Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

July 27, 2023, 11:38:54 PM |

|

The Fed and Jay Powell is so so so full of shit. They'll look at all the seasonal spending over the summer (which would be a completely normal, typical level of spending by the way), call it "still inflation" and hike again in September. But who the fk cares at this point. It really doesn't matter what they do for the rest of this year. They've already signaled that a change in monetary policy is coming next year. They are already signaling that rates cuts are coming. But why, out of the blue, would they just start cutting rates come first of next year? Hint: they won't. There's no fkn way they start cutting rates without a valid reason. That reason is the (planned) rug-pull event they already have hashed out. Whatever the trigger will be, whatever dominoes they allow to fall, it will be a shitshow. And the Fed will be all like, "Oh wow, who could have seen that coming?? Hur dhur, I guess we have to cut rates now."  They would "have" to do a rug-pull because if they don't and just start cutting rates because the inflation is getting low, then real estate would jump and, therefore, the forward looking inflation expectations would increase as well, defeating the whole carefully orchestrated "program". |

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

philipma1957

Legendary

Online Online

Activity: 4102

Merit: 7768

'The right to privacy matters'

|

|

July 28, 2023, 12:00:49 AM |

|

The Fed and Jay Powell is so so so full of shit. They'll look at all the seasonal spending over the summer (which would be a completely normal, typical level of spending by the way), call it "still inflation" and hike again in September. But who the fk cares at this point. It really doesn't matter what they do for the rest of this year. They've already signaled that a change in monetary policy is coming next year. They are already signaling that rates cuts are coming. But why, out of the blue, would they just start cutting rates come first of next year? Hint: they won't. There's no fkn way they start cutting rates without a valid reason. That reason is the (planned) rug-pull event they already have hashed out. Whatever the trigger will be, whatever dominoes they allow to fall, it will be a shitshow. And the Fed will be all like, "Oh wow, who could have seen that coming?? Hur dhur, I guess we have to cut rates now."  They would "have" to do a rug-pull because if they don't and just start cutting rates because the inflation is getting low, then real estate would jump and, therefore, the forward looking inflation expectations would increase as well, defeating the whole carefully orchestrated "program". this is the third time i have watched them do it late 90s ended kind of okay 2007-2008 crash and burn 🔥 2022 to now ? |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

