ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

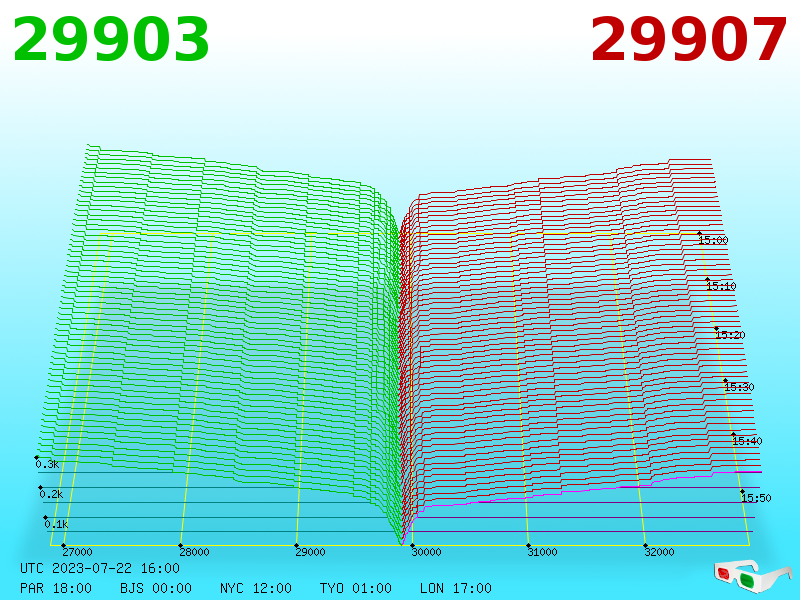

July 22, 2023, 01:04:52 PM |

|

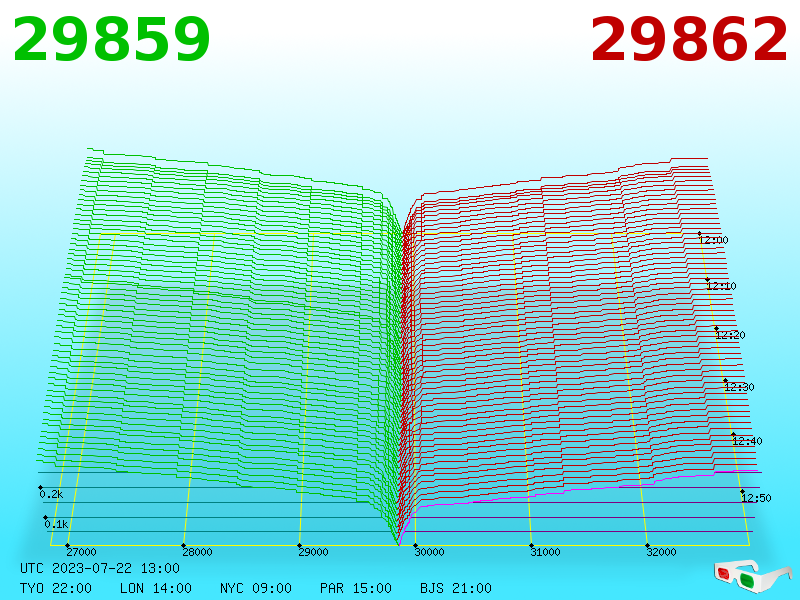

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

|

|

|

|

If you see garbage posts (off-topic, trolling, spam, no point, etc.), use the "report to moderator" links. All reports are investigated, though you will rarely be contacted about your reports.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

Who is John Galt?

|

|

July 22, 2023, 01:12:18 PM |

|

means, the biggest bitcoin holder is US government? No, Satoshi Nakamoto remains the largest bitcoin holder, holding over a million. And of the states, the small European country of Bulgaria has 213,519 bitcoins, so from what we know from open sources, it has the most bitcoins after Satoshi Nakamoto.  We never know if Satoshi will be back or not. He might not be back! Even if he is alive, he might not move it for a long time and his address will remain dormant. BTW, I didn't know about Bulgaris's holding. That's right, we don't know. But that's the beauty of bitcoin, that our knowledge doesn't matter. Satoshi Nakamoto remains the owner of his bitcoins whether he wants to spend them or not, whether he is alive or not, whether we want him to spend them or not. He has full control over his bitcoins. And no state or organization or anyone else has the ability to influence this. Only theoretically the entire Bitcoin community, but it will not do this.  |

