Saint-loup

Legendary

Offline Offline

Activity: 2590

Merit: 2352

|

|

April 01, 2019, 03:41:46 PM |

|

Bitcoin Price Posts Biggest Quarterly Gain Since Late 2017Bitcoin closed the first quarter of 2017 with 10.91 percent gains – the biggest quarterly gain since the fourth quarter of 2017.

Bitcoin made double-digit gains in the first three months of 2019, marking its best quarterly performance since Q4 2017.

The crypto market leader closed (UTC) yesterday at $4,096, representing a 10.91 percent gain on January’s opening price of $3,693, according to Bitstamp data.

That is the first double-digit quarterly gain since the final three months of 2017 when prices had rallied a staggering 220.84 percent.https://www.coindesk.com/bitcoin-price-posts-biggest-quarterly-gain-since-late-2017

|

|

|

|

|

|

|

|

|

|

|

|

Unlike traditional banking where clients have only a few account numbers, with Bitcoin people can create an unlimited number of accounts (addresses). This can be used to easily track payments, and it improves anonymity.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

|

Spaceman_Spiff_Original

|

|

April 01, 2019, 04:26:03 PM |

|

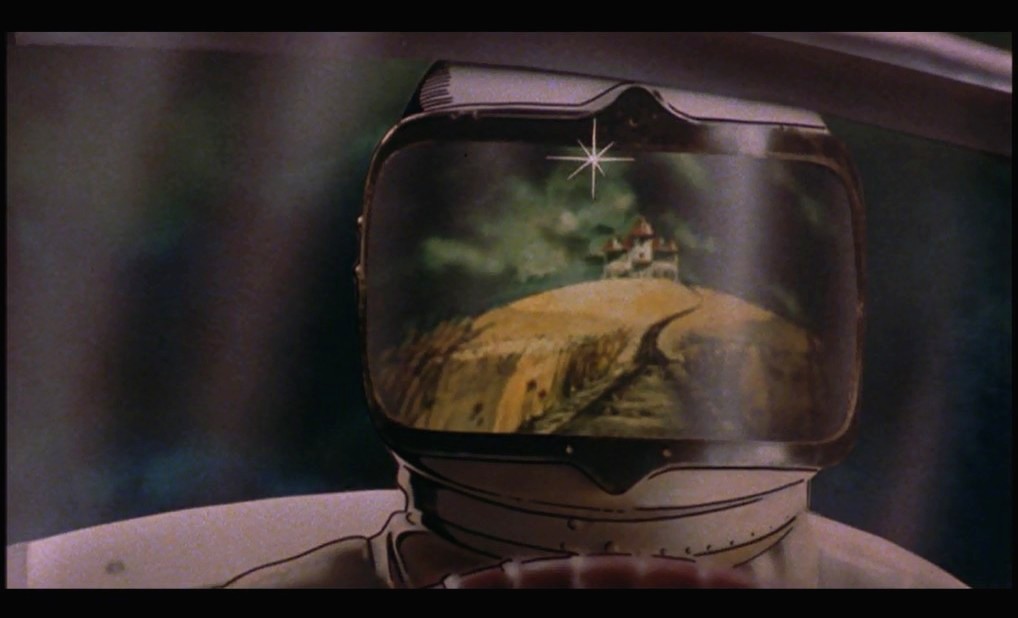

Does anyone know what the leverage (long vs short) situation is looking like? Also: nice  Where is that from jojo? |

|

|

|

|

Retina

Member

Offline Offline

Activity: 252

Merit: 59

|

|

April 01, 2019, 04:30:18 PM |

|

1st of April, be aware of fake news  a lot of propaganda everywhere  |

|

|

|

|

StartupAnalyst

Sr. Member

Offline Offline

Activity: 728

Merit: 317

Crypto Casino & Sportsbook

|

|

April 01, 2019, 04:32:59 PM |

|

Shocked Now the sales announcement hangs in the News inlay on the profile page.  I'm buying all the gifts! I'm afraid you don't have enough merits for that, my dear friend.  |

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

April 01, 2019, 04:35:25 PM |

|

damn

this chart is looking awesome!

y ty  |

|

|

|

|

ThrobbingSausage

Newbie

Offline Offline

Activity: 27

Merit: 16

|

|

April 01, 2019, 04:41:59 PM |

|

Hello.

I understand this is the real seat of power, here on Bitcointalk, and none of the other threads really interest me.

Creating this account on April 1st seemed appropriate.

My name is ThrobbingSausage, and I sometimes help to route your payments on the Lightning Network.