July 28, 2023, 12:01:22 AM |

|

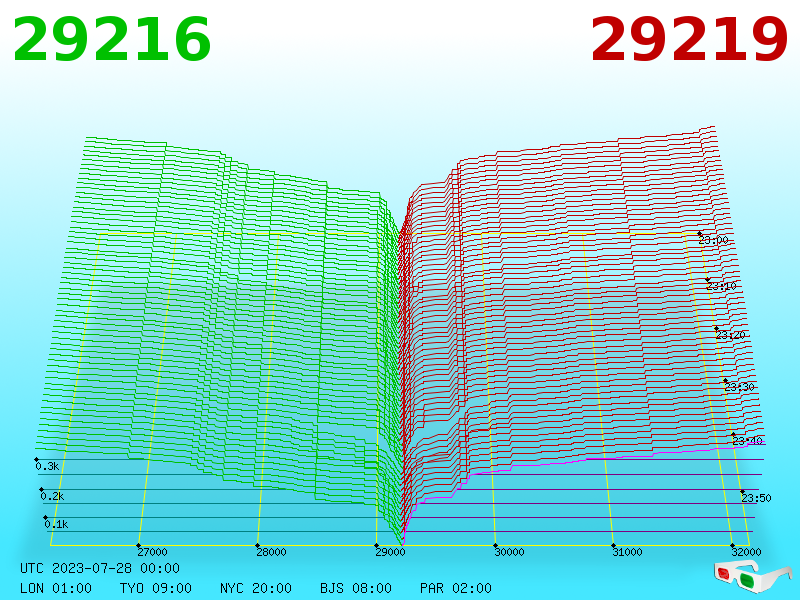

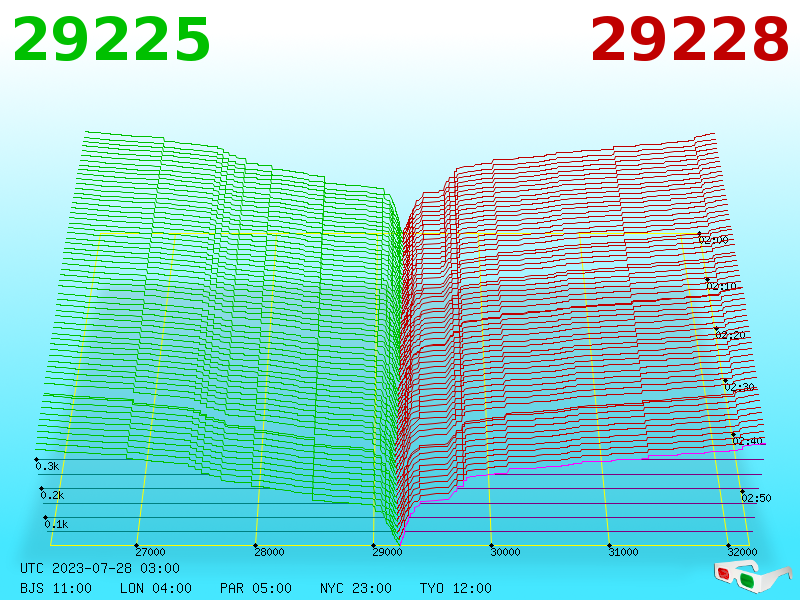

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

OgNasty

Donator

Legendary

Offline Offline

Activity: 4718

Merit: 4234

Leading Crypto Sports Betting & Casino Platform

|

The Fed and Jay Powell is so so so full of shit. They'll look at all the seasonal spending over the summer (which would be a completely normal, typical level of spending by the way), call it "still inflation" and hike again in September. But who the fk cares at this point. It really doesn't matter what they do for the rest of this year. They've already signaled that a change in monetary policy is coming next year. They are already signaling that rates cuts are coming. But why, out of the blue, would they just start cutting rates come first of next year? Hint: they won't. There's no fkn way they start cutting rates without a valid reason. That reason is the (planned) rug-pull event they already have hashed out. Whatever the trigger will be, whatever dominoes they allow to fall, it will be a shitshow. And the Fed will be all like, "Oh wow, who could have seen that coming?? Hur dhur, I guess we have to cut rates now."  They would "have" to do a rug-pull because if they don't and just start cutting rates because the inflation is getting low, then real estate would jump and, therefore, the forward looking inflation expectations would increase as well, defeating the whole carefully orchestrated "program". this is the third time i have watched them do it late 90s ended kind of okay 2007-2008 crash and burn 🔥 2022 to now ? The interesting thing to me about this time as opposed to the other two tightening cycles or rug pulls is that there is high inflation this time. When you look at the crash of 2008, bank assets across the board were taking a heavy hit that lead to cascading liquidations. This time is a little different because higher and more stubborn inflation is keeping valuations buoyed. Instead of banks causing pain from the top down, we’re going to see pain from the bottom up. This means more crime, more people losing their houses, but in a different twist this time, those who are “haves” will continue to see their assets increase in value. The line between haves and have nots is being drawn and it will likely be generational. |

|

|

|

|

BitcoinPak

Member

Offline Offline

Activity: 100

Merit: 26

Chainjoes.com

|

|

July 28, 2023, 12:19:29 AM |

|

Think and proceed wisely   |

|

|

|

|

Torque

Legendary

Offline Offline

Activity: 3542

Merit: 5039

|

|

July 28, 2023, 12:23:48 AM

Last edit: July 28, 2023, 12:35:54 AM by Torque |

|

They would "have" to do a rug-pull because if they don't and just start cutting rates because the inflation is getting low, then real estate would jump and, therefore, the forward looking inflation expectations would increase as well, defeating the whole carefully orchestrated "program".

