Because they were never the true majority. The majority decided not to pursue a hardfork at that time. That's the reality you still seem unable to recognise.

such ignorance and lies from you are astonishing you have been debunked dozens of times. you keep accepting you been debunked, forget that you got debunked to then try to push your nonsense again that there was no hardfork to activate segwit

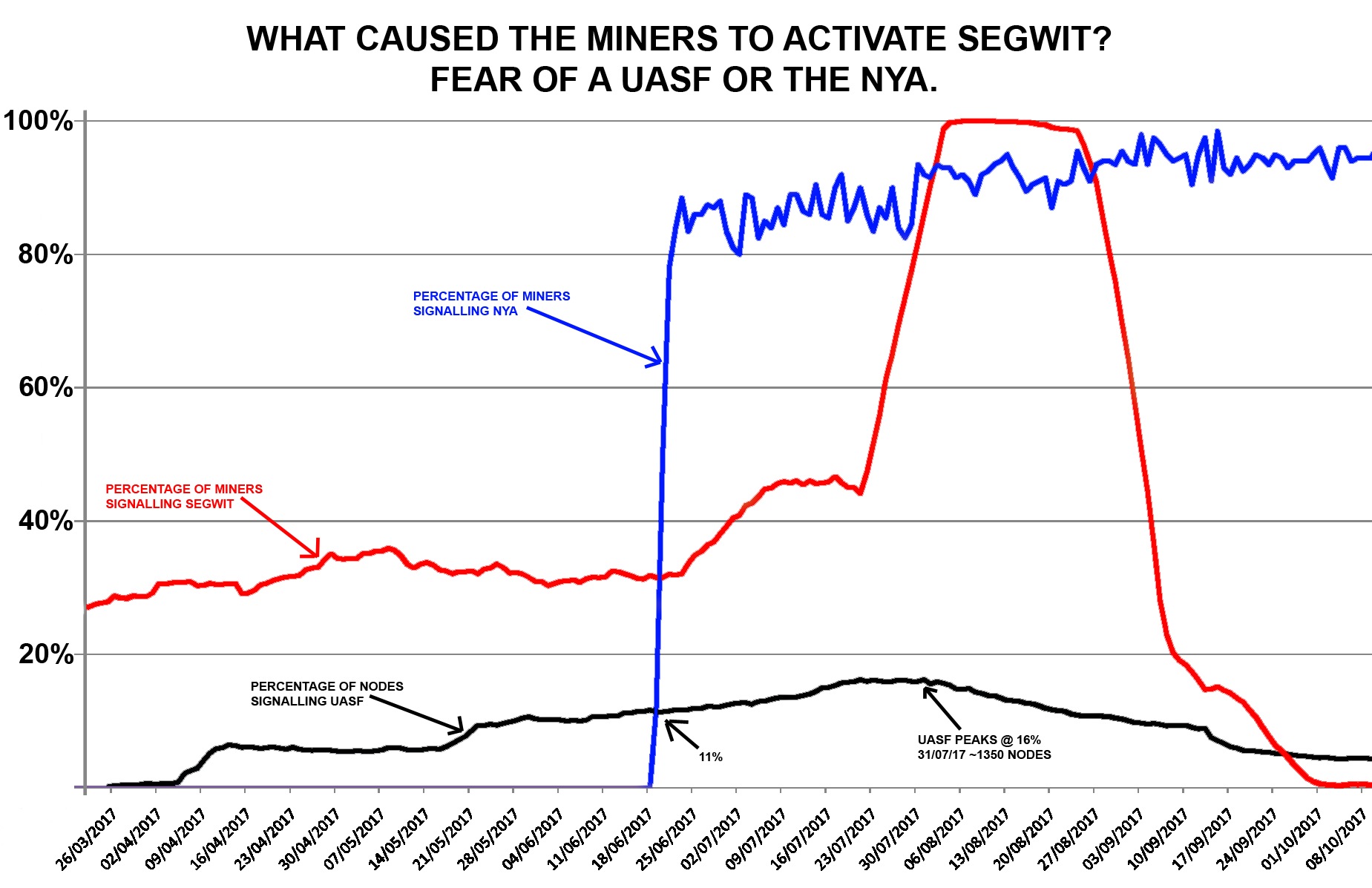

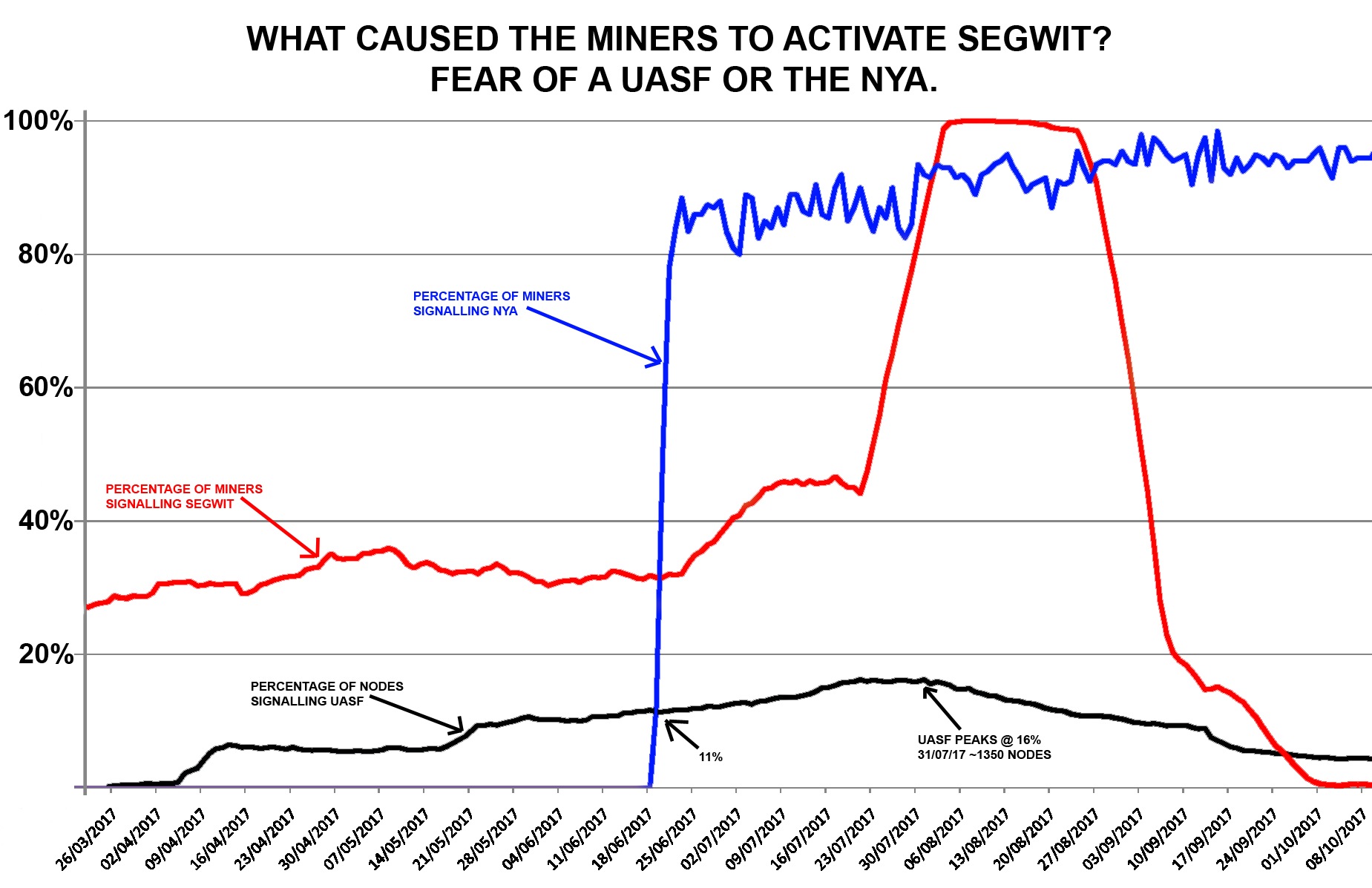

hard data in the blockchain. show that the NYA(blueline) triggered at 80% to start ignoring opposition blocks, to get segwit(redline) activated

by showing a high segwit acceptance via removing opposition blocks.

segwit(redline) only reached a natural consensus of 43.75% in july

but it was because of the blue line which was the NYA which required a flag to reach 80% for a period of time. to then trigger the rejection of opposers

the trigger event of ignoring opposing blocks to segwitshows that the red line then went unnaturally horizontal in an even straight ligne.. because MATH

every day e144 block. if all blocks were 100% segwit signalling due to 0 opposers plays out like this

882-43.75% 1026-50.89% 1170-58% 1314-65.18%

1458-72.32% 1602-79.46% 1746-86.6% 1890-93.75%

2016-100%

thus had 100% on (unnatural to actually have 100% in a decentralised world)

everyone can see the block data

segwit had 100% because there was 0% opposition.

in a natural consensus of decentralised world 100% is not natural

the only way there was 0% opposition is because the opposition blocks were removed by august 1st.

do you know what also happened on august 1st yep BCH

yes the blockdata and BCH exist. there was a fork. now stop being so forgetful

stop pretending segwit was soft becasue the soft had only 20%.. and remember that it was a hard because there was 100% opposition due to the hard mandate tactics to ignore opposers before segwit activated. and yes there was a fork because BCH was created.. and no bch did not create themselves. they were pushed off btc into a fork via the block rejects

there is DATA, there is actual real life proof of events..

so after 5 years of your ignorant trolling pretending you keep forgetting and cant remember events.. just stop

the CODE. the blocdata, is more proof than your social drama links of peoples opinion that wanted to set narratives to shift blame

...

and with that said

give up the social drama games of loyal buddy siding..

instead try to be helpful and actually know that events occurred and those mandated upgrade activations can happen again. so that people can be risk aware incase another mandated activation happened where the tactics are used to activate a feature like PoS

oh and you do realise that the core devs admit it occurred.. so why are you 7 years later trying to pretend it didnt happen. because its no longer fanboy protectionism of your favoured devs reputation for aiding in pulling off the tactic by pretending they didnt.. because they admit it did happen. so whats your agenda for your ignorance?