|

|

|

|

LFC_Bitcoin

Legendary

Offline Offline

Activity: 3514

Merit: 9521

#1 VIP Crypto Casino

|

|

July 22, 2023, 01:26:23 PM |

|

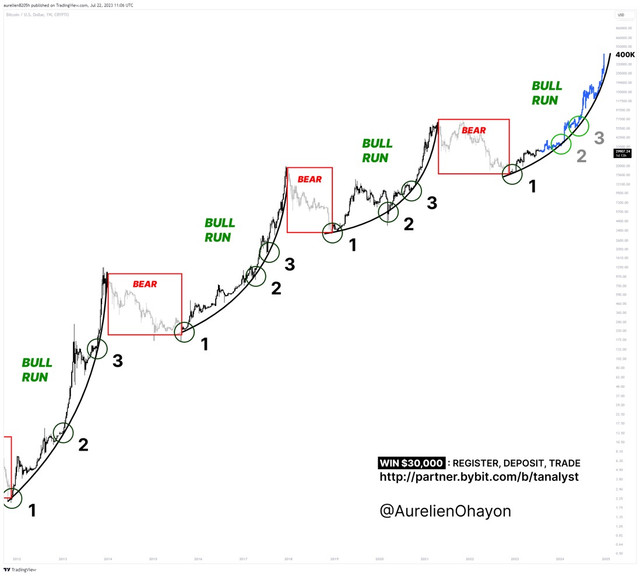

I think we’d all be very happy with something similar to this in the next 1.5 - 2 years. @AurelienOhayon BTC BULL RUN HAS ONLY JUST BEGUN. Each bull run develops in 3 rebounds on ascending curved support.  https://twitter.com/aurelienohayon/status/1682714166480576517 https://twitter.com/aurelienohayon/status/1682714166480576517 |