Exactly. It has to look like a complete blindside accident. But keep an eye on the equities market. It's slowly melting up. Clearly the Wall Street insiders already know what's up. Also, the U.S. interest payment on debt is complete unsustainable long term. And they know this. |

|

|

|

|

philipma1957

Legendary

Online Online

Activity: 4102

Merit: 7768

'The right to privacy matters'

|

|

July 28, 2023, 12:50:41 AM |

|

They would "have" to do a rug-pull because if they don't and just start cutting rates because the inflation is getting low, then real estate would jump and, therefore, the forward looking inflation expectations would increase as well, defeating the whole carefully orchestrated "program".

Exactly. It has to look like a complete blindside accident. But keep an eye on the equities market. It's slowly melting up. Clearly the Wall Street insiders already know what's up. Also, the U.S. interest payment on debt is complete unsustainable long term. And they know this.yeah 2001 or 2000 was last plus year. So a crash and burn will happen if not 2023-2024 maybe when Trump gets reelected in 2024 they use him as the perfect fall guy. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

July 28, 2023, 01:03:26 AM |

|

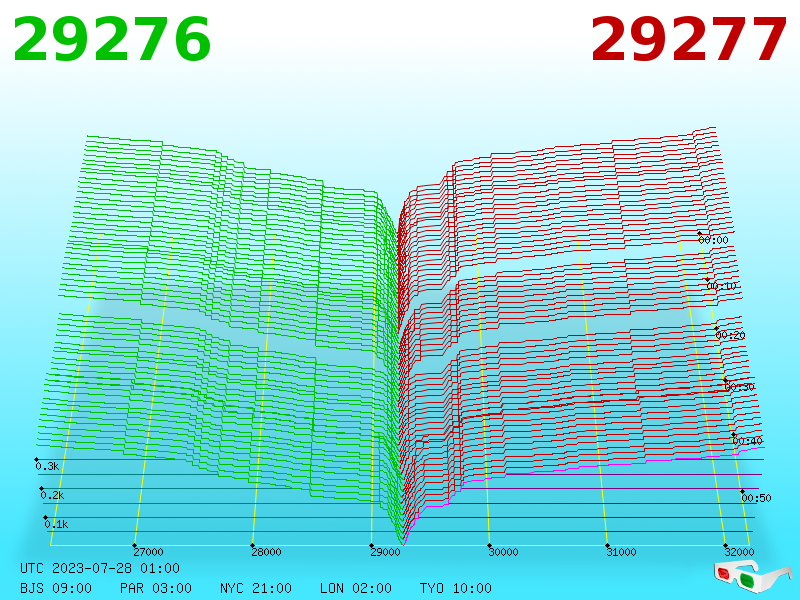

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

|

|

Gachapin

|

|

July 28, 2023, 01:35:09 AM

Last edit: July 28, 2023, 01:48:52 AM by Gachapin Merited by JayJuanGee (1), hisslyness (1) |

|

A general calculation of assets and BTC Total global assets ~ $900T Roughly ~ 15M available BTC If Bitcoin’s market cap acquires 1% of global assets, we have a $9 Trillion asset class. $9T / 15M = $600,000 BTC What are your thoughts on this Where and how did you find the global assets are 900 trillion? why do you think 15 million BTC are available? https://www.blockchain-council.org/cryptocurrency/how-many-bitcoins-are-left/19 million are mined no matter what anyone says all 19 million are 'possibly' available. Ie all 'lost coins' could simply be recovered and reissued by developers.Yes very simple... have fun with the new "developer" fork... ...

So 1 percent = 5.2 trillion/ 19million = 273,684 USD a coin

...

