JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10153

Self-Custody is a right. Say no to"Non-custodial"

|

|

June 25, 2020, 03:56:59 AM |

|

Well, something happened. Some buy orders got filled. 'may' and '$8,800' are quite a stretch  in bitcoin anything can happen, being too confident and getting cocky will get you rekt, im always a "may" and never a "will" with bitcoins price That's why you "may" "will" have abandoned your "cocky" get-rich-quick (on leverage) BTC price prediction thread, when you realized that using leverage in your trading might work for a while, but is likely going to cause you to become "rekt" sooner rather than if you had not used leverage - especially when you are too anxious and unreasonable in trying to 20x or 200x or was it 2000x your money, betting on one direction and not engaging in reasonable risk management (another way of suggesting that betting in both directions might be better). What level might not be "too confident" and "too cocky"? Does reasonableness exist when playing with leverage and putting most or all of your eggs the basket of in one direction? A variation of a Martingale strategy, right? I agree that the increased confidence of successful leveraged trade will likely get you rekt, if you keep on increasing your risk. Though it also depends how you are taking your profit (if you are taking it at all). If you're not taking profit and keep re-investing it each time, you'll get rekt. But if you're taking your profit, especially if you're taking your profit in BTC, then even when your initial investment gets rekt you'll still be on top with your BTC. Then again, I didn't follow all of the referenced thread. I assume it's re-investing profit, which is dumb if so. Yes.. his case seemed to have been reinvesting profits. Well that would explain a lot  The first tip after you have a lucky streak is to take profit until you have taken out your initial investment at minimum. Then if you want to increase your risk and become a degenerate gambler with stupid amount of leverage, you are merely doing so with the profit instead of your initial investment. That said, you're best off merely maintaining your risk (not increasing it) and playing with your new found " house money" (only profit) in order to continue making profit from your profit, so that if you get completely rekt then you still made profit at the end of the day. Then you can even try and learn your lesson and re-invest your profit with increased risk management, but not at the expense of your own capital. Hope that makes some rough sense. Surely stacking away profits, like you said, could be one of the possible ways to strive to ensure ongoing profits..... yet understandably, even with stacking away profits there could be some difficulties that come for a trader whose stash keeps getting depleted by wrong calls or an unlucky trading streak.. In those losing streak cases, does the trader merely add to his trading stash, and wouldn't that be cheating? or would a trader just keep making his/her bets smaller until s/he makes up for the losses, the losing streak and the seemingly ever depleting trading stash?