|

|

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

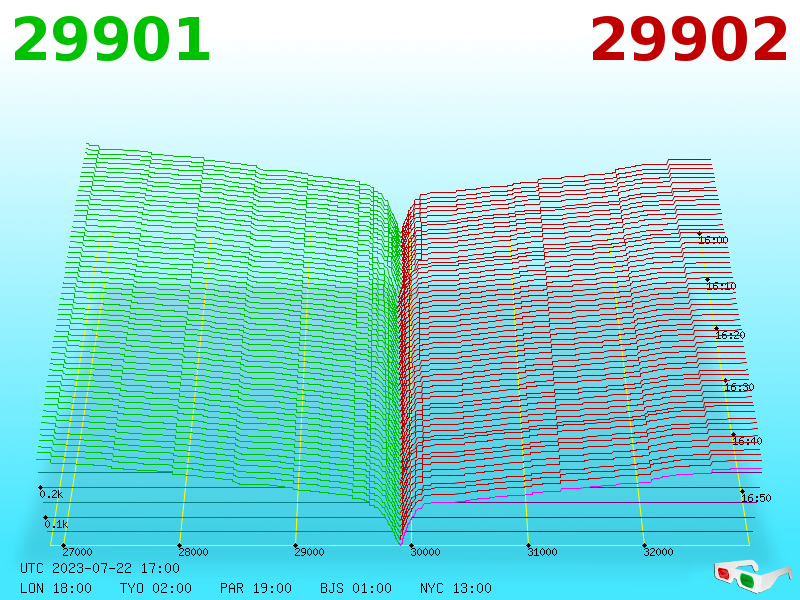

July 22, 2023, 02:01:19 PM |

|

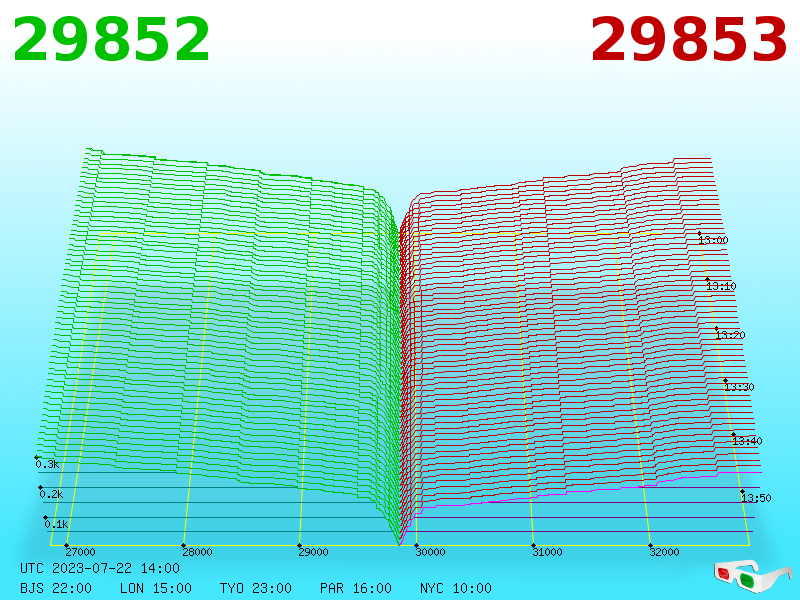

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

Lucius

Legendary

Offline Offline

Activity: 3220

Merit: 5634

Blackjack.fun-Free Raffle-Join&Win $50🎲

|

|

July 22, 2023, 02:20:35 PM |

|

These green activists coated with all the shit of the world would demonize their own mothers and fathers if someone paid them for it. Since this is happening in the US, is it possible to file a lawsuit for presenting inaccurate data and misleading the public? Given all the big companies that are located there and have something to do with Bitcoin, isn't this something that can have a negative impact on their business? |

|

|

|

|

|

Learn Bitcoin

|

|

July 22, 2023, 02:44:13 PM |

|

That's right, we don't know. But that's the beauty of bitcoin, that our knowledge doesn't matter. Satoshi Nakamoto remains the owner of his bitcoins whether he wants to spend them or not, whether he is alive or not, whether we want him to spend them or not. He has full control over his bitcoins. And no state or organization or anyone else has the ability to influence this. Only theoretically the entire Bitcoin community, but it will not do this.  If he is alive and has access to his wallets, I hope he checks it and he has backup in case some of his computers get broken. Ah, what a mystery. We don't even know what is his real name. Where is he from? He is turned into the first and biggest example of being anonymous and how bitcoiner should remain. He gave us financial freedom and anonymity with Bitcoin, and we invented centralized exchanges to ruin that. Gazeta said "if there is not any entity to harm them, people choose on their own to harm themselves" |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10188

Self-Custody is a right. Say no to"Non-custodial"