That's not the price 5.2 trillion going into BTC would generate. It's the same like thinking that if someone bought 570 Billion $ of BTC now, it would only double the current price to 58000$. |

|

|

|

|

philipma1957

Legendary

Online Online

Activity: 4102

Merit: 7768

'The right to privacy matters'

|

|

July 28, 2023, 01:49:29 AM |

|

A general calculation of assets and BTC Total global assets ~ $900T Roughly ~ 15M available BTC If Bitcoin’s market cap acquires 1% of global assets, we have a $9 Trillion asset class. $9T / 15M = $600,000 BTC What are your thoughts on this Where and how did you find the global assets are 900 trillion? why do you think 15 million BTC are available? https://www.blockchain-council.org/cryptocurrency/how-many-bitcoins-are-left/19 million are mined no matter what anyone says all 19 million are 'possibly' available. Ie all 'lost coins' could simply be recovered and reissued by developers.Yes very simple... have fun with your new "developer" fork... ...

So 1 percent = 5.2 trillion/ 19million = 273,684 USD a coin

...

That's not the price 5.2 trillion going into BTC would generate. It's the same like thinking that if someone bought 570 Billion $ of BTC now, it would only double the current price to 58000$. No 5.2 trillion market cap for BTC is not same 5.2 trillion going into BTC . I should be more clear as I did mention shifting wealth so it would seem like that I meant people spend 5.2 trillion to buy all the btc. As John Galt said it would be more complex than stocks trading for btc or gold trading for btc. But yeah if you tried to buy every coin in existence the market cap could go to 15 trillion. As for developers freeing the lost coins they likely will one day. Unfortunate that will take more than 30 years from now maybe 2080. So I won't live to see it. I am almost certain that if BTC does succeed those coins will be freed down the road. But it is arguing a point in time so far away it does not affect me and likely very few of us would be alive to see it happen. |

|

|

|

|

|

Gachapin

|

|

July 28, 2023, 01:53:17 AM |

|

A general calculation of assets and BTC Total global assets ~ $900T Roughly ~ 15M available BTC If Bitcoin’s market cap acquires 1% of global assets, we have a $9 Trillion asset class. $9T / 15M = $600,000 BTC What are your thoughts on this Where and how did you find the global assets are 900 trillion? why do you think 15 million BTC are available? https://www.blockchain-council.org/cryptocurrency/how-many-bitcoins-are-left/19 million are mined no matter what anyone says all 19 million are 'possibly' available. Ie all 'lost coins' could simply be recovered and reissued by developers.Yes very simple... have fun with your new "developer" fork... ...

So 1 percent = 5.2 trillion/ 19million = 273,684 USD a coin

...

That's not the price 5.2 trillion going into BTC would generate. It's the same like thinking that if someone bought 570 Billion $ of BTC now, it would only double the current price to 58000$. No 5.2 trillion market cap for BTC is not same 5.2 trillion going into BTC . I should be more clear as I did mention shifting wealth so it would seem like that I meant people spend 5.2 trillion to buy all the btc. As John Galt said it would be more complex than stocks trading for btc or gold trading for btc. But yeah if you tried to buy every coin in existence the market cap could go to 15 trillion. As for developers freeing the lost coins they likely will one day. Unfortunate that will take more than 30 years from now maybe 2080. So I won't live to see it. I am almost certain that if BTC does succeed those coins will be freed down the road. But it is arguing a point in time so far away it does not affect me and likely very few of us would be alive to see it happen. I don't see why any holder of BTC would want to have dormant or lost coins hitting the market and decrease their networth |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

July 28, 2023, 01:54:18 AM |

|

unannounced? ...and if you move $100, unannounced, then the fee is 1 chf? it would be laughable if it wasn't sad. a bit of a solution: permanently 'announce' that you are withdrawing all funds in your account, then postpone as needed. I used to do it in brokerage accounts in a vain attempt to prevent them from letting people (short traders) borrow my shares. I typically put in a 3X value order, but eventually stopped doing this because someone posted that brokerages don't care and could lent your shares anyway. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