I wouldn't recommend adding to your stash if you're on a losing streak, I'd recommend reducing your position size as well as your risk. Ideally you'd keep a record of your successful trades (be it 40%, 50%, 60% or whatever) and therefore attempt to caluclate trades based on this risk reward that can still make you money (2:1, 3:1, 4:1 or whatever). If you're losing money then adding to it isn't cheating, it's just poor risk management. If you run out of money, then you should probably not be trading at all! Instead, you'd reduce your position size to such a small amount you are effectively just practicing in the hope of trying to become a successful trader again. I know I also got over-confident after the September 2019 breakdown that generated juicy profits for me, despite taking the profit in sats. This led me also to increase my risk, but the main different was I had already taken out my initial investment. At the point of losing a few too many trades, I quickly realised I needed to reduce position sizes and lower my risk, as it was eating away at profit. This is ultimately how you stay "afloat". But that said, I also learnt this back in late 2017 and early 2018 by taking out initial investments, that actually helped me to understand the important of booking profit (not just taking it). The main trick is to be patient I think, anyone rushing to make their money back is doing it wrong. In a weird way, I found it a lot easier to be conservative with risk management when you are playing with the house, rather than your own capital. Not sure why. The other point is trading is a form of gambling. Just like in gambling, you calculate probabilities and take risks appropriately, doesn't matter what the game is. Anyone who thinks trading isn't a form of gambling isn't thinking straight. This doesn't mean you can't be a successful gambler, but that risking your money in order to try and make more of it is the definition of this. Ideally, would you not want your trading to provide you with a salary that is somewhat similar to your regular job, so that you can quit your regular job and sustain your self (and whatever standard of living you had grown accustom)? So, let's say for example, you worked 10 or more years, and you had increased your salary to $100k, but since you had been accustomed to savings and investment with extra money, you figured out that you could live pretty decently on $75k per year, but if if you live more meagerly, you would still be comfortable with $50k per year. Maybe, also you had learned trading with some of your money during your years of work, and in the 10 years, you had reached a savings and investment capital of $300k that you consider to be a kind of working capital that could start out providing you $50k per year, but you wanted to target $75k as being more comfortable, and $100k would be balling. Maybe if you pulled the fuck you lever to your regular job, then you might not have enough capital to really sustain your trading and to generate at minimum 17% per year of profits from trading. Unrealistic? You probably have heard of the 4% formula that is used for having an expectation of 4% passive income, so if you are trading, you should be able to make more than 4% per year, otherwise, you are not beating passive income expectations, right? I might be asking too many questions, and surely there would be a difference between feeling comfortable to quit your day job and considering both how much capital that you have and what minimal level of return do you need to receive from trading in order to be able to sustain yourself, and whether you are being realistic with yourself. Whether you have a day job or not, if you take up trading as a hobby, and you practice trading for 5 to 10 years, then if you are trying to be realistic in attempting to measure your historical performance, you should get a pretty decent idea regarding what level of return are you getting from your trading activities, and whether you are beating the returns that you might be able to get from mere passive investing. I already kind of know the answer to some of this, which is that there are not a lot of traders who either have been able to track their overall performance and/or have decent ideas about the extent to which their trading activities might be able to beat more passive returns. Is living off trading not just another kind of slave wagery, except you have more stress and can never relax ? I guess pure day traders closing all positions every evening might be able to relax, but still. To retire and feel free I would need well diversified investments, including real estate, stuff that will always be in demand like health care, probably geographically diversified too. Well, I was asking those questions to dragonvslinux because he seemed inclined to talk about stacking away profits, which may not be exactly the same thing as the question that I asked, which is making a living off of trading. So, perhaps I was implying that trading might devolve into a bunch of work for nothing, especially if there might we ways to be assured of 4% or more per year return on average from passive income. So maybe in that regard, unless you have at least a few million in capital, traders might not really be attempting to live off of their trading income but instead just supplementing other income and/or investments that they have. So, sure maybe I was trolling dragonvslinux a bit because my own personal philosophy around trading is really revolving around maintaining large swing trades as a kind of insurance policy, but the bulk of any kind of strategy is to largely build up principle in a way that it can largely serve as a passive income stack and not really be put at risk, because it is probably quite difficult to ensure passive income off of a certain amount of principle, and at the same time use some of that principle for trades that are put at risk, which means subject to losses if the market goes against you. I would not deny that there are some strategies that are different from mine but also more profitable than mine, and probably if you build up your principle to a decently large amount, you can sometimes end up taking chances on only portions of your principle, but largely be able to call the right shots on a regular enough basis that your gains make up for any losses that you make, and successful venture capitalists proclaim to be able to accomplish this once they have one or two fairly BIG wins under their belt.. and so frequently they are waiting for the one or two BIG wins before they can really start to have a lot of comfort level that they are profitable even on subsequent loser investments because they made so much money on their BIG wins that are already under their belt. Sometimes just nice to hear the perspective of others, and surely there are not a whole hell of a lot of traders who are actually successful and able to really boil down their trading strategies (and maybe they do not want to share too many details, either). |

|

|

|

|

|

|

|

|

|

|

|

"Bitcoin: mining our own business since 2009" -- Pieter Wuille

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10153

Self-Custody is a right. Say no to"Non-custodial"

|

|

June 25, 2020, 03:59:48 AM Merited by sirazimuth (1) |

|

In an introductory video, he describes the planet’s oceans as “a sort of research and development zone where we could discover better means of governance”, and says that seasteading could “provide the technology for thousands of people to start their own nano-nation on the high seas”, giving people “opportunities to peacefully test new ideas about living together”. The most successful seasteads, he says, “will become thriving new societies, inspiring change around the world”. Source: https://www.theguardian.com/environment/2020/jun/24/seasteading-a-vanity-project-for-the-rich-or-the-future-of-humanityLike it! Sorry to be a party poop.. but that is pure nonsense. |

|

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3794

Merit: 4865

Doomed to see the future and unable to prevent it

|

The U.S failled bending the curve, Americans are not disciplined enough and they reopened way to fast.  We do have an inordinate amount of really retarded people. Hopefully this will change that.  |

|

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2142

Merit: 15390

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 25, 2020, 04:18:08 AM

Last edit: June 25, 2020, 11:38:46 AM by fillippone Merited by El duderino_ (3) |