|

|

July 22, 2023, 02:49:34 PM |

|

Ahhhh Wasn't expecting this from you. Reducing your DCA for Bitcoin to invest in Ibonds or Doggie is something not easy to comprehend. Invest as much as you can easily in Bitcoin but don't go for other options they are all useless. Blame Philip for my bout of temporary insanity. Ahhhh Wasn't expecting this from you. Reducing your DCA for Bitcoin to invest in Ibonds or Doggie is something not easy to comprehend. Invest as much as you can easily in Bitcoin but don't go for other options they are all useless. Nope, they aren't useless my friend, if Bitcoin grows then they will follow its footsteps. I'm more than sure that Bitcoin will take the whole crypto-currency market to another levels during this bull run. We will remember the current days by saying that there was a time when price of Lite coin was around $93 per coin. The whole market is dependent on Bitcoin and if it grows then others will also follow it, but only the good ones because their are many projects which are intentionally created to grab money out of our pockets, and those projects will fail in long term. I'm quite sure that in next bull run some other coins will also gain value like Ethereum, Lite coin, BNB, and maybe Dogecoin, but they will only grow because of Bitcoin not because of their own features. I'm not really positive about those Ibonds because they may or may not be a good choice for investing, but I'm more than sure that Bitcoin will move up, and it will take other crypto-currencies with itself in the upward direction. Note my words, that when Bitcoin moves other crypto-currencies will follow it as it's followers. The King Bitcoin is the real market maker, it's so generous with others in the market that it takes them with itself. Do I really need to explain my post? The reason for my post should be seen in context, and philip has frequently repeated his nonsense that bitcoin is likely going to show broken incentives in around 2050/2060 because the mining rewards are going to be so low that miners are not going to want to mine bitcoin and they will be incentivized to mine POW shitcoins such as litecoin and doggie coin.. and saying dumb shit like that.. so I am reinforcing his dumb ideas through my post. And, in regards to the Ibonds, Philip was hot to trot in terms of recommending those when BTC prices were in the $16k territory. and he spent a few months with passion in regards to Ibonds.. and also he bragged about selling a decent number of BTC below $20k because he was expecting to be able to buy them back in the $12k-ish territory (or alternatively buy Ibonds with some of that money). People who sold bitcoin for $20k and bought Ibonds in the $16k territory got pretty fucking reckt in the short term, and likely the amount of that reckening is going to continue to compound because sometimes it is not easy to get out of some kinds of trades, including that Ibonds are locked in with a tempting interest rate that does not even begin until nearly a year after purchase, and then to get full returns they need to be held for several years including various penalties for early cash outs.. not exactly liquid in order to get those supposedly high interest rates - under the assumption that the dollar either holds value or does not lose value very quickly during the period that you are locked into that product. Don't get me wrong, I am not against having some dollar exposure, since we are in the BTC / dollar thread, and so yeah, there likely needs to be some balancing of our BTC holdings so that we are able to buy more BTC with dollars when the BTC price goes down, and perhaps we might want to shave off some dollars when the BTC price goes up in extraordinarily rapid ways.. but there still can be questions regarding how much to sell and/or how much to buy in order to manage our BTC holdings, but selling BTC on the way down (especially at or below $20k - which was also a few thousand below the 200-week moving average at the time) and buying locked-in dollar assets when BTC prices are not ONLY historically at unprecedented low values was not very smart for anyone who has any kind of fucking clue about what bitcoin is.. .or the power of our lord savior kind daddy bitcoin. I am also not trying to act like I know hardly shit about which way the BTC versus dollar price is going to go in the short term because it can be quite terrifying when BTC prices are going down and then we largely run out of money (dollars) in order to buy more, but the back up practices is likely better to just hold and to fix your cashflow in order to generate some dollars to be able to buy BTC with it when the BTC price is below the 200-week moving average including that in November and December 2022, the BTC price was around 35% below the 200-week moving .. and surely we were likely below the 200 week moving average for more than 6 months if we consider that we first breached it and were floating around it starting in June-ish of 2022.. so those were not exactly normal times to have the BTC price to be that low for that long.. even though some people are kind of thinking of those BTC prices as normal and they were thinking that the BTC price might have gone even lower.. such as down to $12k and some were waiting for sub-$10k BTC prices, which surely I was not considering them to be out of the question, and it became more likely that we could have had visited such low BTC prices once we had already gotten to such low BTC prices that were around $16k for so long. Right now the 200-week moving average is at about $26,981, so even going below it for any kind of meaningful amount of time (such as more than a couple of weeks) should feel uncomfortable rather than normal, and there are still people who are waiting for BTC prices to reach the lower $20ks, as if that would be a somewhat normal correction (Philip happens to be one of those folks, and maybe he will be correct, but probably his chances are around the same level as they were in November/December 2022 when he was waiting for $12k-ish BTC prices). |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