July 28, 2023, 02:03:26 AM |

|

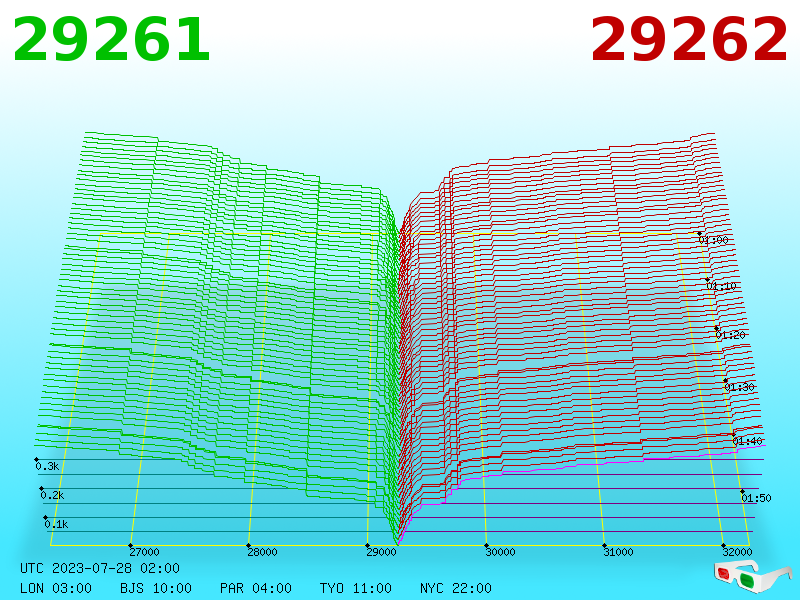

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

|

dansus021

|

|

July 28, 2023, 02:32:08 AM |

|

My guess is Sept is a jump

Then Nov is a pivot.

Which would mean a fall-winter rally for btc and stocks.

Down the road maybe 2032 if btc is 600k with a market cap of 6 trillion it will not be tied to the other wealth sources.

