My RIA sent me this. He said Bitcoin to $1m by 2030.

Source.

Source.I am also hopeful that it will be a $1million touch one day.

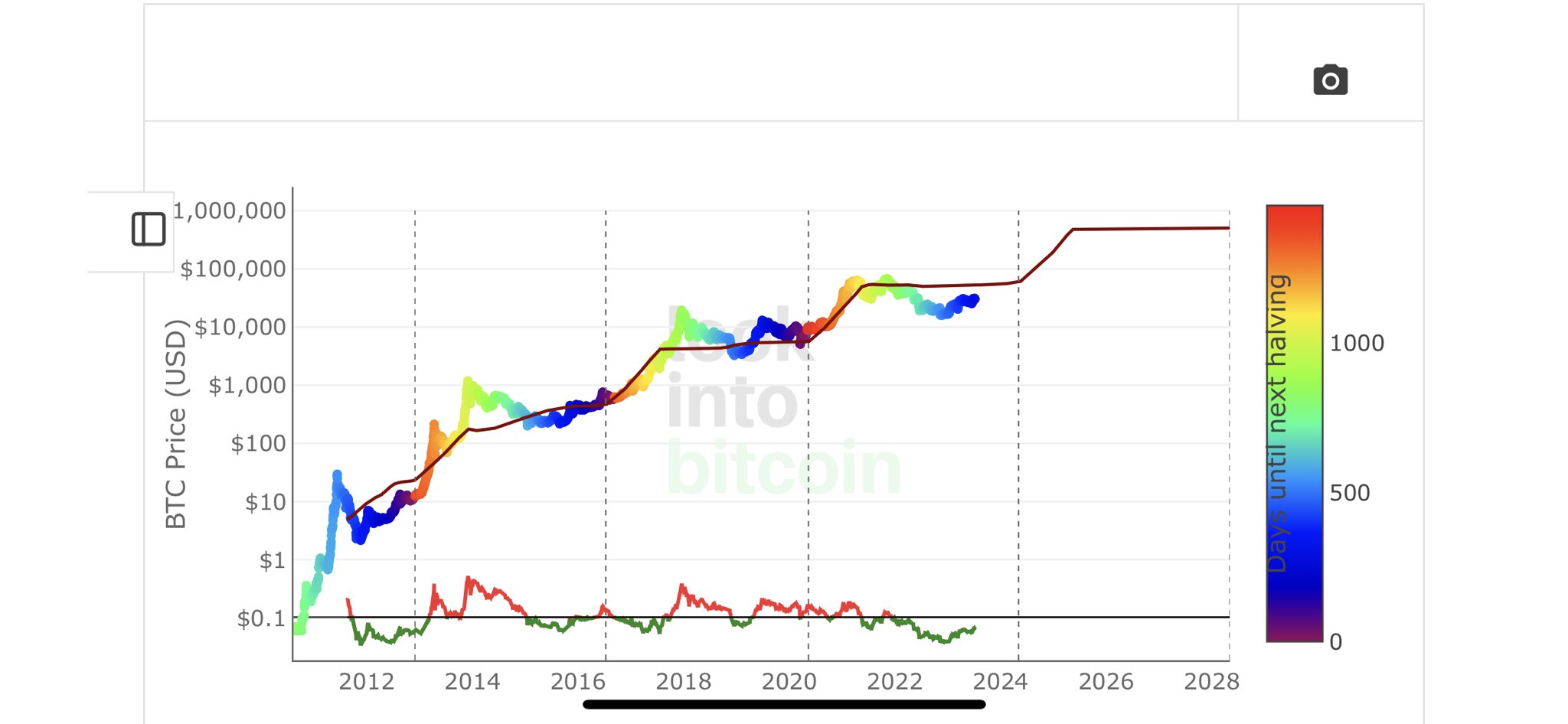

That looks like a stock to flow chart that has it's current plateau shifted down (from $100k-ish where it used to be to something in the $60k territory), and that does seem to be a better representation of where we are at, and where we might go from here - however, stock to flow's chart also had looked pretty good with the $100k-ish as the plateau for this cycle.. which ended up not happening.. so therefore the plateau seems to have had needed to be shifted down in order to account for the real facts rather than the speculative facts that did not end up playing out.

Personally, I don't find this unreasonable to use the same ideas and frame work and then shift them around somewhat in order to account for facts as they play out, which ends up not being exactly scientific, but fuck science anyhow.. there is no real science that is going to predict the future with any certainty - unless it were to just get lucky, because humans are not machines (at least most of us are not), and we are not 100% predictable, and maybe at best we might be in the ballpark of 50%-ish predictable? perhaps?

Anyhow that chart looks pretty reasonable - and if the price does not end up performing up to the level of the curve trajectories, then maybe the trajectories have to be shifted down again.. and there could be some time in the future in which we end up having multiple shifting down of the trajectory, and then at some point later down the road, the trajectory has to be shifted up because it might have had been being artificially held down for way longer than it should have had been, and it ends up regressing to where it should have had been.. Who knows? except directionally, some of us seem to have some ideas that the direction remains up, even though most of us don't really seem to know by how much and when even though we have some approximations... some people claim to know better (or more) than others, and surely each of us are free to exude our level of confidence to the degree that we believe is appropriate.. but still seems to be a wee bit too arrogant to claim too much concreteness in making these kinds of claims and even charts can be provided as guides (and with qualifications rather than being considered as "have to happen like that" (certainties).

I think that it is better to say that you have to act... and you have to continue to act.. which might be similar to making a decision.. and acting brings the decision to fruition.. but it is not just a one time act, it is a continuous act.. because once you start, you have to continue to implement on a regular basis - which is part of the reason that lump sum just does not seem to work in terms of solidifying the ongoing preference (or would it be need?) to reinforce the decision over and over and over.. which builds conviction.. and sure putting $10k into bitcoin in 2015 may well have been fine and dandy to get you 33 BTC, but if you put $5k into bitcoin in 2015 (and got 16.5BTC, and then continued to buy $100 worth of BTC per week for the next 8 years up until now, you would have invested way more into BTC, which would have been

$46,800 ($5k initial investment + $41,800 over then next 8 years), and you would have ended up with more BTC, which would have been about 40.5 BTC (16.5 BTC for the initial investment and then an additional 24 BTC over the next 8 years). 7.5 more BTC by combining lump sum investing with ongoing DCA that would have cost you $31.8k more in terms of your overall investment than the amount of a lump sum investment that would have had been made in 2015 (in this hypothetical).

Sure lump sum investing that would have had an average cost of $300 per BTC would have been more profitable on a percentage invested versus the amount that would have been put into the combination of lump sum and DCA (an average cost per BTC of about $1,156), but the vast majority of normies do not have the finances and/or the psychology to lump sum invest into anything (especially something like bitcoin during a long and extended period - especially in 2015 - not that we can go back to 2015 anyhow - except for attempting to engage in theoretical "what if" exercises)...

By the way, there can also be ways to attempt to front load any investment, and that is part of the reason that I showed my above example of investing $5k from the start and then going into DCA - however there may well also be limitations that real world people (normies) suffer in terms of their own cashflow, and it may well end up being the case that the longer that they are working then the more likely they can increase their pay and to increase their discretionary income.. but even those kinds of assumptions are not always true when it comes to problematic periods that people might face in terms of their own cashflows and the extent to which they are able to generate extra into the future or they might end up in careers in which they are ongoingly being undermined and their income is not even keeping up with the cost of living... so it is not always safe to make too many assumptions in regards to how the circumstances (including cashflows) of individuals might change over the years, even if we might presume to know other things about such persons.

Poll

Poll