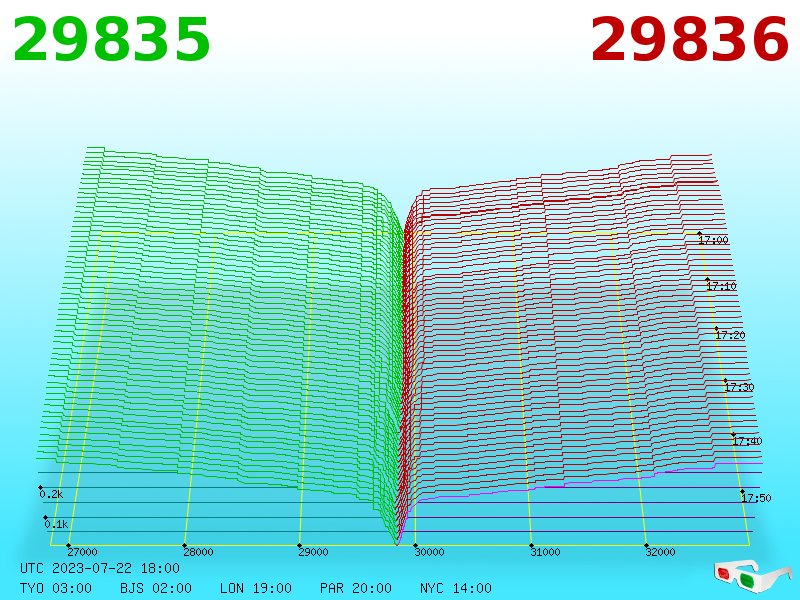

July 22, 2023, 03:01:22 PM |

|

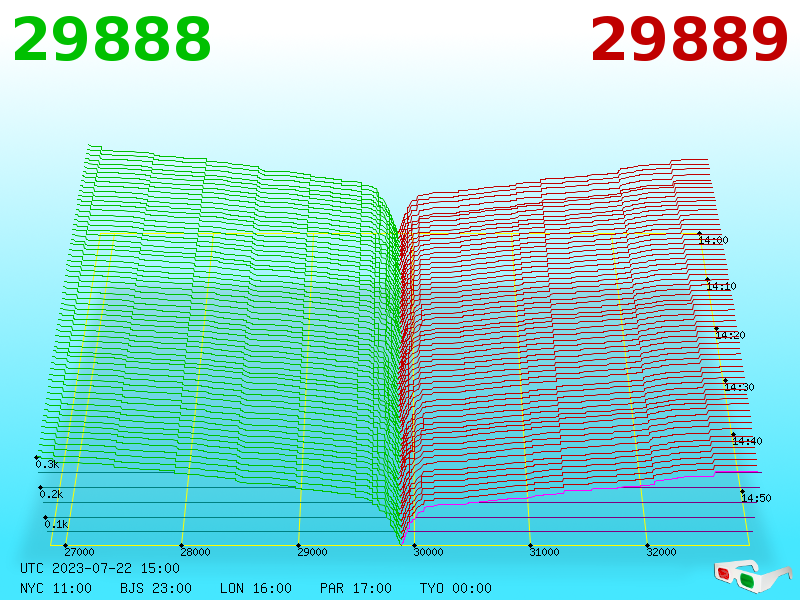

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

SamReomo

|

|

July 22, 2023, 03:08:11 PM Merited by JayJuanGee (1) |

|

Do I really need to explain my post? The reason for my post should be seen in context, and philip has frequently repeated his nonsense that bitcoin is likely going to show broken incentives in around 2050/2060 because the mining rewards are going to be so low that miners are not going to want to mine bitcoin and they will be incentivized to mine POW shitcoins such as litecoin and doggie coin.. and saying dumb shit like that.. so I am reinforcing his dumb ideas through my post. And, in regards to the Ibonds, Philip was hot to trot in terms of recommending those when BTC prices were in the $16k territory. and he spent a few months with passion in regards to Ibonds.. and also he bragged about selling a decent number of BTC below $20k because he was expecting to be able to buy them back in the $12k-ish territory (or alternatively buy Ibonds with some of that money). People who sold bitcoin for $20k and bought Ibonds in the $16k territory got pretty fucking reckt in the short term, and likely the amount of that reckening is going to continue to compound because sometimes it is not easy to get out of some kinds of trades, including that Ibonds are locked in with a tempting interest rate that does not even begin until nearly a year after purchase, and then to get full returns they need to be held for several years including various penalties for early cash outs.. not exactly liquid in order to get those supposedly high interest rates - under the assumption that the dollar either holds value or does not lose value very quickly during the period that you are locked into that product. Don't get me wrong, I am not against having some dollar exposure, since we are in the BTC / dollar thread, and so yeah, there likely needs to be some balancing of our BTC holdings so that we are able to buy more BTC with dollars when the BTC price goes down, and perhaps we might want to shave off some dollars when the BTC price goes up in extraordinarily rapid ways.. but there still can be questions regarding how much to sell and/or how much to buy in order to manage our BTC holdings, but selling BTC on the way down (especially at or below $20k - which was also a few thousand below the 200-week moving average at the time) and buying locked-in dollar assets when BTC prices are not ONLY historically at unprecedented low values was not very smart for anyone who has any kind of fucking clue about what bitcoin is.. .or the power of our lord savior kind daddy bitcoin. I am also not trying to act like I know hardly shit about which way the BTC versus dollar price is going to go in the short term because it can be quite terrifying when BTC prices are going down and then we largely run out of money (dollars) in order to buy more, but the back up practices is likely better to just hold and to fix your cashflow in order to generate some dollars to be able to buy BTC with it when the BTC price is below the 200-week moving average including that in November and December 2022, the BTC price was around 35% below the 200-week moving .. and surely we were likely below the 200 week moving average for more than 6 months if we consider that we first breached it