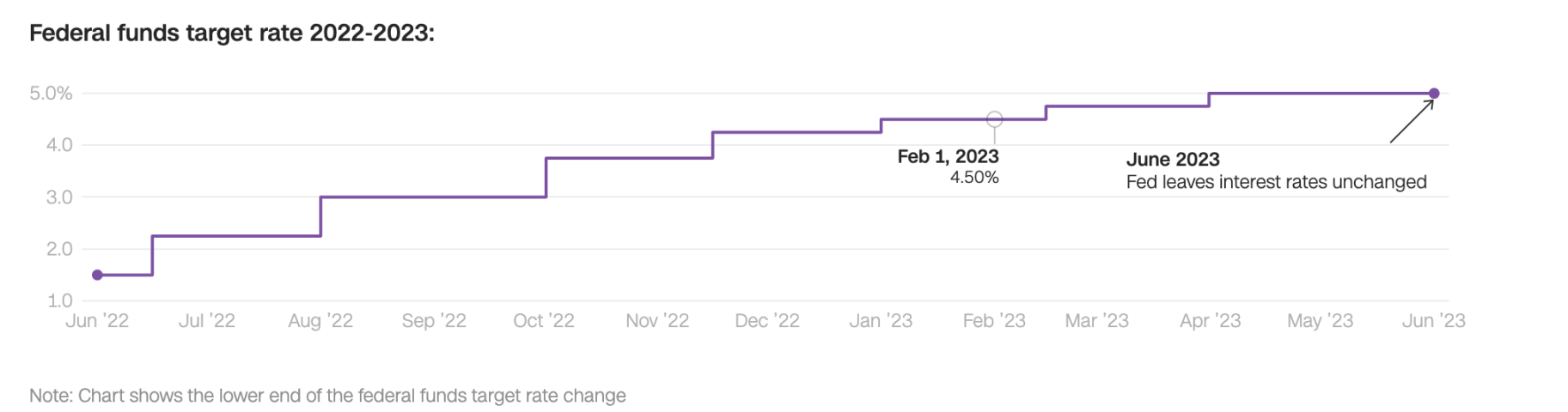

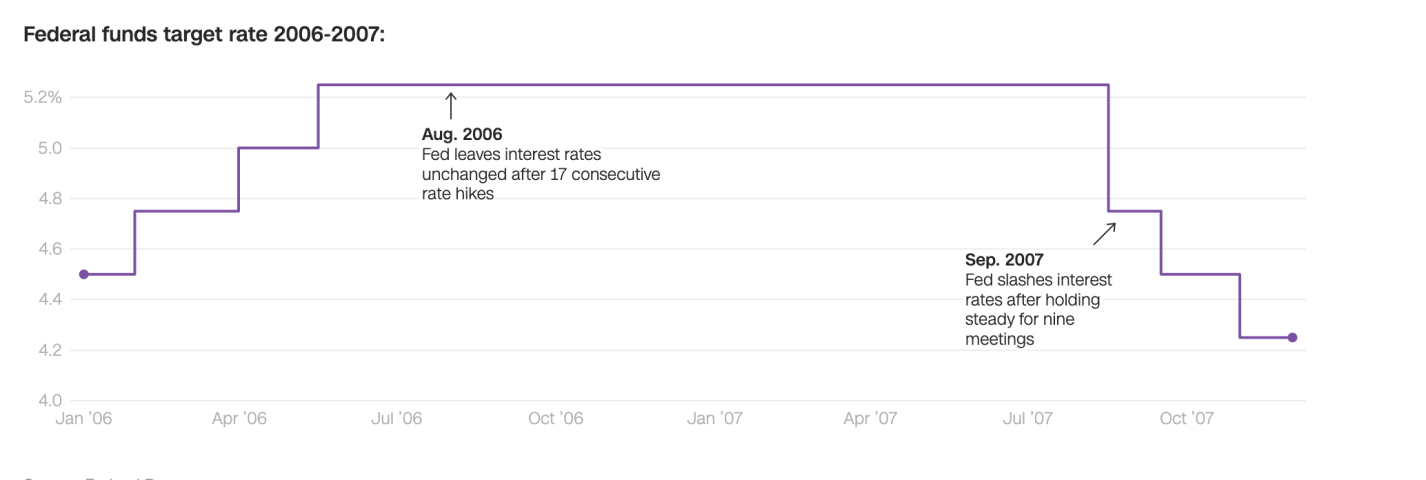

According to this news that September the fed could potentially rise the interest rate again or just hold it still. https://edition.cnn.com/2023/07/25/business/fed-interest-rate-decision/index.htmland in the past history, usually September always become a "SAD"tember  the graph will look like this (Interest rate 2022-2023)  and very similar to this (Graph 2007)  if this happen maybe we are going to see the interest is slashed while bitcoin is halving   you guys know the mean is hahaha |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10180

Self-Custody is a right. Say no to"Non-custodial"

|

So my look at the upper 1% is a bit skewed as I know guys in the 25-800 million dollar range.

Obviously they are in the lower part of the upper 1%.

