all the above little bit by bit advantages this is 'huge' indeed even if you are right for the time being but for 'future' ASIC pow design this is set in stone IMHO for all mnfg's IMHO. chump or champ we will see in a couple of years. be aware, however, this pans out Bitmain will mine them 3 months to drive difficulty up before letting them out the door in their own data halls ..and probably with more than one algo..,tis how Bitmain rolls don't ya know!  Bitmain "Evil Never Rests" (tm Bitmain)  Brad |

|

|

|

|

In other words, I am trying to sell, bit by bit, my attic full of apple 2 stuff on eBay and convert to BTC/Crypto. Now if I'd had done this in 2013 I'd likely have 200 or 300 Bitcoin..so my only hope now that I'm out of both home BTC/crypto mining and data hall mining (the ship has sailed on). This is the ONLY way I can mine anything out of my house that makes sense. Sell stuff in the attic I would otherwise 'die' with and put the proceeds of eBay via Paypal into BTC/Crypto. I figure all the junk of a retro computer and apple 2 types I have well over $5k of crap if I can ever get motivated to do this and piecemeal it out onto eBay. also, if I'm wrong and BTC/crypto goes full 'bennie baby' and worthless...I still have an empty attic and easy rec room and probably increases the worth of my house about $15k. with the now useable attic/rec room.

In other words, I am trying to sell, bit by bit, my attic full of apple 2 stuff on eBay and convert to BTC/Crypto. Now if I'd had done this in 2013 I'd likely have 200 or 300 Bitcoin..so my only hope now that I'm out of both home BTC/crypto mining and data hall mining (the ship has sailed on). This is the ONLY way I can mine anything out of my house that makes sense. Sell stuff in the attic I would otherwise 'die' with and put the proceeds of eBay via Paypal into BTC/Crypto. I figure all the junk of a retro computer and apple 2 types I have well over $5k of crap if I can ever get motivated to do this and piecemeal it out onto eBay. also, if I'm wrong and BTC/crypto goes full 'bennie baby' and worthless...I still have an empty attic and easy rec room and probably increases the worth of my house about $15k. with the now useable attic/rec room.