and were floating around it starting in June-ish of 2022.. so those were not exactly normal times to have the BTC price to be that low for that long.. even though some people are kind of thinking of those BTC prices as normal and they were thinking that the BTC price might have gone even lower.. such as down to $12k and some were waiting for sub-$10k BTC prices, which surely I was not considering them to be out of the question, and it became more likely that we could have had visited such low BTC prices once we had already gotten to such low BTC prices that were around $16k for so long. Right now the 200-week moving average is at about $26,981, so even going below it for any kind of meaningful amount of time (such as more than a couple of weeks) should feel uncomfortable rather than normal, and there are still people who are waiting for BTC prices to reach the lower $20ks, as if that would be a somewhat normal correction (Philip happens to be one of those folks, and maybe he will be correct, but probably his chances are around the same level as they were in November/December 2022 when he was waiting for $12k-ish BTC prices). Very well explained man, and I truly appreciate your informative response. Yeah, if BTC someone goes below 200 week moving average of $26,981 then that's really a matter of much concern. The people who want Bitcoin to go to $20k levels should be aware that the thing is high likely not going to happen, and their wait will be wait forever. Like you said that some people were expecting in 2022 that Bitcoin's price will go to $12k levels and fortunately that thing didn't happen, and now the $20k thing will also not going to happen. I'm very positive about Bitcoin, and that's why I think that it will not go below $26k this time, and even if it goes below that range then still it will recover to good levels during the final quarter of 2023 and early quarter of 2024 without any doubt. I surely believe that Bitcoin's price is going to reach at least $40k in the last quarter of 2023, and if that happens then the next bull run will start, and after that nothing can stop Bitcoin's growth. I'm really not a supporter of those dumb coins, but that thing is a fact that they all follow Bitcoin's price like a slave, and that's why they can also go up in value only because of Bitcoin. They are not of great use at their own and their growth is highly dependent on Bitcoin, and that thing can be proven by the price levels of the previous bull run. I still believe that Bitcoin holds the power to bring up the prices of those useless low utility coins, and maybe some of them have good pumps during the next bull run, but still I would never recommend any one to invest in those coins. |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10188

Self-Custody is a right. Say no to"Non-custodial"

|

|

July 22, 2023, 03:31:45 PM |

|

A spot ETF is likely to be approved next year which will add fuel to the supply shock caused by the halving. I think we are looking at $200,000 or close to.

Why so bearish?     The 2028 halving will see the block reward at 1.5625BTC and I would expect maybe that to be the final 4 year cycle. From the 2032 halving the block reward drops below 1BTC so maybe bitcoin will behave like a more mature asset from then, less volatility and a more stable price. Until then though we will be seeing lots of uppity as our friend JJG would say.