I would think that anyone that has more than $10 million in wealth would be in the 1%.. but yeah, whether they are merely at entry-level 1%, I am not sure. And, maybe it is not a good idea to count the value of your primary residence when measuring your wealth, but surely there still would be some value in the primary residence.. especially if it is mostly paid off.. and surely it can be used to generate cash.. whether by selling it or getting loans against it. We know that for each $1 million in quasi-liquid wealth, you should be able to generate around 4% per year of passive income for that, and maybe part of the reason that no one recommends counting your primary residence as part of your wealth is because generally you are not getting any kind of passive income off of it - even if it might be appreciating in value.. perhaps? So someone with $10 million in quasi-liquid wealth should be able to generate $33k of income per month, and surely that should well be within the 1%.. not necessarily in the "lower" 1% as you assert. Yeah, of course, there are filthy rich folks out there, and I am not even sure where filthy rich begins. I think that at one point (probably prior to March 2020), many of us were speculating that filthy rich might well start at $40 million and above, but these days, we might think that we may well have to double that number and maybe even suggest that filthy rich does not start until $100 million and above, even though surely the $40million to $99 million folks should not really be suffering in any kind of way, but maybe they cannot afford to have both a nice jet and a nice yacht? I am not sure how much you need to have both.. not that merely having a nice yacht and a nice jet would be the ONLY criteria for filthy rich.. and each of those kinds of items including having a mansion or two take extra maintenance helpers.. so there could be several $million in just annual maintenance expenses for each of the luxury items... but still some of that is filthy rich. and I am still going to say that $10million of quasi-liquid capital that you can invest solidly puts you into the 1%... even though I am kind of guessing a bit and I could look it up, but I am not feeling that ambitious at the moment.. and typing/speculating/shooting things out of my ... thingie.. seems easier than googling the answers. Yep and the older guys I know all have 2-5% BTC. But they have BTC. The question is how much will they shift. To go up to 10%-15% is likely all they will do. They will not go to 85-15 as blackrock asks them to as they do not need to. So they have a ton of wealth with not much need to shift to btc. But they are shifting a bit. Should be fun to see this unfold. Their 5% could easily become 30-33%% with bitcoin going up 10X and 10% would become about 50%. Yep. Exactamundo!!!! And then they are faced with choices about whether to reallocate or not. Do you let your winners run or not? and if you let them run, then how much? and when do you stop letting them run? A lot of normies have profited stupendously from bitcoin, by not reallocating and keeping a vast majority of their wealth in bitcoin rather than putting wealth into losing investments. So says the man who never invented anything nor propelled humankind forward in anyway whatsoever. Tell me Exacly or give me 1 Positive Causality that Bljatcoin brought to the world or what is the positive of it ? So far it uses up as much Electricity as entire African continent , it failed its "Store of Value" test at Covid discovery and is terrible as a Transaction means and it made more people poor than sufficiently sustainable with money (Rich). I can go on and on but i do not find any positive aspect of its existence You don't see any positives, and that is likely the primary explanation regarding why you are going to continue to have fun staying poor, just like you have been having fun staying poor up until now... except for the begging for BTC part. I cannot imagine that would have had been fun.. but yeah, each of us have our own interpretations of what might be "fun."Oh well. Not all of us can prosper from some of the easier choices in regards to being able top see and then to act upon the greatest wealth transfer in history taking place in front of our eyes.. so long as we might be able to open such eyes. |

|

|

|

|

ChartBuddy

Legendary

Offline Offline

Activity: 2156

Merit: 1745

1CBuddyxy4FerT3hzMmi1Jz48ESzRw1ZzZ

|

|

July 28, 2023, 03:01:22 AM |

|

Explanation ExplanationChartbuddy thanks talkimg.com |

|

|

|

|

philipma1957

Legendary

Online Online

Activity: 4102

Merit: 7768

'The right to privacy matters'

|

|

July 28, 2023, 03:03:32 AM |

|

A general calculation of assets and BTC Total global assets ~ $900T Roughly ~ 15M available BTC If Bitcoin’s market cap acquires 1% of global assets, we have a $9 Trillion asset class. $9T / 15M = $600,000 BTC What are your thoughts on this Where and how did you find the global assets are 900 trillion? why do you think 15 million BTC are available? https://www.blockchain-council.org/cryptocurrency/how-many-bitcoins-are-left/19 million are mined no matter what anyone says all 19 million are 'possibly' available. Ie all 'lost coins' could simply be recovered and reissued by developers.Yes very simple... have fun with your new "developer" fork... ...

So 1 percent = 5.2 trillion/ 19million = 273,684 USD a coin

...