|

Another quick dive below Vegeta. I sincerely thought we never ever would have met him again. Today Tomorrow is biggest option expiry in bitcoin history. I think we might observe some short lived weird movement. We will see... EDIT: Today is 25, not 26. Note to self: Never post from bed before caffeine. |

|

|

|

|

|

aesma

|

|

June 25, 2020, 04:22:38 AM Merited by BobLawblaw (1) |

|

testing 9000$ BobLawblaw : I didn't eat much and didn't drink anything. At 7AM I'm getting blood drawn for testing, then I'm buying croissants and a pain aux raisins and fill my belly for breakfast :  RIP to your asshole |

|

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3794

Merit: 4865

Doomed to see the future and unable to prevent it

|

|

June 25, 2020, 04:24:08 AM |

|

Another quick dive below Vegeta. I sincerely thought we never ever would have met him again. Today is biggest option expiry in bitcoin history. I think we might observe some short lived weird movement. We will see... So your saying options are tanking us today? Say it ain't so. |

|

|

|

|

Bossian

Member

Offline Offline

Activity: 450

Merit: 59

|

|

June 25, 2020, 04:54:36 AM |

|

So as I see it, there will be a shaking of hands for the next few weeks. I hope I don't panic sell again.In other news. There is now a huge wasp nest on the door to my garden entrance. Do I- A. spray them with water from afar B. Smoke out (or outsmoke  ) the hive or C. Hire that guy who crushes wasp nests with his bare hands? Depends on your strategy, but it is very very likely you will be able to buy at a lower price than 9k so I see nothing wrong with selling today and buying back later. But if your goal is to make money long term, if you are a long term bull, a long term Bitcoin believer then I don't even see the point in checking Bitcoin price everyday. If one day I buy Bitcoin for the long term (probably will do at the end of year, if Bitcoin gets below 5k which will probably happen) then I will wait for the next bubble similar to 2017. A Bitcoin above 50k is absolutely possible in the next few years, but buying at 9k no thanks. |

|

|

|

|

VB1001

Legendary

Offline Offline

Activity: 938

Merit: 2540

<<CypherPunkCat>>

|

|

June 25, 2020, 05:05:54 AM |

|

Bitcoin Optech Newsletter #103

Jun 24, 2020This week’s newsletter summarizes a newly published fee ransom attack against LN users, links to continued discussion about the attack against LN atomicity, and shares a reminder about collision attacks on RIPEMD160-based addresses in multiparty protocols. Also included are our regular sections with popular questions and answers from the Bitcoin StackExchange, a list of releases and release candidates published this week, and notable changes to popular Bitcoin infrastructure projects. https://bitcoinops.org/en/newsletters/2020/06/24/

|

|

|

|

|

Toxic2040

Legendary

Offline Offline

Activity: 1792

Merit: 4141

|

|

June 25, 2020, 05:27:43 AM |

|

Jun 24, 2020

|

|

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2142

Merit: 15390

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 25, 2020, 05:51:30 AM |

|

Another quick dive below Vegeta. I sincerely thought we never ever would have met him again. Today is biggest option expiry in bitcoin history. I think we might observe some short lived weird movement. We will see... So your saying options are tanking us today? Say it ain't so. It’s a possibility I have to demonstrate. I think derivatives trading in general (futures and options altogether) are too small to effectively push the market in a direction, but maybe temporary blips in the moment of the expiry are possible. Or at least, observing such blips (or the lack of), it is something worth observing today. |

|

|

|

|

Toxic2040

Legendary

Offline Offline

Activity: 1792

Merit: 4141

|

|

June 25, 2020, 06:05:47 AM |

|

Think options expire on the 26th...regardless...sometimes little blips intersect other little blips and can form larger blips. short fibs to gawk at #dyor 1h  4h  #strongblips |

|

|

|

|

sirazimuth

Legendary

Offline Offline

Activity: 3346

Merit: 3484

born once atheist

|

|

June 25, 2020, 06:23:27 AM Merited by BobLawblaw (2) |

|

..... shitting out a vile liquid fountain of beer and vanilla ice cream. My last....(snip...ewwww...)