Your "demise of the 4-year cycle" seems to be happening more quickly than I would have considered, but hey let's see. I am tending to think that the 4-year cycle is going to last quite a few more cycles.. maybe even another 4-6 more cycles. But, yeah, I do get the idea that the block reward will not be very high after on or two more halvenings, relative to the overall BTC supply that is already circulating and/or has already been issued (or made available)... but then we still have the dynamic of ongoingly lost coins/access to keys.... which may well continue to be an issue that is greater than people speculate it to be. There are a lot of bitcoiners who have very inadequate succession plans, and even if they believe that they have adequate succession plans, their heirs gotta figure that shit out.. and will such heirs have enough information or even inspiration to sort through some of the puzzles in order to makes sure that they found all of the wallets and the keys - and maybe less fear (or rationale why) for those holding BTC on exchanges, because someone will end up getting the coins on exchanges of the deceased, but not the ones held in private wallets in which the information has not been adequately communicated (people keeping too much in their heads, including instructions upon how to get at the wallets). Quick prediction time -

2025 cycle high (year after halving) - $180,000 to $250,000

2029 cycle high (year after halving) - $500,000 to $750,000

Those are somewhat reasonable and maybe even a bit on the conservative side... I mean shouldn't the range be broader.. but yeah, you are trying to capture the more likely scenarios.. so I get you, I get you. .. it is like my rough ballpark idea that $3k to $5k would be around the top of the 2017 blow off top, but it did not cause me to cry like a baby merely because I found my lil selfie to be wrong by 4-6x, even though the BTC price did end up gravitating back to the $3-$5k arena for it's bottom after the peak,... which is a bit ironic, but did not really cause me to have any kind of correctness in that when that price range ended up being the subsequential bottom rather than the top of the blow-off-top for that period. [edited out]

That's right, we don't know. But that's the beauty of bitcoin, that our knowledge doesn't matter. Satoshi Nakamoto remains the owner of his bitcoins whether he wants to spend them or not, whether he is alive or not, whether we want him to spend them or not. He has full control over his bitcoins. And no state or organization or anyone else has the ability to influence this. Only theoretically the entire Bitcoin community, but it will not do this.  What you are saying Who is John Galt? does not really sound right... Sure you are correct that absent some kind of a breach or sloppily saving the keys, no one has access to the keys except for the person who has access to the keys, and so yeah someone can take their keys to the grave or take their keys with them when they get hit over the head and they no longer can remember which parts of the keys they need to put together or which devices (or services/or derivation paths) they were using in order to assemble each of the needed parts. I am not going to call it control to lose your keys, unless you have done it on purpose, and most of the time, except maybe in Satoshi's case, would there be any kind of real justification to purposefully lose access to your keys.. unless you were purposefully wanting to donate your coins to the whole BTC community.. and sure some coiners may well be o.k. with that way of executing their inheritance to make BTC more scarce... ongoingly and ongoingly, since there are likely some folks who either intentionally or unintentionally have lost access to their coins.. and it is the unintentional ones who I have a problem in agreeing with you regarding their maintaining control of their coins, even though no one else is going to get their coins either. If that kind of BTC price performance were to happen, you are not going to be happy LFC because that kind of BTC price performance would end up overshooting your current BTC price prediction. You would end up being vvvvvvveeeeeerrrrrrryyyyy sad.     loss of sorcerer wannabe status loss of sorcerer wannabe status          |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

July 22, 2023, 04:01:18 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

JayJuanGee

Legendary

Online Online

Activity: 3696

Merit: 10188

Self-Custody is a right. Say no to"Non-custodial"

|

|

July 22, 2023, 04:03:45 PM |

|

Wow!!! I wonder if that is going to work to get the kind of effect that they want? It sure puts a lot of attention on bitcoin, and it could end up undermining Greenpeace's credibility. Greenpeace does have quite a bit of credibility.. but still? People may well learn that they are full of shit when they are making those kinds of bitcoin is bad for the planet accusations... and people will remember... especially when the facts and/or the logic are not really on the side of Greenpeace. Normies are going to figure it out, no? especially with the very loud and vocal bitcoiners who are seeming to increasingly come into more and more spaces and/discussions with their "free and likely correct campaigns." Am I giving too much credit to the abilities of normies to see through the Greenpeace nonsense? |