That's not the price 5.2 trillion going into BTC would generate. It's the same like thinking that if someone bought 570 Billion $ of BTC now, it would only double the current price to 58000$. No 5.2 trillion market cap for BTC is not same 5.2 trillion going into BTC . I should be more clear as I did mention shifting wealth so it would seem like that I meant people spend 5.2 trillion to buy all the btc. As John Galt said it would be more complex than stocks trading for btc or gold trading for btc. But yeah if you tried to buy every coin in existence the market cap could go to 15 trillion. As for developers freeing the lost coins they likely will one day. Unfortunate that will take more than 30 years from now maybe 2080. So I won't live to see it. I am almost certain that if BTC does succeed those coins will be freed down the road. But it is arguing a point in time so far away it does not affect me and likely very few of us would be alive to see it happen. I don't see why any holder of BTC would want to have dormant or lost coins hitting the market and decrease their networth I can give you a long list of reasons why it will happen. But when you talk about the year 2080 no one really knows what is relevant. Just remember holders of coins do not vote since there is no staking. Well maybe one can say LN is kind of like staking. |

|

|

|

|

Biodom

Legendary

Offline Offline

Activity: 3738

Merit: 3844

|

|

July 28, 2023, 03:11:41 AM Merited by JayJuanGee (1) |

|

So my look at the upper 1% is a bit skewed as I know guys in the 25-800 million dollar range.

Obviously they are in the lower part of the upper 1%.

I would think that anyone that has more than $10 million in wealth would be in the 1%.. but yeah, whether they are merely at entry-level 1%, I am not sure. And, maybe it is not a good idea to count the value of your primary residence when measuring your wealth, but surely there still would be some value in the primary residence.. especially if it is mostly paid off.. and surely it can be used to generate cash.. whether by selling it or getting loans against it. We know that for each $1 million in quasi-liquid wealth, you should be able to generate around 4% per year of passive income for that, and maybe part of the reason that no one recommends counting your primary residence as part of your wealth is because generally you are not getting any kind of passive income off of it - even if it might be appreciating in value.. perhaps? So someone with $10 million in quasi-liquid wealth should be able to generate $33k of income per month, and surely that should well be within the 1%.. not necessarily in the "lower" 1% as you assert. Yeah, of course, there are filthy rich folks out there, and I am not even sure where filthy rich begins. I think that at one point (probably prior to March 2020), many of us were speculating that filthy rich might well start at $40 million and above, but these days, we might think that we may well have to double that number and maybe even suggest that filthy rich does not start until $100 million and above, even though surely the $40million to $99 million folks should not really be suffering in any kind of way, but maybe they cannot afford to have both a nice jet and a nice yacht? I am not sure how much you need to have both.. not that merely having a nice yacht and a nice jet would be the ONLY criteria for filthy rich.. and each of those kinds of items including having a mansion or two take extra maintenance helpers.. so there could be several $million in just annual maintenance expenses for each of the luxury items... but still some of that is filthy rich. and I am still going to say that $10million of quasi-liquid capital that you can invest solidly puts you into the 1%... even though I am kind of guessing a bit and I could look it up, but I am not feeling that ambitious at the moment.. and typing/speculating/shooting things out of my ... thingie.. seems easier than googling the answers. Very much correct...In 2019 1% (of fiat holders in US) was $11 mil at the low....now, probably $20 mil, but I agree that very rich (or call it filthy rich if you want) is $30-40 mil and above. Family office used to start at around $30-40 mil, now more like $100 mil (as long it is a single family and not a multi-family office). Also true that you can relatively easily generate 360-400K/year from $10 mil without spending the principal at all. |

|

|

|

|

Out of mind

Full Member

Offline Offline

Activity: 434

Merit: 208

I like to treat everyone as a friend 🔹

|

|

July 28, 2023, 03:12:29 AM |

|

Very interesting comments by Grayscale submitted to SEC today… Said surveillance sharing agreement w/ Coinbase wouldn’t be sufficient to get spot bitcoin ETFs approved. Source |

|

|

|

|

|

Poll

Poll