I like Bitcoin and Bitcoin accessories.

I offer Lightning and Lightning accessories.

Look forward to hanging out with you people.

I am here for the memes, mostly.

#strognhands2019 #hodl

|

|

|

|

|

Paashaas

Legendary

Offline Offline

Activity: 3424

Merit: 4344

|

|

April 01, 2019, 04:42:44 PM |

|

That $1200 bubble looks pathetic at the long time chart, same goes for the $20.000 high somewhere between 2024-2028.

|

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

April 01, 2019, 04:47:52 PM |

|

Hello.

I understand this is the real seat of power, here on Bitcointalk, and none of the other threads really interest me.

Creating this account on April 1st seemed appropriate.

My name is ThrobbingSausage, and I sometimes help to route your payments on the Lightning Network.

I like Bitcoin and Bitcoin accessories.

I offer Lightning and Lightning accessories.

Look forward to hanging out with you people.

I am here for the memes, mostly.

#strognhands2019 #hodl

that'll be quite stroganoff of that tyvm toxic or maybe Lambie Tourist thought TheCactus at first but no |

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

April 01, 2019, 04:55:05 PM |

|

|

|

|

|

|

Retina

Member

Offline Offline

Activity: 252

Merit: 59

|

|

April 01, 2019, 04:55:30 PM |

|

Hello.

I understand this is the real seat of power, here on Bitcointalk, and none of the other threads really interest me.

Creating this account on April 1st seemed appropriate.

My name is ThrobbingSausage, and I sometimes help to route your payments on the Lightning Network.

I like Bitcoin and Bitcoin accessories.

I offer Lightning and Lightning accessories.

Look forward to hanging out with you people.

I am here for the memes, mostly.

#strognhands2019 #hodl

First time find impossible in these threads, you can say that how to find it? just LoL. |

|

|

|

|

BitcoinGirl.Club

Legendary

Offline Offline

Activity: 2758

Merit: 2711

Farewell LEO: o_e_l_e_o

|

|

April 01, 2019, 04:57:32 PM |

|

Good morning WO.

Seems like I need to complete my KYC today 🤣

And yes good to see bitcoins price at $4,142

|

|

|

|

|

Retina

Member

Offline Offline

Activity: 252

Merit: 59

|

|

April 01, 2019, 04:58:13 PM |

|

Just LoL it Is Real or editable    This day is different in this year. |

|

|

|

|

Retina

Member

Offline Offline

Activity: 252

Merit: 59

|

|

April 01, 2019, 05:02:09 PM |

|

Good morning WO.

Seems like I need to complete my KYC today 🤣

And yes good to see bitcoins price at $4,142

Yep man Theymos waiting for you 🤣🤣🤣 Go to https://bitcointalk.org/index.php?topic=5124947.0 threads submit and verify now. |

|

|

|

|

|

|

infofront (OP)

Legendary

Offline Offline

Activity: 2632

Merit: 2780

Shitcoin Minimalist

|

|

April 01, 2019, 05:05:11 PM |

|

damn

this chart is looking awesome!

April Fools! The Bogdanoffs are going to pump it to $4,200 before they dump all over us. |

|

|

|

|

BitcoinGirl.Club

Legendary

Offline Offline

Activity: 2758

Merit: 2711

Farewell LEO: o_e_l_e_o

|

|

April 01, 2019, 05:05:27 PM

Last edit: May 15, 2023, 01:00:05 PM by BitcoinGirl.Club |

|

Not bad LOL   |

|

|

|

|

|

kenzawak

|

|

April 01, 2019, 05:07:12 PM

Last edit: April 01, 2019, 05:22:22 PM by kenzawak |

|

Hello.

I understand this is the real seat of power, here on Bitcointalk, and none of the other threads really interest me.

Creating this account on April 1st seemed appropriate.

My name is ThrobbingSausage, and I sometimes help to route your payments on the Lightning Network.

I like Bitcoin and Bitcoin accessories.

I offer Lightning and Lightning accessories.

Look forward to hanging out with you people.

I am here for the memes, mostly.

#strognhands2019 #hodl

|

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

April 01, 2019, 05:13:48 PM |

|

aaah^ yes very possibru

lol he got verified LOUD

|

|

|

|

|

Retina

Member

Offline Offline

Activity: 252

Merit: 59

|

|

April 01, 2019, 05:15:21 PM |

|

Nice coinmarketcap show Bitcoin hit $4,161.09 USD it is the average price?  |

|

|

|

|

|

|

|

Poll

Poll