|

|

|

|

|

HelliumZ

|

|

July 22, 2023, 04:12:23 PM |

|

Bulls &bears appear... Just like On ,off, on, off,on ,off , on,,, |

|

|

|

|

Out of mind

Full Member

Offline Offline

Activity: 434

Merit: 212

I like to treat everyone as a friend 🔹

|

|

July 22, 2023, 04:12:36 PM |

|

GO TO #BITCOIN BTC Its qualities that, combined, make it a unique asset of great global interest: 🔸 Shelter of value. 🔸 Investment. 🔸 Decentralization. 🔸 Innovation. 🔸 Digitization. 🔸 Free market. 🔸 Deflation. 🔸 Production of wealth. Source

|

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3848

|

|

July 22, 2023, 05:00:28 PM

Last edit: July 22, 2023, 07:29:42 PM by Biodom |

|

I'm not worried. Not at all. I'm just a little bored if I'm honest, and echo LFC's sentiment. That's really what my original post was about.

tl;dr: Just be patient and HoDL/DCA for 1-2 more years.

I don’t think 4 year cycles will be a thing forever. <Snip>The 2028 halving will see the block reward at 1.5625 BTC and I would expect maybe that to be the final 4 year cycle. From the 2032 halving the block reward drops below 1 BTC so maybe bitcoin will behave like a more mature asset from then, less volatility and a more stable price. Until then though we will be seeing lots of uppity as our friend JJG would say. Quick prediction time - 2025 cycle high (year after halving) - $180,000 to $250,000 2029 cycle high (year after halving) - $500,000 to $750,000 While agreeing that it could happen, I am not sure that it would. Here is my reasoning: last cycle was "abnormally" timid (only a 3.45X swing over the previous ATH). Why? There could be two possibilities: one would be externalities, like China mining ban+ shenanigans of Celsius+Blockfi+FTX, plus exorbitant share printing by DCG; on the other hand, it could be just mechanics of the cycles, where each cycle causes less and less upward swing. Therefore, next cycle would be an interesting test and @LFC numbers suggest resumption of the 'strong' swings: 250K would be re-acceleration or rather continuation of the swing strength and 180K just a small decline to 2.6X. The current history of "swings" (from lows to highs) order goes like this: First halving-from $2 cycle low to $1160 high(580X); Second-from $175 low to $20K high (114X); Third-from $3.2K low to $69K high (21.5X); Fourth-from supposed $15.7K low to ? high. Unfortunately, if the "swing" reduction factor from prior cycle to the next would be the same, the next number in the sequence is roughly 4-5X, which is ONLY 63K-78.5K, which is terrible. I, myself, don't believe that we would be "dealt" such cruel cards, but whatever 'acceleration' mechanism could be in play, it's still to reveal itself. Personally, I think that the acceleration that makes @LFC numbers is possible, but would occur via realization of the potential in the realm of inscriptions. Imagine this: each sat could have some informational packet attached. This opens up virtually unlimited potential in the future. Heck, every single Apple share could be inscribed on 157 bitcoins maximum (only 0.00074% of all bitcoin while Apple, by itself, corresponds to 7.4% of US total stock market cap). There is plenty of room in bitcoin for ALL property plus future asteroids, planets, etc, etc...and that is even without going to sub-sats. Think about this. EDIT: Alternatively, see what the 'chatty' one says: https://bitcointalk.org/index.php?topic=178336.msg62445814#msg62445814 |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

July 22, 2023, 05:03:27 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

EmpoEX

|

|

July 22, 2023, 05:42:16 PM Merited by JayJuanGee (1) |

|

The reason for my post should be seen in context, and philip has frequently repeated his nonsense that bitcoin is likely going to show broken incentives in around 2050/2060 because the mining rewards are going to be so low that miners are not going to want to mine bitcoin and they will be incentivized to mine POW shitcoins such as litecoin and doggie coin.. and saying dumb shit like that.. so I am reinforcing his dumb ideas through my post. Bitcoin will grow much more in price then. The block reward will be 0.02441406 in 2052. Currently, the miners getting around $187K for a block; who knows what will be the bitcoin price in 2052? Maybe 0.0244 won't be worth $187K. Maybe this is what he is fearing. |

|

|

|

|

|

Negotiation

|

|

July 22, 2023, 05:56:00 PM |

|

Also the like to same think, i hope this prediction full-filled with time next 1year. 2 year is long but prediction is expected.  |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

July 22, 2023, 06:03:29 PM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

Poll

Poll