Good lord...that was way too much detail.... |

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 11999

BTC + Crossfit, living life.

|

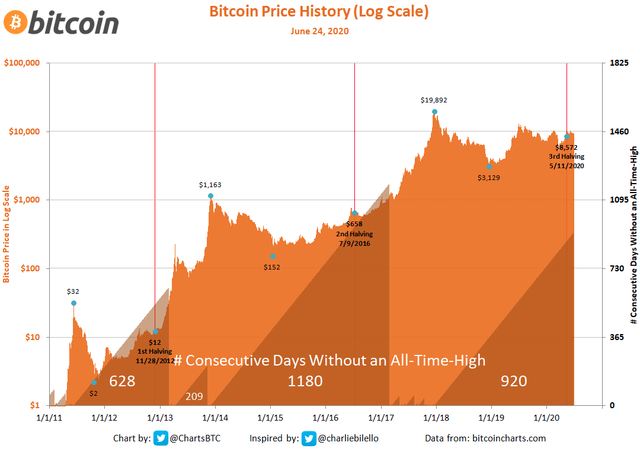

Who is ready, to break this number of days  |

|

|

|

|

Tash

Sr. Member

Offline Offline

Activity: 1190

Merit: 305

Pro financial, medical liberty

|

|

June 25, 2020, 08:36:26 AM Merited by JayJuanGee (1) |

|

Quite satisfied with the dump, now that we are at a clear level of support we seem to have a bounce so im gonna long a bit  Update: Long didnt work out so well, got stopped out so i flipped short and shorted the purple/pink lines on the chart, took profit around 9150, unfortunately didnt get into a long, wouldve been good Gatecrashed the party participated a little while, left early, did not develop to anything legendary.  |

|

|

|

|

JL0

Full Member

Offline Offline

Activity: 817

Merit: 158

Bitcoin the Digital Gold

|

|

June 25, 2020, 08:45:24 AM |

|

|

|

|

|

|

El duderino_

Legendary

Offline Offline

Activity: 2492

Merit: 11999

BTC + Crossfit, living life.

|

|

June 25, 2020, 08:59:29 AM |

|

|

|

|

|

|

goldkingcoiner

Legendary

Offline Offline

Activity: 2030

Merit: 1646

Verified Bitcoin Hodler

|

|

June 25, 2020, 09:17:19 AM |

|

Don't forget to mention to stay away from exchanges. "Not your keys, not your wallet" is the first principle any newbie has to learn first. Even more so now that exchanges are sneakily demanding KYC+AML for withdrawals but keeping quiet about the withdrawal conditions during deposits. |

|

|

|

|

OutOfMemory

Legendary

Offline Offline

Activity: 1526

Merit: 2994

Man who stares at charts

|

...

So yeah, lesson learned, if you have a lactose intolerance, and drink a lot of beer in a short period, you are likely to have a very bad time. Not quite, i fear. Beer is free of lactose afaik, but the vanilla icecream most often contains a lot of lactose (since it doesn't crystallize when frozen). So, how was Wednesday for you folk ?

I'm fructose intolerant (malabsorbtion with systemic symptoms), had some nice bubba kush in my vaporizer yesterday... Short version: Gone over a six pack of lion white and half a bag (250g) of wine gums. Sucrose is half fructose, by the way, and sorbitol in the wine gums is like a malabsorbtion turbo boost. Right before the fourth shit of the day, i might go some 2-3 more times, still. Finished extending the main house by another 40 square meters (roughly), got the window openings sealed at night, right before the rain kicked in. ShitObserver FTW  Have a nice day, y'all, seems like it's buying time this week again  |

|

|

|

|

degxtra1

Member

Offline Offline

Activity: 228

Merit: 46

|

|

June 25, 2020, 09:23:14 AM |

|

The U.S failled bending the curve, Americans are not disciplined enough and they reopened way to fast.

Don't worry to much mate - mortality of this coronavirus is on the level of strong seasonal influenza. “The only means to fight the plague is honesty.” (Albert Camus, 1947)https://swprs.org/a-swiss-doctor-on-covid-19/ |

|

|

|

|

goldkingcoiner

Legendary

Offline Offline

Activity: 2030

Merit: 1646

Verified Bitcoin Hodler

|

|

June 25, 2020, 09:25:15 AM |

|

I'm fructose intolerant (malabsorbtion with systemic symptoms) Have a nice day, y'all, seems like it's buying time this week again  What about Xylitol? Does not raise blood sugar or insulin levels, no fructose and doesn't contribute to dental decay. |

|

|

|

|

|

Poll

Poll